4 minute read

Retail Development Industry Post COVID-19 Thoughts

Phil McArthur, CSM, CRX, CDP, is the Founder and Chairman of McARTHUR Retail Development Specialists, a Past President and member of the Middle East Council of Shopping Centres and Retailers (MECS+R) since 1996. He shares his insights about the Post COVID-19 period, which can help the shopping centre and retail industry.

Operating retail destinations will regain market share slowly after COVID lock downs. Statistics from China indicate today about 30-50% traffic levels from the Pre-COVID period. The China Chain Store and Franchise Association is reporting that 60% of large mall operators are witnessing sales dropping from 30-70% for the first quarter of 2020. Certain tourist destination that had reopened have now recently closed due to fears of a second wave of COVID-19. On a positive note, regionally, Bahrain allowed shopping malls and some stores to resume business from April 9, becoming one of a handful of countries to roll back measures intended to curb the spread of coronavirus. Under the new guidelines, shop workers and customers must wear masks inside stores. Retailers are to limit the number of shoppers allowed inside their businesses, and if a line forms, stores must enforce social distancing outside. Droves of shoppers were reported returning to their favourite malls, making social distancing management a big challenge for mall operators

Advertisement

2.

3. With a large decrease in retail sales, many new retail developments globally will be delayed in oversaturated markets. In some markets, small independent retailers and restaurateurs will be hard-pressed to survive. The retail giants with multiple concepts and thousands of locations will have to reduce their overall operations to try to get to break even or curb the losses. That means closing stores. Without retailer demand, new projects will stall or downsize and developers and lenders will be forced to wait for the market to rebound.

Once the dust settles, and the retail and mixed-use development community understands the shifts in the market, unique new projects will take over market share from a tired old malls and retail formats. More mixed-use projects with significantly less retail will emerge. The need for new destinational occupiers will be strong, as well as professional entertainment attractions and food and beverage operators. The necessity of hosting huge variety in fashion categories

A safe-distancing enforcement officer wearing a red armband watches over customers lining up to buy take-away food at a food court in Singapore on April 18, 2020. (Photo Credits: TIME)

Image Credit: IMG Worlds of Adventure

4.

5.

6.

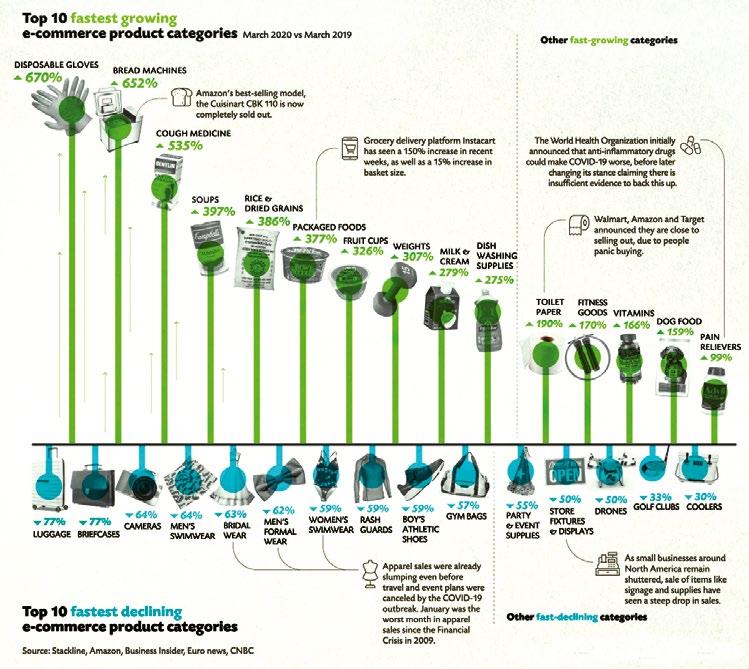

7. will be reduced partially due to the increase in market share going to e-commerce. Open-air centres for communities will make good sense as the customer’s awareness of clean and safe-shopping environments grows.

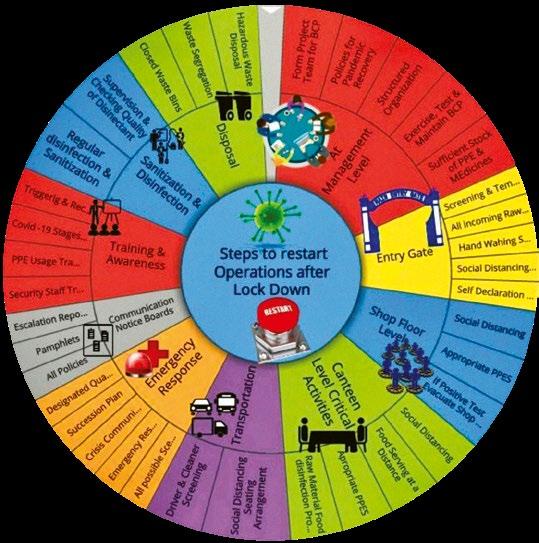

Retail destinations will have to up their cleaning, sanitation and operational game dramatically. Clean and sanitary parking lots, entry doors, common areas, and particularly restrooms, parenting rooms and other similar guest amenities will become demanded by the customers. Mall operators will engage with the customer more deeply than even before. Customers will need to trust their local malls to be clean, sanitized and professionally managed. This will be a major challenge for many retail destinations globally as most have been guilty of poor sanitation standards. In the MENA region, MAF Shopping Malls and Emaar Malls have proven that 5 star maintenance, cleanliness and sanitation are possible and a daily standard requirement.

Mall owners can only survive and profit if the mall tenants are financially healthy. Without retailers, mall owners only have buildings. Rent is a function of sales and during a crisis when there are no or little sales, mall owners and their lenders must find a way to provide relief for their tenants. It must be done now and it must be done in the spirit of partnership. Although the relationship is legal, unless the mall owners cut new deals and collect rent completely in relationship with sales generated, it won’t make commercial sense. Rent has always been a percentage of sales, just calculated by the square meter/foot.

Existing malls need to prepare now for repurposing space due to potentially high vacancies coming and low demand for retail space. In markets, like KSA, where retail space per capita is low, opportunities will still be there.

Shopping habits for food will change and new supermarkets and hypermarkets will improve their design. Better hygiene and more careful shopping habits with social distancing could be the norm for the foreseeable future

8.

9.

10. Air travel may have a challenge bouncing back. Fewer tourists will arrive in the near future making it more challenging for the retailers. Markets heavily dependent on tourism will feel the pinch.

Most retail development owners are tied to the banks, pension funds and private equity. All are impacted by the COVID-19 pandemic as their clients lose sales, rent and retailers. No lender can turn its back on the development community as these assets will take cooperation and solid planning to return to acceptable levels of return and risk.

E-commerce has grown dramatically in the past 2 months and in certain categories will leap forward in market share over physical retail. E-commerce is not perfect and people will eventually return to the malls and their attractions. There will be a new balance between physical shopping and online buying. Mall retailers and owners will have to work very hard to regain customers and market share.