3 minute read

Qatar National Convention Centre (QNCC)

Credit cards: Widely available with all the usual privileges, with the credit limit determined by the cardholder's salary or savings balance. Family members may also be eligible for a card. Check at the time of applying for issuance and renewal fees, conversion charges, and payment options. Customers should notifiy their bank when travelling overseas and wishing to use their credit/debit cards. Since 2014 all card transactions made using the magnetic stripe inside and outside of Qatar will be declined. However, as certain countries (eg the US, India and the Philippines) still use the magstripe for transactions, customers should activate their card before travelling. Offshore banking: Offshore banking can be a secure anchor for an expat's finances while out of their home country. Check with local banks for availability of international bank accounts in USD, GBP, or Euros. Complaints: Unresolved consumer complaints can be made online to QCB's Consumer Protection Department. qcb.gov.qa Under Law No 13 of 2012 QCB and the Regulation of Financial Services, only local insurance providers are permitted to underwrite any kind of risk against properties in Qatar. Decision No 1 of 2016 issued by the Governor of QCB provides instructions related to licencing, regulation and controls, risk management, accounting, and other requirements. Listed companies must have capital in excess of QAR100 mn or a risk-based capital, while unlisted companies must have capital higher than that set by QCB or their risk-based capital. QCB continues to regulate and develop the insurance market under the Second Strategic Plan for Financial Sector Regulation 2017–2022. Decision No 7 of 2019 sets out further instructions for licensing, organising and supervising the services of supporting insurance providers. It sets out the competencies and expertise, the nature of the work, areas of responsibility and functions, and the establishment of professional and ethical codes of conduct.

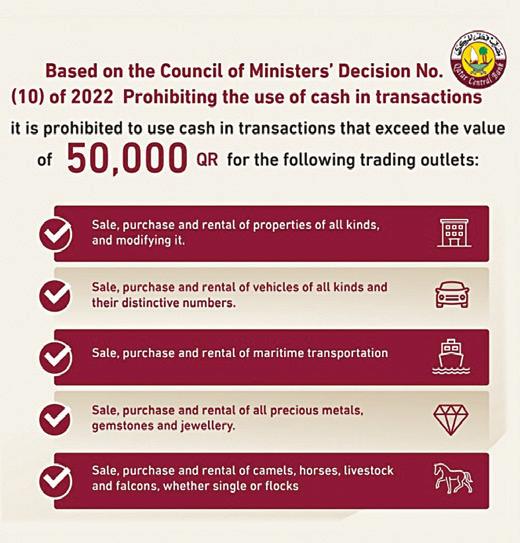

Cash transactions above QAR50,000 prohibited! Council of Ministers' Decision No 10 of 2022 prohibits the use of cash in transactions of more than QAR50,000. All such transactions can now only be made via credit card, debit card, cheque or bank transfer. It applies to the sale, purchase and rental of all types of properties, in addition to their modifications. The law also restricts the use of cash to purchase vehicles of all kinds, maritime transportation, all precious metals, gemstones, jewellery camels, horses, livestock, and falcons, whether single or flocks. The move comes as part of efforts to combat money laundering and terrorism financing, as well as a move towards a cashless society.

Financial Services and Insurance

Financial services are provided by entities registered with the Qatar Financial Centre (QFC). Insurance products are widely available from local and international companies (see Living in Qatar). Islamic Finance

Current Islamic institutions include Dukhan Bank, International Islamic, Masraf Al Rayan and Qatar Islamic Bank. Qatar First Bank – regulated by the QFC Regulatory Authority – is the first independent, Sharia compliant investment bank. Banks were required by QCB to separate their Islamic and conventional lending operations by 31 December 2011. Islamic banking by other conventional banks is now barred from Qatar's market. QCB took this action due to certain supervisory and monetary issues, namely that holding both Islamic and non-Islamic deposits incurs different risks and reporting methods. Law No 13 of 2012 requires that Islamic banks must have a Sharia board with at least three qualified members approved by the shareholders. Neither they nor members of their family may be employed or hold shares in the entity. Institutions and services must abide by regulations set out in the Holy Quran and Sharia (Islamic Law). Charging riba (interest) is haram (forbidden). Islamic banks charge fees for services and engage in profit sharing, enabling them to offer comparable facilities to those of conventional banks. Under a mudharabah (profit sharing) contract, the rabbul maal (owner of the money) authorises the bank to invest funds as per Sharia to make justifiable returns. Other concepts of Islamic banking include wadiah (safekeeping), musharakah (joint venture), and ijarah (leasing). Bai (saving) is halal (allowed). m