7

The stock market is highly volatile, going way up and way down. Many people are holding their money out of the market, and are looking for real estate investments. In the great recession, many turned to single family houses as long term rentals, from your neighbors looking to BRRRR a deal to huge hedge funds

For many reasons we have a shortage of housing stock to buy or to rent, and there is a huge demand for rentals. Many investors across the country have turned to building their own from local investors building a few to hedge funds building entire build to rent subdivisions

One local investor is Dave Lundgren and he is joining us to share his journey in build to rent.

Come learn from how you can get involved..

MAREI's September 13th Monthly Meeting

Landlords of Johnson County Meets on the 1st Wednesday of the Month Get a Legal Update from Attorney Spence Stover

10

Northland Real Estate Investors

Meets monthly on the second Saturday of the month. This month: Property Management

14

Mid America Crime FREE FREE 8 hour training on keeping your rentals crime free, including a workshop on leases and evictions.

20

KC House Trader's White Board Meeting monthly on the 3rd Tuesday.

26

Eastern Kansas Real Estate Investors Meeting on the 4th Monday of the month virtually Covering Lawrence to Topeka

Tuesdays

Home Resource Network

Every Tuesday: Overland Park

Wednesdays

WinVestors

Every Wednesday: Westport & Zoom

Thursdays

Find all of our events on the MAREI Calendar of Events

Cashflow Game Night

Every Thursday: Prairie Village

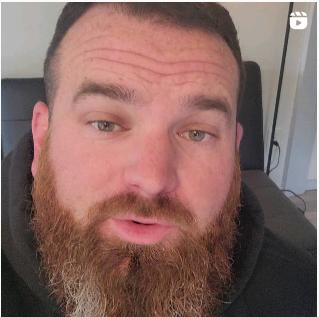

Real Estate Investor, Blogger, Podcaster, Author.

There are a ton of different reasons for you to start a blog. We could talk all day about the reasons a blog is beneficial, but here are my top three reasons you should start a blog today.

You may not believe this right now, but I promise you it is true Hell, I failed English in high school and absolutely hated writing Yet I write almost every day now and think it is one of the best things I have ever done

Writing is amazing for helping you get ideas out of your head and put your mind to rest. You don’t even have to show your blog to anybody for this to be the case I know several people who have a “blog” that is more of a journal, and nobody has ever seen what they write except for themselves

They say if you want to master a subject you should teach it to somebody else. Writing blog posts has the exact same effect. If you really want to understand a topic, write an article about it.

Possibly the most important reason you should start a blog is that it will serve as a central hub for everything you do online!

"You need to start blogging today! Yes, you heard that correctly: I believe that everyone should have their own blog, which is why I decided to write this guide to blogging."

David Pere

FromMilitarytoMillionaire.com

A blog is one place where you have complete control over your platform and what happens with your audience. If YouTube suddenly changed their algorithms and obliterated your revenue, a blog would still be there. This holds true for any social platform.

No matter what your future plans are, a blog is the most necessary piece of the puzzle in my opinion

Don’t jump right into blogging without sitting down and determining what you want the platform to be.

Don’t get me wrong, you could jump into blogging without any idea what you’re doing and just start writing.

That’s exactly what I did, and I recommend you take some time to plan ahead trust me

I basically just grabbed the tiger by the tail at the beginning and enjoyed the ride. This was extremely ineffective, and I don’t recommend it!

You should spend some time and figure out what your goals are with the blog

Do you want to document what you’re doing, use it as a landing page for people coming into your network, or just use it to keep people updated about your life?

Maybe you have no goals with it, and that is fine But it is good to try and plan out your 3 5 year vision for the blog before you begin writing

Once you know what you plan to write about and what you want the blog to look like, you need to determine your Avatar Avatar is just a fancy word that bloggers use to describe your target audience

For example, I know that my Avatar with the Military Millionaire community is 75 85 percent males, between 18 and 40 years of age

Determining who your audience is gives you a great advantage for writing. For example, I would write an article for women over the age of 65 MUCH differently than I do when trying to resonate with a 19 year old male Marine, haha

Do yourself a favor and think this through before planning your content strategy!

What will your content strategy look like?

Will you write for fun, to document life, to boost credibility in your space? Are you looking to create networking opportunities, educate people, monetize your blog somehow, or just write because it is therapeutic?

Depending on your blogging goals, you will have significantly different content.

Ultimately, all of these questions can be boiled down into answering one question:

Once you know the answer to this question, most of the above decisions will just flow naturally.

You have a website name, logo, theme, design concept, and email marketing locked in, and now it is time to start producing content Once you get the kinks ironed out in your website, content becomes king You need to master this and become consistent about pushing content as soon as possible

You have probably seen a lot of listicles online by now. These are the articles like “11 things you need to know about…” or “10 best…”

Collaborations and roundup posts are another great way to drive engagement In these articles you can write about top people in your niche in hopes that they will link back to the article or share it with their audience.

The most important thing you can do when starting a blog is remain consistent

I alluded to this earlier, but you want to focus on topics that people are searching for but that aren’t extremely competitive

Obviously, you want the blog to grow over time Here are some strategies that have helped me grow the Military Millionaire blog over the last two years, and they can work for you as well!

Backlinks are one of the main driving forces behind your growth Other websites link back to your article or page They will grow naturally over time Guest Posts One tried and true way to earn backlinks for your website is to write guest posts for other websites in your niche If you are a real estate blog, and you write guest posts for other real estate blogs, it will help you build authority in your space. Podcasts are a very popular medium for communicating with the outside world right now. There are tons of reasons you should be a guest on podcasts. It will also get you backlinks.

(HINT MAREI is looking for guest authors for blog posts and booking for their PartnerCast)

You know I had to squeeze networking into this article somehow.

You should absolutely be networking with people in your niche all the time The bigger your network is, the more effectively you’ll be able to grow your platform

Networking with other bloggers, YouTubers, and influencers in your niche will open up all sorts of opportunities for you.

Make a conscious effort to reach out to other bloggers in your space and get to know them. I promise you that networking will be one of the most important things you can do for your blog and your real estate business

The moment you’ve all been waiting for!

Can you really make money blogging? The short answer is, yes, you can!

There are more ways to monetize your blog than you can even imagine. Some of these strategies require almost no work at all and are truly passive, while others will require continual improvement and involvement. Click over to Dave’s website (FromMilitarytoMillionaire.com/Guide To Blogging) to dig deeper into all these ways of making money with your blog: Ads, Affiliates, Coaching, Consulting, Courses and Memberships

If you are a real estate investor, there are several indirect ways you can monetize your platform too For example, as your community grows, you will gain more and more credibility. This credibility might lead to people bringing you deals to buy, offering to allow you to partner on deals, asking for you to be a partner with them in order to tackle a deal. It will also open doors to raising additional capital for deals you’re investing in.

There are a ton of indirect ways that you can monetize a blog This is harder to track but can be just as lucrative, if not more so, than the strategies previously described

Ultimately, many industries will have similar opportunities. There are also a ton of other direct and indirect ways to monetize your blogging platform.

No matter what you decide to write about or how you plan to monetize your blog (if at all), there are a few keys to success I want to reiterate

·Consistency

·Networking Collaboration Value

·Double Down When Something Works

Military Millionaire Guide to Blogging

Ultimately, you don’t need to start a blog in order to be successful in life or in business.

However, blogging is a viable strategy to expand your outreach and build a community

If I had never started the Military Millionaire blog, you wouldn’t be reading this, and my platform may not exist on any level

Hopefully this guide to blogging was helpful to you. If you have any questions, jump over to my website and throw them in the comments below, and I’ll be happy to point you in the right direction!

One of the most common questions I get asked is, “What skills do I need in order to become a successful real estate investor?”

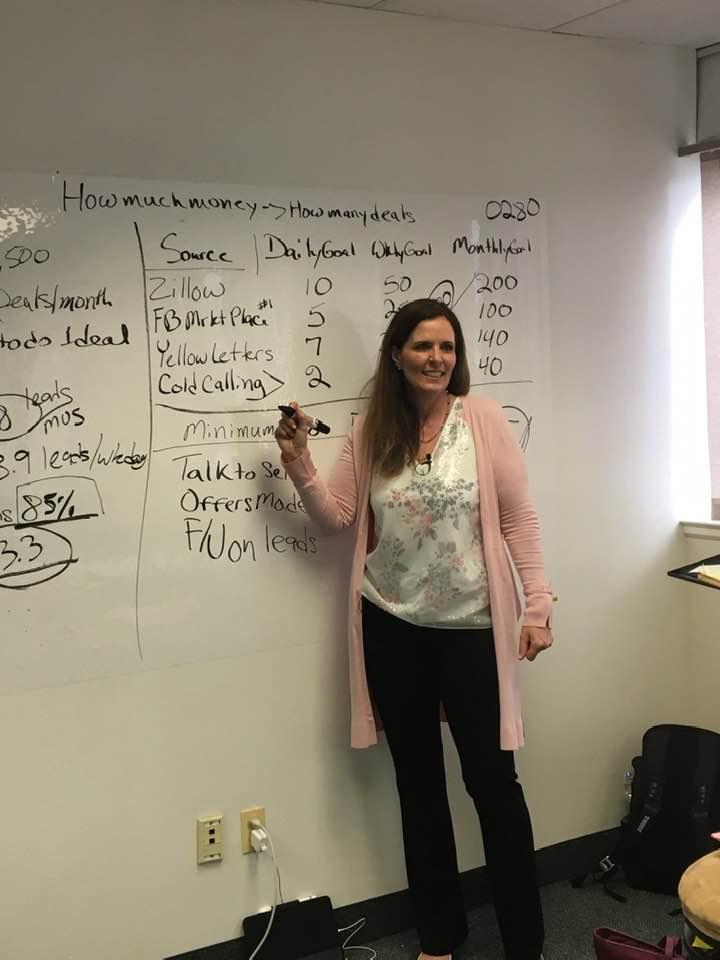

After thinking about this question and discussing it with other experienced, successful real estate investors, there are three main themes that continued to pop up over and over again Most investors attribute their success to marketing for deals, knowing how to be an effective negotiator, and their ability to think creatively.

However, the one skill most investors needed to hone the most was their negotiations. Unlike marketing and creative deal structuring, negotiations seem to be the one skill that most people liked the least. The thing is it doesn’t need to be like that at all!

This may surprise you, but everyone is a born negotiator Yes, you read that

correctly Even you are a born negotiator The problem is most of us, somewhere along the way, stopped negotiating

From the time we are born we are negotiating As an infant you screamed for food when you were hungry As a child you simply screamed when you didn’t get what you wanted, all the way up to those teenage years Just ask any parent out there with a teenager what happens when their newly licensed teenager wants the car, and they say “NO”. Does that teenager go away or does that teenager “double down” and go all in as if their life depends on getting the car Friday night.

Yet, somewhere along the line, usually in our late teens to early twenties, we decide we don’t like to negotiate and would prefer to avoid it if possible It is at this point that we begin to think of negotiations as more of a confrontation

than our ability to communicate with our counterpart In the case of real estate investing, our counterpart is typically the seller

What if I could give you three simple strategies to change all that? As I said, there are very few people who actually like to negotiate If you are anything like me, I hated negotiations In fact, at one time I saw negotiations as more of a task to be avoided or completed as quickly as possible or even worse, handed over to someone else. It wasn’t until I understood that negotiation had more to do with communication and less to do with confrontation or competition.

Once I figured out that all negotiation skills are is communication skills it changed everything. Whether you are a timid negotiator or a competent skilled negotiator there are three very basic skills you need to know to become a

skilled and more confident negotiator.

Since a negotiation is all about communications it’s no wonder that listening is the first thing you need to master However, this doesn’t mean that listening is the easiest skill for you to learn You need to listen to understand which is quite different from what most of us do, which is listening to respond

Instead, learn to shut off that inner voice going off in your head If we are too focused on trying to come up with a reply for what the seller is saying, we will miss valuable bits and pieces of information. It is in these hidden nuggets that we get a better understanding of what our seller’s needs are. Once, we understand our seller we can work with them and even help them to create an offer that best suites our and their needs. Giving the seller “the relief” they really seek.

“Zip It!” isn’t just a clever phrase an exasperated parent or teacher told us as a child Tied right along with listening to understand, is silence The majority of people out there are uncomfortable with silence This is probably more true today then ever before Yet, it is through silence that the magic in negotiations is possible

I’ll be honest, silence is uncomfortable, especially when sitting face to face or across from a seller Use that uncomfortable silence to your advantage. If I were to tell you, you can save yourself an extra $50,000 on that property or even an extra $5,000 from that contractor simply by asking a question and remaining silent, would you, do it? Of course, you would.

That seller or contractor doesn’t like silence any more than you do. So, what

do you think happens when you’re silent? The person you are negotiating with will start to fill in that silence for you If you really struggle with that uncomfortable silence like I did, just count to ten very slowly What I learned is you will almost never get past five before the other party starts to chime in

The third most important thing you must do is get comfortable with “NO” The problem with most negotiations is we begin each negotiations fearing the word “no” However, how many of us experienced investors have had a seller tell us “yes”, but once we leave we can’t reach them, or worse, we have a signed contract and the seller calls title and demands escrow be cancelled. In other words what we thought was a “Yes”, was really a counterfeit “yes”.

When you give the seller permission to say “no” you are getting past trivial issues to the real issues. You and the seller can have decision based

negotiations. What is left to negotiate when you get a “yes”? Nothing, the seller has agreed, but when you don’t first uncover all the seller’s objections and give them permission to say “no” you end up with a counterfeit “yes” instead of the “heck yes” you really want It is the no’s that led up to the “heck yes” and your ultimate payday

Negotiation is a skill all of us were born with Negotiations don’t require any special talent, just a willingness to practice and get better at it In your next negotiation remember to listen to understand, use silence (don’t fill in the quiet with unnecessary chatter), and give your counterpart (seller) permission to say “no”. I guarantee this will be a game changer, not just for your real estate business, but when you buy your next car or even when dealing with family, friends, and colleagues.

Join me at MAREI in November to brush learn more

Dynamic Deal Structuring strategies to profit from any deal Learn beginner to advanced money making strategies. Master the steps to understanding your seller's real estate problems Making Offers The one thing that is missing from 99% of most real estate investor's offers. Why most investors are failing to get their offers accepted. Supercharge your real estate investing with the most proven way to start making money in real estate without cash or credit

Maria Giordano is a full time real estate investor. She initially got her start doing fix n flip properties, then moved to buy and hold and later to spec builds and land development In a former life, Maria was a trauma nurse working days, nights, weekends, holidays and not seeing much of her family. She learned early on that real estate was the answer, creating wealth, cash flow, income and time with her family She is teaching the exact blueprint she used to quit her job in less than 6 months.

By Kim Tucker

By Kim Tucker

Talk to anyone who has been in real estate for 10 to 20 years and they will tell you that the market is changing rapidly A few are jumping up and down with giddy anticipation as the “DUMB MONEY” is getting out of real estate and I guess going back to their day job

Last night I sat in on a conversation between two very veteran real estate investors

On one side we had Vena Jones Cox who has been in real estate since she was in diapers as her father was an investor On the other side we had Robyn Thompson who has been investing for at least the past 30 years They’ve seen a cycle or two and their topic was the what Wholesalers and Rehabbers need to know to survive in the new market But because both use several other strategies, the touched on the entire real estate market at large

I missed the first 5 minutes I am guessing they started with the decision of are we in a recession right now or are we headed for one I got the feeling from the conversation was that the answer was yes we are headed for one if we are not there already

Before we go on, for those that don’t know, a recession, according to the Oxford Dictionary “is a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP (Gross Domestic Product in two successive quarters ” Wikipedia gives us a better feel with “ a business cycle contraction when there is a general decline in economic activity Recessions generally occur when there is a widespread drop in spending ” Yet another definition mentions a “significant rise in the unemployment rate

So, are we in a recession right now?

Forbes says we went into one in the summer of 2022 In recent history we were also in a recession from July 1990 to March 1991, but I was just graduating High College and didn’t watch the news, so I missed that one The next one was March 2001 to November 2001, and again I was busy with life and missed that one as well The next one was December 2007 to June 2009 and we all remember that one, triggered by the sub prime mortgage crises, we saw massive job loss, massive foreclosure and some real estate investors lost everything Others made millions The next one came in February 2020 to April 2020 and was one of the shortest on record because the government started handing out a ton of free money and we all spent it online and on our houses, and on more houses and on more houses

The question between Vena and Robyn was not are we, but how bad is it going to be All the people I follow think it will be bad, but not 2007, 2008, 2009 bad Banks are not going to collapse because we had all the new regulations put in place by the last big one House prices are not going to tank quite the same way because we don’t have a glut of houses but an extreme shortage Vena was in this camp But Robyn sees it being worse, maybe still not great recession bad, but worse than what the experts I follow think Why? Well small banks are not going to collapse due to foreclosure but due to people not borrowing With the rising interest rates, people are not going to refinance out of their super low interest rates And with the economic uncertainty, people are not going to be buying bigger and badder houses, they are going to stick with what they have

Both ladies were pointed back to 2012 and before the great recession First Time Home Buyers will be buying houses because they don’t have one But they are going to want a good deal if they are going to have to DIY it or they will be super picky and want a fully rehabbed house if they are going to buy at market So rehabbers, no more half assed rehabs You gotta do it right

Robyn who rehabs to sell to retail buyers is keeping her focus on cookie cutter bread and butter first time home buyer houses What’s that?Well here in Kansas City, that is going to be a house in the $150 to $250 price range, with 3 to 4 bedrooms, at least 1 and a half bathrooms, a basement and a garage Keep in mind that with the rising interest rates the buyer that could afford that $350,000 house now is looking more at a $275,000 house and may have to put more money down So they don’t have the extra cash to fix things after they buy

Vena who wholesales to landlords and is a landlord herself, has observed in the past quarter than lenders that lend to investors have tightened standards If they are still lending to buy and hold investors, they want more money down Combine more money down and the much higher interest rates and it means that the buy and hold investor wants that house that does not need a huge rehab because they can’t afford it sitting vacant for 4 to 6 months, they want it cash flowing asap

What will they pay for houses?

What is the magic formula going forward, how much should we be paying for houses We all know or should now the MAO, maximum allowable offer formula or the 70% rule That flippers should pay no more than 70% of the ARV (after repaired value) minus repairs

So, if the house is worth $250,000 all fixed up And it will cost $70,000 to fix it up, the most a rehabber should pay would be ($250,000 x 70%) $70,000 = $105,000

Remember that rule, that we have all ignored for the past 3 to 5 years Or if we followed it we pushed that $250,000 to $300,000 and then got lucky and sold the house for $350,000 Those days are gone

Robyn is focusing on building brand new houses in Branson Canyon and not doing a lot of rehabs But she is advising students to be stick to the bread and butter house, no outside the box or weird Where you can rehab it right And you need to use a conservative ARV based on recent numbers not last year or 9 or 10 months ago and you need to be solid at the 70% and not stretch it

Vena shared that many of her rehabber investors have been at the conservative ARV and 70% for a while That means wholesalers, you need to be buying a less than 70% and you really, really need to know how to work your numbers She also shared that because of the amount down that banks are starting to want for the buy and hold investors, that some of her investors want to buy at 50%

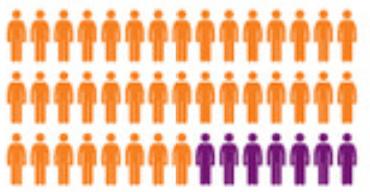

The next big aha, which had half the 250 people on zoom jumping up and down was the comment that the DUMB MONEY was getting out of the market The wholesalers that were offering too much for a house, and the rehabbers that were paying too much but saved by the fact that the house appreciated $50,000 while they were rehabbing are not going to be around much longer Who is that going to leave, the long term, experienced investors, who have been biding their time

Who will be buying houses as we shift into the new market?

Those with the cash to buy that they have been hording for a while There have been quite a few investors that have been sitting out of this hyper inflated market, living off rental income or other forms of income and saving their marketing efforts

Those who sold off all their rentals in areas that became unfavorable towards landlords There are quite a few of those that cashed out in Kansas City Missouri in the past two years

Those with access to private partners and private money So those who take the

time to build those relationships like we will be learning from David Pere in October

Those that can still get bank loans with the tighter standards Those who get a good BRRRR deal at the right LTV and can refinance out, like we learned from Andrew Syrios a few months ago

Those who know how to put together a creative deal buying houses subject to those super low interest rates from the past few years or with seller financing from all those people who own their homes free and clear, we will be learning this from Maria Giordano in November

Is there any bright side to all of this?

Cost of materials are down and the access to labor is getting better Why?

Homeowner Renovations have stalled All those folks that were getting stimulus money or refinancing to renovate their homes over the past few years, are not going to be doing that anymore Freeing up a lot of labor and materials

New Home Builders, at least a large majority of home builders are taking a wait and see approach They have the lots and the permits, but are not sure who is going to be buying So they are not breaking ground Although a few with entire subdivisions to build out are calling up the build to rent hedge funds to see if they might work together I have been reading that this maybe the new trend, new home builders partnering with the major landlord who are building

What about a few other niches ?

Airbnb was a big one that they talked about last night Robyn, if you don’t know is way big in Airbnb She is reporting that lenders are being way more cautious here and some have stopped lending for short term rentals But she is betting the farm that people will still travel and vacation, just on a smaller scale in this recession I attended her Airbnb bootcamp and she shared that her thought was that the average American will still go on vacation, but to a place where the housing is lower cost, where the ticket

prices to do things is much cheaper She said it makes sense to own Short Term Rental in Branson where you can rent for $150 a night and all the Branson activities are rather low cost over a luxury rental in Orlando where the cost to do anything at any of the amusement parks there is very high cost She would also look for short term rentals in regular areas near hospitals

Rentals, our experts didn’t spend a lot of time on the rental market other than the fact that landlords will still be renting houses and still adding to their portfolios, just in a more conservative matter But the Rental Housing Journal that hit my email last week shares that Nationally, rents have declined for a second month in September, but they attributed this to the seasonal trend as there is less demand every year once school starts

A Quote from that article in the RHJ states that “It’s worth noting, though, that rental vacancies are intertwined with housing availability in the for sale market, and it’s possible that spiking mortgage rates are dampening the rebound in the rental vacancy rate High interest rates can sideline potential first time homebuyers and keep them in the rental market longer Two years of sustained rent inflation may also be incentivizing renters to stay put and renew existing leases rather than looking for new ones ”

What should we be doing as real es investors to prepare?

I didn’t get an answer particularly to question, but in reading between the lines I have a few take aways:

Be Cautious over the next few month acquisitions, have more than one exi strategy Can your flip be rented, lea option, sold with seller financing?

Brush up or actually learn how to run comps and estimate repairs and to d that you need to build relationships experienced investors, realtors, lend and contractors

Find access to cash, yours, a banks, partner’s, a private lender’s, which a takes building relationships

Wholesalers, need to build a buyers list of experienced buyers

Brush up or learn how to buy creatively

Learn how to market for motivated sellers with out cold calling or texting

So make sure join us here at MAREI over the next few months as we will be covering almost all the things you need to do and hit up our replays to catch what you ' ve missed

Generate highly targeted Marketing lists of properties that meet your specific investment strategy. Choose numerous property types such as MLS active, expired and failed listings, pre foreclosures, foreclosures, involuntary liens, cash buyers, high equity, vacant, free & clear, bankruptcy, divorce, auctions and more. Then combine your search with hundreds of filter options including ownership, lien, foreclosure, equity, mortgage status and more.

After you have your list skip trace it to get e mail addresses, landlines and cell phone numbers

Market directly to your prospects with PropStream's built in marketing features! Customize and send postcards, email campaigns, deploy in browser online advertisements, create website landing pages, and even send voicemails directly to your prospects cell phones and digital landline voicemail without ringing their phone!

As the real estate market shifts and the days of multiple offers over list price in the first 24 hours go away As prices decline The ability to profit from a deal despite paying way to much for a property will go away

And while you can adjust your amount offer based on the strategy you are using, knowing how the maximum allowable offer works is vital So we have turned to a few lines from one of the training courses we have on our shelf from Tom Zeeb

Knowing whether or not it is a deal comes down to knowing just three critical numbers:

1) After Repair Value (ARV)

2) Repair Cost

3) The very least the seller will accept

Once you have these three numbers, you can easily and quickly determine if a deal is really a deal In general , you determine After Repaired Value from comps (comparable sales values from MLS). Repair costs from learning how to estimate repairs, and the very least a seller will accept, you find out from good negotiating

For you to make a profit as a wholesaler, you need to have a purchase price with the seller for less than what your investor buyer is willing to pay How much less will determine what you make Don't cut into the buyer's profits or it won't be a deal because you won't find a willing buyer The minimum amount you want to make as wholesale profit will determine your MAO Don't go over this number when negotiating with a seller or it won't be a deal If you've market your deal to your buyers and no one wants to purchase it, then it probably isn't really a deal You may have made a mistake in the comps or the repair estimate

In general, in many parts of the country, if the After Repair Value (ARV) of a property is $100,000 or less, then buyers (real estate investor buyers) want to buy at 70% of ARV minus repairs

This formula allows them to easily account for holding, closing, and other costs as well as a margin of error and profit

If you are in a part of the country where values are much higher than $100,000, or if the market has changed dramatically, then some adjustment to the formula may be needed. In some markets I use 65% instead of 70 to account the change in formulas buyers are using to buy How do I know when or how to adjust? Simple I other investors in that market what formula they are using and adjust as needed

The 70% Rule or MAO is a starting point If you are using a creative purchase strategy or are buying to hold, you might start your calculations with MAO but also factor in other formulas that account for Cash Flow, ROI, Debt Service, Interest Rate and More

Coleman Accounting Service

Bob Coleman

ColemanAcctg com

913 787 0308

Attorney Anderson & Associates

Julie Anderson & Jamie Walker

MOKSLaw.com

816 931 2207

See site for Free Forms

Attorney Spence Stover

StoverLawFirm.com

(816)778 2992

Building Supplier

DeMayo Enterprises

Wholesale Cabinets

Mark Yanda www.DeMayoEnterprises.net

913 980 4260

Earthwise of KC

Windows & Doors

James White

EarthwiseKC com

913 777 4862

Home Depot

2% Rebate for Members

20% off Paint

www.HomeDeopt.com

Fireplace / Masonry

Gene Padgitt

ChimKC com

816 461 3665

Olson Foundation Repair

Foundations

OlsonFoundationRepair.com/ (913) 592.3300

Home Buyer

kcmoHomeBuyer.com

Kim, Don, & Scott Tucker 816 408 3600

Inspections

Triton Property Consulting

Michael Coppoc

MikeandZachInspectors com

816 491 3483

Insurance Agema Insurance

Fred Dickinson

www AgemaIns com 913 543 8116

Arcana Insurance Insurance for Investors

NREIA.ArcanaInsurance HUB.com 877.744.3660

Rauber Insurance Agency

Farmers Insurance

LoveIsOurPolicy com (816) 436 1016

IRA Self Directed

CNB Custody

Jenny Heiman

www.CNBCustody.com 800 680 0340

Equity Trust Company

TrustETC.com/NationalREIA 844 732 9404

Quest Trust Company

Kurt Power QuestTrustCompany com

281 492 3434 x 3644

Lending

Crossroads Investment Lending

Hard Money

Britton Asbell

KCLend.com

913 295 8083

Finish Line Funding

Short Term Funding

Bruce Belanger

FinishLineFunds.com 913 346 8090

H E M A R E I P A R T N E R C A S T

Flat Branch Home Loans

Mortgage Banker

Beth Langston

FlatBranchHomeLoans com

816 679 4000

Ground Floor USA

Crowd Sourced Short Term Loans

Todd Russell

www GroundFloor us

316 320 6109

JM Real Estate Capital

Andy Kozycz

www.JMRECapital.com

727 390 7560

Newieco

Private Money

Jeff Newhard (816) 721 9869

Merchants Mortgage

Mushy Money

Susan Aubin

MerchantsMtg.com

913 522 2650

North Oak Investments

Hard Money

TJ Nigro

NorthOakInvestment.com

816 616 3157

Marketing

Carrot

Websites & Online Marketing

www MAREI org/InvestorCarrot

PropStream

Build Marketing Lists

& Research properties

www.MAREI.org/PropStream

Investor Marketing Platform

Websites, CRM, Automation

FREE Trial

MAREI.org/REIBBFREE

REIPro

Investor Marketing Platform

Lists : Direct Mail : CRM

www MyREIPro com/NREIA

Discount Code 66209PRO

Office Supply

Office Depot / Office Max

ODP Solutions

www.OfficeDepot.com

Discount Link & Card in Member Discounts

Property Manager

Brown Bear KC Real Estate Services

Tyler Shirk

BrownBearKC.com

816 465 1252

Evernest

Christina Erickson Hoffman

Evernest.co

816 806 1100

Home Rental Services

Paul Branton

www.Home4Rent.com

913 627 9543

M & M Property Pros

Michael & Michele Belman

www.MMPropertyPros.com

816 490 6745

PMI Destination Properties

Ryan Kernicky

www PMIDestination com

913 583 1515

Property Management Software

Buildium

www.MAREI.org/Buildium

Realtor Crown Realty

Rich Melton

RichMelton.CrownRealty.com

913 215 9004

Realty Resource

Scott Tucker RealtyResourceKC com

916 406 0701

Screening Rent Perfect

Tenant Screening Plus

www.RentPerfect.com

877 922 2547

Discounts www MAREI org/RP

Title Company

Accurate Title Company

Dave Green AccurateTitleCo.com

913 338 0100

Rick Davis Title

Rick Davis

RickDavisTitle.com (913) 374 7254