As I sit here contemplating the year to come, I am humbled by the honour of having the opportunity to serve as Chair of your Mississauga Board of Trade. MBOT has been fortunate to have had many great leaders, including Lucie Shaw of Nurse Next Door and Ken Tencer of Spyder Works. During each of their tenures, I have observed them grapple with unexpected adversities. I hope that I am able to navigate whatever challenges come next with the same success. Thank you both for all you have done over the past two incredibly challenging years.

STEVE RHONE 2023 MBOT Chair President & CEO, Weston Forest

MBOT has built a wonderful community of people and programming dedicated to improving opportunities for businesses. From a resolute staff and dedicated volunteers serving our members, to the Mississauga Economic Resiliency Group (MERG), an initiative of MBOT that has been born out of the challenges created by the pandemic. We continue building on the foundations that have been established, assisting our business community with tools to remain resilient in the face of challenges and uniting with a strong voice for our business community.

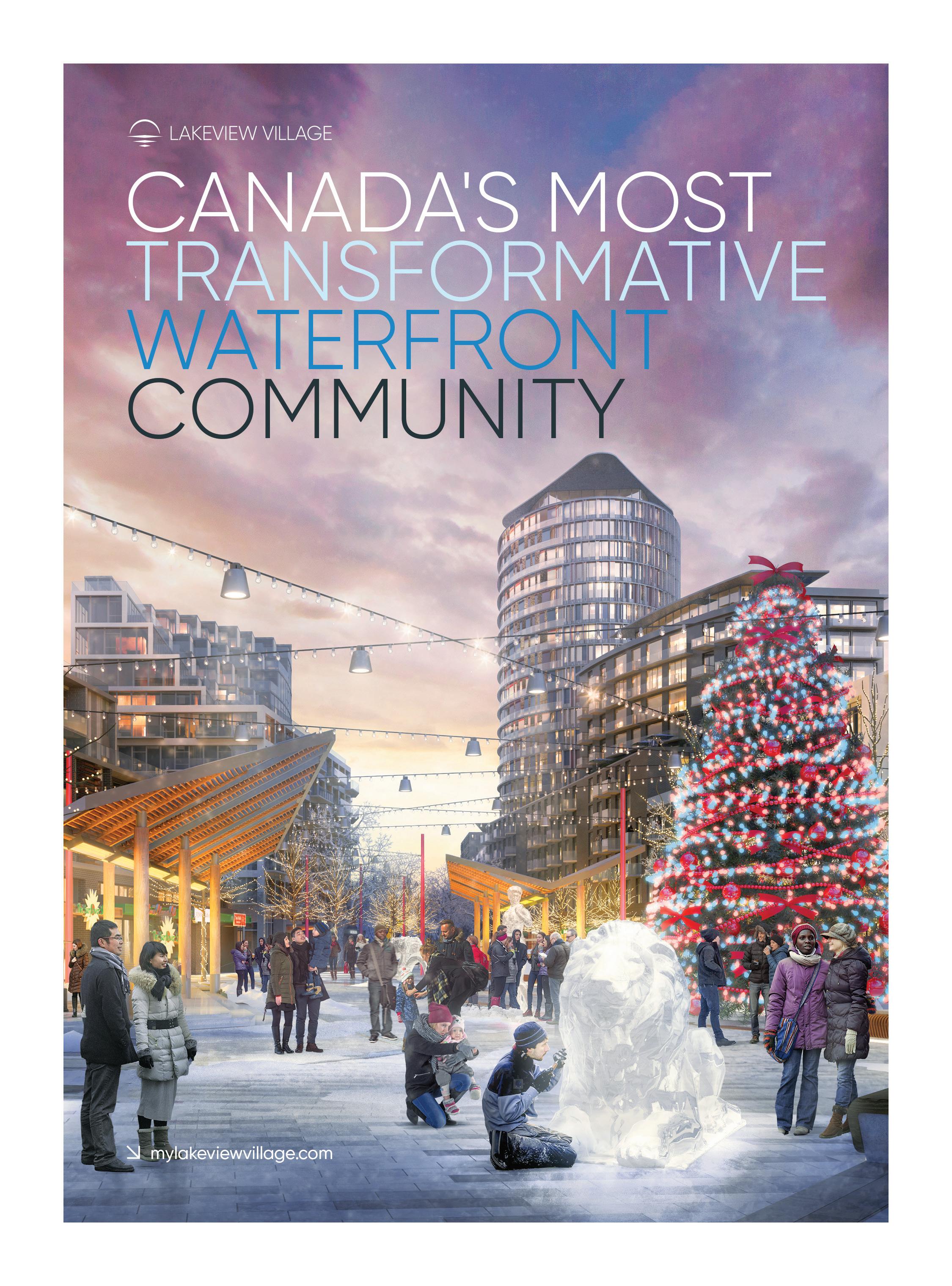

Despite the obvious challenges of inflation and higher interest rates, coupled with ongoing labour challenges, Mississauga is bursting with potential. Our city continues to plan and build for the future with the ongoing development of the downtown City Centre, the Hurontario LRT, and major developments on our waterfront. Mississauga remains a destination of choice, with the expectation of hundreds of thousands of new residents in the coming decades. We have a business community that is diverse, including companies in the creative sector, sciences, logistics and transportation, and educational institutions, to name a few. Many of these companies have their head office located in Mississauga.

Mississauga remains resilient and ready for the future. We must remain focused on advocating for all our businesses in the city and create opportunities for people to come together and share ideas, best practices, and opportunities with each other. I look forward to influencing the continued success of the business community as Chair of the Mississauga Board of Trade.

It is a privilege to serve you all, and I am excited to take on the challenges to come in 2023 together.

• Steve Rhone, Weston Forest | Chair

• Sameer Sharma, Crown Group of Hotels | Vice-Chair

• Lucie Shaw, Nurse Next Door | Immediate Past Chair

• Crystal Reedie, RBC | Treasurer

• Adam Nowak, Gallagher Insurance

• Trevor McPherson, MBOT President & CEO (Ex-officio)

• Dr. Mo Amin, AstraZeneca Canada

• Steve D’Agostino, Avega Inc.

• Parveen Dhupar, BTI Brand Innovations Inc.

• Malaika Mendonsa, Grant Thornton LLP

• Atul Sharma, Greater Toronto Airports Authority

• Linda Kern, The Kern Group, Inc.

• Jonathan Borrelli, Keyser Mason Ball, LLP

• John McKenna, McKenna Logistics Centres

• Janet Wardle, MHI Canada Aerospace Inc.

• Paul Meo, NTN Bearings Corporation of Canada

• Wade Hall, Sheridan College

• Amanda Pautler, University of Toronto Mississauga

endless uncertainty having become the status quo. With everything from labour and housing market shortages, to rising interest rates, supply chain disruptions and the economic impacts of the conflict in Ukraine, it’s difficult to think of a time when there have been this many contributing factors weighing on the minds of today’s business leaders. I haven’t even mentioned climate change or the continued threat of COVID-19 and its impacts on society and business. All of it has led renowned U.S. economist Larry Summers to proclaim, “…we’ve got the most complex, disparate, and cross-cutting set of challenges that I think I can remember in the 40 years I’ve been following this stuff.”

TREVOR McPHERSON President & CEO Mississauga Board of Trade

Let’s face it – the current business and economic climate is downright dizzying. It’s difficult to be optimistic with so many clouds circling above us. In fact, there’s a buzzword to describe what we’re going through and it’s making the rounds in corporate boardrooms and at global thinktanks: the polycrisis. Historian Adam Tooze says this is when economic and non-economic shocks” are entangled “all the way down”. No doubt, many of the challenges we face have been years in the making. There are no quick fixes! No overnight solutions. All of that said, there remains tremendous opportunity for exponential growth and prosperity in Mississauga over the coming decade, but only if we act together to advance a shared economic agenda.

As we approach the three-year anniversary of the onset of the pandemic, it can feel like the multitude of economic and business challenges simply keep mounting, with

We add to this a potential self-fulfilling prophecy that we are poised to enter a recessionary period through 2023. Central banks have the difficult task of walking a fine line on monetary policy in their effort to slow inflation while not triggering a monumental downturn. Many businesses are already becoming more conservative in how they are managing risk. Increasingly, firms are “hunkering down” by curtailing expenditures, slowing or altogether freezing hiring (or worse yet, downsizing) and hitting the pause button on new business activities. For individual businesses, the current environment of extreme ambiguity and volatility has the potential to stifle a critical element of longterm business success: future planning and making regular investments in things like technology, innovation, and top talent. That’s where our future growth will come from!

Which communities and regions have an outsized shot at coming out ahead? It’s hard to bet against Mississauga. We possess a highly educated and diverse workforce. We punch above our weight in areas such as life sciences and health care technologies, fintech, cleantech, aerospace, food processing, information technology, music, film and television, and so much more. It’s a recipe for success, but only if we work together and leverage our collective assets. It’s why I’m so excited about how MBOT’s Mississauga Economic Resiliency Group (MERG) of leading CEOs from the community are working collaboratively across 4 Leadership Tables to lay a foundation for future growth: 1. Business Climate and Brand 2. Talent and Workforce 3. Technology, Innovation, and Productivity 4. Sustainability & ESG

I’m grateful that Ken Tencer (Spyder Works), Paul Meo (NTN Bearings Canada), and Alexandra Gillespie (University of Toronto Mississauga) have volunteered to help guide this important work. Together and in collaboration with our government partners, the possibilities are limitless. Watch this space. We’re just getting started!

Experience luxury living in the heart of charming Port Credit, the GTA’s hidden gem. With plenty to do, see and savour, and the city just a 25-minute GO Train ride away, nothing is far from your doorstep at The Shores of Port Credit.

Introducing Luxury Senior Rentals, where 5-star amenities and first-class service is the rule, not the exception. We take care of the details so you’re free to live your way. Refine your golf swing in our golf simulator, sip wine in the cellar with new friends, take up a new fitness routine at The Shores Aquatic & Fitness Club, or dine in at one of the many restaurant options. The only thing left to question: where will today take you?

At The Shores of Port Credit, you have the freedom to choose — and the peace of mind that should you need assistance, our professional team is at your service.

“You have the freedom to choose.”

We’re certain you’ll discover your new favourite place amongst the impeccably designed spaces featuring curated art collections around every corner and smart technology focused on comfort, safety, and security.

Every space, every amenity, every detail has been carefully considered and designed to perfection — beautiful, contemporary finishes of natural materials, soothing colour palettes, and floor-toceiling windows to maximize natural light and the captivating views — all from the comfort of your luxury private residence. Plus, a 24-hour emergency response system for peace of mind — just another way you’re part of The Shores of Port Credit community.

Are you ready to experience unparalleled senior living? Come tour your future today.

www.TheShoresOfPortCredit.com

From the graceful flow and natural lightinfused spaces to our 5-star amenities and exceptional service, we take care of the details so you’re free to live.

Your way. On your terms.

It’s all about your choice.

à nos solutions de financement flexibles et notre service-conseils d’experts. with our flexible financing solutions and expert advisory services.

If you’re a business owner these days, the uncertainty never seems to end. Inflation, labour shortages, supply disruption, economic headwinds—the list goes on.

Entrepreneurs do have a choice in how to manage their business to respond to the challenges. One powerful—but often-overlooked—strategy is improving your productivity.

In my experience working with entrepreneurs, I’m often struck by how much a small, relatively simple change in operations can boost productivity and strengthen a business.

Entrepreneurs are usually amazed when they take a closer look at their operations and discover the difference between how processes work in theory and how they actually work day-to-day. This gap is where a lot of waste happens, by increasing costs without increasing value for customers.

Finding this waste isn’t hard. There’s even a basic process for doing so called a Gemba Walk—literally walking through your facility to observe employees and ask them about their tasks.

Improvements are often surprisingly simple, too. You don’t need to go out and buy expensive robotics (although that can be an interesting project too!). Common initiatives that can give you quick, easy wins include:

MBA, leader of BDC’s small business team in GTA West (Mississauga, Halton Region and Etobicoke) BDC Advisory Services

• investing in digital technology to automate order entry and other processes

• ensuring staff are proficient and cross-trained where possible

• reorganizing facility layout to reduce wasted movement of people and things

• cleaning up workspaces

• selecting key performance indicators to measure productivity and monitoring them with dashboards

Projects like these can have amazing benefits. They reduce costs, errors and accidents. They tend to make employees and customers happier. And as a recent BDC study found, they help businesses address inflation, labour and supply challenges.

What’s more, the study said, businesses that focused on productivity reported five times more profit per employee than their peers, six times more sales and four times higher earnings (before interest, taxes, depreciation and amortization).

The business landscape may be uncertain; but focusing on productivity should make it easier for your company to navigate the challenges—and even find ways to thrive!

Toreceiveadetailedpersonalreportandideastoimproveyour business’s productivity, try BDC’s free online benchmarking tool at bdc.ca/performancebenchmarking.

November is “Make a Will Month” in Ontario. In the spirit of raising awareness for how essential it is to have a Will, I thought it would be helpful to debunk some common myths I often hear as an estate planning lawyer. By shedding a spotlight on these themes, I hope that you will be invigorated to take action to complete your estate plan.

This is not necessarily true. In Ontario, if an individual dies without a valid Will (called dying “intestate”), his or her estate will be distributed according to a government distribution scheme called the law of intestacy that is set out in Ontario’s Succession Law Reform Act (the “SLRA”). It is only in the scenario that someone dies without a legally married spouse, lineal descendants or relatives that the estate would “go to the government” i.e. becomes property of the Crown.

Simply put, if you die without a Will, it is not likely that the government will get your estate, but the law will determine how your estate is distributed. An important reason to make a Will is so that you have a say in who your estate goes to.

The SLRA only provides for legally married spouses, not common-law spouses. This means that if you have a common-law spouse and die without a valid Will, he/she will inherit nothing under the SLRA. If you would like to benefit your common law spouse, you would need to do so in a Will.

If you die without a valid Will and are legally married and have a child or children, your surviving (legally married) spouse would be entitled to what is called a “preferential share” of your estate, which is currently prescribed at $350,000, and anything over this amount is split among the surviving spouse and the children. What often comes as a surprise to parents is that, if a minor child inherits in this scenario, and if the amount is over $35,000, the surviving parent does not get to hold the child’s inheritance on his or her behalf – it is “paid into court” and paid out to the child when he/she turns 18 years old.

If you die without a valid Will, no one, not even your closest family, will have the legal authority to administer your estate until someone makes an application to court to be appointed as your estate trustee (also known as an “executor”). One of the important things a Will does is appoint an estate trustee, who is responsible for administering the estate, which can save time and reduce complexity after you die.

It is not a given that your family dynamic will remain the same after you are gone. Not having an estate plan, or not having a good one, can lead to confusion and friction between even the closest of families. Making a plan is one of the best things you can do for your loved ones so as not to leave a mess at an already difficult time.

Your Will may not necessarily apply to all of your assets. How assets are owned and held on death determines how they pass. While there are always exceptions, generally assets held

jointly as “joint tenants” as between spouses pass automatically to the surviving spouse when one spouse dies, by right of survivorship, outside of the estate. Similarly, proceeds of plans or policies, such as RRSP/RRIFs, TFSA, life insurance and segregated funds can pass outside the estate by beneficiary designation, if a beneficiary is named on the plan/policy and if that beneficiary survives. A good estate plan focuses not only on the Will but on the entire plan.

One point that individuals are often surprised to learn is that separation or divorce does not automatically override any existing beneficiary designations naming an ex-spouse. This means that if, at one point in time, you named your now former spouse as the beneficiary of your plans and policies, did not update the beneficiary designations, and you pass away, the ex-spouse could inherit the proceeds of the plans and policies because they are still the named beneficiary. A good estate planning lawyer will draw attention to these types of matters to avoid unexpected or undesirable outcomes.

A Will appoints an estate trustee, responsible for administering an estate on death. Power of Attorney documents appoint an attorney, responsible for decision-making during life. An attorney for property deals with decisions regarding financial affairs, while an attorney for personal care deals with decisions regarding health and well-being. The word “attorney” also sometimes causes confusion – the attorney is the person appointed as the decision-maker, not the person’s lawyer (and they do not have to be a lawyer).

Ontario law does not use the term “living will”, although sometimes people use this term to refer to written wishes regarding medical treatment and/or personal care. This is also known as an advance directive.

There is often confusion around this point. A Last Will and Testament, Power of Attorney for Property, and Power of Attorney for Personal Care are three separate legal documents. A Will takes effect on death, while Power of Attorney documents do the opposite: they apply during life and are no longer effective on death.

The expense is relative, as there are several great estate planning strategies and opportunities that could lead to tremendous savings in estate administration tax (i.e. probate tax), income tax and legal costs down the road, which could far outweigh the cost of working with an estate planning lawyer to design a tailored estate plan. A well-crafted estate plan could also reduce the prospect of a disputed estate, which could be eaten by legal cost, expense and delay that could have been avoided with a solid plan.

Completing or updating your estate plan should not be a stressful or difficult experience. We encourage you to work on your estate-planning project today with one of the specialists in our Estate Succession Group.

5. “I DON’T NEED A WILL BECAUSE I ALREADY HAVE A LIVING WILL, AND/OR “IN MY WILL I CAN APPOINT SOMEONE TO MAKE DECISIONS FOR ME IF I LOSE CAPACITY”.

T h e M i s s i s s a u g a E c o n o m i c R e s i l i e n c y G r o u p ( M E R G ) i s t h e v e h i c l e t h r o u g h w h i c h s e n i o r - l e v e l l e a d e r s f r o m t h e c o r p o r a t e a c a d e m i c a n d n o t - f o r - p r o f i t s e c t o r s c o n n e c t , c o l l a b o r a t e , a n d d e v e l o p p r a c t i c a l s o l u t i o n s a i m e d a t d r i v i n g b u s i n e s s s u c c e s s a n d e c o n o m i c p r o s p e r i t y i n M i s s i s s a u g a

M E R G w a s l a u n c h e d i n S e p t e m b e r 2 0 2 0 w i t h a v i s i o n o f “ C o n n e c t i n g B u s i n e s s f o r a T h r i v i n g M i s s i s s a u g a ” I n i t i a l l y c r e a t e d i n r e s p o n s e t o t h e m a n y c h a l l e n g e s a s s o c i a t e d w i t h t h e o n s e t o f t h e C O V I D - 1 9 p a n d e m i c , t h e p r o g r a m h a s s i n c e e v o l v e d i n t o a t r u s t e d f o r u m f o r C E O s f r o m a c r o s s M i s s i s s a u g a ’ s d i v e r s e e c o n o m y t o s h a r e i d e a s e x p l o r e p a r t n e r s h i p s a n d c o l l e c t i v e l y b u i l d o u r e c o n o m i c c a p a c i t y

M E R G i s c u r r e n t l y e n g a g i n g m o r e t h a n 5 0 s e n i o r - l e v e l d e c i s i o n m a k e r s f r o m M i s s i s s a u g a ’ s m o s t p r o m i n e n t a n d i n f l u e n t i a l p r i v a t e - s e c t o r e m p l o y e r s , n o t - f o rp r o f i t s , a c a d e m i c i n s t i t u t i o n s , a n d o t h e r s w h o f i r m l y b e l i e v e i n t h e p o t e n t i a l o f M i s s i s s a u g a t o l e a d O n t a r i o a n d C a n a d a ’ s e c o n o m i c r e c o v e r y b y l e v e r a g i n g o u r u n i q u e a s s e t s a n d d e v e l o p i n g i n n o v a t i v e , s c a l a b l e , a n d r e s u l t s - d r i v e n s o l u t i o n s t o m e e t t o d a y ’ s m o s t p r e s s i n g c h a l l e n g e s a n d t o m o r r o w ’ s o p p o r t u n i t i e s

Canada’s economy is expected to experience two consecutive quarters of negative GDP in Q1 and Q2 of 2023, according to expert economists.

This will constitute a technical recession, and while economists are optimistic it will be short lived, it is better to prepare for the worst as a business owner. Lowered consumer spending, a more challenging labor market, and rising interest rates will all present challenges to your business in the short term and, if not handled well, may continue to plague you even after the recession ends and the economy recovers. It is important to prepare yourself with the right tools now so that you’re able to overcome these challenges when they arise, and invoice factoring is a strong option. Here is why.

When consumer demand is lower, your clients take more time to pay you as they handle their own challenging financial situations. Delayed payments begin to impact even businesses that are not consumer facing. As the impacts ripple through the economy, most businesses will find themselves shorter on cash than normal. You’ll still have to pay your operating costs or make investments for new work, but the payments you receive for work that has already been completed will be delayed.

The results of a constrained cash flow can be very negative for your business. It can lead to missed opportunities to invest and become more competitive,

delayed payments to your own supplier weakening your relationship, and more. While temporary cash flow challenges can sometimes be met by dipping into savings, this is not a sustainable solution when facing a recession, especially not a lengthy one.

Invoice factoring allows you to skip the wait to get paid. Your factoring company pays you immediately for any invoice that you issue and waits to collect the money from your client themselves. As a result, you have cash available even as your clients take much longer to pay. That is valuable money for any business, but especially those who have small margins or who need to make investments to keep their business competitive through the recession. You can afford to hire new talent even amid the labor shortage, invest in new software solutions to make your business more streamlined or competitive, and stay afloat through a macroeconomic downturn by avoiding any cash flow issues.

Lines of credit, credit cards, and loans from banks and financial institutions are no longer as viable a solution as they once were. With interest rates

rising, lending is no longer the most beneficial approach to counteract cash flow issues in a recession and can instead lengthen the road to economic recovery for your business.

If you choose new lending products today, more payments will go to interest while less go to principle, and you will end up paying more for the same amount of money than you would have in the past. For businesses with small margins, making larger payments on loans can put serious strain on your cash flow—precisely what you are trying to avoid.

In contrast, the fee for factoring is not directly connected to the interest rate and you do not make payments on the money forwarded to you by the factoring company. A small fee is paid immediately, which the factoring company withholds from you when they pay your invoice. The rest is immediately available cash, which you can use to continue to run and scale your business in a recession.

You can learn more about factoring as a tool to weather the recession by contacting J D Factors.

Located at 315 Matheson Blvd E. Mississauga, ON L4Z 1X8 1-800-263-0664 www.jdfactors.com

Every homeowner highly values their home. Your home is your castle, right? A very common mistake when selling your house is to set a price that’s too high. Needless to say, pricing it too low (for a quick sale) won’t help either! Finding the right balance while pricing your home is detrimental to the success of your transaction, set your emotions aside

What’s equally important is having sufficient knowledge about the market. There’s a wide range of ways to access market information starting from free online home estimates all the way to certified/unbiased appraisers/realtors.

Ignoring a major issue in your home is not strategic. A buyer’s home inspector could easily pinpoint major problems/defects in the property. So, your choices are to either disclose it and you will then need to price your property accordingly - or, even better - you might decide to get the issue fixed so you don’t lose buyers who would want to move in right away. The best approach would be hiring an inspector yourself, so you can be better informed about any issues before putting your house on the market.

Renovations/upgrades you invested in throughout the years usually pay off when you’re selling your home, as buyers

appreciate new floors, new windows, upgraded kitchen, appliances etc. So, it’s a win-win here, you enjoyed the upgrades while living in the house, and it added value to your home.

Homeowners think about making money when they sell their house, but sometimes they overlook/underestimate some the expenses they will incur.

The following standard costs are important to account for:

• Closing Costs: usually between 1-3% of the home price. These include the title transfer fee, sales tax, attorney fee, and a fee for a title company or a lawyer who organizes the final transaction.

• Agent commissions – the seller usually pays both the seller’s and the buyer’s agent commission. This would usually amount to 5%, so be sure to plan for it (build it into the selling price), or choose an alternative selling option, like selling directly, to keep this hard-earned money. At PropertyGuys.com, we support homeowners take control of their home selling process without having to go through the traditional model. We provide all the tools and service needed to complete the transaction, including an unbiased appraisal, property listing and marketing on traditional platforms and non-traditional platforms/ channels, advertising, helping with showings and offer negotiation, all the way to legal assistance throughout the process. This is supported by keeping the homeowner educated and well informed on the process. We charge

a flat fee, and we have different service packages to suit different preferences of hands-on/off involvement from the homeowner. The key to this is transparency and flexibility, so homeowners know what they are getting into and the services they are paying for.

While the highest offer might be attractive, it might not be the best. Offer conditions such as closing date, financing, inspection… among others to consider when deciding on the most suitable offer for YOU!

Disclaimer: About PropertyGuys.com: PropertyGuys.com Inc. is a private sale franchise network and marketplace. Each PropertyGuys.com franchise is independently owned and operated (collectively “Us” or “We”). We represent neither the buyer nor the seller and we are not licensed to trade in real estate. We neither warranty nor make any representations as to the outcome of a property sale and we do not warrant or guarantee the services provided by third parties. © 2022/2023 PropertyGuys.com Inc., All Rights Reserved. Legal Disclaimer: The subject matter developed within this article is only intended to provide general information and is for general informational purposes only. The contents do not constitute advice, are not intended to be a substitute for professional advice, and should not be relied upon as such. You should always seek legal advice or other professional advice in relation to any legal or financial decisions that you intend on making.

For almost 50 years, Square One Shopping Centre has served as the pinnacle of Mississauga’s city centre.

Helping to put Mississauga on the map for visitors the world over and drawing crowds that drive guests to nearby businesses and attractions across the city. Completed in 1973 by local visionary Bruce McLaughlin, the Mississauga that we know today has grown around this important landmark, with Mayor Hazel McCallion choosing to locate the new City Hall nearby, forming the downtown core.

Today, Square One is an essential, vibrant thread woven into the fabric of our community. Sprawling across 2.2 million square feet, it’s not only Ontario’s largest shopping centre, it’s also a fully-fledged entertainment and leisure destination. Featuring over 100+ dining options including The Food District, an elevated dining experience inspired by classic food emporiums, as well as entertainment offerings like The Rec Room and GYGO, it’s no surprise that it welcomes 24 million visitors annually.

“It’s impossible to overstate the importance of Square One to our city and our community,” said Tourism Mississauga CEO, Victoria Clarke. “Not only is it a key amenity for local residents, it is a designated tourist destination with tremendous draw for guests year-round. This visitor audience has a ripple effect on all of the nearby hotels, tourist destinations, restaurants and local businesses. Many visitors come to Mississauga specifically to shop at Square One and then discover so much more”

Along with its close proximity to transportation hubs, including Pearson international airport and major highways, Square One’s broad appeal is part of what makes it a popular tourism destination. With over 330 shops, it houses the biggest names in luxury goods, including Holt Renfrew, Apple, and Tiffany & Co., along with a vast array of shopping options. Beyond beloved brands, it also offers unique experiences, from artisan markets to pop-up shops and immersive attractions like the World of Barbie.

“The shopping landscape is evolving, so providing a unique, engaging customer experience, along with a diverse range of stores and restaurants, is critical,” said Lesley Boughen, Senior Tourism Manager, Oxford Properties Group. “Square One is known for its dedication to providing innovative, fashion-forward experiences and, that is why visitors return, to discover Square One, and the city”

The untold economic benefits it provides to the larger community are immeasurable. From its long-standing history, to its central location, Square One is truly at the heart of Mississauga.

“If you’ve been running everything through your personal accounts it’s tough to pull all that data apart,” says Cline. “It can be particularly challenging for businesses that operate with cash or e-transfers to separate those from personal transactions. Challenges like this could be the difference between a bank wanting to do the mortgage with you or not.”

you. We need to clearly understand how and where you accept payment from your customers and how and where you pay for your expenses.”

“It’s incredibly more difficult to apply for a business loan when it’s complicated to interpret and understand your finances. That can potentially limit your lending options and who’s willing to work with you,” says Butler.

“And it’s not just commercial lending where intermingling your accounts can create a hitch”, explains Cline. Say you’re applying for a home mortgage. A common document you’ll be asked to produce is a Letter of Employment – but you won’t have one if you’re selfemployed, and so the bank will ask to see your business’ financial statements as an alternative.

“In general, it makes it a lot easier to keep track of things. And it should be no surprise that having personal and business transactions neatly separated makes tax time go much smoother,” says Butler. Adds Cline: “If you’re paying yourself from the business, you’ll also want a clean record of those funds going from your business account to your personal account for personal income tax purposes.”

“You look more legitimate when you can issue a cheque with your business name on it and you’re taking deposits into a business account,” says Cline. “Legitimacy is a big piece for the bank to feel confident in doing business with

It’s really to your benefit to make it easy for people to understand your business finances, adds Butler. “If someone is evaluating your business – like your banker, or a supplier who’s looking at extending you credit, or someone who’s interested in acquiring your business – they need a clear line of sight to your bottom line and cash flow. You don’t want people to have to decipher and make assumptions about your financials.”

You want to keep a strong pulse on the health of your business – and that’s difficult to do if everything’s all combined in one account. “If you don’t have a good view on your cash flow, how can you gauge your performance against your metrics – or even properly set those metrics?” says Cline. She also notes that clean financial statements will better support your business and financial planning.

Learn more: Visit cwbank.com/blog for more insights from CWB’s business banking experts.

B.A. (Hons) LL.B, Barrister and Solicitor Babel Immigration Law

On Tuesday, November 1, 2022, The Minister of Immigration, Refugees and Citizenship announced Canada’s 2023-2025 Immigration Levels Plan. This multiyear plan has one of its primary focusses the needs of Canadian business to attract and foreign workers to fill positions in key sectors including health care, skilled trades, manufacturing and technology. Furthermore, the Government is expecting an increased focus on attracting newcomers to small towns and rural communities to help manage anticipated social and economic challenges.

In 2021, Canada welcomed over 405,000 newcomers and is optimistic to surpass those numbers with this new strategy. The new plan is set to see targets of 465,000 permanent residents in 2023, 485,000 in 2024 and 500,000 in 2025.

The OINP Pilot program, Entrepreneur Success Initiative, was announced in 2021 as part of an initiative to help build Ontario’s economy. The program’s goal is to help entrepreneurs establish and grow businesses across the province, providing services such as:

Identifying business creation and succession opportunities outside the GTA.

• Marketing the Entrepreneur Stream and Business opportunities.

• Supporting, Matching and Helping qualified entrepreneurs develop high-quality expressions of interest and mechanisms to establish a new business.

• Helping registrants with an invitation to apply in submitting a high-quality application.

This initiative is set to be administered for two (2) years and will help support 100 new applicants.

As of October 31, 2022, the Labour Department announced updates to processing times for permanent labour certification applications and prevailing wage determination requests.

PERM applications filed in February 2022 commenced the adjudication processes, and the department is currently reviewing applications filed in December and earlier. Appeals for reconsideration are also under review for applications filled in May.

Based on the current trends, PERM processing times have taken longer, with the average processing times for adjudication being 249 days, while audit reviews are 368 days.

On November 17, 2022, the Department of State announced efforts to address the current backlog and wait times for visitor visas to the United States, with a goal of nearing prepandemic processing trends.

Current updates show that the median wait time for a tourist visa (B1/B2) appointment is approximately two (2) months. There are also options available for applicants with dire travel needs, as they can apply for an emergency appointment.

To help alleviate the backlog, efforts have been made in the past year to help reduce appointment wait time, many of which include waiving in-person interviews where possible and processing more visas with fewer consular officers. These changes have been implemented to increase efficiency and manage applicants’ expectations.

APA Results Inc.

ARJ Airparts Inc.

Armor Canada Imaging Supplies Inc.

AXIS Communications Inc.

CEO Global Network

Challenge Island - Mississauga

D&G Laboratories Inc.

Detail Guys

DriverCheck

Health Partners International of Canada

Inwit Solutions Inc.

iPOTS

Just Boardrooms Inc.

Mississauga Music

Ontario Heroes Health and Social Services

Ontario’s Big City Mayors (OBCM)

PPL Aquatic, Fitness & Spa Group Inc.

Property Guys

QSi Security

Results and Solutions

Symposium Cafe Restaurant & Lounge

The Gardener Mississauga

Uniparts O.E.M. Canada Inc.

Universal Music Watterson Financial Solutions Inc.

WorkBright

XenTegra Canada

ZHS Professional Corporation

ANDREW WESOLOWSKI Electronic Recycling Association

ANDREW WESOLOWSKI Electronic Recycling Association

The Electronic Recycling Association (ERA) – a not-for-profit that reduces the environmental impact of discarded electronic waste by offering accessible services to help corporations and individuals manage their retiring IT assets – has a goal of collecting 10,000 laptops and computers for Canadian organizations and individuals.

Many charitable organizations are in dire need of used electronics right now, including the Salvation Army, March of Dimes Canada, YMCA, Kids Cancer Care, and the Native Child and Family Service of Toronto. See a full list of charitable organizations in need.

“All told, we know of more than 1,000 charities in need,” said ERA Founder and President Bojan Paduh. “At the heart of the problem is education and disadvantage. We have kids across Canada living in households where there is no laptop or PC. While the exact number is unknown, if 11 per cent of Canadian households had no internet access in 2019, a device shortage can be reasonably assumed. In the COVID ‘era’ this assumption has been proven correct. Many students do not have access to a laptop.”

But students aren’t the only group in need of used electronics. Charitable organizations in particular find it extremely difficult to use a portion of their strict budget to purchase

equipment that would help them create more awareness online, said Paduh.

“More often than not, such purchases must be put on the back burner in favour of more immediate priorities. ERA donations take a great weight off these organizations’ shoulders, allowing them to focus on their immediate ‘everyday’ projects and priorities.”

The ERA’s list of organizations in urgent need is growing daily. The items needed, from laptops and computers to printers and projectors, make a real difference in the ability of charities to make a measurable impact in their communities.

“Over the years we have seen a notable increase in the need for technology through the staggering numbers portrayed on our waiting list each year,” said Paduh. “If we all give a little, these requests could be filled in no time. I am looking for your help in making these organizations’ dreams a reality.”

Companies and individuals considering donating electronic devices will often come to a mental roadblock on the point of data security: “How can we be sure any residual data on these devices will be safe?” Unfortunately, unanswered questions in this area will lead to certain conclusions, with the end result being a “No” decision to donating.

“Study after study reveals this great fear among potential donors that data recovered from their old equipment will be snatched,” said Paduh. “Fortunately companies and individuals have no cause for concern when they make a donation through us.”

The ERA offers 100% no-worry donation through services such as:

• Physical, onsite data destruction

– The ERA has several AmeriShred mobile hard drive shredders that can be delivered to your location. These machines can shred hard drives, data tapes, servers, and other data storage hardware.

• Offsite data destruction – The ERA can pick up your hard drives and perform data destruction at one of our facilities.

Working with ERA gives you perfect assurance that your data has been completely destroyed, said Paduh. “Regardless of what service the ERA completes for your organization, certification will be provided, whether that’s a Collection Certificate, a Collection Inventory Spreadsheet, a Data Wipe Certificate, a Certificate of Destruction, or a Donation in Kind Certificate.”

Help ERA by booking a pickup of your unwanted devices through our online form.

O u r f o c u s i s o n r e d u c i n g u n n e c e s s a r y w a s t e a n d e n v i r o n m e n t a l i m p a c t t h r o u g h r e t i r i n g e l e c t r o n i c a n d I T e q u i p m e n t . B y r e p u r p o s i n g u n w a n t e d e l e c t r o n i c s , w e c a n d o n a t e r e f u r b i s h e d e q u i p m e n t t o f o u n d a t i o n s a n d c h a r i t i e s i n y o u r c o m m u n i t y R e c y c l e y o u r e l e c t r o n i c e q u i p m e n t s a f e l y a n d s e c u r e l y w i t h t h e E l e c t r o n i c R e c y c l i n g A s s o c i a t i o n

T h e E l e c t r o n i c R e c y c l i n g A s s o c i a t i o n ( E R A ) i s a n o n - p r o f i t o r g a n i z a t i o n f o u n d e d i n 2 0 0 4 t o a d d r e s s t h e g r o w i n g p r o b l e m o f e - w a s t e a n d t h e i n c r e a s i n g ‘ d i g i t a l d i v i d e ’ . E R A o f f e r s s i m p l e s o l u t i o n s t o h e l p i n d i v i d u a l s a n d o r g a n i z a t i o n s p r e v e n t o p e r a t i o n a l e q u i p m e n t f r o m p r e m a t u r e d e s t r u c t i o n . W i t h a f o c u s o n r e c o v e r y , r e f u r b i s h m e n t , a n d r e u s e , E R A c o n t i n u o u s l y s u p p l i e s c h a r i t a b l e g r o u p s w i t h d o n a t e d I T e q u i p m e n t w h i l e s e c u r e l y m a n a g i n g t h e r e t i r i n g I T a s s e t s o f o r g a n i z a t i o n s a n d i n d i v i d u a l s a c r o s s C a n a d a .

P I C K - U P S E R V I C E 1 0 0 % S E C U R E D A T A D E S T R U C T I O N

E - W A S T E M A N A G M E N T

A commercial robot vacuum designed to work alongside your staff while they focus on what matters - helping customers and growing your business.

Cutting Edge AI for Elevated Health & Safety

Canon is a registered trademark of Canon Inc. in Canada and elsewhere. Softbank Robotics and Whiz are trademarks of Softbank Robotics America, Inc. All other referenced product names and marks are trademarks of their respective owners and are hereby acknowledged.© 2022 Canon Canada Inc. All rights reserved.