Matchmaking

Mexico’s leading B2B conference organizer uses a customized app to deliver an unparalleled experience

The MBE App delivered AI-powered intent-based matchmaking to Mexico Talent Forum 2023 attendees

MBE App Impact

222 participants

850 matchmaking communications

296 1:1 meetings conducted

32 speakers

254 In-person Participants

13 sponsors

9,448 visitors to the conference website

Conference social media impact Pre-conference social media impact

4,076 direct impressions during MMF 177,782 direct pre-conference LinkedIn impressions

19.72% click through rate during MMF 2.62% pre-conference click through rate 10.08% conference engagement rate 4.06% pre-conference engagement rate

Matchmaking intentions

Total

2,009 875 Trading 1,119 Networking

• ABB

• ACD Parts

• Adisa

• Aggreko

• Alamos Gold

• Albaa

• Alberta Mexico Office

• Almaden Minerals

• ALN Abogados

• Alvarez y Alvarez Arquitectura Ingenieria

• Americas Mining Corporation

• AMSAC

• ANZMEX Business Council

• AOSENUMA

• Ardebili Engineering

• Autlán

• BAr MEX

• Bat tery Depot

• Boltronic

• BTB

• Bufete Asali

• Bureau Veritas

• Business France

• Calidra

• Nordic Chamber of Commerce

• CAMIMEX

• CANCHAM

• Carpi WS Mexico

• Ceoestrategos

• Chesapeake Gold Corp

• Chile Mining Foundation

• CICMEX

• CIMMGM

• Citi

• Sonora Mining Cluster

• Coeur Mining

• Colegio de Ingenieros de Minas, Metalurgistas y Geológos de Mexico

• Compañia Minera Cuzcatlan

• Compañia Minera Pangea

• Covia

• Cribor

• C rYOINFr A / G rupo INFr A

• CYPLUS

• DB r

• Delegación General de Québec

• Discovery Silver

• DOPPELMAY r Transport

• Dräger

• D r AVLOSKA

• Dynapower Company

• EC rubio

• Ecodrill

• Embassy of Canada

• Embassy of Chile

• Embellie Advisory

• Empresas Matco

• Empresas Salgado

• Endeavor Silver

• Energex

• Epiroc Mexico

• Equinox Gold

• ESG Solutions

• ETMX

• Explosivos del Istmo

• EY

• FALMET

• FArO

• Fatigue Science

• First Majestic Silver Corp.

• FLSmidth

• Fogmaker International AB

• FO r MIMEX

• Fresnillo

• FUG rO

• Gambusino Prospector de México

• GANAr-GANAr

• Gas Natural del Noroeste

• Gas Natural Industrial

• GCC

• GEOSErVIX

• Government of Sonora

• G r Silver Mining

• G rSL

• Grupo ABSA

• Grupo Askatlan / BTB

• Grupo Construccioned Planificadas

• Grupo Mexico

• Grupo Multisistemas de Seguridad Industrial

• Grupo Prosesa

• Heiras Abogados

• HH Consultores Soluciones Ambientales

• Holland House Mexico

• Hooman

• Huawei Technologies

• Iberdrola

• ICA Fluor

• Identec Solutions

• Insuco Colombia

• International Business Solutions

• International Consulting Bconnect

• Janus Group

• J rC Mining and Construction

• Just refiners

• Kepler Constructora

• Kiewit

• Knight Piésold Consulting

• KPMG

• Luca Mining

• M3

• MacLean

• Madisa

• MAG Silver Corp.

• Marsh Corporate

• McEwen Mining

• METSO

• Minera Camargo

• Minera C amino rojo

• Minera Media Luna

• Minesense technologies

• Minova

• MK Metal Trading Mexico

• Molina, Hanff & Pérez-Howlet

• MOLY- COP MEXICO

• Monarc a Minerals

• Moodys

• Mujeres WIM México

• NewFields Servicios de México

• NOKIA

• OCA Global

• Oficina Comercial del Perú en México

• Ontario Office of Investment

• ONU-UNECE

• Orgullo Minero

• Orion Productos Industriales

• O rla Mining

• Paterson & Cooke USA

• Peñoles

• Pontones y Ledesma

• PPG Industries

• Prima

• Pro Chile

• PrOESMMA

• radar Minero

• rama Mantenimiento Industrial

• r EMPSA

• rerrocarril Mexicano

• riverside resources

• Sapuchi Minera

• SErCOM

• Servicios Legales Mineros

• SGS

• Siemens Energy

• SIK A MEXICANA

• SINDA Minería responsable y sostenible

• SLIM STOCK

• SOLENSA

• Solum Consulting Group

• Speakap

• Stantec

• State Goverment of Guerrero

• State Government of Chihuahua

• State Government of Sonora

• State Government of Zacatecas

• TAK r AF

• TBC&SK Ciberseguridad

• TBSEK

• Techint

• Thomson reuters

• Torex Gold

• Trafigura

• Trousselle Asociadas

• Victaulic

• Vinton Ball LLC

• Vizsla Silver Corp.

• Wesco Anixter

• Wood Mackenzie

• Worley Engineering de Mexico

• WSP

• WTS Energy

WEDNESDAY, SE PTEMBER 04

09:00 CHARTING NEW HORIZONS: THE MEXICAN MINING INDUSTRY’S VISION FOR THE FUTURE

Speaker: Pedro Rivero, CAMIMEX

09:15 TOWARDS THE NEW MINING

Moderator: Karen Flores, CAMIMEX

Panelists: Luis Chavez, Alamos Gold

Faysal Rodríguez, Torex Gold

Octavio Alvídrez, Fresnilllo PLC

Fernando Alanís, Independent Consultant

10:15 MEXICO MINING POLICY FRAMEWORK ASSESSMENT AND LEGAL OUTLOOK

Moderator: Pablo Méndez, EC rubio

Panelists: Joel González, ALN Abogados

Andrés Pérez Howlet, Molina, Hanff & Pérez-Howlet

José Jabalera, Discovery Silver

11:00 NEW DEVELOPMENTS IN MINING: PLOMOSAS PROJECT, SINALOA

Speaker: Marcio Fonseca, Gr Silver Mining

12:00 SAFETY AND PREVENTION IN THE MINING INDUSTRY

Speaker: Javier Robles, Grupo Multisistemas de Seguridad Industrial

12:15 ENHANCING MINING SUPPLY CHAIN DYNAMICS

Moderator: Hernando Rueda, Vizsla Silver Corp.

Panelists: Alejandro Hernández, ACD Group

René Valle, MacLean

Diego Torroella, TAKrAF Mexico

13:00 HOW TO FACE ENERGY CHALLENGES IN MINING WITH HYBRID TECHNOLOGIES

Speaker: Mariano Souto, Aggreko

13:15 WOMEN LEADERSHIP IN THE MEXICAN MINING INDUSTRY

Speaker: Olivia Segura, KPMG Mexico

13:30 ESG CHALLENGES AND OPPORTUNITIES: ENERGY, SUSTAINABILITY AND CLIMATE CHANGE

Moderator: Alicia Moreno, KPMG Mexico

Panelists: Cornelio Delgado, Orla Mining

Ulises Neri, ONU-UNECE

Salomón Amkie, Citi

Leopoldo Rodríguez, Peñoles

15:30 OPPORTUNITIES FOR MEXICO-CHILE MINING COLLABORATION

Speaker: Francisco Lecaros, Chile Mining Foundation

15:45 CYBER RESILIENCE IN MINING: SAFEGUARDING OPERATIONS AMIDST DIGITAL THREATS

Moderator: Marcos Lopes, EY

Panelists: David Tintor, TBSEK

Alexandro Fernandez, Intelligent Networks

16:15 MEXICO’S MINING HUBS: NEW PRIORITIES AND AMBITIONS

Moderator: Alfredo Phillips, Independent Board Member

Panelists: Rodrigo Castañeda, Government of Zacatecas

Rocío Flores, State Government of Chihuahua

Margarita Vélez, State Government of Sonora

Teodora Ramírez, State Government of Guerrero

CHARTING NEW HORIZONS: MINING INDUSTRY’S VISION FOR THE FUTURE

r egulatory changes and ESG trends are impacting all industries, mining included. In this context, Pedro r ivero, President, CAMIMEX, considers it crucial for the mining industry to strengthen its efforts to promote knowledge and education about mining activities and the ways in which they have evolved to meet sustainability and ESG standards, as well as their role in society and the Mexican economy.

The target of maintaining the global temperature increase at 1.5°C requires cutting emissions by 42%, according to rivero, which means that the country relies on technologies that in turn depend on mining activities. Electric vehicles (EVs), green hydrogen, upgrades to electrical grids, and the development of renewable energies, are all among the main strategies to reduce emissions, and all these supply chains heavily depend on critical minerals, many of which are mined in Mexico.

The trend toward electrification and cleaner energy consumption places the Mexican mining industry in a critical position, as it seeks to support the North American bloc with reliable raw material supply chains. “Mining constitutes a strategic link in North America’s trade and production chains,” explains rivero.

“There needs to be a common base of education and knowledge on which informed and appropriate regulation can be created to contribute to the country’s development”

Pedro Rivero President | CAMIMEX

climate change,” reiterates r ivero. He further explains that mining is essential for 70 different sectors, including automotive, pharmaceuticals, electricity, construction, and energy, among others.

rivero points out that, contrary to common belief, minerals extracted in Mexico are not exclusively exported but are also used within the country, something crucial for the development of various domestic supply chains. Companies with production in Mexico, like Ford, GM, and Chrysler, consume minerals mined in Mexico, as do stateowned companies like CFE and PEMEX. In this process, sustainability is paramount. “To support North America in its energy transition and in reducing the impacts of climate change, CAMIMEX-affiliated companies pursue continuous improvement, always promoting sustainability in their operations,” says rivero.

Mining adheres to good ESG practices and operates under what is known as the three Ps of mining: social performance, economic performance, and environmental performance. Thanks to this approach, Mexico has secured its place among the Top 10 producers of 16 metals and minerals globally. It generates an economic spillover (through salaries, national purchases, and services) of MX$219.7 billion (US$11.052 billion) annually, largely benefiting national SMEs. It is one of the Top 5 industries contributing to industrial GDP, with 8.63%, and 2.75% of national GDP in 2023. Additionally, in terms of social development, 91% of communities close to mining sites have a medium to high level of social development.

Among the minerals that Mexico extracts, the most important for the energy transition include copper, zinc, silver, and, soon, lithium. “Mining is a fundamental ally in the energy transition and the fight against

While the industry is continuously seeking to grow, rivero explains that the country’s concessioned area represents 6.86% of the national territory, with only 0.08% occupied by mining operations. Furthermore, the mining operations of CAMIMEX-affiliated companies derive 38% of their total energy consumption from clean sources. According to CONAGUA, the volume of water allocated to CAMIMEX

members is equivalent to 0.27% of the national total. About 70% of the water comes from treated and recirculated wastewater, with 100 water treatment plants in 16 states across the country.

While there is still great mining potential that can add value through nearshoring, rivero

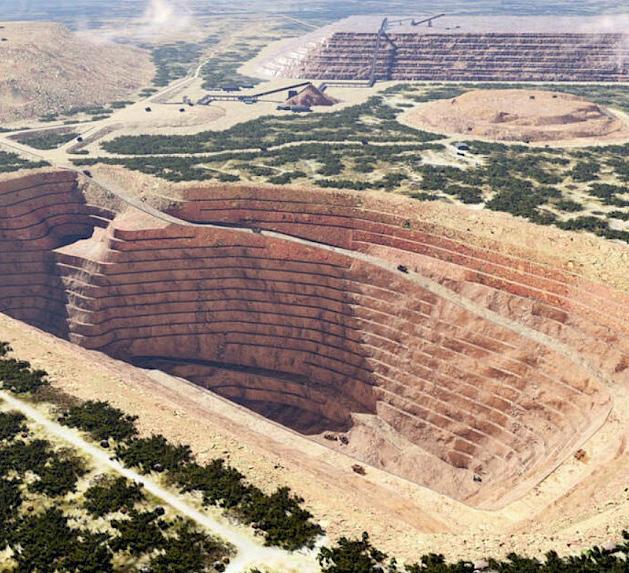

TOWARDS THE NEW MINING

Throughout López Obrador’s administration, the mining sector has faced significant challenges. Among these are the 2023 reform of the Mining Law and the recent proposal to ban open-pit mining. Additionally, issues of insecurity and rule of law are critical factors that influence decisions regarding mining investments. The challenges for companies and the industry at large are how to navigate these complexities and how to secure mining’s position as a key industry for Mexico’s future, agree experts.

“The main problem we face is more ideological than political and, unfortunately, this happens just when the expectations for mining are excellent. There is an urgent need for metals to work toward combating climate change. We are in the best moment for mining; we have a mining country with a mining vocation, but this is countered by the politicians we have. Ideology has prevailed, there is a profound lack of understanding of the mining sector, and anti-mining groups have influenced the spread of false, incorrect, and unfounded information, flooding the discourse with misleading messages. A significant challenge is how to better

considers it important for the mining industry to continue communicating its activities and their adherence to best practices. “There needs to be a common base of education and knowledge on which informed and appropriate regulation can be created to contribute to the country’s development,” he states.

communicate everything we do, find a way to neutralize that ideology, and more effectively convey the economic and social value of the sector,” says Fernando Alanís.

In this context, Karen Flores, Director General, CAMIMEX, explains the importance of communication bridges for any industrial sector, especially mining, as it supplies 70 productive sectors and reaches remote communities. The sector’s potential must be harnessed to turn it into development opportunities for the country, Flores says.

According to the Fraser Institute’s 2023 Mining Survey, Mexico ranked 74th out of 86 mining jurisdictions evaluated on their level of investment attractiveness. The country dropped from the 37th position in 2022, reflecting the negative outlook from foreign investors. Among key concerns cited in Fraser’s survey are infrastructure, uncertainty regarding protected areas, and regulatory duplication. regarding the survey, Alanís highlights four major areas: rule of law, mining potential, infrastructure, and security as the biggest challenges the mining sector faces today.

“ r ule of law is something that causes significant problems. Mining is a long-term vision, and when the rules change, it creates uncertainty. Strict application of the law is critical, but conditions have changed significantly, generating a lot of doubt. This is one of the main issues that makes people hesitant. Security is also a major concern, especially since we operate in remote, vulnerable areas. With a real tax rate of 5253%, we also have to factor in the costs of security, finding ways to deter and avoid

becoming victims. These issues are heavily impacting investment,” states Alanís.

Octavio Alvídrez, CEO, Fresnillo, highlights geological potential but says this must be realized through investment that transforms the profile of both the region and the community where we operate. “Economic growth is essential for the country, and we have seen how mining contributes to this growth, especially in regions where it is the only viable option for economic development. We bring health, infrastructure, education, and training to our human talent base, enhancing the business capabilities of the communities around our operations. This alignment is beneficial for both the mining companies and any public administration,” he says. Beyond that, Alvídrez underscores mining’s essential role in electromobility, the energy transition, and maintaining the standard of living for present and future societies.

As the future of the Mining Law reform and the proposal to ban open-pit mining remains uncertain, the mining industry has expressed its intention to build bridges and establish communication channels with society and the incoming administration of Claudia Sheinbaum, who is perceived as more open to dialogue. The sector aims to share technical and science-based knowledge to help formulate public policies that benefit both sustainable mining and the national economy. “Our goal now should be to engage with a leftist government whose priority is not the mining industry. We need to find a way to fit into that leftist narrative,” highlights Faysal rodríguez, Senior Vice President, Torex Gold.

Luis Chávez, Senior Vice President Mexico, Alamos Gold, considers communication essential to ensure all parties understand that mining operations are regulated fairly and treated equally. “Every mining operation is different, with unique characteristics based on location and surrounding communities. The government must understand that it is not a general mining sector but specific sub-sectors that require different types of support.”

“We must continue finding ways, being empathetic with the government, to insert the positive narratives and impacts of the mining industry into the broader conversation. This is the challenge for everyone involved in the industry—to transform the economic narrative into a social one to make a connection,” comments rodríguez.”

rodríguez also showcases the importance of the upcoming renegotiation of the USMCA and how it is often viewed from a Mexican perspective, but it is crucial to consider it within the broader framework of the treaty itself. “It is important to work with representatives from the United States and Canada, going beyond borders to seek their support in this matter, for the benefit of shareholders and investors. There are points of alignment—there are things we can accomplish with this government by viewing it from different angles, particularly understanding how a leftist government perceives the mining industry. We need to start reaching agreements,” shared rodríguez.

Despite the challenges, the mining industry has shown remarkable resilience, with Foreign Direct Investment (FDI) in the sector rising by 329% in 1H24, compared to nearly US$700 million in 1H23. Mining now accounts for 10% of total FDI, with preliminary figures indicating at least US$3 billion in investments. The sector is currently the third biggest contributor to FDI, only behind manufacturing and financial services.

“There is a strong possibility of a more productive mining sector in the coming years. The end of a cycle always sees an upward shift, and both the public and private sectors are aligned. The public sector requires resources and investment for infrastructure projects and social programs, while the private sector is ready to invest. What remains is for us to sit down and negotiate. If both sides want the same thing, we just need to find the right conditions, restoring confidence and creating a new economic engine,” mentions Chávez.

MEXICO MINING POLICY FRAMEWORK ASSESSMENT AND LEG AL OUTLOOK

During President López Obrador’s administration, the sector has been mired in uncertainty, primarily due to the Mining Law and the advancing open-pit mining ban reform. Despite some established legal protections, experts emphasize that uncertainty will persist. To address this, they point out that the sector must ensure expert opinions are included in the reforms’ debate. Furthermore, a compelling message that resonates with both the public and the federal government is paramount, rather than letting the message remain confined to the mining sector.

In 2023, the Mining Law reform was approved, which proposes to reduce the duration of mining concessions from a maximum of 100 to 80 years. The text also establishes that exploration is reserved for the State through the Mexican Geological Survey (SGM) or through assignments to entities of the federal public administration. However, no clear guidelines have been established for its enforcement. José Jabalera, Vice President of Sustainability, Discovery Silver, highlights that this has significantly contributed to a new wave of uncertainty for companies. “The reform altered our reality, but it did not provide clear guidelines. These legal gaps hindered our progress. While we understand the importance of adhering to new norms, we cannot do so without knowing how to comply.”

According to CAMIMEX, the proposed reform, currently suspended by the Supreme Court (SCJN), is unviable as exploration demands significant investment and expertise, often taking years with no guarantee of success. This makes it impractical to allocate public funds for such activities. Additionally, experts argue that shortening concession durations reflects a lack of understanding of the longterm nature of mining projects, which would discourage site development.

In addition to the Mining Law, a proposal to ban open-pit mining was presented by President López Obrador on Feb. 5, 2024, further increasing the sector’s risk. Pablo Mendez, Mining Partner, EC r ubio, notes that while the sector was becoming familiar with the Mining Law, the proposal to ban open-pit mining has reignited uncertainty. “We were previously confident that the unconstitutionality of the Mining Law would be declared. However, the open-pit mining proposal signals interesting times ahead, compelling us to rethink our strategies and determine how to defend ourselves.” Mendez emphasizes that the industry must wait until 2025 to understand the sector’s future under a new government. In the meantime, legal tools should be utilized for protection.

Jabalera notes that the government’s aim to propose new regulations is not necessarily negative, as these regulations address previously overlooked issues such

as mine closures and water management. However, without complete information, these proposals may not be the best for companies, communities, or the country as a whole. “reforms are needed, but instead of being reactive, let us be proactive. We should inform the government about what is needed and propose the changes ourselves. Otherwise, outsiders will set the rules. While it is important to consider diverse perspectives, we must prioritize the most knowledgeable ones.”

Experts recommend enhancing communication, emphasizing the need to inform both government officials and the general public about how mining is modern and responsible. While the next administration is expected to be more flexible and open to dialogue, it is crucial to know how to deliver a stronger message. Joel González, Senior Partner, ALN Abogados, points out that while industry insiders understand the message, “if the average person searches online for the impact of mining, only the negative aspects

come up. There is still a significant need to communicate beyond people within the mining sector. We need to engage with the broader audience.”

Andrés Pérez-Howlet, Partner, Molina, Hanff & Pérez-Howlet, notes that concerns about new regulations should also be addressed within the sector, as many fear expropriations. However, he clarified that these proposals should not be retroactive, meaning companies with existing permits are protected by current law.

Pérez-Howlet highlights that a new challenge the sector must consider is the judicial reform, which aims to elect ministers and judges by direct vote. This could result in decisions influenced by ideology rather than law. “Since judges and magistrates handle industry cases, there is a risk of biased rulings. Therefore, we must protect ourselves as much as possible. If national institutions fall short, we should also explore international avenues for protection.”

NEW DEVELOPMENTS IN MINING: PLOMOSAS PROJEC T, SINALOA

G r Silver Mining is advancing its mining initiatives in the r osario Mining District in Sinaloa, focusing on the Plomosas and San Marcial mines. The project promises to yield high-grades at low development costs. Furthermore, while the mining industry deals with important regulatory challenges, the Plomosas district highlights the great opportunities and development that further mining exploration can bring to Mexican localities.

“We have made alliances with local suppliers. We think that they should be included since the industry’s benefits span from infrastructure construction to job creation.”

Marcio Fonseca President and COO | GR Silver Mining LTD.

Marcio Fonseca, President and COO, G r Silver Mining, explains that this project was often overlooked, and it came with its own challenges, but the company was able to adapt and commit to find valuable resources in the San Marcial mines. The company also faced the uncertainty and volatility currently reigning in the industry. Yet, Fonseca says Mexico has great potential; the challenge is to publicize Mexico’s opportunities and share more information on mining activities and ESG efforts. “Mexico is in a tough position and investors do not see the country’s potential due to uncertainty. But, there are many benefits to continuing developing this industry in Mexico,” he adds.

Gr Silver holds 78km2 of concessions and is leveraging its extensive experience in Mexico to identify high-grade silver deposits and expand its mining operations. The Plomosas project, located in the Sierra Madre Occidental, is central to Gr Silver’s strategy.

The project includes the Plomosas and San Juan mines, both undergoing revaluation for the potential restart of mining activities at a low cost.

Fonseca underscores Gr Silver Mining’s disposition to train and develop Mexican talent to explore opportunities like these projects. “From the beginning, Gr has made alliances to develop local talent, and our group is 100 percent Mexican,” he mentions. “We have made alliances with local suppliers. We think that they should be included since the industry’s benefits span from infrastructure construction to job creation.”

Gr Silver aims to expand mineral resources through modern exploration techniques and partnerships with established mining operators in Mexico. The San Marcial project is

being evaluated for its potential as a highly profitable underground silver mine. From 2019 to 2023, the mineralized zone in the southeast area of San Marcial expanded threefold, marking a significant discovery. This expansion was driven by thorough geological investigation and the identification of a new geological system. The project is now recognized for its high-grade silver deposit, which exhibits favorable geometry

for the development of a highly productive underground mine, with the potential for both lateral and depth expansion.

Gr Silver emphasizes minimal environmental impact during exploration and adherence to Mexican and international regulations. The project also includes collaboration with local communities, focusing on employment, training, and regional development. According to Fonseca, the Plomosas mine features modern infrastructure, which is expected to support the restart of operations with minimal investment and low implementation risk. The project has existing licenses and permits for underground mining, and the company has a predominantly Mexican team integrated into the local communities.

As part of its long-term strategy, Gr Silver plans to continue expanding its resource base and forging strategic alliances to consolidate its mining business in Sinaloa. The company’s ongoing efforts are expected to contribute significantly to the economic growth of southern Sinaloa and Mexico as a whole. “Mining has a bigger impact than is generally believed, especially when we understand how to navigate challenging circumstances, which is what we have had to do in the current context,” says Fonseca.

SAFETY AND PREVENTION IN THE MININ G INDUSTRY

Insecurity remains a significant concern for the mining industry in Mexico, with theft, kidnapping, extortion, and protection payments posing daily challenges. While facing the situation may be challenging, reporting incidents to the authorities, investing in security and effectively using technology are all key to address this, says Javier r obles, Country Manager, Grupo Multisistemas de Seguridad Industrial.

The mining sector covers a large part of the country and is present in regions with high incidences of homicides, extortion, trafficking, and cartel presence. “The expansion of organized crime and the increase in armed violence have a significant impact on supply chains and production in various sectors, including mining. Mexico is now ranked as the fourth most dangerous country in Latin America for conducting these activities,” robles mentions.

CAMIMEX reports that criminal attacks on mining companies result in operating cost increases of over 20%. This figure could rise further when factoring in continuous training and the increased employment of security guards. According to AIMMGM, some mining companies have to pay off criminal gangs, resulting in a 3% increase in the final costs of minerals. In some cases, companies seeking help from authorities are advised to negotiate directly with organized crime, says robles. “It is crucial to file reports. Unfortunately, in Mexico, this is often seen as a waste of time.

However, the more reports there are, the higher the chance that authorities will take action,” he states.

Numerous cases showcase how organized crime affects mining operations, highlighting the critical need for government involvement.

r obles emphasizes the need for the incoming president Claudia Sheinbaum’s to invest in improving the country’s security system. In this regard, r obles sees Omar García Harfuch’s appointment as the new Minister of Citizen Protection with optimism due to his notable technical expertise in security matters.

While r obles mentions that while some mining companies, in an effort to maintain their operations running, have negotiated

terms with organized crime, this must cease. Instead, it is crucial to report these issues to the appropriate authorities and to present as much evidence as possible.

robles also notes that to effectively evaluate security solutions in the mining sector, it is necessary to review the regulatory compliance of security companies, ensuring they are properly registered with r EPSE. Additionally, a thorough risk assessment is essential to inform the client about the likelihood of specific threats. Finally, technology is also paramount to address security issues. “Companies may be investing a lot in security systems and contracting service providers. However, if no one is using these systems, then all that investment is for naught,” he adds.

ENHANCING MINING SUPPLY CHAI N DYNAMICS

Over the past four years, the reconfiguration of supply chains has highlighted the need to enhance production processes and incorporate technology to optimize operations and efficiency within the mining supply chain. However, this advancement has also brought certain challenges, such as a lack of communication among stakeholders and uncertainty in the mining sector.

Alejandro Hernández, CEO, ACD Group, points out that the COVID-19 pandemic was a turning point for supply chain issues.

“To this day, supply chains have not been fully restored. Some chains are still not fully operational,” explains Hernández.

Although Mexico offers significant opportunities to expand supply chains due to its diversification in trade agreements, there are regulatory limitations that hinder the optimal exploitation of these resources.

“regulatory changes, such as tariff increases coming from Asia, are secondary issues that need to be resolved for the supply chain. Free trade agreements—not just USMCA, but also with Europe, Brazil, and Chile, which are mining powerhouses—still face challenges because many of the products and equipment required come from Asia, where regulations and supply chain limitations cause delays,” adds Hernández.

r ené Valle, Director General, MacLean Engineering, highlights that customs issues and the involvement of armed forces often present legal challenges, with “the law being full of loopholes and open to interpretation.”

“Until these things are fundamentally changed and there is certainty about how the rules work, nothing will improve. In terms of importation, it is unbelievable to see how something can be imported with a specific tariff code at one border and completely differently at another,” he says.

Amid these changes, companies have had to be resilient and adaptable. Diego Torroella, Director General, Takraf, mentions that companies have had to adapt as the entire logistics landscape has changed.

“Time is becoming a significant concern, and adaptability is crucial. Constant communication with suppliers is essential. Often, communication gaps can significantly impact us. It is a major challenge to maintain strong communication with both the corporate office and the mine. Adaptability is the key word when working with mining clients.”

While regulatory challenges may present obstacles for certain sub-sectors within the mining industry, suppliers must adapt to changing conditions and offer effective aftersales services. r ené Valle, Director General, MacLean Engineering,

emphasizes the importance of automation and digitalization. “How far we can go with automation and digitalization depends on the access we are given. Today, with the information and data generated by the equipment, we can achieve any objective set by the client. But it is pointless to generate a world of information if there is no one to monitor it, no direction for decision-making based on the evaluation of that data, and no long-term plan. There needs to be a strategy based on the data to determine the adequacy of what the provider delivers,” he explains.

regarding investment, Hernández asserts that there is still a lot to be done in technology, security, and the necessary infrastructure. “In Sonora, regulatory issues regarding lithium have not been well defined, and the roads to get there are challenging. Infrastructure investment is crucial. As a country, we are not investing enough at the human, technical, and technological levels, and these shortcomings are evident.”

The recruitment of new personnel and attracting younger generations to the mining industry is also a challenge. Hernández notes that young people are not interested in the mining sector. Companies need to rethink how to attract talent, banking on what interests new hires. “The critical factor is finding the right people. The most important challenge is how to attract them, understanding their value, and involving the communities and mining companies. We need to create a comprehensive plan because, in the long run, we may face significant problems.”

To address these challenges and seize emerging opportunities, Hernando rueda, Director of Mexico, Vizsla Silver Corp, recommends improving communication between mining companies and their entire ecosystem, acting as business partners. “It is essential to link with suppliers and the educational sector and establish these kinds of connections to have a broader portfolio. Collaboration with clusters is crucial for training, and we should fully utilize the clusters by leveraging available technologies,” says rueda.

HOW TO FACE ENERGY CHALLENGES IN MINING WITH HYBRID TE CHNOLOGIES

As mining companies seek increased efficiency and a lower environmental impact, they are faced with growing challenges when embracing hybrid energy technologies. With the right support, however, mining companies can rapidly transition to alternative fuels, achieving significant cost savings and moving closer to their goal of zero emissions, says Mariano Souto, Director General, Aggreko.

The challenges mining companies face when using hybrid technologies include access to energy, maintaining a stable energy supply, high investment and operating costs, resource price fluctuations, flexibility to meet energy demands at various stages of a mine’s lifecycle, and reducing carbon footprints. Aggreko, a company with global and local expertise that operates 10GW of capacity across 80 countries, has become a key partner in addressing these challenges, offering expertise in determining fuel lifecycles and roadmaps, and providing a comprehensive fuel evolution plan throughout the contract, with the flexibility to adjust fuel types as needed.

“We face many challenges because there are numerous factors to consider for a project to be viable. There are many variables in which we must generate a transition, and we are responsible for this. We have to work with transition solutions”

Mariano Souto Director General | Aggreko

“We face many challenges because there are numerous factors to consider for a project to be viable. There are many variables in which we must generate a transition, and we are responsible for this. We have to work with transition solutions,” he explains. In this sense, Aggreko adapts to what the client needs and has, while also seeking solutions that are sustainable both economically and environmentally, and that truly make sense during the transition. Improving efficiency, perhaps using diesel in some cases, is part of what the transition entails.

“At Aggreko, we have had to do a lot of work in education and outreach. It is often thought that deploying solar energy is simple and that is not the case, as it is not always available. We need hybrid operations to ensure a stable supply, capable of supporting mining operations,” says Souto.

Aggreko’s roadmap to energy transition, before reaching renewables, typically involves:

+ Diesel/HFO: The quickest and easiest fuel to use for short-term projects or as a temporary solution while securing an alternative fuel supply.

+ Dual Fuel: If gas is intermittently available, Aggreko can implement an ADDGAS dual-fuel solution, which blends diesel with gas.

+ LPG: The next step, involving LPG via a virtual pipeline.

+ Natural Gas: As supply chains expand and gas becomes more readily available (such as LNG or CNG), companies can transition to gas usage.

Souto explains that the road to the energy transition requires understanding Mexico’s unique position. As a result, Aggreko remains “agnostic” to different technologies, recognizing that when implementing energy solutions, especially for mining operations, Mexico must adopt technologies that best suit its needs.

Once renewables can be adopted, Aggreko recommends a hybrid solar-battery-thermal solution, which offers an optimal energy mix for the lowest cost of electricity without compromising reliability. Key benefits include 24-hour reliable energy, zero emissions, and enhanced grid stability. One of the advantages of integrating distributed solar or wind energy into a simplified energy network

is the unique hybrid contract term of five to 10 years, which is shorter than typical solar IPP contracts. This approach also enables high renewable energy penetration, advancing the mining sector toward net-zero emissions.

Aggreko’s success stories include Gold Fields’ Salares Norte Mine in Chile, BTr Copper Mine

in Indonesia, r esolute Mining in Mali, and another project with Gold Fields in Australia. At the Salares Norte Mine, the company achieved significant results, including a US$15 million cost reduction in energy, a reduction of 105,000t of emissions, US$500,000 saved in carbon taxes, and the implementation of 7.7MW of solar power.

WOMEN LEADERSHIP IN THE MEXICAN MININ G INDUSTRY

The need for change in how the mining sector approaches talent management is becoming increasingly evident. As the industry seeks to attract, retain, and develop the talent it requires, there is a growing focus on fostering an inclusive environment that supports women at all levels of the organizations, states Olivia Segura, Partner Advisory, People & Change, KPMG Mexico.

Addressing gender gaps in the mining sector, which is predominantly male-dominated is an important task for all stakeholders. These gaps, along with the absence of inclusive policies, have hindered the effective inclusion of female talent, particularly in leadership roles.

Female representation in mining companies is crucial for developing policies and processes that cater to a diverse workforce. The absence of equity standards poses risks for companies, including potential reputational and financial impacts. According to a KPMG’s 2023 survey, 61% of women in the mining industry are motivated by the potential for professional growth and skill development, while 45% are driven by the belief that their work can make the sector more competitive

and pave the way for other women to enter the industry. Similarly, over 41% of them are motivated because they feel they can be a role model and pave the way for younger generations. KPMG’s 2024 survey found that 64% of women in managerial positions believe that participating in high-impact and visible company initiatives is crucial for keeping female leaders motivated. Additionally, 45% of respondents in the 2024 survey highlighted the ambition for professional growth and the development of new skills as another key motivating factor.

Mentorship programs were highlighted as a key strategy to support women in building confidence and developing professional networks. The presentation also emphasized the importance of flexible work arrangements to help women balance personal and professional responsibilities. Almost 54% of respondents identified defined career and succession plans for key positions as crucial for advancing to leadership roles, while 49% stressed the need for an inclusive corporate culture with clear diversity and equity indicators. Leadership support for worklife integration and targeted mentorship programs for women were also recognized

as essential by 41% and 38% of respondents, respectively.

The current uncertain environment has had significant impacts on women’s professional development, however. While 52% have become more resilient through improved skills, and 44% have advanced by taking on greater responsibilities, 25% have experienced instability in their positions and reduced income. To navigate these

“These challenges highlight the lack of a culture of camaraderie, which, as we have seen in leading industries and companies worldwide, is what makes a difference in business outcomes”

Olivia Segura Partner Advisory, People & Change | KPMG Mexico

challenges, women rely on key strengths: 66% emphasize adaptability and resilience, 49% value teamwork, 32% focus on emotional intelligence, and 31% highlight decisionmaking abilities. “(Women in mining) have turned something perceived as a drawback in other sectors into a driving force for mining companies,” says Segura, referring to challenges such as the COVID-19 pandemic.

Segura noted that the perception of female participation has increased, as over 88% of surveyed women consider female participation in mining has increased, while 11% consider the proportion remained unchanged, and only 1% of them consider it has decreased. “We now see more women in operations, more women in the sector overall, including in administrative positions, where we have traditionally found the most women,” Segura added.

Segura considers the mining industry has positively performed in formulating the right policies to foster women’s participation. According to KPMG’s survey, 79% of surveyed women acknowledged that their companies have inclusion metrics, though these metrics need refinement. Another 16% believe their

companies lack these metrics but have plans to implement them, while 5% report that there are no metrics or plans to introduce them.

Segura emphasized the importance of breaking paradigms to increase female participation in the mining industry, retain talent, and maintain a positive perception among investors. She highlighted the need for flexible work arrangements that allow women to balance their professional and personal lives, which is essential for fostering a more inclusive and supportive environment in the sector.

KPMG’s survey also identified several barriers that hinder women from reaching highmanagement positions. The most frequently cited barrier, reported by 69% of respondents, is discrimination based on stereotypes, unconscious biases, or microaggressions. Other significant obstacles include workplace harassment and bullying (36%), burnout (33%), and self-limitation due to a lack of selfesteem and confidence (31%). Additionally, 31% of respondents pointed to the lack of gender-sensitive policies during critical moments such as maternity or paternity. Other challenges include a culture of extreme competition (18%) and a lack of openness to collaboration from other senior management members (18%).

Finally, KPMG’s survey noted the main challenges for women to remain in highmanagement positions. The most significant challenge, identified by 51% of respondents, is a lack of openness to collaboration from other senior management members. Other major challenges include burnout (49%), a culture of extreme competition (36%), and a lack of alignment between job expectations and team performance (36%). Additionally, 33% of respondents pointed to the absence of gender-sensitive policies during critical moments such as maternity or paternity, among other issues. “These challenges highlight the lack of a culture of camaraderie, which, as we have seen in leading industries and companies worldwide, is what makes a difference in business outcomes,” Segura concluded.

ESG CHALLENGES, OPPORTUNITIES: SUSTAINABILITY AND CLIM ATE CHANGE

ESG efforts have become a priority for many mining companies. Experts emphasize that companies that diversify their strategies and adapt to the evolving landscape will remain the most competitive. Yet, there are still challenges to address toward truly embracing ESG standards, merely beyond emissions reduction, according to mining industry experts.

“Emphasis should be placed on comprehensive environmental, social, and governance strategies, not solely on decarbonization and the reduction of greenhouse gas emissions,” said Alicia Moreno, Environmental, Social & Governance Strategy Director, KPMG Mexico. Because of this, the United Nations is seeking to ensure fairness in the responsibilities assigned to each actor, according to Ulises Neri, Vice Chair Mexico - Expert Group on resource Management, ONU-UNECE.

Leopoldo r odríguez, Head of Energy at Peñoles, mentions that one way to address this challenge is to understand where interactions occur and in which areas the most significant impact can be made. Therefore, it is crucial to develop a decarbonization roadmap to identify where most emissions are generated. Additionally, r odríguez highlights the importance of energy supply in mining projects, emphasizing the value of using renewable energy to reduce emissions.

Mexico is currently responsible for 0.5% of global emissions, and only 1% of that percentage comes from the mining sector. regardless of the percentage, ESG considerations are increasingly integrated into mining strategies, decision-making, projects, and reporting. These continue to pose significant challenges to the industry, as poorly executed ESG strategies could result in underinvestment and even the closure of operations. Key ESG concerns for investors include water management, decarbonization, green production, emissions reduction, and diversity.

According to experts, Mexico is lagging in ESG matters due to years of legal uncertainty, with companies still not investing as much in this area as in other countries, states Salomón Amkie, Director and Head LatAm Metals & Mining Banking at Citi. Yet, Cornelio Delgado, Director of Sustainability at Orla Mining, mentions that the current tools offered by the market, such as emission taxes, are a wakeup call to respect decarbonization processes.

Social engagement is another matter of concern regarding ESG efforts. Neri mentions that, on many occasions, social impact assessments are presented that, although well-crafted, do not truly reflect the community’s needs. To adequately understand the community, it is necessary to conduct a social impact assessment accompanied by consultations and an indepth analysis of data from INEGI and CONEVAL. This would allow for a better understanding of what sustainability means, as well as the development of indicators and key elements in the decarbonization roadmap.

Water management has gained additional importance due to a new reform proposal that seeks to ban water concessions in areas with low water availability and prioritize water use for personal and domestic consumption. CONAGUA data shows that 76% of Mexico’s water is allocated to agriculture, 14% to public supply, 5% to the energy sector, and 5% to the

industrial sector. The water used by CAMIMEX affiliates accounts for just 0.27% of the nation’s total water volume. Yet, regulations are limiting its use for mining further.

Amkie mentions that, although Mexico has abundant resources for renewable energy, water is scarce, as there is a lack of treatment plants and water infrastructure. While many projects have been promoted in the energy sector with private investment, there has been significant lag in water management over the years. It is not a well-developed sector, and he believes there is a huge gap to properly address its shortage. Delgado mentions that a strategy used by mining companies is to talk to the communities and understand the sustainability methods they use so as not to exclude them from decarbonization processes. “If we have water but the community does not, it creates an imbalance that hinders mining companies from operating effectively,” he states.

The mining industry in Mexico, despite being one of the most socially and environmentally engaged sectors, also faces a significant challenge: it struggles to communicate its

commitment to responsibility to the general public and government. Experts note a critical need to close these communication gaps, especially as anti-mining narratives, which can sometimes spread misinformation, have a broader platform for dissemination.

“If we do not tell our story, our story will be told by others. It is very important for all mining companies, and those that are part of the sector, to share what mining is from this side. The more miners who tell this story, the more likely it is that the public will change its perspective,” said Carmen Gardier, Senior Director of Digital Marketing Capacity for Latin America, LLYC, in an interview with MBN.

OPPORTUNITIES FOR MEXICO-CHILE MINING COL LABORATION

In an era of increasing globalization and environmental challenges, mining remains a cornerstone of both Chilean and Mexican economies. Francisco Lecaros, President, Chilean Mining Foundation, highlights the deep interconnection between the two countries, emphasizing the importance of sharing knowledge and strategies to address common challenges and seize joint opportunities in the mining sector.

Chile stands out as the world’s leading copper producer and holds 52% of global lithium reserves. The country also stands out in lithium production, surpassed by Australia, and gold and silver, trailing Peru. Mining accounts for 12% of Chile’s GDP, with its real impact rising to 20% when considering associated productive sectors.

In the past five years, mining has attracted an average of 36% of foreign investment in

Chile, with significant contributions from the United States, Australia, China, and Canada. Chile’s exploration budget is substantial, with US$396.6 million allocated for copper, US$150.7 million for gold, US$24.6 million for lithium, and US$10.1 million for other metals. The country represents 5% of global metal exploration.

Chile also leads in exploration investment per unit area, with US$762 per km2, compared to Mexico’s US$310 per km2. The Chilean mining sector directly employs around 34,000 people annually, and with future projects and environmental evaluation (SEA), this number is expected to increase significantly by 2030.

Chile is committed to a sustainable future in mining. By 2030, it is estimated that 90% of the electricity used in mining will come from renewable sources, with a goal of reaching 100% by 2050, possibly even

earlier due to ongoing investments in solar and other renewable energy projects. The current energy project portfolio in Chile totals US$16.967 billion, with 140 projects under evaluation.

“Regarding the reform that bans open-pit mining, it is important to note that 70% of the mines in Chile are open-pit. If a law related to this is passed in Mexico, it could negatively impact Chile as perceptions in other regions affect our local realities. What happens in Mexico has repercussions in Chile”

Francisco Lecaros President | Chilean Mining Foundation

Specifically in the mining sector, there are still challenges to face in Chile, including regulatory approvals needed to advance product development, as these can take up to 10 years. “Chile is working to streamline and reduce bureaucracy in the system. Developing new mining projects in Chile can take up to 10 years, and project judicialization has led to US$2.6 billion in investments being stalled. Bureaucracy and permitting remain significant obstacles, but efforts are underway to streamline these processes. Opportunities also lie in tailings management and policy improvement,” he says.

At the same time, Lecaros highlights how mining is essential for the development of green energy and electromobility, as it provides the minerals needed for these technologies. In particular, the Chilean solar energy market greatly benefits from this relationship, given that Chile is a significant producer of critical minerals for the production of solar panels and other key components for the transition to cleaner energy.

The mining industry is also exploring new water management strategies, with 74% of the supply coming from reuse, 18% from continental sources, and 8% from desalinated seawater. Additionally, Chile is developing projects in hydrogen and water resources to ensure environmental sustainability.

Chile faces challenges like those in Mexico, including the need for better mining socialization, environmental education, and regional development. Negative perceptions of mining, particularly open-pit mining, are also rampant in Chile. “regarding the reform that bans open-pit mining, it is important to note that 70% of the mines in Chile are open-pit. If a law related to this is passed in Mexico, it could negatively impact Chile as perceptions in other regions affect our local realities. What happens in Mexico has repercussions in Chile,” states Lecaros.

Both countries must advance in effectively communicating the importance of mining and its contribution to daily life and economic development. “The mining industry should take pride in its contributions, as it helps address the social needs of countries.” shares Lecaros. “Mining is an integral part of daily life, and we must prevent misunderstandings. It is impossible to remove mining from our lives; the public must receive accurate messages through education.”

SAFEGUARDING OPERATIONS AMID DIGITAL THREATS

The year 2024 marked a pivotal shift in the mining sector’s approach to cybersecurity, with the issue reemerging as a major concern in EY’s risks and Opportunities Survey 2024, where it secured the eighth position. This renewed focus on cybersecurity is largely driven by the sector’s increased digitization, the widespread adoption of remote work, and escalating geopolitical tensions.

Digitization has led to a significant rise in cyberattacks, with incidents increasing by 15% in 1H24 compared to the same period in 2023. According to cybersecurity firm SILIKN, there were 1.5 million hacking attempts, underscoring the urgent need for the industry to enhance its protection against these digital threats.

Marcos Lopes, Partner and Managing Director for Mining & Metals, EY, noted that EY’s survey data showed 40% of corporate boards express confidence in their understanding of the most critical risks facing their organizations. Paul Mitchell, Global Mining & Metals Leader, EY, emphasizes the importance of this awareness, noting that a deep understanding of the current cyber risk landscape and emerging threats is essential for ensuring reliable and resilient operations.

David Tintor, Director of Operations, TBSEK, pointed out that the mining sector faces unique challenges related to equipment obsolescence. Unlike other industries, mining equipment is typically designed to last up to 30 years. “The challenge of obsolescence in mining is complex; it is not just about outdated software. While cyber threats evolve rapidly, production lines installed 10 or 15 years ago were not designed to counter the sophisticated techniques used by today’s cybercriminals,” Tintor explained in an interview with MBN.

Alexandro Fernández, OT Cybersecurity Executive Director, Intelligent Network, agrees with Tintor’s vision adding that cybercriminals see opportunities in outdated

operational technology (OT) that has not been updated. “As companies seek to connect these systems to the internet, they expose themselves to increased risk,” he adds.

Tintor noted that mining companies are particularly attractive targets for cybercriminals due to the easily quantifiable nature of potential damages, adding that for a mining company, if cyber criminals disable a mill, every second of downtime costs approximately US$5.97. “I had the unfortunate experience of having a mill shut down for weeks in a project I investigated due to a cyberattack that entered through the IT infrastructure. Due to the significant convergence with OT, it reached the control systems,” Lopes testified.

Tintor notes that cybercrime has become such a lucrative business that the average salary for an attacker is approximately €50,000 (US$55,430) per month, plus the success of their operations. He also highlights that attacks on the sector have increased by 300%.

As for the origin of such cyberattacks, Fernández notes they are usually linked to certain national governments. On the other hand, Tintor highlighted that while drug trafficking once reached the status of the sixth-largest economy in the world, cybercrime is now approaching the third position. In 2023, cybercrime surpassed drug trafficking in scale, and some organized crime groups are even seeking to diversify into cybercrime.

Fernández said that while surveys are important and illustrative, sometimes they fall short because some companies do not report when a cyberattack happens and how it happened, which makes it harder to evaluate the real state of cybersecurity in the mining sector. Nonetheless, experts agree that the mining sector is relatively mature in terms of cyber resilience as the sector is well trained in other security measures for the physical world. “We saw it in Acapulco during Hurricane Otis: miners were able to

significantly reduce the risk within a couple of days after the hurricane,” Tintor notes.

Alexandro stressed that cybersecurity is not an option, it is a necessity if companies want to operate safely. He also notes that one of the key actions to take is conducting an assessment that includes OT, evaluating the existing technologies, network configurations, interconnections, and protection measures. A second crucial point is having a robust incident response team with the experience and skills necessary to handle threats,

acknowledging that there are very few such experts available. Additionally, visibility is critical; it is essential to understand which assets are connected, the protocols in use, and how everything is interconnected.

Fernández says there are many frameworks available, and while he would advise adopting one, it should be tailored to fit specific operations. Similarly, Lopes adds that it is important to educate people working in each business division, so they understand why there is a specific way to perform their tasks.

MEXICO’S MINING HUBS: NEW PRIORITIES AND AMBITIONS

Mexican states with mining operations deeply understand the value that the mining industry brings to their regions. In accordance with global and national trends, the Mexican mining industry is adapting to the implementation of ESG standards, development of local supply chains, and adapting to regulation that has evolved importantly over the past administration. These mining states remain hopeful as the industry’s activities and benefits are ingrained in their economic activities and expect a continued dialogue with federal authorities that appear receptive of the importance of this industry for mining states.

The mining sector is fundamental for several states, as explained by Alfredo Phillips, Independent Board Member. He explains that in Zacatecas, it represents 33% of the GDP, in Sonora 23%, and for Guerrero—an industry newcomer—it now accounts for 6.5%, while in Chihuahua it represents 4%. “For these states, mining is not just any activity; it is a crucial driver of their economies,” emphasizes Phillips.

Sonora

The state leads in copper production, accounting for 75.6% of the national total, making it the largest copper producer in Mexico and the fifth-largest in the world. Sonora also ranks first in gold production in Mexico, contributing 25.7% of the national output. Additionally, it ranks second in barite

production with 21.4% of the national volume, second in iron with 10.7%, and fifth in silver with 6.5%.

“In Sonora, mining is the priority and the central axis of economic activity,” emphasizes Margarita Vélez, Minister of Economy, State Government of Sonora. Vélez explains that Governor Durazo’s focus is the Sonora Plan for Sustainable Energy, which is closely linked to mining. The Sonora Plan is driven by President López Obrador and supported by Claudia Sheinbaum, with several significant objectives: contributing to the decarbonization of the economy, strengthening and participating in the energy matrix, reducing emissions, and fighting climate change.

The Sonora Plan connects with mining through multiple elements. One is powering renewable energy with solar park projects. Another involves the liquefaction of gas, supported by a shared project with Chihuahua: the Sierra Madre gas pipeline. An LNG plant will be installed in Puerto Libertad, with gas destined for Asian and European markets. Another aspect focuses on basic infrastructure for developing and integrating value chains, including the value chain for mission-critical materials, electromobility, and semiconductors. “This is why we consider mining a priority sector, essential for supporting these industries. Mining has much to contribute to decarbonization,” says Vélez.

Zacatecas

Zacatecas stands out as Mexico’s top producer of silver, lead, and zinc, ranking second in copper production. The state contributes significantly to Mexico’s mining output, with 35.8% of the national silver production, 18.7% of gold, 62.8% of lead, 47.9% of zinc, and 9.2% of copper. Zacatecas is home to Mexico’s largest gold mine, Newmont’s Peñasquito, contributing over 13% to the state’s GDP. At the same time, with an approximate value of US$888 million, Zacatecas generates 22.4% of Mexico’s mining production value. Almost one-third of the state’s territory (31.7%) is designated as “concessioned land” for mining activities.

Governor David Monreal Ávila has prioritized mining since the start of his administration, making it one of the four pillars of the state’s development plan. Mining serves as a key axis of Zacatecas’ public policy for economic growth. r odrigo Castañeda, Minister of Economy, Government of Zacatecas, explains that the governor has maintained a close relationship with the mining sector, acting as a liaison between the industry and the federal government, while always adhering to federal regulations. The governor has also facilitated communication between the Ministry and mining companies.

“As part of Zacatecas’ priorities, we identified three key areas. The first one is to create synergies with mining in order to diversify other sectors that benefit from it. The second priority is the development of local suppliers, an important issue. We have agreements with most mining companies

to develop local suppliers, which is also embedded in public policy. Finally, enhancing other value chains through mining processes is another focus,” says Castañeda. He also notes that Zacatecas already has companies assembling and refurbishing heavy vehicles, converting them into electric vehicles. A cross-cutting theme in all these efforts is the focus on environmental sustainability, adds Castañeda.

Chihuahua

According to CAMIMEX’s 2023 report, Chihuahua ranks as the state with the second-highest number of mining projects, totaling over 160. The state contributes 20.7% of Mexico’s mining output, making it the third largest contributor to the national mining industry. Mining plays a crucial role in Chihuahua’s economy, with the state’s mining production alone valued at over US$2.4 billion in 2023. Mineral exports from the state also contributed significantly, valued at above US$441 billion. Additionally, Chihuahua received over US$143 million in mining FDI in 2023.

r ocío Flores, Mining Director, State Government of Chihuahua, explains that the priority in mining-related matters is to establish a constructive dialogue to understand the direction of this new era in mining. “We need to understand and facilitate this dialogue in the sector, always respecting the federal government’s authority on the matter, but being open to cooperation so that, together with the sector, we can navigate the new rules and provisions required for sustainable economic development,” says Flores. She emphasizes that the mining industry is indispensable: “We cannot advance in areas of transition and sustainability without mining playing an active role.”

Nearshoring is also vital for the country, and for that, mining, along with the necessary infrastructure and talent, is essential. Flores also highlights recent discoveries of important deposits in Chihuahua as a result of exploration and stresses the need to

establish a strong connection with the federal government to maximize these opportunities.

Guerrero

The Guerrero Gold Belt, one of Mexico’s premier gold deposits, has become a major mining region after nearly thirty years of exploration and drilling. In 2023, Guerrero ranked third nationally, contributing 15.4% of Mexico’s total gold production, an increase of 1.6% from 2022. The state also produces silver, copper, iron, lead, and zinc. Experts suggest that Guerrero may contain over 10Moz of undiscovered gold. This geological formation extends approximately 80km in width, making Guerrero one of Mexico’s top four gold-producing states.

In Guerrero, mining is the second most important sector after tourism. Teodora ramírez, Minister of Economic Promotion and Development, State Government of Guerrero, explains that the local government’s focus is on strengthening and consolidating the industry, while acting as a facilitator to ensure its continued development in coordination with the federal regulatory body. Equally important, she notes, is “to be a facilitator so that the value chain continues generating jobs, especially in our state, where we have the lowest competitiveness levels in the country. The northern zone of our state is crucial. Without this industry, these municipalities would face even greater challenges.”

State Governments’ role in Promoting the Mining Industry

Phillips believes that new opportunities could emerge under the incoming government for states to assume greater responsibility, as allowed by federal laws, reflecting past trends.

“This has already been happening. Our governor in Zacatecas has been a key intermediary, highlighting the importance of each project, as they all have unique circumstances,” says Castañeda, who sees an opportunity for states to play a more prominent role in emphasizing the significance of their projects to the federal

government, as they are more familiar with the local environment, context, and value of these initiatives. “The dialogue between state and federal governments must continue, but in partnership with the mining companies,” he adds.

Flores similarly notes that the government of Chihuahua has fostered constructive dialogue. “Our governor, Maru Campos, has already met with president-elect Claudia Sheinbaum. Through the Ministry of Innovation and Economic Development, we have shared our state’s strengths and priority projects. We are ready to collaborate with the new administration to promote smart and sustainable mining,” she says. “We believe the states are prepared to take a more active role in supporting this sector, which aligns with the president-elect’s regional development plans—Chihuahua, as a mining state, cannot be expected to move away from its core industry.”

Vélez emphasizes the significant economic force of mining in states where it is present. “I am optimistic. Based on the efforts of the ministries of economy and the federal government’s actions, we are hopeful that the mining sector and the specific roles of each state will continue to be respected. Our governors have opened productive dialogues with both the outgoing and incoming administrations,” she explains.

ramírez adds that, in Guerrero, the first major task for the state’s first female governor, Evelyn Cesia Salgado Pineda, was to quantify the scale of mining’s contribution and share this information to drive further support for it. “In Guerrero, mining provides 30,000 direct and indirect jobs with just four mines,” she shares.