42 minute read

Supply Chain

3

Supply Chain

The pandemic accelerated smart manufacturing and sustainable operations among auto parts producers, while placing the health of employees as the absolute priority. After production shutdowns, auto parts producers invested heavily in ensuring all the necessary sanitary protocols would be followed. As social distancing measures were enforced, companies quickly realized the advantages of automation. Those that were already at greater degrees of digitalization adapted faster to the change. Among the rest, the interest in eliminating as much manual labor as possible increased and automotive clusters encouraged suppliers to embrace new technologies. At the same time, automakers have announced ambitious plans toward carbon neutrality. Some companies like Toyota and Audi have already published new standards for suppliers’ operations to ensure more sustainable practices across the supply chain.

Overall, auto parts production is expected to grow 24 percent in 2021, compared to 2020. Investments from large Tier 1 and Tier 2 companies took place despite the pandemic, decisions mostly driven by a quick recovery in US vehicle demand. Notably, Chinese and other Asian companies are looking forward to establishing a manufacturing footprint in North America, allowing Mexico to take advantage of this unique opportunity brought by USMCA’s new rules of origin for automotive goods, as well as regionalization trends seen after supply chain disruptions brought by the pandemic.

3Supply Chain

49 Analysis

Supply Chain Transformation Follows Global Disruption

50 View From the Top

Ignacio Moreno | CEO of Bocar Group

51 Conference Highlights

Opportunities Aplenty Through Smart Manufacturing

52 View From the Top

Francisco Maciel | CFO and Country Leader of Faurecia México

53 View From the Top

Felipe Villareal | CEO of Alian Plastics

54 View From the Top

Martín Toscano | President and General Manager of Evonik Industries de México

55 View From the Top

Antonio López | CEO of MLD

57 Analysis

New Supply Chain Standards: Safe, Sustainable, Smart

58 View From the Top

Jordi Torras | CEO of Zanini Auto Group

59 View From the Top

Lourdes Cobos | Operations Manager of Yanfeng Automotive Interiors México

60 Roundtable

What Should Companies Do to Embrace Industry 4.0?

61 View From the Top

Victor Fuentes | Director General of Mitsubishi Electric Automation for Mexico and Latin America

63 View From the Top

Gerardo Varela | General Manager of ZF Services

65 Conference Highlights

Human Capital Management and Challenges of New Labor Standards

66 Content Links

FDI IN MOTOR VEHICLE PART MANUFACTURING 20112020 (US$ billions)

4000 4.0

3400 3.4

2800 2.8 2.90 3.52 3.90

3.12

3.11

2.72

2200 2.2

1600 1.6 1.96

1.94

1.50

1000 1.0

20112011 20122012 20132013 20142014 20152015

Source: Ministry of Economy 20162016 20172017 20182018 1.37

20192019 2020 2020

Read the complete article Last year, supply chains were forced to demonstrate resilience and adaptability to avoid disruption, securing inventory and guaranteeing logistics continuity. The Mexican automotive sector was dependent on Chinese and Southeast Asian imports for specific components, mainly tooling and plastics. With the fragility of global supply chains exposed, industry leaders agreed the pandemic accelerated a trend toward regionalization. “Regionalization will occur at a faster pace in this decade than in the previous one,” said Oscar Silva, Leader Partner Global Strategy Group of KPMG, during MBN’s webinar, “Supply Chain Relocation and Development in North America.”

Regionalization also implies nearshoring, a buzzword when talking about the automotive supply chain. Nearshoring means companies relocating production closer to large consumer markets. Over the last year, regionalization and nearshoring trends have created two scenarios for Mexico: large Tier 1 players either expand their operations in the country or ramp up production, while Tier 2 suppliers are further developed to meet RVC requirements established in USMCA.

Tier 1 Expansion Executive President of INA Oscar Albin mentioned in early January 2021 that the sector expects to grow 24 percent compared to 2020, to reach US$96.9 billion in production value, close to the US$97.8 billion reached in 2019. Albrecht Ysenburg, Partner Leader of Automotive Industry of KPMG, told MBN: “We support customers relocating their operations and we have seen a renewed interest from companies to relocate operations from the US or China to Mexico. This is happening as we speak.”

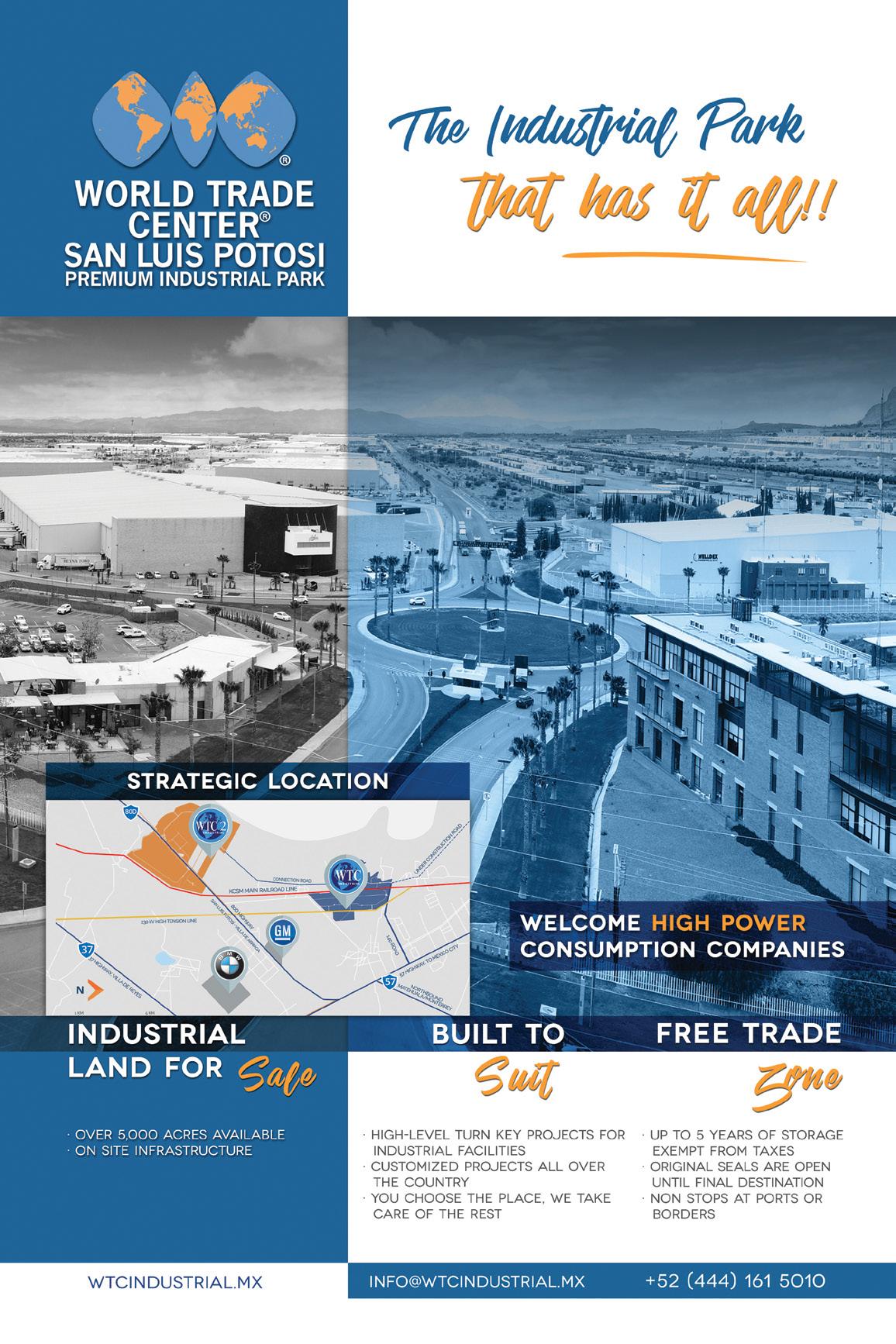

Government data from the Ministry of Economy highlights 2017 as the year with the highest FDI in Motor Vehicle Parts Manufacturing (NAICS Code 3363) with US$3.9 billion invested in the sector. FDI in auto parts manufacturing remained above US$3 billion in 2018 and 2019 but the pandemic dealt a blow and reversed investment to its lowest since 2009, with just US$1.37 billion invested in 2020. That being said, the sector is undergoing a transformation and to increase RVC, FDI in the sector is expected to rise. “This is a great opportunity to attract more investment to North America because OEMs need to comply with rules of origin requirements, which will reward those suppliers that can manufacture in North America,” said Alejandro Lara, Chairman of American Industries.

Tier 2 Growth Opportunities Only half of the auto parts imported to Mexico come from North America. According to INA, 55.2 percent of auto parts imports in 2020 came from North America (50.2 percent from the US), while 16.2 percent came from China. There is room to grow, either to attract investments or to develop local suppliers. “The country seems to be in a risk-averse environment but the opportunities are there. OEMs and Tier 1s are actively looking for components locally,” says Alberto Torrijos, Automotive Sector Leader Partner at Deloitte Mexico. This also creates many opportunities for foreign players to launch projects in the country as Tier 2 suppliers and for Mexican suppliers to enter the supply chain.

Ignacio Moreno

CEO of Bocar Group

Anticipating Customer Needs to Sustain Growth

Read the complete article

More about this person Q: What values have allowed Bocar Group to remain a market leader for decades?

A: Bocar Group was founded more than 60 years ago by Mr. Federico Baur. Over the years, the company has lived by its core values and principles. People are the company’s main asset and all our employees follow our values as well as our primary concept of discipline, order, and cleanliness. The Baur family continues to play a fundamental role in the company, keeping us on the path of success set by our founder. We have built a successful relationship with our customers and created a diverse customer portfolio based on win-win relationships.

Q: How will USMCA’s new rules of origin influence aluminum processes?

A: Opportunities are similar due to our diversified portfolio. We supply OEMs in the US, as well as European and Asian companies based in the US. Our main market is in North America, so the fact that USMCA has been signed provides us with certainty about the future of our operations and the future economic growth of the region. Risks remain low as long as we comply with the norms established in the agreement.

Q: How did Bocar Group embrace the effects of the pandemic?

A: In the beginning, the situation was complicated for everyone. In March, the US started to close its borders and at that very moment, we decided that our priority was our employees’ safety and wellbeing. Fortunately, we prepared ourselves by having enough stock available for our customers, which allowed us to maintain supply even though operations remained suspended. We implemented state-of-the-art sanitary protocols to resume operations and we were among the first companies to be cleared by IMSS to go back to work. We handled the crisis effectively. Bocar Group has the capabilities to endure the peak of the crisis, avoiding supply chain disruptions for us and our customers.

Q: How are you participating in the development of CASE vehicles?

A: With the incoming US administration, the trend towards electric and hybrid vehicles will increase considerably. Our strategies are also heading in this direction. Most of our customers have announced billions in investments in electric and autonomous vehicles as a standalone or through a partnership. This has driven us to take part in this trend. We are anticipating their requirements and maintaining close contact with their engineering departments during the early stages of the R&D process. CASE vehicles are a reality and they are coming at a fast rate. We take this seriously, not only at our plant in the US but also at our plants in Mexico.

Q: What opportunities can the Mexican automotive industry take advantage of this year?

A: Engineering and design are great opportunities for the country. We have capable engineers who can support these efforts but we have to educate them to embrace engineering. In this way, we could advance from being a country with solely high-quality manufacturing to being a country that also contributes to product development. Tooling development also remains an important opportunity. We must also capitalize on USMCA.

Opportunities Aplenty Through Smart Manufacturing

Tarsicio Carreon

President of Chihuahua Automotive Cluster

Alejandro Preinfalk

President & CEO of Siemens

Matt Myrand

Manuel Sordo

Country Manager at Universal Robots

Marcio Delgado

Read the complete article On Mar. 24, experienced panelists in the automotive manufacturing environment debated the latest trends in smart manufacturing in a panel moderated by Tarsicio Carreón , President of Chihuahua Automotive Cluster during Mexico

Automotive Summit.

The pandemic and environmental challenges in the US complicated manufacturing heavily in recent times, according to Carreón. Panelists agreed on the many solutions that are already available in the area of smart manufacturing to keep operations safe and cost-effective during the pandemic and beyond. For Matt Myrand, Group Advanced Manufacturing and Supply Chain Manager at Faurecia, adopting these solutions requires testing. “If it works, we move it into our toolbox,” he said. It is also important that solutions can be stacked on top of older solutions. A long-term vision is therefore of the essence, said Myrand.

“Data is the new oil,” said Alejandro Preinfalk, President & CEO of Siemens Mexico. He mentioned that life in general was becoming more connected at an accelerated rate because of the pandemic. For Siemens, digital twins of vehicles are the future. A digital model of a car, for instance, is useful for R&D, as well as for manufacturing. Afterward, the car can be connected to the cloud for data collection to schedule maintenance. “This creates value for all stakeholders,” he said.

Marcio Delgado , Vice President of Production and Global Manufacturing at ZF, agrees that digital twins and data are increasingly crucial for resource optimization. “Given the importance of optimizing business results, our main contribution is optimizing resources and costs toward product optimization,” he said. ZF needed to rely more on agile tools to achieve this optimization. Other than digital twins, apps helped the company to enhance visibility of manufacturing data. Programmable logic controllers (PLCs) are becoming a common feature, as well.

The only area more important than costs might be employee safety, especially during this new normality. “The new normal has impacted safety at manufacturing facilities. Automation is effective and keeps our employees safe in this environment,” said Manuel Sordo, Country Manager of Universal Robots. Manual labor is still as important as ever but social distancing needed to be introduced to global operations in the automotive sector. “Through collaborative robot automation and virtual reality, you can maintain productivity and the distance,” said Sordo.

Francisco Maciel

CFO and Country Leader of Faurecia México

Local Development for the Car of the Future

Read the complete article

More about this person Q: What role does sustainable mobility play in Faurecia’s offering to the automotive industry?

A: We have been working on innovative solutions for fuel savings, air quality and zero emissions, focusing on emerging hydrogen fuel cells and battery packs. As a world leader for the last 15 years in air quality and energy efficiency solutions for passenger vehicles, Faurecia is expanding its experience in passenger vehicles to commercial vehicles and highpower engines.

Sustainable mobility technologies are aimed at significantly reducing emissions for cleaner cities. Through strategic partnerships around the world, Faurecia addresses the megatrends and expectations of consumers in today’s automotive industry, from customization, connectivity and autonomy to sustainable mobility and zero emissions.

Q: What were the key factors behind Faurecia’s new corporate offices in Puebla?

A: We decided to construct the new Faurecia building in Puebla because the state has the right talent and conditions to locate a world-class headquarters. This marks a milestone in Faurecia’s history. Mexico has allowed us to consolidate our operations in one of the most dynamic economic regions for the automotive sector. This building represents an investment of more than MX$400 million (US$20.5 million) and is a clear sign that the company is still investing in Mexico.

Q: What is Faurecia’s strategy to sustain growth?

A: Faurecia cares about being close to its customers and the current market, so it directs its strategies to the needs of the future, anticipating solutions for its customers’ vehicles. For several years, Faurecia has been working on the cockpit of the future, facing new challenges to make vehicles more intuitive, connected and personalized.

After the recent acquisition of Clarion Electronics, Faurecia continues to add elements to maintain constant innovation. Faurecia’s Cockpit Intelligence Platform (CIP) integrates key functions such as driver information, infotainment, safety, comfort, thermal management and sound system to ensure the cockpit interacts intuitively and provides a seamless and predictive on-board experience for all.

Q: How is Faurecia participating in the development of EVs regarding lightweighting and efficiency?

A: For several years, Faurecia has collaborated with the leading brands of electric cars in technological solutions that allow them to embrace electrification and sustainability. A clear example is the manufacture of decorative pieces in wood, which provide an advantage in weight and are totally biodegradable.

Likewise, there are developments based on natural fibers and light materials such as aluminum, all aimed at equipping electric vehicles with quality interiors adapted to the new sustainability trend. It is important to mention that these developments and their manufacturing processes are being carried out at our development and manufacturing centers in Puebla.

Felipe Villareal

CEO of Alian Plastics

Smart Manufacturing to Attract New Customers

Read the complete article

More about this person Q: How has the pandemic influenced Alian Plastics’ operations?

A: It created a revolution for everyone. We needed to adapt our strategies prioritizing health and safety, while focusing on our staff and sales. In March, most of our automotive customers started to suspend operations. Fortunately, we started a diversification process toward other industries in 2018. Our projects required years to be developed and by starting in that year, we were able to complete our diversification successfully in February, gaining participation in the HVAC niche. Amid the shutdowns mandated by the government, the HVAC industry remained an essential sector, which helped to keep our operations running.

At that moment, we were worried about how the automotive sector was going to behave after the lockdown. Our surprise was that companies resumed operations stronger than before. Premium brands we work with, such as Audi, Tesla and BMW, presented stronger demand than before the lockdown. We adapted our staff accordingly while implementing cost reduction strategies to keep the company healthy.

Q: You have proven successful in leading through times of crisis. What elements have helped that success?

A: Maintaining balance with the help of family and exercise has been essential. At the corporate level, protecting our staff was our priority. A strong, safe and stable worker will perform well. Even though there were times when I myself felt uncertain about the future, I needed to provide employees certainty.

A second element was home office. We were not sure how remote work would turn out but through KPIs and clear goals, we made it work. The mental health of everyone was really important, too.

Q: Given the company’s successful strategy of diversification, how has Alian Plastics’ portfolio changed?

A: The automotive industry continues to be our core business. The second niche we are focusing on is HVAC, which is a demanding industry in terms of quality and delivery times. We are handling a just-in-time delivery every four hours. In the beginning, it meant adapting our day-to-day operations since automotive companies pick up products only two or three times a day. I accepted this challenge gladly because we recognized the potential of our operations. This year, we also entered a new industry: toys. We manufactured pieces for iconic characters, such as Barbie and Batman, and for toy animals. We also invested, despite COVID-19. We bought new machines and robotic end-arms and grippers.

Q: The pandemic also drove companies toward greater levels of digitalization. How has Alian Plastics experienced this trend?

A: We started our smart manufacturing projects in 2019, collecting data faster and making better decisions in a really short time. 2020 was a year of consolidation and I feel very proud of our IT team. Having all the tools available to perform our job remotely and efficiently provides us with the capabilities to diversify our operations. We enabled Industry 4.0 tools for each one of our presses. These tools send us alerts in real-time to identify area to address, whether it is production, quality, materials or maintenance.

Martín Toscano

President and General Manager of Evonik Industries de México

Read the complete article

More about this person Q: How did the pandemic influence Evonik and its clients’ business?

A: B2B companies such as ours have an obligation to think about our role in the future and how disruptions in different sectors will impact our products and technologies. This adds up to a massive advancement of digitalization. In a 12-month period, digitalization grew the equivalent of what we went through over the past 15 years. We remain open and confident we will achieve greater levels of innovation and the development of new technologies along the value chain.

Q: Why did Evonik realign its structure to focus on smart materials, specialty additives, and nutrition & care?

A: Our company structure is systematically oriented toward our operational business. The engine of our company consists of the five divisions with their business lines: Smart Materials, Specialty Additives, Nutrition & Care, Performance Materials and Technology & Infrastructure.

In Mexico, this proved to be the right strategy in 2020 for delivering good results. This is particularly due to the diversity of our product portfolio and it is resilient. And we operate and supply practically to all manufacturing and industrial sectors and markets. To increase the value of the company, we target three strategic focus areas: portfolio, innovation, corporate culture.

Q: The pandemic accelerated different trends, among them additive manufacturing. What is Evonik’s focus in this regard?

A: This is an area where Evonik continues to invest, particularly in the high-performance polymers business line where we participate actively. In this segment, we bet on the future while actively developing these technologies. We have a clear strategy that involves investments and acquisitions, as well. We are aware of the promising future this area represents.

Q: What business lines were boosted in Mexico due to the pandemic?

A: In 2020, compared to 2019, we grew our business in Mexico. Some business lines experienced more challenges than others during the peaks of the pandemic but all businesses have proven to be resilient, among them automotive, agriculture, pharmaceuticals, among others. Depending on the sector, our business lines adapted to market conditions and the general situation. This has been essential to navigate the pandemic.

Q: What changes are here to stay?

A: Process digitalization and automation, the ways we do business and supply chain relocation, mainly from Asia, are trends that are here to stay. Particularly in 2020, the US supply chain relocation created more jobs than FDI. Last year tested all sectors equally. It also allowed us to better understand our capabilities as an organization and team in the country. Without question, human capital continues to be a priority and as organizations, we need to understand what the future is and the kind of profile future business leaders should have based on the challenges we are facing today.

Antonio López

CEO of MLD

Digitalization: 200 Percent Sales Increase Story

Q: What trends have shaped the aftermarket sector in 2019?

A: MLD specializes in GM vehicles. We are ranked by the OEM as the No. 1 wholesale suppliers of spare parts in stock, customer service and quality. We have expanded our supplier base to premium brands, always looking for better quality. Part of our success is our 84-person team and our ability to supply spare parts for more recent models.

As an OEM supplier, our market niche are vehicles aged 1 to 5 years. After that, they go into the true aftermarket. Within our market niche, we have had to innovate continuously. Today, we are already in the process of integrating spare parts for 2019 and 2020 models. For us, it has been a matter of innovation through product integration.

Q: What opportunities does the arrival of new brands represent for aftermarket companies?

A: GM is highly complex compared to any other brand. ACDelco, GM’s original equipment spare parts brand, has a broad offering, whereas other aftermarket brands like Bosch handle a single product line.

We supply parts for Chevrolet vehicles from bumper to bumper. We are constantly integrating new part numbers into our catalog and one of our main strengths is having the spare parts even when the dealership does not. MLD handles an average of more than 11,000 SKUs and 25,000 on demand.

Q: What have been the results of your digitalization strategy?

A: Our e-commerce platform has brought great benefits, but these were greater for our customers. Through our platform, they have increased their sales and product lines and have shortened their response times.

Our platform shows stock availability, price, images, applications and shipping orders. Before, our customers used to take orders by phone, which was a waste of time. Product photos are really important as users’ trust increases when they can compare the photo to the product they need. In the first three months, sales of some of our product lines increased by 200 percent due to greater efficiency of an online operation compared to a phone call. In addition, as the system provides different alternatives, customers can choose a cheaper option and increase their sales accordingly.

Our platform became fully available in December 2017. We launched a beta version with 25 of our best customers in September. The platform can also provide an expenditure record and a record of shipping orders. Over the first month, 33 percent of our product orders were processed through the site. In two years, the figure has increased to 85 percent.

Q: What are the strategies to advance e-commerce among workshops and retail spare shops?

A: Many of our customers had their first e-commerce experience with us. While some were very excited about it, others were weary of the platform. However, when they realized what they were missing, they started to participate in the process. We

implemented several strategies, such as offering sales discounts through the website and reward points.

Today, many of the benefits we offer to our customers are online. For financing or discounts, for example, we require that at least 75 percent of their orders are online. Some of our customers already process all their orders online. This also gives our team more time to take on other responsibilities.

Our site was filled with so much valuable information that even some shops started to use it as a catalog. Our site drove so much traffic that it slowed down the service. Consequently, we created a user-only service to make it faster. Our distinctive offer is our specialization in GM vehicles, bumper to bumper.

In addition, SKUs change constantly at GM. Through our platform, we update these while maintaining information on previous SKUs to make it easier for potential customers looking for a specific part.

Q: How has your partnership with Mercado Libre influenced your operations?

A: We operate the official stores for Bosch and ACDelco on Mercado Libre. In addition, we have our own site where we offer other products. To be an official store, these brands had to grant us that status on Mercado Libre, which helps us to appear first in online searches. Our store was the leader in terms of growth in the auto parts sector in 2019 and we are ranked fourth in Mercado Libre’s auto parts sector.

We also trade virtual stocks from other companies on the platform. Mercado Libre has different levels of sellers: there are integrators, operators and regular sellers. We started as a regular seller but we are now considered an operator. As such, Mercado Libre connects you with other brands that want to sell their products through the site. Integrators boost automated sales.

Q: What key elements have you identified regarding digital sales?

A: The longer you take to answer, the more likely clients will go to another marketplace. Online channels also do not have a fixed schedule; they have to remain active seven days a week, all year round, which is what customers are looking for.

Regarding transparency, it is really important to reassure our customers. People want to use marketplaces that can provide warranties, easy payment methods and clear delivery costs.

Read the complete article

More about this person

New Supply Chain Standards: Safe, Sustainable, Smart

Read the complete article The pandemic brought new meaning to “safe operations.” The challenge to balance the economic impact and virus outbreaks forced governments to end lockdowns and companies to operate under strict health standards. Companies implemented social distancing measures and consequently accelerated the implementation of smart manufacturing strategies. Meanwhile, at the global level, automakers announced unprecedented commitments toward carbon neutrality that will also drive suppliers to meet more thorough environmental standards.

Safe Operations Over the year, MBN has interviewed more than 100 industry leaders and they all agree: “people come first.” Companies are focusing on employees’ well-being holistically, meaning both physical and mental health. For the supply chain in particular, safe operations are meant to prevent, monitor and track COVID-19 contagions. Implementing social distancing measures required investments from suppliers. In Queretaro, for instance, the automotive cluster reports an average initial investment of about US$28,794, followed by a monthly investment of US$4,479 to keep up with all the necessary protocols and additional health equipment.

Smart Manufacturing Needed More Than Ever Health measures also led to increased digitalization. Industry leaders agreed that manual processes and tracking systems needed to evolve as fewer people were allowed at the plant. “The pandemic demonstrated that even though it might be expensive to embrace automation, it might be costlier to not be prepared for a situation where manual labor is unattainable,” said Daniel Hernández, Director General of the Querétaro Automotive Cluster.

As US vehicle demand started to recover, production capacity needed to increase while keeping all employees safe. “Thanks to USMCA, automotive companies have also experienced greater levels of demand from their customers since August,” said the President of CLAUGTO, Alfredo Arzola.

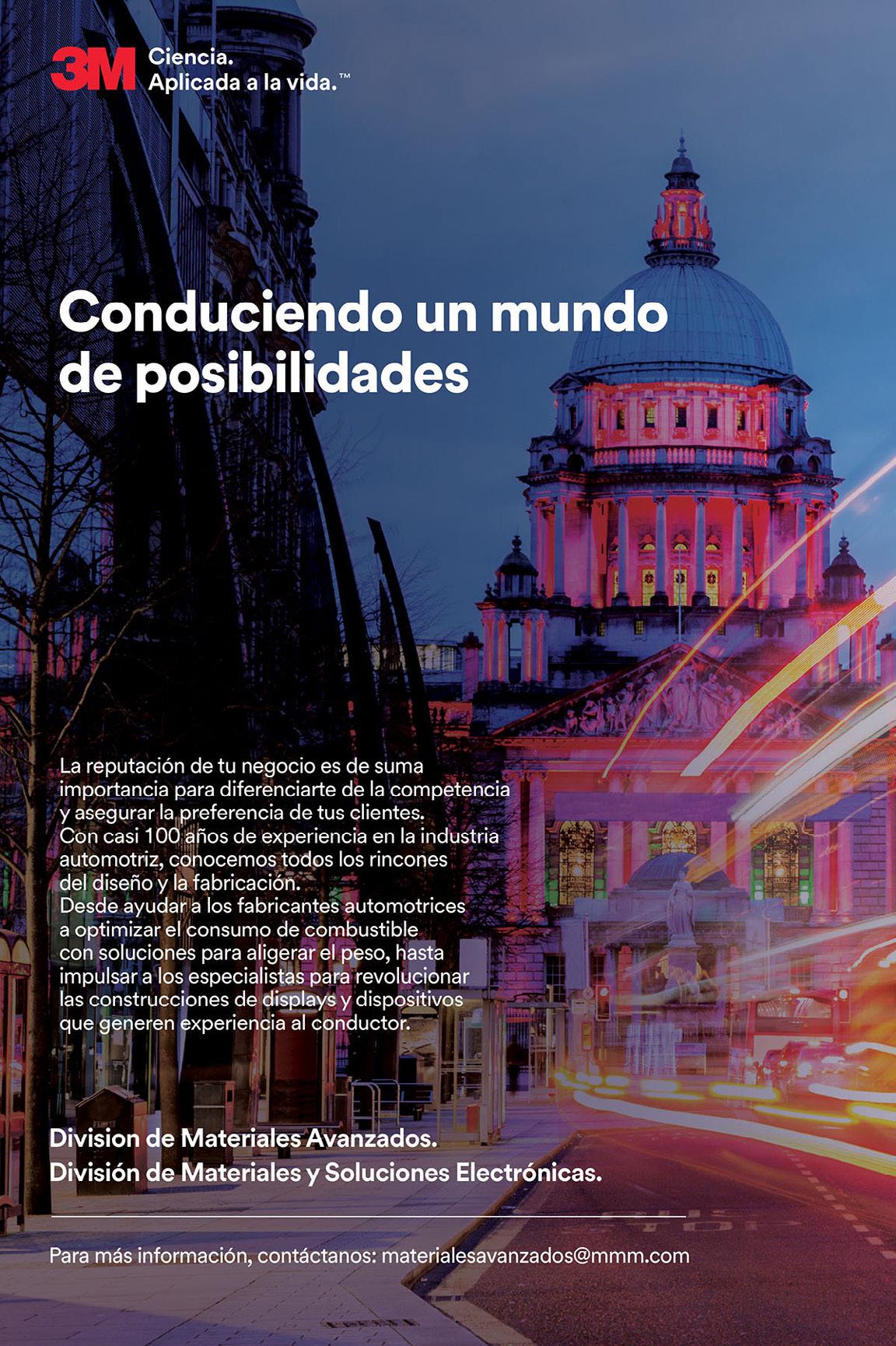

Automakers Go Carbon Neutral While the industry is coping with the effects of the pandemic, it is not losing its focus on long-term goals, particularly those related to the environmental impact of vehicle production and use. “The global car industry must shift to low carbon to survive,” stated a Carbon Disclosure Project report in 2018. Under the Paris Agreement, countries must meet strict emissions standards, which means industries must follow.

Over the last three years, most major automakers have announced detailed plans to reduce greenhouse emissions and all of these plans focus on the downstream and upstream value chain. Key areas include manufacturing operations, carbon credits and an aggressive offer of electric vehicles. “The environmental trend is gaining strength. Our customers used to focus greatly on auditing our operations and quality systems but now, all of them are asking about the environment, sustainability and green energies,” Felipe Villareal, CEO of Alian Plastics, a Mexican Tier 2 supplier for premium OEMs and EV brands, told MBN.

Jordi Torras

CEO of Zanini Auto Group

Continuous Innovation in Wheel Trim Applications

Read the complete article

More about this person Q: What factors allowed Zanini to evolve from a family-owned company to a global manufacturing automotive supplier?

A: First and foremost is having the willingness to do it. Going global represents a great effort both financially and organizationally, which requires a change in mindset. The key to achieving our global manufacturing footprint has been our leadership in a specific product. Our motivation has been to maintain our leadership in the wheel trim segment. To do so, we expanded our capacities to other continents to supply most of the world’s automotive groups.

One out of every four wheels in the world has Zanini components. In North America, we hold more than one-third of the wheel trim market. In Europe, we have around 30 percent market share, and we hold around 50 percent of the market in the MERCOSUR region. Mexico was our first venture outside Europe and it has always been a fundamental market for us, considering OEM production strategies. China is our latest venture.

Q: How do wheel trim products influence the end consumer’s final purchasing decision?

A: Beyond aesthetics, wheel trims also have an important functional element. We merge style with functionality as these components are placed in a dynamic element, the wheel while facing rough environmental conditions. Wheels are a very important factor when assessing the vehicle’s attractiveness. OEMs focus greatly on this element to ensure the customer has a wide variety of options to choose from.

Q: How has Zanini adapted to the pandemic?

A: The pandemic has affected the entire industry. We started to feel the effects at our manufacturing plant in China, and in March, we saw our European operations disrupted and a little bit later in Mexico. The pandemic had an overall 25 percent impact on our sales in March, which increased to 85 percent in April and then dropped to 45 percent in May. By June, we had a 30 percent impact on our sales. Despite this, our plans remain intact. We have successfully adapted by being flexible in our costs and operations. We expect positive results by the end of the year, albeit not the same as the previous years.

Q: What are Zanini’s priorities for 2020?

A: We are at the initial stage of ramping up our operations in India. This greenfield will remain our priority as we continue to grow in the country. Another priority is our electromagnetic, transparency, and backlighting products, which are innovative solutions for the market. We are developing this first product line for the Volkswagen Group at the global level. Zanini will also focus on new wheel trim business lines, particularly the inserted pieces in alloy wheels needed for assembly, instead of screws, which can be more expensive. The alloy wheel market went from a threat to a great business opportunity for us.

Mexico was our first greenfield project and this has been a really positive experience despite the years it took us to consolidate its capacities. Now, we can produce in Mexico any wheel trim component with the quality and requirements demanded by the automotive sector.

Lourdes Cobos

Operations Manager of Yanfeng Automotive Interiors México

Automotive Interiors Taken to the Next Level

Read the complete article

More about this person Q: How did Yanfeng Automotive Interiors (YFAI) transition from a joint venture to a successful automotive company?

A: YFAI was born as a joint venture with Johnson Controls. Five years ago, Johnson Controls sold its interiors division to Yanfeng, mostly based in China. Yanfeng acquired 80 percent of Johnson Controls’ participation in its plants for interiors. In North America, we have 22 active plants, four of them in Mexico and one more to be inaugurated in the near future. One of our biggest achievements is successfully transitioning from one corporate culture to another. Yanfeng is relatively young in North America but we are expanding our presence in the region. In Mexico, all our plants are focused on automotive interiors but soon we will announce an upcoming plant that will manufacture seat components, as well.

Q: What are YFAI’s strategies regarding local tech design and engineering?

A: In the Queretaro area, our tech design center has 40 Mexican designers who are working on different projects. We are looking forward to doubling our capacity in the coming years. The center is already working on several innovative projects with multiple OEMs, and others. Mexico plays an important role in YFAI’s approach to innovation.

Q: Which companies have helped YFAI to build its presence in the region?

A; We work with multiple OEMs throughout North America. Our plants in Ramos Arizpe produce components for Toyota in the region, as well as BMW. We have room to grow in the local market and that is one of our current strategies, alongside strengthening our technical and design center in Queretaro to attract more local customers. We are pioneers in automating leather cutting for automotive interiors. This gives us freedom to design our patterns and adapt to our customers’ needs. At our new plant in Ramos Arizpe, Coahuila, we will have our excellence center where customers can view our product portfolio and prototypes.

Q: How has the pandemic influenced YFAI’s operations?

A: In the automotive industry, adaptability is key. For over two months, our operations were idled, as was the rest of the industry. Naturally, our strategies changed and we adapted to the circumstances by investing time into strategic planning, prototypes, team projects and installing new equipment. I can proudly say that during this period, we did not have to reduce our workforce. Now that we are back, we are stronger, have new projects and, in fact, we are starting our recruitment process for our new plants.

Q: What are YFAI’s plans for the future?

A; We will continue to innovate in automotive interiors. YFAI is focusing on prototypes for doors, instrument panels and center consoles, remaining flexible to our customers’ needs, including textures, colors, designs and shapes, among many other elements. Betting on Mexican talent will be essential to growing not only design operations but also developing a specialized workforce. I see Yanfeng as a strong company in the North American region with a diverse product portfolio.

What Should Companies Do to Embrace Industry 4.0?

Mauricio Blanc

Executive Director Latin America of OMRON

Social-distancing measures made smart manufacturing capabilities the best option to prevent outbreaks and assure ongoing, efficient operations. Companies, from large manufacturers to small Tier 2 suppliers, are looking for strategies to balance the initial investment of a new technology and cash flow. Leaders from robotics, automation and technology integration solution companies shared their views on the steps companies should consider when embracing Industry 4.0, particularly regarding an adequate ROI analysis.

Typically, Industry 4.0 solutions are complex in hardware and software required to collect, manipulate, store and normalize data. Our solutions are simple, transparent and the initial investment is not that high. We allow customers to get to the same goal in a very clear and secure way. Often, potential customers do not believe that what we are telling them is possible. We usually create a demo solution for the customer to test it. Companies can see the effect that monitoring quality and efficiency can have, representing millions in savings. Once they try the demo, they want more. Demos have helped a great deal in boosting Industry 4.0 awareness. With USMCA, we expect greater automation levels, higher wages and consequently higher quality for auto parts manufacturing.

Sergio Bautista

Robotics and Discrete Automation Director of ABB México

The pandemic has highlighted the vulnerabilities of a manufacturing plant that strongly relies on manual labor. Before COVID-19, digitalization was a fashionable topic the industry was aware of but did not really embrace it. Now, it is critical. Although investments are not yet there, companies are getting their budgets ready to implement these solutions. ROI sometimes took a backseat when the priority was to remain in operation. ABB has been a strong player in Industry 4.0 for years. Since 2019, all of our robots are able to connect to Wi-Fi networks. We have also introduced OmniCore, our new controller for smaller robots. This is the sixth generation of our platform, which is now slimmer, lighter, more intuitive and more energy efficient. By the end of 2020, we will release a new lineup of collaborative robots.

Sergio Macías

The first step to advance Industry 4.0 is to take advantage of cloud and SaaS solutions. Cloud solutions “flatten the curve” of the initial investment. That being said, before technology, there need to be processes. Technology is just a tool to be prepared for strict requirements, short times and many other issues automotive suppliers face. The second element is to establish the data that will be required to make the decision, as well as streamlining the data. Once that is in place, we can decide which solution fits best. This applies to all companies throughout the chain, from big global players with clearly defined processes to small companies aiming to break through. My recommendation for Mexican companies is to be open to innovation and to adapt. Openness can change and create processes for the better. It is a balance between a long-term vision and being agile enough to achieve short-term results.

Victor Fuentes

Director General of Mitsubishi Electric Automation for Mexico and Latin America

Customized Solutions to Embrace Automation

Q: How has Mitsubishi Electric adapted to the digitalization of sales channels accelerated by the pandemic?

A: Five years ago, Mitsubishi Electric started providing digital content to its clients and abandoned paper until we realized that the Latin American market still used it. The pandemic allowed us to bring back our digitalization efforts and renew our bet on digital processes. This extends to our distributors. Every year, they undergo a certification process that assures excellence in their operations and technical support in situ. This certification usually takes place physically but from mid-March 2020, we decided to implement home office schemes and conduct the certification process online, which was quite successful. We are pleased with the results. In fact, by betting on digital channels we have expanded our market scope by incorporating people from Argentina, Colombia, Chile, and Ecuador.

Q: What has Mitsubishi Electric performed in Latin America during the pandemic?

A: We had positive results in 1Q20. Uncertainty emerged in 2Q20 in the face of an atypical market that, combined with the political and economic landscape, created adverse conditions for businesses in general. However, in 3Q20, the market started waking up. Naturally, demand has declined for some products, particularly in the automotive sector that suffered drops of around 40 percent as people were not that eager to buy a new vehicle.

We supply for manufacturing plants focused on ICE vehicles and their related components. As the industry transitions toward hybrid and EVs, we know that a plant reconfiguration is on the way. When it will happen remains uncertain but we see opportunities there.

Mitsubishi Electric has had offices in Mexico for 30 years but our products have been in the market for almost 50 years. 2020 made us recognize that we could not postpone our bet on direct solutions for our customers. We became a provider for plant renewals, startup projects, equipment reconfiguration, and more. We are certain Mitsubishi Electric will be a relevant player in this field.

Q: What opportunity do nearshoring practices represent for Mitsubishi Electric?

A: This will continue to strengthen Mexico’s role as an auto parts supplier. Given our location, we can also take advantage of the trade tensions between the US and China. Mexico’s manufacturing quality is world-class and this is in part thanks to access to state-of-the-art technology like Mitsubishi Electric. Companies from Asia, Europe, and the US continue to invest in the country because they recognize the country’s added value. In addition to new investments, I also see opportunities to develop local talent. At Mitsubishi Electric, we have invested around US$400,000 per year in local universities so they can access the technology we provide.

Q: How does Mitsubishi Electric help companies in Mexico to embrace automation? How do you add value to customers?

the product and reassures our customers regarding the equipment they are acquiring. All of our equipment is tested for at least one year at our manufacturing plants. We also support our customers through IoT solutions, mainly for machinery monitoring, at competitive prices. Our philosophy is “change for the better,” which means that any small suggestion that helps to improve the overall process is part of our added value. Industry 4.0, or E-F@ctory as we call it, means that a complete migration is not necessary because we can provide the specific elements that will help our customer to get the best of digitalization, from compressors or pump equipment to edge computing. Regarding the latter, we are performing AI tests for manufacturing operations.

Mitsubishi Electric supports the advancement of E-F@ctory in Mexico by bringing cost-competitive technology to the market. Our solutions do not require large investments. Moreover, we accompany our clients every step of the way. Our solutions are scalable and are set according to our clients’ priorities. Besides, our partnerships can provide support to ERP systems. Having the correct adviser in this process is key for mutual understanding. Again, our solutions allow clients to select what they need without necessarily migrating all their systems and equipment to smart manufacturing. We are the experts on automation technology. If we combine this with our customers’ expertise, it is a win-win scenario.

Q: What opportunities do companies at the lower level of the supply chain represent for Mitsubishi Electric?

A: There is a before and after of the pandemic. The industry saw the benefits of increased automation levels and two opportunities have appeared. One is to accelerate manufacturing plant automation for companies that are used to manual processes. For instance, one customer-focused on plastic injection had a turnover rate of between 25 to 30 people a week. This implies high costs when it comes to training. By automating part of the processes, savings in training can compensate for the initial investment while lowering the total ownership costs given that our products have some of the longest life cycles in the market. We are not laying valuable labor off. Rather, our focus is to professionalize the work as robots will not work alone.

The second opportunity is to integrate processes into IoT technologies. This means having real-time information about different plants, including material consumption, scrap, energy consumption, and other key variables. Our IoT solutions are to be launched by 2Q21. We are now focusing on modernization, migration, and system launches.

Read the complete article

More about this person

Gerardo Varela

General Manager of ZF Services

COVID-19 Breaks Dynamics Between Fleet and Aftermarket Growth

Read the complete article

More about this person Q: How Important is the aftermarket for ZF’s operations?

A: The aftermarket is vital to ZF as we are suppliers of various systems, components and auto parts for the assembly of new cars that sooner or later will need spare parts. We believe that the aftermarket has different drivers to satisfy installers and end-user requirements. Consequently, ZF Services has developed successful strategies to lead this market. Our focus is on building a complete product portfolio.

This business unit is very important to ZF and we have defined the structure and factors that will lead us to success in this market. First, we focus on coverage. As OE suppliers, we meet OEMs’ minimum quality standards and, in some cases, when we identify certain design deficiencies in the original equipment, we correct them. In this way, we can offer a component that will guarantee a continuous use of the vehicle under normal conditions. Our goal is to be able to cover the needs of 95 percent of the vehicle fleet in Mexico. In the case of shock absorbers, we cover 99 percent of the national demand, but there are other areas such as brake systems where we cover 92 percent.

The third factor that we take into account and in which we find ourselves successful is customer service. We can deliver an order within 24 hours. One area in which we have worked and in which we have a lot of experience is pricing. At ZF Services, we always make sure that the price for the enduser is appropriate, based on the current value of the vehicle. All these factors have allowed us to position in the mind of not only of the installer and the distributor, but also of the end-user.

Q: How is e-commerce influencing aftermarket strategies?

A: At the moment, 93 percent of our sales are done through traditional channels, such as a dealer network, while the rest come from our website, Mercado Libre and Amazon. The crisis generated by COVID-19 has given us the opportunity to grow in this segment – sales through e-commerce increased 74 percent in April and May. However, this is not sustainable over the long term because once we return to the new normal, the growth of e-commerce is going to slow down.

Q: Is the drop in consumption of new vehicles an opportunity for the aftermarket?

A: It is an opportunity but a very limited one. New vehicle sales have been falling since 2016 and that trend will continue. According to AMDA, car sales will drop more than 20 percent in 2020 compared to 2019 due to the pandemic. Although it is true that this drop will not generate growth in the vehicle fleet, there are two factors that must be taken into consideration: most components and auto parts are manufactured in China and the peso has devaluated by up to 26 percent this year, while these types of products are bought in dollars. This has caused auto parts made in China to increase in price from 10 to 15 percent. That said, with the decrease in people’s purchasing power and unemployment, it is difficult for the auto parts sector to benefit from this crisis. Gone are the times when less growth in the vehicle fleet meant more growth in the aftermarket. That correlation no longer exists.

Human Capital Management and Challenges of New Labor Standards

Mónica Doger

Director General of CLAUZ

Marcela Barreiro

HR Director at Daimler

Maite Delgadillo

HR Director of Scania

Evelyn Erendida

Sales Director of Lavartex

Luis Monsalvo

Founding Partner at Monsalvo Duclaud

USMCA brought tougher rules of origin for automotive goods. Conciliation and effective union representation under USMCA’s Chapter 23 are now the new normal. At the same time, the pandemic forced the industry to rethink how it managed its workforce, bringing challenges but also great opportunities for companies, agreed panelists at the Mexico Automotive Summit 2021 on Mar. 25. The panel, “Human Capital Management and the

Challenges of New Labor Standards,” was moderated by Mónica

Doger, Director General of CLAUZ.

“The changes in the new treaty are aimed at a concept that for most companies in Mexico is difficult. However, for those that have already experienced a trade union environment, it is easier: the democratization of labor relations,” said Luis Monsalvo, Founding Partner at Monsalvo Duclaud, a law firm specialized in labor, employment and social security.

Faced with these changes, companies like Daimler have had to rethink the way they manage human capital. “Our main resource is always human capital. We have handled these changes gradually. During the pandemic, we have reacted in different ways and we are not the only ones who have faced this,” said Marcela Barreiro, HR Director at Daimler. Evelyn Gonzalez, Sales Director of Lavartex, said her company has union delegates at each of its plants, with whom they organize quarterly meetings to establish strategies. “As a supplier to the automotive industry, by having this system in place and complying with these regulations, we are one step ahead in being able to offer certainty to our customers.”

At Scania, a Swedish company that manufactures heavy trucks and buses, the transition has been smooth, said Maite Delgadillo, HR Director of Scania. “The practices required by the new treaty were already in place and we do not have anyone outsourced.” Delgadillo pointed out that one of the characteristics that has allowed the company to move forward is flexibility, agility and change management.

Mental health has also been a concern for companies during these months. “When we started to notice that the pandemic was going to last longer than expected, the first thing we asked ourselves was what was happening to the emotional health of our employees,” said Barreiro. Among the actions Daimler implemented, she said, were forums to communicate directly with everyone in the company so they could feel heard despite the distance. The company also launched online yoga and meditation courses and other activities to take care of employees’ mental state.

Read the complete article

Ripipsa: How to Climb the Supply Chain Ladder

Francisco Santini CEO of Ripipsa

Keys to Becoming a Successful Mexican Tier 2 Supplier

Jessica Madrid CEO and Co-Founder of Laser & Manufacturing

A Cleaner, Easier Way for Auto Industry to Cut Through Steel

Mauricio Torres Director General Aqua Machinery

Bechem: Lubrication Technology Adapting to the New Normal

Claudia Mora Director General of Bechem Lubrication Technology Mexico

Material Technology for Heavy Vehicle Auto Parts

Javier Gómez Plant Manager of Eaton San Luis Potosi

NSK: Supporting Local Suppliers

Javier García Plant Manager of NSK Bearings Manufacturing Mexico

Kayser Automotive Adapting to The Future

Ignacio Sanz Director in Mexico of Kayser Automotive

Pfeiffer Vacuum: Addressing Battery Manufacturing Needs

Daniel Kuchenbecker Global Market Manager Industry of Pfeiffer Vacuum

ABB: Battery Trays Are Transforming Manufacturing Processes

Sergio Bautista Robotics & Discrete Automation Director of ABB México

Blue Yonder: Artificial Intelligence for Demand Forecasting

Sergio Macías Business Consultant for the Automotive Industry at Blue Yonder