8 minute read

What Lies Ahead for the Med?

The Mediterranean transshipment market has been one of the positives for container trade for many years. However, the market is changing and being accelerated by the COVID-19 crisis

Container demand in the Mediterranean has been badly hit by the COVID-19 crisis with volumes slipping in virtually all the major gateway ports. Until economic recovery is fi rmly underway the weakness in these markets can only continue – the regional transshipment hubs have been impacted, but the position is complex.

There are major trends underway that will reshape this important market, with far-reaching investment implications.

WHAT IS HAPPENING?

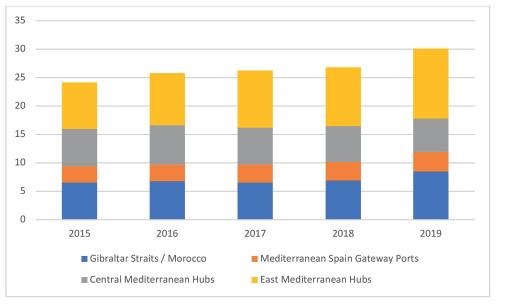

Figure 1 summarises the development of transshipment demand in the Mediterranean since 2015. The market is divided into the western market (focused on Algeciras and Tangiers) the major Spanish gateway ports that handle significant transshipment (Valencia and Barcelona), the central Mediterranean hubs – dominated by Gioia Tauro and Malta – and the eastern Mediterranean (Egyptian ports plus Piraeus).

Demand has grown from 24.1m TEU to 30.1m TEU over the period 2015 -2019. The major trends have been the increase in East Med volumes and market share and steady expansion in the combined volumes of the Gibraltar Straits terminals. The central Mediterranean has been squeezed in terms of volume and market share.

Only partial data is available for the COVID19-impacted first half of 2020 and this is summarised in Table 1 which focuses on those ports where transshipment is the dominant business. It is shown in million TEU. At this stage only total port volumes are available, but the trends are clear:

8 Figure 1: Mediterranean Transshipment Volumes,

Key Regions 2015-2019 in million TEU

5 Overall volumes have fallen by around 6.5 per cent – this is a less severe decline than noted for Med gateway terminals. 5 Smaller terminals have been most severely impacted, with the squeeze on central Mediterranean ports intensifying. 5 Piraeus and Tangiers have seen robust demand, despite the weaker broader position.

So, what’s going on and why?

EAST-WEST POLARISATION

Initial demand growth for transshipment was driven by the central Mediterranean hubs as lines sought to serve Italy, France and Spain by feedering due to limited facilities and poor labour relations in regional ports. Both drivers are no longer present. Direct calls in the largest vessels are the order of the day, with hub ports limited to a local distribution role to secondary ports and the Adriatic. Also, ship sizes have run ahead of these ports, with further investment required to upscale both water depth and handling equipment. The lack of interest in Cagliari’s new concession tender is a symptom of this.

Investment in these ports (for transshipment) needs to be carefully considered. Upgrading existing facilities – for example, TIL’s full takeover of Gioia Tauro from Contship Italia – can make sense with limited required investment. Developing an essentially new offer such as Yilport’s purchase of Taranto must be more problematic in these markets. Development of new facilities in Tunisia (Enfidha) also promises to be difficult to bank.

The western ports offer other possibilities. Their location makes relay transshipment (linking discrete deep-sea services) highly competitive and this has driven demand more than the classic ‘hub-and-spoke’ model. Low cost and efficient terminals will continue to grow demand – even if the macro position remains uncertain. Recent interest has been focused on the sale of crisis-hit Hyundai’s 50 per cent shares in its TTIA terminal in Algeciras, which has now been confirmed by CMA CGM. Longer term investments in Tangiers continue.

The eastern market has been primarily driven by Cosco’s investment in Piraeus which has seen volumes grow by around 54 per cent over 2016-2019. Piraeus’s transshipment hinterland includes the Black Sea, where port development continues to lag behind demand for political and investment reasons.

The Greek port has succeeded in diverting volumes from central Med ports on the basis of low costs, critical mass and

8 Will Yilport

succeed at Taranto where others have failed?

favourable location for Asian containers. Cosco seems committed to further expansion at the port.

These forces have also driven volumes and investment in Egypt – especially the twin ports of Port Said.

These trends will continue with lines deploying larger vessels on direct Mediterranean services, bypassing central Med hubs. The western terminals will continue to grow their relay business and the eastern ports will benefit from strong regional demand and limited investment in Black Sea littoral terminals.

SHIPPING MARKET SPILLOVER…

Developments in the container shipping market will have significant impacts on Med transshipment prospects. Specifically: 5 Oversupply in the largest vessel classes is the dominant issue. Lines are bleeding badly on these investments and demand is simply insufficient to absorb existing and planned capacity. This is being obscured by tonnage management measures based on current crisis conditions. The rationale for these vessels was predicated on high transshipment activity to lift load factors. In reality these vessels are trading light and can actually enter many ports. These rotations are not ideal, but the lines have to do something with the capacity and this will continue. Use of transshipment hubs rather than, say, direct calls in Marseille Fos is much less attractive in reality than on paper given over-capacity. This will exert negative pressures on some locations. The question of vessel size transiting the Mediterranean is also a direct issue insofar as some ports constructed during

Konecranes Gottwald

2016 2017 2018 2019 2020** % change***

Algeciras 4.76 4.38 4.77 5.12 2.55 -5.6 Tangiers 2.96 3.32 3.47 4.80 2.35 1.5 Marsaxlokk 3.06 3.15 3.31 2.71 1.28 -8.5

Gioia Tauro 2.80 2.45 2.33 2.52 1.11 -7.5

Piraeus 3.67 4.14 4.91 5.65 2.80 1.5

Alexandria 1.63 1.61 1.70 1.80 0.75 -6.5

Damietta 0.81 1.31 1.15 1.07 0.68 -12

Port Said 3.04 3.00 3.10 3.82 1.95 -1.5

Total 22.73 23.36 24.74 27.49 13.47 -6.5

8 Table 1: Major

Transhipment Hub

* - selected data ** - estimated 1st half volumes 6 months 2020 / 6 months 2019 Source: Mundy Penfold Ltd

the initial transshipment boom are not ideally formatted for the largest classes of vessels, either in terms of water depth or handling equipment. In a market where margins are wafer

thin decisions to invest further will be highly problematic.

Ports – Total Volumes, 2016- 2020* in Million TEU

5 The Cape Option – i.e. routing via the Cape of Good Hope rather than Suez for Asian trades to northern Europe – could be a major headache. At present, this is driven by the need to absorb capacity by increased haul lengths and by the very limited price differential on low-sulphur fuels. The

Suez Canal Authority has sought to mitigate this by lowering transit fees, but the scope to directly influence deployments,

Our Experience – Your Benefit

and maintain profits for the Canal, is limited.

MRS Grabs

Timber Spreaders

Samson Bulkhandling

Your Partner in Scandinavia Also for used equipment

www.port-trade.com Tel.: +45 7628 0102

If a significant proportion of Asia-north Europe services continue to be routed via the Cape, then the scope to combine north and south Europe cargoes by transshipment in the Med will be reduced. It seems likely that some of these ‘short term’ alterations may prove durable. The impact will be focused on terminals within the

Mediterranean, especially in the central region, with Port

Said also seeing some negative fallout. Conversely, the impact could be positive for the Gibraltar Straits terminals give their relay emphasis and minimum diversions. Although not actually in the Mediterranean but serving overlapping markets, this could also boost prospects at

Lisbon and in the Canaries.

It seems certain that the overall outlook for Mediterranean transshipment will be modified by the combined impact of these trades.

IMPACT ON PORT INVESTMENT

It is clear that past assumptions about demand growth will need very careful examination. The idea that you could simply build new capacity and transshipment would fill up the terminal is long-dead. The major demand trends will continue to focus the need for capacity on the far west and eastern parts of the market for the reasons here defined. Margins are extremely thin for container transshipment everywhere and the over-capacity in parts of the Mediterranean market focus these concerns.

There are a number of on-going or planned expansion projects, as shown in Table 2, where transshipment is a factor.

It is important to note that the most successful transhipment

Port Development Project Summary Details

Beirut Rebuilding & reconstruction From explosion

Piraeus Ongoing investment US$600 million from Cosco on expansion Valencia Northern Terminal New terminal, ultimately 5 million TEU p.a. Livorno Europa Platform New terminal, 1.6 – 2.0 million TEU p.a. Savona Vado Ligure (APM Terminals) New terminal, 1.1 million TEU per annum & additional multipurpose facility La Spezia LSCT (Contship Italia) Expand capacity to 2 million TEU p.a. Taranto Taranto Container Terminal Acquired by Yilport, re-commissioning and investment works

Gioia Tauro Medcenter Container Terminal MSC acquired remaining 50 per cent not owned

Source: Port Strategy

terminals in the Mediterranean region are those with lineequity ownership. Strategic decisions by lines focus demand on their own facilities as has been illustrated by Cosco in Piraeus and Maersk Line in both the east and west of the region.

Line involvement will remain critical, although the financial strength of most lines will be sorely tested regarding port investment.

The jury is still out on the role of lines in the port sector at the global level. This is nowhere more significant than in the Mediterranean markets.

8 Table 2: Selected

Port and Terminal Investment Projects at Mediterranean Hub Ports

Cargo / Passenger and Recreation / Military Facilities

Core Services

Advisory Services Port Planning and Analysis Environmental Services Engineering Services Coastal Engineering Program Management Construction Services Asset Management wsp.com/maritime

Simon Harries Tel: +44 777 322 8338 simon.harries@wsp.com