1 minute read

NEW

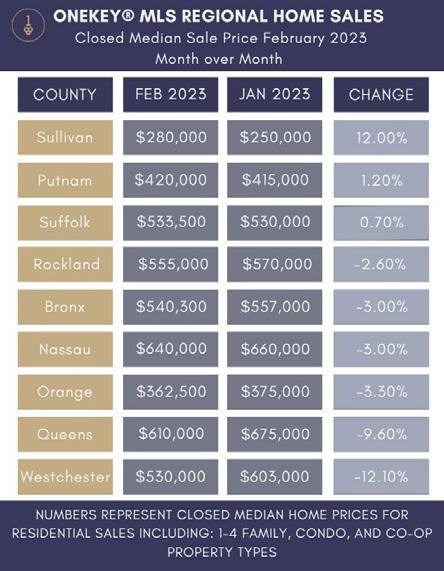

YORK RESIDENTIAL CLOSED MEDIAN SALE PRICE DROPS 4.4% IN FEBRUARY

Is the boom over? For February 2023, OneKey MLS reported a regional closed median sale price of $550,000 for metropolitan New York residential real estate transactions, representing a 4.4% decrease from the reported $575,000 in January 2023. Between January 2023 and February 2023, closed regional sales transactions, including residential, condo and co-op sales, decreased to 2,988 from 3,621, a 17.5% drop. Across the region, pending sales transactions rose in a month-over-month comparison, reaching 3,974 in February, 23.3% more pending transactions than the 3,224 reported in January.

SOTHEBY'S INTERNATIONAL REALTY EXPANDS IN NEW YORK

Sotheby's International Realty has announced that Finger Lakes Realty Partners has joined the network and will now operate as Finger Lakes Sotheby’s International Realty. The addition marks the brand's 59th office in the state.

The firm is owned and operated

ZILLOW: HIGH INTEREST RATES KEEPING INVENTORY LOW

Mortgage rates — both their high levels and their wild swings — are making life difficult for both buyers and sellers, said Zillow’s February market report. Relatively high rates have brought new listings to record lows.

The flow of new listings in February was at a record low for that time of year, nearly a third lower than before the pandemic and 22% lower than in 2022. Mortgage rates are likely driving the decline — those who bought or refinanced in 2020 or 2021, when rates were well below 3.5%, are unwilling to trade in their current mortgage for a new one with double the interest, Zillow said. The largest annual by Jerry Morrissey, who brings more than 20 years of real estate experience to the company, and will serve the Central New York region, the Finger Lakes region and areas up to Lake Ontario. The company consists of several real estate associates and is currently headquartered in the city of Skaneateles, New York. declines in new listings are in West Coast markets: San Jose (-47%), Portland (-46%), Seattle (-45%) and Sacramento (-44%).

The trickle of new listings is contributing to extremely low levels of total inventory, now 17% higher than the absolute bottom in February 2022.