5 minute read

Greenfield vs. Brownfield Communities?

By Edward Hicks

Slugging it out with the other hundreds of investors each vying for the few reasonably priced manufactured housing properties is getting harder and harder these days. There are a finite number of existing investment-grade communities out there. And the pool is ever decreasing.

With a few exceptions, in the past 25 years there have been no new non-age restricted communities built. The few that have been built are larger, 55+ communities in retirement areas or near large metros.

Creating a new “greenfield” land-lease community takes more time and attention than just negotiating a contract and going through due diligence, as is the case when buying an existing community. However, with the typical leveraged internal rate of return landing between 35 and 65%, greenfield projects

can make the extra work and wait all worthwhile for those with capital who are seeking higher returns.

Even existing “brownfield” communities that include entitled land for expansion, or those with adjacent land at a premium, are rare. With the basic operating expense base already in place, additional income from leases was virtually only subject to additional property taxes. Hard to find? Yes, but impossible, no. Additional effective cap rate went from a poor 5.5% to a whopping 9.5% the first year. These kinds of “value-added” deals make sense to me and my clients.

Privately funded multi-family guaranteed loans for combination construction to 40-year low interest non-recourse permanent loans are worth the discomfort of obtaining zoning and land use approvals. Once the necessary entitlements are assured, the key to getting development loans is to show consistent market demand. That means not only producing a review of area metrics showing intrinsic household growth, or at least stability, but also comparisons of the proposed housing costs for target residents in the context of other housing alternatives: apartments, single-family »

MOVE ITand LIFTIT INTO PLACE... QUICKLY, SAFELY and PRECISELY.

The Platypus lifts and moves housing units with ease. Mating the halves ofa modular home is done without the need for jacking and rolling, resulting in higher productivity and a safer job site. The radio remote controlled Platypus provides an unobstructed view of the work zone.

Radio Remote Controlled

Radio Remote Controlled

Get it on the pad safe and sound with a House-Tug! Housing placement is quick and easy in places where no tru ck or dozer could ever go. With our full line of options and accessories,site prep is no problem.

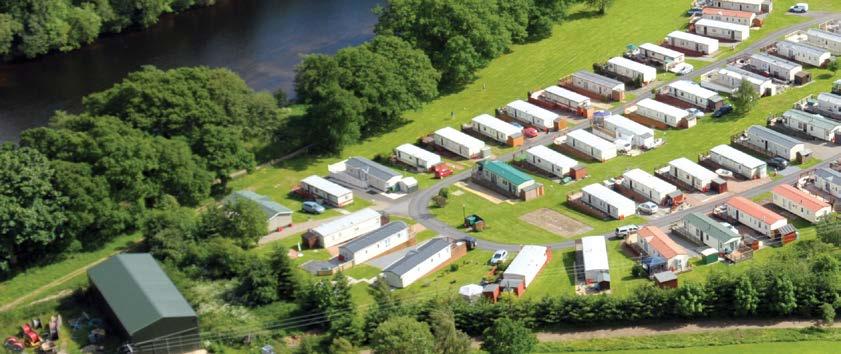

Photo courtesy of Edward Hicks

starter homes, and even RV parks where indicated.

These rarely used loan guarantee programs provide for acquisition and rehabilitation, or rehabilitation and refinance of existing communities, as well as new development financing by private lenders for qualified manufactured home land-lease or cooperative communities. Subdivisions and condominium projects are not included. Private lenders provide for up to 90% of construction costs, the land at value (not necessarily cost), and all on-site infrastructure including, but not limited to: • Storm water management, • On-site utilities • Water/sewer distribution/collection • Electrical service • Telephone and cable TV services • Natural gas • Grading and roadways • Engineering and survey costs • Governmental impact or utility tap fees

Amenities

Additionally, general contractor fees, overhead, security costs, interest taxes, and insurance during construction are all included up to the loan limits. Off-site construction and excess land are not funded. These must be left out of the first phase of financed work, but may be included upon refinancing for phased expansion. Typically, no rent controls or limitations are imposed other than regular operating statements, a yearly rent roll, and compliance with all local, state, and federal equal housing laws and regulations.

The community must be operated as a single-purpose legal entity, and all investors or owners with more than a 25% equity are subject to a personal history questionnaire to verify no serious previous history of default on government loans (including student loans) and no pattern of business failures. Previous real estate and/or business experience is helpful in obtaining an approval, but this is considered rather than required.

Manufactured homes may be sold in the community by the developer, but not to the exclusion of other area retailers, as long as the homes and installations meet community requirements. Cash flows from in-community home sales may not be used as a financial justification for net operating income calculations or to justify loan equity requirements at closing.

Another similar loan guarantee program is for new apartment construction using HUD-code homes, as single-family detached housing,

Photo courtesy of Edward Hicks

provided the development site is zoned and approved for manufactured housing. If not, factory-built modular units must be used. This is typical when building a project with duplex or single-family attached units. Under

writing and subsequent funding is by a private lender for qualified projects using the Multi Family Accelerated Processing system, and then is sent to HUD staff for review and approval. As with the infrastructure program for land loans, land value and infrastructure costs are included, but no general contractor’s fees or overhead if the builder and sponsor’s profit and risk allowance is used. Loan fees range from 1.5 to 3.5 points plus audit and engineering supervision.

HUD code dwelling units must be new, not used or rehabilitated. Funding provides for up to 90% of land value, infrastructure, foundations, dwelling units, and accessories (a/c, drives, carports or garages, for instance). If the project is cost limited, the builder and sponsor profit and risk allowance and any excess of land value over cost may be used as a part of the project’s equity requirements.

For the right market conditions, reasonable construction costs, some marketing, and home sales acumen, greenfield projects may be in order. A quick summary review of a proposed project can be done online and/or with the help of a qualified lender or commercial loan broker. MHV Edward “Eddie” Hicks is principal consultant for Con sultants Resource Group, available at (844) 642-6668 and easteddie@aol.com. With over 45 years experience as a manufactured home retailer, manufacturer, developer, and real estate broker assisting clients with their community development, financing, and acquisitions. Learn more at www.mobilehomepark.com.