4 minute read

Me Being a Nimrod

The most powerful document in real estate investing is the option agreement. Sadly, the least used and most misunderstood document in real estate also happens to be the option agreement. Why don’t more folks know how to effectively use options to control property? Probably because there are so few investors who have experience using options.

by Bill Cook

Advertisement

I hate being an idiot, but when you screw up like I just did, it qualifies me to be the biggest nimrod in the land!

The most powerful document in real estate investing is the option agreement. Sadly, the least used and most misunderstood document in real estate also happens to be the option agreement. Why don’t more folks know how to effectively use options to control property? Probably because there are so few investors who have experience using options.

Most folks have heard of Lease Options, but what about Purchase Options, Performance Options and First Right of Refusal Options, to name but a few? An option is a right, but it’s not an obligation. Let me explain: If you’re selling your house and we sign a Purchase and Sale contract, I’m contractually obligated to buy your property and you’re contractually obligated to sell me your property. If

either one of us refuses to perform, there’s a fair chance attorneys may get hired –cha-ching!

On the other hand, if I buy a Purchase Option from you, it gives me the right to buy your property for the agreed-to price and terms…but you can’t force me to perform! However, you ARE obligated to sell me your property for the agreed-to price and terms, if I choose to exercise my option. Think about it: Doesn’t using an Option to control a property sound a whole lot safer than using a Purchase and Sale contract?

Let’s get back to me being a nimrod. 201 0, Kim and I bought a threebedroom, two-bath home on Hamilton Crossing in Cartersville, Georgia for $2,1 00. The home needed a huge rehab.

We sold it a few weeks later for about $1 8,000 and gave owner financing with monthly payments of $375 per month. The buyer was an experienced contractor who planned to rehab and then move into the home.

An option is obligation. increased to $40,000! (Remember 2010)

Fast forward to 2015.

The homeowner fought the law and the law won. He was then forced to relocate to an eight-bytwelve foot jail cell. This caused him to quickly fall behind on his home payments. Before we could foreclose, he sold his property for $1 7,000 and paid off the mortgage we were holding.

Question: What if I had had the right to buy this $40,000 property back from the seller for the seller’s $1 7,000 asking price?

Wouldn’t that have been a smart business move? Welcome to the world of First Right of Refusal Options.

Normally, when Kim and I sell a property, as part of the terms of the sale, we get a First Right of Refusal Option from the buyer.

An Option is a Right, but it’s not an Obligation

This means that if the new owner ever decides to sell his home, whatever price and terms he and his buyer agree to, the seller must first ask us if we’d like to step into the agreement (as buyer) that he and his potential buyer worked out.

If we say yes, we buy according to that price and those terms. If we say no, the seller sells to his buyer, no muss and no fuss, and our option is cancelled.

In the Hamilton Crossing case, if I had done my job right instead of screwing up, before the owner would have been allowed to sell his property for $1 7,000, he would have first had to offer it to us for that price…and believe me, we would have exercised that option in a heart beat!

Going back to when we first sold this property, why didn’t we do what we normally do and get a First Right of Refusal Option?

Simply put: I didn’t want to take the time to write one up. Can you believe that? This mistake cost Kim and me tens of thousands of dollars –and Kim is none too happy with me!

Now do you see why I was an idiot? There are so many ways for real estate investors to make money –don’t limit yourself to just one. Keep learning new creative ways to structure your deals!

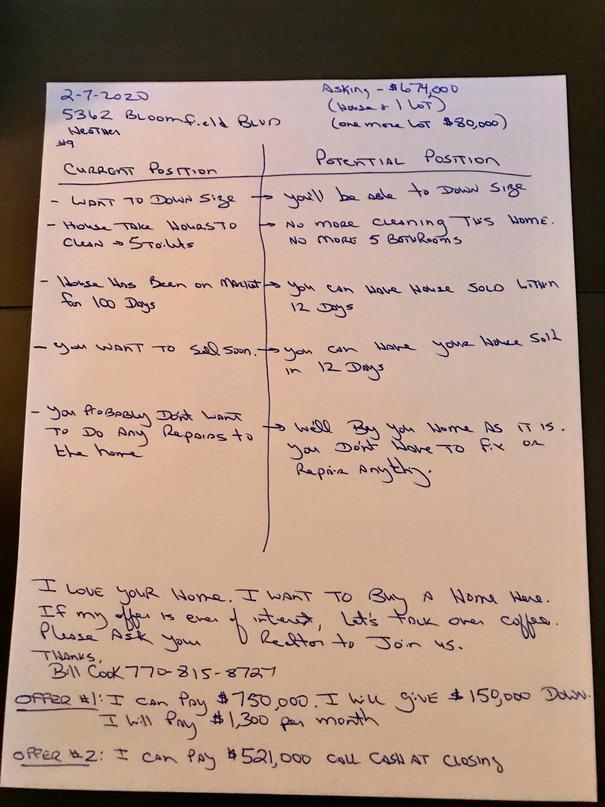

I will be sharing a few options and how to use Canvas Cards and T Bar offer pictured below among other things at my workshop on Saturday June 1 3th here at MAREI. I hope you can join me, I've learned a lot more in 201 0 and wouldn't you rather learn from my mistakes so you can avoid them?