IMPACT REPORT

Platinum Sponsor

Networking Lunch Sponsor

Matchmaking Sponsor

Pole Sponsor

Gold Sponsors

Sponsors

Networking Coffee Break Sponsor

Sponsor

Silver

Charging

Landyard

The oil and gas industry stands in a scenario vastly different from what was envisioned a decade ago, when the Energy Reform opened the market. Despite the challenges, the sector is advancing at a rapid pace. Private operators have discovered oil, developed significant fields, and ventured into Mexico’s first deepwater projects, significantly transforming the supply chain.

Mexico is undergoing an administrative transition under the leadership of President Claudia Sheinbaum, who had previously stated that she aims to follow Andrés Manuel López Obrador’s plan, known as the Fourth Transformation. Despite the government’s emphasis on PEMEX as the centerpiece of its energy policy, private players believe there are numerous ways the private sector can support the NOC, especially given its tight circumstances. The NOC has managed to reduce its debt below the US$100 billion mark, largely thanks to government support.

However, payment delays to suppliers are causing ripples across the supply chain, so some experts are proposing reshaping PEMEX’s strategy. Major operators and service providers have been crucial in providing the necessary financing for companies to continue operations, but finances must be addressed to foster continued development in the industry.

PEMEX and other players in the sector are also prioritizing ESG considerations, which are increasingly crucial for the supply chain to remain competitive and secure financing. The NOC now has a sustainability committee that has worked to integrate ESG issues into its agenda. The impact of these initiatives extends across the industry.

At Mexico Oil and Gas Summit 2024, experts shared their insights and perspectives on the state of the industry, and discussed strategies to remain competitive and navigate the future of the sector under the next administration.

182 companies

274 conference participants

Breakdown by job title

29% Director/VP/Partner

29% Manager

27% CEO/President/ MD/C-Level

15% Associate/Executive/ Coordinator

Matchmaking

Mexico’s leading B2B conference organizer uses a customized app to deliver an unparalleled experience

The MBE App delivered AI-powered intent-based matchmaking to Mexico Oil and Gas 2023 attendees

MBE App Impact

268 participants

604 matchmaking communications

149 1:1 meetings conducted

30 speakers

11th Edition

15 sponsors

16,594 visits to the conference website

Conference social media impact Pre-conference social media impact

9,286 direct impressions during MOGS 170,370 direct pre-conference LinkedIn impressions

12.55% click through rate during MOGS 3.52% pre-conference click through rate 8.2% conference engagement rate 4.4% pre-conference engagement rate

Matchmaking intentions

Total

2,216 1,1392 Trading 824 Networking

• ABB

• Achilles

• Aggreko

• AINDA Energía & Infraestructura

• Airswift

• Akali Marine

• Alberta Mexico Office

• American Bureau of Shipping (ABS)

• AMESPAC

• AMEXHI

• AMGN

• Analítica Energética

• Aosenuma

• ARHIP

• ASEA

• Asociación Mexicana de Fabricantes de Válvulas y Conexos

• Assist

• Avani Clean Fuels

• A xess Group

• Baker Hughes

• Biogas

• Black Eagle Logistics

• Blin-Co

• BN SF Railway

• Bollore Logistics / CEVA

• BP

• Brilliant Energy Consulting

• CargoWeld

• Caterpillar

• Center on Global Energy Policy at Columbia University

• ChampionX

• China Chamber of Commerce

• CMC

• COMCE SUR

• COMENER

• Coparmex

• Cotemar

• CSE W-Industries Mexico

• Cuatrecasas

• DHL

• Diavaz

• Dliver Grupo Estrella Roja

• DNV

• DORIS USA

• Dräger

• ELEVATIONiDEAS

• Embassy of Canada

• Endress+Hauser

• Energy 21

• ENGIE

• Eni

• Evonik

• EY México

• Fieldwood Energy

• Fitch Ratings

• Fueltrax

• G-Global

• GMG Enviroservice

• Government of Tamaulipas

• G rupo CIITA

• Grupo Cresser

• Grupo Financiero Monex

• Grupo Industrial Aguila

• Grupo Tecnovidrio

• Gulf Companies

• Harbour Energy

• Heerema

• Hokchi Energy

• Holland House Mexico

• HOOMAN

• Hooman Recursos Humanos

• Ibañez Parkman Abogados

• Indimex Group

• INERCO

• Innomotics

• Integron Services

• International SOS

• INTERTEK

• iPS Power ful People

• Jaguar E&P

• James Fisher Offshore

• John Crane

• KDM Fire Systems

• Kiewit

• Kizer Energy

• KPMG

• Linker Energy

• LRQA

• Lukoil Upstream Mexico

• LW Partners

• McDermott

• Mexican Petroleum Institute (IMP)

• Mexico Petroleum Company

• MG Technical Solutions

• MGI (a PEMEX subsidiary)

• Milenio Diario

• MRS RE

• MSC Mexico

• MSConsulting

• National Hydrocarbons Commission (CNH)

• Naturgy

• Nokia

• NOMARNA

• NOROC

• Núcleo Sepec

• Oca Global

• OH Maritime Services

• Oil & Gas Alliance

• Oilmex

• OPEX

• OSBOG

• Pemex

• Perenco

• Perenco

• Petróleos Mexicanos (PEMEX)

• Pietro Fiorentini

• Pontones y Ledesma

• Promecap

• Protexa

• Pypsagroup

• QORLEY

• Quantum Energía

• R.H. SHIPPING & CHARTERING

• R9 Holdings

• RelaDyne Reliabilit y Services

• Relyon Nutec

• REP

• Repsol

• Rosetti Marino

• Rovesa

• S&P Global

• Samson control

• SANPETROL

• SB M Offshore

• Sea Cargo Logistics

• Select USA

• Sensia Energy

• Sensia Global

• Servicios De Extracción Petrolera Lifting de México

• Servicios Integrales Nuevo Santander

• Shallow and Deepwater Mexico

• SHELL

• SIEC Consultores

• Siemens Energy

• SL Intelligent

• SLB

• Solar Turbines

• Speakap

• SPM Oil & Gas

• STE Consultec

• Summum

• Summum Projects

• TC Energy

• Techint E&C

• TechnipFMC

• TenarisTamsa

• Texas European Chamber of Commerce

• TH MARITIM E SERVICES

• Thomson Reuters

• Tiger Offshore

• Tiger Rentals

• TMM

• Triton Maritime de Mexico

• Tubería y Válvulas del Norte (TUVANSA)

• Turbo Drill Industries

• Tuvansa

• U.S. Commercial Service

• U.S. Department of State

• U.S . Embassy

• U.S. Trade

• Upstream Strategy

• V&A Legal

• Victaulic

• Voz Experta

• Walworth

• Weatherford

• WiM

• Wintershall Dea

• Woodside Energy

• WTS Energy

• XWells

• ZRG Partners

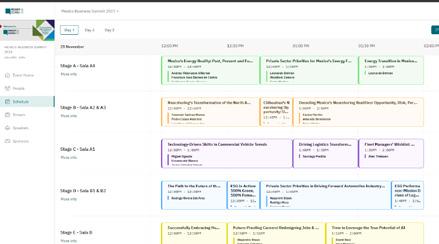

WEDNESDAY, SE PTEMBER 25

09:00 PEMEX’S FINANCIAL REALITY, PRIORITIES AND OPPORTUNITIES

Speaker: Adriana Eraso, PEMEX Analyst

09:30 CLEAN ENERGY FOR ALL MEXICANS

Speaker: Carlos Hernández, Coparmexen

11:30 OPPORTUNITY, RISK AND FINANCIAL HEALTH OF MEXICO’S OIL & GAS SUPPLY CHAIN

Moderator: Alejandra León, S&P Global

Panelists: Marcos Ávalos, Tubería y Válvulas del Norte (TUVANSA)

José Rinkenbach, AINDA Energía & Infraestructura

Ibis Colli, Black Eagle

12:30 MEXICO E&P ANALYSIS & OUTLOOK

Moderator: Javier Mundo, KPMG Mexico

Panelists: Antonio William, SLB

Germán Gómez, Baker Hughes

Jorge Mendoza, IMP

15:00 THE RISE OF ESG IN MEXICO’S O&G INDUSTRY

Moderator: Sara Landon, KPMG Mexico

Panelists: Lorenzo Meyer, PEMEX

Luis Vera, V&A Legal

Carlos de Regules, Assist

Javier de la Cruz, Dräger

16:00 COST OPTIMIZATION AND EMISSIONS REDUCTION: SUSTAINABLE ENERGY SOLUTIONS

Speaker: Nicté Ovando, Aggreko

16:15 HARBOUR ENERGY: A SUCCESS STORY OF GROWTH IN THE INTERNATIONAL OIL & GAS SECTOR, INCLUDING MEXICO

Speaker: Gustavo Baquero, Harbour Energy Mexico

THURSDAY, SE PTEMBER 26

09:00 ANALYSIS OF THE ENERGETIC AGENDA 2030-2050

Speaker: Juan Acra, COMENERt

09:30 HR STRATEGIES FOR THE MEXICAN OIL AND GAS INDUSTRY

Moderator: Rebeca Rodríguez, ARHIP

Panelists: Lennart Rietveld, WTS Energy

Emilse Barragán, Jaguar E&P

10:15 CRITICAL SUCCESS FACTORS FOR PRODUCTION OPTIMIZATION IN 2024-2030

Moderator: Javier Estrada, Analítica Energética

Panelists: Óscar Roldán, R9 Holdings

William Waggoner , Mexico Petroleum Company

James Buis, ChampionX

12:00 SUPPLY CHAIN PRIORITIES, OPPORTUNITIES, TECHNOLOGY TRENDS

Moderator: César Vera, Fueltrax

Panelists: Ricardo Ortega, Alliance

Eckhard Hinrichsen, DNV Energy Systems Mexico

Ana Ludlow, ENGIE Mexico

13:00 ZAMA PROJECT UPDATE

Speaker: Sylvain Petiteau, Harbour Energy

PEMEX’S FINANCIAL REALITY,

PEMEX has encountered significant financial challenges, grappling with high debt levels and ongoing financial commitments that have pushed its liabilities to the US$100 billion mark. Experts indicate that key factors for improving PEMEX’s financial outlook include increasing government support and enhancing communication about its objectives and strategies in the Mexican market.

Adriana Eraso, PEMEX Analyst, Fitch Ratings, emphasizes that while PEMEX has benefited from government support, it is still insufficient to meet the company’s needs. “The amount is inadequate as it lacks the necessary proportionality. While it may appear to be a significant figure for the government, for a company as large and complex as PEMEX, it does not create a meaningful impact. PEMEX is grappling with substantial financial and operational challenges, making the allocated resources insufficient to address its needs effectively,” says Eraso.

Eraso explained that PEMEX’s credit ratings are significantly influenced by its status as a government-related entity (GRE). Fitch Ratings, which assesses PEMEX, considers several factors in this evaluation, including criteria such as its standalone credit profile (SCP) and long-term issuer default rating

PRIORITIES AND OPP ORTUNITIES

(IDR) of the supporting government. These currently stand at ccc- and BBB-, respectively.

The SCP reflects PEMEX’s financial health and operational efficiency without extraordinary government support. In contrast, the government’s IDR indicates the ability and willingness of the Mexican government to support PEMEX in financial distress. The gap between PEMEX’s SCP and the government’s IDR is a crucial metric, as it highlights the extent of reliance on government support.

The criteria for evaluating governmentrelated entities like PEMEX also involve key risk factors (KRFs):

RS1 - Decision Making and Oversight. This is currently labeled as “Strong.” This factor examines the extent of the government’s involvement in PEMEX’s decision-making and oversight. Given PEMEX’s strategic importance to Mexico’s economy and energy security, the government’s role is substantial in ensuring alignment with national energy policies. “However, the government does not tell PEMEX who to do business with or who to sell its products, so there is some independence in its operations,” states Eraso.

IS1 - Preservation of Government Policy Role. It is also labeled as “Strong.” In this case, the Mexican government has strong incentives to support PEMEX. These are driven by the company’s critical role in the country’s energy supply and its significant contribution to government revenues. Any financial distress in PEMEX could have severe economic repercussions, making government support almost certain. “We have seen that other mechanisms have been implemented to address these concerns, which is why we maintain this factor at the medium level,” adds Eraso.

IS2 - Contagion Risk. This is also considered “Strong,” as it refers to PEMEX’s influence on the country’s performance, as well as other state companies related to it.

IS2 - Precedents of Support. This last factor is currently established as “Non-Applicable” for PEMEX. “Even though there has been support from the government, we have no way of knowing when that support will come or in what measure. Furthermore, as stated before, this support is not in line with the level of debt facing the company,” states Eraso. However, acknowledges that the government has now included a PEMEX Support item in its budget, which provides more visibility. “Should this continue, we could move this element to the ‘Strong’ bracket,” adds Eraso.

Considering all these factors, Fitch Ratings gives PEMEX an overall score of 25 in a scale of 0 to 60 regarding its attachment to the country and its own performance, leading to an overall GRE IDR of B+.

Eraso emphasized that one of the primary challenges facing PEMEX is governance issues, as its roles and objectives remain unclear. The company’s excessive debt has imposed a significant financial burden, and with limited cash available for interest payments, there are fewer resources for investment. This situation ultimately leads to operational and even environmental challenges.

“Priorities must be communicated more effectively. What role will PEMEX play in the crude oil and fuel sectors? Will it focus solely on refineries or also on exports? What is the overarching business strategy, and how can it be conveyed effectively? The prevailing message has been that PEMEX is essential for energy security; however, significant information gaps remain. It is vital to gain a clearer understanding of the rationale behind these decisions,” says Eraso.

Regarding its operations, Fitch Ratings is also unclear regarding the company’s priorities. Eraso compares PEMEX with other stateowned oil companies in Latin America, such as Ecopetrol, Petrobras, and YPF. The analysis reveals that PEMEX’s cost per barrel is significantly higher, reaching US$48, while it is sold for approximately US$68, resulting in a profit of approximately US$20. In contrast, Petrobras has operational costs that are nearly half of PEMEX’s, at US$33.60. Additionally, PEMEX incurs an interest cost of US$10, which, if reduced by half, could lead to a substantial increase in profits.

“One of the problems we see is that the government is doubling down on a refining strategy that we currently see as a destructor of value. If PEMEX makes US$20/b sold in the market, it makes only US$11/b through refining. We need more context behind this decision to properly assess this,” states Eraso.

Eraso highlighted that the Mexican oil market presents significant opportunities, particularly in unexplored fields and deepwater drilling. However, seizing these opportunities requires substantial investments in technology and infrastructure. Moreover, the rising demand for natural gas—driven by industrial and residential use—creates a lucrative market for PEMEX. By enhancing its gas production capabilities, PEMEX can capture a larger market share and bolster its financial performance.

“The gap between oil consumption and production highlights Mexico’s significant potential to continue generating value. The government should seize this opportunity to establish a track record of support for PEMEX, which could result in improved ratings.”

CLEAN ENERGY FOR AL L MEXICANS

Mexico’s energy landscape faces significant challenges, including frequent blackouts as energy demand increases during the summer months. These outages not only disrupt daily life but also have a substantial economic impact, causing companies to lose up to 3.4% of their sales. In response to these pressing issues, Mexico’s Employer Confederation (COPARMEX) has launched a comprehensive proposal titled “Clean Energy for All Mexicans,” aimed at ensuring reliable, sustainable, and cost-effective electricity for the entire nation.

One of the primary goals of COPARMEX’s proposal is to reduce energy poverty. By securing a stable and sufficient energy supply, COPARMEX aims to bridge this gap, promoting social equity and enhancing the quality of life for underserved communities. The institution aims to ensure energy access for 550,000 more people by the end of Claudia Sheinbaum’s presidential administration.

The proposal also seeks to capitalize on nearshoring opportunities, attracting an estimated US$35 billion in annual investments. This influx of capital is expected to drive economic growth, create jobs, and stimulate the development of new

businesses. Additionally, reinvestment of profits will further bolster the economy, creating a virtuous cycle of growth and prosperity. “To make this happen, we need to invest in transmission and distribution, not only for connection of electric centrals, but also for the connection of large investments,” says Carlos Aurelio Hernández, President of the Energy Commision, COPARMEX.

A key component of the confederation’s initiative is the collaboration between the government and the private sector to strengthen CFE. By adopting diverse renewable energy sources, the initiative aims to reduce dependence on any single energy type. Hernández says that collaboration was somewhat stagnated during the current administration, but COPARMEX remains optimistic about the future of the energy transition, as representatives from the organization have engaged with Sheinbaum’s team, and show interest in developing join initiatives, opening the door for the possibility of a deeper private participation in the energy sector.

COPARMEX has also engaged with Congress and the academic sector, leading to an initiative that advocates for recognizing energy consumption and energy injection as a human right, similar to what has been done in countries like France. Additionally, Congress should establish a framework for imposing stricter penalties for energy theft, states Hernández. It is equally important to strengthen the oversight of the Electric Industry Law (LIE) by ensuring better coordination between CRE commissioners to prevent undue influence from companies and by granting greater autonomy to CRE.

For the academic sector, the initiative encourages a focus on promoting renewable energy generation, redesigning electrification strategies for marginalized areas, and addressing water crises through energy projects. It also calls for legislative reforms to improve the monitoring of

the Wholesale Electricity Market (MEM) and emphasizes the need for certifying competencies related to the MEM.

COPARMEX also stressed the need to promote knowledge democratization, energy efficiency, independent market monitoring, and effective resource management. Its initiative proposes replicating the “Gasolineras del Bienestar” gas stations model in marginalized communities for distributed generation, where the private sector can participate. Additionally, it calls for promoting socially focused energy auctions and reactivating the National Commission for the Efficient Use of Energy (CONUEE).

To ensure the reliability and efficiency of Mexico’s energy supply, COPARMEX proposes significant investments in the country’s energy infrastructure. This includes an annual investment of US$9 billion for transmission and distribution, totaling US$54 billion over six years. Additionally, US$12.6 billion per year should be allocated for energy generation, aiming for a cumulative investment of US$75.66 billion over the same period. Hernández said these investments are crucial for modernizing Mexico’s energy grid and supporting the transition to clean energy, with the goal of adding approximately 9,700MW of clean energy capacity annually.

The success of this initiative relies heavily on fostering innovation and collaboration.

COPARMEX emphasizes the importance of dialogue and joint efforts between the government and the private sector. This cooperative approach is essential for overcoming technical and regulatory challenges, ensuring that Mexico’s energy system can meet future demands. Hernández noted CFE has strong capital attraction capacity, as demonstrated by the issuance of the FIBRA E issued by Mexico Infrastructure Partners (MIP), which helped the company to recently acquire assets from a private energy company. “We believe this investment model can be replicated, allowing CFE, along with private companies, to develop new centrals,” he added.

Hernández noted that PEMEX could play a key role in Mexico’s energy future by transitioning toward renewable energy through blending biofuels with gasoline, similar to models in Brazil and the United States, where biofuel content reaches 27% and 6%, respectively, fostering a local economy less reliant on hydrocarbons.

According to Hernández, PEMEX could also leverage its gas station infrastructure to support the growing demand for electric vehicles (EVs). If Mexico were to transition its entire vehicle fleet to EVs, it would require a 27.5% increase in electricity generation. Hernández emphasized that PEMEX should play a key role in supplying this energy, as it has the potential for efficient cogeneration, with available space at its gas stations and a capacity of around 4,000MW.

OPPORTUNITY, RISK, FINANCIAL HEALTH OF THE OIL & GAS SU PPLY CHAIN

The financial health of Mexico’s oil and gas supply chain has faced new challenges over the past few years. Four years after the pandemic, the industry is back on track. However, the reversal of the 2014 Energy Reform and PEMEX’s financial struggles now threaten the stability of suppliers. Market volatility, regulatory uncertainties, and the capitalintensive nature of the industry force players to weigh opportunities and risks carefully.

The significant shift in energy policy during this administration has created a challenging regulatory environment for suppliers. The increased prominence of PEMEX in the market and the decreased participation of private investors have made the industry heavily reliant on public projects.

According to Alejandra León, Director of Latin America Upstream, S&P Global, the main challenges across the value chain relate to the amount of activity in the sector and payment issues, all compounded by the energy transition. Companies are at a point in the industry where they do not only need to be efficient but also take into account the effects of the energy transition. “Oil and gas continue to be key energy sources and play an important role in the development of countries,” León explains.

However, as PEMEX deals with high levels of debt, delays in payments to suppliers are becoming a major concern for companies. In this context, companies are diversifying their portfolios, investing in certifications and training, and adding services to remain competitive and, in some cases, to survive.

Experts concur that the way payments are taking shape responds more to survival rather than growth for companies, and the supply chain. “We are not growing and on top of that many companies are reaching their limits to continue dealing with the economic burden,” says José Pablo Rinkenbach, Co-Founder, AUM & ESG Executive Director, AINDA Energía & Infraestructura.

Ibis Alejandro Colli, Director General, Black Eagle, adds complexity to the picture stating that even more flexibility is being asked from providers, on top of delayed payments, which pushes suppliers to reconsider budgets, and operation efficiency. “Operational efficiency is at risk, and in some cases the whole operation of the company,” says Colli “We previously faced a 30-day to 90-day payment scheme. Nowadays, this can go from 180 to 240 days. It is clear that PEMEX is using the supply chain as a source of financing but these companies are not banks. Even then, there is no bank that would accept these payment structures. Without an industrial policy directed to this sector that responds to current challenges, there will not be enough national content, which is crucial given the geopolitical changes the world is facing.”

Access to financing remains a critical issue, particularly for SMEs that often struggle to secure the necessary capital to support their operations and growth initiatives. Compliance with ESG standards is also becoming increasingly important for

accessing financing, winning contracts, and remaining competitive.

Marcos Ávalos, Director General, Tubería y Válvulas del Norte (TUVANSA), adds that the issue of financing for companies is not completely clear. He considers that part of dealing with delayed payments and financing should be linked to a more robust industrial policy that provides financial incentives for companies to continue developing. “There is no successful industry experience in the world that does not include subsidy policies,” states Ávalos.

José Pablo Rinkenbach, Co-Founder, AUM & ESG Executive Director, AINDA Energía & Infraestructura, considers that that the way that payments are taking shape responds more to survival rather than growth for companies, and the supply chain.

Ibis Alejandro Colli, Director General, Black Eagle, adds complexity to the picture stating

“We are not growing and on top of that many companies are reaching their limits to continue dealing with the economic burden”

José Rinkenbach Co-Founder, AUM & ESG Executive Director | AINDA Energía & Infraestructura

and operation efficiency. “The momento operational efficiency is in risk, another big problem arises, achieving operational targets,” says Colli.

Additionally, Ávalos adds the factor of the national supply chain’s development, “Without an industrial policy directed to this sector that responds to the challenges there will not be enough national content, which is crucial given the geopolitical changes the world is facing.”

To address these financial challenges, León mentions that there are various strategies are available to ensure the stability and diversification of the supply chain.

that even more flexibility is being asked from providers, on top of delayed payments, and this pushes suppliers to reconsider budgets,

MEXICO E&P ANALYSIS & OUTLOOK

One of the targets of the current administration has been fuel self-sufficiency. While efforts have been made to rehabilitate the National Refining System, it is also crucial to create strategies to enhance production and meet production targets, while increasing reserves through exploration activities. As PEMEX increasingly focuses on shallow waters, the development of new areas, including deepwater fields, now relies

Regarding diversification, experts identify that the sector is big enough to share among plaers. Adittionally, the nearshoring trend, added to geopolitical challenges, opens up the opportunity to develop a regional block that can help continue to develop Mexico’s national oil and gas supply chain and increase competitiveness, shares Ávalos. “Rethink and industrial policy thought as a regional policy,” adds León. Diversifying revenue streams is another important strategy. By expanding their product and service offerings, companies can reduce their dependence on any single market segment. For instance, suppliers can explore opportunities in adjacent industries such as renewable energy, which provides additional revenue and aligns with global sustainability trends. “Rethink your portfolio, drop what is not profitable, improve what works for you,” says Ávalos.

heavily on partnerships between the NOC and private operators.

The success of Mexico’s upstream sector relies on strategic partnerships and investment in technology. However, clear and consistent government policies are crucial for building investor confidence and encouraging longterm resource commitments. “The energy factor is essential for all economic activities as

82% of the primary energy consumed globally comes from hydrocarbons and Mexico is no exception,” says Javier Mundo, Head of Energy and Natural Resources, KPMG Mexico.

The regulatory landscape in Mexico’s oil and gas sector is evolving, presenting challenges and opportunities for stakeholders. Experts highlight that collaboration among service providers, PEMEX, and private operators is essential to create a more attractive investment landscape.

Previous licensing rounds played an important role in boosting Mexico’s production as was the case with the areas developed by companies like ENI and Wintershall Dea. These rounds, which allow national and international companies to bid for exploration rights, could be essential for attracting further investment and discovering new reserves. Experts note how well-structured licensing rounds can boost exploration activities and bring fresh capital and technologies into the sector. However, publicprivate cooperation can also drive efficiency in already operating fields, suggests William Antonio, Managing Director Mexico, Central America and Venezuela, SLB. “PEMEX operates more than 400 fields, but 80% of its production comes from just 20% of them. Due to budget constraints, some of the mature fields are not producing at its maximum potential. Hence, there is a significant opportunity to form strategic partnerships to manage these fields more effectively,” he says.

Another crucial factor for success in exploration and production activities is the technological advances that service providers can offer to increase efficiency and profitability. As

Mexico’s oil fields mature, adopting state-ofthe-art technologies becomes imperative. Collaboration can unlock not only efficiency, but also the development of local talent and knowledge sharing, says Jorge Mendoza Amuchástegui, Exploration and Production Director, IMP.

The adoption of automation and remote monitoring technologies can lead to safer, more efficient operations. These innovations help reduce human error and enhance operational consistency, ultimately contributing to better profitability. “Increasing and maintaining production requires boosting efficiencies through technology. This is also linked to improving the recovery factor. Data science must be applied not only to manage massive amounts of data but also to enhance efficiency. The use of these tools allows us to make better decisions in less time,” adds Mendoza.

However, to develop more technology, collaboration between service providers and operators, both public and private, is essential. “Mexico’s area of opportunity lies in developing joint technology efforts, as seen in countries like Brazil, Norway, and Oman, where operators collaborate closely with service companies. In some countries, a certain percentage of operator company resources is allocated to joint R&D initiatives with service companies,” Antonio notes.

German Gómez, Corporate Director for Mexico & Central America, Baker Hughes, says Mexico still has a lot of opportunities, as the country features variety of its basins, including offshore, unconventional, and deepwater fields, which he considers unparalleled in this part of the world.

“Mexico’s current recovery factor stands at around 20-21%. Compared to the international average, this presents a significant potential”

German Gómez

Corporate Director Mexico & Central America | Baker Hughes

One of the main challenges in fostering collaboration between the public and private sectors lies in developing a robust set of rules for contractual operations. These regulations must support cooperation in technology development, the introduction of new products and services, and the improvement of efficiencies in the fields. Additionally, the government’s stance toward the oil and gas sector needs to adapt to market realities. Oil prices fluctuate, and fields that were attractive during high-price periods can become less viable when prices drop, as noted by Antonio.

“The sector expects that the next administration will adopt a pragmatic approach in favor of Mexico. Sovereignty and energy security are interconnected, but they require a crucial element of pragmatism. Cases like those of Equinor and Saudi Aramco have successfully transformed the contractor-client relationship into a long-term partnership, recognizing that

we mutually depend on each other. This is the kind of pragmatism we hope to see in the coming years,” Gómez added.

Environmental concerns are also gaining prominence, and companies in Mexico’s upstream sector are implementing innovative measures to reduce their environmental impact and promote sustainable practices. PEMEX’s incoming director Víctor Rodríguez has voiced her intentions to boost sustainability in the NOC’s processes. Gómez notes this challenge also involves an economic dimension, needing collective efforts to develop more efficient processes.

Despite the challenges, sustainability initiatives positively affect the perception of investors and regulators. A commitment to environmental stewardship is increasingly viewed as a prerequisite for investment, and companies that prioritize ESG Environmental, Social, and Governance (ESG) principles are likely to attract more funding and favorable regulatory conditions. “It is important to work on the recovery of ecosystems in areas that have been explored, as this not only benefits the environmental aspect but also enhances the perception of stakeholders and regulators regarding the industry’s commitment to sustainability,” said Mendoza.

THE RISE OF ESG IN MEXICO’S O& G INDUSTRY

Integrating ESG practices in Mexico’s oil and gas industry is becoming increasingly essential as stakeholders demand more sustainable and responsible operations. However, the industry still faces challenges in effectively communicating its efforts. PEMEX serves as a key case study; although the company has placed sustainability at the core of its strategy, uncertainty regarding its budget and communication hinders the development of long-term projects and financing.

ESG standards are essential for minimizing environmental impact, enhancing social responsibility, and ensuring robust governance. By adopting these standards, companies can improve their operational efficiency, reduce

risks, and foster positive community relations. Carlos de Regules, Former Director, ASEA, and CEO, Assist, highlights the significant evolution in oil regulation since 2014, when new investments exposed the country’s regulatory gaps. He stressed that although ESG progress remains voluntary, pressure from institutions, investors and academics has driven considerable advancements.

Luis Vera, Managing Partner, V&A Legal, explains that industry permits already incorporate social and environmental considerations. The issue, however, lies in communicating these efforts clearly, as key concepts are often misused. “ESG standards in the oil industry are significantly higher than in other sectors. Still, the industry

needs greater alignment to clarify definitions. Many companies claim compliance, but they do not address how, what, or why.”

Javier de la Cruz, Business Development Manager FGDS, Dräger, agrees that there has been limited progress in communicating ESG efforts within the oil industry. “ESG strategies are being demanded not only because it is fashionable, but also because it is now required across all sectors. We have not started from scratch, yet there is criticism as we lack good communication channels and clearer ways to convey the message.”

Lorenzo Meyer, Independent Board Member and President of the Sustainability Committee, PEMEX, emphasizes that the state-owned company has long prioritized ESG matters and their communication. “When it comes to ESG, most companies focus on the environmental aspect. However, for PEMEX, the social dimension is the most critical to ensuring long-term viability. We no longer see ESG as a trend—it is embedded in everything we do.”

Regules emphasizes that the cornerstone of ESG compliance is strong governance, as clear measures are essential to tackle a critical issue that can undermine all other areas: corruption. In addition, business processes should be designed to naturally incorporate a holistic view of social and environmental factors. “A business plan and an investment strategy are what guide the organization. By incorporating checkpoints to evaluate ESG risks throughout these processes, the product becomes inherently socially responsible, rather than attempting to achieve compliance only after

the project is completed. I would recommend PEMEX to focus more on its governance area.”

Cruz states that implementing ESG standards presents different challenges and opportunities, particularly when comparing new projects to mature fields. New projects offer a blank slate for incorporating ESG principles from the outset, allowing for the integration of the latest technologies and practices. However, mature fields pose significant challenges due to existing infrastructure and established operational practices that may not align with modern requirements.

Cruz also emphasizes the opportunities for leveraging technology and international best practices to support ESG transitions. Technologies such as carbon capture and storage (CCS), renewable energy integration, and advanced monitoring systems can play a crucial role in enhancing environmental performance. He stated that Dräger provides solutions that enhance safety during operational activities, particularly in scenarios such as temperature spikes and flow changes that could lead to spills and potential fires. “There is a broad array of technologies already implemented in various industries that we can further leverage in the oil and gas sector to enhance control and optimize operations.”

Meyer explains that while PEMEX aims to incorporate new technologies, it faces budget constraints that other companies and state entities do not. “Without clarity on our resources for the coming year, developing sustainable long-term plans becomes difficult. We need a better understanding of our budget

and agreements, but since these depend on the deputies and the Ministry of Finance, executing multi-year projects is quite complicated.”

Experts highlight that PEMEX’s ESG performance directly affects its ability to secure funding and partnerships with international entities. Investors and partners are increasingly prioritizing ESG compliance when making decisions, and PEMEX’s adherence to these standards can enhance its attractiveness as a partner. Conversely, any shortcomings in ESG performance can deter potential investors and collaborators, impacting the company’s growth and the broader industry’s perception. They also underscore the broader implications

of ESG integration for Mexico’s oil and gas industry. Companies that proactively adopt ESG standards are likely to gain a competitive edge, attracting investment and fostering longterm sustainability. On the other hand, those that lag in ESG compliance may face financial and reputational risks.

Regules expresses hope that the country’s energy policy evolves from merely being an end goal to becoming a means for national development, attracting investments, and strengthening industry. “It is not just about achieving energy sovereignty; it is about our approach and the objectives we aim to accomplish.”

COST OPTIMIZATION, EMISSIONS REDUCTION: SUSTAINABLE SOLUTIONS

The oil and gas industry is at a pivotal point, as balancing the growing global demand for affordable energy with the imperative to reduce emissions is a complex challenge. Nicté Ovando, Business Developer, Aggreko, highlights how innovative strategies can optimize costs while reducing the environmental impact of oil and gas operations.

One of the most significant opportunities for cost savings and emissions reductions lies in the utilization of vented gas. A substantial

portion of associated natural gas has historically been flared, leading to economic losses and unnecessary emissions of methane, a potent greenhouse gas. Recent reforms, such as the Energy Transition Law and the National Strategy for Methane Emission Reduction in the Hydrocarbon Sector, have made strides in reducing gas flaring and venting. These regulations encourage the productive use of natural gas, aligning with international climate commitments. By using this natural gas, instead of diesel, companies can significantly cut emissions. Natural gas emits up to 40% less CO2, 80% less NOx, and 99% less SO2 compared to diesel, making it a much cleaner alternative.

Aggreko’s approach involves converting vented gas into a flexible power solution that integrates with existing energy infrastructures. In scenarios where vented gas alone is insufficient to replace diesel, a hybrid system can be used. This system combines vented gas with battery energy storage systems (BESS) or a minimal amount of diesel to manage peak loads efficiently. This strategy not only reduces waste but also provides a reliable and economical power source.

“Today, we provide innovations that capture vented gas for electricity generation, transforming a source of pollution into a

production opportunity while maximizing environmental benefits. By adopting such sustainable solutions, we comply with government regulations that oversee emissions and enhance the environmental and social image of our clients,” shares Ovando.

Aggreko is committed to supporting Mexico’s Natural Gas Utilization Program, which aims to reduce gas flaring and optimize the use of associated petroleum gasses. By offering temporary and mobile power solutions, Aggreko helps oil operations to minimize gas waste and maximize efficiency. This approach not only supports environmental sustainability but also provides economic benefits by lowering fuel costs and improving operational efficiency.

“We are aligning with global commitments to mitigate climate change. Today, it is tangible to assess the cost-benefit of emission reductions; this is not just an environmental responsibility but also a business opportunity for energy sector companies,” says Ovando. She highlights that, especially in a country like Mexico that has vast gas potential, energy companies can significantly benefit from these solutions by improving their operational margins while reducing their carbon footprint and complying with local and international regulations.

The challenges of using associated natural gas for power generation often require a flexible

solution. Aggreko’s modular power systems are designed to adapt to the varying generation capacity needs throughout a project’s lifecycle. Unlike traditional generator purchases, these modular systems provide scalability and flexibility, allowing for adjustments as project demands change. This flexibility is crucial for managing the dynamic conditions of oil and gas projects, ensuring that energy solutions remain efficient and cost-effective.

In addition to utilizing vented gas, Aggreko advocates for the use of virtual pipelines. By transporting compressed or liquefied gas to various points within a project, companies can replace diesel with cleaner gas options. This not only reduces emissions but also provides a more sustainable and reliable energy supply chain. Virtual pipelines offer a practical solution for projects located far from existing pipeline infrastructure, ensuring that cleaner energy is accessible even in remote areas.

Another key aspect of Aggreko’s strategy involves integrating renewable energy sources with battery storage systems. By combining solar and wind energy with BESS, companies can create hybrid energy solutions that further reduce reliance on fossil fuels. These hybrid systems offer numerous benefits, including enhanced energy security, reduced environmental impact, and potential cost savings over the long term. “This approach maximizes the available energy resources when they are needed most,” highlights Ovando.

Aggreko’s innovative energy storage solutions are a cornerstone of the company’s sustainable energy strategy. The company has developed a unique mobile storage product housed in containers, designed for rapid power delivery and precision. These storage systems come in two configurations: BESS 30 and BESS 60. The BESS 30 provides 1MW of power with 30 minutes of duration, offering 500kWh of usable energy, while the BESS 60 offers 1MW of power with 60 minutes of duration, providing 1000kWh of usable energy. These systems feature zero emissions and the capability to either discharge or absorb electricity within 30 to 60 minutes, making them highly efficient and environmentally friendly.

A SUCCESS STORY OF GROWTH IN THE INTERNATIONAL OIL & GAS SECTOR

Harbour Energy, founded in 2014 by private equity, has quickly established itself as a prominent player in the global oil and gas sector. Through strategic acquisitions and a robust growth strategy, Harbour Energy has built a diverse portfolio, expanded its international footprint, and achieved significant milestones, positioning itself as the largest UK oil and gas producer in 2023.

Harbour Energy’s growth trajectory is marked by several key acquisitions and mergers, all critical steps in expanding the company’s asset base and resulting in being listed on the London Stock Exchange. The most recent acquisition of Wintershall Dea’s assets in 2024 further solidified Harbour Energy’s position as a leading global player. With assets in 11 countries, a production rate of 480Mboe/d, and 2P reserves of 1.5Bboe with a reserve life of eight years, Harbour Energy has created a sustainable and diverse portfolio. The company employs 5,000 people, including contractors, and prioritizes maximizing production value, progressing international growth opportunities, and maintaining financial discipline.

Gustavo Baquero, Managing Director and Country Chair, Harbour Energy Mexico, notes that the company’s ESG approach has also benefited from the company’s acquisitions.

“With the acquisition of Wintershall Dea, we expanded our assets in Norway and Denmark, and gained key clients in Germany. This has positioned us with Europe’s largest SCC portfolio in terms of carbon capture capacity,” Baquero highlights.

Harbour Energy has been active in Mexico since 2017, developing an extensive exploration and production portfolio with significant growth potential. The company’s operations in Mexico include several key assets:

Located in Tabasco, Ogarrio has been operated by Harbour Energy since 2018, holding a 50% stake with the other 50% owned by PEMEX. The field produces approximately 6.2Mboe/d. Harbour Energy is focused on optimizing the production base through workovers and infill drilling programs. The company is also evaluating secondary oil recovery projects, such as waterflooding, to enhance production. Additionally, Harbour Energy is committed to sustainable social programs, including health and education initiatives for local communities in Tabasco.

Discovered in 2017 and located in the Sureste Basin, Zama is one of Harbour Energy’s most significant projects in Mexico. The project is 50.4% owned by PEMEX, 32.2% by Harbour Energy, and 17.4% owned by Talos Energy. The unit development plan for Zama was approved in June 2023, and the front-end engineering design (FEED) began in 2024. A joint project team, with experts from all partners, is dedicated to successfully developing this project. The targeted oil plateau for Zama is approximately 180Mb/d, with recoverable oil volumes estimated at around 675MMb, according to Sylvain Petiteau, Vice President Zama Project, Harbour Energy. The capital investment for the project is projected to be about US$4.5 billion (pre-FEED estimate).

In the Sureste Basin, Block 30 was the most contested block during Round 3.1 in 2018. It is 60% owned by Harbour Energy and 30% owned by Sapura Energy and OMV.

The Kan discovery holds volumes between 200 to 300MMboe in place. An appraisal drilling campaign is ongoing in 2024, and the evaluation of development concepts is focused on creating a value-accretive, synergistic, and sustainable project.

Operated by Hokchi Energy, a subsidiary of Pan American Energy (PAE), the Hokchi field is also located in the Sureste Basin. The project is 55% owned by Hokchi Energy, 17% by Harbour Energy, and 8% by AINDA. The field is currently producing approximately 23Mboe/d. A waterflood process started in April 2023, with seven injector wells now operational to stabilize production. Crude oil from Hokchi is transported to the onshore processing facility via a 24-km pipeline.

In the Salina Basin, the Polok and Chinwol fields were discovered in May 2020. The Polok field holds volumes of around 722MMb, while Chinwol holds approximately 277MMb. The Polok and Chinwol fields are operated by Repsol, which holds a 30% stake, while Petronas holds 28.33%, Harbour Energy 25%, and PTTEP 16.67%. Polok is a play-opening field within the Early Miocene, and Harbour Energy is currently evaluating a floating production storage and offloading (FPSO) development option for the maturation of the Polok project to the next decision phase.

The company also holds exploration blocks in partnership with PEMEX. Following its acquisitions, Harbour Energy became Mexico’s

largest private company by reserves, with over 400Mboe awaiting development. In terms of net production, the company produced more than 12Mboe in 1H24.

Talking about the future of the industry, Baquero says development in Mexico’s offshore projects will now depend on collaboration between public and private entities. “We will need to come together and organize to ensure the barrels from the Mexican fields are fully developed. If projects like Zama and Trion are optimized and developed, along with others, it could provide a production base of nearly 600Mb/d, which is about a third of the country’s current output. The upcoming period is crucial for making these investments, and it will be a significant time for the development of offshore reserves in Mexico,” he said.

Baquero highlights that current production levels have room for growth, given the substantial reserves and resources. The strategy is to transform reserves into resources, and resources into barrels. Harbour has the potential to exceed 100Mboe using its existing assets. According to Baquero, this could allow the company to multiply its production tenfold through organic business development. With headquarters’ approval, the company could also expand further through additional acquisitions. “We know how to operate in Mexico, we know how to work onshore, and now we are proving our offshore capabilities with the drilling of Block 30. Ogarrio has been the proof of this,” Baquero highlights.

ANALYSIS OF THE ENERGY AGENDA 2030-2050T

Mexico is currently navigating a complex landscape of energy and political transitions, where private sector investments play a crucial role in accelerating energy development. To tackle the most pressing energy challenges, the Mexican Energy Council (COMENER) conducted an extensive study with approximately 30 experts, aiming to create a strategic vision for 2030-2050. The organization’s goal is to consolidate recommendations for the government’s upcoming term and players in the energy industry, focusing

on sustainability, energy security, and accessibility, explains COMENER President Juan Acra.

“By promoting regional energy planning and development through decentralized public bodies, COMENER aims to boost decarbonization and attract investments,” he says.

COMENER is at the forefront of efforts to revitalize the nation’s energy sector. Established in 2015, COMENER is the premier

business representation organization in Mexico’s energy industry, dedicated to ensuring that its members have access to key decision-makers, essential knowledge, information, and human capital necessary for effective energy project development.

To prevent stagnation, COMENER emphasizes the need for strategic development guidelines that transcend individual administration cycles. “Mexico has not had the development it could have over the past years, now there is great opportunity to contribute to the following steps to leverage on the opportunities Mexico has,” says Acra.

Building consensus among authorities, entrepreneurs, specialists, and social leaders is essential to make informed decisions that facilitate necessary projects. This unified approach aims to achieve energy sovereignty and deliver its anticipated benefits to the nation, explains Acra.

COMENER advocates for an alliance with the North American market through innovative and responsible initiatives that benefit the communities of the region. To facilitate industrial relocation processes like nearshoring, Mexico

requires robust and reliable infrastructure. This includes the entire energy supply chain, from generation to transportation, storage, and distribution. Ensuring energy availability is paramount to support this infrastructure.

COMENER’s strategic recommendation centers on the hydrocarbons sector, calling for a profound review of the economic model and the role of the oil and gas sector within the context of energy transition and climate action. This involves reformulating the sector’s institutional design and determining the involvement of state-owned enterprises. A new institutional architecture and oil policy should integrate the three components of energy sustainability: energy security, social equity, and environmental impact mitigation.

PEMEX should be positioned as a key agent in sustainability and energy transition, industrialization, regional development, income improvement and redistribution, and scientific and technological research. COMENER believes that PEMEX must be endowed with genuine budgetary and managerial autonomy, as well as the operational flexibility necessary to act both domestically and internationally. “Many see PEMEX as a burden due to the financial aid it has had. However, the NOC is important for the sector and COMENER identifies an opportunity in rethinking its refining strategy and restructuring it to reverse the money it loses,” says Acra.

To optimize the oil and gas sector, COMENER recommends the creation of a specialized company for the natural gas value chain. This entity would be responsible for exploring and developing natural gas resources and reserves, aggregating volumes to facilitate commercialization. Additionally, renewing the regulatory framework to allow companies to request areas included in previous rounds but not awarded is crucial for further development, states Acra.

Beyond hydrocarbons, COMENER identifies biofuels as a sector with great potential, albeit still in preliminary stages. For the electrical sector, the organization supports sovereignty and energy security through the promotion

of clean energies, CFE’s specialization, and institutional and regulatory strengthening. Addressing transmission and energy availability challenges is essential to attract investments. Energy efficiency is another critical area, where COMENER highlights the need for solid policies and regulations, education, technological innovation, financial incentives, and training programs. Hydrogen development is also featured prominently, with a call for a clear and robust roadmap to guide its growth.

Social impact is an overarching theme in all of COMENER’s recommendations. Ensuring that energy projects benefit communities

and contribute to social equity is paramount. Additionally, Acra’s final recommendation focuses on regulatory bodies’ crucial role in fostering healthy competition and autonomy in the sector. Promoting flexibility in resource management and encouraging dialogue among stakeholders are key to advancing Mexico’s energy sector, he says.

“By fostering sustainability, energy security, and accessibility, and addressing key challenges through innovative strategies and collaborations, COMENER aims to propel Mexico toward a sustainable and efficient energy future,” says Acra.

HR STRATEGIES FOR THE MEXICAN OIL AND GA S INDUSTRY

Mexico’s oil industry benefits from a robust workforce shaped by the sector’s specialized nature, and significant progress has been made in cultivating a highly skilled local talent pool. Nonetheless, challenges remain in addressing generational, technological, and gender disparities. HR professionals are essential in navigating these challenges and ensuring the industry’s long-term success and sustainability.

HR professionals must prioritize building sustainable talent pipelines to attract and retain workers. However, challenges remain in Mexico, such as limited capital, the absence of labor laws specific to the oil industry, and the sector’s traditional nature, which calls for more innovative thinking. “We need to make the industry

more appealing. At WTS Energy, we have partnered with schools to gauge their interest, shift our company culture, and better understand employee motivations,” says Lennart Rietveld, Regional Director for the Americas, WTS Energy. Rebeca Rodríguez, President, ARHIP, echoes concerns about the lack of tailored regulations. “Our association is working with a firm to conduct an analysis and present a legislative proposal to regulate the sector within the Federal Labor Law,” expressing her hope that this issue will soon be addressed.

Lennart added that another key challenge in retaining talent is the cyclical nature of oil projects, where workers are often

hired on a temporary basis, making it easy for them to be drawn to other projects or industries. Emilse Barragán, Human Capital and Strategic Planning Director, Jaguar E&P, emphasizes that to retain talent despite these challenges, a strong value proposition is essential. ‘It is not just about compensation; values and opportunities also play a crucial role.”

Experts say that investing in continuous professional development for existing employees is crucial, especially as technology has widened the generational gap. By offering training and certification programs, companies can help their workforce acquire new skills and stay updated with the latest industry trends. Rodríguez notes that there is now a trend of reverse training, where young talent teaches older generations how to improve efficiency and address the new priorities of today’s workforce.

Barragán also emphasizes the importance of HR strategies today in empowering women in an industry that has traditionally been maledominated. She explains that the shortage of women in the field is partly due to their hesitation to apply for jobs if they do not meet all the qualifications. Additionally, even when hired, women often face challenges in seeking and seizing opportunities. “At Jaguar,

29% of our workforce is female. We strive to ensure that at least one woman is included in our selection processes to encourage their role within the company. We want to provide opportunities that go beyond administrative roles, allowing them to engage in fieldwork as well. However, it is quite challenging,” she says. Rodríguez agreed that promoting women across all areas is challenging, as it was previously believed that fieldwork could not accommodate them. However, this perception has shifted, with projects now operating with 100% female crews. “It can be done with effort and awareness,” she states.

Another key aspect for the industry is the need to balance national and international talent, which requires a strategic approach. Rietveld explains that there are misconceptions about Mexico and its workforce, and it is the responsibility of large companies to destigmatize these issues. He notes that it was once believed that international individuals possessed greater expertise and leadership. “However, this is not the case, as there is a wealth of strong local talent. We need to promote local talent, which can be supported by international expertise, but should not be overshadowed by it,” he says.

Barragán explains that Jaguar serves as an interesting example of promoting the local workforce. Although it is 100% Mexican, the company initially had a significant number of foreign executives due to the limited experience available in Mexico. However, today, 90% of the team is national, with only 10% being international. “The future of our industry is rooted in this country, and it is our duty to nurture it by creating opportunities for local talent, women, and all generations. As the world evolves, it is our responsibility to adapt and lead the way.”

CRITICAL SUCCESS FACTORS FOR PRODUCTION OPTIMIZATION IN 2024-2030

“Mexico’s oil and gas industry is facing a different context than what was expected a decade ago. With PEMEX increasingly focusing on shallow waters, the development

of new areas, including deepwater fields, now relies importantly on partnerships between the NOC and private operators. The pressure to increase production has also led

the industry to develop new solutions for mature fields.

Despite a decline in production from 3.38MMb/d in 2004 to 1.72 MMb/d in 2018, PEMEX reported a rebound to 1.88 MMb/d in 2023. PEMEX’s focus remains on known areas and mature fields, such as Tupilco Profundo, where continuous drilling and enhanced recovery methods have extended the well’s production.

“The

issue of mature fields is critical in Mexico, as over 90% of the country’s reserves are in these fields. PEMEX has implemented hydrogen and water injection methods, but no more sophisticated secondary or enhanced recovery systems have been applied yet”

Óscar Roldán

Director

Oil and Gas Division | R9 Holdings

optimize production, improve efficiency, and minimize environmental impact. Investing in R&D and collaborating with academic institutions and research centers will also be essential for driving innovation and adapting to market changes, especially because of the importance of mature fields for PEMEX’s production.

Beyond mature fieds, over this administration, PEMEX has developed 54 new fields, both offshore and onshore, including deeper wells such as Tupilco Profundo, Quesqui, and Ixachi. The construction of marine structures has also seen significant improvements in time, weight, and cost. Deepwater fields are on the horizon, albeit through partnerships between PEMEX and major operators like Hokchi, Wintershall, Woodside, and Talos to leverage their international expertise for Mexican projects.

James Buis, District Manager Mexico, ChampionX, emphasizes that mature fields constitute most oil fields in Mexico, making their optimization essential. Effective modeling can identify the extractable resources and the appropriate recovery methods. Javier Estrada, Founder and Director, Analítica Energética, highlights that data analytics must be supported by a solid strategy, organizational structure, and suitable contracts to achieve optimal production.

Operators are encouraged to adopt advanced technologies toward digitalization, enhanced oil recovery techniques, and automation to

Nonetheless, the halt on licensing rounds remains a major concern for the industry. Experts suggest that bidding rounds and granting areas to private players could be vital for sustaining production levels. “We hope to engage in open discussions about contracts to find mutually beneficial solutions. We cannot afford to waste time, as delays prevent oil from being extracted,” says William J. Waggoner, CEO, Mexico Petroleum Company.

Future success in Mexico’s upstream sector depends on strong public-private partnerships, attractive fiscal terms, reduced bureaucratic hurdles, and data transparency. “Securing contracts with experienced operators can lead to faster development and quicker returns on investment (ROI), limiting PEMEX’s spending,” highlights Buis. “A tax regime with lower taxation than the current one is

necessary, along with a tax reform to attract private investment and make contracts more appealing,” adds Roldán.

Roldán advises the incoming government against attempting to create new types of contracts and instead recommends focusing on established industry practices. “Mexico is not currently in a position to innovate in sensitive areas like this,” he added.

Experts highlight Mexico’s potential for unconventionals, as they represent several promising areas, which are close to the

United States, which has developed a strong industry around these projects, including fracking technology. Buis noted that fracking technologies are widely utilized in United States reservoirs, whose geological formations extend into Mexico. This suggests the potential for similar projects in Mexico, especially as fracking technologies have evolved to minimize water usage. “In West Texas, for example, where water is scarce, we have learned how to treat and reuse every ounce of water recovered. Mexico will need to adopt similar practices,” Waggoner added.

SUPPLY CHAIN PRIORITIES, OPPORTUNITIES, TECHNOL OGY TRENDS

In the rapidly evolving energy sector, companies are reshaping their supply chains to boost operational efficiency, sustainability, and transparency. Technologies like artificial intelligence (AI), data analytics, and the Internet of Things (IoT) are revolutionizing supply chain management, but leaders must overcome workforce resistance and cultural barriers. Local content regulations are also influencing priorities, creating opportunities for collaboration and growth. To foster innovation, experts agree that leaders need to embrace change and emerging technologies.

César Vera, Director of Global Reach and Strategy, Fueltrax, notes that the criteria for enhancing supply chains have evolved beyond mere cost considerations. “While cost will always be a factor, it encompasses much more. We must promote national content, diversity, and technology to drive the industry forward.” Ricardo Ortega, CEO of Alliance,

agrees that companies are transforming their supply chains mainly to achieve greater operational efficiency, sustainability, and transparency while ensuring national compliance and fostering collaboration and innovation.

Ortega emphasizes that leading companies such as ENGIE, PEMEX, Shell, and TotalEnergies have transformed their supply chains by adopting advanced methodologies and technologies. Innovations like AI, data analytics, and IoT are revolutionizing supply chain management in the oil and gas sector, presenting significant opportunities to enhance efficiency and sustainability. For example, AI and data analytics provide predictive insights that enable companies to anticipate and mitigate potential disruptions, while IoT offers real-time visibility into supply chain operations, facilitating better decision-making.

However, the integration of these digital technologies is not without challenges.

Eckhard Hinrichsen, Country Manager and Market Area Manager, DNV Energy, emphasizes that despite significant advances in Mexico’s oil industry, there is still resistance to change due to fears of job losses and a perceived lack of capability. “Technological evolution is nothing new. However, there has always been a fear that technology will eliminate jobs. I see it more optimistically; while some jobs may disappear, new and more interesting roles will emerge,” he says.

Ana Ludlow, Vice President and Chief Government Affairs and Sustainability Officer, ENGIE Mexico, adds that particularly within ENGIE, there is still much work to be done in terms of digitization, as many processes are still managed through Excel, highlighting a clear area of opportunity. “We aim to digitize and automate our processes to eliminate

ZAMA PROJ ECT UPDATE

The Zama field, one of the most significant oil discoveries in recent years, continues to shape the landscape of Mexico’s oil and gas future. Sylvain Petiteau, Vice President of the Zama Project, Harbour Energy, shares

human error. However, we are aware that technology will never fully replace human input; rather, it serves as a facilitator. At the end of the day, human supervision remains essential,” she explains.

Ortega notes that another challenge is Mexico’s tendency toward egocentrism, where knowledge is often perceived from a singular perspective. This leads to fears about tools like ChatGPT, particularly regarding data validity. In contrast, these technologies are widely and effectively utilized in other parts of the world.

Local content also plays a pivotal role in shaping supply chain priorities. By fostering local collaborations, companies can enhance their supply chain resilience and gain a competitive edge. Ludlow noted that successful adaptation for operators requires a deep understanding of the local market and proactive engagement with regulatory bodies. “Promoting local content in practice is complicated because the risk of failing to meet deadlines is greater. It requires a commitment from both parties. While we must also align with local companies’ capabilities and economic circumstances, we believe it is worthwhile. We see this as a mutual development opportunity; not only do we benefit, but we also contribute to the growth of the industry together,” says Ludlow.

Hinrichsen points out that while there is a strong commitment to promoting national content, some solutions are still being sourced from other regions like Asia. “We have an exciting journey ahead of us, as Mexico is home to world-class manufacturers. This presents us with unique opportunities for collaboration that can elevate our industry and drive innovation right here at home.”

crucial updates on this groundbreaking development. The Zama field, which has been a first in many aspects for Mexico’s oil and gas industry, is poised to become a cornerstone of the country’s energy strategy.

Discovered in 2017, the Zama field featured the first wildcat exploration well drilled by a private company in Mexico, marking a major milestone following the 2015 bidding round 1.1 for Block 7. The field’s significance grew even more when it was found to extend into PEMEX’s Uchukil project. This overlap led to Mexico’s first unitization process, a collaborative effort between PEMEX, Harbour Energy, and Talos Energy. After years of negotiation, a resolution was reached in 2022, setting the stage for Zama’s development.

Located approximately 65km northeast of Dos Bocas in shallow waters of 150-200m depth, the Zama field spans about 8km by 2.5km. Along with PEMEX, the project is now developed by two partners, Talos Energy Mexico with 35% of the private part of the project, and Harbour Energy, which after the acquisition of Wintershall Dea’s share represents the other 65%.

In 2023 and 2024, the team created and submitted its Unit Development Plan. The approved UDP outlines the ambitious scope of this project, which includes the drilling of 46 wells, comprising 29 producers and 17 water injectors. These wells are expected to be developed using Tender-Assisted Drilling or Modular Platform rigs, featuring advanced

technology, such as double frac-pack and artificial lifts with Electric Submersible Pumps (ESPs).

The project has an estimated 675MMb of recoverable oil from a total of 1.65Bb of oil in place, targeting a production plateau of 180Mb/d. With a pre-FEED (Front-End Engineering Design) capital investment estimate of US$4.6 billion, the Zama field represents a substantial financial commitment and a critical component of Mexico’s energy future.

Key activities for 2024 focus on setting up essential project management functions for the Zama Unit. These include establishing an independent SAP system, creating an operating trust for cash-calling processes, and consolidating the Zama Project Team. The execution of the FEED phase, awarded to the consortium of DORIS, NOMARNA, and SUMMUM in May 2024, is expected to be completed by the end of the year, delivering around 3,500 documents. Concurrently, geotechnical and geophysical surveys will be conducted to support the engineering and design phases.

A crucial aspect of the infrastructure development involves the construction of two offshore platforms, equipped with gasliquid separators and a seawater treatment plant. This setup will facilitate the processing and injection of water for onshore energy production. Additionally, the project requires the installation of two 63.5km pipelines for transporting gas and liquids to shore, along with a power cable from the coast. These elements will connect to newly constructed, Zama-dedicated onshore processing facilities along the Dos Bocas coast, ensuring efficient resource management and delivery.

Petiteau emphasized the importance of the Integrated Project Team (IPT) formed by the Zama partners to enhance collaboration and streamline decision-making. This team, consisting of experts from Harbour Energy, Talos Energy, and PEMEX, aims to execute the activities outlined in the Unit Development Plan effectively. By capitalizing on the diverse

talents and capabilities of each partner, the IPT seeks to build trust and foster a unified approach to the project’s challenges and opportunities.

Addressing the challenges of working collaboratively in this field, Petiteau comments: “From my perspective, the unification process has faced two significant challenges. The first is administrative: Despite having a written plan, implementation is always more complicated in practice. The second challenge is the initial difficulty of unification. The reservoir is split in half, making it unclear if any actor has a larger share within their area, leading to difficulties in dividing responsibilities. However, the idea is to work

as Zama, not as individual companies.” This collaborative model, while not necessarily ideal for all projects, has proven beneficial for the Zama field, leveraging the unique strengths of each team member to drive the project forward.

Despite the challenges inherent in such a large-scale project, Petiteau expressed confidence in the team’s ability to deliver, highlighting its proven capacity to overcome obstacles and achieve milestones. “There will be a lot of challenges as in every project, but we proved that after previous challenges, we are here talking about the development of Zama, which shows the team’s capacity to deliver,” he stated.