SEPTEMBER 2023 VOL 1023 ISSUE 7 portstrategy.com

OR

OPERATOR SELECTION MINEFIELD MORE PUBLIC SECTOR $ TACKLING LITHIUM-ION FIRES

Ukraine Concessions | STS: Remote Operation Bandwagon Rolls on | Electric Product Launches

NEARSHORING

‘NO-CHINA’

MIKE MUNDY

MIKE MUNDY

Cost Conscious Times: But $ Not The Whole Story

Recognition of the increasing cost of employing China as a manufacturing base is progressively striking home and is one of the catalysts inducing companies to look for new manufacturing locations. This is effectively a NO to China in favour of a new location offering lower cost production but also other potential benefits such as a less troubled political climate. The alliance with Putin, sabre rattling over Taiwan and trade and other conflicts with the USA are all seen as potential disruptors to the uninterrupted flow of business – see p22.

Recent supply chain problems, especially those during and immediately following the Pandemic, are also major catalysts to the idea of near shoring – reducing the length of supply chains and the risk of associated supply chain problems. Mexico is a typical alternative location for US-based companies pursuing this path.

Keeping costs down and efficiency levels up are primary goals.

The cost factor is also to the fore in the article on p26 which discusses the challenges posed by the rapid pace of containership design over the last decade or so and the onslaught of today’s inflationary times. There appears to be a strong case for a rethink on conventional approaches to funding infrastructure works due to these and other influential factors.

Then there is the other end of the spectrum, i.e. when one party comes along to offer a pile of cash as part of a government-togovernment deal aimed at securing port sector business opportunities along with more in other sectors. In these days when money is tight for governments as well as companies and individuals, it is very tempting for governments to sign up to such a deal to realise instant benefit but whether it is a wise course of action or not remains to be seen. As the article on p20 highlights, government-to-government deals can lead to political conflict – a point that seems to be proven in Dar es Salaam where a proposed deal between Tanzania and Dubai, involving port company and logistics operator DP World, is giving rise to serious concerns being raised at every critical level including the threat of national demonstrations – see News p6.

The Tanzania Port Authority (TPA) appears to be pursuing a similar path – it is sending out signals that Adani Port & SEZ could be a possible candidate to operate its Dar es Salaam container terminal, which would suggest DP World has not achieved exclusivity, although this could of course just be a smokescreen with it eventually likely to follow the will of its political masters. Either way, pursuing what can be termed a selective process for terminal operator appointment, as opposed to a much more competitive open tender, as recommended by independent entities such as the World bank, could turn out to be ‘short-term gain for long term pain.’

It is also important to recognise in this process that the structure of the international container terminal operating sector is changing – there are now big differences between the players – and it is fundamentally important to get up-to-date in this context before settling on any specific party – see p20.

The international magazine for senior port & terminal executives

EDITORIAL & CONTENT

Editorial Director: Mike Mundy mmundy@portstrategy.com

Features Editor: A J Keyes keyesj186@gmail.com

Consultant Editor: AndrewPenfold andypenfold@yahoo.com

Regular Correspondents: Felicity Landon; Stevie Knight; Ben Hackett; Peter de Langen; Charles Haine; AJ Keyes; Andrew Penfold; Oleksandr Gavrylyuk Johan-Paul Verschuure; Phoebe Davison

Production David Blake, Paul Dunnington production@mercatormedia.com

SALES & MARKETING t +44 1329 825335 f +44 1329 550192

Media Sales Manager: Arrate Landera alandera@mercatormedia.com

Marketing marketing@mercatormedia.com

Chief Executive: Andrew Webster awebster@mercatormedia.com

PS magazine is published monthly by Mercator Media Limited, Spinnaker House, Waterside Gardens, Fareham, Hants PO16 8SD UK t +44 1329 825335 f +44 1329 550192 info@mercatormedia.com www.mercatormedia.com

Subscriptions

Subscriptions@mercatormedia.com

Register and subscribe at www.portstrategy.com

1 year’s print subscription £295.00

1 year’s digital subscription with online access £228.50

For Memberships and Corporate/ multi-user subscriptions: corporatesubs@mercatormedia.com

©Mercator Media Limited 2023. ISSN 1740-2638 (print) ISSN 2633-4232 (online). Port Strategy is a trade mark of Mercator Media Ltd. All rights reserved. No part of this magazine can be reproduced without the written consent of Mercator Media Ltd. Registered in England Company Number 2427909. Registered office: c/o Spinnaker House, Waterside Gardens, Fareham, Hampshire, PO16 8SD, UK.

For the latest news and analysis go to www.portstrategy.com SEPTEMBER 2023 | 3

There are key drivers associated with the growing exodus from China of manufacturing companies which is, in turn, promoting port development in alternative locations. There are also cost and shipping system development factors at work which promote the case for a rethink on the financing of infrastructure and dredging works. But perhaps most striking is how the international container terminal operator sector can now be identified with diverse categories of operator – a reality that parties looking to appoint terminal operators would do well to take account of

PORTSTRATEGY INSIGHT FOR PORT EXECUTIVES

VIEWPOINT

Remote working Discover the power of automation and remote control for your container handling operations. www.liebherr.com Container cranes Liebherr Container Cranes Ltd. Killarney, Ireland Tel: +353 (0)64 6670200, sales.lcc@liebherr.com

For the latest news and analysis go to www.portstrategy.com SEPTEMBER 2023 | 5 Weekly E-News Sign up for FREEat: www.portstrategy.com/enews CONTENTS SEPTEMBER 2023 is a proud support of Greenport and GreenPort Congress GreenPort magazine is a business information resource on how best to meet the environmental and CSR demands in marine ports and terminals. Sign up at greenport.com The Congress is a meeting point that provides senior executives with the solutions they require to meet regulatory and operational environmental challenges. Stay in touch at greenport.com Online portstrategy.com 5 Latest news 5 Comment & analysis 5 Industry database 5 Events Social Media links LinkedIn PortStrategy portstrategy YouTube On the cover PSA control centre for remote quayside crane operations. Remote operations are identified as a primary route to improved crane performance and particularly in conjunction with working higher capacity vessels. Already enjoying a fast take-up, further impetus to the adoption of the system is expected with the influx of the large number of high-capacity vessels that will join the fleet over the near-term NEWS FEATURE ARTICLES REGULARS 18 The New Yorker FMC to Smooth Box Flow 18 The Analyst Bold but Missed Opportunity? 19 The Economist Positive Asia Prospects 19 The Strategist Panama Canal Problems 20 Tread Carefully Operator Selection Minefield 22 Near Shoring or “No China” Alternative Strategies 24 Climbing the Ladder The Cambodia Option 26 More Public Sector $ A Path to Greater Eiciency 29 Readying Concessions Ukraine’s Concession Programme 30 ETS: Trade Diversion Risk? ETS Impact Assessed 32 Portside Solution Arguing the Case for M2H2 34 Lithium-Ion Fires The Risks & Counter Measures 36 Electric Domination The New Electric Cargo Handling Products 38 STS Crane Automation Market & Technical Initiatives 41 Peterhead Plan Energy Transition Ambitions 46 Postscript Container Shipping Fleet Development SEPTEMBER 2023 VOL 1023 ISSUE 7 portstrategy.com Ukraine Concessions STS: Remote Operation Bandwagon Rolls on Electric Product Launches NEARSHORING OR ‘NO-CHINA’ OPERATOR SELECTION MINEFIELD MORE PUBLIC SECTOR $ TACKLING LITHIUM-ION FIRES 16 Controversy Stirring Dar Es Salaam Ructions 16 High Noon Adani Judgement Nears 16 Dar Debacle Adani in the Mix 17 Traction Gained Simandou Iron Ore Project 17 Rail Developments Sagunto Inner Rail Moves 19 H2-Hub™ Deal H2U and Vopak Collaborate 19 Integrated JNPT New Rail Yard Links 11 Long Beach Building Supply Chain Information 11 BlueTechPort Launched Barcelona Innovation Space 13 LA Power Tests Carbon-Free Ocean Energy 13 Embrace Partnerships Digital Catapult Solutions 15 Hydrogen for Big Red Cummins Engine Integration 17 Innovative Bagging New IMGS Solution 17 Upbeat Konecranes Increases Predicted for 2023

GOVERNMENT-TO-GOVERNMENT DEAL IN DAR ES SALAAM STIRS CONTROVERSY BRIEFS

Nigeria Initiative

Nigeria has established the Marine and Blue Economy Ministry as a wholly separate entity to the Transport Ministry. This follows on from recognition of the escalating requirement to establish a stronger shipping infrastructure. The news was received favourably by the Nigerian Shipowners Association and other industry bodies.

NYK Buys In

NYK has acquired, from Toyota Tsusho Corporation, a 25 per cent stake in PT. Patimban International Car Terminal located at the Indonesian port of Patimban. The port, 120km east of Jakarta, has been developed in successive phases since 2018 with the car terminal now in the process of raising vehicle capacity from 220,000 units/yr to 600,000 vehicles/yr.

QTerminals Rotterdam

Qatar-headquartered

QTerminals Group has concluded the purchase of a 90 per cent stake in Kramer Group, a integrated logistics and container services company, located in the Port of Rotterdam. Kramer Group provides handling and storage, container development and logistics services to the terminals across the Maasvlakte and the Eem-/Waalhaven areas of the port.

AD Ports Invests

AD Ports Group is set to invest in the Multifunctional Marine Terminal in Kuryk Port, Kazakhstan. AD Ports has signed an agreement with Semurg Invest LLP, the terminal owner, under which the two companies agreed to invest in and expand.

The fall out from a move by the Emirate of Dubai to try to secure the management of Tanzania port facilities, including facilities in the main port of Dar es Salaam, continues. Some observers go so far as to suggest it has the potential to derail President Hassan’s re-election beyond 2025.

The root of the problems is the strong resistance being put up to the proposed deal, which would see Dubai-owned DP World step in and takeover key Tanzanian port facilities on a long-term basis. This resistance has been taking place at a very public level with groups known to be opposed to President Hassan taking a leading role but also a wider response from the public and business which is asking fundamental questions about why such a government-togovernment deal needs to be struck and/or why not stick with the conventional arrangement of

As PS goes to press, the release of the findings of the Securities and Exchange Board of India (SEBI) into accusations by US-based Hindenburg Research that the Adani Group is guilty of “brazen stock manipulation and accounting fraud schemes” is imminent.

This follows on from the SEBI requesting 15 more days to complete its inquiry. At this stage it stated that it had “substantially progressed” its investigations =- 17 of 24 investigations were “final and complete” and another completed with an interim report approved by the competent authority.

With the remaining six

government agencies retaining management of the port facilities and concessioning the different business units; container break-bulk and so on?

The government response to this opposition is not helping. Local sources report that this amounts to a crackdown on the opposing voices. Dr Willibrod Peter Slaa, Tanzania’s ambassador to Sweden from 2017 – 2021 is identified as one party recently arrested due to his opposition to the deal with his home subsequently searched. His arrest was preceded by those of other well-known figures and against a background of calls for nationwide mass demonstrations.

From the side of the authorities, there was a stern warning from Camilius Wambura, Inspector General of Police, who stressed that the law enforcement agency will not tolerate anyone “plunging the country into chaos.” He further

noted that actions such as mass demonstrations and calls to bring down the government are treason and cannot be tolerated. The Intergovernmental Agreement between Tanzania and the Emirate of Dubai functions via a document, dated 25 October 2022, and under a heading which states it concerns the Economic and Social Partnership for the Development and Improving the Performance of Sea and Lake Ports in Tanzania Exactly what it covers is not fully known but Prof Makame Mbarawa, Minister for Works and Transport, has said that it will not cover the Tanga, Mtwara, Bagamoyo ports and Dar es Salaam port’s Berths 8-11 as well as the Kurasini oil Jetty (KOJ) one and two, and oil storage facility. This nevertheless leaves plenty of prime facilities in Dar and as such the deal is also open to accusations of ‘cherry picking.’

HIGH NOON FOR ADANI…

investigations, four were reported as under process of approval by the competent authority, one with an interim report under preparation and the other at an ‘advanced stage.’

Speculation is rife as to what the report, being submitted to the Supreme Court, will contain with views spanning the full range of options right through from no negative findings to a hard hitting report.

The report follows hot on the heels of the resignation of Deloitte, the Adani Ports division’s auditor, citing the lack of a wider

audit role as a reason. The net effect of this has been to provide new energy to the Adani Group – Hindenburg Research controversy, and particularly as a result of the fact that Deloitte identified certain transactions that it had concerns about which Adani did not want to independently look into.

As of mid- August, it was estimated that shares of Adani’s 10 listed companies had recouped around US$47 billion in value having lost US$150 billion of their joint value in the wake of the Hindenburg report.

ALSO A PLAYER IN THE DAR DEBACLE…

The Adani Ports and SEZ (APSEZ) division is additionally noteworthy today for its interest in securing the concession for the Dar es Salaam container terminal – a prize which DP World is also known to have a strong interest in (see story top of page).

The Tanzania Port Authority (TPA) has acknowledged that it is aware of Adani’s situation with

Plasduce Mbossa, Director General, TPA saying publicly: “These are only allegations… We cannot make a decision until the claims are proven.”

The TPA has itself drawn criticism for fielding a selection process for the terminal operator which is based on talking only to select parties rather than launching a broad-based

competitive tender process, the more conventional and proven route for terminal operator selection. This action promises to further push under the microscope Tanzania’s actions with regard to its key port facilities and especially as the port of Dar es Salaam functions to serve not just the Tanzania hinterland but key landlocked countries surrounding it.

PORT & TERMINAL NEWS

6 | SEPTEMBER 2023 For the latest news and analysis go to www.portstrategy.com

SIMANDOU IRON ORE EXPORT PROJECT: PROGRESS ON RAIL AND PORT CAPACITY

Rio Tinto and the Simfer joint venture (Simfer) have reached an important milestone by concluding key agreements with the Republic of Guinea and Winning Consortium Simandou (WCS) on the trans-Guinean infrastructure for the Simandou iron ore project. This involves the construction of a 600-kilometre rail system running from Simandou via Forécariah, Kassa and Nialinko to a new export terminal located in the port of Morebaya in southeastern Guinea.

As a result, the proposed development of the world’s biggest untapped iron ore mine moved a step forward. The Simandou project in Guinea is understood to contain some of the richest iron ore deposits anywhere in the world, but the development has struggled to gain traction for several years due to various disputes over ownership and infrastructure, plus frequent political changes in Guinea.

However, there have been a series of agreements signed between the partners and the government, which appear to be giving the project a fighting chance of success.

The infrastructure capacity, including the 600km of rail lines necessary to transport the mined iron ore to Morebaya for export, the new port facilities, and the associated costs will be shared equally between Simfer, which is developing blocks 3 and 4 of the

Vadhavan is Go

A new deepwater port at Vadhavan, India has reportedly received approvals to commence construction. The new facility is 120 miles north of Nhava Sheva Port (JNPA) but despite Indian government approval for a public-private partnership (PPP) deal in 2020, the US$9bn project stalled due to mandatory delays.

The new port is reported as providing a capacity of 15 million TEU in Phase One, going up to 24 million TEU.

Sagunto Inner Rail Project Advances

The Port Authority of Valencia (PAV) is advancing the development of the inner rail network of the Port of Sagunto by requesting technical support for site management, health, and safety coordination.

This project is a key part of PAV’s rail traffic strategy, which has total estimated costs of more than €240 million (US$304 million). It supports the port authority’s objective of decarbonising port activities and combating climate change and becoming an emission-neutral precinct by 2030.

Simandou project, and WCS, which is developing blocks 1 and

2. China Baowu Steel Group has also previously entered into a term sheet agreement with WCS that may see it partner in the WCS scope for blocks 1 and 2 of the Simandou mining concession and the infrastructure joint venture.

To put the size of the project into perspective, Rio Tinto maintains that its share of the cost of the overall development will be approximately US$4bn. It offers, what is already the world’s second largest mining company, a huge new source of iron ore cargo supply.

Bold Baatar, Executive Committee lead for Guinea and Copper Chief Executive, Rio Tinto, notes: “With these agreements

Electric Barcelona

The government of Spain has awarded APM Terminals (APMT) Barcelona €3.9 million (US$4.3 million) to help finance an electrification pilot project. It includes purchasing five zero-emission electric straddle carriers, four charging stations, civil and electrical works, an IT network, plus all required technology necessary for equipment operations and recharging activities. All electricity comes from renewable sources.

8 The Simandou iron ore project has reached a key milestone according to Rio Tinto, with agreement now reached on the pan Guinea rail system and port capacity required to export ore

we have reached an important milestone towards full sanction of the Simandou project, bringing together the complementary strengths and expertise of Rio Tinto and our partners, the Government of Guinea and Winning Consortium Simandou, for the infrastructure that will unlock this world class resource. Simandou, the world’s largest known undeveloped supply of high-grade, low-impurity iron ore, will strengthen Rio Tinto’s portfolio by complementing our existing Pilbara and Iron Ore Company of Canada products.”

NOLA Funding Boost

A new container terminal project being planned by the Port of New Orleans (NOLA) has had funding reinstated. The news follows a recent contentious decision by legislators in Louisiana to remove financial support. According to released budget documents, the port has already spent US$55 million on land acquisition and US$6.5 million for design and will now receive a further US$13.5 million to cover expenses for the ‘final design phase.’

The development of the Port of Sagunto’s inner rail network is estimated to cost €17.5 million (US$22 million). It entails an 11-month schedule and involves the design of an intermodal goods facility with one area for containers and another facility for automobiles.

The tender deadline is September 25, 2023.

PAV has also issued a tender for the provision of a service that maintains the units that monitor the quality of air and other environmental parameters, as part of increasing understanding of emissions generated by port activities. There are two of the environmental control facilities in the Port of Valencia offering a wide coverage of air quality and port noise in real time,

BRIEFS

Pilbara Record

The Pilbara Ports Authority (PPA) which manages the western Australian ports of Ashburton, Dampier, Port Hedland and Varanus Island, has confirmed a record throughput for the fourth consecutive fiscal year. A three per cent rise over the previous fiscal year has been achieved, with 752.4 million tonnes recorded in 2022-23, valued at an estimated AU$164 billion (US$110.3 billion). PPA processed more than 43 per cent of worldwide iron ore traffic.

For the latest news and analysis go to www.portstrategy.com SEPTEMBER 2023 | 7 PORT & TERMINAL NEWS

GLADSTONE GREEN HYDROGEN AND AMMONIA PARTNERSHIP

New Integrated Rail Yard for JNPT

Nhava Sheva Port (JNPT) is supporting all five container terminals with a new rail yard capable of handling doublestack freight trains.

JNPT states that the new rail facility is a “state-of-the-art” operation for the port’s marine terminals, with the aim of “streamlining operations and enhancing efficiency.” It is also a key part of the Dedicated Freight Corridor (DFC) being developed in India. The new yard has three 1500m rail lines for double-stack container trains, with two for loading and unloading of containers, and one is for engine turnaround of electric locomotives.

The Hydrogen Utility® (H2U) and Vopak Terminals Australia (Vopak) are collaborating in relation to H2U’s H2-Hub™ Gladstone project. This new multi-billion renewable energy complex is planning to produce green hydrogen and green ammonia at a proposed site in Gladstone, Queensland. Gladstone has been identified as one of seven clean hydrogen hubs across the country in Australia’s National Hydrogen Strategy.

H2U has recently announced a number of planned strategic collaborations and green ammonia offtake with partners in the domestic and export markets, including:

5 Orica Australia, the world’s largest provider of commercial explosives, operating the nearby Orica Yarwun Manufacturing Facility,

5 Mitsubishi Heavy Industries (MHI Group), one of the world’s

Westports AGVs?

Westports Malaysia is investigating the viability of using electric Automated Guided Vehicles (AGVs) in the future. The operator has been requesting manufacturers and suppliers of electric AGVs to submit a proposal for a system covering capacity, navigation capabilities, safety features, and the ability to connect with the current infrastructure. New charging solutions that maximise AGV working time are also a key area of interest.

leading industrial groups, spanning energy, smart infrastructure, industrial machinery, aerospace and defence.

5 Korea East-West Power (Korea EWP), one of six key power generation companies in Korea and is a wholly owned subsidiary of Korea Electric Power Corporation or KEPCO, and the operator of the multi-GW Dangjin Power Generation complex.

Paul Kanters, Managing Director of Vopak Terminals Australia, points out the collaboration with H2U is a natural progression of Vopak’s participation in the development of a global green ammonia value chain: “This partnership fits well within the Vopak strategic goal to accelerate towards New Energies. We are excited to help shape a sustainable future by developing infrastructure

Nigeria LNG Support

Onne Multipurpose Terminal (OMT) is supporting Nigerian LNG (NLNG)’s Train 7 expansion project at NLNG’s facility in Bonny Island. OMT discharged critical project components from three boats on Berth 10 of the Federal Ocean Terminal in partnership with Horatio Ltd., Chairborne Global Services Limited, Kerry Logistics, and IO Materials Services. The US$10bn Train 7 expansion aims to increase Nigeria’s LNG production from 22 million to 30 million tonnes per year by 2027.

solutions for new vital products, focusing on zero- and low-carbon hydrogen, ammonia, CO2, long duration energy storage and sustainable feedstocks.”

H2-Hub™ Gladstone is the largest green hydrogen and green ammonia development in Queensland, with 3 GW in planned electrolyser capacity and over 1.7 million tonnes per year of planned green ammonia production, representing one of the most advanced export projects on a global scale. H2U and Vopak will collaborate with existing partners to progress development of the project, focussing mainly on the Export Terminal of H2-Hub™ Gladstone.

Evergreen Deal

Global container operator, Evergreen, has acquired a 20 per cent stake in Euromax, one of the existing terminals at the Port of Rotterdam in the Netherlands. It is understood that the Taiwanese-headquartered company is likely to have obtained this share from Hutchison Ports and for a reported price of €72.5 million (US$79 million). China’s Cosco is another existing shareholder in the facility.

The Western part of the DFC project is a 1504km broad-gauge freight only connector between Dadri, the busiest ICD in North India, and Nhava Sheva. In addition, on the DFC route it is estimated that wagons can carry freight of up to 81 tons per wagon at a speed of 100km, which includes double-stack container trains, compared with 60 kmph on the normal network.

JNPT states that a primary objective is to target the conversion of truckloads to rail to alleviate road congestion and improve container dwell times.

For the first quarter of fiscal year 2023-2024 (April-June 2023), JNPT handled 1.52 million TEU, an increase of three per cent year-on-year. Of this total, rail traffic accounted for a share of 16.6 per cent.

BRIEFS

MSC Withdraws

Mediterranean Shipping Co (MSC) has withdrawn its interest in buying Terminal Darsena Toscana (TDT) at the port of Livorno in Italy. The deal was first announced in January 2023. The exact reasons for the decision are not known, but Luciano Guerrieri, President of the Port System Authority (Adsp ) of the northern Tyrrhenian Sea remains upbeat: “Whatever the reasons that led MSC to withdraw the offer…the port of Livorno keeps its potential intact.”

For the latest news and analysis go to www.portstrategy.com SEPTEMBER 2023 | 9 PORT & TERMINAL NEWS

8 H2U and Vopak Terminals are collaborating on establishing a new multi-billion dollar renewable energy complex in Gladstone, Queensland that will produce green hydrogen and green ammonia

Converting a conventional RTG into an electrical one (E-RTG) means to shut down the diesel generator and to power the RTG with electrical power only – the emission saving, sustainable basis for automation. This is possible with electric power solutions, including E-RTG auto-steering and positioning systems, developed by Conductix-Wampfler: Plug-In Solution, Drive-In Solution, Hybrid Solution, Full-Battery Solution and Motor Driven Cable Reel Solution with CAP - Cable Auto Plug-In.

We move your business! www.conductix.com

We add the “E” to your RTG Electrification of Rubber

Gantries

Tyred

E-RTG with Drive-In L Solution and ProfiDAT® E-RTG with Motor Driven Cable Reel Solution and CAP - Cable Auto Plug-In E-RTG with ECO BatteryPack Hybrid Solution

LONG BEACH: BUILDING SUPPLY CHAIN INFORMATION

The Port of Long Beach’s digital Supply Chain Information Highway tool is being updated. Already in its second phase of development, current field testing is fine-tuning its capacity to supply aggregated data that will assist logistics partners in better planning, scheduling, and tracking cargo movement in real time from origin to destination.

Three additional features are being added to the platform to further improve the efficiency and visibility of cargo shipments passing through the port’s facilities:

5 A dashboard designed for beneficial cargo owners allows

customers to access information about the location of their containers within the port complex, highlighting which containers have arrived, which are undergoing inspection by the U.S. Customs and Border Protection, and which are ready to be picked up.

5 A public “track and trace” page allows users to access the most up-to-date information about the status of containers moving through the Port of Long Beach. After inputting a unique tracking number, the user will be presented with a detailed list tracing every step the container goes through from the time it is

Be Pro-Active says Voyager

loaded onto a vessel until it is unloaded on the docks.

5 A public port operations dashboard that contains much of the information currently found in the port’s Weekly Advance Volume Estimate, or WAVE Report, including projected container volumes, vessel calls and turn times for trucks accessing marine terminals. Other participants collaborating in the project include the Port of Oakland, the Northwest Seaport Alliance, the Utah Inland Port Authority, Port Miami, the South Carolina Ports Authority and the Port of New York/New Jersey.

BLUETECHPORT LAUNCHED IN BARCELONA

The Port of Barcelona and Tech Barcelona have launched a new project area in the port that is designed to target all innovative matters related to the blue economy. It is called BlueTechPort.

The new venue has been established at Tech Barcelona’s Pier 01 at the Palau de Mar. It will be “home” for companies and entrepreneurial projects linked to the port across the logistics and blue tourism sectors. It will also cover more specialised activities such as underwater robotics, artificial intelligence relating to the marine environment and the recovery of marine biodiversity made from marine products, amongst others.

Lluís Salvadó, President, Port of

AET Transitioning

Antwerp Euroterminal (“AET”) and Envisiion Digital are partnering to progress AET plans to transition to fully renewable energy sources of wind and solar energy. AET will leverage Envision Digital’s proprietary operating system, EnOSTM, to improve its energy storage management and reduce peak power demand by 25 per cent. This effective management will result in cost savings of up to eight percent on total electricity costs.

Barcelona highlighted the importance of the project at the recent launch ceremony: “All of these sectors spell new opportunities for the maritime and port ecosystem, and at the Port of Barcelona we want to support these initiatives, becoming a benchmark for the blue economy in Europe,” he underlined.

Tech Barcelona is the independent non-profit

Transicold Launch

Specialist provider of intelligent climate and energy solutions, Carrier Transicold, has launched the BluEdge Partner Programme.

It is establishing a global network of BluEdge Partners, expanding its capacity and distribution reach, by approving the sale, installation and commission of the latest telematics technologies, including the Carrier’s Lynx™ digital platform. It offers end-to-end supply chain visibility, real-time monitoring, and improved sustainability.

association that works to consolidate Barcelona as a world-class technological and digital hub. Set up in 2013, it represents more than 1300 companies and has more than 80 partner organisations committed to the project.

API from APMT

Global terminal operator, APM Terminals (APMT), has launched a new Application Programming Interface (API) which allows its customers to track schedules and key milestones for vessels calling to specific terminals. APMT says that ships can be tracked up to one week in the past and two weeks in the future, with provision of real-time and reliable terminal estimated time of arrival/departure and truck appointments.

Operations and demurrage management platform for bulk commodity shipping, Voyager, is suggesting a more pro-active approach to reduce the costs and risks of demurrage. The company says that recent surges in port congestion and supply chain disruptions have generated longer cargo wait times and higher demurrage costs, but feels the position can be changed through the following:

1. Estimate and assess demurrage immediately after the first load port to gain a real-time view of demurrage risk at every stage.

2. Digitalise data to gain granular insight throughout load and discharge activities to streamline demurrage calculations and gain real-time insights.

3. Connect charter party agreements to demurrage logic and understand if any specific contract clauses impact demurrage claims, especially if more costs are incurred at a certain port berth.

Matthew Costello, Voyager co-founder and CEO explains further: “Issues are particularly severe in the bulk shipping sector, where demurrage costs can exceed 20 per cent of the total freight cost for a voyage….by implementing three key Best Practices, companies can significantly reduce the cost of demurrage:”

BRIEFS

OptETruck from PSA

PSA Singapore (PSA) has introduced a new proprietary cloud-based transport management system that employs Artificial Intelligence (AI) to improve haulier efficiencies. Working with Enterprise Singapore, the new OptETruck application generates automatic scheduling via a real-time resource-matching algorithm and predictive modelling to improve resource utilisation and match and recommend tasks to haulers.

For the latest news and analysis go to www.portstrategy.com SEPTEMBER 2023 | 11 DIGITAL NEWS

8 New innovation space at the Port of Barcelona is supporting the blue economy

The European Commercial Marine Awards (ECMAs) ceremony celebrates individuals and innovative companies on Tuesday 11 June.

experts, helps visitors to keep up to date with the latest challenges and emerging opportunities.

The Careers & Training Day on Thursday 13 June 2024 delivers a programme focused on careers in the commercial marine industry.

RTE rte-usa.com

for Terminals Discover what 80+ locations worldwide already have. Refrigerated Transport Electronics | New York - Panama | Since 1981

Southampton United Kingdom 11 13 TO

25th

in

25th

workboat

for security interventions

&

Reefer Monitoring

JUNE

Seawork celebrates its

anniversary

2024! The

edition of Europe’s largest commercial marine and workboat exhibition, is a proven platform to build business networks. Seawork delivers an international audience of visitors supported by our trusted partners. Seawork is the meeting place for the commercial marine and

sector. 12,000m2 of undercover halls feature 400 exhibitors speed

and Search

Rescue.

For more information visit: seawork.com contact: +44 1329 825 335 or email: info@seawork.com #Seawork Media partner MARITIMEJOURNAL COMMERCIAL MARINE BUSINESS Speed@Seawork Sea Trials & Conference SIGN UP TODAY

According to the US Energy Information Administration, carbon-free, ocean-wave energy could have supplied about 64 per cent of the country’s utility-scale generated electricity in 2021 – if the power could be captured.

A Stockholm-based startup is planning to test the waters of an untapped source of clean energy at the Port of Los Angeles in California’s San Pedro Bay. Eco Wave Power, which has pioneered wave-power installations in Israel and Gibraltar, has unveiled plans for a pilot wave-power project that will, in coming months, extract power from ocean waves at the AltaSea campus — within the Port of Los Angeles — to generate electricity. The pilot will be Eco Wave’s first in the United States.

Consisting of floating paddles mounted to piers or wharfs, Eco Wave’s technology generates

CARBON-FREE OCEAN ENERGY: L.A. TESTS SCHEDULED

about 21m of wharf frontage, while its energy-conversion unit will sit inside a standard shipping container. The system will provide an installed power capacity of 100kW per hour, enough to potentially power about 80 average homes, although the actual generated power will depend on wave heights and periods.

power from waves as small as 0.5m high. As incoming waves move the paddles up and down, they add pressure to a hydraulic system that, in turn, drives a generator to produce electricity.

8 Electricity could soon be available in the Port of Los Angeles thanks to wave power

With eight paddles, each about the size of a small car, the Los Angeles pilot project will take up

“Wave power is the least intermittent source of renewable energy. As such, wave energy can be used to stabilise other renewable energy sources, such as wind and solar, thus creating stable renewable energy generation,” says Eco Wave founder and CEO Inna Braverman.

DIGITAL CATAPULT EMBRACES PARTNERSHIPS

Digital Catapult has announced a new partnership to solve critical supply chain challenges for companies working in the UK. The company is an authority in the UK relating to advanced digital technology and is now working with five leading technology companies and six pioneering small-to-medium enterprises (SMEs). The new programme is part of the Made Smarter Innovation | Digital Supply Chain Hub initiative that supports and helps overcome issues faced by small-to-medium sized manufacturers across the country. Key objectives and aims include:

5 Significant investment for innovators: Funding the

Syncrotess is Live

The Syncrotess Optimisation Plus solution has been successfully deployed by INFORM at the Norfolk Southern (NS) Rossville Terminal near Memphis (TN). NS has added the Yard Optimizer (YO) modular function to its existing Terminal Operating System (TOS). The YO collaborates with the TOS to designate container storage places and minimise travel distance in/out the stack.

development of advanced digital solutions with up to GBP£100,000 for each tech company to deploy its solutions into the supporting manufacturer’s businesses, who will receive GBP£25,000 to bolster this activity.

5 Solving pressing manufacturing challenges: Improved compliance and export growth for SMEs through extensive use of paperless systems, reduction of textile waste by diverting to secondary markets, better supply visibility for SME automotive manufacturers, and greater analysis of purchasing costs to optimise sourcing.

SDIC Finalists

Eight maritime and logistics technology companies have been selected as finalists for the Standardised Data Innovation Challenge (SDIC). The competition is organised by Smart Maritime Network and ClassNK and retains the support of Japan’s major shipping companies, ‘K’ Line, MOL and NYK line. The finalists get to work with data sets from Japan’s maritime companies via the Internet of Ships Open Platform (IoS-OP).

5 Leveraging cutting-edge emerging technology: Leverage emerging technologies that can be deployed at scale, to sharpen the UK’s manufacturing edge, including solving industrial challenges by utilising artificial intelligence (AI), machine learning, internet of things (IoT) technologies, and blockchain.

Digital Catapult states that the timing of this project comes as a recent survey from Make UK and BDO highlighted the challenges currently facing UK manufacturers, with output growth for 2023 expected to be at -0.3 per cent. Supply chain pressures have been specifically

PET Gets eModal

Advent eModal (AeM) has confirmed intermodal facility, Port Everglades Terminal (PET), is now live with its eModal® platform to power its new gate appointment system. The eModal platform includes AeM’s PreGate and Fee Manager applications, which are integrated into the eModal Community Portal (eCP). The module streamlines processes by increasing cargo visibility, facilitates fee payments, and oversees appointment functions.

outlined as a key challenge for medium-sized firms, with continued disruption and increased costs in the UK and throughout international markets stalling business growth.

Tim Lawrence, Director of the Digital Supply Chain Hub states: “With around 250,000 SME manufacturers in the UK, it is important that the work that we do as part of the Digital Supply Chain Hub backs these organisations as we introduce advanced digital tools to the supply chain. We’re excited to work on this initial rollout.”

BRIEFS

Solar Portsmouth

The UK port of Portsmouth now has a fully operational solar and battery system. The project has been completed with an upgraded connection to the national grid to allow the full potential of the 1.2-megawatt peak system to be available. The system consists of 2660 solar panels and can generate 35 per cent of required port electricity. The solar system has an onsite battery that captures renewable energy and redirects it to the port’s buildings.

For the latest news and analysis go to www.portstrategy.com SEPTEMBER 2023 | 13 DIGITAL NEWS

OCT Lisbon Portugal

Host Port: Balancing environmental challenges with economic demands

Secure your place now & Save 20%

Join the world’s leading conference for the port community in Lisbon, Portugal. Keynote Panel includes:

Programme out now

reduction & adaptation

Waste Management and Circular Economy

Carbon Neutral Ports

Infrastructure Development for Ports & Cruise

Digitalization and Technology

Sponsored by:

Supported by:

Meet and network with over 200 attendees representing port authorities, terminal operators and shipping lines. For more information on attending, sponsoring or speaking, contact the events team: visit: greenport.com/congress

Media Partners:

tel: +44 1329 825 335

email: congress@greenport.com

#GPCongress

Isabelle Ryckbost, Secretary General , ESPO, (European Sea Port Organisation)

Nicolette van der Jagt, Director General, CLECAT (European Association for Forwarding, Transport, Logistics and Customs Services)

Isabel Moura Ramos, Executive Board Member, Port of Lisbon Authority

Christopher Wooldridge, Science Coordinator EcoPorts, European Sea Ports Organization, Senior Trainer ECO Sustainable Logistic Chain Foundation

HYDROGEN ENGINES FOR BIG RED

Carbon Emissions Drives APMT Order

To help meet future decarbonisation targets, APM Terminals (APMT), Barcelona placed a new equipment order with Konecranes Noell in Q2 2023. The terminal operator is acquiring a combination of four battery Konecranes Noell Straddle Carriers and 17 hybrid Konecranes Noell Straddle Carriers to support its Spanish terminal in meeting its decarbonisation targets, but without compromising reliability and efficiency objectives.

US-based Taylor Machine Works Inc. is integrating hydrogen engines from Cummins Inc. into its product line. The move is part of Taylor Machine Work’s “Beyond Clean Lifting” initiative.

“Big Red” – as Taylor Machine Works is also known – has signed a letter of intent with Cummins to utilise the 6.7-litre and 15-litre hydrogen engines for its range of equipment activities across industrial steel, wood products, concrete, oil and gas, and port operations activities.

Taylor Machine Works has confirmed its intention to develop low and zero-carbon solutions across the company’s entire product line, which includes battery electric trucks, hydrogen fuel cell trucks, and now Hydrogen Internal Combustion Engines (H2ICE).

H2ICE engines reduce carbon

eWolf on the Way

Ground has been broken for the new shoreside charging station that will provide clean energy at the Port of San Diego for Crowley’s planned zero emissions tugboat, eWolf. The facility will recharge the vessel quickly while reducing peak loads on the community energy grid. It is equipped with two containerised energy storage systems provided by Corvus Energy and is designed to operate during off-peak hours.

emissions without sacrificing productivity. “Big Red” states that adding H2ICE to the mix of zero carbon solutions also reduces the pressure on utility grids, while still delivering dependable solutions that match more traditional internal combustion equipment, but without increasing service and maintenance requirements.

Antonio Leitao, Cummins Vice President Off-Highway Engine

TT Gets 18 Tractors

AJL Group Pty Ltd has placed an order with Kalmar, part of Cargotec, for 18 terminal tractors. The equipment will be supplied to TT-Line Company, the stateowned operator of the Spirit of Tasmania ferry service between Geelong on the Australian mainland and Devonport on Tasmania’s Northwest coast. The order includes a 12-month subscription to the Kalmar Insight the performance management tool. Delivery: Q1 and Q2 2024.

Business, highlights the aims of the joint venture: “We see hydrogen internal combustion engines as a solution to help drive sustainability improvements in our industry. Hydrogen power will help both original equipment manufacturers and end-users looking to making carbon emissions reductions on their paths to zero.”

Established in 1927, Taylor has been manufacturing highcapacity forklifts, lift trucks and container handling equipment for the lumber, steel, concrete, intermodal and paper industries. Cummins is a specialist, US-headquartered manufacturer of heavy industrial lift equipment and already provides engine power to more than 100 different models of trucks manufactured by Taylor.

Patrick Takes 10

Patrick Terminals in Melbourne has placed an order for 10 new hybrid straddle carriers in Cargotec’s Q3 2023 intake. Delivery of the units is scheduled for completion by the end of Q1 2024. The hybrid straddles reportedly cut fuel consumption by up to 40 per cent compared to equivalent diesel-powered machines and are expected to play a significant role in supporting Patrick Terminals with its ongoing decarbonisation strategy.

The four battery Konecranes Noell Straddle Carriers will be delivered in Q3 2024 and include two automated charging stations. They can move containers one-over-three high, all with twin-lift capabilities. The 17 hybrid Konecranes Noell Straddle Carriers will also be twin-lift and stack one-over-three, with deliveries commencing in Q4 2023.

APMT is also planning to utilise the Konecranes “out of operation” battery charging approach to optimise intelligent machine deployment and work shifts.

Hubert Foltys, Director of Business Line Straddle Carriers at Konecranes, notes: “The highperformance, reliable, lowemission and zero-tailpipeemission container handling equipment that APMT has ordered from Konecranes will contribute significantly to achieving its decarbonisation targets. APMT is the first company globally to order battery-powered Konecranes Noell Straddle Carriers.

BRIEFS

Chinese Support

Russian maritime port operator, Global Ports Group, has introduced two new heavy duty reachstackers at its Vostochnaya Stevedoring Company (VSC) terminal in Asia. The units were supplied by Chinese port equipment manufacturer, ZPMC and bring the total in use at the facility to 15. During 2023-2024, nine Chinese rubber-tyred gantry cranes (RTGs) and rail-mounted gantry cranes (RMGs) are expected to be delivered to this facility.

For the latest news and analysis go to www.portstrategy.com SEPTEMBER 2023 | 15 EQUIPMENT NEWS

s o e d o of emissionswithoutsacri B th hy e d im H o m lo e p

8 Taylor Machine Works Inc. is integrating hydrogen engines from Cummins Inc. into its product line, as part of the US equipment provider’s “Beyond Clean Lifting” initiative

Green Ports and Shipping Congress will identify and prioritise the areas that ports-based organisations and shipping companies need to collaborate on to reduce emissions.

Green Ports & Shipping Congress will cover a range of topics addressing the aspects of energy transition plans and

operations and ships.

Sessions and streams will focus on the required infrastructure, alternative fuel options/bunkering, technical solutions and how these align with the shipping lines and logistics chains.

It is a must-attend event for policy makers, ports and terminal operators, shipping companies, shippers and logistics companies, fuel & propulsion providers, decarbonisation clusters.

Media partners: PORTSTRATEGY INSIGHTFOR PORTEXECUTIVES GREENPORT INSIGHTFOR PORTEXECUTIVES MOTORSHIP MARINETECHNOLOGY THE Visit www.greenseascongress.com Supporters:

For further information about speaking, sponsoring or attending as a delegate, contact the Events

Register your interest now!

team on +44 1329 825335

IMGS has introduced a new mobile bagging process which is said to deliver an exceptional performance.

The new system involves the use of the company’s innovative solution, dubbed the Mobile Bagging Machine. The unit is strategically positioned under grain bins, with the product filtered into the machine, which then bags 150 metric tons of cargo per hour. This means running two bagging lines will see 2000 bags generated per hour.

This new mobile unit is constructed from steel, is moveable around the terminal and can operate on a 24 x 7 basis.

IMGS confirms that the new equipment has already been deployed in a port in East Africa and has seen output increase four-fold.

Despite the fragility of supply chains globally, Konecranes is predicting it will see increases in net sales in 2023. This is according to Anders Svensson, CEO, who reported that the company saw improved EBITA margins over 2022, even though challenges in availability of materials remain.

For Q2 2023, key indicators over Q2 2022 included:

5 Order intake €1,092.9 million, +1.0 percent (+3.5 percent on a comparable currency basis)

5 Order book €3,411.4 million at the end of June, +20.7 percent (+25.1 percent on a comparable currency basis)

While for H1 2023, the following summary applies over H1 2022:

5 Order intake €2,382.5 million, +9.3 percent (+10.4 percent on a comparable currency basis)

5 Sales €913.0 million, +16.0 percent (+18.7 percent on a comparable currency basis)

A summary of the company’s performance indicators are shown in Table 1,

Svensson offered the following summary on activities in 2023: “Konecranes’ Q2 financial performance was strong. Both orders received and sales grew year-on-year. We posted a record-breaking Q2 comparable EBITA margin of 10.8per cent powered by continued good delivery capability and a positive pricing impact. Our all-time high

INNOVATIVE BAGGING SOLUTION FROM IMGS

Combilift Three-High

IMGS Group’s mobile bagging units are engineered in Canada and manufactured under the brand name RAPIDPACK™. The company is headquartered in Toronto and has been in operation for 60 years. Its products handle around nine

8 IMGS has developed a new mobile bagging unit is said to greatly improve bagging productivity, while able to operate on a 24 x 7 basis

million tons of bulk and breakbulk cargo annually, across 65 ports globally.

KONECRANES UPBEAT FOR 2023

Ireland-based Combilift is delivering its first ever three-high straddle carrier. The recipient is FBT Transwest, an Australian container transport and storage company, based in Sydney. The new unit left the factory in August 2023 and is expected to provide improved selectivity of containers in the yard while maintaining a low level of ground pressure. Combilift specialises in multi-directional forklifts but also manufactures the Combi-SC straddle carrier range, which specialises in containers and over-sized loads.

Eco Tractor Trials

orderbook of €3.4 billion and continued strong performance provide a solid foundation for reaching our new, ambitious financial targets.”

He clearly remains upbeat for the remainder of 2023, explaining: “Our demand environment within industrial customer segments has remained good and continues on a healthy level, despite the weakened global macro indicators and some signs of weakening in all three regions.”

However, there is also a note of caution here too, with the company stating that the “worldwide demand picture remains subject to volatility and uncertainty” adding that while long-term prospects for container handling are expected to be “good overall,” there is one trend being monitored: “We have

started to see hesitation in decision-making in the short term among some port customers,” said Svensson.

Konecranes has commenced Q3 2023 strongly, announcing that an order has been placed by CMA CGM Kaohsiung Terminal Co. Ltd to supply seven hybrid Konecranes Noell Rubber-Tyred Gantry (RTG) cranes to its facility in Taiwan. Handover for operations is scheduled for Q4 2024. The combined diesel and electric power units see lower fuel use and reduced carbon emissions, while also benefitting from use of GPS for the Auto-Steering smart feature, which helps the operator keep the RTG on a straight drive path.

Duvenbeck has taken a further step towards fully switching its fleet to lowemission vehicles after a new electric terminal tractor passed its practical trials. The freight forwarding and logistics company has been testing the Terberg YT203-EV electric unit that uses a battery with capacity of 150 kilowatt hours (kWh), meaning a full day’s shift is possible on one charge. The eco tractor is almost two-and-a-half times more expensive than the diesel equivalent version to purchase.

New Houston Cranes

Three new neo-Panamax ship-to-shore (STS) cranes have been delivered to the Bayport Container Terminal at the Port of Houston. The ZPMC units are equipped with electric motors, gears, and control systems, which means zero diesel emissions are emitted. These new cranes, which have an outreach of 22 containers wide, are for Bayport’s new Wharf 6, which is scheduled for operations to commence in Q4 2023.

For the latest news and analysis go to www.portstrategy.com SEPTEMBER 2023 | 17 EQUIPMENT NEWS

BRIEFS

8 Table 1: Konecranes Performance Indicators – Q2 2023 vs Q2 2022 and H1 2023 vs H1 2022

Recently, the Federal Maritime Commission (FMC) announced that one of its Commissioners would be convening a set of meetings regarding movements of containers in and around the largest U.S. ports. In the FMC outreach on this new effort, the emphasis was on speeding up cargo moves (with the next “supply chain disruption” being a matter of “when” and not “if”) through discussions with industry, rather than via regulatory mandates.

The thrust of the potential reforms would be smoothing out the movement of boxes in and out of terminals. A familiar refrain in this respect from seaport entities (sometimes, not always), is “We are a landlord port…it’s up to the individual terminal

FMC LOOKS TO SMOOTH OUT BOX FLOW TO AND FROM TERMINALS

operators to keep throughput running smoothly.” Legalistically, there is a lot of truth to this. However, my hope always (sorry, readers, for repetition) is that all concerned- including port management bodies, would look at the bigger picture, and, where possible, participate in discussions arranged by the FMC (and by others in the future that will build on the FMC efforts).

This new initiative comes a year into one real regulatory effort- the Ocean Shipping Reform Act of 2022 (OSRA 2022); visitors to the FMC’s freely available pages on its website can follow the progress of the various complaints by shippers as they

THEANALYST

PETER DE LANGEN

Amsterdam’s city council has approved a plan to ban cruise from Amsterdam’s city centre. Another bold move from a port that some years ago took the decision to phase out the handling of coal by 2030.

While I was (in a previous column in Port Strategy) and continue to be positive about the decision on coal, in my view the ban on cruise is short-sighted. For very understandable reasons, Amsterdam aims to reduce the negative impacts associated with tourism. But negative effects from tourism are not a given, and they certainly are not similar across all tourist types.

Amsterdam’s core tourism problem is that it attracts large numbers of tourists attracted by the prospect of ‘drugs and drinking’. Banning cruise does not help address this problem. Furthermore, banning cruise ships will certainly result in cruise calls in other cities (mainly

work their way thru the FMC’s administrative apparatus. In my view, most of them are smallish items, many by small shippers (one exception, Bed Bath & Beyond is in the celebrity case category- and, by the way, supply chain issues were not the cause of this retailer’s demise) against carriers who have contracted with various terminals in the ports.

From time to time, in scanning through some of the filings, I get the sense that ambiguity about localised container movements is a big part of the problem. And I can’t help thinking that some broader guidance, built hopefully with an industry consensus (in the style of another body well

known to maritime readersthe International Maritime Organisation, or IMO, which relies extensively on “working groups” of industry participants, to guide its efforts), might be helpful here.

So, back to the FMC’s upcoming meetings- the ports to be examined, actually by “Supply Chain Innovation Teams,” will be Los Angeles (approximately 9.9 million TEU handled in 2022), New York/ New Jersey (9.5 million TEU handled) and Long Beach (9.1million TEU handled).

If problems at these three behemoths can be meaningfully addressed, then suggestions could be applied across a broader swathe of ports on all coasts.

AMSTERDAM’S CRUISE BAN, A BOLD MOVE BUT A MISSED OPPORTUNITY

instance through zero-emission daytrips spread out over the city, to avoid overcrowding of tourism hotspots?

Amsterdam is such an attractive destination that this could affect cruise lines decisions. And why not seek alliances with other ports in the same destination market, like Oslo, Copenhagen or Hamburg, to establish a coalition of port cities leading the transition towards sustainable cruise tourism?

Rotterdam and Ymuiden) with bus excursions to Amsterdam, while a mere three per cent of all Amsterdam’s tourists arrive with a cruise, so the decision is hardly material in reducing tourism numbers in Amsterdam.

Amsterdam’s decision was also justified by rightly pointing out that the cruise tourism industry is not environmentally sustainable. This is where, in my view, the missed opportunity kicks in. Why

not ban polluting ships only, while welcoming environmentally sustainable cruise calls if they submit a realistic plan to make sure the cruise activity in Amsterdam is environmentally and socially sustainable, for

In such an approach, cruise would not be ‘labelled’ as intrinsically ‘bad’, but instead, Amsterdam would use its attractiveness to drive change in the right direction. Of course, more work would have to be done on the feasibility and spatial implications of such an approach, but an outright ban without much consideration of potential alternatives is in my view short-sighted.

18 | SEPTEMBER 2023 For the latest news and analysis go to www.portstrategy.com

PARKER THENEWYORKER

BARRY

8 Amsterdam is closing the door on cruise ships – a bold move under the banner of environmental sustainability but is it a missed opportunity?

BEN HACKETT THEECONOMIST

As North America and Europe struggle with lagging economic growth Southeast Asia is expanding its economic base and benefiting from new investments.

We hear a lot about the economic trials and tribulations in North America and Europe, and the expectations around a recession as national central banks continue to raise interest rates. There is less reported about what is happening in Asia except for China, and that data is less than reliable.

Visiting Singapore, however, provides a more optimistic outlook for 2023 and the coming two years, notwithstanding the fiscal pressures from the high interest rates in the Western Hemisphere. In the first half of this year the ASEAN economies could not avoid these pressures and as a result there is consensus that 2023 economic growth will be down compared to 2022 but nevertheless it will remain robust and most likely have stronger growth than its regional neighbours and the major global players.

ASIA PROSPECTS ARE POSITIVE DESPITE WESTERN STAGNATION

supported by the governments looking for an edge in transitioning from the older manufacturing industries which had come in search of cheaper labour. As the globalisation of manufactured goods focused on China is coming to the end of an era of expansion, following the supply chain problems and political issues dominating Western national politics, the reduction in the reliance on China is strongly benefiting Southeast Asia as infrastructure improves and economic policies are more favourable towards FDI investments and ownership.

The Asian Development Bank is projecting 4.7 per cent growth for the 10 economies that make up ASEAN with this accelerating to five per cent in 2024. This is being borne out by the expected strengthening of economic activity in the second half of this year that is already becoming apparent. Part of this is due to foreign direct investment (FDI) shifting from China to Southeast

MIKE MUNDY THESTRATEGIST

It is interesting to note the detailed remarks of SagittaMarine, a dry bulk operator primarily active in the handy-ultramax segments, about the impact of low water levels on the performance of the Panama Canal during August. There are the upfront problems but also what it cites as a knockon effect on the global economy.

The company reports: “Delays at the Panama Canal averaged about 15-19 days per vessel in the first week of August, with low water levels in the Gatun Lake restricting the numbers of fully-laden vessels able to make the transit.” As a result of this it went on to say that it believes the

Asia looking for political and economic stability. Added to this, Chinese companies are also growing their foreign investments. Another factor is the trend of increased investment in technological and digital industries and initiatives,

This trend is reflected in the maritime sector as more investment is flowing into new port developments together with improved highway connectivity in countries such as Vietnam, Cambodia, Thailand and Indonesia. The shift of container capacity to the North-South Asia regional trades lanes has been very noticeable and to the benefit of associated ports and terminals.

PANAMA CANAL PROBLEMS: MICRO AND MACRO

delays are causing inflationary pressures for shippers forced to consume more fuel on longer voyages.

“The Panama Canal is a vital trade route for our industry, and the current delays are having a significant impact on our operations,” underlined Thomas Zaidman, Managing Director of Sagitta Marine. “We are seeing congestion in several ports in South America and the canal but still the demand side is so depressed we don’t see the expected market reaction despite the pressure on the supply chain.”

The company, headquartered in Mexico, further observed:

“Already low water levels at the Gatun Lake are continuing to decrease amid the dry season and the canal authority has said that limiting transits is a necessary measure so that additional draft restrictions could potentially be avoided. Climate change is also contributing to unpredictable levels of rainfall, exacerbated by this year’s El Nino.”

The delays at the Panama Canal, SagittaMarine believes, are having a ripple effect throughout the global economy. Ships that are delayed in the canal are forced to take longer routes, which increases fuel costs and shipping times. This can lead to

higher prices for consumers and disruptions in supply chains.

Longer term, Zaidman underlines the industry will need to continue to reduce its climate footprint and contribution to global carbon emissions. This is driven by commercial interest as well as concern for the environment.

“The Panama Canal delays are a reminder of the urgent need to address climate change. The shipping industry is one of the most vulnerable sectors to the impacts of climate change, and we need to take action to reduce our emissions and mitigate the risks,” he emphasises.

For the latest news and analysis go to www.portstrategy.com SEPTEMBER 2023 | 19

8 Vietnam is one of the countries benefitting from foreign direct investment shifting from China to Southeast Asia

OPERATOR SELECTION MINEFIELD

Need a container terminal operator? Tread carefully, all is not what it seems. Mike Mundy takes a detailed look at how the international container terminal operating sector is now structured, the different classifications of operator and their respective pros and cons

Outwardly the most visible sign of structural change in the container terminal operating sector is the considerable enlargement of the presence of shipping lines. But actually the scale of change goes far beyond this, with significant implications for those parties offering concessions or investment opportunities in general. Essentially, for these latter parties – seeking serious investors – it is important to understand that the international terminal operating sector is today made up of different categories of terminal operator and to seek out the category most appropriate to their respective needs.

Table 1 presents Port Strategy’s current view of the container terminal operating industry, unveiling an inherently more complex picture than might be anticipated even by quite experienced port authorities or other government agencies. It shows that when it comes to operator selection there is a lot to think about with quite marked differences between different categories of operator. Inevitably, there is a degree of subjectivity in assembling such a categorisation and defining the associated characteristics but this has been done tapping into the extensive knowledge of Port Strategy’s in-house team and the input of diverse industry professionals. The analysis also goes one step further by identifying the leading players in specific categories.

‘‘

The traditional method of appointing a terminal operator –as recommended by the World Bank, IFC and other leading agencies – is via a competitive tender with this usually consisting of two key elements, a technical submission and a financial bid. It is a tried and tested process, with a competitive base, that will mechanically deliver the best terminal operating partner. Points are awarded for both the technical submission and financial offering – the party with the largest number of points wins and is awarded preferred bidder status.

QUESTIONABLE APPROACHES

Approaches to securing a terminal opportunity that have recently been much more prevalent, such as country to country deals – the mechanism for example that is said to have delivered the new Patenga Container Terminal (PCT) opportunity in Bangladesh to Red Sea Gateway Terminal –are essentially designed to deliver exclusivity and as such do not possess the inherent advantages of the more competitive open tender approach. The same can be said of when political pressure is brought to bear on behalf of a given party or if a multi-bidder process is run but this is open to undue internal influence – basically corruption – to place the opportunity in the hands of a specific bidder. Angola, for

example, has run tender processes open to diverse bidders where the winner (in terms of points over a technical and financial bid) has not actually been designated the winner but another party has with a lower score.

In all instances, it is important to ensure bid integrity. Not to do so, is to work against the host country’s economic objectives and in all probability to add to costs for importers and exporters. Or to put it more crudely, for the agency issuing the bid to ‘shoot itself in the foot.’

Just as there are tried and tested bid processes there are tried and tested mechanisms, some involving arms-length bodies, to ensure clean bid processes.

SHIPPING LINE TWIST

Readers will recognise that shipping lines have long been involved in the terminal sector with the last three decades seeing the formation of shipping line linked terminal groupings that have not only been established to meet the needs of the associated line but also to service third party business. The full pros and cons of such entities are detailed in Table 1, but it is worth highlighting here a ‘new twist’ to shipping line involvement in the terminal sector. This follows on from the dive by certain lines into logistics on a broad scale and is when the ownership of a terminal by a shipping line affiliated operator is instrumental in the sister line exerting strong control over a supply chain as a whole. This is a step that can remove healthy competition and impair profitability.

Bottom line, today’s international container terminal operating sector has a complex structure and it is fundamentally important for any government agency offering a concession to understand the different categories of operator and their respective merits and demerits to secure the best fit partner.

8 Operator selection under a country-tocountry deal lacks the inherent advantages of a more competitive open tender process

CONTAINER TERMINAL OPERATION 20 | SEPTEMBER 2023 For the latest news and analysis go to www.portstrategy.com

It is to necessary to understand the different categories of operator and their respective merits and demerits to secure the best fit partner

CONTAINER TERMINAL OPERATION

8

GOVERNMENT OWNED/CONTROLLED/COUNTRY-TO-COUNTRY DEALS

Companies: AD Ports, China Merchants Port Holding Company Ltd, COSCO Shipping Ports, DP World, Red Sea Gateway, Qterminals

Profile:The recent distinguishing characteristic of these companies is that they have all played the government-to-government card to gain access to market opportunities. Frequently, this approach has a backcloth to it which offers a wider level of engagement designed to be attractive to the country presenting the opportunity and with this invariably possessing a strong element of financial inducement that extends way beyond the port sector.

The downside of this approach is that it can eliminate healthy competition focused on securing the best investor/operator for the opportunity at hand and similarly set against a wide offering the importance of the core opportunity can be undermined. It can also have severe consequences in terms of political fall out and social unrest as DP World is now finding in Tanzania where it is pursuing a large scale port management project.

8 GOVERNMENT OWNED

Companies: PSA International (Port of Singapore Authority affiliate), Shanghai International Port Group

Profile: These two companies reflect something of a conservative nature in accordance with their public ownership – they are not at the far end of the risk-taking spectrum. PSA International is a first-generation entrant to the international terminal operating sector and has a strong global presence often reflecting its strong skill set in the area of transshipment activity. SIPG has a much tighter relationship with government with its terminal operations largely in China.

8 PRIVATE/STRONG POLITICAL BACKING

Companies: Adani Ports & Special Economic Zones (AP&SEZ), Yilport, Hutchison and CMA Terminals/Terminal Link

Profile: It is the past activities of these four groupings that identify them as having strong political backing from their respective home countries – Adani (India), Yilport (Turkey) and CMA Terminals and Terminal Link (France), although it should be acknowledged Terminal Link is 49 per cent owned by China Merchants Port Holding Company Limited. This political backing has been useful consolidating their presence at home and advancing their expansion overseas. It is not infallible, however, as witnessed by the recent situation with Adani which has seen billions wiped from the market cap of the conglomerate’s listed companies. This followed a report issued by New York-based Hindenburg Research which accused Adani of using an offshore shell network to manipulate earnings and “avoid a material writedown and negative impact to net income.” Now, as PS goes to press, Adani awaits the imminent findings of a probe by The Securities and Exchange Board of India plus it has just seen Deloitte, the longtime auditor of its ports division, resign voicing concerns it could not comprehensively scrutinise transactions between companies in the group and the ports unit. India’s Prime Minister, Narendra Modi, is recognised as a long-time supporter of Adani but as the group’s current troubles indicate such affiliations can prove problematic.

8 SHIPPING LINE AFFILIATED OPERATORS

Companies: Africa Global Logistics (MSC affi liate/ex Bollore), APM Terminals, COSCO Shipping Ports, Hapag Lloyd, Terminal Investments Limited, CMA Terminals/Terminal Link Profile: The above are the major shipping line affiliated terminal operators that offer their services not just in conjunction with the activities of their sister shipping line and its consortia partners, if applicable, but also to other lines in a general context. As noted at the outset of this article, shipping lines during the lucrative years of the pandemic have greatly increased their presence in the terminal sector with a number of notable deals for terminal portfolios, and particularly:

5 MSC’s purchase of the Bollore businesses in Africa comprising 22 port and rail concessions, 66 dry ports, two river terminals and over 250 logistics/maritime agencies. These businesses were rebranded under the name Africa Global Logistics, and

5 Hapag Lloyd securing a 40 per cent stake in J M Baxi’s Indian port and logistics operations which comprise key container terminals, a multi-purpose terminal, inland container depots, CFS and other logistics activities. Further this acquisition followed on the heels of the company buying SAAM Ports and SAAM Logistics from Chilean multinational port services company SAAM with the terminal portfolio comprising 10 port terminals located in six countries in the Americas. Such shipping line affiliated operators have a number of core characteristics including:

5 With new concession opportunities, holding out the carrot of bringing volume to the facility via their partner shipping line.

5 The downside of this is that liner operated terminals will typically operate them as cost and not profit centres when serving their sister line and partners.

5 In a service context, while publicly they will deny it, the priority is to meet the needs of the affiliated shipping line(s).

5 As a rule, competing lines do not like to use each others’ terminals denying some business opportunities.

5 Increasingly, terminal assets are seen by lines as an integral part of their efforts to control a whole or large part of a supply chain with the knock-on effect of reducing competition.

8 PRIVATE & INDEPENDENT OPERATORS

Companies: International Container Terminal Services Limited (ICTSI), Eurogate Hutchison (outside China) & SSA Marine

Profile: All the above companies have long been established in the terminal operating sector and largely offer services on a neutral basis (without preference) to all shipping line customers. This neutrality or independence contributes to their strength, facilitating highly productive common user terminal operations.

The Eurogate network covers 12 terminals in Europe and it does operate in partnership with shipping lines at the Eurogate Tanger SA facility where it has a 20 per cent equity stake.

Hutchison, a pioneer in the sector, has a big global presence but has been quieter in recent years.

ICTSI is the most independent of the three companies with a global portfolio of over 30 terminal facilities including the newly added Durban Pier 2 Container Terminal where it is in partnership with Transnet.

SSA Marine is active on a global basis but has a particularly a large footprint of terminals in the Americas.

TABLE 1: INTERNATIONAL TERMINAL OPERATOR CATEGORIES & CORE CHARACTERISTICS For the latest news and analysis go to www.portstrategy.com SEPTEMBER 2023 | 21

NEARSHORING OR ‘NO-CHINA’

There are far-reaching trends underway shaping container trades and, thus, port development. Uncertain political conditions and the erosion of China’s cost-advantages are redirecting attention to alternative strategies. Andrew Penfold looks at the driving forces…

The upheavals of the Pandemic and then the Ukraine war have led to a sharp reappraisal of supply chain security issues. The increased level of sabre rattling over Taiwan has also shaken up earlier complacencies about the desirability of relying on China as the primary source of manufactured and semi-manufactured goods. How will this pan-out and what are the implications for port investments by the public and private sectors?

On the one hand, these changes have been driven by increasing manufacturing costs in China as the economy moves up the value chain. This has seen a now wellestablished search for cheaper sources for manufactured goods. The pace of this was actually quite sluggish before the recent upheavals but has now accelerated sharply.

The strategic response for multi-nationals has been twofold – on the one hand there has been a desire to move production closer to demand. For the US this means Mexico and the smaller central American states. For western Europe this means the lower cost parts of eastern Europe and also Turkey. The driving force here is partly lower costs but – more importantly – supply chain security. Alternatively, there has been a surge in the search for other low-cost Asian suppliers. This means the less developed economies in Southeast Asia and the Indian Subcontinent. Here the driving force is, and will remain, labour costs.

It’s far from clear how far this process is really one of ‘nearshoring’ and not simply a ‘no-China’ policy. Which of these two approaches become dominant is not clear, with a mixed approach probably the most likely outcome. The implications for port development of these competing strategies are quite different.

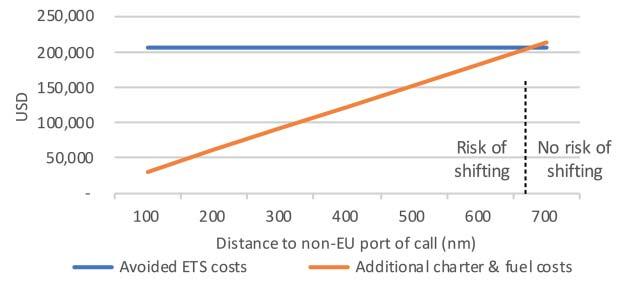

LABOUR COSTS ARE KEY