45 minute read

AMERICANS SAY THEY PREFER PRODUCTS MADE IN USA AND WILL PAY MORE FOR THEM

by ROSEMARY COATES

THE RESULTS ARE IN - Americans say they prefer products that are Made in the USA and they are willing to pay up to 20% more for them. The Reshoring Institute recently surveyed nearly 500 Americans across the country and asked if they prefer to buy products that are labeled “Made in USA.” Would they be willing to pay more for these items? Nearly 70% of the respondents said they prefer American-made products. Slightly more than 83% said they would pay up to 20% more for products made domestically.

Our quick survey validated what we have been hearing anecdotally from consumers and manufacturers everywhere. The strong preference for American-made products has been a growing trend over the past several years. Respondents to the survey were both consumers and industrial buyers. Perception of Better Quality We also asked a series of questions about the perceived quality of products Made in the USA. Over 46% of respondents believe that products manufactured in America are better quality than those manufactured in other countries. In our survey, there was no evidence offered that American-made products are better – it was simply a perception.

Reshoring Over Time In the late 1990s and early 2000s companies sought cheaper labor in other countries such as China, Mexico, and Taiwan. Products made in China and sold in the U.S. grew particularly fast after China joined the World Trade Organization (WTO) in 2001, and markets were opened for U.S. manufacturers to sell into China and for Chinese manufacturers to

sell in the U.S. In addition, the low-cost production environment and the rapid industrialization of China made it an attractive destination for American manufacturers seeking low-cost sourcing and manufacturing.

In parallel, American’s voracious appetite for low-cost goods and consumerism accelerated manufacturers seeking low-cost production to move offshore. As China’s manufacturing sophistication and capability expanded, so did offshoring trends in America. During the presidential election of 2012, both Obama and Romney were criticizing China for stealing U.S. jobs, subsidizing their industries, and currency manipulation. This sparked the start of the reshoring movement in America. Today, reshoring has become part of many businesses’ strategic plans.

What the Data Suggests What our data suggests is that there exists a belief that products Made in the USA are better. Our data results were consistent with the data collected from a Consumer Reports survey from a few years ago. Americans consistently prefer “Made in the USA” products over imported products from another country. What does this mean for companies looking to Reshore to the U.S.? U.S. consumers look for, appreciate, and buy products that are made in the USA. In addition, American consumers are willing to pay more for products made here. Manufacturers should take note.

You can find the full results here: https://reshoringinstitute.org/made-in-usa-survey/

About the Author Ms. Coates is the Executive Director of the Reshoring Institute and the President of Blue Silk Consulting, a Global Supply Chain consulting firm. She is a best-selling author of: 42 Rules for Sourcing and Manufacturing in China and Legal Blacksmith - How to Avoid and Defend Supply Chain Disputes Ms. Coates lives in Silicon Valley and has worked with over 80 clients worldwide. She is also an Expert Witness for legal cases involving global supply chain matters. She is passionate about Reshoring.

BREAKING NEWS

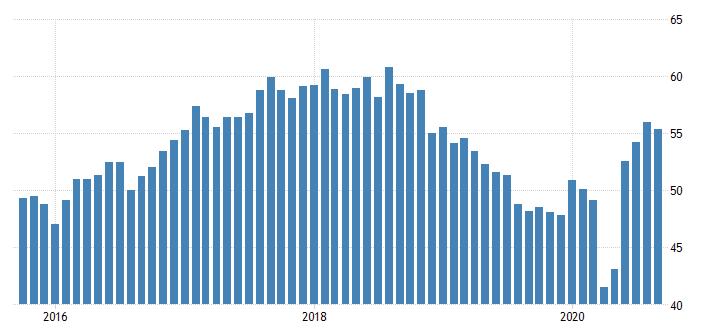

ISM PMI at 55.4% for September ISM PMI for the past 5 years

SEPTEMBER 2020 55.4%

INSTITUTE FOR SUPPLY MANAGEMENT® reportonbusiness

Analysis by Timothy R. Fiore,CPSM, C.P.M.,

Chair of the Institute for Supply Management® Manufacturing Business Survey Committee

Economic activity in the manufacturing sector grew in September, with the overall economy notching a fifth consecutive month of growth, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business® .

The September PMI® registered 55.4 percent. The New Orders Index registered 60.2 percent, a decrease of 7.4 percentage points from the August reading of 67.6 percent. The Production Index registered 61 percent, down 2.3 percentage points compared to the August reading of 63.3 percent. The Backlog of Orders Index registered 55.2 percent, 0.6 percentage point higher compared to the August reading of 54.6 percent. The Employment Index registered 49.6 percent, an increase of 3.2 percentage points from the August reading of 46.4 percent. The Supplier Deliveries Index registered 59 percent, up 0.8 percentage point from the August figure of 58.2 percent.

Of the 18 manufacturing industries, 14 reported growth in September, in the following order: Paper Products; Wood Products; Food, Beverage & Tobacco Products; Furniture & Related Products; Electrical Equipment, Appliances & Components; Nonmetallic Mineral Products; Fabricated Metal Products; Chemical Products; Miscellaneous Manufacturing‡; Plastics & Rubber Products; Machinery; Textile Mills; Computer & Electronic Products; and Transportation Equipment. ISM

PMIPMI® at 55.4% MANUFACTURING

Manufacturing grew in September, as the PMI® registered 55.4 percent, 0.6 percentage point lower than the August reading of 56 percent. The PMI® signaled a continued rebuilding of economic activity in September, with all subindexes either remaining in moderate to strong growth territory or slowing their rate of contraction (Employment and Inven-

2018

50% = Manufacturing Economy Breakeven Line

42.8% = Overall Economy Breakeven Line

2019 2020

55.4%

tories). Five of the big six industry sectors continue to expand. The New Orders and Production indexes continued at strong expansion levels. The Supplier Deliveries Index continues to reflect supplier difficulties in maintaining delivery rates due to factory labor safety issues and transportation challenges. Eight of the 10 subindexes were positive for the period. A reading of ‘too low’ for Customers’ Inventories is considered a positive for future production.

Manufacturing at a Glance

INDEX Sep Index Aug Index % Point Change Direction Rate of Change Trend* (months)

Manufacturing PMI®

New Orders Production Employment 55.4 56.0 -0.6 Growing 60.2 67.6 -7.4 Growing 61.0 63.3 -2.3 Growing 49.6 46.4 +3.2 Contracting Slower 4 Slower 4 Slower 4 Slower 14

Supplier Deliveries 59.0 58.2 +0.8 Slowing Faster 11

Inventories

47.1 44.4 +2.7 Contracting Slower 3 Customers’ Inventories 37.9 38.1 -0.2 Too Low Faster 48

Prices 62.8 59.5 +3.3 Increasing Faster 4

Backlog of Orders New Export Orders Imports 55.2 54.6 +0.6 Growing 54.3 53.3 +1.0 Growing 54.0 55.6 -1.6 Growing Faster 3 Faster 3

Slower 3

Overall Economy Growing Slower 5

Manufacturing Sector Growing Slower 4

*Number of months moving in current direction. Manufacturing ISM® Report On Business® data is seasonally adjusted for the New Orders, Production, Employment and Inventories indexes.

‡Miscellaneous Manufacturing (products such as medical equipment and supplies, jewelry, sporting goods, toys and office supplies).

Commodities Reported

Commodities Up in Price: Aluminum (4); Aluminum Extrusions; Copper (4); Freight (2); High-Density Polyethylene (HDPE) (3); Lumber (3); Natural Gas (2); Polypropylene (3); Polyvinyl Chloride; Precious Metals (3); Propylene (2); Resins; Sanitizers; Steel (2); Steel — Cold Rolled; Steel — Hot Rolled; Steel — Scrap (2); and Steel Products. Commodities Down in Price: Oil. Commodities in Short Supply: Aluminum; Cable Assemblies; Capacitors; Lumber (2); Personal Protective Equipment (PPE); PPE — Gloves (7); PPE — Masks; Polypropylene; Resins; Resistors; and Sanitizers.

12 ISMWORLD.ORG

Note: The number of consecutive months the commodity is listed is indicated after each item.

ISM® Report On Business®

Manufacturing PMI®

September 2020

Analysis by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® Manufacturing Business Survey Committee

New Orders (Manufacturing)

2018 2019

20

2020

60.2%

52.5% = Census Bureau Mfg. Breakeven Line New Orders

ISM’s New Orders Index registered 60.2 percent. Of the 18 manufacturing industries, the 12 that reported growth in new orders in September — in the following order — are: Wood Products; Electrical Equipment, Appliances & Components; Plastics & Rubber Products; Furniture & Related Products; Paper Products; Printing & Related Support Activities; Food, Beverage & Tobacco Products; Fabricated Metal Products; Nonmetallic Mineral Products; Machinery; Chemical Products; and Transportation Equipment.

Production (Manufacturing)

2018 2019

51.7% = Federal Reserve Board Industrial Production Breakeven Line 2020

61%

70

Employment (Manufacturing)

2018 2019 2020

50.8% = B.L.S. Mfg. Employment Breakeven Line 49.6%

20

Supplier Deliveries (Manufacturing)

2018 2019 2020 53.1%

80

59%

Inventories (Manufacturing)

2018 2019 2020

44.3% = B.E.A. Overall Mfg. Inventories Breakeven Line 47.1%

‡Miscellaneous Manufacturing (products such as medical equipment and supplies, jewelry, sporting goods, toys and office supplies).

Production

The Production Index registered 61 percent. The 14 industries reporting growth in production during the month of September — listed in order — are: Wood Products; Electrical Equipment, Appliances & Components; Furniture & Related Products; Paper Products; Machinery; Chemical Products; Fabricated Metal Products; Nonmetallic Mineral Products; Transportation Equipment; Primary Metals; Food, Beverage & Tobacco Products; Computer & Electronic Products; Plastics & Rubber Products; and Miscellaneous Manufacturing‡ .

Employment

ISM’s Employment Index registered 49.6 percent. Of the 18 manufacturing industries, the eight industries to report employment growth in September — in the following order — are: Textile Mills; Furniture & Related Products; Miscellaneous Manufacturing‡; Computer & Electronic Products; Paper Products; Food, Beverage & Tobacco Products; Chemical Products; and Transportation Equipment.

Supplier Deliveries

The delivery performance of suppliers to manufacturing organizations was slower in September, as the Supplier Deliveries Index registered 59 percent. Sixteen of 18 industries reported slower supplier deliveries in September, listed in the following order: Paper Products; Nonmetallic Mineral Products; Textile Mills; Fabricated Metal Products; Printing & Related Support Activities; Food, Beverage & Tobacco Products; Plastics & Rubber Products; Wood Products; Miscellaneous Manufacturing‡; Machinery; Computer & Electronic Products; Chemical Products; Furniture & Related Products; Primary Metals; Electrical Equipment, Appliances & Components; and Transportation Equipment.

Inventories

The Inventories Index registered 47.1 percent. The four industries reporting higher inventories in September are: Apparel, Leather & Allied Products; Food, Beverage & Tobacco Products; Miscellaneous Manufacturing‡; and Paper Products.

ISM® Report On Business®

Manufacturing PMI®

September 2020

Analysis by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® Manufacturing Business Survey Committee

Customer Inventories (Manufacturing)

2018 2019 2020 Customers’ Inventories

ISM’s Customers’ Inventories Index registered 37.9 percent. Of the 18 industries, the two reporting higher customers’ inventories in September are: Apparel, Leather & Allied Products; and Printing & Related Support Activities.

37.9%

Prices (Manufacturing)

2018 2019 2020

62.8%

52.5% = B.L.S. Producer Prices Index for Intermediate Materials Breakeven Line

Backlog of Orders (Manufacturing)

2018 2019 2020

55.2% Prices

The ISM Prices Index registered 62.8 percent. The 15 industries reporting paying increased prices for raw materials in September — listed in order — are: Wood Products; Textile Mills; Furniture & Related Products; Plastics & Rubber Products; Fabricated Metal Products; Machinery; Primary Metals; Electrical Equipment, Appliances & Components; Miscellaneous Manufacturing‡; Printing & Related Support Activities; Computer & Electronic Products; Chemical Products; Transportation Equipment; Paper Products; and Food, Beverage & Tobacco Products.

Backlog of Orders

ISM’s Backlog of Orders Index registered 55.2 percent. The 10 industries reporting growth in order backlogs in September, in the following order, are: Electrical Equipment, Appliances & Components; Wood Products; Plastics & Rubber Products; Fabricated Metal Products; Miscellaneous Manufacturing‡; Chemical Products; Food, Beverage & Tobacco Products; Transportation Equipment; Furniture & Related Products; and Machinery.

New Export Orders (Manufacturing)

2018 2019 2020

54.3%

Imports (Manufacturing)

2018 2019 2020

54 %

‡Miscellaneous Manufacturing (products such as medical equipment and supplies, jewelry, sporting goods, toys and office supplies).

New Export Orders

ISM’s New Export Orders Index registered 54.3 percent. The 10 industries reporting growth in new export orders in September — in the following order — are: Furniture & Related Products; Nonmetallic Mineral Products; Electrical Equipment, Appliances & Components; Paper Products; Food, Beverage & Tobacco Products; Transportation Equipment; Fabricated Metal Products; Miscellaneous Manufacturing‡; Computer & Electronic Products; and Chemical Products.

Imports

ISM’s Imports Index registered 54 percent. The 10 industries reporting growth in imports in September — in the following order — are: Wood Products; Electrical Equipment, Appliances & Components; Paper Products; Transportation Equipment; Nonmetallic Mineral Products; Furniture & Related Products; Machinery; Computer & Electronic Products; Food, Beverage & Tobacco Products; and Chemical Products.

OCTOBER 2020 NORTH AMERICAN

OUTLOOK by AMELIA ROY

The Institute of Supply Management PMI figure eased slightly from August’s 56.0 to 55.4 in September, although this is still very positive, strong territory. Tim Fiore, committee chair for the ISM™ Manufacturing Report on Business® stated, ‘This is a strong report on month-over-month gains, although we are not at pre-Covid levels.’

New orders and production are growing; employment is contracting; supplier deliveries are slowing at a faster rate; backlogs are growing; raw materials inventories are contracting; customer inventories are too low; prices are increasing and exports and imports are growing. Production and new orders were down from August; employment contracted at a lower rate.

Of the 18 manufacturing industries, 14 reported growth in September, in the following order: Paper Products; Wood Products; Food, Beverage & Tobacco Products; Furniture & Related Products; Electrical Equipment, Appliances & Components; Nonmetallic Mineral Products; Fabricated Metal Products; Chemical Products; Miscellaneous Manufacturing; Plastics & Rubber Products; Machinery; Textile Mills; Computer & Electronic Products; and Transportation Equipment.

The four industries reporting contraction in September are: Apparel, Leather & Allied Products; Printing & Related Support Activities; Petroleum & Coal Products; and Primary Metals.

Comments from the industry are mostly positive, but Petroleum and Coal Products are feeling a lack of demand. There is a great demand for wood in China. There are supply-chain problems, and in certain cases problems with employees testing positive for COVID-19.

Commodities Up in Price Aluminum (4); Aluminum Extrusions; Copper (4); Freight (2); High-Density Polyethylene (HDPE) (3); Lumber (3); Natural Gas (2); Polypropylene (3); Polyvinyl Chloride; Precious Metals (3); Propylene (2); Resins; Sanitizers; Steel (2); Steel — Cold Rolled; Steel — Hot Rolled; Steel — Scrap (2); and Steel Products.

Commodities Down in Price Oil

Commodities in Short Supply Aluminum; Cable Assemblies; Capacitors; Lumber (2); Personal Protective Equipment (PPE); PPE — Gloves (7); PPE — Masks; Polypropylene; Resins; Resistors; and Sanitizers.

CANADA saw expansion of new orders at the fastest pace since June 2018, together with a sharper rise in employment. This further brought up production levels and stimulated job creation. Heavy supply-chain pressures continued, contributing to the accumulation of backlogs and incomplete work as firms faced longer delays in raw material deliveries. The PMI for September rose from August’s 55.1 to 56.0.

The increase in employment was solid, but there were attendant signs of struggles to keep up with increasing workloads, and there was a continuing accumulation of incomplete work, together with stock depletion. Business sentiment in Canada remains positive. Canadian light vehicle sales for September were up 2.4 percent year-over-year to 169,876 units.

MEXICO’s PMI was up for the fifth consecutive month, but manufacturing is still in contraction. Business conditions worsen, but at a softer pace. New orders and production fall at rates sharper than any seen pre-virus. The business sentiment regarding future output goes positive in September. The PMI for September was at 42.1, slightly up from August’s 41.3. Mexico’s manufacturing problems are being put down to COVID-19. Amelia Roy, Staff Writer

BRAZIL saw continuing improvement in September with reported nearrecord expansions in new orders and production, together with renewed growth in export sales. There were quicker expansions in employment. Hiring was on the up, as was purchasing, and optimism regarding future production. The PMI rose from 64.7 in August to 64.9 in September.

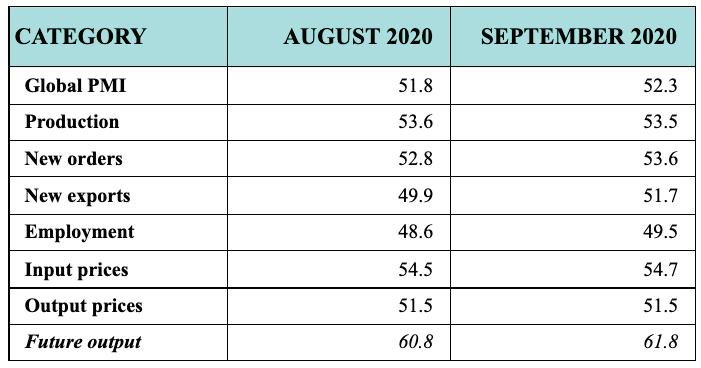

The JP MORGAN GLOBAL MANUFACTURING PMI – a composite index produced by JPMorgan and IHS Markit in association with ISM and IFPSM (International Federation of Purchasing and Supply Management) – rose from 51.8 in August to 52.3 in September - a 25-month high. There were further increases in production and new orders, and new export orders increased for the first time since August 2018.There was an easing in the pace of job losses. There was growth in all three major categories, with a 10-year high in investment goods.

Of the 29 nations for which data were available, 21 registered growth in September. The month also saw the first increases in international goods trade since May 2018. Global supply chains stayed stretched by increases in demand for input stocks

GLOBAL OUTLOOK SOUTH AMERICA

by JEANNE-MARIE LOWRIE

as economies re-opened. Average vendor lead times increased for the 14th consecutive month. Business optimism improved to a 28-month high September, with strong confidence at consumer, intermediate and investment goods producers.

New export business continued its decrease during the past two years, with lower new export orders being registered across much of Asia, with the notable exception of China, which saw a slight increase for the first time in eight months. Input cost inflation increased to a 20-month record, with part of the increase being passed on to Jeanne-Marie Lowrie, clients. Staff Writer

GLOBAL OUTLOOK ASIA OUTLOOK

by CHRIS ANDERSON

CHINA saw a continuing solid manufacturing performance in September. There were marked increases in production and new orders, with new orders up at the strongest rate since January 2011. There was an accompanying solid rebound in export sales, and a stabilization in employment. There was a sustained increase in backlogs of work. There was a further significant increase in input costs, but a lower increase in selling prices. The September PMI, at 53.0, was very slightly down from August’s 53.1. Operating conditions have now strengthened in each of the past five months, and the latest month culminated in the best quarterly performance since Q4 in 2010. There was an increase in general optimism regarding production increases over the next twelve months. Chinese passenger car and commercial vehicle sales rebounded in August by 11.6 percent year-over-year, to 2.186 million units, according to data from the Chinese Association of Automobile Manufacturers. Sales for the first eight months of the year are still down 9.7 percent on 2019, from 16.2 million units to 14.6 million units. JAPAN’s PMI rose to a seven-month high in September, from August’s 47.3 to 47.7, but is still in contraction, and it is a function of slow decreases in new orders and production, rather than increases. Employment stayed relatively stable. There is confidence that production will increase over the next twelve months, with more than double the number of manufacturers seeing an increase than seeing a decrease. INDIA’s manufacturing PMI reached its highest level since January 2012, with production up at the third-fastest rate in survey history, and similar increases in new orders. There was renewed expansion in export sales. The PMI rose from 52.0 in August to 56.8 in September. There was a further reduction in employment, which in many cases was attributed to efforts to maintain social distancing guidelines. The overall degree of optimism was at its highest in over four years.

Chris Anderson, Staff Writer

PRO-ACTION EDUCATION NETWORKTM

APPRENTICESHIP PROGRAM

Apprenticeships offer many NJ workers the opportunity to receive an earn-whileyou-learn education. Relevant professional credentials support job performance and open the door to sustainable income.

Pre-apprenticeship programs create future applicants for full-time, paid apprenticeship positions with NJ employers. Students in a pre-apprenticeship program learn skills needed for the occupation and have the opportunity to potentially bridge to a Registered Apprenticeship Program. Apprenticeship provides an additional option for NJ’s existing and future workforce in all industries. The Pro-Action model can be used for all industries.

CALL TODAY FOR MORE INFORMATION - 973-998-9801 WWW.NJMEP.ORG • INFO@NJMEP.ORG

GLOBAL OUTLOOK EUROZONE

by CHRIS ANDERSON

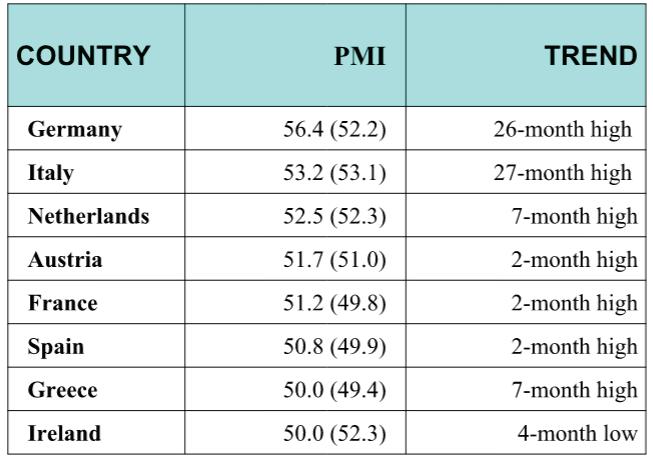

IHS Markit’s Eurozone Manufacturing Composite Purchasing Managers’ Index (PMI), backed by a strong recovery in Germany, rose to 53.7 in September from 51.7 in August, as manufacturing showed its best performance for over two years. There was a sharp increase in both production and new orders, together with a resurgence in exports.

There were improvements in all three sectors: consumer goods, intermediate goods, and investment goods, with investment goods at their strongest for over two years. There was a solid rise in backlogs. There were continuing job losses, but at the slowest rate since February. There were continuing delays in vendor deliveries.

Business confidence regarding future production improved during September, to its highest level since April 2018. Car sales in Western Europe were down 33.1 percent on a YTD basis, with August sales down 15.5 percent year-over-year. (August 2019 was a particularly strong month.) French sales, YTD, were down 32% year-over-year; German down 28.8%; Spanish down 40.6%; Italian down 39.0 % and UK down 39.7 %. Forecasts are putting the reduction in sales for the year at 24 percent. Plug-in electrics in Europe in August were up year-over-year by 171 percent. Tesla model 3 was August’s best selling plug-in. Some 11 percent of cars sold in Europe in August were plugin hybrids or battery electric vehicles.

IHS Markit’s PMI for the UK was at 54.1 in September, down slightly from 55.2 in August. There was continuing improvement, with increases in new orders - both domestic and export. There was good growth in all three sub-sectors, with intermediate the strongest. Large manufacturers showed the fastest growth ; small-sized firms the slowest. New export business was up for the second successive month, with stronger demand from Europe, Asia and North America. There were job losses for the eighth consecutive month, but the rate of loss eased to the lowest since February. Sixty percent of manufacturers are looking for higher production in the coming year, although there are concerns over COVID-19 and Brexit.

Boris Johnson reneged on an international treaty he signed just last year, making a chaotic split between the UK and the EU at the end of this year increasingly likely. Boris Johnson’s reneging on an international treaty recently signed has the potential to poison relations with the EU bloc for a generation. The EU is threatening legal action, and the EU’s chief negotiator says, “The UK has not engaged in a reciprocal way on fundamental EU principles and interests.” The German ambassador took the comments to a higher level, “In over 30 years as a diplomat, I have not experienced such a fast, intentional and profound deterioration of a negotiation. If you believe in the partnership between the UK and the EU like I do, then don’t accept it.” NO DEAL will mean border chaos and increased business costs.

Chris Anderson, Staff Writer

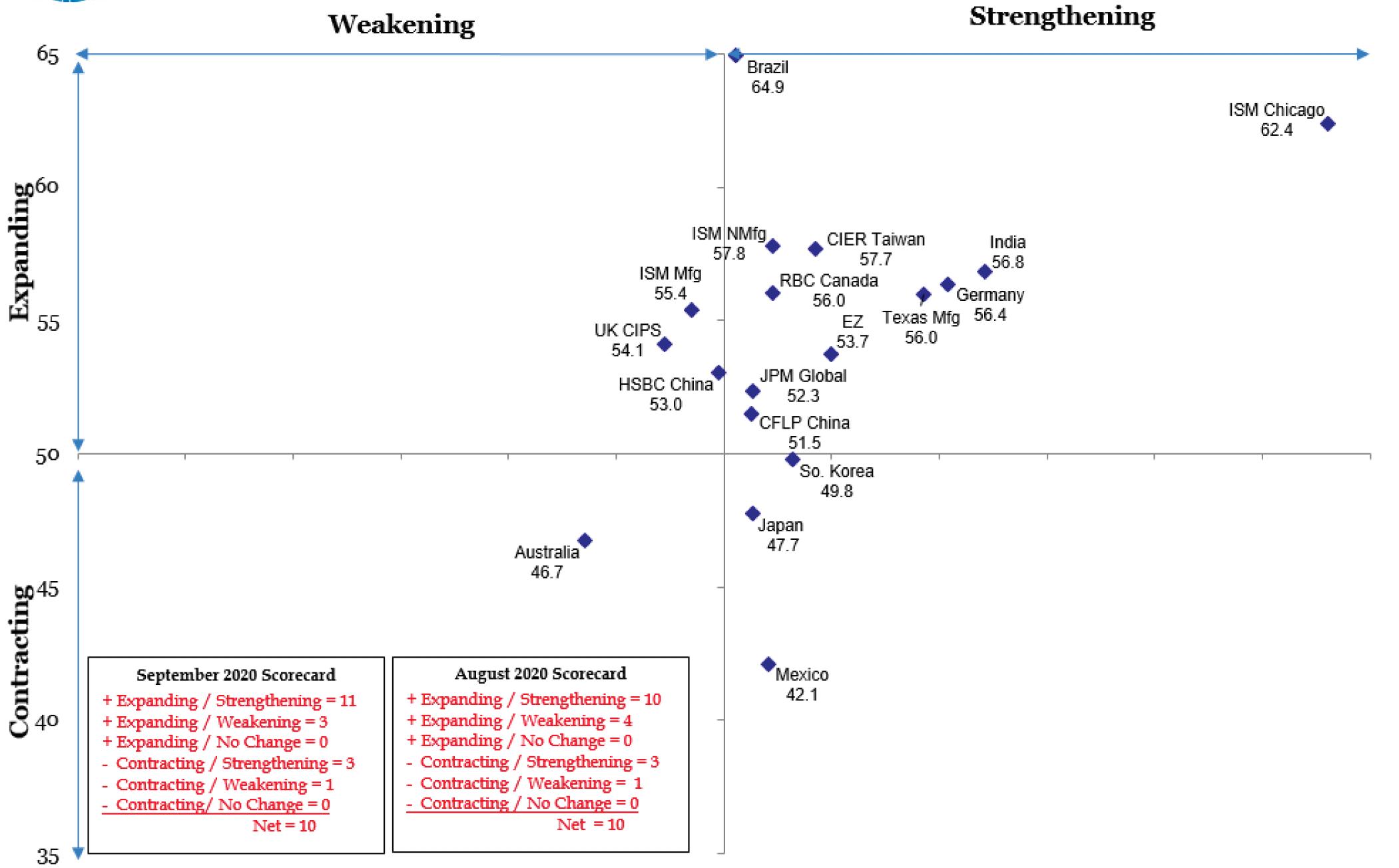

GLOBAL PMI OUTLOOK

by NORBERT ORE, DIRECTOR, HEAD OF INDUSTRIAL SURVEYS, STRATEGAS RESEARCH PARTNERS Four months of growth led by the U.S., Germany, and the U.K. have supported a V shaped recovery. Fourteen of the 18 surveys we follow grew at an average PMI of 56.3 in September, up from 54.2 in August. The remaining four surveys contracted at a 46.6 average in September: Mexico (42.1), Japan (47.7), South Korea (49.8), and Australia (46.7). New orders and production indexes are trending in the right direction and are positioned to support continued expansion. Lagging employment numbers will add significantly to all global indexes when re-openings progress and confidence recovers. The JPM Chase Global Index has trended upward since April with Q3 above the historical average. Overall, economic data for manufacturing and services activity point to a continuing recovery.

Further improvement, as evidenced by the September PMI™ (55.4, -0.6), will drive manufacturing growth through the balance of the year. New Orders (60.2, -7.4) and Production (61.0, -2.3) made major contributions to the rapid acceleration. The past relationship between the PMI®and the overall economy indicates that the PMI®for September (55.4) corresponds to 3.7-percent annualized GDP growth, according to the press release. Drivers: In addition to the improvement in New Orders and Production, the PMI® expansion was aided by slower Supplier Deliveries (59.0, +0.8). Inventories (47.1, +2.7) indicated some liquidations are starting to take place and Employment (49.6, +3.2) moved at a slower rate of contraction.

New Orders Minus Inventories: This key measure at +13.1 (60.2 minus 47.1) shows New Orders continued to expand faster than Inventories in September. Compared to the average gap (+6.8), inventory availability can become an issue and concerns about constraints may become more prominent and a problem to supply chains.

Customers’ Inventories: Only two industries reported higher customers’ inventories in September: Apparel, Leather & Allied Products; and Printing & Related Support Activities. Fifteen industries reported customers’ inventories as too low: Wood Products; Primary Metals; Fabricated Metal Products; Paper Products; Furniture & Related Products; Machinery; Plastics & Rubber Products; Textile Mills; Chemical Products; Transportation Equipment; Food, Beverage & Tobacco Products; Electrical Equipment, Appliances & Components; Nonmetallic Mineral Products; Computer & Electronic Products; and Miscellaneous Manufacturing. We continue to believe a Customers’ Inventories Index at this level (37.9, -0.2) Norbert Ore, Director, indicates inventory replenishment will be broad based and spill over into 2021. Head Of Industrial Surveys, Strategas Research Partners

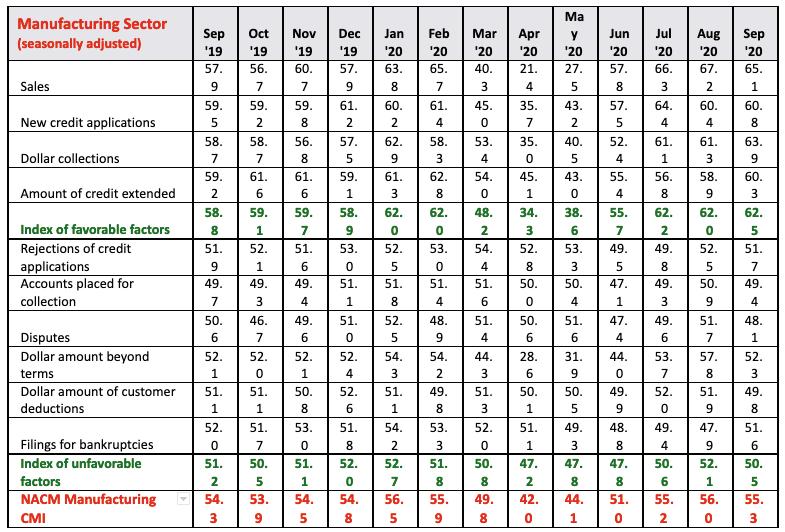

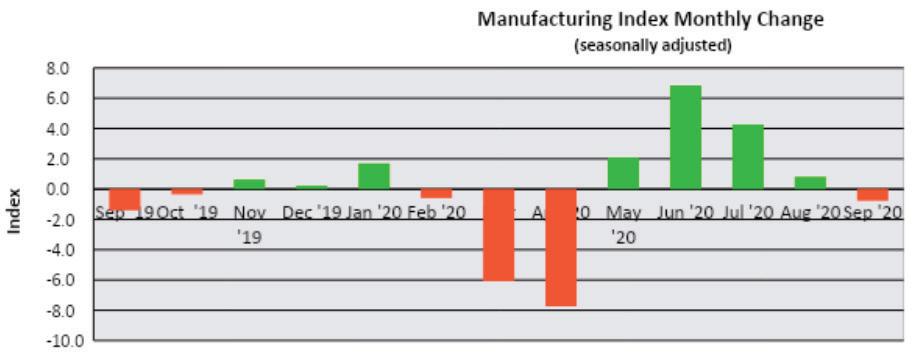

CREDIT MANAGERS’ OUTLOOK

by DR. CHRISTOPHER KUEHL MANAGING DIRECTOR OF ARMADA CORPORATE INTELLIGENCE THIS REPORT REPRINTED COURTESY OF THE NATIONAL ASSOCIATION OF CREDIT MANAGERS (NACM.ORG) WHERE MORE IN-DEPTH INFORMATION CAN BE FOUND.

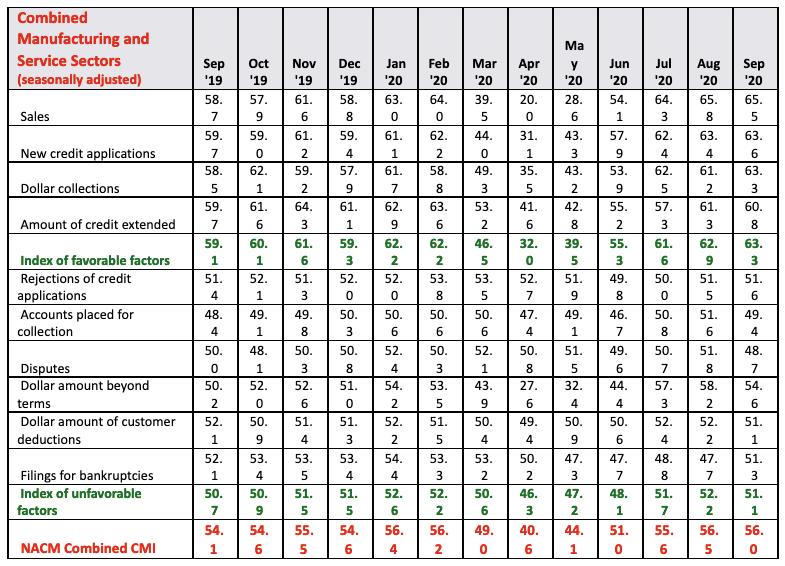

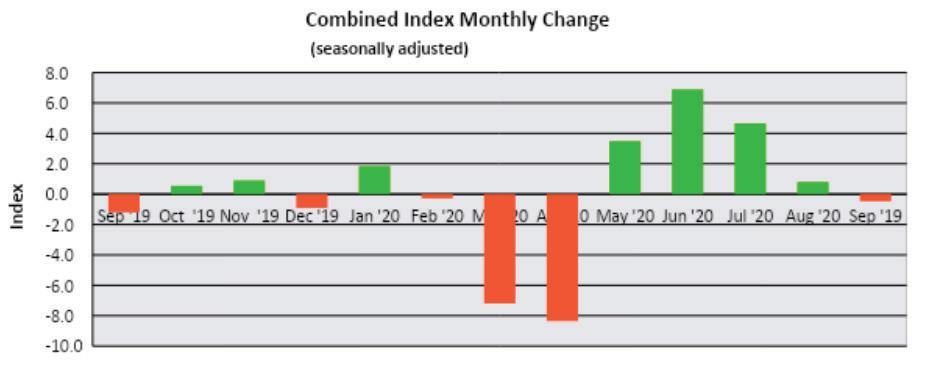

Combined Sectors

This is the point at which data analysts begin pulling their hair out (assuming they still have some). When there is a collapse as complete and dramatic as the one experienced in the second quarter of this year it becomes nearly impossible to make sense of the data that comes in afterwards. What does a rebound of 30 points in the third quarter mean after a dive of 35 points in the second quarter? Does that mean there was an actual decline of maybe 5.0% or is there more to this than that. The truth is that data will be hard to interpret for a while as we wait for some sense of normalcy to return. The data in the CMI is similar as there has been a significant surge in the data but it is coming off some record lows.

Overall, there was a slight decline from where the index stood just a month ago. The combined score stood at 56.5 and is now at 56.0. This is a fairly minor decline and the important point is that the reading is still in the mid-50s. The combined score for the favorable factors improved by quite a bit and that is considered a very positive sign. It had been at 62.9 and now stands at 63.3 – the highest point reached in well over a year. The last time these numbers were even close to that level was in January and February when they stood at 62.2. The rebound in these factors bodes well for the coming months. The combined index for the unfavorable factors slumped a little as it fell from 52.2 to 51.1 and that is the lowest reading since June.

The detail in the favorable and unfavorable sectors point in some interesting directions. There was a dramatic fall in the favorable factors as the crisis emerged but the unfavorables didn’t respond as negatively at first. Now they are becoming the problem and the favorables are carrying the load. It is all a matter of timing. The initial impact of the shutdown was felt in everything from sales to applications but issues like bankruptcies and collections took a little longer to develop. This month the sales numbers remained very high at 65.5 – only a bit down from the 65.8 registered last month. The new credit applications reading improved a little from 63.4 to 63.6 and most importantly there was an improvement in dollar collections as these went from 61.2 to 63.3. To cap off a nice month of gains the amount of credit extended went from 61.3 to 60.8 – a slight decline but still above the 60 line. This makes the second month in a row for all four readings sitting above 60.

The rejections of credit applications stayed stable with a reading of 51.6 compared to last month’s 61.5. Given the large number of new applications this is a very good sign. Often there are increases in applications during stressed economic times but too few qualify. One area of concern is the accounts placed for collection as they moved from 51.6 to 49.4. This suggests there are companies that are reeling from the lockdown and are falling behind. The disputes readings also deteriorated from 51.8 to 48.7 and for the same reason. The dollar amount beyond terms also sagged a bit but remained in solid territory with a reading of 54.6 after sitting at 58.2 the prior month. The dollar amount of customer deductions slipped a bit as well but stayed above the 50 line that separates expansion from contraction. It went from 52.2 to 51.1. The filings for bankruptcies actually improved with a reading of 51.3 as compared to last month at 47.7

Manufacturing Sector

As has been repeated ad nauseum the lockdown recession of 2020 has hit certain parts of the economy far harder than others. The sectors that have been most sensitive are those where interaction is the foundation of the business – everything from hospitality to tourism, restaurants and retail. The manufacturing sector has been far less affected and, in some respects, has been benefiting from the shift in consumption from paying for services to spending on goods.

The combined score for the manufacturing sector fell a little from 56.0 to 55.3 but this is still firmly in the expansion zone. The index of favorable factors improved from a reading of 62.0 to one of 62.5 while the index of unfavorable factors slipped and has gotten a lot closer to contraction territory. The reading last month was 52.1 and this month it is sitting at 50.5. There is some distress showing up in segments of the manufacturing sector that serves aerospace, travel in general as well as some parts of retail.

Then good news is in the favorable sectors as they continue their climb out of the lockdown. The sales numbers are not quite as high as the record setting levels of last month but they remain very respectable at 65.1 (last month they sat at 67.2 and that was nearly unprecedented). The data for new credit applications improved a little but essentially stayed stable with a reading of 60.8 as compared to the 60.4 notched in August. The dollar collections data improved nicely with a reading of 63.9 compared to the 61.3 from last month. The amount of credit extended left the 5os behind with a reading of 60.3 as contrasted with the 58.9 in August. This marks the first time that all these factors have been in the 60s since last January and that suggests that there has been a real recovery as far as current and future business is concerned.

The unfavorable data was not as inspiring but it could certainly have been worse. The rejections of credit applications sank a little from 52.5 in August to 51.7 in September. This takes a little enthusiasm

away from the expanded number of applications as there are more applicants that do not qualify and seem to be desperately seeking someone willing to take on more risk. The accounts placed for collection is worrying as these numbers are now in contraction territory with a reading of 49.4 after getting into expansion territory last month with a 50.9. The disputes category also fell out of expansion as it went from 51.7 to 48.1. There is quite obviously a segment of the manufacturing community that has not been able to shake off the lockdown impact. The dollar amount beyond terms category had made some dramatic progress last month with a reading of 57.8 but that has slowed a bit since as this month’s reading has fallen to 52.3. This is certainly still in expansion territory but not in as comfortable a position as had been the case. The dollar amount of customer deductions slipped out of expansion territory as well with a reading of 49.8 compared to the 51.9 in August. The filings for bankruptcies regained its expansion status with a 51.6 compared to the 47.9 in August. The bankruptcy numbers have been in contraction since May and this reversal is more than welcome.

Overall, the manufacturing data has been trending in a positive direction with gains seen in everything from the Purchasing Managers’ Index to capacity utilization, industrial production and durable goods orders. Granted, there is still a long way to go to offset the damage that was done earlier in the year but the data has been trending in the right direction. Author profile

Dr. Christopher Kuehl (PhD) is a Managing Director of Armada Corporate Intelligence and one of the co-founders of the company in 1999. He has been Armada’s economic analyst and has worked with a wide variety of private clients and professional associations in the last ten years. He is the Chief Economist for the National Association for Credit Management and is on the Board of Advisors for their global division – Finance, Credit and International Business. He prepares NACM’s monthly Credit Managers Index. He is the Economic Analyst for the Fabricators and Manufacturers Association and writes their biweekly publication, Fabrinomics, which details the impact of economic trends on the manufacturer. Chris is the chief editor for the Business Intelligence Briefs, distributed all over the world by business organizations and he is one of the primary writers (with Keith Prather) for the Executive Intelligence Briefs. He also makes close to a hundred presentations each year to business and industry associations in the US and overseas. He is on the Board of the Business Information Industry Association in Hong Kong and serves as a resource for the media and for many trade publications.

Chris has a doctorate in Political Economics and advanced degrees in Soviet Studies and Asian Studies and was a professor of international economics and finance for over 15 years prior to starting Armada.

TO READ THE COMPLETE REPORT CLICK HERE OR VISIT MFGTALKRADIO.COM

OCTOBER 2020 METALS OUTLOOK

A NEW U.S. STEEL PLAYER

There is news from the U.S. steel front this month, news that may change both the present and future outlook of the industry. Cleveland-Cliffs Inc., headquartered in Cleveland, Ohio, an iron ore and steel producer, will acquire ArcelorMittal USA and its subsidiaries for approximately $1.4 billion. This will give Cleveland-Cliffs access to six steelmaking facilities, eight finishing facilities, two iron ore mining and pelletizing operations, and three coal and cokemaking operations. As such, Cleveland-Cliffs, with a potential annual capacity of 17 million tons, will overtake Nucor Corp. as the biggest flat-rolled steel producer in North America.

This acquisition by Cleveland-Cliffs adds to that of AK Steel in March this year. AK Steel - formerly Armco - has long been a major player in the U.S. steel industry, and is renowned for the quality of its flatrolled products, particularly its stainless and alloy products. The company is a major factor in the U.S. automotive industry. by ROYCE LOWE Cleveland-Cliffs’ name will now be put at the forefront of the U.S. steel industry. It will have nowhere to hide. It will have much experience on its side, and it is to be hoped it uses it wisely. It will need to invest heavily in technology if it is to keep up with the likes of Nucor. There’s little doubt that the equipment and technology it has inherited from ArcelorMittal (who inherited it from names of yore in the U.S. steel industry) does not measure up to that at Nucor and Steel Dynamics Inc.

The sale by ArcelorMittal USA does not include Dofasco Inc., in Hamilton, Ontario. Long before its acquisition by ArcelorMittal, the Canadian company was globally recognized as a world leader in the production of quality flat-rolled steel products. We don’t yet know what plans Cleveland-Cliffs has for future expansion, but we’ll certainly be interested to find out.

The timing for acquisitions in the steel business may or may not be good at the moment. Demand is up and prices along with it. Scrap costs are up, there are gaps in stocks, and increasing demand from the auto and construction industries. Recent prices on hotrolled, cold-rolled, and hot-dip galvanized coil are at levels not seen in some months. Since early August, up to early October, for example, U.S. hot-rolled has gone from $440 per ton to just over $600 per ton, cold-rolled from $610 per ton to $770 per ton. Similar price increases were the norm in the Canadian market. In fact, increases are global, as the hot-rolled price in Europe shows, from 410 Euros per ton in early August to 500 Euros per ton in early October. Some facilities in Europe were slow to ramp up following idling due to the pandemic, and a return to full capacity is not expected until early 2021. Demand is coming back, in some cases quicker than anticipated, and there are stock shortages on some products. Imports into the EU are down 20 percent from January to July. There is ongoing uncertainty to go along with the present optimism.

The U.S. has lifted tariffs on Canadian aluminum imports. There will only be imposition if certain import limits are exceeded.

Non-ferrous metal data show aluminum down slightly at $0.805 per lb. in early September to $0.785 in early October; copper effectively unchanged at $3.00 in September, but showing a six-month gain from $2.20 to $3.00; Nickel down in September from $7.10 to 6.50, but showing a six-month gain from $6.00 to $6.50. Zinc was down slightly in September, from $1.15 to 1.09, but showed a six-month gain from) $0.85 to $1.09.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook.

200” Max O.D. 6” Min O.D. To 80,000 lbs.

ISO9100:2015 and AS9100D - Since 1994 - NIST SP 800-171 (Compliance Under Development)

800.600.9290 - 973.276.5000 - CANADA: 416.363.2244 - INFO@STEELFORGE.COM - STEELFORGE.COM

OCTOBER 2020 AEROSPACE OUTLOOK

by ROYCE LOWE

MORE FLACK FOR BOEING

Events often occur at the most inopportune times. Boeing, long the U.S. aeronautical flagship, has been dragged upwards and downwards and sideways since the two fatal crashes of its 737 MAX. What has been said and written about the company since has put info about others in the business in the shadows. But we’re not in normal times, and enquiries and trials and oversight committees are out there in force, and Boeing has just had nowhere to hide. The company is in the spotlight, and this is made worse by the fact that ‘nobody’s flying.’

The 737 MAX may have been the subject of more testing than any other commercial airliner. All the better, since it has brought home the need for improved quality and engineering integrity that many of the investigations have brought to light. At last look, test flights had been carried out in the U.S., Canada and Europe. The information from the flights has, in some cases, been analyzed. The European Aviation Safety Agency (EASA) conducted three days of test flights on the 737 MAX around Vancouver. These tests will be put together with those from the U.S. and Canada, and further analysis carried out. The FAA boss, Steve Dickson, a licensed 737 pilot, recently flew a MAX himself, and although generally pleased with the plane’s performance he said ‘more work was needed to rectify the jet.’ At time of writing there is no set date for the aircraft’s return to service.

A 238-page Congressional report has been released which pointed to a series of design mistakes in the 737 MAX, as well as failure by the FAA to properly oversee the aircraft’s certification process, resulting in two crashes and 346 fatalities. The report says that Boeing put profit before safety and described allegations

that Boeing pressured its employees to expedite the 737 MAX design and certification process as evidence of disturbing cultural issues. The report said concerns on the part of Boeing employees relative to design were inadequately addressed.

The report was effectively scathing, and left Boeing’s reputation in tatters, that of the FAA ‘adversely affected.’ The report went on to call the crashes, ‘the horrific culmination of a series of faulty technical assumptions by Boeing’s engineers, a lack of transparency on the part of Boeing’s management, and grossly insufficient oversight by the FAA.’ A recent lawsuit names almost two dozen former Boeing officials, pointing to passivity of the board toward operational problems on earlier Boeing models and overly trusting of (former CEO) Dennis Muilenburg’s explanations for the disasters.

The EU’s safety chief, Patrick Ky, said the plane could receive certification to fly again by the end of the year. To add to all this, according to a WSJ source, the FAA is reviewing Quality Control issues at Boeing’s South Carolina plant on the heels of revelations of flaws in composite material structures of some 787 Dreamliners.

Boeing subsequently slowed deliveries of the wide-body 787 as it inspects more recently completed aircraft. A new defect has been found on a tail assembly fabricated at a plant in Salt Lake City.

Boeing’s worries are not over. Both United Airlines and American are looking at layoffs in the order of 15,000 employees each.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook.

OCTOBER 2020

ENERGY OUTLOOK by JOCELYN BRIGHT

WIND AROUND AMERICA

The U.S. has worked itself up, over the years, to become the country that raised the bar when it came to production of oil and gas. The recent, ongoing coronavirus pandemic has put a damper on consumption and prices, to the point where companies in the business are losing very serious money. Nobody’s flying, and since virtually the beginning of the year, people have been driving a lot less.

It’s strange to say that the pandemic is pushing investment toward renewable energy, from such major oil companies as BP, Enel, Total and Shell. The pandemic has highlighted the uncertainty of the oil and gas business, making the case for renewables stronger. BP’s chairman recently wrote down the value of the company’s assets by some $17 billion as a shift away from fossil fuels was accelerated by the pandemic. BP will invest $12 billion in renewables. It’s certain that a large number of people both in and out of the oil and gas business might be described as climate change deniers, but this doesn’t alter the fact that the vast majority of countries are moving in the renewable direction.

Wind power and offshore turbines come to mind. Germany and Denmark are two of the leaders in this technology, which has to date seen the installation of 4,000 wind turbines in 11 countries in Europe. It is hoped that if the U.S. could see 1,700 turbines installed by 2030 off the seven Eastern states working on this now, that would be great. The knowledge and technology are available, and the U.S. needs to pick them up and run with them. There is an investment tax credit for offshore wind, and it is hoped Congress will come up with a five-year extension.

So, if the U.S. has a really good decade for building wind turbines, they’ll have half as many as Europe has now. The bright spot is that a lot of European countries have worked out the kinks in the process. They have become less expensive and more efficient. The (U.S.) National Renewable Energy Laboratory is helping the International Energy Agency with the design of a 15 megawatt turbine that could become the industry standard. This adds up to 40,000 jobs, just with offshore, throughout the U.S. by the end of the decade. Renewables are here to stay, and they will grow like the proverbial wildfire.

On the other hand, oil and gas, especially gas, for power generation, are not going anywhere, despite the green push. Someday the world may be powered exclusively by renewable energy sources, but this day, should it come, is a way away. Fossil fuels are here for a goodly time. Right now, oil is not in a happy place, and may stay there for some time. But the world will rely on it for awhile to come, and the industry will surely see better times in the coming years.

It’s perhaps timely that the major oil companies are moving into renewables. There shouldn’t be a fight between fossil fuels and renewables, rather cooperation. Surely the two can see what’s good for the planet, and act accordingly.

On a final note, Boris Johnson, Britain’s Prime Minister, announced on October 6 that by 2030 all UK homes will be powered by offshore wind. It should be noted that Boris is in trouble at the moment, with Brexit and a general waning popularity. But it’s a good thought.

Jocelyn Bright, Staff Writer

OCTOBER 2020 AUTOMOTIVE OUTLOOK

by LAWRENCE MAKAGON

A NEW “ARRIVAL”

There seems to be no way, these days, that we can get away from alternate ways of propelling automobiles when talking about the industry. The internal combustion engine seems to be the bad guy. Earlier this year both UPS - minority - and Hyundai-Kia - $110 million - invested in Arrival Element, a company in the UK in the business of producing electric commercial vehicles.

Arrival says it’s reimagining the entire electric vehicle process, whereby it starts from scratch, rather than trying to adapt the EV concept to traditional designs. It has what it calls a micro factory strategy, which involves the manufacture of small to medium commercial vehicles. This is in contrast to normal, massive facilities used to build just one model of vehicle. The micro factories, at 10,000 square meters (approx 100,000 square feet) allow a shorter production time, around six months. The goal is to build such facilities near big cities and key customers, allowing a level of flexibility not found in traditional automobile production.

More than half of Arrival’s 1,100 employees are software engineers, and together with hardware engineers, they have designed a lot of core concepts, their own chassis, powertrain, body and electronic components. The core components are modular, plug and play. Arrival’s CEO is a lady named Tracey Yi. She has great plans for the company. The UPS minority investment goes along with a commitment to purchase 10,000 custom-built electric vehicles, with priority access to purchase additional electric vehicles. Hyundai-Kia, with a major investment of $110 million, will work in close cooperation with Arrival on new vehicle development. Arrival has plans to open it’s first U.S. micro factory, which will focus on the company’s bus manufacture.

Hyundai has shipped the first 10 units of its XCIENT fuel cell, the world’s first fuel cell heavy-duty truck, to Switzerland. The company will produce 50 trucks in 2020, and a total of 1,600 by 2025. The trucks will be powered by a 190-KW fuel cell system that will do 400 kms (approx 250 miles) on a single charge. Hyundai will develop a tractor unit with a driving range of 1,000 kms on a single charge.

Ford, meanwhile, will operate under Jim Farley, its new choice for boss, a ‘car guy’ who enjoys racing 1960s sports cars. Farley takes over from the slow, ponderous Jim Hackett, seems more dynamic and is high-tech, all of which will be important in view of Ford’s aspirations in the EV area. Farley recently announced that America’s best-selling truck, the F-150, is being towed into the electric age. The truck has been boosted and torture tested, has power with a capital P , and will just tow and tow, to six tons. It will be available to be driven hands-free over more than 100,000 miles of divided highway in the U.S. and Canada.

Ford is investing in a new $700 million manufacturing center of excellence at the Rouge. This is all to keep Ford ahead in the truck game, which it owns in the U.S. Of the over 2 million full-sized pickups assembled in the U.S. in 2019, Ford assembled nearly half, or twice as many as any other automaker.

It seems that any automaker that wishes to be taken seriously these days needs to be researching or building alternately-powered vehicles. The race is only just beginning, but some companies are already out in front. The auto industry will always be newsworthy.

Lawrence Makagon, Staff Writer

The Manufacturing & Business Podcast Network

MFGTALKRADIO.COM

OUR PODCASTS:

LISTEN TO OUR PODCASTS AT:

www.jacketmediaco.com

OCTOBER 2020 ISSUES OUTLOOK

by ROYCE LOWE

MANUFACTURING “SCHOOL”

In the month of September, 66,000 manufacturing jobs were returned to the U.S. economy, twothirds of them to the durable goods sector, mostly motor vehicles and parts, and machinery. Considering the jobs lost in March and April in the sector, some 1.8 million, and those regained since, the bottom line is that there were 647,000 fewer manufacturing jobs in late September than there were in February. That’s due to the pandemic; that’s quite a shortfall. It’s a favorite topic: employment. So is unemployment. It’s often a percentage figure, showing how well the economy’s doing, fodder for politicians to take credit for. But 647,000 is a big number, and what does it mean for the U.S. manufacturing sector? Manufacturing jobs - or lack of them - have been a hot topic for years, but particularly from the point of view of the people with the skills to work in a sector that is becoming increasingly technologically advanced. The industry is unanimous in stating that there are just not enough people with the necessary skills to make the sector operate at anywhere near optimum efficiency. None of this is news. What is news is the impetus, when it’s there, to do something about the situation. It’s been left too much up to politicians, people with the power to pass bills to allot millions of dollars to something that might be called an apprenticeship scheme. Industry giants have been persuaded to back these schemes, and to pass on their own experience and money. Stephen Gold, the president and CEO of the Manufacturers’ Alliance for Productivity and Innovation (MAPI) has recently joined the forum on this topic, and some of what is written here is taken from what he recently published. Even before recent technological advances, American manufacturers were struggling to attract enough employees with appropriate skills to keep their factories operating. People with STEM (Science, Technology, Engineering and Math) training were not interested in manufacturing; those interested often didn’t have the necessary skills. A recent (pre-COVID) study from the Manufacturing Institute forecast that 2.5 million manufacturing jobs would go unfilled in the coming decade due to a lack of trained workers. Even with the slow recovery from the spring economic collapse, there are 400,000 manufacturing jobs open. U.S. manufacturers are looking for technological evolution, as 85 percent of CEOs, in a recent MAPI study see investments in smart factories rising in the next year. In this event, the skills gap could grow even wider.

There has long been a stigmatization of vocational training/apprenticeship schemes in the U.S. In the past four decades, the push has been to go to college. Vocational training was for those who couldn’t go to a ‘real’ school. This set up a psychological roadblock. In 1980, there were 7.5 million four-year college enrollments,14 million in 2020. The figures for two-year colleges, including technical schools, were 4.5 million and 5.8 million respectively.

All this is not to say that there are no apprenticeship schemes in the U.S. The speed of change and the lack of qualified personnel is forcing manufacturers’ hands. A 2019 MAPI study found that well over one-third of manufacturers were building relationships with local academic institutions (high schools, community colleges and universities), another 25 percent were adopting massively open online courses (MOOCs) and other forms of online education, and 20 percent were developing internal training courses to increase new-technology skills. Those bastions of apprenticeship schemes, Austria, Germany, and Switzerland, put their prospective employees into such schemes around the age of seventeen. The normal age in the U.S. is nearer the late twenties. Isn’t this an opportune time to ramp up programs in the U.S.? With so many unemployed in manufacturing, what better time to offer a unique experience to those youngsters who maybe can’t afford to go to university, but would surely have a go at a job in manufacturing. It would give them a chance to get cosier with machines, friendly with robots, and familiar with the technological advances that are coming in, for example, automotive and alternate energy, to name just a couple of fields. The time has never been more opportune, nor more urgent.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook.