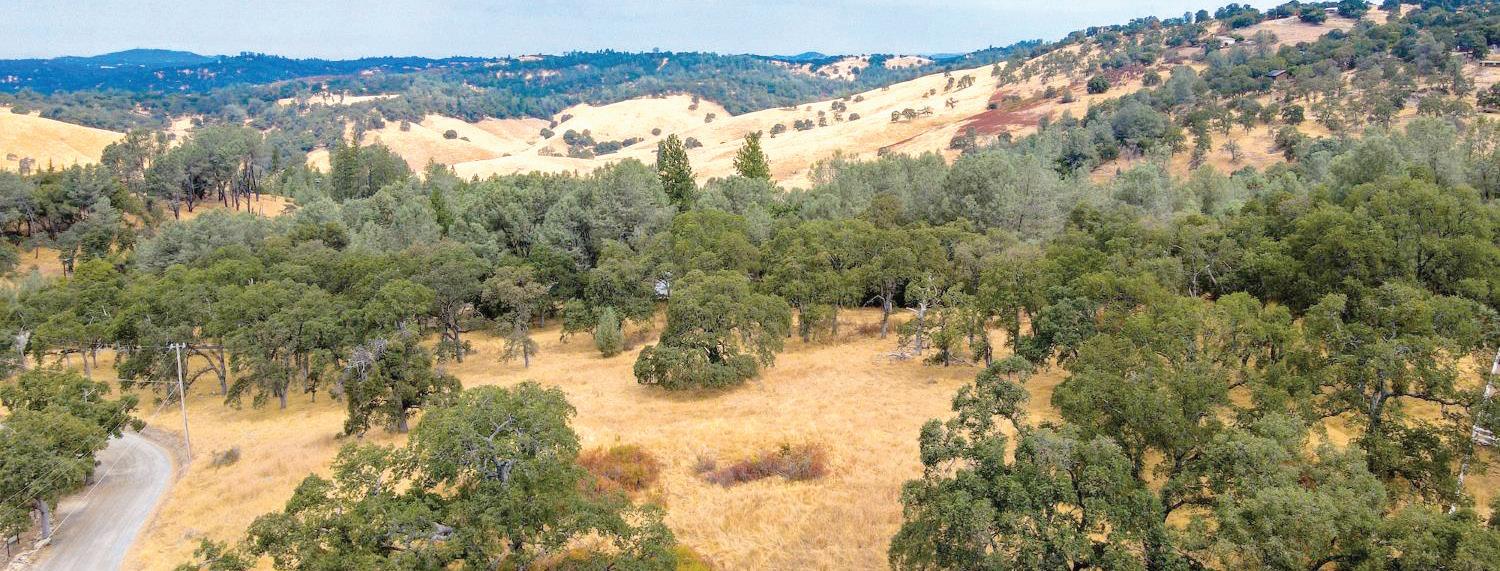

hat do you think about going without homeowners insurance?” It was a question I had been asked before. Tim is a past client who I helped buy a home in Shingle Springs several years ago. He told me when he rst purchased the home State Farm was their insurance provider and his yearly policy was around $1,500. Since then, State Farm and two other insurance companies have refused to renew his homeowners policy, leaving Tim with the only insurance available, the California FAIR Plan.

In 2019 Tim’s FAIR Plan premium was $4,500. His most recent renewal quote was over $17,000. Tim had paid o his mortgage, subsequently a homeowners policy was optional. Doing without homeowners insurance was a risk Tim

was considering. Roughly 40% of U.S. homeowners own their home free and clear of a mortgage. Many are nding homeowners insurance an expensive option.

Lenders require homeowners with a mortgage to have a comprehensive full replacement costs policy in force during the life of the loan. If the security for their loan is damaged or jeopardized they want to be paid rst. If a homeowner fails to maintain acceptable coverage, a lender will obtain a lender’s policy which insures the lender in the event of an insurable loss. Lender policies are expensive, and their cost is invoiced to the homeowner. Failure of a homeowner to pay for insurance coverage is a foreclosure risk. Homeowners without a mortgage may have some exibility in determining the amount and extent of their insurance coverage but not much. Most insurance

companies have limits on the policy deductions and require minimum coverage. With few opportunities for substantial savings on a policy premium, more homeowners are electing to do without.

According to the Insurance Information Institute, the percentage of Californians without homeowners insurance has doubled since 2019. Currently, 12% of homeowners have opted to go without homeowners insurance, compared to 5% in 2019. That percentage is likely to increase. California homeowners insurance premiums are expected to increase by 80% within the next four years. An expensive option for the 7.4 million California homeowners without a mortgage.

While one third of California homeowners have the option of going without insurance, most don’t have the nancial strength to withstand a signi cant loss. The majority of homeowners have 80% or more of their

household net worth in their home’s equity. If the equity in a personal residence accounts for more than 30% of the family’s total net worth, going without insurance is not advisable. Tim’s home equity amounted to less than 30% of his net worth. If a re destroyed his home, it would be a catastrophe, but his net worth would allow him to buy another home or rebuild.

PLEASE READ CAREFULLY! A proof is provided to avoid printing errors & to show the arrangement of composition. Mark all corrections with a pen. We cannot be responsible for printing errors not corrected on the proof.

does not allow

Statistically, the odds of losing a home to a re were in Tim’s favor. According to Cal Fire, about 2,000 homes each year are destroyed by res from di erent sources. That’s a large number. However, there are about 14 million homes in the state. The risk increases for homes that are located in high re areas, older homes without re hardening features and homes with poor defensible space. I suggested Tim hire a re-inspection service to evaluate the likelihood that Tim’s home could survive a wild re and o er suggestions how to improve his ■ See CALHOON, page 4

We are all a little house blind. That is, we put o seeing what needs refreshing, replacing, updating or upgrading for as long as we can. It’s selfprotective. If we don’t see that the drapes are fraying, the carpet has worn spots, our furnishings are so last century (and not in the cool sense) and that televisions the size of Volkswagens belong in museums, we can dodge the inconvenience and expense of doing something about it.

one connected space, were woefully out of date. The Old-World look I had adopted and loved over 20 years ago — the tapestry fabrics, the heavy carved furniture, the iron xtures — had passed its expiration date. So, I did what any rational person would do. I stuck my head back in the sand.

Good design keeps up with the times

European antiques, and pair a chromeand-glass table with a vintage Persian rug. It’s perfect for those of us who have traditional furniture they don’t want to replace, but who also want to inject a modern vibe at home.

anked the tapestry for simpler vertical ones, which elongated the room. I wallpapered the main wall and ceiling in a textured, azure grasscloth, giving the dining area more de nition.

However, as your therapist will tell you, denial only works for so long. Then you’re le with — ahem — reality. Here’s one of those realities: As times change, styles change. You can either keep up or live in your time capsule.

This realization hit home, literally, a short time ago when I pulled my head out of the sand, took an honest look at my dining room and entryway and recognized that these areas, actually

I knew that once I broke open the time capsule and updated one part of the room the rest of the room would only look worse, the way putting shiny chrome wheels on a rusty old car just exaggerates its condition.

Because I didn’t want to replace everything, nor could I a ord to, I tried to gure out how to work with the large, more expensive pieces by updating the furnishings around them. This is why I am so glad some designer invented the transitional style, a look that lets you mix older traditional décor with newer contemporary pieces. Transitional design gives you permission to mix modern art with

I began slowly. Using the traditional marble-topped Bombay chest in the entry and the walnut dining room table with its French-curved and carved legs as anchor pieces, I made one change at a time. First, I replaced the heavy iron light xtures, which hung from the ceiling like giant looming spiders, with lighter, more modern xtures. Next I swapped the woven seagrass runner in the entryway (which was supposed to be temporary but had stayed for four years) with a more colorful and durable handknotted wool one.

Progress stalled for over a year until this past spring the prospect of hosting a dinner party for six illustrious community members kickstarted my redecorating plans. I made more changes. Some I shared in this column. I sold a large French tapestry that dominated the main wall and replaced it with a more transitional pastel. I traded the art-deco round mirrors that had

Over the last few weeks, I made my nal (as if there is ever an end) two moves. I replaced the high-back tapestry chairs with sleeker, more modern seating in a performance cobalt-blue fabric and replaced a large traditional oil landscape painting that hung over the Bombay chest with a new vibrant piece. The modern chairs and art next to the traditional furniture create that transitional bridge between the old world with the new. At least that was the plan.

It took time, but nally the space is nished. Well, at least for now. Now being temporary.

If you, too, need to pull a room in your house out of the doldrums, but don’t know how to start, here are some considerations:

• Be honest. Every few months, look at your house as a visitor would. Imagine having company coming over

Marni Jameson At Home

Photos by Marni Jameson

This traditional dining room and entryway, left photo, were overdue for an update. Contemporary chairs, modern art and accessories and transitional light xtures, right photo, updated the old-world look making the space look more current without replacing the larger furniture.

Calhoon

Continued from 2

defensible space and house hardening. Homeowners who elect to self-insure should either set aside the insurance premium they would have paid to o set potential expenses in the event of a loss or use the money to upgrade a home with re-prevention features in preparation for a potential re. Spending the savings of a yearly insurance premium on a resuppression system is a one-time cost and will improve the home’s value. Both the cost of insurance and the risk of going without is stressful. Amy Bach, co-founder of consumer advocacy group United Policyholders explained, “The stress levels households are experiencing around the insurance crisis is unprecedented. You can’t a ord to lose most of your net worth because you don’t have insurance, but the $18,000 and $40,000 premiums people are quoted is insane.”

The declining number of insurance companies in California has eroded homeowners options for lower premiums. Insurance companies are not negotiating on premiums. Bundling home with auto, higher deductibles and threats of

Jameson

Continued from 3

and seeing your home for the rst time. What looks tired, dated or not up to the look you want to project? This will prompt if not action, at least awareness.

• Evolve. Designers agree that the best rooms look as if they came together over time, not as if they were furnished in one day from the same furniture store. My entryway and dining room makeover took three years and included pieces I’ve owned for over 20. Continually making small moves over time will help your rooms feel current, curated and cared for.

• Take your time. Finding just the right piece is worth the wait. We lived with a blank wall for several months before nding the right painting for the entry. When I found out the dining room chairs I liked best would take three months to arrive, I kept shopping for chairs I could get sooner. Eventually I realized that if I chose anything else, I’d be sorry. Better to live without than hurry and live with second best.

• Keep up. If you care about how your home looks, don’t be a slave to fashion

shopping around will not substantially lower premiums. However, re hardening improvements and more defensible space will substantially decrease a home’s potential loss to a wild re.

If a homeowner is willing to take the risk of self-insurance they must think like an insurance company. They must be prepared for a loss with adequate reserves to build or buy another home. They should objectively view their home’s potential for a re loss and evaluate mitigation measures to insure it survives a re. Homes are subject to damage from other sources normally covered in a comprehensive policy. A general liability policy should also be considered. Homeowners are caught between a rock and a hard spot. With the median selling price of a California home north of $900,000, few homeowners can sustain that loss. However, costly premiums are forcing rural homeowners to accept the risk of no coverage or selling their home and relocating.

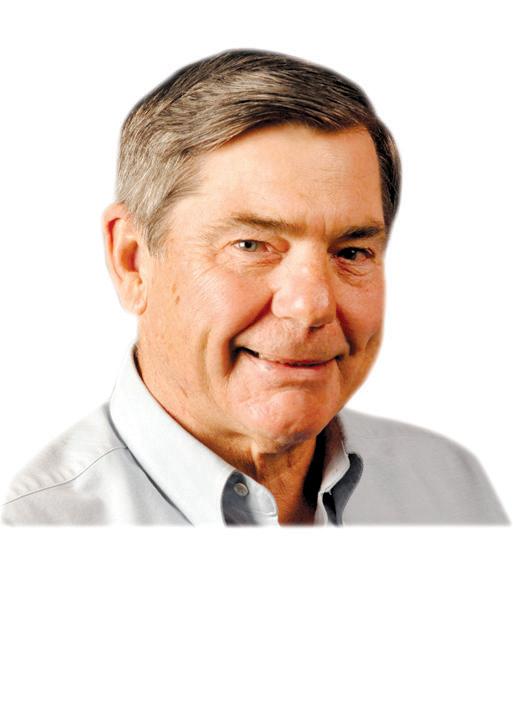

Ken Calhoon is a real estate broker in El Dorado County. He can be reached for questions and comments at ken@kencalhoon.com.

and don’t adopt a look because it’s “the style,” but do pay attention to trends and make small moves to keep your décor looking current.

• Make the transition. If, like me, you want to move away from traditional looks toward a more contemporary style without starting over, look for ways to trade patterns for solids, fringe for clean edges, ornate for sleek and wood for glass or chrome.

• Let go. Don’t cling to the status quo because you don’t know what to do with your old furnishings. A er trying unsuccessfully to sell my old dining chairs online, I donated them to a charity that helps those who’ve lost their homes furnish new places. Clinging to the past robs you of the present. Move forward. Marni Jameson is the author of seven books including the newly released “Rightsize Today to Create Your Best Life Tomorrow,” “What to Do With Everything You Own to Leave the Legacy You Want” and “Downsizing the Family Home.” You may reach her at marnijameson.com.

Find out how much your home is really worth in today’s market!

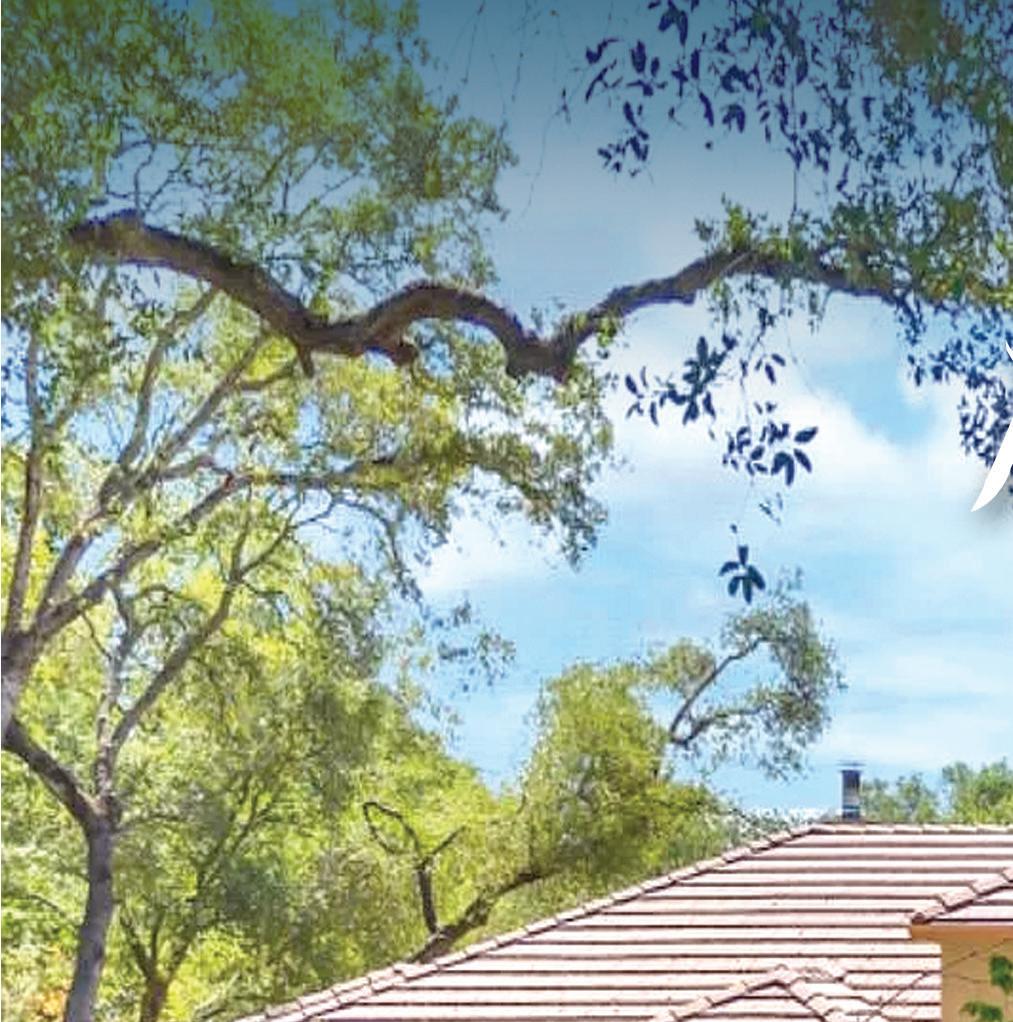

NEW HOME Sanctuary in Placerville. Experience the perfect blend of luxury and tranquility in this 2023 custom-built two level home. Nestled at the end of a peaceful culde-sac, backed by a lush greenbelt, this stunning residence o ers unparalleled privacy. is spacious new home with each oor boasting its own eating and entertainment areas, chic wet bars and laundry rooms. Upstairs enjoy gourmet kitchen with custom cabinetry, stainless steel appliances, granite counters and main living areas; along with your primary suite and ensuite guest bedroom and half bath. Entry level includes another ensuite guest bedroom and half bath along with eating and living space - perfect for guests or additional family. Your home is extremely energy e cient with multi-zone heating and cooling, tankless water heater, OWNED solar panels, re sprinklers and pre-wired for a generator and home theatre. e expansive 890 sq garage features 16’ doors, is perfect for RV or boat storage and can park 2-3 cars. Priced to sell quickly. Please submit your o er today and make this dream home yours. MLS# 224080602 $785,000

to Cameron Beautiful home on 5 sprawling home epitomizes spacious living stone replace and hearth add a complements the open kitchen, spread out and unwind in this meticulously windows, highlighting the seamless grounds o er endless possibilities, the serene surroundings. Every

Stacked stone replace Sprawling acres, Majestic oaks Road, Cameron Park

Where Luxury Meets Tranquility

for both entertaining and everyday life. Discover room to meticulously cra ed home, where natural light oods through large seamless blend of elegance and natural beauty.Outside, the expansive possibilities, whether you envision creating your own oasis or simply enjoying Every detail has been thoughtfully designed to elevate your lifestyle. MLS#224076978 Listed at $1,265,000

August 17 & Sun, August 18,

12-3

2842 NORTHRIDGE DRIVE, PLACERVILLE

$529,000

Immaculate 3bd/2ba home sits on .36 of acre. Minutes from downtown Placerville. Gorgeous Hardwood Flooring, plantation shutters/dual panes, ceiling fans, central HVAC, whole house fan. The Kitchen has reverse osmosis ltration, granite counter tops, plenty of cabinets, pantry closet. The Living room has a replace w/newer insert. Dining room area has a woodstove. Large master suite w/walk-in closet, slider to balcony. 2 car garage.

CENTURY 21 SELECT • VICKI EMERY (530) 409-3707

Saturday, August 17, 2024

12-3 3720 MARINKO COURT, PLACERVILLE

$665,000

This charming 4-bedroom, 3-bathroom gem, featuring 2 master suites, could be ideal for multigenerational living. Enjoy spacious family and living rooms with a cozy wood stove. Set on over 1 acre of usable land, the property is perfect for outdoor fun and relaxation. Additional perks include RV access and solar for ultimate convenience and sustainability. Embrace the best of both worlds - close to town yet privately nestled.

CENTURY 21 • HELEN RIVARD 530-409-2687 • ASHLEY CAMPBELL 530-391-4058

Sunday, August 18, 2024

12-3 4257 PINE FOREST DRIVE POLLOCK PINES

$375,000

Sweet Cabin in the Woods. Features include, Vaulted Ceilings with a Wall of Windows. A expansive deck. Large lot, Plus, the adjacent .41 Acre lot is included in the price. Cozy woodstove on a rock hearth plus an upper loft area. The entry level has 2 bedrooms, a full bath, kitchen, dining area and Living room. Upstairs is another full bath, bedroom and loft. There’s a re hydrant right across the street for insurance savings. No Home Owners Fees! RE/MAX

3

Discover your dream retreat nestled among towering pines and cedars in this charming single-story home. This 3-bedroom, 2-bathroom residence spans 1,504 sqft and sits on a serene 1-acre lot. The home welcomes you with vaulted ceilings that create an airy, spacious feel, while a cozy wood-burning stove adds warmth and character. The kitchen and living areas flow seamlessly, perfect for family gatherings and entertaining. The over sized primary suite offers comfort and privacy, with two additional bedrooms providing ample space for family or guests. The 2-car garage ensures convenience and security for your vehicles and storage needs. Step outside to enjoy the tranquility from your front porch, surrounded by nature’s beauty. Just minutes from Jenkinson Lake, you’ll have easy access to outdoor activities like boating, fishing, and hiking. You will also find an extra room with a half bath located under the main living area, offering potential for conversion into a separate unit, ideal for guests, rental income, or a home office. This property combines the best of mountain living with modern comforts, making it a perfect getaway or year-round residence. Don’t miss the opportunity to own this unique, versatile home in a breathtaking setting. MLS#224088004

01733424

$1,618,460 5201 Wild Oak Ln 4 5 (4 1) 3984 0.4022 224070149

$1,650,000 2781 Via Fiori 4 5 (4 1) 3617 0.43 224061037

$1,699,000 2616 Orsay Way 5 5 (4 1) 4652 0.2 224085339

$1,699,000 870 Leighton 4 5 (4 1) 4038 0.22 224054202

$1,795,000 2510 Orsay Way 4 5 (4 1) 4059 0.33 224085512

$1,799,999 1272 Van Gogh Dr 5 6 (5 1) 4382 0.2 224010522

$1,888,888 2791 Giorno Way 5 6 (5 1) 5097 0.5 224077091

$1,899,000 3350 Greenview 5 5 (4 1) 4889 0.45 224037717

$1,970,000 683 Encina Dr 5 5 (3 2) 4200 0.33 224045049

$1,995,000 2954 Capetanios Dr 4 4 (4 0) 3338 1 224062476

$1,995,000 4121 Greenview Dr 3 4 (3 1) 4509 0.48 223113721

$1,998,800 4101 Hawk View Rd 4 3 (3 0) 3512 9.36 224043058

$2,299,900 4940 Greyson Creek Dr 3 5 (4 1) 3615 0.58 224042384

$2,299,988 4205 Greenview Dr 4 5 (4 1) 4087 0.55 224080619

$2,350,000 960 Villa Del Sol 4 4 (3 1) 4297 1.03 224082193

$2,495,000 7488 Sangiovese Dr 4 5 (4 1) 5246 0.69 224083380

$2,499,000 4005 Raphael Dr 4 5 (4 1) 4184 0.49 224086328

$2,499,000 4033 Raphael Dr 5 5 (5 0) 4213 0.48 223118525

$2,549,000 613 Thalassa 6 5 (4 1) 5845 0.71 224087084

$2,699,900 4950 Greyson Creek Dr 4 6 (5 1) 4163 0.48 224085185

$2,748,000 5263 Da Vinci Drive 4 5 (4 1) 4561 0.62 224055931

$2,950,000 4251 Cordero Dr 5 7 (6 1) 6637 0.48 224083776

$3,099,000 5011 Greyson Creek Drive 4 6 (5 1) 4865 0.46 223105112

$3,229,000 890 Las Brisas Ct 5 6 (5 1) 4272 0.72 224053845

$3,399,900 410 Jordan Ct 6 9 (6 3)

12605 Residential Homes

latrobe/sHinGle sPrinGs soutH

$589,000

12701 Residential Homes

Greater PlaCerville

Coloma,

12802 Residential Homes PolloCk Pines

Little Cabin in the Woods

PLACERVILLE