3 minute read

A hint at rewards for COVID-19 diligence

New Zealand, Singapore and Korea fared well in the latest Cap Rate Survey by CBRE Asia Pacific

Henry Chin, Ph.D.

Advertisement

Head of Research Asia Pacific & Global Head of Investor Thought Leadership

henry.chin@cbre.com.hk I nvestment enquiries in all three countries are improving while in several markets up to 40 percent of enquiries are from cross border investors.

That said, nearly 80 percent of those who responded to the survey do not expect to be reaching anywhere near pre- pandemic level before the second half of next year.

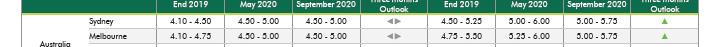

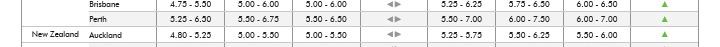

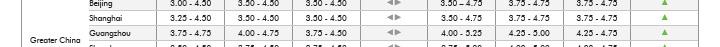

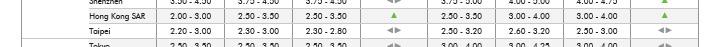

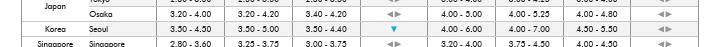

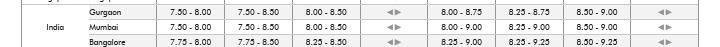

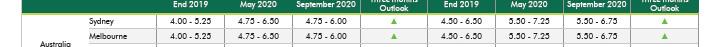

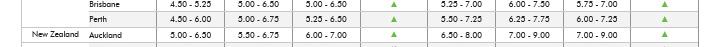

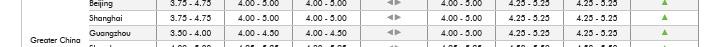

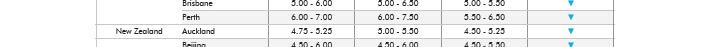

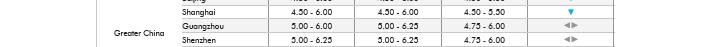

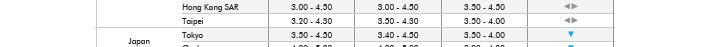

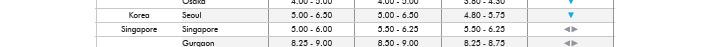

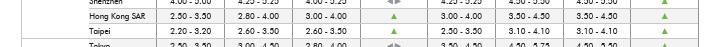

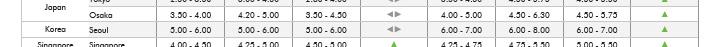

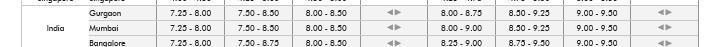

Cap rate ranges narrowed with support from low borrowing costs in the Asia Pacific Region. I\Despite what CBRE quaintly lists as “a mismatch between buyers and sellers” price expectations, buyers appear willing tol pay more for logistics assets while sellers are increasingly willing to discount prices for decentralized offices and shopping malls. Hotel prices have fallen by up to 30 percent since 2019 and lenders continue to take a cautious stance towards the sector. CBRE says cap rate ranges are best estimates provided by CBRE professionals based on recent trades in their respective markets, as well as communications with investors.

The ranges represent the cap rates at which a given asset is likely to trade in the current market.

Cap rates within each subtype will vary, occasionally falling outside the stated ranges, based on asset location, quality and property-specific opportunities for net operating income (NOI enhancement, the company notes.

Capital markets respondents provided NOI yield without leverage while Valuation & Advisory Services respondents provide the capitalisation rate (net).