9 minute read

Biofuel expertise

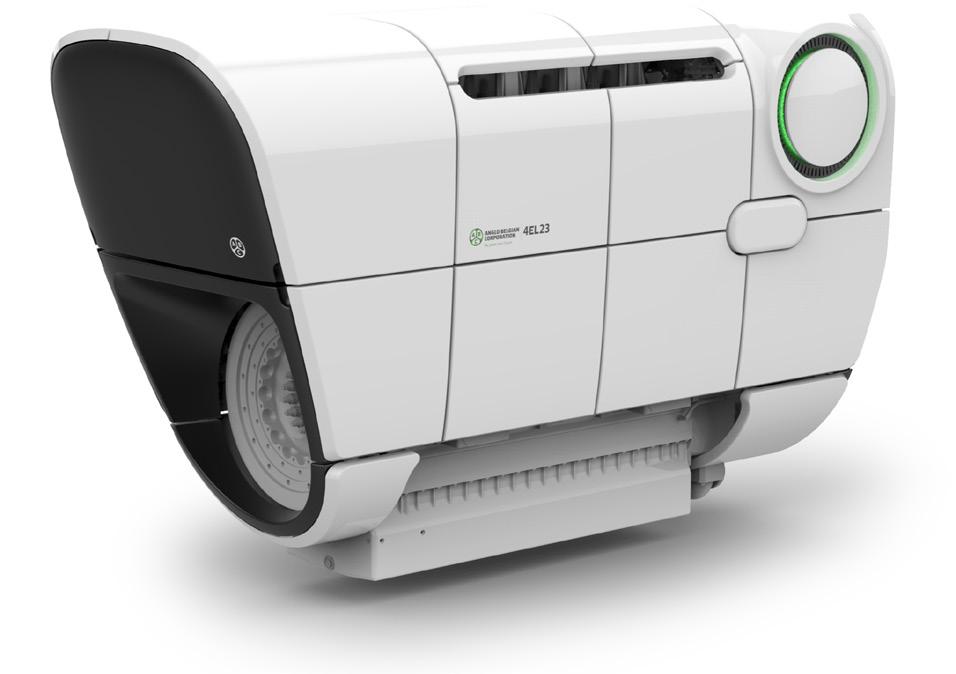

ABC LAUNCHES FUEL-FLEXIBLE EVOLVE 20EV23 ENGINE

Anglo Belgian Corporation (ABC) has launched its second EVOLVE engine, the 20-cylinder medium speed 20EV23.

Like the first engine in the series, the 4-cylinder 4EL23 launched last year, the 20EV23 has cylinder heads adaptive to multifuel solutions. The engine allows for a choice between liquid, dual fuel and gas combustion: including a highly efficient Common Rail or pump-line-nozzle (PLN) fuel injection system for liquid fuels, a micro pilot liquid fuel injection combined with gas injection system for dual-fuel operation, and a spark ignited gas system.

This facilitates financially viable conversion or retrofit to new fuel types, such as diesel, biodiesel, MDO, HFO, methanol, LNG, CNG and hydrogen, using the same engine. The engine is IMO TIER II and IMO TIER III certified and EU stage V compliant.

The company claims the engine displays impressive response times at heavy load pick up, combining extreme reliability and distinctive speed with the best power-toweight ratio. It offers 20 x 360kW of acceleration (7.2MW) and two-stage turbocharging which increases load pick-up and improves shock load acceptance. Higher power is available in special applications.

The 230mm bore, 310mm stroke 20EL23 engine features speeds from 400 to 1,200 rpm (400 rpm idling), and a nominal power range of 3,960-7,200kW. ABC claims best-in-class fuel and lube oil consumption due to the optimised throttle air and fuel volumes in its injection technology and the twostage turbocharging.

In recent years, ABC has invested heavily in the development of environmentally friendly power systems. Last year, ABC was the first in the world to receive the official EU Stage V certificate for its DZC engines which limit the emission of NOx and soot particles to very low values. Before that, together with CMB, it launched BeHydro, a marine dual fuel hydrogen engine range that reduces CO2 emissions by 85%.

ABC’s DZC engine is already hydrogen-ready in a dual fuel version (DZD - 85% hydrogen gas and 15% liquid fuel). This hydrogen engine is available with 6, 8, 12 or 16 cylinders and has a power output from 1,000 up to 2,670kW. The DZD hydrogen engine can be combined with an after-treatment system in which the smaller proportion of diesel that is burned can be filtered through a particle filter for the soot particles and a catalytic converter for the NOx emissions.

The 20EV23 is 100% manufactured in ABC’s production facility in Ghent. All components are produced within the EU. No conflict or rare materials are used during the manufacturing process.

WITHOUT URGENT ACTION, SHIPPING FACES AN EMISSIONS OVERSHOOT: MAN ES’S WAYNE JONES

In a plain speaking interview at SMM, Wayne Jones OBE, Chief Sales Officer at MAN Energy Solutions calls for the industry to take action, and for regulators to deliver certainty to encourage investment

QWhat do you think the overshoot that MAN ES expects to see in shipping emissions will mean for the industry? A Wayne Jones: Well, we do have some possibilities to arrive at the [IMO] goal. It depends on the ambitions that are put into the regulatory framework. But we also need intermediate targets to push down the overshoot.

In practical terms, I think we can encourage the retrofitting of the existing fleet. Another way to do it is to accelerate the uptake of new fuels. So there are various levers to pull on the new or general direction.

But the development of supply chains for alternative fuels is going to be a challenge. So we need other industries, and companies to be first movers as well. And I think there's lots of ways to encourage that. One of the things we wanted to achieve with the paper was to show that we can actually reduce the severity of the forecast overshoot if we begin to act now. That's the biggest challenge.

Do you feel that the industry should expect renewed pressure for the imposition of market-based

measures, such as a carbon levy, in the short term? Wayne Jones: Something like a carbon levy has to be high on the agenda [at the IMO], because nothing will happen unless we introduce regulation. When I say nothing, not to the level we need to keep to the Paris Agreement. So regulation, whether we like it or we don't, is going to part of the puzzle. And this is something we have to drive… We shouldn’t forget that there are other industries that don’t have the same institutions [as the IMO] to regulate on such a global scale.

But more widely, we see greater regulatory certainty as an important condition to encourage investment. We also want to let the market function properly, using market mechanisms. As a technology developer, we can see how regulation has encouraged the takeup of other technologies in other areas.

Are you concerned that some of the proposed

Qsolutions under develo-pment by regulators appear to be excessively focused on short-

sea routes, or the demands of smaller vessel types?

Well, there are a range of alternative energy A efficiency solutions under development. And there is a role for batteries to improve the operation of our 4-stroke engines, for instance. We have experience delivering these solutions. However, if we are looking at deep sea shipping, which accounts for around 70% of overall emissions, alternative fuels are the main solution. Electrification isn’t really a solution for our largest 2-stroke engines, which have maximum power output of weigh in at up to 2MW more than 80 M.W Q Since we spoke last year, cost differentials between LNG and conventional fuels have become even more

volatile. How do you see such price pressures affecting the development of LNG and alternative fuels more widely?

AWayne Jones: I think that that’s where the advantages of dual fuel options reveal themselves. The clever thing is that you can still run on traditional fuels. While people do take a longer-term view when they're making these investment decisions, because the capex investment is significant… there has to be commercial viability to [LNG and alternative fuel pricing] as well.

8 “I think we’re

past the point of discussion and should be really looking at acting now”: Wayne Jones, Chief Sales Officer at MAN Energy Solutions

Looking ahead, one of the advantages is that ship owners will have the flexibility to operate on other fuels, such as biodiesel, if there are supply or availability issues. We expect that the traditional laws of supply and demand will expand the supply of alternative fuels in the future, with suppliers moving to fill local supply gaps.

Do you feel that there is a risk that ship owners and operators will delay investment decisions until there is greater regulatory clarity before deciding on retrofits, for example?

Wayne Jones: I think shipping really should take care of its own business… If you wait around for legislation to become as you want to, if you wait around for governments to do, then you'll be waiting a long time.

Let’s not make the perfect the enemy of the good, or progress… let's at least retrofit what we've got, let's at least go to LNG, today. It's a fossil-based fuel, but it still gives us 20% improvement on CO2 emissions. I think we’re past the point of discussion and should be really look at acting now.

One of the reasons that I'm trying to preach this all the time is that I believe agility is going to be the new corporate currency.

We recently interviewed your colleague Dorthe

Jacobsen about the progress of the ammonia engine research project. It looks like you are on track to bring the first commercial 2-stroke ammonia engine to market in 2024. From a commercial perspective, would it be possible to discuss how clients are responding to the new ammonia engine?

Wayne Jones: We’re making good progress with the ammonia engine and we're testing the one cylinder, literally, as we speak, we're going to launch it 2024. And, of course, our launch customer is the biggest ammonia carrier in the world.

For ammonia carriers, it is a very sensible decision to use the cargo to power the engine, in the same way that LNG carriers [benefit from running on their cargo]. I hear from companies looking at ammonia supply chains that they believe that ammonia will play a huge role in the future across various industries.

But there are other sections of the market that are waiting to see our first engines launched and the first year of production. I remember people saying the same thing about methanol engines three years ago – we’re probably at a similar stage of development. And then after the first year, people start to say, “actually, yes”.

8 According to MAN ES analysis, shipping’s greenhouse gas

emissions are likely to rise by 10% over the coming decade as the global fleet expands.

QQuestion: How do you see the introduction of methanol engines proceeding? A The introduction of methanol has been very successful. We have 70 engines on order, and people can see for themselves that it works. There are no major technological technology challenges, and we’re getting to the stage where we can call it a proven technology.

The customer reaction to methanol has been pleasantly surprising, with particularly strong interest from some of the larger vessel segments, such as the container market, driven by major customers who are now looking at it.

8 Conventional

engines will account for over 50% of installed engine capacity on newbuildings until 2040.

Urgent action on alt fuel supply and retrofits needed

Shortly before speaking to The Motorship at SMM, Wayne Jones, MAN Energy Solutions’ Chief Sales Officer, warned that without urgent action to encourage a faster adoption of synthetic fuels, global shipping might “significantly overshoot” the targets set by the Paris Agreement to limit temperature increase.

The analysis is based upon a 60% increase in the global fleet, which would contribute to an overall increase in shipping’s greenhouse gas emissions of 10% (measured on a well-to-wake basis) over the coming decade, despite an improvement in the efficiency of individual assets.

In order to prevent an overshoot in greenhouse gas emissions which would lead to shipping failing to meet its targets to comply with the Paris Agreement, Jones called for urgent action for the industry to meet its targets.

The proposals included regulatory levers, such as accelerating the pace of CO2 regulation alongside the potential introduction of carbon pricing.

Jones also specifically identified the issue of incentivising ship owners to retrofit vessels to operate on alternative fuels as an area of focus.

Lastly, and most ambitiously, Jones called for the industry to do more to attract outside investment into green energy production earmarked for the use of the shipping industry.

This was particularly pressing as MAN ES’s analysis had indicated that fuel availability was likely to act as a potential constraint on the adoption of alternative fuels, such as methanol and ammonia, after the end of the current decade.