3 minute read

From Import Dependence to Solar Power Dominance: A Look at the Future of U.S. Solar Production

by Jessica Baron

U.S. solar panel production has grown rapidly in recent years, with significant expansion expected in the near future. This is partly due to the $1.2 trillion U.S. Bipartisan Infrastructure Law (BIL) which has earmarked funds for raw materials mining, factory production, and utility-level adoption, as well as tax credits to encourage consumer adoption of photovoltaic (PV) solar systems.

However, the U.S. still faces challenges before it can become a dominant player in the solar energy market.

Trends in U.S. Consumer Adoption of Solar Panels

Solar panel adoption is growing steadily in the U.S. for small and residential installations, and there is currently enough solar equipment to power 25 million American homes.

Increasing U.S. consumer adoption of solar panels has been driven by the availability of government incentives and a growing awareness of solar’s environmental benefits. Although the price of residential photovoltaics (PV) and their installation has significantly decreased for residential consumers, uptake is still the highest among high-income Americans with high-value homes. However, the incomes of solar adopters have been slowly moving toward the median in recent years.

Between 2020 and 2021, small-scale solar capacity for residential homes rose 35% from 2.9 to 3.9 gigawatts (GWdc). But 2022 set a record of 40% growth for residential homes, which added 6 GWdc of solar installations.

Yet, while the U.S. installed 20.2 GWdc of solar PV capacity in 2022 for a total of 142.3 GWdc and solar made up 50% of the new domestic electricity-generating capacity, that was actually a growth reduction of 16% compared to 2021. At the root of the problem were supply chain issues, which led to a 31% reduction in solar adoption at the utility level.

The History and Future of U.S. Solar Panel Production

In 1978, U.S. companies produced 95% of the global market share of solar panels. By 1984, that number was 55%; by 1990, it was 32%; by 2005, it was a mere 9%. The reasons behind the decline are complex but are partly due to the growth of Japanese consumer electronic companies and their investment in solar cell production to complement new semiconductor investments. This foresight made them dominant in solar panel production at the turn of the century, even though much of the production has since shifted to China and Taiwan.

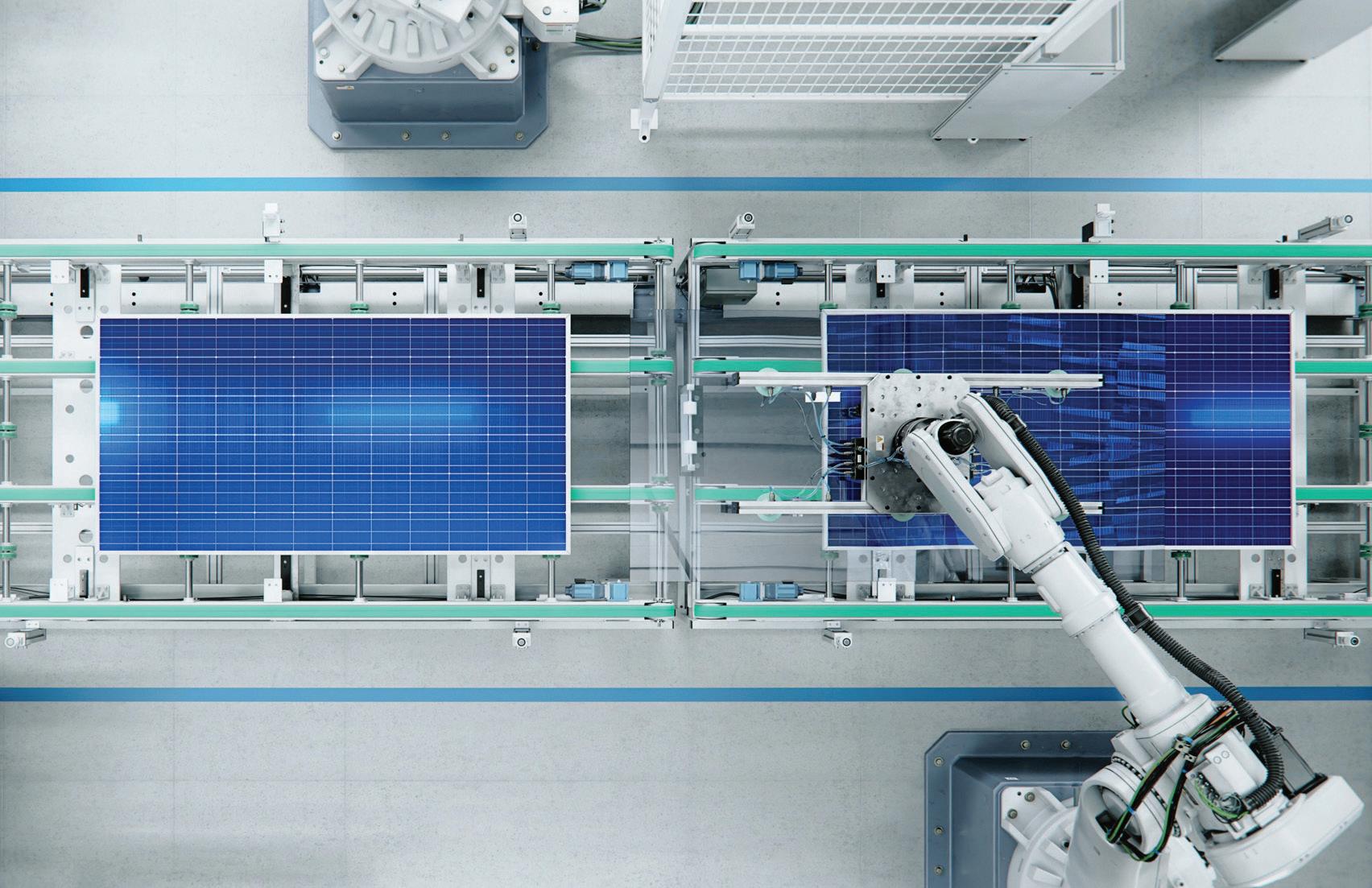

According to the Solar Energy Industries Association (SEIA), dozens of companies have made announcements about opening factories addressing all parts of the supply chain in the U.S., which could add 47 gigawatts (GW) of module manufacturing capacity, and well over 100 gigawatt-hours of battery manufacturing. But for the U.S. to develop capacity in all parts of the supply chain—silicon ingots, wafers, solar cells, and solar panels—it must first grapple with China’s dominance in polysilicon production, a critical component of solar panels.

Boosting U.S. Solar Production Along the Supply Chain

The U.S. currently has eight active polysilicon or silicon metal facilities, with the largest in Michigan and West Virginia. However, the Department of Energy reports no active domestic polysilicon ingot manufacturing. Furthermore, just one U.S. facility (run by CubicPV in Massachusetts) refines ingots into polysilicon wafers. There is zero domestic solar cell manufacturing capacity. However, there are sixteen domestic polysilicon module manufacturers, and promise to add more from companies, including Qcells, Enel North America and 3Sun USA, Mission Solar, and Philadelphia Solar.

Crucial parts of the supply chain remain overseas, but this is set to change. In January 2023, Hanwha Qcells pledged $2.5 billion to manufacture solar ingots, wafers, cells, and finished modules in Cartersville and Dalton, Georgia. The South Korean solar manufacturer Hanwha Solutions plans to build a massive solar manufacturing facility in the United States to produce ingots, wafers, and solar panels by 2025.

Last year, SPI Energy signed a letter of intent to set up wafer production in the U.S., and Convalt Energy pledged to produce ingots, wafers, and cells in upstate New York by 2024. First Solar has not only invested over $1 billion in expanding its footprint in Ohio and plans to open new facilities in the Southeast, but they’ve found a workaround for mining and importing silicon by replacing it with thinfilm cadmium telluride (CdTe).

A Bright Future for U.S. Solar Power

In 2021, the U.S. imported 80% of its solar panel modules. But new production facilities have sparked predictions that the U.S. solar fleet will reach 700 GWdc by 2033 and 1,600 GWdc by 2050, in which case solar would account for half of U.S. electricity. Currently, only 3.4% of domestic electricity is generated from solar power.

If all goes well, the supply chain issues that interrupted the growth of U.S. solar energy in 2022 will become a thing of the past.

Author profile: Jessica Baron is a freelance writer covering the fields of science and technology. n