4 minute read

Tax Planning for 2020 with an Eye Toward 2021

Sponsored Article By PERRY GREEN, CPA/PFS, CFP®, CFA® Chief Financial Officer, Senior Wealth Strategist Waddell & Associates

Due to COVID-19 and the election, it’s likely that 2020 year-end tax planning will take on more significance than usual. Read on to preview possible income and estate tax planning implications of the election.

Scenario A: Trump Remains President

Because the calculus is easier, let’s start with the planning implications of a Trump win first.

Estate and gift tax laws are expected to remain the same. Year-end estate tax planning should focus on annual exclusion gifts and ensuring that clients’ plans are in line with their wishes. Spousal Limited Access Trusts (SLATs) make sense for clients who wish to transfer future growth out of their estates but still retain access to amounts transferred.

Individual income tax planning became easier with the passage of the Tax Cuts and Jobs Act (TCJA). The standard deduction was essentially doubled from 2018 ($12,400 for single taxpayers and $24,800 for married filing joint in 2020). Itemized deductions are

Table 2

now allowed for: medical expenses in excess of 7.5% of Adjusted Gross Income (AGI), state and local taxes capped at $10,000, home mortgage interest, charitable contributions, and gambling losses to the extent of any winnings. This effectively limits annual personal income tax planning to the timing of charitable contributions.

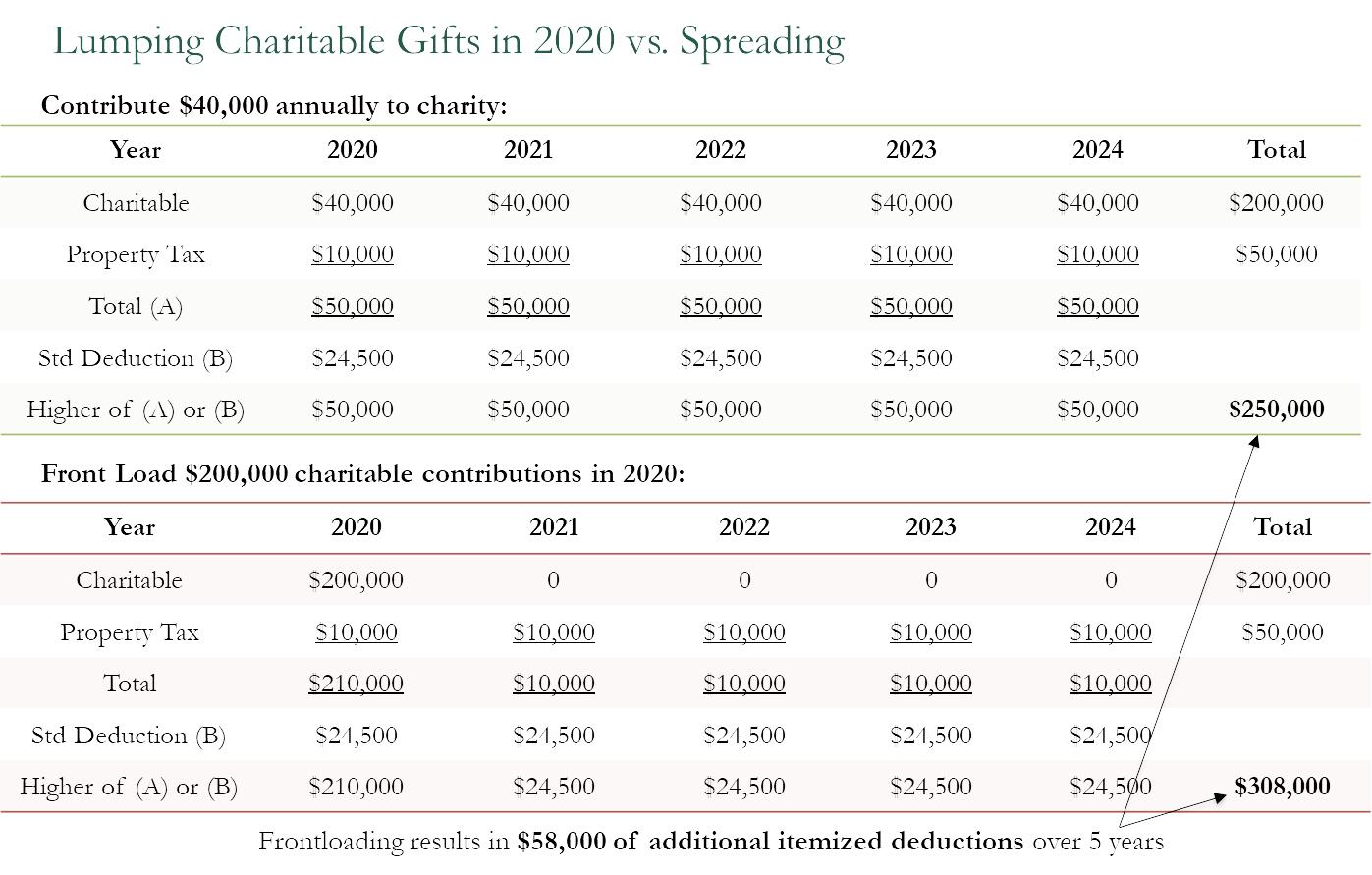

The increase of the standard deduction has made the tax benefit of grouping charitable contributions using a donor-advised fund even more advantageous. The charts below illustrate the potential impact of using a donoradvised fund to make five years’ worth of charitable contributions in one. In the illustration (Table 1), taking a large charitable deduction in 2020 and then the standard deduction in the following years reduces taxable income by $58,000 over the five-year period.

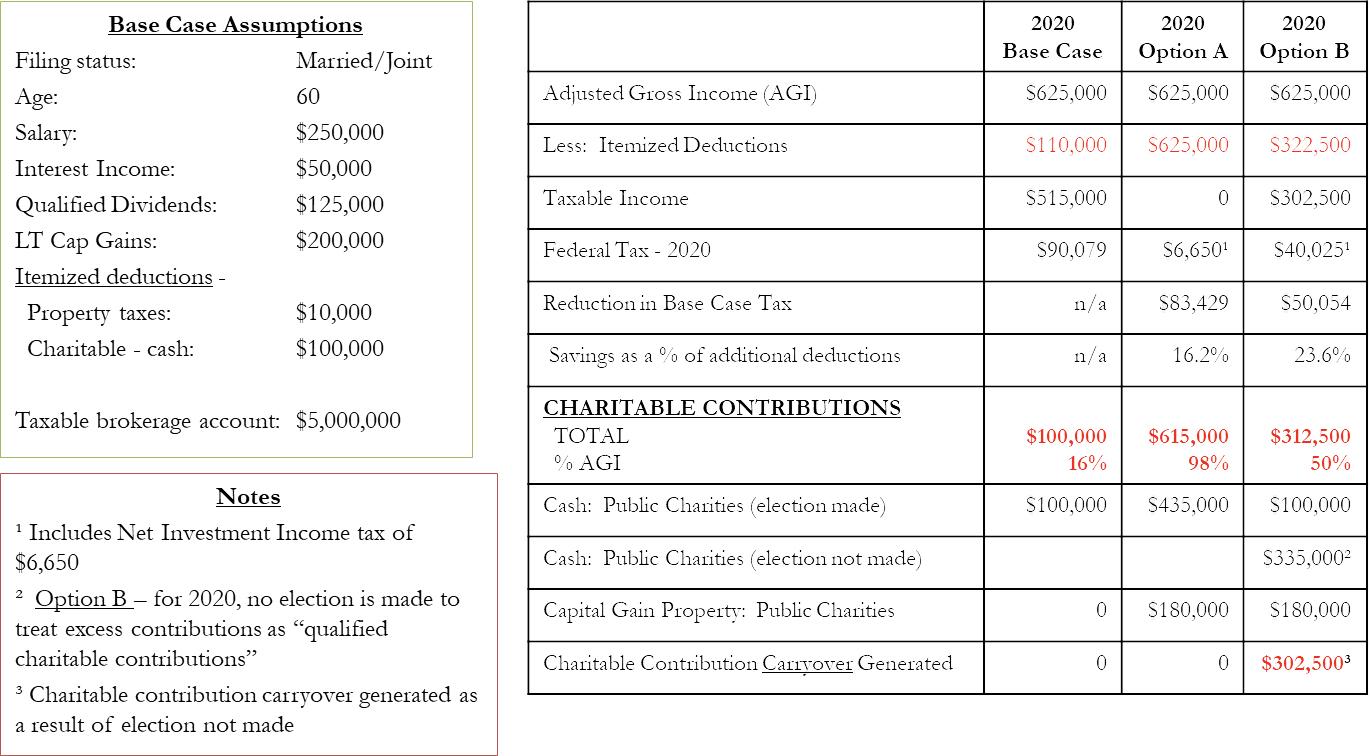

Another wrinkle in charitable planning for 2020 is the opportunity to deduct charitable contributions up to 100% of AGI under the CARES Act. Congress was concerned about the effects of a recession on charitable gifting and increased the deductible amount of charitable contributions from 60% of AGI (assuming only cash gifts to public charities) or 50% of AGI (assuming a mix of cash and marketable securities) to 100% of AGI. In order to qualify, donations in excess of the normal 50% or 60% of AGI limits must be made in cash to a qualified charity. The above chart (Table 2) illustrates the potential tax impact on a couple who is considering increasing their normal charitable contributions to take advantage of the 100% AGI limitation.

The couple has until the due date of their tax return (October 15th if extended) to determine if they will limit their deductions to the normal 50% or elect to deduct 100% of their contributions in 2020. Deducting 100% eliminates their income tax liability, but not their Net Investment Income Tax. Taking the full deduction in 2020 provides a 16.2% tax savings while limiting the deduction to 50% provides a 23.6% tax benefit. If their effective tax rate is greater than 16.2% in 2021, they should use the old rules. If their effective tax rate is 16.2% or lower in 2021, they should deduct the full amount of contributions in 2020.

Scenario B: Biden Becomes President

What if we have a blue wave in November? The calculus gets much harder.

According to the Tax Foundation, Biden’s income tax plan includes the following tax increases:

Increasing the top marginal tax rate from 37% to 39.6% and capping the value of itemized deductions at 28% for taxpayers making over $400,000

Taxing capital gains at ordinary income tax rates for those making over $1 million

Restoring the Pease limitation on itemized deductions

Imposing the Social Security payroll tax on salaries and self-employment income over $400,000

Reducing the current $11.58 million estate and gift tax exemption to the pre-TCJA levels and eliminating step up in basis for inherited assets

How to Prepare

Based on current proposals, here are some conversations I expect to have with clients between the election and year-end. If your taxable income is consistently over $400,000, using a donor-advised fund to accelerate future year’s charitable deductions into 2020. This could allow you to receive a 37% tax benefit instead of 28% and you would avoid the Pease limitation, assuming it is brought back to life. Highincome earners who have the ability to time salary or bonus should consider accelerating a portion of 2021 compensation into 2020 and avoid the additional Social Security tax. For taxpayers with AGI consistently over $1 million, consider selling some appreciated securities at the end of 2020 instead of waiting until 2021. This will lock in a 20% capital gains rate vs. a potential 39.6% rate. Taxpayers selling a business on an installment basis should consider electing out of installment treatment and pay the entire tax in 2020 instead of as payments are received.

Individuals with taxable estates (in excess of $11.58 million single or $23.16 for a married couple) who can afford to do so should consider transfers in trust to use their current unified credit before the limits decrease. A SLAT can provide the opportunity to transfer assets out of the estate while retaining indirect access for those unwilling to give up complete control.

As you can see, the election may have a significant impact on tax moves clients should make by year-end. Since it is possible for Congress to make tax changes retroactive to the beginning of the year, estate planning attorneys may be stuck working through the holidays.