New propulsor: ABB Dynafin concept

WinGD’s Ott: VCR launch

Retrofit feature: Cautionary note sounded

New Accelleron TC: Circular service model ALSO IN THIS ISSUE: CCS feature | OPS confusion | GTT LH2 design | Topeka boxships

New propulsor: ABB Dynafin concept

WinGD’s Ott: VCR launch

Retrofit feature: Cautionary note sounded

New Accelleron TC: Circular service model ALSO IN THIS ISSUE: CCS feature | OPS confusion | GTT LH2 design | Topeka boxships

Today’s marine propulsion choices are significantly influenced by fuel costs and decarbonization requirements. These factors have driven the development of the MAN 49/60DF. It sets a benchmark in efficiency to keep fuel costs and CO2 emissions low. The built-in flexibility of a dual fuel engine, its low methane emissions and high efficiency ensure multiple paths for long-term emissions compliance. Based on this state-of-the-art engine platform, MAN Energy Solutions plans options ready for future fuels.

www.man-es.com/MAN-49-60

9

Accelleron is introducing a new generation of turbochargers for two-stroke engines, the X300-L series. The new series boasts industryleading power density and efficiency levels.

10 Port fuel injection

MAN Energy Solutions will upgrade a 48/60 engine to a 51/60 using a low-pressure injection strategy as its first retrofit of a 4-stroke diesel to dual-fuel MeOH.

17 Ammonia

Researchers at Fraunhofer IMM in Germany are actively developing methanol and ammonia reformer technology suitable for mobile applications, including shipping.

7 Leader Briefing

Daniel Bischofberger, CEO of Accelleron calls for a levy on shipping emissions to support solutions that exist, such as turbochargers, fuel injection and digital solutions.

The ABB Dynafin cycloidal propeller concept allows the unit to utilize a trochoidal blade path, analogous to the movement of a whale tail, writes Wendy Laursen.

42

The entry into service of the first of P&O’s muchvaunted Fusion-class ro-pax vessels heralds a new chapter in the annals of the crossChannel ferry business, writes David Tinsley.

A new ship design concept for the carriage of liquified hydrogen (LH2) will evolve from experience gained with LNG but faces unique technical challenges.

The scaling up of e-fuels production has started, and with it, the technological advances that aim to reduce upstream emissions and bring costs down.

As MEPC80 prepares to look at incorporate CCS technologies into the CII framework, Patrik Wheater asks whether carbon capture projects can overcome technical obstacles without a carbon levy.

While autonomy and automation technologies are advancing apace, can the underlying technology meet the everexpanding expectations of ?

Two newbuild boxships under construction in China for intra-European trade under charter to North Sea Container Line (NCL) will combine Berg Propulsion’s direct-drive solution with methanol fuel.

It has been one of the greatest pleasures of my professional career to cover the cascade of technical developments that have been announced in a few short weeks.

Whether we are talking about WinGD’s successful delivery of a variable compression ratio solution for its X-DF2.0 engines, or ABB’s paradigm-shifting trochoidal propulsor reveal in May, or Accelleron’s introduction of a circular turbocharger concept that will potentially transform turbocharger servicing models, we are in the midst of a period of intense innovation.

While all three of these innovative developments are the subject of features in this month’s issue, I recommend you begin by reading Wendy Laursen’s inspiring Design for Performance feature on the Dynafin propulsor concept, and how its biomimetic whale tail-like blade path may lead to radical changes in vessel design in the near future in affected vessel classes.

Accelleron’s proposed introduction of a circular business model, permitting the replacement of turbocharger cartridges with refurbished units in port, is likely to be have even wider-reaching implications. I have written about the introduction of power-as-aservice type contracts in the maritime sector in the past, but the introduction of a digitally-enabled circular turbocharger model in the 2-stroke sector, and potentially later this year in the 4-stroke sector, is a step towards Accelleron assuring your asset’s availability.

While demand for such as a service may appear limited to cruise vessels, LNG carriers and passenger ferry segments, the rising cost of alternative fuel means such arrangements may be seen in other vessel segments in the future.

Such changes are affecting many business models within the industry: Wartsila 2-Stroke’s Fit4Power engine conversion model is leading class societies to reimagine the essential requirements for a factory acceptance tests, in order to permit FATs to be conducted on engines installed on vessels, as Wendy Laursen explores in a feature in this month’s issue.

Unfortunately, we are also living through a period of regulatory innovation without parallel in the shipping industry.

The 80th meeting of the IMO’s Marine Environment Protection Committee (MEPC) will be held in London at the beginning of July 2023.

Towering above all other issues are the vexed issues of: the 2023 Greenhouse Gas Strategy, and whether the IMO will adopt proposals for full decarbonisation of the world’s maritime sector by 2050; the finalisation of the LCA Guidelines covering the GHG intensity of marine fuels, and the proposed introduction of a well-to-wake approach to allow for a holistic comparison of different fuels; and the selection of mid and long-term measures for further development, potentially including a carbon levy.

By this point, I expect few if any of our readers will not have made up their own minds about the respective pros and cons of different topics under consideration. For myself, I echo Tancredi’s perspective in Il Gattopardo, and note that things must change if we wish things to remain as they are.

After a year of intensive research, coastal ferry and cruise specialist Hurtigruten Norway has revealed early concept plans for an emissionfree ship promising to set a new benchmark in energy efficiency.

Following a rigorous feasibility study conducted by the company with partners in the first phase of the Sea Zero project, the most promising technologies and innovations were pinpointed for future vessels. Those elements will now be tested and developed over a two-year, second phase so as to create the next-generation ship and prepare the ground for a construction contract.

In line with a focus on ‘sustainable’ operations throughout the country’s long, rugged and heavily-indented coastline, Hurtigruten Norway has laid ambitious plans for a new fleet composed of smaller, custom-built ships designed to have no deleterious impact on the environment. The initial representative of the zeroemission, electrically-powered class now being formulated is due to be ready for service in 2030, as a template for the eventual transformation of the entire fleet.

The concept vessel is modelled at 135m length, incorporating 270 cabins for 500 guests, and having a complement of 99. While achieving robust growth in the cruise segment, the company’s traditional role as a key component of the coastal transportation infrastructure has ensured that the new ship type will have a cargo hold and provision for carrying cars.

Combining 60MWh battery solutions with wind-assisted propulsion technology, the vessel is expected to feature numerous innovative and improved solutions, including retractable sails with solar panels, artificial intelligence(AI) manoeuvring, contra-rotating propellers, and retractable thrusters, under-hull air lubrication and proactive hull cleaning.

Hurtigruten’s Norwegian Coastal Express is a scheduled service running the length of the west coast from Bergen to Kirkenes, connecting 34 ports and communities, carrying local passengers and tourists, and also goods. The line will use AI to collect data and ‘learn’ the most efficient docking and undocking procedures in each port, and under adverse weather or otherwise challenging conditions.

The exceptionally high capacity energy storage system, made up of cobalt-free, nickel-minimised batteries, will be charged from the shore, and from the solar arrays embedded in the three retractable, autonomous wing rigs. When fully extended, the sails will reach a height of 50m, and will enhance the aerodynamics of the ship.

With the vessel incorporating dozens of exterior sensors and cameras, and manoeuvring aided by AI, the size of the bridge can be slimmed down and a setup employed akin to that of an airliner cockpit. This arrangement facilitates the forming of a more aerodynamic foreship section.

Seawork celebrates its 25th anniversary in 2024!

The 25th edition of Europe’s largest commercial marine and workboat exhibition, is a proven platform to build business networks.

Seawork delivers an international audience of visitors supported by our trusted partners.

Seawork is the meeting place for the commercial marine and workboat sector.

12,000m2 of undercover halls feature 400 exhibitors with over 70 vessels, floating plant and equipment on the quayside and pontoons.

Speed@Seawork on Monday 10 June in Cowes offers a sector specific event for fast vessels operating at high speed for security interventions and Search & Rescue.

Speed@Seawork Sea Trials & Conference

The European Commercial Marine Awards (ECMAs) and Innovations Showcase.

For more information visit: seawork.com contact: +44 1329 825 335 or email: info@seawork.com

#Seawork

Media partners

The Conference programme, chaired by industry experts, helps visitors to keep up to date with the latest challenges and emerging opportunities.

The Careers & Training Day on Thursday 13 June 2024 delivers a programme focused on careers in the commercial marine industry.

Japan Engine Corporation (J-ENG) has announced that it plans to develop a successor to its lowspeed UEC60LSE design. The development of the UEC60LSH engine will retain the LSH ultrawide rating concept, and is expected to meet very large gas carrier (VLGC) requirements, as well as Capesize bulk carriers, coal carriers and specialist car carriers.

J-ENG has announced plans to co-develop conventionallyfuelled and NH3-fuelled variants of a 60-bore LSH type engine.

J-ENG has also announced that it will concurrently develop a 60-bore ammonia-fuelled engine variant, UEC60LSJA, alongside the conventional fuel oil-fuelled 60LSH version. The UEC60LSJA type is expected to be brought to market after 2026.

Ghent-based mediumspeed engine designer and manufacturer ABC Engines has added another string to its bow through the development of a methanol dual-fuel range. Covering the output band from 955kW up to 3,536kW, the new DZD MeOH series derives from the DZ engine family, and addresses the evolving needs of the Belgian company’s target markets in shipping, power generation and rail traction.

Available in two in-line and two vee-form configurations, each deliverable at four crankshaft speeds, the 256mm-bore design can produce a maximum continuous output of 221kW per cylinder in its 1,000rpm versions.

Depending on operational profile and load, a fuel usage ratio of 70% methanol and 30%

Maersk has awarded MAN

PrimeServ a contract to retrofit the main engines aboard 11 container vessels equipped with MAN B&W 8G95ME-C9.5 prime movers. These will be retrofitted to dual-fuel MAN B&W 8G95ME-LGIM10.5 types capable of operation on fueloil/methanol. The first vessel will be retrofitted in mid-2024. PrimeServ will provide a solutions package comprising engineering, parts, project management, onsite technical assistance at yard, sea-trial assistance and recertification service during the work.

The introduction of a 60-bore variant means that J-ENG would be able to cover the entire layout points for ship designers to include an ammonia engine in very large gas carriers (VLGC), pure car and truck carriers (PCTC), container feeders, Panamax and Newcastlemax bulkers and LR1 and LR2 tankers.

The development of the 60-bore variant is expected to meet an expected increase in demand from the large ammonia carrier segment. J-ENG notes that it expected the international ammonia market to expand towards the end of the current decade and at the beginning of

the next decade as demand for ammonia from the agricultural supply chain and from the thermal power market (where ammonia can be co-fired alongside other feedstocks) expands. This is likely to lead to the introduction of larger capacity ammonia carriers, as well as an overall increase in the number of vessels in the ammonia carrier fleet.

The ammonia engine development will proceed alongside the development of J-ENG’s first 50-bore ammoniafuelled engine size, the UEC50LSJA, which it aims to complete in 2025.

conventional fuel, or biofuel, can be achieved, ensuring stable combustion. The dual-fuel concept means that a seamless switch to diesel oil or biofuel can be made if methanol is not available, and may be effected automatically and even under load without incurring loss of power in the event of a problem with the fuel supply system.

ABC claims that the DZD MeOH type reduces CO2 emissions by up to 70%. By incorporating the proprietary exhaust aftertreatment system(EATS), particle emissions(PM) and nitrogen gases(NOx) are virtually eliminated. The modular EATS equipment comprises a diesel particulate filter(DPF) and

Malaysian ship owner and operator MISC Berhad has signed collaboration agreements with WinGD and DNV. Under the new, strategic collaborations with WinGD, a central feature relates to the training of mariners to safely manage vessels built with new technologies and ammoniacapable engines. The initiatives involve subsidiary AET and maritime education institution Akademi Laut Malaysia (ALM), which is run by a MISC subsidiary, the Malaysian Maritime Academy (MMASB).

selective catalytic reduction (SCR)/oxicat arrangement, so that the strictest emissions standards are achieved. In cases where biodiesel or hydrogenated vegetable oil(HVO) are used in place of conventional fuel, CO2 is cut to an even greater extent.

In the MeOH design, liquid methanol is injected at low pressure(less than 10 bar) into the combustion chamber via port injection, i.e. before the intake valves. The system is less complex than high-pressure fuel injection, incurring lower cost as regards both purchase and maintenance. Through the adoption of double-wall methanol fuel pipes to eliminate leakage, engine installations are IGF Code-compliant. The MeOH

The European Commission has announced a raft of proposals to improve and modernise safety in maritime and reduce pollution. The proposals include measures to prevent any type of illegal discharges into European seas, and include measures to improve enforcement of maritime regulations by strengthening CleanSeaNet, EMSA’s surveillance and information sharing database.

series does not call for lubrication additives in the methanol.

The new range has been released with immediate effect, and ABC states that it has already received orders for the methanolcapable engines from several sources in various applications. Furthermore, the technology provides for retrofit of existing ABC diesel engines to dual-fuel methanol operation. Under an EU-funded project, an ABC twin-engined tug owned by the Port of Antwerp-Bruges is currently being converted to methanol propulsion, as part of the port’s strategy to attain CO2 neutrality and ‘sustainability’.

ExxonMobil has successfully completed a commercial marine biofuel oil bunkering in the port of Singapore. On 1 April 2023 Evergreen Line’s vessel, Ever Ulysses, received ExxonMobil’s marine biofuel oil blend via a ship-to-ship transfer in Singapore waters before heading to the discharge port. The marine biofuel oil is a combination of a conventional 0.50% sulphur fuel with up to 25% waste-based fatty acid methyl esters (FAME).

Ports must be able to check the background of all vessels and show bodies such as OFAC that they have the technology to screen ships for suspected sanctions evasionn The new engine will a fourth in the LSH series, following the 50LSH type, the 42LSH type and the new 33LSH engine

This week will see the latest attempt by a group of world leaders to push industries to accelerate their journey to net zero emissions while finding new ways to finance the energy transition in the process

Beginning in Paris on Thursday, The Summit of the New Global Financing Pact is spearheaded by Emanuel Macron and marks a colossal effort to reach an inter-governmental agreement on issues relating to multilateral development bank reform, the debt crisis, innovative financing, and international taxes.

One such international tax that the Summit will deal with relates to an emissions levy on global shipping. With the UN’s International Maritime Organisation due to meet in two weeks’ time, Macron’s Summit is expected to pressure the IMO to tax the emissions of global shipping to draw additional revenue necessary to fund the transition while decarbonising an industry that represents close to 3% of emissions globally.

Macron is right to want shipping to decarbonise, however such a levy must come with the appropriate recommendations if the industry is to be successful in its aims without significantly increasing the cost of the day-to-day trade of goods that are essential to sustaining the global economy.

To date, the conversation around decarbonising shipping has been dominated by the prospect of switching to alternative fuels, which include ammonia, methane, methanol, and hydrogen. Adopting any of these presents its own unique challenge to overcome. These include adapting existing ships to store fuels in particular conditions, in addition to scaling the production of alternative fuels to an industrial level – it may take decades before we have an industrial output large enough of any alternative fuels to sustain the global shipping industry at its current level. Moreover, ship operators are preparing for a transitional period by ordering ships with dual fuel engines. Accelleron estimates, based on latest figures that by 2025 60% of orders will be dual fuel engines.

Alternative and future fuels will be and should be used once their production infrastructure is at the right scale, however conventional marine fuel oil will continue to be used at some level until this point. In this scenario, the most effective means of reducing emissions comes from drastically improving energy efficiency.

Shipping’s answer to energy efficiency already exists for today: turbochargers. A turbocharger acts as an extension to a conventional marine propulsion engine that forces air through a combustion chamber at a higher pressure and can improve an engine’s performance by up to 300% while reducing fuel consumption by up to 10% and C02 emissions by 20%.

As future fuels replace fuel oil that ships use today are estimated to be 2 to 3 times more expensive than today’s fossil fuels, the role of turbochargers will become even more important. This applies both to the importance of saving costs by improving turbocharger efficiency, but also to the application of more fuel-efficient turbocharging systems such as flexible cut-out.

Turbochargers, such as Accelleron’s low-speed X300-L series are designed with both these long- and short-term needs in mind. In the short-term, the X300 series reduces emissions by providing the highest efficiency levels in the industry and in the mid- to long term it provides the flexibility for component upgrades tailored to needs of future fuels and enhanced turbocharger cut-out options.

Reducing the environmental impact of maritime transport is imperative, however a levy on shipping emissions must be implemented with guidance by offering solutions that exist, such as turbochargers, fuel injection and digital solutions that have the potential to drastically lower emissions in the short-term while improving energy efficiency. Such a levy should empower industry to change, not scare it into an illinformed leap into the unknown.

Turbochargers, such as Accelleron’s low-speed X300-L series are designed with both these long- and short-term needs in mindSource: Accelleron

Winterthur-based two-stroke engine designer WinGD is adding a variable compression ratio option (VCR) to its engine portfolio, Marcel Ott, General Manager, Application Engineering at WinGD, explained to The Motorship

The new VCR solution will be initially offered as an option for 62-bore and 72-bore dual-fuel X-DF engines, although the engine designer anticipates extending the range of the engines covered by the solution, as well as introducing retrofit packages for existing dual-fuel X-DF engines.

The solution was being added as a selectable option for WinGD’s X62DF-2.1 VCR, X62DF-S2.0 VCR, and X72DF-2.1/2.2 VCR engine types.

The first orders for 62-bore engines equipped with the solution have been placed and a bulk carrier and a pure car and truck carrier (PCTC) will be delivered in 2024, Ott explained to The Motorship

The first orders for X-DF 72-bore engines, which are typically installed on board LNG carriers, have not yet been finalised, Ott noted, adding that commercial discussions are underway.

Ott added that the decision to add VCR to the portfolio was made following the conclusion of tests on a full-scale installation on a 6X72DF test engine. Ott paid tribute to the development team, which had worked closely with engineers from Japanese engine licensee MES DU.

“This is a significant achievement, and represents the culmination of a decades-long search. For combustion engineers, the search for VCR has been like the search for the Holy Grail.”

Compression ratio is altered by changing the piston position to adjust combustion chamber volume. The simple mechanical configuration has no impact on engine footprint or installation requirements. VCR can also be adjusted for part load operation, meaning relatively larger savings can be achieved at the low speeds that operators may consider to further reduce their emissions.

While the underlying concept behind the VCR solution has not changed significantly since Motorship covered the technology in an indepth feature in 2020, the intervening period has seen significant research into the solution, in collaboration with Japanese engine licensee MES DU.

“The project has seen cooperation in validation tests, and we have worked together to simplify the design of the solution, and to reduce the manufacturing cost,” Ott noted. As a result, the footprint of the engine is unchanged within the dimensions of the previous engine, and the

solution does not require any changes to auxiliary systems. This ensures that the solution is likely to be highly suitable for retrofit installations, Ott noted.

The solution can be seen as an elegant solution to some of the trade-offs required during the design of an engine for dual-fuel operation. Engine efficiency has been limited by the need to avoid potentially damaging peak pressures.

WinGD is introducing a variable compression ratio selectable option to its portfolio for a number of X-DF engine types.

As dual-fuel engines are optimised for operation in gas mode, the engine efficiency in diesel mode operating on conventional fuels is typically lower. By introducing the ability to dynamically modify compression ratios, VCR will optimise fuel consumption in diesel mode and will also contribute to favourable efficiency in part-load gas

Ott explained that the consumption improvements are significant, with savings seen in gas mode at part and low load operation. By contrast, the improved combustion efficiency in diesel mode means that there will be a reduction in fuel consumption across the load range.

The potential benefits vary according to the operational pattern of the vessel, as well as the proportion of conventional fuel that a dual-fuel engine is using, but WinGD estimated BSGC consumption reductions of 5g/kWh at 50% load and 6g/kWh at 25% load.

“In diesel mode, you gain between 8-12g/kWh,” Ott said. These fuel savings were likely to be make the solution compelling for ship owners, Ott noted, without even taking into account the likely greenhouse gas emission reduction potential of the

“In gas mode, the savings are only 2.4%, but in diesel mode, you gain between 5% and 7%,” Ott said, adding that the highest savings seen were seen in the bulker and container feeder segments.

As well as optimising compression ratios for different fuels, VCR can also benefit engines operating under different ambient conditions and intake air compositions, such as when using exhaust gas recirculation. This makes it a critical advance as shipping adopts the new fuels and technologies that will allow it to reach decarbonisation targets.

n Marcel Ott, General Manager Application Engineering, WinGD

Accelleron is introducing a new generation of turbochargers for two-stroke engines, the X300-L series. The new series boasts industry-leading power density and efficiency levels, while enhanced turbocharger cut-out options will support lowest engine fuel consumption

The next-generation turbocharger boasts a platform-based compact design, making it easy to service and easy to adapt for different requirements that might evolve from an increasing variety of fuels. A new turbocharger design means that the entire rotor subassembly can be exchanged in a single port call, using a new or refurbished cartridge.

The advance in serviceability means that turbocharger overhaul is no longer tied to dry docking schedules. Instead of servicing turbochargers every five years, exchange at port means the full run time between overhauls can be used, resulting in just three scheduled services rather than four across a 25-year vessel lifespan. This is expected to significantly reduces operating costs and provides operators with greater flexibility in their service regimes.

The power density improvements in combination with the unique cartridge concept leads to more flexibility for the X300-L on engine arrangement. Concept studies have shown the feasibility of turbocharging an engine with a twin arrangement where two X300-L type turbochargers are applied per intercooler instead of one large conventional type without fundamentally changing the engine design concept.

By doing so the benefits of port call cartridge exchange can be extended to the largest engines and vessel types. In addition, the turbocharger cut-out options increase leading to tangible fuel savings.

The first X300-L turbochargers are expected to be delivered by the end of 2025, with the first orders being taken in the second half of 2024.

The platform-based and easy-service concept complemented by Accelleron’s Turbo Insights digital technology sets a new benchmark for turbocharging that will offer ship operators the flexibility to respond to uncertainty around the fuels they will use and how they will operate their vessels in the future.

The X300-L series is fully enabled with Accelleron’s Turbo

One of the most intriguing aspects of the new service concept is the possibility of introducing a circular business model for turbocharger cartridges.

The concept envisages monitoring the performance of individual turbocharger cartridges, and permitting their replacement with new or refurbished turbocharger cartridges drawn from assets operated elsewhere within a shipowner’s fleet, or even

Insight, giving operators the ability to identify performance improvement opportunities and identify when service will be needed well in advance and helping Accelleron to judge exposure-based maintenance needs.

The platform-based concept is essential for delivering flexibility to adapt to future changing requirements. The series has been designed with margin for the even higher pressure ratios that new fuels could require. As a result, turbocharger core components for specific fuels can be incorporated more rapidly for newbuild projects as well as for upgrading the existing population.

Christoph Rofka, President of Accelleron’s Medium and Low Speed Product Division said: “The X300 –L series reimagines turbocharging for an era of multiple fuels and increasing cost pressures in shipping. A platform-based design means upgrades can be introduced more easily as technology advances and provides the enhanced serviceability that operators need in order to control operating costs. Ship operators need flexible technology to exceed existing performance and excel on their path to decarbonization. The X300-L series delivers exactly that.”

potentially from cartridges drawn from another owner entirely.

The use of digitally enabled technologies will enable the introduction of advanced service models, as the precise condition of the turbocharger cartridge and the asset’s operational history will be understood.

Such a circular service model would lead to an extension to the operational life of turbocharger components, and would also

n Accelleron’s X300-L represents an upgrade in power density and efficiency, and offers the prospect for optimised turbocharger overhauls

lower emissions from the turbocharger asset overall if measured on a life cycle analysis basis, by reducing the need for cartridges to be recycled.

Leaving aside the practical considerations of building up inventories of turbocharger components, the model will also draw heavily on Accelleron’s plans to develop a core offering of frame sizes incorporating its modular design concept.

MAN Energy Solutions has confirmed that it will upgrade a 48/60 engine to a 51/60 using a low-pressure injection strategy as its first retrofit of a 4-stroke diesel to dual-fuel MeOH

Last year, MAN signed a Memorandum of Understanding (MoU) with Stena Teknik and Proman for a retrofit project, and a similar one with Norwegian Cruise Line. Bernd Siebert, Head of Retrofit & Upgrades at MAN PrimeServ in Germany, has now confirmed that the projects will involve the adoption of their port fuel injection retrofit concept due to its inherent advantages for legacy installations.

After internal benchmarking the different technologies with market requirements and customer demands, these retrofit projects will involve pre-mixed combustion via the installation of a port fuel injection system for MeOH in addition to the existing diesel injection system. This simpler injection system esp. as a retrofit kit for existing engines in contrast to the high-pressure diesel direct injection based on Diesel combustion for new-built engines like the MAN L/V 32/44CR MeOH ready or the MAN 49/60.

Siebert says the system provides economic benefits for owners looking to retrofit their existing engines with the simply to retrofit PFI (port fuel injection) technology. Also, there’s no need to open the ship to remove the engine compared to an exchange with a new engine, so less time is required in drydock. “The larger the bore size and the younger the engine, the more reasonable a retrofit is from a commercial perspective.”

The simpler injection system comes with a reduced MCR map for MeOH – currently operation up to 70% MeOH is possible, but on-going testing is expected to increase it up to 80%, enough for shipowners to remain compliant with existing legislation up to 2045. The amount of diesel in pilot injector will be limited to a maximum of 1-3%. In case the ship owner requires 100% MCR this can still be maintained in Diesel operation. In addition to the engine modifications retrofits will include a MeOH pump skid, and to be compliant with class rules, this will be containerised.

This PFI retrofit option for methanol operation will also be available for the entire 48/60 fleet (A, B and CR release status) . With the MeOH retrofit kit the 48/60 engine will be converted to a 51/60 engine type including an optimized combustion chamber (cylinder head, liner and piston) and a pilot oil system that reduces diesel performance but increases the MeOH map to 80%, making it comparable in performance to other MAN dual-fuel engines.

“With port fuel injection, we only have pressure of between 10 to 20 Bar, so it’s relatively easy to handle from an operating perspective. This leads consequently to lower efforts in piping and auxiliaries. When we talk about high pressure injection, we’re up to 300+ bar operating pressure. This is a challenge when it comes to piping on existing vessels, and that’s why we are

concentrating on port fuel injection for retrofit,” says Siebert.

Converted engines will be technically equivalent to newly built MAN 51/60 units and, as a result, achieve significant savings in fuel consumption, CO2 and pollutant emissions, and increase reliability, says MAN.

AiP for newbuild engine

MAN continues to make progress on its MeOH engine for newbuilds. Most recently, RINA granted an Approval in Principle (AiP) certificate for its MeOH-ready MAN L/V 32/44CR engine. The AiP covers an upgrade concept for the four-stroke engine for conversion to dual-fuel running on methanol to provide greater flexibility to shipowners. “The idea behind this is that the subsequent retrofit is able to be done during operation of the vessel. We can take the engine out of operation for the conversion period – in best case when the engine is on standard maintenance anyway – and install the MeOH components without needing to have a trial period,” says Siebert.

He notes that MeOH has several, physical advantages as a fuel, including a liquid state at ambient temperatures and its accordingly easy handling aboard vessels compared to gaseous fuels. Under combustion, MeOH also emits fewer NOx emissions and no SOx or soot emissions. MeOH is also much less hazardous to marine life compared with conventional marine fuels. The AiP certificate permits the use of outer ship hulls as bunker tanks, thereby increasing fuel-storage capacity on-board.

MAN estimates that for four-stroke, newbuilds amount to approximately 750 per year for engine units larger than 1MW, and the existing fleet is around 30,000 ships. This highlights the importance of implementing decarbonisation action for both the existing and newbuild fleet. “Newbuild engines will always be equipped with high pressure direct injection: this is the long-term future,” says Siebert.

n MAN ES will upgrade a 48/60 engine to a 51/60 using a lowpressure injection strategy as its first retrofit of a 4-stroke diesel to dual-fuel MeOH.

The energy-saving Becker Twisted Fin is suitable both for newbuildings and retrofits. It significantly reduces SOX, NOX and CO2 emissions and saves energy by 3% on average – even more when combined with a Becker Rudder.

Somas exhaust valves have been used for long time to control exhaust flow after combustion for large Diesel and dual fuel engines.

Valves from Somas are reliable with minimal wear on the disc and valve seat, which decrease maintenance.

Optimized for high temperature

Slim body design and low weight

Flow optimized disc

Easy maintenance

Bi-directional

www.becker-marine-systems.com

www.somas.se

In the shipping and shipbuilding industry a reliable valve is required to ensure that media stored in different tanks are not mixed.

Somas triple excentric butterfly valve is an excellent choice for pipelines used for both onand off loading of media. The valve is reliable due to minimal wear on the shaft and seat.

Triple excentric design

Excellent choice for on- and off loading

Reliable valve

Minimal wear

Class societies are actively collaborating with yards and manufacturers to ensure successful and timely engine retrofit projects, but there are challenges

There are practical challenges when it comes to the testing and certification of the exhaust gas emissions of engines after they have been retrofitted, says Dr Fabian Kock, Head of Section at DNV, citing Regulation 13 of MARPOL Annex VI (Nitrogen oxides (NOx)) and the NOx Technical Code 2008. “These regulations do not cover a detailed procedure for how to improve the performance of existing marine diesel engines that are installed onboard a ship and which cannot be tested on test beds retroactively. One could say that the requirements of the NOx Technical code are somehow hindering the development of new technologies when retrofitting already certified engines on board of existing vessels,” he says. “This dilemma has just recently been addressed to IMO MEPC80.”

Additionally, the conditions on board a ship are not optimal for conducting a parent engine emission test according to the procedures and requirements as outlined in chapter 5 of the NOx Technical Code. Kock cites some practical challenges:

n Weather and sea conditions, vessel draught and other conditions prevent the engine from running constantly at 100% power. Each wave, change in rudder angle, etc has repercussions for the torque the engine provides to the propeller.

n A dedicated dynamometer (water break) cannot be installed or connected onboard a ship which leads to compromises in the accuracy of power measurements.

n Weather and sea conditions, vessel draught, vessel hull, propeller and other conditions prevent the engine from running on the ideal (theoretical) propeller curve on board at a test run.

DNV is working closely with engine manufacturers, equipment makers, ship designers and yards to ensure safe ship operation on individual retrofit projects. One recent project is its collaboration with BW LPG, the Isle of Man Ship Registry, Wärtsilä Gas Solutions and MAN Energy Solutions on a fleet of vessels retrofitted for LPG fuel. The last of 12 retrofitted vessels successfully left the repair yard earlier this year, and the conversions are a first for very large gas carriers.

Mark Penfold, LR's Technical Specialist for Power Generation, says that the broad range of potential modifications, and the specific implications for each ship, means that LR will assess all proposals on a case-by-case basis.

"The reality is that conversions are difficult, particularly for cryogenic gaseous fuels. Onboard emissions testing is usually one of the more difficult aspects to verify. The issues (and our requirements) are relatively straightforward for a synthetic fuel (as in synthetic diesel, or a biofuel such as HVO) which may be considered as direct dropin fuels. That is very different to hydrogen or ammonia as alternative fuels.

Our approach is therefore case-by-case and requires compliance with the rules.”

He says that while LR is well practiced in undertaking sea trials as part of the process for issuance of ship and equipment class and statutory certification, there are additional parts of equipment and system testing undertaken at type tests or factory acceptance tests that can be challenging if these have to be undertaken onboard. “In the case of modifications or conversions involving changes to internal combustion engines the statutory NOx implications can also be one of the more challenging aspects and the difficulties with undertaking emissions measurements onboard are well known.”

Julien Boulland, Global market leader for sustainable shipping at Bureau Veritas Marine & Offshore, says one of the critical aspects of engine retrofitting is the certification process. “Due to the limited number of cases, approval will always be, for the moment, on a case-by-case basis, and the process depends on whether the new engine is already type-approved or not.”

In the case where the new engine is already typeapproved, BV follows a two-fold procedure consisting of a review of engineering drawings, sanctioned with a review attestation, and a subsequent onboard survey, leading to the final certification. The survey is based on an approved tests program that is thoroughly discussed and approved by class.

In the past, BV has collaborated with engine manufacturers on significant projects such as the 1,000 TEU Wes Amelie, now named the ElbBlue, which was the first container ship to undergo a dual-fuel LNG conversion in 2017. This retrofit served as a pioneering effort to test the viability of LNG technology in a container ship setting.

n Some of the more challenging aspects of engine conversions include the statutory NOx implications, as well as the undertaking of emissions measurements onboard.

n JulienBoulland, Global market leader for sustainable shipping at Bureau Veritas Marine & Offshore: “Due to the limited number of cases, approval will always be, for the moment, on a case-by-case basis

Another notable project is the conversion of some ships in the Spanish ferry operator Balearia’s fleet to LNG. The conversion works were carried out at Portugal’s West Sea yard where the engines were adapted to dual-fuel LNG propulsion.

Currently, BV is working with a leading engine maker and a large container ship operator on the retrofit of engines in several phases. This ongoing project involves the development and implementation of a two-stroke future fuels conversion solution. The retrofit conversion initially allows for operation with LNG fuel and is designed to be adaptable to ammonia in the future. The first commercial conversion project is expected to be completed in 2025 at the earliest, and it will contribute to making existing fleets ready to meet future emission requirements.

Changing demand

Boulland sees changes ahead for the market. “In terms of retrofitting, we have observed varying levels of interest based on different factors. For example, in the case of LNG, retrofitting with LNG technology has been conducted on a few projects in the past to test the viability of the technology. However, nowadays, ships can be ordered with full dual fuel technology, making costly LNG retrofits less common.”

He says it is important to note that beyond engine retrofits, the scope of retrofitting can extend beyond the engine itself: from total engine replacement or conversion, to complete replacement of machinery spaces, or more extensive modifications of the hull (jumboisation, bulbous bow).

“At BV, we actively collaborate with yards and manufacturers on engine retrofit projects. We have worked with engine manufacturers on various initiatives in the past, and we continue to engage in partnerships for ongoing and upcoming projects,” says Boulland.

“These collaborations with shipyards and manufacturers are essential to ensure the successful execution of retrofit projects, leveraging their expertise and resources to achieve the desired outcomes. Close cooperation between all stakeholders, including owners, classification societies, and flag states, is crucial for the seamless integration of retrofitted components and compliance with applicable regulations.”

New fuel ready

Boulland notes strong interest for fuel-prepared notations for new fuels such as methanol and ammonia. However, he says it is important to distinguish between the concept of retrofit and the notion of fuel-prepared notations. “The fuelprepared notation can be seen as the initial step towards an actual retrofit and certifies that a ship has been designed and constructed to later be converted to use a different fuel. Furthermore, it is important to refer to the specific class rules to determine the applicability and degree of preparation required for each ship system.”

For BV’s Boulland, the most significant factor influencing the decision to carry out retrofit operations remains the cost of conversion, as ship operators need to evaluate the economic feasibility. Some projects may involve subsidies or other forms of support to encourage and facilitate conversion projects.

Retrofits at scale

MAN Energy Solutions and DNV summarised the technical issues for engine retrofits in a recent white paper Potential for dual-fuel conversions of marine engines that current technical IMO regulations present a challenge for fast implementation of retrofitting to dual-fuel at scale. At issue is that a parent engine test of exactly the same electronically controlled engine type is required for a dual-fuel conversion to be NOX compliant. This is a problem for the pace and cost of decarbonisation.

The paper states: “Imagine relatively new engine technologies such as methanol and ammonia that are not available for all bore sizes. Today shipping needs to wait for a newbuild test before the new technology can be implemented as retrofit. But certain historical engine types are not made for newbuilds anymore. So there are engines in operation running on HFO where shipowners want to retrofit to dual-fuel based on a positive business case, but where a test of a newbuild engine – a parent engine test – is not possible.”

DNV and MAN have supported IMO member states as they raise attention to the issues at IMO level. They have also proposed new procedures for certifying the NOx exhaust emissions of existing engines on board of ships which have undergone a retrofit.

n DNV and MAN have proposed new procedures for the certification of NOx exhaust emissions of existing engines on board ships which have undergone a retrofit.

n Dr Fabian Kock, Head of Section at DNV: "One could say that the requirements of the NOx Technical code are somehow hindering the development of new technologies."

At BV, we actively collaborate with yards and manufacturers on engine retrofit projects. We have worked with engine manufacturers on various initiatives in the past, and we continue to engage in partnerships for ongoing and upcoming projects

The conversion of one of the engines on the ro-pax vessel Stena Germanica inspired the initial growth of the market for methanol powered vessels, and Wärtsilä continues to expand its engine and service offerings

The 240-metre ferry Stena Germanica, with a capacity for 1,500 passengers and 300 cars, was retrofitted with a first-of-its-kind Wärtsilä 4-stroke engine that can run on methanol or traditional marine fuels back in 2015. Since then, given the modularity of modern Wärtsilä engines, many can now be upgraded for methanol use, including the Wärtsilä 32 engine, the Wärtsilä 46F diesel engine and Wärtsilä ZA40S 4-stroke engine.

Earlier this year, Wärtsilä announced that it will supply methanol-ready engines for Celebrity Cruises’ new ship, the fifth vessel in the cruise company’s Edge Series. Giulio Tirelli, Director Business Development at Marine Power, Wärtsilä, says: “To enable this advance, we will convert two Wärtsilä 46F engines to allow them to utilise methanol as fuel, marking the first-ever such conversion for this particular engine type. Not only does the conversion project promote lower carbon cruising, adding methanol as a fuel option will ensure that emissions of SOx, NOx and particulate matter will be significantly reduced.”

Wärtsilä will also supply Wärtsilä 25 engines for four new 7,999dwt chemical tankers being built for Swedish fleet owner Erik Thun. The Wärtsilä 25 is the latest future-fuels ready addition to the company’s engine portfolio, and key to the order was the shipowner’s ability to have the option to operate on future fuels.

Wärtsilä announced last year that a new offshore wind installation vessel being built for Dutch contracting company Van Oord at Yantai CIMC Raffles Shipyard in China will be powered by five Wärtsilä 32 engine capable of operating with methanol. This was Wärtsilä’s first order for newbuild methanolfuelled engines. The Wärtsilä 32 is applicable either as a main engine or auxiliary generator on a wide range of vessel types from offshore support vessels to deep-sea merchant ships.

“Our Wärtsilä 32 engine has been designed to operate reliably in a wide range of vessel applications, whether that’s running on methanol and/or fuel oils,” says Tirelli. “This makes it a strong asset for different vessels, such as special vessels, merchants and ferries, to name just a few examples. What’s more, as methanol infrastructure can vary significantly – especially depending on the region – and will constantly evolve, our Wärtsilä 32 engine is a leading candidate due to its fuel flexibility.”

The Wärtsilä 32 methanol engine does not require any technical conversion when starting to run on methanol. “However, it is important that there is a methanol supply system in place along with the adequate safety measures taken in the engine room and tank space. That’s why, last year, we announced that Wärtsilä has developed a dedicated fuel supply system for methanol, MethanolPac.”

MethanolPac includes both the low- and high-pressure parts of the fuel supply system as well as the related control and safety functions. This includes the high-pressure methanol fuel pump unit, low-pressure pump module, fuel valve train, bunkering stations and tank instrumentation.

MethanolPac will gain its first reference alongside the debut installation of the Wärtsilä 32 methanol engine, on the wind turbine installation vessel under construction for Van Oord.

“Methanol fuel injection can also be retrofitted to any of the more than 5,000 conventionally fuelled Wärtsilä 32 engines in operation. MethanolPac means that such retrofits can be dramatically simplified, with one supplier providing both engine and fuel supply system,” says Tirelli.

When considering converting an existing vessel to run on methanol, there are many factors to take into account, Tirelli says. “First and foremost, you would either need a methanol engine conversion or to replace existing engines with methanol-capable engines. What’s more, converting an existing vessel to operate on methanol mainly depends on the space required by the tanks and additional equipment needed such as certain auxiliary, safety, and control systems which would all need to be fitted onboard too.”

Wärtsilä’s methanol conversion service is a holistic solution to convert existing vessels to use methanol as a fuel. The full project can be delivered from feasibility studies to execution planning and implementation. “At Wärtsilä, we support customers with the initial decision-making by providing an overall concept of vessel conversion, as well as a calculation of their emissions levels after conversion and an engineering design for vessel integration.”

n Wärtsilä methanol engines offer a route to maritime decarbonisation.

Accelerating interest in methanol fuel among the shipping community has led to the unveiling of a new engine type in the Japanese low-speed, four stroke mould, writes David Tinsley. The addition of the LA28M model to the line-up of trunk piston machinery produced by Hanshin Diesel is the culmination of many years’ development work and test campaigns involving methanol combustion.

The new design is based on the LA28 diesel, and expresses the company’s view that methanol offers a raft of environmental, practical and logistic benefits at a lower capital cost than that entailed with other alternative fuels such as hydrogen or ammonia.

An early reference for the six-cylinder, LA28M will be as the propulsion engine in the methanol-fuelled coastal tanker newbuild project announced earlier this year by the Mitsui OSK Lines(MOL) Group. The 65.5m vessel ordered from Murakami Hide Shipbuilding for delivery in December 2024 will be jointly owned by MOL Coastal Shipping, Tabuchi Kaiun and Niihama Kaiun.

Employing the same 280mm bore and 590mm stroke of the LA28, the methanol-capable Hanshin engine has a slightly lower nominal power of 1,103kW, compared to the diesel’s 1,323kW, at the 330rpm crankshaft speed.

Compared to conventional use of heavy fuel oil(HFO), operation on methanol brings a considerable reduction(80%) in NOx, virtual elimination of SOx(99%) and particulates(95%), with the further advantage of a 15% abatement in CO2. As an energy transition pathway, machinery designed to ingest methanol as the primary fuel paves the way to use of synthetic methanol produced by hydrogenated CO2. Although easier to handle and store than LNG or hydrogen, and widely available using existing infrastructure, methanol’s calorific value is about half that of marine distillates.

With the new addition to the Hanshin portfolio, marine diesel oil(MDO) or marine gas oil(MGO) will be used for starting, and for operation through the low-load range until the engine speed increases to the higher-load point whereupon methanol will be injected as main fuel, supplemented by MGO or MDO to ensure stable combustion.

In the event of a failure of the methanol fuel supply or its double-wall piping, back-up operation can be secured on MGO or MDO. Provision is made for the methanol piping to be purged with nitrogen gas before maintenance disassembly.

Favoured over the medium-speed four-stroke, and lowspeed two-stroke options, the low-speed, four-stroke engine concept retains a strong following among Japanese and east Asian operators engaged in coastwise and short-sea trade. The moderate crankshaft speed enables direct drive to the propeller, dispensing with the need for a gearbox.

Hanshin and other manufacturers involved in the sector continue to attach particular importance to design simplicity, high reliability and cost affordability, given the financial capacity and competitive considerations of companies within the target market sectors, and these principles have endured in the developmental path that has led to the LA28M. Sixcylinder formats predominate in the low-speed, four-stroke stakes, and such is the methanol engine’s configuration.

The intake and exhaust valves use a hydraulic system, reducing noise around the cylinder cover, preventing

sprinkling of lube oil, and obviating the requirement for tappet clearance adjustments. Camshaft drive is retained for methanol fuel and pilot fuel injection and valves, with the cam profile tailored to methanol usage. The crankcase is integrated with the cylinder frame, cam case, and cooling water main inlet pipe, thereby enhancing engine rigidity, reducing the component count and simplifying the overall structure.

The LA28M follows last year’s release by Hanshin of a gas monofuel engine, the 300mm-bore G30, using diesel architecture and the low-speed, four-stroke cycle formula.

The development of methanol and ammonia cracking technologies is expanding to offer a more compact alternative to onboard hydrogen storage

Element One, founding company of e1 Marine, recently announced its new M Series M30 methanol to hydrogen generator, a high-density model for multi-MW scale marine applications. First sales are expected in Q1 2024. The M30 is a scaled-up version of the earlier M18 model and has increased hydrogen density relative to its footprint. The Hydrogen One towboat included 10 M18 hydrogen generators, and the next vessel in the line will require six M30s, bringing space savings of nearly 40%.

The M-Series includes a port to provide the operator with the option to efficiently capture CO2. “The M-Series provides superior conditions for carbon capture with an impressive 50% of H2 depleted syngas stream, with the H2 generator future-proofed for carbon capture and a zero-emission profile possible with green methanol. As a result, CO2 emissions after carbon capture will be 20% – 50% reduced in comparison to the previous iteration,” says Robert Schulter, managing director, e1 Marine.

Element One is working with Saudi Aramco to perform testing and a sensitivity analysis of its carbon capture solution to determine the cost relative to the carbon capture rate. This analysis should be complete in Q3 2023. “Typically, we see in this type of analysis that the cost will quickly escalate at some point relative to the carbon capture rate. We anticipate that we will be able to economically capture carbon somewhere in the range of 50% to 80%,” says Schulter.

e1 Marine has also been commissioned to build an S Series 130 methanol to hydrogen generator by Current AG for the development and evaluation of techniques to capture waste heat and CO2 from the exhaust stream created during the reforming process. The S Series S130 Hydrogen Generator is a modular system designed for ease of use on board vessels as part of a quiet, low vibration, low emission power solution for luxury boats or as a range extender supporting batterycentric power solutions on workboats. The technology can integrate with PEM fuel cells.

If the lab-based tests are successful, the additional heat and reduced CO2 emissions will improve the overall economy and environmental footprint of the methanol to hydrogen reforming process. This knowledge will then be incorporated into existing plans to construct commercial vessels with methanol to hydrogen reformers so that hydrogen can be

used to power fuel cells for generating electricity on e-vessels or hybrid vessels.

“Our methanol to hydrogen generators are already providing an accessible, safe and commercially viable low emission power solution for use in ports and on a range of vessels,” says Schulter. “The technology is already proving to be effective to slash total emissions, including the full removal of particulate matter, SOx and NOx. Although our generators already enable vessel owners to meet the incoming carbon reduction regulations, we are delighted that companies like Current AG are working to explore how we can help customers get closer to zero carbon emissions.”

Element 1 is also preparing to announce a new containerised, integrated fuel cell power solution for ports supporting e-vessel charging, cold ironing, and port electrification.

Ammonia and hydrogen mix means less pilot fuel Pherousa Green Technologies (PGT) has developed an ammonia cracker to enable deep-sea shipping to use hydrogen as a fuel. Pherousa Green Shipping (PGS) is preparing to order up to six Ultramax dry bulk carriers, designed by Deltamarin, incorporating the technology. PGT will deliver the plug-and-play ammonia crackers to PGS for installation onboard the newbuildings which are intended to service the worldwide copper industry.

PGT’s ammonia cracking technology allows the ship’s engines to be operated with a minimal amount of pilot fuel, instead using enriched ammonia and hydrogen as fuel. The system also enables the use of pure hydrogen in PEM fuel cells for electric power production. “The only fuel that is truly zero emission is hydrogen, but hydrogen storage is the biggest challenge for deep-sea shipping. Ammonia is the only readily available hydrogen carrier that has no carbon in its molecule, therefore the only truly zero-carbon hydrogen carrier. The ammonia cracking technology developed by PGT is a game changer that could become a major contributor toward the realization of the world´s zero-emission shipping,” says the PGT Group Chairman Hans Bredrup.

n Pherousa Green Technologies (PGT) has developed an ammonia cracker to enable deep-sea shipping to use hydrogen as a fuel

Researchers at Fraunhofer IMM in Germany are actively developing methanol and ammonia reformer technology suitable for mobile applications, including shipping

“The most important power-to-x fuel is currently hydrogen itself,” says Dr Gunther Kolb, Deputy Institute Director and Division Director at Fraunhofer IMM. “However, before hydrogen can be utilised as an energy source on a widespread basis, there are still some considerable hurdles that need to be overcome in terms of its transportation and storage. These include either high space requirements for its storage or other energetically unfavourable conditions.”

As ammonia can be liquefied at a moderate temperature of -33°C, and its volumetric hydrogen content is significantly higher than that of compressed hydrogen at 700 bar, it is a desirable hydrogen carrier.

“In a cracking reactor ammonia can be split into nitrogen and hydrogen when suitable catalysts are applied. A mixture of ammonia, hydrogen and nitrogen, known as spaltgas, is suited for homogeneous combustion and can be used as an energy source,” says Kolb. As part of the Spaltgas project, the researchers and project partners are developing a combustion technology that will use the gas mixture in the brick firing process

The researchers are also developing another cracking reactor based on new catalyst and micro-structure reactor technology. In this process, pure hydrogen is produced from ammonia through cracking and subsequently purified. The hydrogen can then be injected into PEM fuel cells.

“By utilising the off-gas of the pressure swing adsorption (PSA) applied for hydrogen purification as an energy source for the cracking process, we are able to achieve an efficiency of 90% in comparison to 70% which is achieved when conventional technologies are applied,” says Kolb. In the framework of AMMONPAKTOR project, the researchers have also reduced the size of the ammonia-cracking reactor by 90% compared to conventional reactor-technology. They have also lowered the carbon footprint in comparison to electrically heated reactor concepts by only using the exhaust gases from the cracking process to generate the energy required.

The first generation of the technology achieved the secondhighest specific hydrogen production rate ever published, and the current second generation has a throughput of 25 kg/h of ammonia and produces 70 kg of purified hydrogen per day.

Kolb sees maritime applications. Spaltgas, partially cracked ammonia, for example, could be combusted in ship engines. The gas mixture, containing some hydrogen, would aid the combustion of ammonia in the engine, negating the need for pilot fuels such as diesel or biodiesel.

His Fraunhofer IMM team is also participating in the ShipFC project to develop the world’s first ammonia-based fuel cell system for maritime applications. The ammonia required for fuel cells would need to have higher purity levels, and the project partners have demonstrated this along with the ability to reduce NOx from the exhaust gas to levels tenfold below current regulatory requirements.

Methanol reformer advances

Methanol is gaining popularity as a hydrogen carrier in the

shipping industry, and Kolb’s team is also developing a methanol reformer to produce hydrogen at the point of use onboard ships. The endothermic reaction to crack methanol requires heat, steam and catalysts. Existing catalysts are made from copper-zinc-oxide powder that is added to the reactor as extruded pellets. In mobile applications, movement leads to catalyst attrition and the reaction rate is low owing to relatively low reaction temperatures.

As well as optimising the catalysts, Kolb’s team has reduced the size of the reformer itself to about one sixth of other reactors. The are also opting for catalyst coatings containing precious metals similar to those used in automotive catalytic converters, because there is no attrition with these coatings, says Kolb. The catalysts are highly active and do not produce unwanted byproducts such as CO at partial load.

The research team has also optimised the heat management by developing plate heat exchangers coated with a catalysts and combined into stacks of up to 200 plates. When the exhaust gas flows over the plates, it comes into contact with the catalyst and is also heated highly efficiently in the small channels.

“By utilising the waste heat, we achieve excellent heat integration and high system efficiency,” says Kolb. At present, the researchers have a 35kW prototype running, and a 100kW prototype for maritime applications will be running by the end of this year. Kolb is now aiming for a 200kW system – to suit the fuel supply required for the 200kW maritime fuel cell modules currently on the market.

Australia is pushing ahead with its plans to be a leading green hydrogen producer with a new A$2 billion funding program

There’s some concern that the clean energy funding provided in the US’s Inflation Reduction Act will pull project and technology developers from around the world. Australia has ambitious plans to become a leading green hydrogen producer and exporter, and perhaps in part to counter a “brain drain” to overseas projects, the nation has allocated A$2 billion in its latest federal budget to subsidise projects that will reduce the cost of producing green hydrogen at home.

The program will help bridge the commercial gap for early projects and put Australia on course for up to a gigawatt of electrolyser capacity by 2030 by funding two or three flagship projects that can be scaled up to meet that goal. Expressions of interest will be accepted in 2024, and contracts will be awarded and provided with ongoing payments over a 10-year period from 2026-27.

Australian Renewable Energy Agency (ARENA) CEO Darren Miller said: “Australia has an unparalleled opportunity to become a global green hydrogen leader, but we can’t afford to lose our momentum as other competing countries step up their ambitions and support. With this funding, we are looking to incentivise green hydrogen production in Australia by backing early projects that will be among the largest in the world.”

Industry has been positive about the program. Fortescue, which has a pipeline of hydrogen projects both in Australia and overseas, said it demonstrates how seriously the government is taking the green hydrogen industry and its critical role in Australia’s future. Australia has the highest solar radiation per square metre of any continent in the world.

Enough sunlight falls on a 50 square kilometre area to satisfy our entire nation’s electricity needs, says Mark Hutchinson, CEO Fortescue Future Industries. “According to a 2022 study, Australia would need to allocate just 2% of its land mass to solar and wind to replace all of the energy it currently exports via LNG and thermal coal with green electrons and green molecules.”

bp also has a project pipeline. Lucy Nation, bp’s vice

president, hydrogen - Australia and Asia Pacific said, “The Albanese Government has provided a much-needed response that gives industry increased confidence to invest. This program of competitive production contracts assists producers by helping to de-risk significant investments in an important new industry as well as attract global capital to Australia.”

bp is progressing three world-scale hydrogen projects in Western Australia with H2 Kwinana in the Kwinana Industrial Precinct, Project GERI (Geraldton Export-Scale Renewable Investment), and the Australian Renewable Energy Hub in the Pilbara, a joint venture with Macquarie, CWP Global and Intercontinental Energy.

The Australian Government has already announced up to A$70 million in funding for the green hydrogen hub at Kwinana which brings together a unique combination of existing infrastructure, concentrated industrial demand, and strong connections to one of Australia’s largest industrial hubs. The hub will include installation of an electrolyser of at least 75MW, hydrogen storage, compression and truck loading facilities, and upgrades to bp’s existing on-site hydrogen pipeline. The hydrogen produced will support domestic and export demand including hydrogen supply for bp’s renewable fuels production, ammonia, metals and minerals processing, on-site gas blending and hydrogen for heavy duty transport.

The Australian Renewable Energy Hub project offers a major decarbonisation opportunity for the Pilbara, an industrial region identified for having significant potential for emissions reductions through the greening of iron ore mining and processing, green steel production, diesel fuel displacement and potential use and bunkering of green shipping fuels at Port Hedland. At full scale, the project is expected to be capable of producing around 1.6 million tonnes of green hydrogen, or 9 million tonnes of green ammonia, per annum and abate around 17 million tonnes of carbon in domestic and export markets annually.

bp’s hydrogen projects represent the opportunity to decarbonise today’s industry and set conditions for

tomorrow’s low carbon economy, says Nation. This includes decarbonised energy for processing critical minerals and supplying hydrogen to Australia’s major trade partners as they also decarbonise their economies.

ARENA has also announced $20 million in funding to Stanwell Corporation to support a front-end engineering and design (FEED) study for a large-scale renewable hydrogen project in Gladstone, Queensland. The $117 million project will finalise the development stage of the Central Queensland Hydrogen (CQ-H2) Project, which will initially involve the installation of up to 640MW of electrolysers to produce hydrogen for commercial operations commencing in 2028. The hydrogen production facility will produce gaseous renewable hydrogen that will be purchased by offtakers and converted to renewable ammonia and liquefied hydrogen for export. The facility will initially produce 200 tonnes per day (tpd), with full scale anticipated to be 800 tpd for commercial operations in 2031.

The Australian government is also targeting Australian manufacturing, with Tim Ayres, Assistant Minister for Trade and Manufacturing, saying there’s clear intent to set up a process to make sure that, given what’s happening overseas, particularly in the American system where there are big production subsidies for manufacturing there, that Australian manufacturing maintains its competitive edge. “The Government is sending that clear market signal to the investment community and the scientific community now that Australia should be the destination for renewable energy investment.”

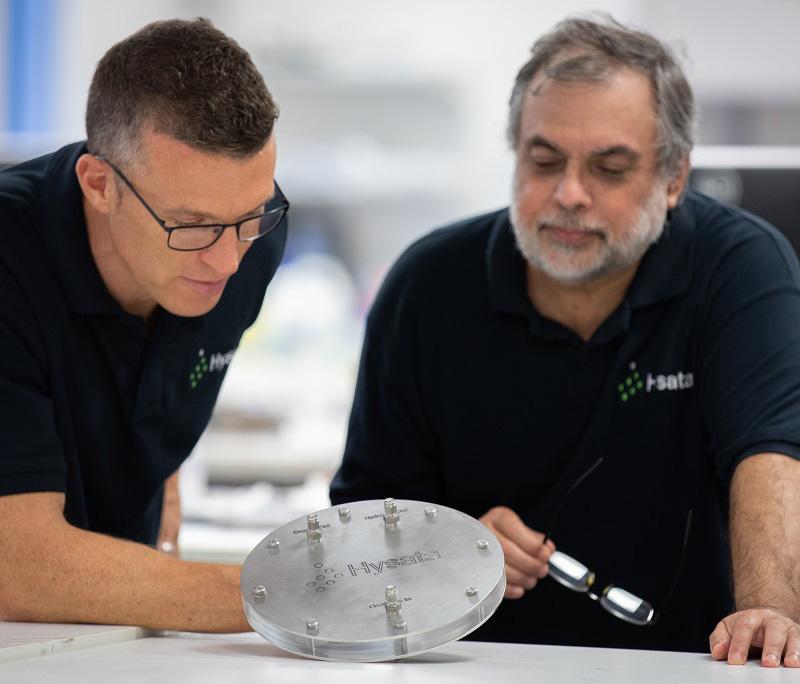

Paul Barrett, CEO of Australian electrolyser technology company Hysata, said the Headstart program funds his company’s customers. “There’s going to be multiple projects around Australia that have now got an economic benefit to get their green hydrogen projects to scale quickly. And as a manufacturer of electrolysers, that are the technology that manufactures the green hydrogen, we’ve now got an opportunity to sell early to these Australian customers rather than shipping our product overseas.”

He says Hysata, a company spun out of the University of Wollongong, can make hydrogen cheaper than anyone else in the world. Research published in scientific journal Nature Communications confirms Hysata’s ‘capillary-fed electrolysis cell’ can produce green hydrogen from water at 98% cell energy efficiency, well above International Renewable Energy Agency’s (IRENA) 2050 target and significantly better than existing electrolyser technologies, enabling a hydrogen production cost well below A$2/kg (US$1.50/kg). The technology involves water supplied to hydrogen- and oxygen-evolving electrodes via capillary-induced transport along a porous inter-electrode separator, leading to inherently bubble-free operation at the electrodes.

Professor Kondo Francois Aguey-Zinsou of the University of Sydney says one of the main goals right now is to take hydrogen production and storage to industrial scale. His

research includes solid-state hydrogen storage: rather than compressing and liquifying hydrogen, this involves holding hydrogen atoms within a solid substance.

In the early days that substance was often magnesium, but Aguey-Zinsou and his team are investigating combinations of metals, termed intermetallics, to find one that would maximise hydrogen absorption and stability. This offers the possibility of hydrogen being part of a solid-state device that could be easily carried and plugged into fuel cells. An electric bike and barbecue have already been built to successfully demonstrate the principle.

Nanoscale advances

Scientists from the University of NSW have demonstrated a novel technique for creating tiny 3D materials that could eventually make fuel cells cheaper and more sustainable. In the study published in Science Advances, the researchers show it’s possible to sequentially ‘grow’ interconnected hierarchical structures in 3D at the nanoscale which have unique chemical and physical properties to support energy conversion reactions.

The researchers were able to carefully grow hexagonal crystal–structured nickel branches on cubic crystal–structured cores to create 3D hierarchical structures with dimensions of around 10-20 nanometres. The resulting interconnected 3D nanostructure has a high surface area, high conductivity due to the direct connection of a metallic core and branches, and has surfaces that can be chemically modified.

In conventional catalysts, which are often spherical, most atoms are stuck in the middle of the sphere. There are very few atoms on the surface, meaning most of the material is wasted as it can’t take part in the reaction environment. These new 3D nanostructures are engineered to expose more atoms to the reaction environment, which can facilitate more efficient and effective catalysis for energy conversion.

“If this is used in a fuel cell or battery, having a higher surface area for the catalyst means the reaction will be more efficient when converting hydrogen into electricity,” says Professor Richard Tilley. This means that less of the material needs to be used for the reaction so costs will be reduced, making energy production more sustainable and ultimately shifting dependence further away from fossil fuels.

Australia has an unparalleled opportunity to become a global green hydrogen leader, but we can’t afford to lose our momentum as other competing countries step up their ambitions and supportSource: Hysatas

Australia-based Provaris aims to offer its compressed hydrogen supply chain solution as an alternative to ammonia as a hydrogen carrier in upcoming European projects

n The engineering and approvals process for the H2Neo hydrogen carriers is continuing, with the H2Leo set to become available in 2025.

The company aims to have its solutions ready for when both Europe and Australasia have matured production projects in a few years’ time.

Martin Carolan, Provaris Managing Director and CEO, says recent announcements relating to ports and pipelines in Europe indicate they are getting ready for hydrogen delivery from 2027. This fits with his timeframe for offering a competitive alternative. Already partnered with Norwegian Hydrogen, he is in talks with companies in the UK, Germany and southern Europe. The company is ideally targeting supply that is less than 1,000 nautical miles to port, and up to 2,000 nautical miles, where Carolan says Provaris’s compressed hydrogen transport solution is “super competitive.”

Provaris and Norwegian Hydrogen entered a collaboration in January to accelerate the development of a hydrogen value chain covering large scale production and export of hydrogen from the Nordics to key ports of Europe. A preferred site in Norway has been identified for a production facility. The project aims to deliver 50,000 tonnes of green hydrogen a year commencing in 2027, with a competitive transport cost for compression, loading, shipping and discharge of EUR 1.00-1.50/kg, based on the use of Provaris’s recently launched floating storage (H2Leo) and two of its H2Neo compressed hydrogen carriers. The partners are now developing a blueprint for multiple bulk-scale compressed hydrogen export sites in Europe.

Germany and the Netherlands are already considered key import locations for bulk-scale hydrogen and are well advanced in the planning and development of the HyPerLink project which aims to develop an open access, cross-border hydrogen backbone in northern Germany. This will include connection between sites for the large-scale import of hydrogen and final consumers in industrial and urban centres in Northern Germany. A grid system established from repurposing of existing gas storage and pipelines will allow for integration with Provaris’ compressed hydrogen solution at the ports in Netherlands and Germany. The project is expecting to deliver a large scale hydrogen network (up to 7.2GW) with a total length of approximately 610km.

Hydrogen storage capacity will be built in. Provaris launched its gaseous hydrogen floating storage solution, H2Leo, earlier this year after earlier launching the design of a compressed hydrogen carrier, H2Neo. The storage concept has a design capacity range of 300 to 600 tonnes of hydrogen, expandable to up to 2,000 tonnes. “We have undertaken research in 2022 with the support of a consultant looking for storage solutions up to 500 tonnes,” says Carolan. “When looking at the alternatives of purchasing containerised solutions that use carbon fibre high pressure tanks or customer build c-type carbon steel, the capital costs for such scale resulted in a range of US$1-2 million per tonne of hydrogen storage. With our proprietary tanks integrated with a barge hull design, the cost per tonnes, based on 300-600 tonnes of storage capacity, is estimated to be US$200,000 to US$300,000 per tonne.”

Storage adds flexibility and redundancy to the loading and discharge of hydrogen cargos to cater for variability in hydrogen supply based on renewable power generation. “It will also optimise the round trip scheduling and in some instances remove the need for a carrier. This reduces overall capex which flows on to lowering overall delivered costs.

“Additionally, we know that all giga-watt scale supply chains for ammonia that are based on renewable generation and hydrogen supply will require hydrogen storage and power storage (batteries). The amount of storage will vary based on the load factor of the renewable supply, but this can be in the range of 200-600 tonnes.”

We have undertaken research in 2022 with the support of a consultant looking for storage solutions up to 500 tonnes

‘‘Source: Provaris

A further potential use for the barge would be maritime bunkering operations. “We have held discussions in Norway and other areas where bunker storage applications for small ships and ferries are planned to run on compressed hydrogen and fuel cells. The logistics will need fixed land-based storage or an alternative would be a floating barge near to the shore where you can have the advantage of central location, without the complication of exclusion zones for hazid.”

Carolan also sees potential for barge storage along the river systems in Europe to be located near industries such as cement or chemical or steel.

The H2Leo floating storage barge is designed to have two cargo tanks with independent isolation, safety valves, and manifolds for compressed hydrogen transfer. The company targets a US$0.2 - 0.3 million/tonne capital cost for the H2Leo, making it significantly cheaper than onshore solutions.