4 minute read

Post-Pandemic Retailers are Reinventing

SPECIAL FEATURE

Post-Pandemic Retailers are Reinventing

Advertisement

If 2020 was about survival, 2021 is about strategic reinvention as retailers redefine ‘normal’. From rethinking sales channels to reimagining floor space, refocusing sales strategy to rebooting loyalty, transformation has become a top priority for retailers. Despite disruption and unpredictability, several regional businesses have successfully created a retail ‘renaissance’ by overhauling processes, reevaluating channels and, importantly, by pivoting quickly.

Examples to consider: Abu Dhabi-based retail conglomerate LIWA Trading Enterprises expanded its home business by adding new and relevant categories. While Saudi Arabiabased fashion and lifestyle retailer Fawaz A. Alhokair & Co. accelerated digital transformation to create an omnichannel presence in a matter of weeks.

Omnichannel isn’t a choice

The pandemic was a “wake-up call” for Fawaz A. Alhokair & Co., making it clear that omnichannel was not a matter of choice. Within weeks, the retailer launched some of its brands on e-commerce marketplaces, while creating 14 mono-brand online sites within months. From 0.5%, online now accounts for 6.5% of the retailer’s overall sales, quite sizeable for a SAR6-billion business.

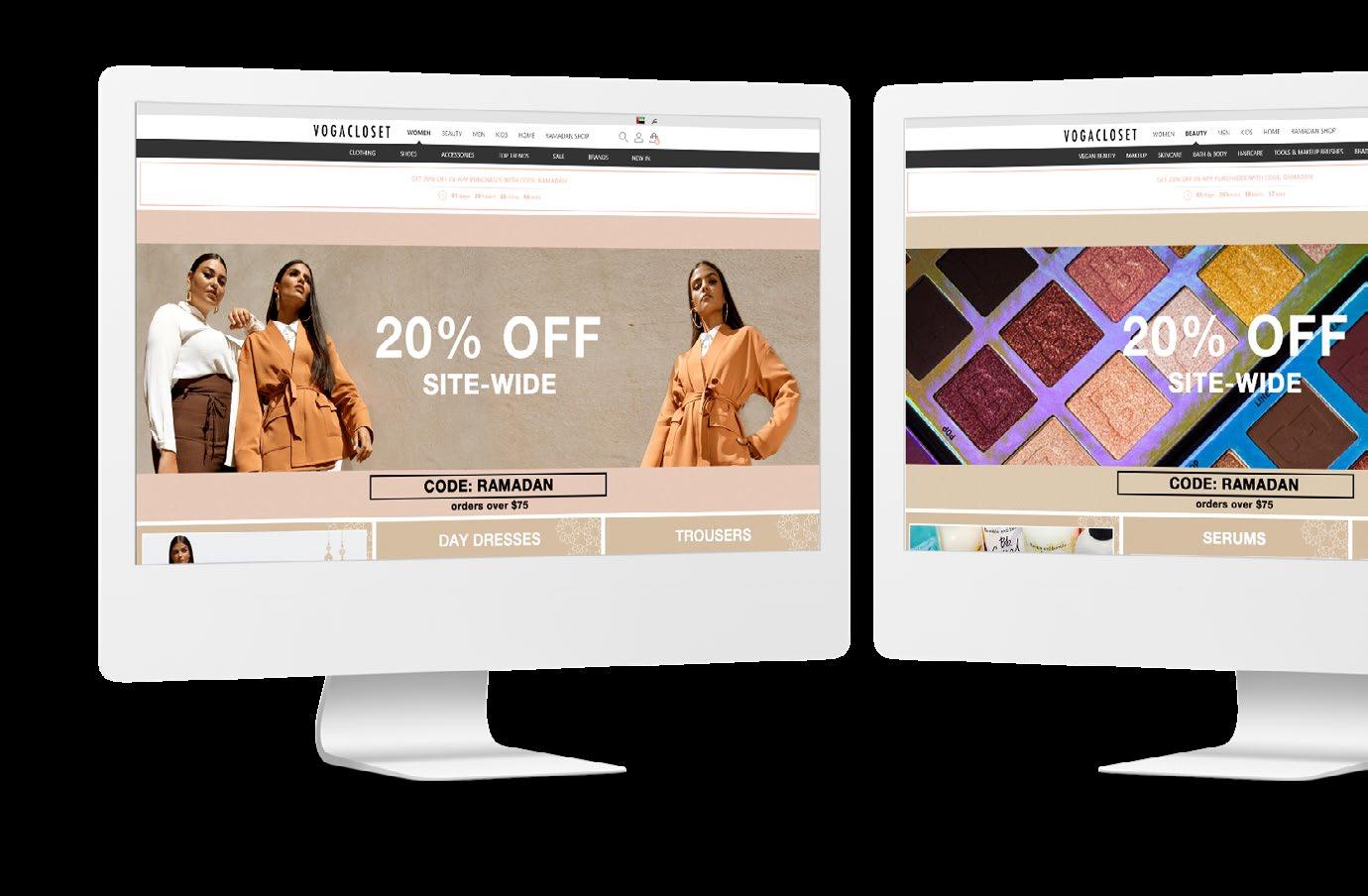

Already a leader in the offline space in Saudi Arabia, the company’s strategy is to become an “exciting” lifestyle company offering an “unmatched” omnichannel experience. As a step in this direction, Fawaz A. Alhokair & Co. and mall operator Arabian Centres Company have acquired a majority stake (51%) in VogaCloset, a UK-based online fashion marketplace. Strategically timed, 17 of Fawaz A. Alhokair & Co.’s brands will be available on VogaCloset by Eid Al Fitr in May.

“Our goal is to offer customers a flexible, convenient, entertaining and omnichannel shopping experience,” said Marwan Moukarzel, CEO, Fawaz A. Alhokair & Co. “That’s why, we decided to invest in a profitable online platform like VogaCloset, with a deep understanding of regional and global fashion trends. Almost 52% of VogaCloset’s sales already happen in Saudi Arabia. This will strengthen our future omnichannel strategy. We will gradually increase the range of brands on VogaCloset, adding 24 within a month of launch and several more before the year-end. Over the next three years, we have the option to completely acquire VogaCloset.”

Refocusing buying strategy

With completely different market dynamics at play, most retailers were “stress-tested” and had to refocus their buying strategy aligned with customer needs. Amid a rapid decline in supply from five million

to under-one million units for one of its franchised brands, LIWA Trading Enterprises decided to independently procure products to fill the gap.

“We had to quickly refocus our buying strategy to protect sales and profitability. We had to analyse the demand for every product to optimise our business,” stressed LIWA CEO, Mark Tesseyman. “For example, we measure linear footage – return per square foot – for all our stores on a weekly basis to analyse category performance. This helps us to flex space based on performance, maximising the overperforming categories by buying more, while cutting back on underperforming ones.”

Applying this buying strategy for its home brands DWELL and Simply Kitchen, LIWA has expanded the choice and product range within the same footprint. “We are now selling decorative accessories and furniture in DWELL, along with bath and bedding that used to be the primary categories. In fact, we are thinking of increasing the average size of the DWELL stores from 200 to 350-400 square metres in certain locations,” Tesseyman explained.

In 2020, the home was the most profitable category for LIWA, followed by lingerie and leisurewear/loungewear. But fashion, especially occasion and formal wear has suffered. Rupkatha Bhowmick Writer & Content Strategist

Reinvention is key

Looking ahead, Euromonitor International estimates retail sales in the UAE, alone, to grow 6.6% annually in the medium term and reach $70.5 billion by 2025. As the GCC retail industry is preparing for the ‘next normal’ characterised by altered customer expectations and transformed retail dynamics, resetting traditional business models and reinvention will be crucial.

With a total of 245 stores in the GCC, mid-March, LIWA stores were still 25% below the 2019 footfall. “But our sales are positive. We have opened two more Simply Kitchen and DWELL locations, and all are performing in line with expectations. Since March, traffic has also improved slightly in Dubai, although still well behind the 2019 numbers. In addition, stricter Covid-19 related measures in Qatar and Kuwait/Oman have further hindered traffic flows in markets that were performing ahead of expectations. We have to think of ways to optimise our space and maximise returns, by sourcing new products to create an exciting mix, while personalising our engagement strategy with customers. Irrespective of the pandemic, reinvention is the key to successful retailing. Every day is a learning curve.” Tesseyman stated.

As opposed to “growing for the sake of growth,” Fawaz A. Alhokair & Co. is committed to creating a differentiated – channel-agnostic – shopping experience through a selection of leading brands under every category. “Doing business differently and constant evolution to meet the changing consumer expectations will be our key priorities. In the age of Instagram, our stores must be exciting and technology-enabled,” shared Moukarzel. “For this, we are revisiting our investments, prudently deciding locations and relevance of brands. There could also be consolidation.”