4 minute read

RHP Expands Portfolio to North Carolina

by MHInsider

MMichigan-based RHP Properties, the nation's largest private owner and operator of manufactured home communities, has acquired six manufactured home communities in North Carolina, its first in the state.

This expands the company's portfolio to 30 states and its total of manufactured home communities to 308 nationwide. The announcement was made by

Ross Partrich, CEO, RHP Properties.

With these purchases, RHP Properties now owns and operates Homestead in Fletcher, River

Oak in Mills River, Riverview and Ridgeview in

Asheville, Wellington Estates and Wellington West in Arden, North Carolina.

The communities are near Asheville, the largest city in western North Carolina, located in the Blue

Ridge Mountains with convenient access to numerous freeways and major cities. Major employers in the

Asheville area include Eaton Corporation, GE Aviation

Asheville, and Sierra Nevada Brewing.

A top-rated travel destination, Asheville has grown from a small town into a flourishing metropolis known for the arts and the great outdoors. The city features more than 30 art galleries, a burgeoning culinary and music scene, and close proximity to the Appalachian Mountains.

“RHP Properties is pleased to announce our first communities in North Carolina, offering affordable housing options to the Asheville area” said Partrich. “Our manufactured home communities provide peace of mind for our residents with amenities such as on-site professional staff and clubhouses. We offer a true community setting including RHP Social, our activities and events that bring residents together to socialize through family friendly events such as holiday parties, barbeques and more.” MHV

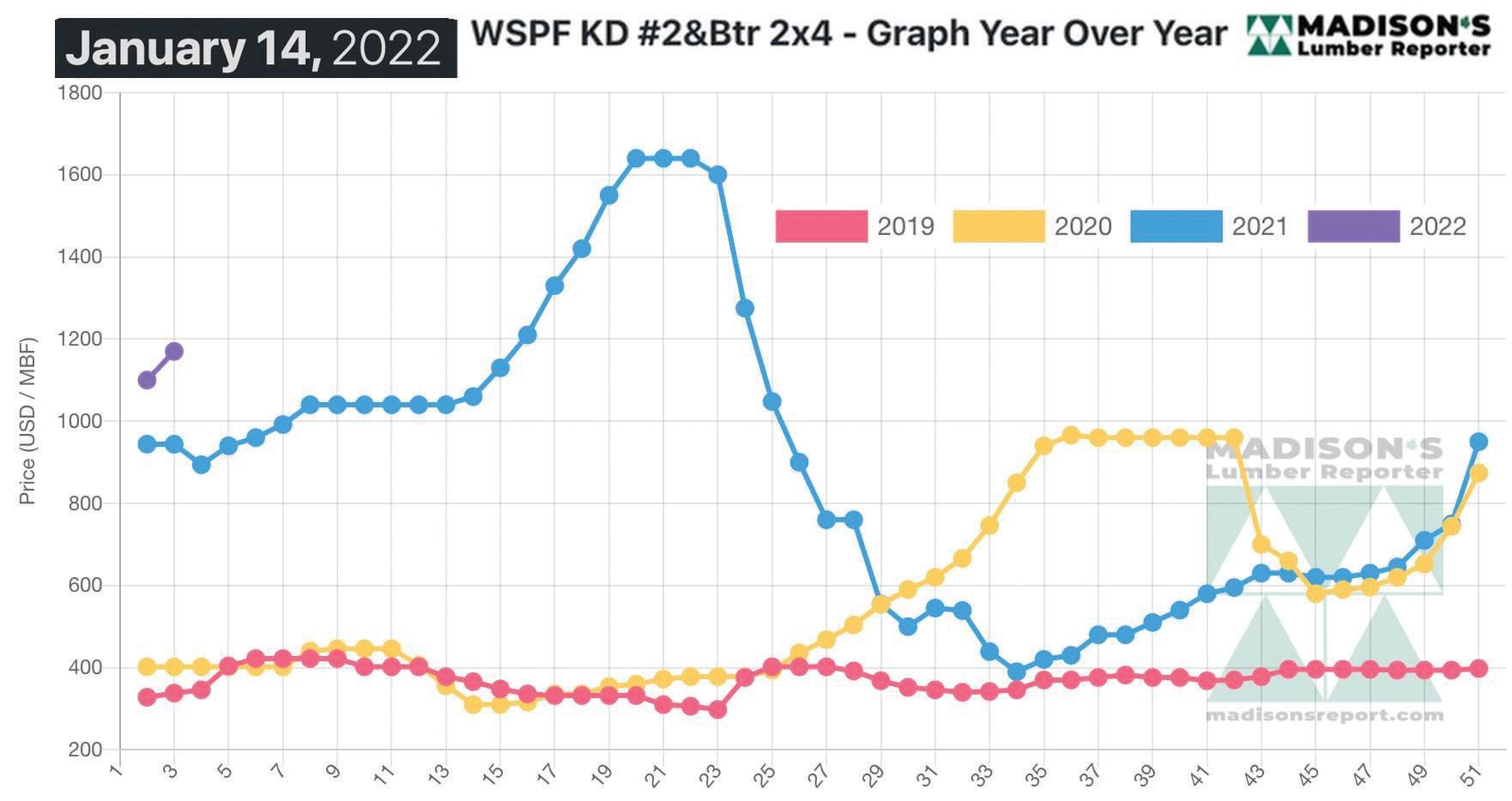

Marrying U.S. Housing Starts and Softwood Lumber Prices for Market Insight

Lumber Prices Jan 2022 and US Housing Starts Dec 2021. Lumber prices are an excellent forward indicator of construction.

UUnusual for the time of year but a surprise to no one, lumber prices rose further in the second week of January. Ongoing momentum of strong demand from the end of 2021 combined with significant supply constraints, most notably from the northwest and especially in

British Columbia, has kept prices high. Transportation issues throughout the supply chain caused a feeling of panic among buyers, as the usual 6-week delivery time turned into two-months or longer. Frustration reigned with customers as the location of wood previously ordered was unknown.

At least part of the problem with deliveries was due to a series of very powerful storms and massive flooding through November, which completely destroyed all four highways and both rail lines in southern B.C.

An upward bump in U.S. housing starts, again unusual for the season, kept the pressure on to order dimensional lumber products.

New home building in the U.S. in December exceeded the historical trend with total housing starts increased by +1.4% from November 2021. to a seasonally adjusted annual rate of 1.702 million units. This is a +2.5% rise from the same month last year. Meanwhile, December permits for future home building rose to 1.873 units, a whopping +9.1% gain from the previous month. December 2021 permits are up +6.7% compared to a year ago, when it was 1.106 million.

The backlog of houses authorized for construction but not yet started shot up +1.1% to a rate of 270,000 units last month, the highest on record.

Building permits are generally submitted two months before the home building is begun, so it’s quite unusual for this metric to be rising in December. Normally, not many builders want to break ground on a new house in February. Last year was different, of course. December 2021 single-family permits grew by +8.5% compared to one year ago, when it was 1.128 million units.

Insiders know that construction framing softwood lumber prices are a good leading indicator for U.S. housing activity, including home building and home sales. Benchmark Softwood Lumber Prices January 2022

Looking at lumber prices, momentum from strong demand at the end of 2021 pushed prices higher, so in the week ending Jan. 14, 2022, the price of benchmark lumber item Western S-P-F 2x4 #2&Btr KD (RL) continued rising, up by $70 or 6% to $1,170 per thousand board feet, according to forest products industry price guide newsletter Madison’s Lumber Reporter. That week’s price is up by $367, or 46%, from the month prior when it was $803. That week’s price was up by $226, or 24%, again the month prior when it was $944.

A closer look at the housing data shows that the availability of lots is hampering the speed of new construction in the general housing market as well. The number of single-family homes on which builders started construction in December actually dropped by roughly 2% on a monthly basis. Put another way, the number of housing units that construction companies haven’t started work on despite having the authorization to begin building is up 44% from a year ago and is rising on a monthly basis. For each single-family unit completed in December there were 9.5 single-family units still under construction. This is the highest ratio in the life of the database.

As of December, there were 769,000 single-family homes under construction, a 26% gain from a year ago, and there were 750,000 multifamily units under construction, a 15% increase from December 2020. MHV