BillofRights inAction

THEU.S.BANKINGSYSTEMHAD COLLAPSEDWHENFRANKLIND. ROOSEVELT(FDR)WASINAUGURATED PRESIDENTIN1933.FDRAND CONGRESSMOVEDQUICKLYTO RESTOREPUBLICCONFIDENCEINTHE BANKS.THENTHEYENACTEDMAJOR BANKINGREFORMS.

Afterthestockmarketcrashin 1929,economicconditionsintheU.S. worsenedintoadeepdepression.Industrialproductionslowedsteadily, stockpricescontinuedtofall,andunemploymentwentfrom4percentin 1929to25percentby1933.

Economistshaveexplaineda numberofcausesforwhatbecame knownastheGreatDepression.One ishowthebankingsystemoperated.

Thebankingsystemconsistedof privatelyownedbankscharteredby

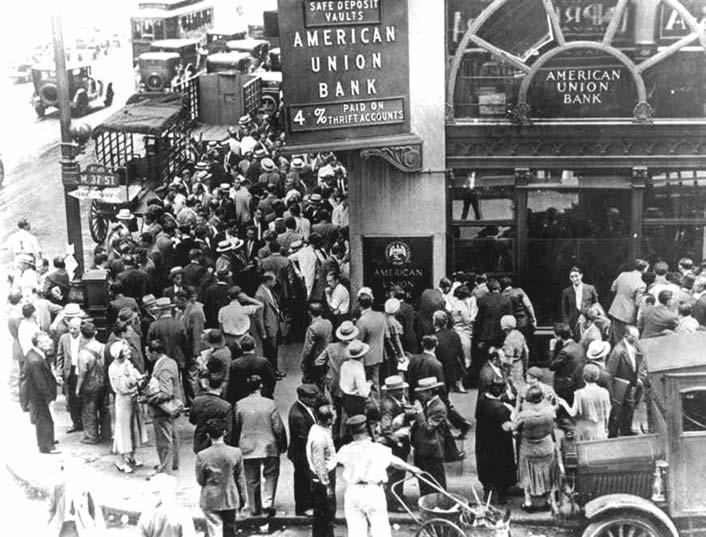

ANXIOUSDEPOSITORSMILLEDoutsideabankearlyintheGreatDepression.

statesorthefederalgovernment. Mostbankingregulationwasdoneby thestates,butthefederalgovernment alsooperatedtheFederalReserveSystem,commonlycalled“theFed.”All federallycharteredbankshadtobe membersoftheFed.

TheFedwasgovernedby12FederalReserveBanksindifferentregionsofthecountryandaFederal ReserveBoardinWashington.Cre-

Thiseditionof BillofRightsinAction examinescrises—pastandpresent. Thefirstarticleexploresthebankingcrisis,nottherecentone,buttheonein the1930s.ThesecondarticleexaminestheMunichagreement,madeinthe faceofthethreatofNaziGermany.Thelastarticlelooksatourcurrent unemploymentcrisisandtheprospectforfuturejobsintheU.S.

U.S.History:FDRandtheBanks WorldHistory:Munichand“Appeasement” CurrentIssue:UnemploymentandtheFutureofJobsinAmerica GuestwriterLucyEisenberg,Esq.,contributedthearticleonMunich.Our longtimecontributorCarltonMartzwrotetheothertwoarticles.

atedbyCongressin1913,theFed’s rolewastostabilizethebanking system,whichhadbeenplaguedby numerousbankpanicsinthe19th andearly20thcentury.

Bankpanicscouldoccurwhendepositorsbelievedabankwasinfinancialtrouble.Theymighthearthatthe bankhadmadebadinvestments,ora rumormightcirculatethatbankemployeeshadembezzledfunds.Ina panic,depositorsrushedtothebankto demandmoneyfromtheiraccounts. Bankshadsomemoneyonhand,but mostoftheirmoneywasinvestedor lenttoothers.Thusevenasoundbank mighthavetroublepayingitsdepositorsinapanic.Abankmighttryto borrowfromanotherbank,butother banksmightturnitdown.Oncea panicbeganinonebank,itcould easilyspreadtoothers,aspeoplegrew unsureaboutthebankingsystem.Ifa bankclosed,thiswouldbeadisaster

foritsdepositorssincenonationalsystemofdepositinsuranceexistedasit doestoday.Depositorswouldloseall themoneyintheiraccounts.

OnepurposeoftheFedwasto serveasthe“lenderoflastresort.”It wasakindofbankers’bank,lending moneytofederallycharteredbanksin anemergency,suchasabankpanic.

AnotherpurposeoftheFederalReserveSystemwastomakesurethatprivatebankscharteredbythefederal governmenthadenoughcurrency(gold coinsandpapermoney)tomeetthe needsofcommerce.TheFeddidthisby regulatinginterestratesonborrowing tokeepthemoneysupplystable.

In1931inthemidstoftheGreat Depression,theFedactedtoincreaseinterestratesonsavingsaccounts.TheFedwantedto encouragebankdepositorstokeep theirmoneyinbanksandearninterest.Manydepositorshadbeendemandingtheirmoneybackingold.

TheUnitedStateswasonthegold standard.Bylaw,papermoneywas backedbygold.TheTreasuryDepartmentcouldonlyprintmoneyifthe bankingsystemcouldbackitwith gold.Ifdepositorstookgoldoutofthe banksandhoardedit,thepapermoney supplywouldeventuallyshrink,depressingeconomicactivity.

Byraisinginterestrates,theFed affectedconsumerborrowing.Higher ratesmeanttightercreditandfewer peoplecouldqualifyforloans,which furtherreducedtheamountofmoney incirculation.

Althoughdesignedasthe“lender oflastresort”forbanks,theFedwas designedmainlytokeepthebigWall Streetbanksstable.Almostallthe bankpanicsinthepasthadoccurred inNewYorkCity.Thuswhenbanks beganfailingoutsideNewYork,the Fedfailedtoloanmoneytohelpthe troubledbanks.TheFedconcludedit couldstopthebankingcrisisbyjust makingloanstotheWallStreet banks.ThispolicyworkedonWall Street,butbankscontinuedtofailall overthecountry.Sincemanyofthese bankswerenotmembersoftheFederalReserveSystem,theFedleaders

believedtheyhadnoresponsibilityto helpthem.

Morethan5,000banksclosed theirdoorsbetween1930and1932. Asaresult,publicconfidenceinthe bankingsystemvanished.

In1932,PresidentHerbertHoover, aRepublican,establishedtheReconstructionFinanceCorporation(RFC). Thiswasagovernmentagencysetup tomakeloanstoallbanksintrouble whethertheyweremembersofthe FederalReserveornot.

Duringthefirstmonthsof1933, however,increasingnumbersofbank depositorswithdrewandhoarded papercurrencyandgold.Morebanks failedatafasterratethantheRFC couldsave.

Rooseveltrealized whatHooverand manyothersfailed tosee:Thebanking crisiswasmainly aboutpeople’slack ofcon dencein thebanks.

InearlyFebruary,officialsfrom theHooveradministrationappealed toHenryFordtolend$7.5millionto alargeDetroitbankwherehewasa majorshareholder.Fordrefused. Hoover’sofficials,theRFC,andthe Fedarguedoverwhoshouldstepup tosavethebank.Noneofthemdid, andthebankfailed.

ThegovernorofMichiganthenorderedastate“bankholiday,”closing allthebanksinhisstate.Thispreventeddepositorsfromwithdrawing theirmoney.Itwasadrasticwayto preventbanksfromcollapsing.

Severalstateshadalreadyclosed theirbanks,andtheMichiganbank holidaystampededmanyotherstates todothesame.Thestatesactedin

theirowninterests,ignoringhow theirbankclosureswouldaffect the restofthecountry.BythetimeDemocratFranklinD.RooseveltwasinauguratedpresidentinMarch1933, everystateinthenationhaddeclared someformofbankholiday.

BetweenJanuaryandMarch 1933,morethan4,000banks throughoutthenationfailed.Many weresmallbanks,ofteninfarm areas,thatwerenotmembersofthe FederalReserve.ButeventheWall Streetbanks,keptafloatbyloans fromtheFederalReserve,werein dangerduetothebankingpanicthat grippedtheentirenation.

PresidentHooverhadconsidered declaringabankholidaytoputthe processofreopeningthebanksinfederalhands.Hedoubted,however,that hehadthelegalauthoritytodothis, sohedidnotact.

TwodaysafterRooseveltwasinauguratedpresidentonMarch4,heissuedaproclamationthatdeclareda federalbankholiday.Theproclamation alsoputthefederalgovernmentin chargeofreopeningthebanks.

Thestateandfederalbankholidayshadharshconsequencesfor mostpeople.Theycouldnotcash checksorgetmoneyfromtheirbank accounts.Somehadtroublebuying foodandothernecessities.OthersresortedtowritingIOUsorbartering goods.

FDRjustifiedhisactionasnecessarytostopfuturemassivebank withdrawalsandhoardingofcurrency andgold.Ifthiswereallowedtocontinue,thecirculationofmoneywould stall,furthercripplingtheeconomy.

Threedaysafterhisproclamation, FDRsenttoCongresstheEmergency BankingAct.Thisacthadbeen mainlydraftedbyHooveradministrationofficials,whohadprepareda blueprintforclosingandreopening thebanksthattheformerpresident neverused.

Theactlaidoutascheduleforreopeningthenation’sbanksafterTreasuryDepartmentexaminersevaluated theirsoundness.Strongbankswould openquickly.Weakenedbankswould

receiveloansandshipmentsofFederal ReserveNotes(papercurrency).Insolventbankswouldbepermanently closed.Theactalsobarredtheexport ofgoldtoforeigncountries.

Inoneday,thesolidlyDemocratic CongresspassedtheEmergencyBankingAct,andFDRsignedit.Thisfirst NewDeallawlegalizedRoosevelt’s proclamationandgavehimunheardof authorityoverthenation’sprivately ownedbankingsystem.

TheFirst‘FiresideChat’

RooseveltrealizedwhatHoover andmanyothersfailedtosee:The bankingcrisiswasmainlyaboutpeople’slackofconfidenceinthebanks.

Torestoretheirconfidence,FDR decidedtospeaktothepeopledirectlyovertheradio.

OnMarch12at10p.m.,RooseveltspokelivefromtheWhite Housetoanestimated40million Americansacrossthecountry.Aradio announcerintroducedhim:“The presidentwantstocomeintoyour homeandsitatyourfiresideforalittlefiresidechat.”

“Myfriends,”thepresidentbegan, “Iwanttotalkforafewminuteswith thepeopleoftheUnitedStatesabout banking....”Headoptedaconversationaltoneandspokeinplainlanguage aimedataverageAmericans.Hetold themthathewantedtoexplainwhat hadbeendone,whyitwasdone,and whatthenextstepswouldbetoend thebankingcrisis.

Rooseveltexplainedthebanking systeminfivesentences.Hepointed outthat“whenyoudepositmoneyin abank,thebankdoesnotputthe money intoasafedepositvault.”Instead,hesaid,“. thebankputs yourmoneytoworktokeepthe wheelsofindustryandofagriculture turningaround.”

Hedescribedhowrusheson bankstowithdrawcashorgoldwere causedbythe“underminedconfidence”ofthepublic.Hethengave hisreasonsfordeclaringabankholidayandhowthereopeningofthe bankswouldwork.

Hepromisedthatbankswith “goodassets”wouldreopenimmediately,andmostoftheothersassoon

astheyhadbeen strengthened.He said,“Icanassureyou,myfriends, thatitissafertokeepyourmoneyin areopenedbankthanitistokeepit underthemattress.”

Heagreedthatsomebankers wereincompetentordishonestand haduseddepositors’moneyforrisky speculationandunwiseloans.But,he continued,thiswasnottrueabout thelargemajorityofbanks.

“Andso,”hesaid,“itbecamethe government’sjobtostraightenout thissituationanddoitquickly.”He cautionedthatafewbanks maynever reopen,andsomeindividualsmay losetheirmoney.

Rooseveltconcludedbyappealing totheAmericanpeopletohaveconfidenceagaininthebankingsystem: Wehaveprovidedthemachinery torestoreourfinancialsystem,itis uptoyoutosupportandmakeit work.Itisyourproblemnoless thanitismine.Togetherwe cannotfail.

InresponsetoRoosevelt’sfirst FiresideChat,tensofthousandsof lettersarrivedattheWhiteHouse. Mostexpressedappreciationfor Roosevelt’sfrankandconfidencebuildingspeech.

Whenthefirstbanksreopened, longlinesofpeopleformedoutside them.Thesepeoplewerenotwithdrawingtheirmoney;theyweredepositingtheirhoardedcashandgold. TheTreasuryDepartmenthad plannedamassiveprintingofFederal ReserveNotestomeetthebanks’ needforcash,buttheprintingwas notneededsincesomanyvoluntary

depositsflowedbackintothebanks.

OnMarch14,the WallStreet Journal headlineproclaimed,“ConfidenceBackasBanksReopen.”By theendoftheyear,mostbankswere operatingagainandprovedtobe solventornearlyso.Only5percent ofthebankswereclosedpermanentlyduetoinsolvency.

Publichostilitytowardallbankers washighin1933.Manycalled bankers“banksters,”afterAlCapone andotherwell-knowngangstersof thetime.

Congressheldhearingson“bad banking”practices.Thehearings turnedupevidencethatsomebanks haduseddepositors’moneytospeculateinstocksandotherriskydealsto increasebankprofits.

SenatorCarterGlass(D-Va.)becamethechiefcriticofthesepractices. Glassbelievedthatbanksshouldnot becollectingdepositsfrompeopleand speculatinginthestockmarketwith theirmoney.Hesponsoredabill, backedbyFDR,thatrequiredbanksto choosetheirformofbanking.Banks couldbecommercial(checking,savings,andloans)orinvestment(stocks, bonds,andfinancing).

Glassarguedthatbankersshould notputtheircustomers’moneyindangerthroughriskyinvestmentschemes. Infact,GlassblamedtheGreatDepressionontheinterminglingofcommercialandinvestmentbanking.

Whilebankershadapplauded FDR’sfederalbankholiday,they

stronglyopposedhissupportofthe billtoseparatecommercialandinvestmentbanking.Theycomplained thatthiswouldhinderraisingcapital neededtogettheeconomymoving again.

WallStreetbankerJackMorgan, sonofthefounderofJ.P.Morgan&Co., bitterlyopposedFDR.Morgancalled himthe“crazymanincharge.”But publicopinionopposedthebankers.

TheGlassbillprohibitedcommercialbanksfrombuyingandselling stocksandbondsorengaginginmost otherinvestmentactivities.Onlyinvestmentbankscouldfullydothese things.Investmentbanks,however, couldnotreceivedepositsforcheckingandsavingsaccounts.

Between1930and1933,depositorslostmorethan$6billionwhen almost10,000banksfailed.In1933, Rep.HenrySteagall(D-Ala.)championedafederalinsuranceprogramto protectthemoneypeopledeposited intheirbanks.Depositinsurance, Steagallargued,wouldalsostopthe panicwithdrawalsofcurrencyand goldthathadplaguedthebanking systemforoveracentury.

Atfirst,FDRstronglyopposedfederaldepositinsurance.Hefearedthat thepremiumsbankswouldhaveto payintoaninsurancefundwouldcripplethem.Healsoworriedthatifthe banks’insurancefundhadbeenused up,thegovernmentwouldbestuck withcompensatinginsureddepositors.

Anotherargumentagainstfederal depositinsurancewasthatitwould encouragebankerstoact more recklessly.Thiswouldhappen,theargumentwent,becausethegovernment guaranteedabank’sdepositorstheir moneyevenifthebankermaderisky loansthatcausedthebanktofail.

Economistscallthissituationan exampleofa“moralhazard.”Thisoccurswhenpeopleororganizationsare protectedfromthebadconsequences oftheirriskyorunwiseactions.Ineffect,theyaresavedorbailedout. Thus,theymaybeencouragedtotake achanceonrepeatingthesameactions inthefuture.

DespiteRoosevelt’sopposition,

MANYTIMESDURINGHISpresidency,FDR addressedthenationonradioinwhat cametobeknownas“firesidechats.”

popularsupportforfederaldeposit insurancewasoverwhelming.Rep. Steagallintroducedabillthatcreated theFederalDepositInsuranceCorporation(FDIC).

TheSteagallbillinsureddeposits upto$2,500.Anysolventbank(includingstatecharteredbanks)couldjoin theFDIC.Memberbankspaidasmall percentoftheirinsurabledepositsinto acommonfundfromwhichpayouts wouldbemadeto reimbursedepositors fortheirlossesinfailedbanks.

ThebillbySen.Glassseparating commercialandinvestmentbanks andtheonebyRep.Steagallinsuring bankdepositswerecombinedintothe BankingActof1933.ThisisfrequentlycalledtheGlass-SteagallAct, whichFDRsignedonJune16.

TheBankingActof1933gavethe Fedmoretoolstocontrolthemoney supplyandsetinterestratesonborrowingbybanks,whichaffectconsumerloanrates.Thesemeasures weredesignedtokeepthemoney supplyandpricesstable.

Bankerscontinuedtoarguethat separatingtheircommercialandinvestmentfunctionslimitedtheirability tofinanceeconomicgrowth.Some scholarsproducedstudiesshowingthat bankingabusesinthe1930swere overblownbyCongress.Overtheyears, theGlass-SteagallActwasmodifiedto

allowcertainkindsofinvestment bankingbycommercialbanks.

In1999,aRepublicanCongress andDemocraticpresident,BillClinton, repealedtwokeysectionsofthe Glass-SteagallAct.Thisrepealeliminatedmostoftheremainingbarriers thatstoppedcommercialbanksfrom engagingininvestmentactivities.

Afterthefinancialcrashin2008, however,someeconomistsandpoliticiansclaimedtherepealofthe Glass-Steagallprovisionshadledtoa returntohigh-riskspeculationby largecommercialbanks.Asaresult, thebanksfacedfailureandhadtobe bailedoutbytheU.S.government.

Othersrejectedthisview.Theyarguedthatthemortgageinvestment productsthatbroughtonthefinancial crisiswereneverregulatedbythe Glass-SteagallActorwereallowedbeforethe1999repealtookplace.

InsteadofrestoringtheGlassSteagallregulations,Congress enactedanewrulethatlimitedcommercialbanks’tradinginstocksand otherinvestmentsfortheirownshorttermprofit.

TheFederalDepositInsurance CorporationhasbeentheleastcontroversialofFDR’sbigbankingreforms.Hisfearsaboutfederal depositinsurancewereneverfulfilled.Today,theFDICinsuresdepositsupto$250,000(oneaccount perbank).DuringtheGreatRecessionfrom2008to2011,theFDIC managedtheclosingofabout400 banksandmadesurethatdepositors didnotloseapennyfromtheir insuredaccounts.

1.WhatdidFDRbelievewasthe maincauseofthebankingcrisis in1933?Howdidhetrytosolve thisproblem?Doyouthinkhe succeeded?Explain.

2.WhydidCongressandFDRseparate commercialandinvestmentbanks?

3.Whatisa“moralhazard”?Whatis thepossiblemoralhazardoffederaldepositinsurance?Evenwith amoralhazard,doyouagreethe FederalDepositInsuranceCorporationisstillagoodidea?Whyor whynot?

Alter,Jonathan. TheDefiningMoment:FDR’sHundredDaysandthe TriumphofHope. NewYork:Simon& Schuster,2006.

Kiewe,Amos. FDR’sFirstFireside Chat:PublicConfidenceandtheBankingCrisis. CollegeStation,Texas: TexasA&MUniversityPress,2007.

Theexistenceofapossible moralhazarddoesnotmean anactionshouldneverbeundertaken.Itdoesmeanthat oneshouldbalancethegood oftheactionagainstthepossibledangersorunintended consequences.

Meetinsmallgroupsto evaluatethefollowinggovernmentactions.First,identify oneormorepossiblemoral hazardsintheaction.Second, decideifyouagreewiththe governmentactiondespitethe moralhazard(s)involved.Finally,explainyourdecisionsto therestoftheclass.

1.Topreventthecollapseofthe U.S.bankingsystem,thegovernmentmakesloanstobig banksthatinvestedheavilyin packagesofcarelesslyapprovedhomemortgages.

2.Congresspassesalawthat reducestheprincipalon mortgagesofhomeowners whenthecurrentmarket valueofthehomeismuch lessthantheyowe(so-called “underwatermortgages”).

3.Thegovernmentmakes loanstopoorlymanaged autocompaniestokeepthe industryaliveintheU.S. andtosavejobs.

4.Congressextendsunemploymentinsurancepaymentstothosewhohave beenoutofworkformore thansixmonths.

Nat ional U. S. History Hi gh School Standa rd 24: Understands how t he New Dea l addressed the Grea t Depressi on, t ra nsformed American federal ism, and init iated t he wel fare state. (1) Understands the first and second New Deals . . . . (5) Understands the significance and ideology of FDR and the New Deal (e.g., . . . how the New Deal changed the relationship between state and federal government)

National Economics High School Standard 8: Understands basic concepts of United States fiscal policy and monetary policy (5) Knows that monetary policy refers to actions by the Federal Reserve System that lead to changes in the amount of money in circulation and the availability of credit in the financial system. (8) Understands that when banks make loans, the money supply increases, and when loans are paid back, the country’s money supply shrinks

Cal iforni a History Soci al Science Sta ndard 11.6: Students a nal yze the di fferent expl anat ions for t he Grea t Depression and how t he New Dea l fundamenta ll y cha nged the role of the federa l government (2) Understand the explanations of the principal causes of the Great Depression and the steps taken by the Federal Reserve, Congress, and Presidents Herbert Hoover and Franklin Delano Roosevelt to combat the economic crisis. (4) Analyze the effects of and the controversies arising from New Deal economic policies and the expanded role of the federal government in society and the economy since the 1930s . . . .

Cal iforni a History Soci al Science Standa rd 12e. 3: Students a nal yze t he influence of the federa l government on the American economy. (4) Understand the aims and tools of monetary policy and their influence on economic activity (e.g., the Federal Reserve).

National World History High School Standard 39: Understands the causes and global consequences of World War I (8) Understands the human cost and social impact of World War I

Nat ional World History High School Standa rd 40: Understands the sea rch for peace a nd stabi lity throughout the world in the 1920s and 1930s. (1) Understands treaties and other efforts to achieve peace and recovery from World War I . .

Nat ional World History High School Standa rd 41: Understands t he causes and global consequences of World Wa r II (1) Understands motives and consequences of the Soviet nonaggression pacts with Germany and Japan (e.g., the Munich Agreement in 1938 . . . .) (6) Understands the argument that the severity of the Treaty of Versailles caused unavoidable revolt against the nations that imposed it.

California History Social Science Standard 10.6: Students analyze the effects of the First World War. (1) Analyze the aims and negotiating roles of world leaders, the terms and influence of the Treaty of Versailles . . . . (2) Describe the effects of the war and resulting peace treaties on population movement, the international economy, and shifts in the geographic and political borders of Europe and the Middle East. (3) Understand the widespread disillusionment with prewar institutions, authorities, and values that resulted in a void that was later filled by totalitarians.

Cal iforni a History Soci al Science Standa rd 10. 8: Students ana lyze the ca uses and consequences of World Wa r II (2) Understand the role of appeasement, nonintervention (isolationism), and the domestic distractions in Europe and the United States prior to the outbreak of World War II.

Nat ional Hi gh School Economics Standa rd 5: Understands unemployment, i ncome, a nd i ncome distributi on i n a ma rket economy. (1) Understands that personal income is influenced by changes in the structure of the economy, the level of gross domestic product, technology, government policies, production costs and demand for specific goods and services, and discrimination. (6) Understands that the standard measure of the unemployment rate is flawed (e.g., it does not include discouraged workers, it does not weigh part-time and full-time employment differently, it does not account for differences in the intensity with which people look for jobs). (7) Understands that many factors contribute to differing unemployment ratesor various regions and groups . . . . (9) Understands frictional, seasonal, structural, and cyclical unemployment and that different policies may be required to reduce each.

Cal iforni a History Soci al Science Standa rd 12 4e: Students ana lyze the elements of the U S la bor ma rket i n a gl oba l setting (1) Understand the operations of the labor market . . . . (2) Describe the current economy and labor market, including the types of goods and services produced, the types of skills workers need, the effects of rapid technological change, and the impact of international competition. (3) Discuss wage differences among jobs and professions, using the laws of demand and supply and the concept of productivity. (4) Explain the effects of international mobility of capital and labor on the U.S. economy.

Standards reprinted with permission: National Standards © 2000 McREL, Mid-continent Research for Education and Learning, 2550 S. Parker Road, Ste. 500, Aurora, CO 80014, (303)337.0990.

California Standards copyrighted by the California Dept. of Education, P.O. Box 271, Sacramento, CA 95812.