5 minute read

Helping everyday investors

By Claire Wright

Sharesies co-founder and co-CEO, Sonya Williams chats with Canterbury Today magazine about how the company has its sights on shifting investing away from solely an old boys’ club.

To everyday people, there’s been a prevailing perception of investors coming from a certain demographic – rich, older, male and white. This circles around the fact that the traditional way to buy shares required minimums of the number of shares you could buy. Sharesies reinvented the game, becoming the first wealth development platform to fractionalise the New Zealand Stock Exchange, then doing the same in Australia. You can now own shares starting at one cent, just owning a fraction of a share. Sharesies co-founder and co-CEO, Sonya Williams says, “That ownership from one cent is a part of what makes it so accessible for us. “We know through our research a reason people weren’t investing was because of the perception that you needed too much money to start. “Information is a really big part of investing, and so is being part of the conversation. The [investing] game has changed as well around this democratising access to information.” Through the platform, users can become better informed in easy-to-digest ways – from Sharesies’ daily podcasts to weekly webinars with CEOs around the world, investors can ask questions about how companies are run directly and get those questions answered, Sonya says. “We do believe providing things like these interviews with the CEOs, that’s a fantastic opportunity that hasn’t been accessible, even if you had lots of money. “Everyone should have access and the opportunity to invest. As an investor, you’re a business owner, you’re a shareholder. You own a bit of that business. “When you put yourself in that mindset and you go well, ‘What would I like to know about? What do I need to you know? What do I want to have communicated?’ “There’s so much opportunity to really be connecting people closer with the investments they have and really feel like a shareholder. “Our vision is that someone with five dollars has the same investment opportunities as someone with five million. “That’s what we see on our platform. It doesn’t matter whether you have five dollars or five million, people are investing how they want on Sharesies.” Through Sharesies’ market research, most people said they got information either from the internet – or through their friends or partners. “What we’re interested in is being able to provide access to those who are looking to grow their wealth and helping empower them to do so. “This is a really important part for us; when I talked about how 20 percent of people who had shares in the past, that was people who are typically male, over 60 and living in Auckland. When we think of the make-up of our population, that’s only a subset of the population.” Growing yourself and growing your knowledge is investing in yourself. Being able to create those conversations is really important no matter how old you are. ”

- Sharesies co-founder and co-CEO, Sonya Williams

The internet has really democratised how people receive their information, Sonya says, and has helped level the playing field across industries, from education to investment. “Growing yourself and growing your knowledge is investing in yourself. Being able to create those conversations is really important no matter how old you are.”

Tips for investing later in life

One of the sayings in the finance industry is, “The best time to plant a tree was 20 years ago – the second-best time to plant a tree is now.” Even if you’re hesitant to start investing, Sonya says whenever you start is the best time for you – and there’s huge opportunity. “A pro is you might have more money to invest as you’re older as well. “People are at different ages and stages, and you might have different assets that you’ve invested. “There’s a chance to diversify through investing and potentially add a bit more liquidity if you have something like your own property and you’re planning to live in that. Being able to invest in something a bit more liquid provides you a bit more flexibility. Not all investing is for your retirement.” Investing is also how you can grow wealth for yourself, your children, and your whanau, to create the type of world you want your loved ones to live in. “People support what they want to support and how they want to see the world. A big part of investing is looking forward and saying, ‘What type of world do I want to want to live in for myself? “What do I want to be achieving financially for myself but for also those around me? What kind of world is that? What kind of companies do I think should exist?’ “That’s a really powerful thing to do because you can really support these companies, and support the type of world you want to live in, through being a business owner as well as a shareholder.”

Co-founders and co-CEOs, from left to right: Leighton Roberts, Sonya Williams, and Brooke Roberts.

Sharesies was one of the first New Zealand financial services to become a B Corp, a new kind of business that balances purpose and profit. Sharesies co-founder and co-CEO, Sonya Williams says, “We really put a lot of energy into how we run our business as well and making sure that we are really committed to reducing inequality, lowering the levels of poverty and creating a healthy environment for our teams and the people. “We want to be really understanding the impact that we have as a business, and making sure that we’re doing what we can to make sure it’s a positive one.”

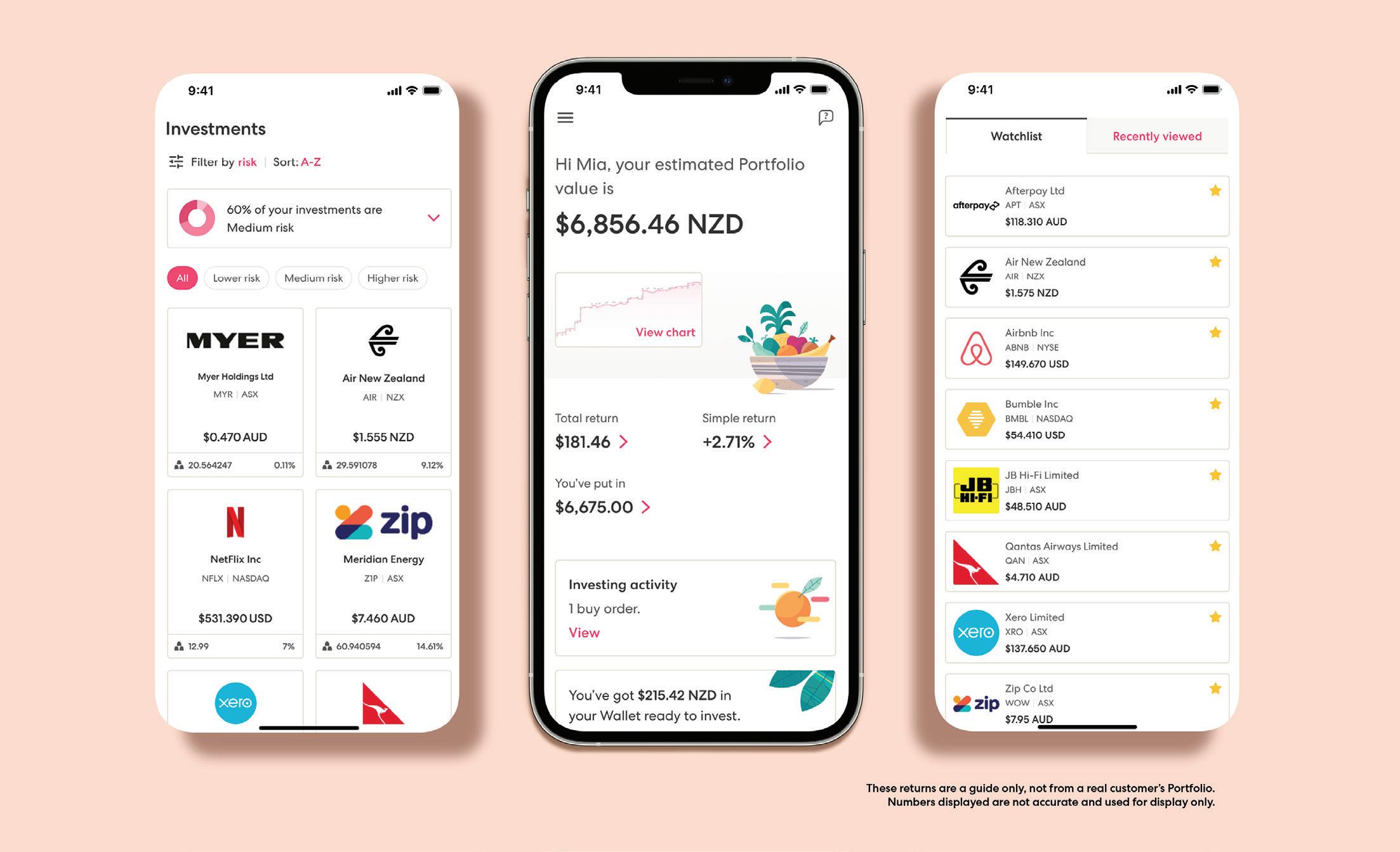

With over 400,000 investors, Sharesies makes it simple to start investing –no jargon, no minimum buy-ins, all online. To find out more, visit www.sharesies.nz.