41 minute read

Workplace Relations

JOBKEEPER AND APPRENTICE WAGES INCENTIVE EXTENSIONS

JobKeeper Extension

The Federal Government has announced that the JobKeeper scheme will continue until 28 March 2021 with amendments to the current scheme to take effect from 28 September 2020.

The existing JobKeeper scheme will continue until 27 September 2020 where each eligible employee receives $1,500 gross per fortnight. From 28 September 2020, the JobKeeper extension scheme will continue over two periods (the first period from 28 September 2020 to 3 January 2021 and the second period from 4 January 2021 to 28 March 2021) and on a tiered system based on the average number of hours that each employee worked prior to 1 March 2020.

Business Eligibility

The current JobKeeper system requires businesses to provide a one-off turnover test of a 30% reduction (or 50% reduction, if aggregated turnover is more than $1 billion) in GST turnover. The two extension periods of the JobKeeper scheme will no longer have a reference to the ‘projected GST turnover’. Instead, the eligibility test will depend solely on whether the actual GST turnover in those quarters has fallen by the required percentage compared to the same quarters in 2019. This means: • For the first period from 28 September 2020 to 3 January 2021, businesses will need to demonstrate that their actual GST turnover has fallen by the required 30% in both quarters ending 30 June 2020 and ending 30 September 2020; and

Meet Sharlene. She’s a good person to know for insurance.

Insurance: Business | Trades | Contract Works Farm | Strata | Home

WFI is a proud alliance partner of MPAQ. Insure with WFI and you’ll deal directly with a local area manager who will take the time to understand you and your insurance needs. So, for personal service that comes to you, contact your local WFI Area Manager, Sharlene Smith.

Sharlene Smith | WFI Area Manager 0427 194 033 | sharlene.smith@wfi.com.au | wfi.com.au

• For the second period from 4 January 2021 to 28 March 2021, businesses need to demonstrate fall in GST turnover in each quarter ending 30 June, 30 September and 31 December 2020.

JobKeeper Payments

The JobKeeper extension payments will gradually reduce over the two extension periods and the amount of JobKeeper payment will depend on the number of hours the employee worked either before 1 March 2020 or 1 July 2020.

The amended JobKeeper payments are as follows: First JobKeeper Second JobKeeper Extension Extension

28/9/2020 –03/01/2021 04/01/2021 –28/03/2021

Tier 1 Employees

• Eligible employees who worked for 80 hours or more in the four weeks of pay periods before either 1 March 2020 or 1 July 2020; and $1,200 gross $1,000 gross • Eligible business participants per fortnight per fortnight who were actively engaged in the business for 80 hours or more in February and provide a declaration to that effect.

Tier 2 Employees

This rate is expected to apply to: • any other eligible employees and eligible business participants that $750 gross per fortnight $650 gross per fortnight are not considered Tier 1.

The wage condition will continue to apply so employers will need to ensure they are paying the correct amount to employees and the payments from the ATO to the business will continue in arrears.

Apprentices and Trainees Wage Subsidy Extended

The Australian Government has further announced that the apprentice and trainee wage subsidy of 50% of an eligible apprentice or trainee’s wages will be expanded to include medium-sized businesses who had an apprentice in place on 1 July 2020 and that the scheme will be extended until 31 March 2021.

A small business may be eligible if: • The business employs fewer than 20 people; or • The business has fewer than 20 people but is using a Group Training

Organisation; and • The apprentice or trainee was undertaking an Australian apprenticeship with the business on 1 July 2020. Claims prior to 1 July 2020, will continue to be based on the 1 March 2020 eligibility date.

A medium-sized business may be eligible if: • The business employs fewer than 200 people; or • The business has fewer than 200 people but is using a Group Training

Organisation; and • The apprentice or trainee was undertaking an Australian apprenticeship with the business on 1 July 2020.

Any employer (including all small, medium, or large businesses and Group Training Organisations) who re-engages an apprentice or trainee displaced from an eligible small or medium business may also be eligible for the subsidy.

The extension of these subsidies is a welcome relief for businesses.

Please note: These details were correct at time of printing, and they may be subject to change. If you have further queries, please contact our workplace relations team on 07 3273 0800.

Article written by Emma Ross, HR Advisor, MPAQ

EMPLOYEES VS SUBCONTRACTORS: HOW TO DETERMINE WHICH WAY TO ENGAGE A PERSON

Determining the best way to engage a person whether it be through an employment arrangement or through a sub-contractor arrangement can be a challenge, and, unfortunately, there is no one deciding factor.

The decision of how to engage someone is instead based on the situation as a whole of each individual circumstance. Simply detailing in a contract that the person is a subcontractor, or because the person has provided their ABN that they are automatically a sub-contractor, is not sufficient to make the engagement a sub-contractor arrangement.

The Fair Work Act 2009 and the Independent Contractors Act 2006 provide protections for both employees and sub-contractors (also termed independent contractors), but it is up to the business to make the right decision as to the type of engagement, which must be based on the actual practice and agreement that is made. For example, if a person is required to work a 38-hour week, wear the business uniform, is paid on a regular basis (i.e. weekly on a Wednesday), and are told how and when to do the work, then this type of relationship would be an employment relationship.

The risk of getting it wrong can cost your business thousands of dollars in not only making the required back payments to someone (i.e. superannuation back payments) but also in penalties for breach of legislation, such as a breach of the Fair Work Act 2009, which imposes penalties of up to $12,600 for an individual (such as a director) and up to $63,000 for the business per contravention.

Under the Fair Work Act 2009, an employer cannot engage in a sham contracting arrangement where an employer attempts to disguise an employment relationship as a sub-contracting arrangement. Further, an employer cannot: • Misrepresent an employment relationship or a proposed employment arrangement, as a subcontractor arrangement; • Dismiss or threaten to dismiss an employee for the purpose of engaging them as a subcontractor; or • Make a knowingly false statement to persuade or influence an employee to become a subcontractor.

Often employers engage in sham contracting arrangements to avoid paying employee entitlements, such as leave, overtime, regular hours, superannuation, workers compensation, etc. However, in some subcontractor arrangements, such as wholly or principally for labour, the principal contractor is still responsible for providing superannuation, and for contracts of service there is a requirement to provide workers compensation even for the subcontractor.

The Fair Work Ombudsman has outlined that Sham Contracting is a highpriority area of focus for this financial year. They have inspectors dedicated to cracking down on businesses engaging in such arrangements; therefore, it is important to have each person engaged correctly with your business.

The following table^ provides a summary of some of the differences between employees and subcontractors and has been developed by the Fair Work Commission based on the case of Abdalla v Viewdaze Pty Ltd t/a Malta Travel (2003) 122 IR 215 and these details were further updated in the case of Jiang Shen Cai t/a French Accent v Do Rozario (2011) 215 IR 235.

To be Generally Considered an Employee

Employer exercises, or has the right to exercise, control over the manner in which work is performed, the location and the hours of work, etc. Employee works solely for the employer*. Employer advertises the goods or services of its business.

To be Generally Considered an Independent Contractor

Worker controls how work is performed.

Worker performs work for others, or is genuinely entitled to do so. Worker has a separate place of work and or advertises his or her services to the world at large. Worker provides and maintains significant tools or equipment.

To be Generally Considered an Employee

Employer can determine what work can be delegated or sub-contracted out and to whom. Employer has the right to suspend or dismiss the worker. Employer provides a uniform or business cards.

Employer deducts income tax from remuneration paid. Employee is paid by periodic wage or salary. Employer provides paid holidays or sick leave to employees. The work does not involve a profession, trade or distinct calling on the part of the employee. The work of the employee creates goodwill or saleable assets for the employer’s business. The employee does not spend a significant portion of their pay on business expenses.

To be Generally Considered an Independent Contractor

Worker can delegate or sub-contract any work to other persons to complete.

Contract may be terminated for breach.

Worker wears their own uniform or other clothing of their choice. Worker has own business cards. Worker responsible for own tax affairs.

Worker provides invoices after the completion of tasks. Worker does not receive paid holidays or sick leave. The work involves a profession, trade or distinct calling on the part of the worker.

The worker creates goodwill or saleable assets for their own business.

The worker spends a significant portion of their remuneration on business expenses.

*generally referring to full-time employment—some employees may choose to work additional jobs.

The above table is not exhaustive and whether a worker is an employee or contractor may be determined by a factor other than those listed above.

To further assist in determining how someone is engaged, the ATO has developed an employee/sub-contractor decision tool. Although it is not a decisive indicator, it can provide a decision for the engagement of someone based on the information the business inputs into the decision tool.

Additionally, please contact our HR team on 07 3723 0800 for further general assistance.

^Source: www.fwc.gov.au/general-protections-benchbook/sham-arrangementsdivision-6

SCAM WARNING: THIRD-PARTY PAYMENTS

Following a recent surge of reported cases, MPAQ wants to ensure members are on the lookout for possible scams targeting businesses. One of the most common scams we have seen recently is what’s known as the “third-party scam.”

The third-party scam involves the fraudster contacting a business owner who’s offering a service—like a plumber—asking to add an additional cost onto the fee for the services and charge it to their credit card. Usually, the additional fee is introduced to the conversation after a few emails have been exchanged and the reasoning given by the fraudster is usually that they need to pay a third party who doesn’t accept credit card payments.

In a recent example from a member, a fraudster (Mr. A moving forward) contacted the business asking for a quote on a hot water install-site unseen. Mr. A would only communicate over email because they indicated that they were hearing impaired. While an address was provided, Mr. A stated that the plumber wouldn’t be able to see the property because they were going into surgery to have their hearing loss repaired.

Once a price was provided, Mr. A advised that the plumber could gain access to the property on the same day that movers would be there and the movers would hand over the keys to them. Mr. A then requested that he pay the plumber an additional $2,000, which would then be given to the movers because the movers don’t accept credit card payments and in the current situation, it is the only payment option available to Mr. A.

Where Does the Fraud Take Place?

In most instances of a third-party scam, the credit card details that are provided are stolen or fraudulently obtained. Usually, once the payment clears and the payment is made to the third party, the fraudster is suddenly uncontactable. In some instances that they request a cash payment to the third party, there may in fact be a third party that comes to pick up the cash but the original contact will disappear.

Once the credit card company picks up the fraudulent transaction, a chargeback notification will generally be issued saying the cardholder claims the transaction wasn’t authorised. Unfortunately, if the credit card is stolen, businesses are financially liable to return those funds once they’re issued with a chargeback notification.

Overall, this means the business is out of pocket the cost of the hot water replacement, the $2,000 additional that was charged to the credit card, AND

26

the $2,000 cash that was handed over to the third party. Add to this the cancelled job that may not be able to be replaced in the schedule, this can be a VERY expensive issue.

Tips to Help You Safeguard Your Business

Being alert to fraudulent payment activity can reduce the chances of your business falling victim to scams and suffering costly chargebacks and other financial loss. We’ve got some simple tips you can follow: • Educate all front-line staff about fraud risks associated with your payment terminal and payment scams in general. • Ensure employees are the only ones to have access to your payment terminals. Don’t allow customers to edit or manually enter transactions, and if you don’t require the manual key entry feature on your terminal, ask your banker to switch it off. • Always refund a transaction to the same card and remember to change your refund password regularly. • Be cautious of customers who wish to correspond via email only and are not contactable by other means such as phone. • Watch out for customers who claim to be not contactable. • Beware of customers who are willing to pay more than the cost advertised or place unusually large orders for goods. If it sounds too good to be true, it usually is. • Never accept payments on behalf of third parties or for services you didn’t provide. • Don’t agree to forward payments or funds to other businesses or people. • Be aware that if you accept transactions when the card is not present in the sale, it is you, the merchant, who is ultimately liable should a dispute be successfully raised against the transaction. • Avoid any requests to transfer funds via Western Union. • Trust your instinct – if you have concerns about a transaction, contact your bank or terminal provider for guidance.

Have you received the same scam email recently? Let us know at info@mpaq.com.au or call us on 07 3273 0800.

Article written by Summer Adams, Project Management and Marketing Executive, MPAQ

QBCC MINIMUM FINANCIAL REQUIREMENTS LODGEMENT RULES FOR 2020 EXPLAINED?

As most plumbing business owners know, last year was the first year you had to lodge your financial data with the Queensland Building and Construction Commission (QBCC) so that QBCC could check to make sure you were meeting the Minimum Financial Requirements (MFR) for your licence class.

In November 2019, QBCC advised licensees that even if you did not satisfy the MFR you were still required to lodge your financial data, and you had until 31 December 2020 to improve your balance sheet and meet the relevant MFR.

What Are the Minimum Financial Requirements?

To trade in the plumbing industry in Queensland, you need to hold a certain amount of assets that increase as your turnover increases. In addition, your total current assets (e.g. cash, accounts receivable, stock) need to be greater than your total current liabilities, which are bills that need to be paid in the next 12 months (e.g. trade creditors, tax obligations). QBCC then checks your financial data to ensure you have sufficient assets for your licence category and annual turnover.

What Is the Requirement for Lodgement for 2020?

All licensees must lodge their financial data for the year ended 30 June 2020 by 31 December 2020. If you are a SC1 or an SC2 licence holder, you only need to provide the financial information requested such as revenue, current assets, current liabilities, etc. However, if you hold a Category 1 licence or greater, you must also provide supporting financial documents, such as your balance sheet and profit and loss statement.

How Do I Lodge?

The portal on the QBCC website opened on 1 August 2020 for online lodgements. Of course, you are still able to lodge a paper copy by downloading the online form on the QBCC website.

So, What Has Changed with QBCC Since COVID-19 Hit?

Anecdotally, I think it is fair to say the plumbing industry has fared quite well so far; certainly, maintenance has stood up well, project plumbing less so. How bad it might get of course will depend on how long COVID-19 goes

on for and whether Queensland is further impacted by increasing cases and lockdown restrictions like Victoria.

While there has been no formal response from QBCC in relation to COVID-19, and specifically in respect of the 2020 MFR, there are murmurs QBCC will soon outline its response, which may include some relief for those businesses that have been impacted by COVID-19 and are unable to meet their 2020 MFR obligations. What this looks like, we do not know.

In the absence of a formal announcement from QBCC, all business must meet their MFR obligations by 31 December 2020. It is, therefore, essential that you: 1. Commence preparing your FY2020 financial statements and test to make sure your balance sheet complies with the MFR for your licence class as at 30 June 2020; 2. If it does not comply, then liaise with your accountant as soon as possible to ensure compliance by 31 December 2020; and 3. Lodge your FY2020 Financial Statements with QBCC by 31 December 2020.

If you would like assistance from Xact Accounting you can call them on 1300 233 723, and to learn more about the packages they have available for MPAQ members, visit www.mpaq.com.au/ benefits/xact-accounting.

Article written by Mick Renton, CEO, Xact Accounting

Best practice health and safety Best practice health and safety training for the construction industry training for the construction industry

T r a i n i n g t o s k i l l , u p - s k i l l a n d r e - s k i l l CEPUTEC Plumbing Technical Education Centre CEPUTEC Training is delivered at PICAC Beenleigh OHS/WHS, Plant/Equipment and First Aid training available now with discounted rates for MPAQ Members! Contact us to find out more: T r a i n i n g t o s k i l l , u p - s k i l l a n d r e - s k i l l CEPUTEC Plumbing Technical Education Centre CEPUTEC Training is delivered at PICAC Beenleigh OHS/WHS, Plant/Equipment and First Aid training available now with discounted rates for MPAQ Members! Contact us to find out more: Ph: 1300 222 727 Email: infoqld@picac.edu.au Ph: 1300 222 727 Email: infoqld@picac.edu.au RT0: 4612 RT0: 4612

THE PERFECT TOOL TO IMPROVE THE OVERALL MENTAL HEALTH OF ALL EMPLOYEES

Technology and mental health are two words we don’t often think about concurrently. And yet, if implemented well, automation can significantly improve the mental health of both business owners and employees. More than ever, we have a duty of care to support the mental wellbeing of our employees—but what is the best way to achieve this?

Perhaps your staff are spending too much of their day sorting through paperwork. Maybe you’re spending your evenings tearing your hair out over spreadsheets, or endlessly following up invoices and timesheets. The reality is, such work-related stress has the potential to produce real long-term mental health issues, which can mean that productivity falls, staff turnover increases, and the possibilities for growth and success for your organisation shrink. What started as just a little extra paperwork every now and then fast turns into a big problem.

If your team is spending too much of their time double handling and correcting errors on completed tasks that could have been performed automatically, they’ll never be able to devote their time to the work that matters most. Your vision for growth becomes buried under paperwork and processes.

Optimising your systems allows your organisation and your employees to operate more efficiently. It will automate your business processes to save time, minimise errors, and, most importantly, ease the overall stress of your employees. From helping you schedule your team, to keeping track of quotes and invoices, implementing the right software and automating your processes will reduce the time spent on administrative tasks—supporting you and your team to feel on top of the workload and, consequently, improving overall mental health.

The process of implementing a job management software doesn’t need to be difficult. If done effectively, it gives your team ownership over the new system, a sense of belonging, the commitment to a common goal, and shows them that you are truly invested in them and their wellbeing. Your new operational system provides the opportunity to enhance the psychological health of your employees by streamlining the workload and allowing you and your team to focus your energy on achieving business success. Momentum builds as your team transforms into a well-oiled machine; being less weighed down by the small stuff means that you can focus on that brighter bigger picture.

This is where Modus Operandi can help, supporting you every step of the way. With extensive trades and industry experience, we individually assess your business to find and recommend the best job management software to suit your specific business needs.

For more information on how we can help, you can contact us via our website, www.findyourmo.com, or register for our free online simPRO Q&A via our Facebook page findyourmo.

Article written by Modus Operandi

MEET DAN PASFIELD

In March 2020, at MPAQ’s annual World Plumbing Day Breakfast, Dan Pasfield, Director of Pasfield Plumbing, was announced as one of four MPAQ plumbing ambassadors. We asked Dan to share his plumbing story, what a typical day looks like for him, and what he hopes to achieve as a plumbing ambassador.

Getting an Apprenticeship

In 2009 I was introduced to a local plumber in Shailer Park by a family friend, Tony from Alpine Plumbing. I was 17 and really wanted to see what it would be like to be a plumber. I really pushed hard for an opportunity and was given the chance for some unpaid work experience. In 2010, I had just turned 18 and signed up with All Trades as an apprentice plumber and was plumbing new mine camp demountable blocks in Yatala. Tony then reached out and offered me a placement with him for the remaining time of my apprenticeship, and I was extremely grateful for the opportunity.

A Typical Day

I start work in the office at 4:30am, organising purchase orders and quotes, following up on emails, reviewing the schedule for the day, and responding to notes left for me from the day before.

At 6:30am, I get coffee and a ham and cheese croissant before heading to my home branch to pick up my purchase orders for the day.

7:00am on the dot, never any later, I start my first job. Throughout the day I will travel from Logan to Brisbane then back to Logan or the Gold Coast responding to emergency gas, plumbing, and leak detection jobs. A lot of our work is reactive maintenance, which means we have to be on the ball all the time as every minute counts. When our team is singing a song and all is going to plan we can average 8-12 jobs a day per plumber. It’s a juggling act and everyone/everything has to be running 100%. It’s great fun, and you get very quick at problem solving tricky jobs as nothing is ever the same.

Throughout the day I am frequently on the phone to customers, suppliers and the team, helping where I can with technical support, job enquiries, purchase orders and customer relations.

The Pasfield Plumbing team

I normally finish working on the tools at around 4:30pm to 6:00pm, and then clock off for the day and spend precious time with my family.

Running a Business

My experience as a business owner is rapidly expanding as I grow every day. I love to learn and always keep an open mind; I’ve honestly learned a lot more than I ever have in a small amount of time and really thrive to learn and grow more and more. It’s a super hard gig in these early days of business. At just three years into the business, I’m sure anyone else who has been there would agree that it doesn’t just come handed to you. I work with awesome people in our small team, which makes business so much better and enjoyable (our little plumbing family team). I couldn’t do it without the team’s support.

Plumbing Ambassador

I’d like to help the next generation of youth coming into the workforce see the value and appeal of a career in plumbing. There are plenty of bright and hardworking kids out there, and we need them in our trade to keep it strong and innovative. I enjoy the opportunity that comes with the ambassadorship to talk to young people at the end of their schooling period and telling them about the trade. It’s an awesome program that MPAQ does for the community.

Looking after My Mental Health

Having a good work-life balance is very important for me. Working long hours and running a small business is stressful. I’ve recently gotten into mountain bike riding and going to the gym twice a week helps me destress.

Also having an amazing wife who keeps me accountable and reminds me of my role as a father and husband keeps me grounded and happy.

Dan with his daughter

Dan talking to a group of school students

Dan and Cooper, who undertook a weeks’ work experience with Pasfield Plumbing

Do you have a story you would like to tell? Let us know by emailing advertising@mpaq.com.au or calling 07 3273 0800.

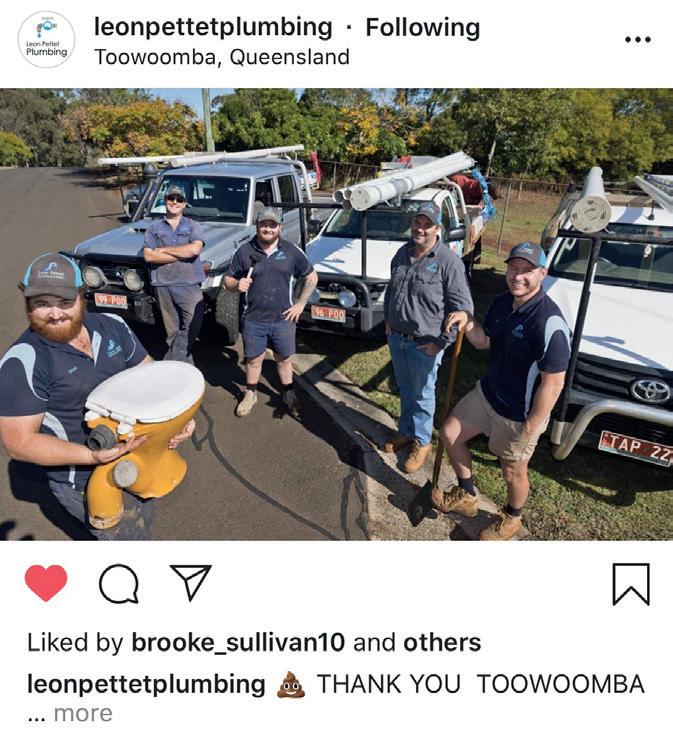

#MPAQ

ANSA PLUMBING CELEBRATES 35 YEAR MILESTONE

Founded by Andrew MacDonald in 1985, Ansa Plumbing started with a team of four people working in the business and has grown to a current team of 12.

While the business started out working in maintenance, it has transitioned over the last 35 years to specialise in hospital fit outs. Having recorded two record months during the COVID-19 pandemic, Ansa Plumbing’s goal for the future is to be successful and grow long term. One of the biggest changes Ansa Plumbing has recognised in the industry over the years is more regulations; however, their MPAQ membership has helped them with any questions they may have.

MPAQ congratulates Ansa Plumbing on reaching 35 years of membership!

SUPER BUILT FOR YOU.

Be you with BUSSQ.

We’re a leading industry fund that makes super easy with personalised service to help you, your employees and family.

We’re here to help you. Visit bussq.com.au or call us on 1800 692 877.

The information supplied in this advertisement is general advice only and does not take into account or consider your personal objectives, financial situation or needs. Before acting, you should review the relevant Product Disclosure Statement to ensure you have all the information about the relevant BUSSQ product and how it works and consider the appropriateness of the information to your needs or seek independent advice from a properly qualified professional. Prepared by BUSS(Queensland) Pty Ltd (ABN 15 065 081 281, AFSL 237860) as Trustee for BUSSQ (BUSSQ Fund, ABN 85 571 332 201).

McDIARMID PLUMBING SERVICE REACHES 30 YEAR MEMBERSHIP MILESTONE

Mac McDiarmid started plumbing in 1973 on the Gold Coast as a single operator. In 1983 McDiarmid Plumbing Service became a partnership with Mac and his wife Judy until 1989 when McDiarmid Plumbing Service became a company and is still trading 47yrs later in 2020, with Mac and Judy’s son Lewis now taking over management of the business.

Variety in our scope of work is what we are proud to be known for. We have taken on many plumbing and drainage jobs that others back away from. Our work covers plumbing maintenance services to homeowners, rental properties, factories, restaurants, shopping centres, churches, and local government projects. Our work covers all of the Gold Coast and Hinterland, and we also have clients in Brisbane.

This variety of work has allowed us to produce some of the best tradespeople in the local plumbing industry. Over 20 apprentices have been employed in the company throughout our history and some have gone on to run successful businesses of their own.

When the business started it was Mac, Judy, and a labourer, and in the mid-80s up to 27 employees were in the business. Of the seven staff currently employed, two have been with the business for over 30 years. Several staff that are now retired were with the company for 20 to 30 years.

The plumbing industry has changed over the years, and it is extremely difficult to keep up with changes in legislation and different takes on interpretation of the plumbing code by different local councils and individual council inspectors. New products and methods of installation are evolving at a very fast rate. Being a member of MPAQ is a benefit for always being able to get assistance with legislation queries and wage awards, etc.

With Mac’s son Lewis taking over running of the company we are determined to stay competitive and viable and continue to offer quality of service to our customers and look after our staff that look after our company. Article written by McDiarmid Plumbing Service

NOTICE OF MEMBER PASSING

Cyril Arthur Brown from Port Douglas, Far North Queensland

One of MPAQ’s long-term members, Cyril Brown of Brownie’s Plumbing and Gas in Far North Queensland, passed away suddenly at his home in Port Douglas in early July.

Cyril and his wife Beryl have been members with MPAQ since 5 July 2000 and had just reached their 20-year membership milestone with the association, dedicating many years of support to the industry.

Our deepest sympathies and condolences go out to Beryl, Cyril’s family, and his friends.

Successful Gold Coast businessman and plumber Ed Ahern has been in the industry for over 44 years and celebrated 25 years of MPAQ membership this year.

During his time plumbing he was becoming concerned about the significantly increased failure rates he was seeing in pipes and drains. Like most plumbers at the time he recognised the difficulties that lay ahead as aging pipe infrastructure across the region continued to deteriorate. He also recognised that alternatives to traditional methods of excavation and replacement of pipes had to be found. In 2004 he bought a license from Cameron Manners’ Canadian technology and launched fully Australianowned Nuflow ® Technologies, entering markets in Australia, New Zealand, Asia and middle east regions. This brought an innovative trenchless pipe repair system to the southern hemisphere.

A determined, hard-working, problem-solver, Ed thinks big and plans accordingly, taking the original technology to new heights, creating products and processes to cater specifically for Australasian conditions. He has expanded the business to have a trenchless solution for drainage, water, and pressure pipes, with his Blueline ® and Greenline ® products ranging from DN40 to over DN1800 with custom solutions fit-for-purpose. A unique Redline ® blowable epoxy system rehabilitates steel and copper pipes as small as 15mm in water supply.

Ed’s innovative approach and introduction of these technologies has now made pipe relining a common household solution that 10 years ago people would never have thought of.

Thanks to the determination and commitment of Ed and his team, noninvasive methods of pipe rehabilitation like Nuflow’s relining systems are now very important elements of drain and pipe maintenance and repair programs.

Congratulations to Ed on reaching this milestone!

REGIONAL REPRESENTATION FOR MEMBERS

At the Fraser Coast Online Forum on Tuesday 28 July it was officially announced to members that Jason Searle, MPAQ Sales and Membership Specialist, would be moving to Bundaberg and operating out of the regional location as of Monday 3 August.

Jason’s role with MPAQ is to offer one-on-one support for our members, support our local member meetings, provide updates on local issues, raise any local issues with MPAQ and encourage plumbing businesses to join MPAQ. Jason is looking forward to better assisting our members in Central and North Queensland.

Want to get in touch? Contact Jason via email at Jason.searle@mpaq.com.au or phone 0439 565 240.

Jason Searle is wearing a TradeMutt shirt, which was donated by MPAQ corporate supporter Tradies Accountants. Trademutt is a social enterprise workwear brand, with the mission to make the invisible issue of mental health impossible to ignore.

Get the tools you need to succeed!

Always helpful, would not be in business without the support of MPAQ. - Roy Walker Plumbing, member since 1971

Membership with MPAQ provides the resources you need to run your plumbing business. Visit www.mpaq.com.au or contact our membership team on 07 3273 0800 to find out more.

MAKE THE MOST OF YOUR MEMBERSHIP WITH THESE SPECIALS

Good cash flow management will ensure you always have money available for paying your expenses when they are due, and MPAQ has a suite of benefits that help you with this. Visit www.mpaq.com.au/membership/ member-benefits to see all the member offers available and learn more about those listed below.

American Express provides powerful backing to businesses of all types and sizes through payment solutions tailored to meet their needs.

Some of the benefits your business could also take advantage of include: • Extended Cashflow • The valuable breathing room you need to keep cash flow moving, and make sure suppliers are paid on time. • Agreements with major suppliers such as Reece, Tradelink and Samios give your business an extended period of time to pay off their purchases. • Rewards On Spend • Be rewarded for business expenses through a loyalty program that is hard to rival. • Increased Visibility and Control • Get the expense visibility, reporting and business tools you need to maximise control.

Bill Chaser is offering MPAQ members 25% off their pricing and no upfront cost*.

Backed by Australia’s largest independent Debt Collector, Bill Chaser helps you collect overdue and unpaid invoices ensuring you’ve got more time to spend on the enjoyable and profitable parts of your business. *applies to Pro Live plan only

Turn one big payment into easy, bite-sized instalments. Offer your customers zero interest payment plans up to $10,000.

Offer flexible buy now, pay later payment plans that suit what you’re selling. Available as an online or on-the-go service, you can use Payright in the way that makes sense to your business.

As a member of MPAQ, Payright is offering you a discount on merchant rates.

Corporate Profile

Supporting MPAQ Members

Smartpay – The Independent EFTPOS Experts

Smartpay is the largest independently owned and operated EFTPOS provider in Australasia, and we’ve been helping Aussie businesses with payment products, especially for business owners like you.

Need a mobile terminal in the truck to get instant payments for jobs and the money the next day? Want to eliminate your merchant fees and save thousands of dollars each month?

Smartpay offers you more choice on how to manage your merchant fees with simple, easy to use mobile EFTPOS machines. Try our zero cost EFTPOS to eliminate monthly fees or simple flat rate to know exactly what you’ll pay each month – no surprises!

We provide reliable EFTPOS solutions and a superfast settlement. We’re big on service with 24/7 expert support and include many add-on features as standard. We offer a choice of flat rates or automated surcharging, so you know what to expect every month.

Basically, we just do a whole lot of things better than the banks, and it seems Australian businesses like that.

For a competitive quote, give us a call on 1800 571 969 or check out www.smartpay.com.au/mpaq.

CONGRATULATIONS TO MPAQ’S MILESTONE MEMBERS

NAME COMPANY

Bruce Wallace Ron Johnston Rick Quire Ansa Plumbing Stephen Cosgrove Plumbing by Steve Pty Ltd Rod Gramenz Sunshine State Plumbing Pty Ltd Ian Swinbourne Brent Boddice Fixzit Plumbing Stephen Walker Fluid Industries Plumbing Pty Ltd Bruce McDonald HPS Contractors Mark Williams Mark’s Plumbing Service Greg Campbell Childers Plumbing & Drainage Corey Stevens AC Plumbing QLD Robert Sharman A N & R Sharman Pty Ltd Michael Piekoszewski Acacia Plumbing Benjamin Johnston BCJ Plumbing & 24/7 Maintenance Services Peter Maloberti Big Pete’s Plumbing Tony Rose De Rose Plumbing Services Gregory Parr Greg Parr Plumbing Justin Thomas J T Plumbing Solutions James Woodman James Woodman Plumbing Dirk Neugebauer Jayden Enterprises Pty Ltd David Kimber Kimber Plumbing Pty Ltd Dean Eiser Mackay Regional Council Matthew Glover MGM Plumbing Solutions Jackie Hammond Rain Harvesting Shane Emerson SE Plumbing Stephen Etherington Stephen Etherington Plumbing Tracey Hall Stormtech Pty Ltd Scott Farley Sure-Line Plumbing Pty Ltd Sally Traynor T & D Plumbing Steve Toon Toons Plumbing Drainage And Gas Leesa Ostrofski Tru-Flow Services Pty Ltd John Neary David Talbot David Talbot Plumbing Allan Callaghan APC Plumbing & Drainage Payam Salehi AusPress Systems Pty Ltd Adam Charles Australian Plumbing Gas & Solar Brenton Langley Brenton Langley Plumbing Matthew Scott Connect Right Plumbing & Gas Pty Ltd Michael Dunne Dunne & Co Pty Ltd Ben Seeley Finlease Garry Adams Garry Adams Plumbing Grant Goltz Grant Goltz Plumbing Pty Ltd Daniel Weuffen iPlumb Solutions Jason O’Shea Jason O’Shea Plumbing Adrian Smith KMS Mechanical & Electrical Services Pty Ltd Philip Lister P.A.L. Plumbing Pty Ltd Warwick Royal Plumbaround Pty Ltd Rodney Beatson Rodney Dale Beatson Barry Hurd Solahart Townsville & Free Flow Plumbing and Gas Services Stephen Close STC Plumbing & Maintenance Paul Brinkworth

DIVISION

Brisbane South Brisbane North Brisbane South Ipswich Ipswich Sunshine Coast Brisbane South Fraser Coast Far North Qld Brisbane North Bundaberg Brisbane North Brisbane North Far North Qld Sunshine Coast Far North Qld Far North Qld Far North Qld Sunshine Coast Ipswich Mackay Fraser Coast Mackay Brisbane South Brisbane North Central Brisbane South Outside Queensland Brisbane North Brisbane North Central Ipswich Central Brisbane North Gold Coast Outside Queensland Brisbane South Far North Qld Brisbane South Brisbane South Brisbane North Country Central Gold Coast Bundaberg Brisbane North Brisbane North Brisbane North Central

North Qld

MILESTONE 80 75 35 35 35 35 30 30 30 30 25 20 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5

5

30 YEAR MILESTONE

Nathan Sharland, McGrath & Frisby Plumbing Pty Ltd

30 YEAR MILESTONE

Brent Boddice, Fixzit Plumbing

30 YEAR MILESTONE

Frankie O’Leary and Noel O’Leary

15 YEAR MILESTONE

WELCOME TO MPAQ’S NEW MEMBERS

NAME

Paul Coleman Cameron Anderson Ian Tunks James McNee

Andrew Macfarlane

COMPANY

4G Plumbing and Civil AK Gas and Plumbing I.R.T. Plumbing Services Pty Ltd S & J Plumbing And Gas Fitting Pty Ltd A & T MacFarlane Plumbing

DIVISION

Brisbane North Brisbane North Brisbane North Brisbane North

Brisbane South

Daniel Paoli, Calibre Plumbing and Drainage Pty Ltd

Matthew Forge, Forge Plumbing and Gas Fitting Pty Ltd NAME

Zane Bassingthwaighte Mark Timms

Daniel Paoli Daniel Wilson David Levenspiel Matthew Evans Brett Mitchell Edward Prior Chris Theuerkauf Nicholas Alford Barton Smith Chantal Horton Brade Stephenson Ray Plate Julie Payne Clayton Hearn Marcel Donnelly Matthew Forge Phillip Rowe Andrew Marquis

COMPANY

B-16 Plumbing Services Budget Plumbing and Home Services Calibre Plumbing and Drainage Greenstar Plumbing Services Liqwyd Solutions Pty Ltd Tested Plumbing and Backflow Capcoast Plumbing Eddie Prior Plumbing Theuerkauf Plumbing Services Alford Plumbing & Gas Pty Ltd Blackjade Pty Ltd LPGC Pty Ltd Ipswich Hot Water Treatwater & Plumbing Pty Ltd Alan Payne Plumbing Claytons Plumbing FlatRateNOW Forge Plumbing and Gas Pty Ltd Rowe Plumbing Pty Ltd A.C Marquis Plumbing

DIVISION

Brisbane South Brisbane South

Brisbane South Brisbane South Brisbane South Brisbane South Central Far North Qld Fraser Coast Gold Coast Gold Coast Gold Coast Ipswich Mackay North Qld North Qld Queensland Sunshine Coast Sunshine Coast Toowoomba

Matt Miles, PipeTech Plumbing QLD

RENEW YOUR MPAQ MEMBERSHIP AND YOU COULD WIN A $5,000 Holiday $5,000 Holiday $5,000 Holiday $5,000 Holiday $5,000 Holiday $5,000 Holiday $5,000 Holiday THANKS TO RWC!

Pay your 2020 Contracting Membership Renewal prior to the due date and you could go into the draw to win a travel voucher worth $5,000.

VIST WWW.MPAQ.COM.AU/RENEW OR CALL 07 3273 0800 FOR MORE INFORMATION

1900 - 2020

This competition is available for contracting members renewing their membership with the Association between 1 January 2020 and 31 December 2020. Receipt or confirmation of payment for renewal must be received by the renewal date in order for member to gain an entry in the 2020 Membership Renewal Draw. This competition is only applicable to contracting members. Renewing members must elect to enter the draw via a link provided in membership confirmation emails. All entries must be received by 11.59pm AEST on 31 December 2020. The competition is open to MPAQ contracting members who are Australian residents aged 18 years and over. Only one entry per company is permitted. The winner will be drawn at random on 15 January 2021 at noon AEST at 11/243 Bradman Street, Acacia Ridge, Brisbane, QLD 4110. The winner must accept the prize within 10 business days of this date. Full Competition Terms and Conditions Apply - visit www. mpaq.com.au/renew for more details.

THE SUPPORTERS OF OUR INDUSTRY

Platinum Corporate Supporters

Reece Reliance Worldwide Corporation Rheem Australia Pty Ltd simPRO Software Pty Ltd Toyota Tradelink WFI Insurance

Gold Corporate Supporters

BUSSQ Building Super Bretts Trade Plumbing Supplies Construction Skills Queensland Decina Bathroomware Pty Ltd Dial Before You Dig (Qld) Ltd GWA Group Kembla QLeave Zip Heaters (Aust) Pty Ltd

Silver Corporate Supporters

Halgan Pty Ltd FlatRateNOW Hilti Australia Smartpay Australia Pty Ltd

Corporate Supporters

Advanced Enviro-Septic All Trades Queensland Pty Ltd Alpha390 Finance Ancra Australia Pty Ltd APT Management Services Pty Ltd Aquacure Water Treatment Pty Ltd Aquaknect Aquatech Solar Technologies Pty Ltd Astivita Limited AusPress Systems Pty Ltd Australian Industry Trade College Australian Pump Industries Pty Ltd Australian Valve Group AustWorld Autodesk Construction Cloud AutoTender Backflow Central & Hydromet Bermad Water Technologies Bunnings Trade Busy At Work Comsure Insurance Brokers Con-Serv Corporation Australia Pty Ltd Construct Law Group Cornwalls Law + More Davey Water Products Pty Ltd Elson Australasia Pty Ltd Emerson Valvcheq Backflow Enware Australia Pty Ltd Everhard Industries Pty Ltd Fair Water Meters Finlease Global Roto-Moulding Pty Ltd Gould Instruments Green Drains Asia Pacific Groundplan Software Grundfos Pumps Pty Ltd Handford Virtual Services Hydroflow Distributors InSinkErator K & R Plumbing Supplies - Toowoomba Kennards Test and Measure Qld Lifestyle Tradie Group Pty Ltd Logical Metering 03 9274 0000 07 3018 3440 07 3412 9200 1300 139 467 1800 679 247 1800 758 624 1300 934 934

07 3369 1111 07 3203 2105 1800 798 488 07 3271 1944 1300 329 375 07 3131 5999 07 3868 7888 07 3212 6811 02 9796 3100

07 3208 8339 02 7202 6008 131 292 1800 433 876

07 5474 4055 07 3441 2699 1300 390 390 1800 426 272 07 3215 6619 07 3277 6696 07 3805 3800 07 5520 6701 07 3726 2000 1300 287 773 www.aitc.qld.edu.au 02 8865 3500 03 9462 2666 1300 780 430 0412 013 255 1300 882 578 07 5407 0151 03 9464 2374 13 30 62 13 28 79 07 3434 7800 07 3630 5744 07 3139 1874 07 3223 5900 07 3370 3700 02 9625 7899 07 3260 2555 02 8556 4000 13 19 26 1300 324 701 07 3324 2655 07 4697 7099 07 4779 6750 0406 003 446 07 3062 7737 07 5540 6700 0487 000 557 1300 493 359 0447 886 648 07 4634 2955 07 3823 0055 1800 704 822 0418 185 751 Modus Operandi MTS Warehousing and Distribution Ozzi Kleen Payright Plastec Australia Pty Ltd Plumbing Plus Queensland Plumbspec Plus Technologies Podium Porters PROTRADE United Queensland Brassware Association Queensland Gas Association QUT Facilities Management Rain Harvesting Rehau Pty Ltd Ridge Tool (Aust) Pty Ltd Rinnai Samios Saniflo Shower Sealed Pty Ltd SkillsTech Australia Snap Fire Systems Pty Ltd SolarEast Australasia Pty Ltd Specialised Plumbing Centre Square Stiebel Eltron (Aust) Pty Ltd Stoddart Stormtech Pty Ltd Stratco (Qld) Pty Ltd Studor Australia Pty Ltd Supakwik Water Heaters Pty Ltd Taylex Industries Pty Ltd The Bidet Shop The Couta Group The Service Trades College Australia The Wondercap Company Pty Ltd Totally Workwear Tradie Bookkeeping Solutions Tradies Accountants Valves R Us Viega Pty Ltd Vinidex Pty Ltd Xact Accounting Zetco Valves Pty Ltd 0421 399 107 07 3865 4811 07 5459 4900 1300 338 496 07 5413 4444 07 4634 2955 0423 563 030 07 3357 3367 0478 180 191 07 4967 3333 1300 767 774 0410 194 667 1300 792 239 07 3188 2331 07 3248 9600 07 5527 1833 03 9930 7000 07 3137 6600 07 3907 8399 1300 557 779 1300 519 133 07 3244 0209 07 3348 9417 1300 668 886 07 3862 1166 1800 760 137 1800 153 351 07 3440 7600 02 4423 1989 07 3451 4444 1300 551 519 07 3800 0575 07 3441 5200 07 5591 7744 03 8405 3386 07 3255 5698 07 5539 3665 07 3249 4000 0468 944 130 07 3174 5010 07 3865 1488 02 8853 7867 07 3277 2822 1300 233 723 02 9516 1336

Associate Council

Brisbane City Council Bundaberg Regional Council Gympie Regional Council Isaac Regional Council Livingstone Shire Council (LSC) Logan City Council Mackay Regional Council Mareeba Shire Council Moreton Bay Regional Council Mount Isa City Council Quilpie Shire Council Rockhampton Regional Council Southern Downs Regional Council Sunshine Coast Regional Council Townsville City Council 07 3403 8888 07 4130 4814 1300 307 800 07 4964 5400 07 4913 5000 07 3412 3412 07 4961 9011 07 4086 4720 07 3205 0555 07 4747 3200 07 4656 0500 07 4932 9000 1300 697 372 07 5420 8618 13 48 10

New HiLux Awaken Your Unbreakable Bolder look, smoother drive and more powerful.

Pre-production model shown

New HiLux invites you to awaken your unbreakable and experience the legendary performance, durability and bold design. With more power 1 and more torque 1 , the enhanced best-selling HiLux engine 2 is stronger and more capable than ever. An upgraded suspension system builds upon Hilux’s legendary off-road capabilities, offering drivers superior comfort and handling even in the harshest conditions.

It’s the ute built for real Aussie businesses. Whatever’s around the corner, HiLux is ready for the challenge.

To find out more, visit your Toyota Fleet Specialist or call 1800 444 847

toyota.com.au/fleet

MPAQ membership details required to redeem Gold Fleet Discounts^.