4 minute read

Out of the Shadows

from Maine Educator April 2016

by Maineea

The H t List Discover these educator recommended tools and be inspired to reimagine your day

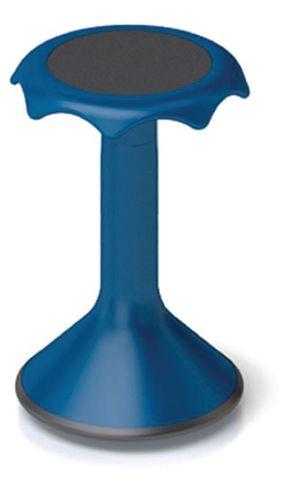

Hokki Stools

The Hokki Stools are consistently given rave reviews for their ergonomic design that allows students to keep moving, while sitting still. Teachers who have Hokki Stools rave about their impact on student learning saying, “It’s that whole mindbody connection, if our body is in motion our mind is in motion. Kids who can move while they work are more likely to focus on their work and be engaged in what they’re doing.” There are several sizes of stools with prices starting around $110 per stool.

Cocoon Grid It Organizer

If you’re tired of getting cords, flash drives and the like lost in your bag from home to school teachers recommend the Cocoon, which is about the size of a sheet of paper. One online teacher reviewer said: “For a while, I tried to assign items to various pockets to try to keep them organized, but that never worked very well. I'd forget what went where and spend way too much time digging around for something. That changed once I got the Cocoon.” Cost: starting at $15.

OSMO

Osmo is an iPad accessory that claims to foster “social intelligence and creative thinking by opening up the iPad to the endless possibilities of physical play.” Osmo was rated TIME Magazine’s Best Invention of 2014. It uses the camera on the iPad as a way to track motion for different games. There are currently four apps available for Osmo, which include Masterpiece, Words, Tangram, and Newton. Cost: Starting at $78.

AmazonBasics 4 Port USB 3.0 Hub

Need more USB ports? MEA’s Technical Coordinator recommends using a USB 3.0 Hub—it’s the newest standard in connection and allows you to download and transfer data more quickly from an external hard drive or flash drive. You can also use the additional ports for charging your devices. Cost: $17.

Soft Grip Brushes

These brushes help students understand where to grab the brush, and teachers rave about their ablity to reinforce fine motor skills in younger students. You can find the brushes on fabercastell.com. Cost: $4.99/4-pack

Money Talks 6 Smartest Ways to Spend Your Tax Refund

Should you save it or spend it? Actually, you can do both. Find out how personal finance experts recommend divvying up your windfall.

To help provide some guidance, NEA Member Benefits spoke to several personal-finance professionals who offered these six wise ways to spend your refund:

Pay down that credit card balance. Financial experts universally rank paying down expensive debt at the top of the list of “smart tax-refund spending ideas.” And guess where you’re likely keeping your most costly debt? That’s right: It’s generated by that tiny piece of high-rate plastic in your wallet. “By using proceeds from your tax refund to pay off that debt, you’re reducing your interest,” says Ryan S. Himmel, a certified public accountant (CPA) and president/CEO of BIDaWIZ Inc., an online marketplace for professional tax and financial advice and services.

Invest for a comfy retirement. Let’s say you pay off your credit card bill every month. You can opt to invest all or part of your tax refund into your retirement portfolio, and you’ll avoid even more taxes in the process. “You can sock it away into an IRA—or make additional contributions to your work-based retirement plan—and reap the rewards of tax-deferred investing,” Himmel says.

Build a “rainy day” cushion. Personal-finance experts recommend that you keep no less than six months’ worth of expenses in an emergency fund that’s readily accessible vehicle, such as a savings account. Building up that cushion isn’t exactly fun, but it’s necessary in an unpredictable economy.

Keep it “in house.” If you own your home, consider making an extra mortgage principal payment. “That brings down the effective cost of that debt,” says Anna K. Pfaehler, a certified financial planner (CFP) and portfolio manager with Palisades Hudson Financial Group, a financial planning and investing firm. However, there are downsides to this idea, especially if you have significant credit card debt, which typically has a higher interest rate than a mortgage. (See suggestion No. 1)

Give it away. Donating all or part of the donation to charity isn’t just the right thing to do; it’s also a smart financial move. “Not only are you helping a good cause,” Pfaehler says, “you’re reducing your tax bill.”

Have fun! It’s perfectly reasonable to enjoy spending a big

refund. But maybe you should consider a tech toy or nice dinner as opposed to a luxury cruise or new car. “I have a little trick you can use here,” Reining says. “I call it the 90/10 rule. Take 90% of your return and commit it to a ‘responsible’ choice. Then, take what’s left over and enjoy that new gadget, fancy dinner or weekend getaway.”