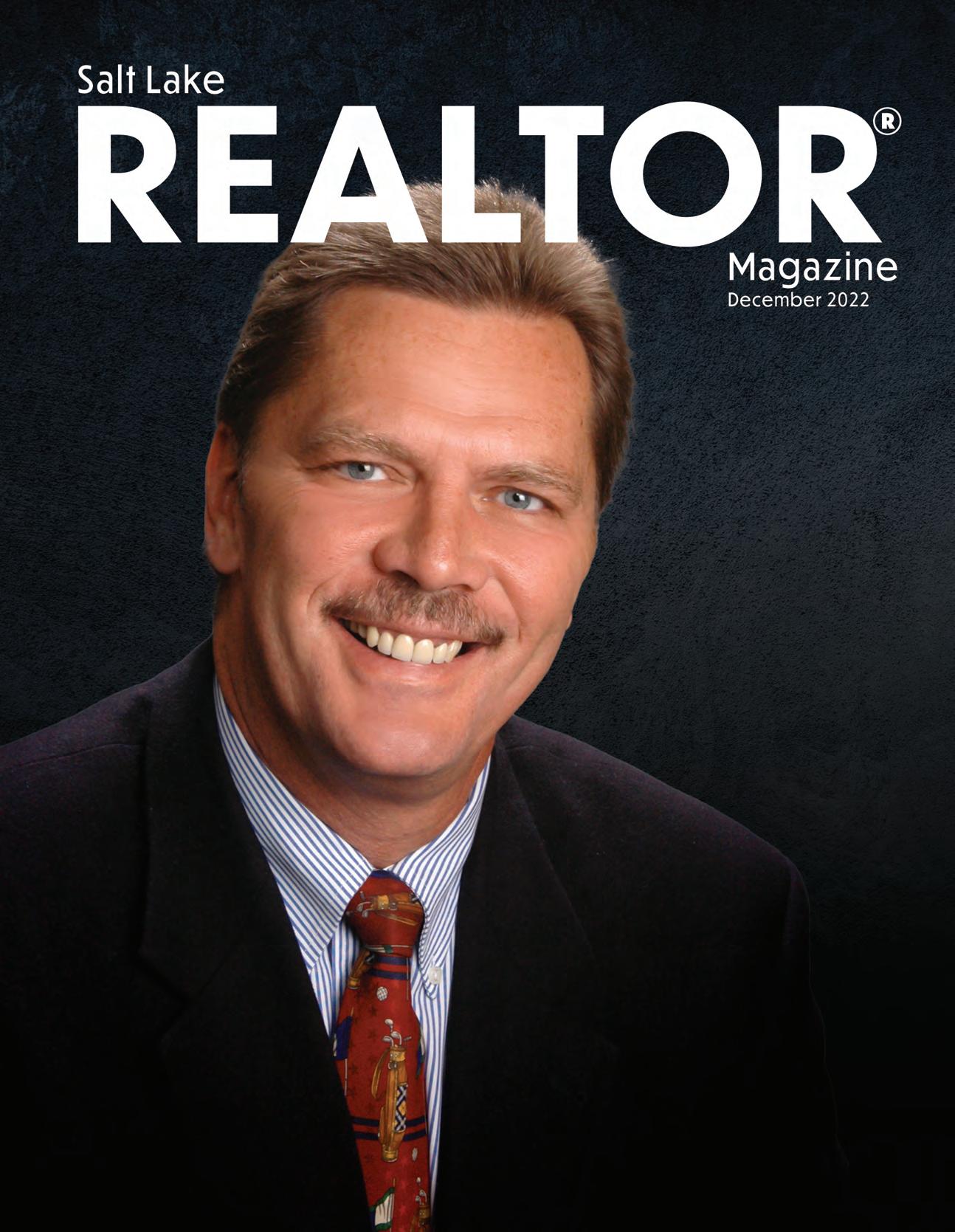

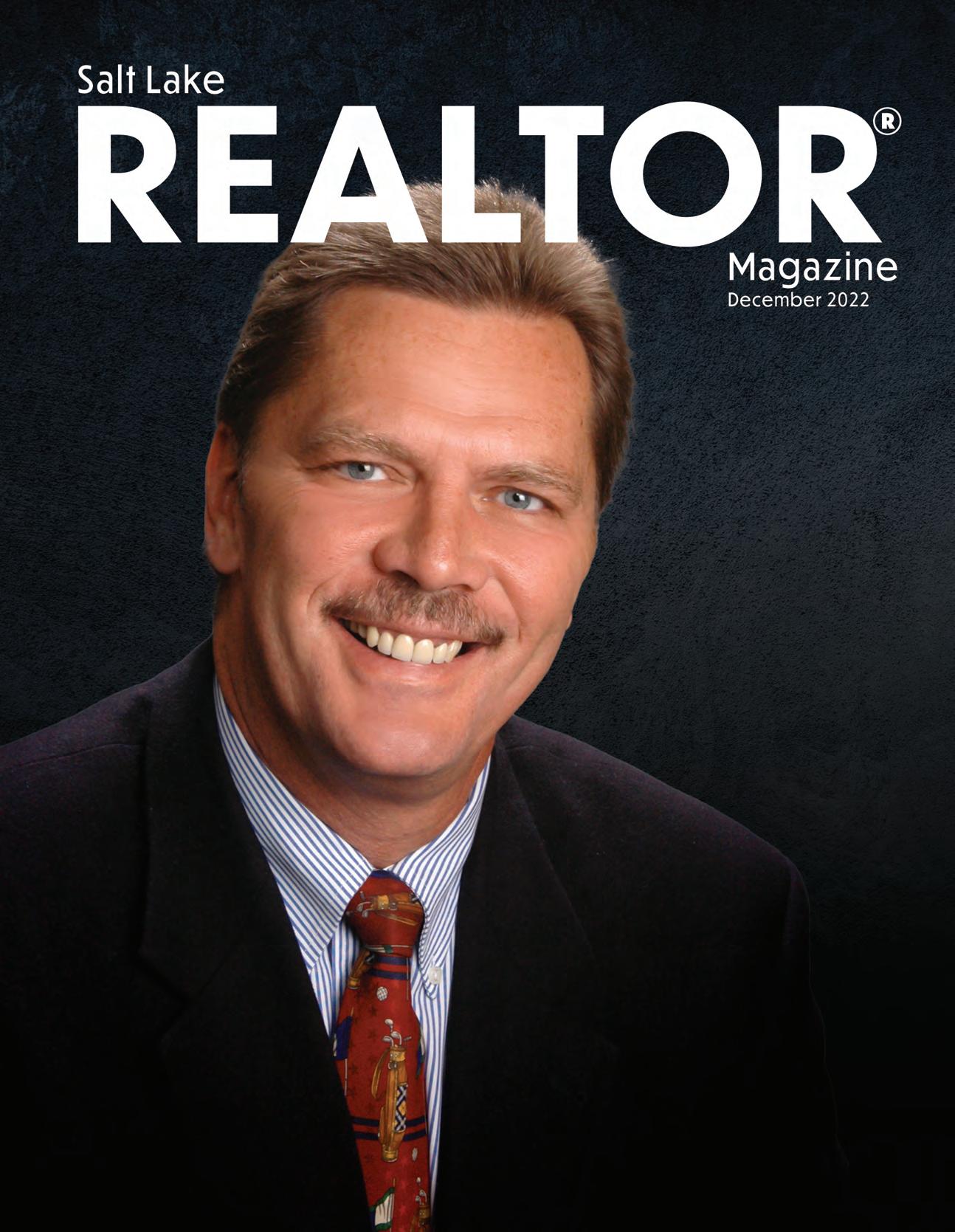

Realtor® of the Year

Dave Frederickson

With sister companies in insurance and memorial services, we offer a level of horizontal integration that strengthens the entire company. We’ve weathered financial storms that have ruined less prudent companies and we continue to grow with offices coast to coast to better serve your clients.

President

Steve Perry

Presidio Real Estate

First Vice President

Rob Ockey

Century 21 Everest

Second Vice President Dawn Stevens

Presidio Real Estate

Treasurer Claire Larson Woodside Homes

Past President Matt Ulrich Ulrich Realtors®

CEO Curtis Bullock

Directors

Jenni Barber

Berkshire Hathaway

Morelza Boratzuk RealtyPath

Hannah Cutler

Coldwell Banker

Laura Fidler

Summit Sotheby’s

Amy Gibbons Keller Williams

Jennifer Gilchrist

Utah Key Real Estate

Tony Ketterling Equity Real Estate

John Lucky Berkshire Hathaway

Jodie Osofsky

Signature Real Estate Utah

Janice Smith Coldwell Banker

Carlye Webb Summit Sotheby’s

Advertising information may be obtained by calling (801) 467-9419 or by visiting www.millspub.com

Managing Editor

Dave Anderton

Publisher

Mills Publishing, Inc. www.millspub.com

President Dan Miller

Art Director Jackie Medina

Ken Magleby Patrick Witmer

Office Administrator

Cynthia Bell Snow

Sales Staff Paula Bell Paul Nicholas

The Salt Lake Board of Realtors® strives to be the voice of real estate. This year was no exception. From January through November there were 468 news stories that referenced our association. These stories appeared in television, Internet, radio, newspaper, and magazine spots in Utah and across the United States. An analysis by a media news service found that most of these stories, 50.4%, were viewed with a positive sentiment. 42.5% were considered neutral.

Just 7.1% were negative. When you combine blogs, Twitter, YouTube, and Facebook mentions, there were more than 1,000 sources that mentioned the “Salt Lake Board of Realtors®.”

Our media engagement established greater credibility with the public by addressing current trends, home prices, mortgage rates, first-time buyers, and what buyers and sellers should know about Utah’s housing market.

Our MLS, UtahRealEstate.com, is one of the best and largest MLSs in the nation. Our sales data is unique and paints an accurate picture of real estate trends for the Wasatch Front and across Utah. This data is sought after by journalists, professionals, and our clients.

One recent TV story addressed the opportunities that existed for potential homebuyers in Utah in a slowing market. Another local story titled, “Housing market needs difficult correction to balance out, Fed says” was the No. 1 story with the most reach. The article was picked up by MSN.com with a national reach of 155 million viewers. I was quoted in this story as saying the Federal Reserve’s aggressive rate hikes were having little effect on inflation, but a chilling effect on the housing market.

Salt Lake Board: (801) 542-8840 e-mail: dave@saltlakeboard.com Web Site: www.slrealtors.com

The Salt Lake Board of REALTORS® is pledged to the letter and spirit of U.S. policy for the achievement of equal housing opportunity throughout the nation. We encourage and support the affirmative advertising and marketing program in which there are no barriers to obtaining housing because of race, color, religion, sex, handicap, familial status, or national origin.

The Salt Lake REALTOR is the monthly magazine of the Salt Lake Board of REALTORS . Opinions expressed by writers and persons quoted in articles are their own and do not necessarily reflect positions of the Salt Lake Board of REALTORS®

Permission will be granted in most cases, upon written request, to reprint or reproduce articles and photographs in this issue, provided proper credit is given to The Salt Lake REALTOR as well as to any writers and photographers whose names appear with the articles and photographs. While unsolicited original manuscripts and photographs related to the real estate profession are welcome, no payment is made for their use in the publication.

Views and opinions expressed in the editorial and advertising content of the The Salt Lake REALTOR are not necessarily endorsed by the Salt Lake Board of REALTORS . However, advertisers do make publication of this magazine possible, so consideration of products and services listed is greatly appreciated.

REALTOR is a registered mark which identifies a professional in real estate who subscribes to a strict Code of Ethics as a member of the NATIONAL ASSOCIATION OF REALTORS

This year the Salt Lake Board of Realtors® hired our very own chief economist, Dejan Eskic, who is also a senior research fellow at the University of Utah’s Kem C. Gardner Policy Institute. Dejan has appeared in numerous media stories, explaining real estate market trends and what opportunities and challenges home buyers and sellers face today. Trust and credibility are established when Realtors® and associations step up to tell their stories and present the facts. By doing this we excel in media and public relations.

One of my goals as your 2022 president was to raise the bar in professionalism and communication. I believe we accomplished this goal by championing the importance of having a Realtor® when buying or selling a home, especially in this changing market. I express my thanks to the directors, committee members, and everyone who helped make this year a success. It was my pleasure to serve as your president and to represent the more than 10,000 Realtors® and affiliate professionals at the Salt Lake Board of Realtors®.

Utah was the fastest growing state in the nation, increasing by 18.4% between 2010 and 2020, according to the U.S. Census Bureau. That growth has many Utahns concerned over Utah’s future quality of life. In fact, Utahns are more concerned about growth now than at any point in the last 25 years, according to Envision Utah, a nonprofit that engages Utahns in collaborative, bottom-up decision making. Housing costs are the primary driver, followed by traffic and community impacts. “People don’t just disappear because you deny them a place to live,” said Ari Bruening, CEO of Envision Utah. “Maybe you deny them a house, but now they are going to live in their parent’s basement.” Bruening’s remarks were the focus of a Realtor® Town Hall held in November at the Realtor® Campus in Sandy. Bruening added that the question isn’t “Should we grow?” but “How should we grow?” “We don’t want to grow in a way that ruins that quality of life,” he said. “That’s what we are all about at Envision Utah – maintaining that quality of life.”

National Associ ation of Realtors® President Kenny Parcell issued the following state ment after the Department of Housing and Urban Development (HUD) published the final rule to the Federal Register enabling Federal Housing Administration (FHA) borrowers to obtain private flood insurance:

“The National Association of Realtors® applauds HUD for issuing the FHA final rule opening the door to private market flood insurance options in addition to the National Flood Insurance Pro gram,” said Parcell. “The new rule is a victory for consumers, for choice, and for flood coverage that will protect more borrowers and property from the number one natural disaster in the United States. NAR has long advocated for an updated rule to address an inequality with conventional borrowers, and this action will increase the flood insurance choices available to FHA borrowers.”

Utah ranks fifth in overall prosperity according to the American Dream Prosperity Index (ADPI), released by the Milken Center for Advancing the American Dream in partnership with Legatum Institute. The United States continues to see a rise in prosperity, even as we faced the long-term impacts of a pandemic and the economic realities of rising inflation and a shrinking economy. But while the overall trend points to a prosperous nation, prosperity continues to be unequally distributed regionally, often eluding rural communities and Black Americans. Utah places itself firmly in the front of the pack, ranking fifth in overall prosperity and first in social capital, or how much people trust, help, and respect their neighbors and institutions. The state’s additional strengths include ranking in the top ten in economic quality (ranked 3rd), living conditions (ranked 9th) and personal freedom (ranked 10th). To raise its overall ranking, the state could improve its pillar placement in infrastructure (ranked 28th), governance (ranked 21st), and health (ranked 18th).

The final rule posted to the Federal Register today by HUD extends to FHA borrowers more insurance choices that have been available to conventional loan holders. The previous FHA rule was written decades ago, when there was no private flood insurance market. The market today is increasingly providing higher quality, lower cost alternative options than the National Flood Insurance Program. Conventional bor rowers have been able to choose between NFIP and private policies since most of the federal lending regulators issued a final regulation in 2019. Now, because of this new rule, FHA loan holders will have the option to choose either flood insurance to meet federal coverage requirements. While the FHA rule does not perfectly align with the other federal rules, NAR stands ready to work with HUD to address any remaining differences that could create lender confusion.

Dave Frederickson sees solutions where others see barriers. He is one of the foremost experts in real estate practices and the Code of Ethics, according to Adam Kirkham, 2018 president of the Salt Lake Board of Realtors®. “Dave is a broker’s broker,” Kirkham said. “He is good at deescalating conflicts that arise between agents.” Dave’s real estate skills were evident early in his career. Robert Farnsworth, 2003 president of the Salt Lake Board of Realtors®, first met Dave in 1984. They both worked as rookie agents for Miller and Company. “We grew up in the business together. He’s always been my big brother,” Farnsworth said. “I wouldn’t have made it without him. He taught me how to work with people in sales. He is a great negotiator and one of the best transaction troubleshooters I have ever met. He is such a people person and has a high level of understanding of contracts. That’s what makes him such an amazing broker.”

That friendship and trust led to the two of them starting a full-service brokerage, Proactive Properties, in 1990. They operated the business for more than a decade. Brook Madsen, a Realtor® with Keller Williams Salt Lake City, has known Dave since 2009. “It’s nice knowing that your broker has your back,” Madsen said. “We often deal with emotional buyers and sellers. Dave makes the transaction go smooth. He can outline a scenario that is good for both sides. He’s good at putting things in perspective.”

Boyd Brown, owner of Keller Williams Salt Lake City, hired Dave in 2011 as principal broker because of his outstanding reputation and experience. “He is an advocate for our agents,” Brown said. “I have agents that are so loyal to Dave. We have agents that credit their careers to Dave. His real strength is teaching people how to write offers that are compelling and compliant.” Dave has taught Code of Ethics and Realtor® Essentials for the Salt Lake Board of Realtors® for many years and was president of the Board in 2013.

On the family front, Dave’s daughter Lindsay praises her father for giving his time freely. “He considers his family to be his greatest achievement,” she said. “His life has always revolved around his family, and he will drop everything to be there if needed.” In fact, Lindsay recalls her father driving to Cedar City for the day just to have dinner with his daughter Sarah because she was having a tough week in college. Dave has been married to his wife Linda for 37 years. They have two daughters and one grandson, Bennett. Bennett, who is just eight months old, was recently diagnosed with retinoblastoma, a rare type of eye cancer that can affect young children. Dave never misses Bennett’s chemotherapy and laser treatments.

“His successful career, the committees, board positions, being the broker of hundreds of agents, and having his own business, have never caused him to miss anything in his children’s lives,” Lindsay said. “We are so proud of you and all your achievements, Dad! We love you!”

John Gonzales is generous with his time, talents, and money. His integrity and determination have blessed his family, colleagues, and thousands of clients he has worked with during his 25-year career. His everyday work turns the dream of homeownership into a reality for homebuyers.

He is the only affiliate member of the Salt Lake Board of Realtors® to achieve the Realtors® Political Action Committee (RPAC) Hall of Fame level ($25,000 or more in lifetime investments). In 2012, John was appointed by Utah Gov. Gary Herbert to the Residential Mortgage Regulatory Commission. He works frequently with some of the state’s top real estate agents, builders, financial planners, CPAs, and attorneys.

John is a big supporter of Salt Lake Board of Realtors® events and causes. He has served on committees and typically attends every Board event. “You see John and his team everywhere,” said Lisa Jungemann, Realtor® with Windermere Real Estate Utah. “I love John because he works as hard or harder than I do. When John says he’ll get it done, he gets it done,” Jungemann said. “My clients are always satisfied with his professionalism and personal touch. This past Thanksgiving break, he got my clients approved for a loan in record time, and they were able to go under contract because of John. I just think he is a class act.”

He is the founder, broker, and owner of South Towne Mortgage, a Sandy-based residential mortgage loan company. “John has been one of the best managers I’ve worked with in my 40 years of doing mortgages,” said BJ Hansen, senior loan officer with South Towne Mortgage. “He is kind and thoughtful. I followed him whenever he changed companies.”

On the personal side, John loves cars. He collects them and loves to clean them. He is a rabid Utah Jazz fan and doesn’t miss watching or attending a game. He loves movies and Seinfeld. John met his wife, Paula, while working at Zions Mortgage in the early 1990s. They have been married for 25 years and have two sons, Zach and Nathan.

Ryan Kirkham is smart, approachable, and quick to offer his expertise to help others and the real estate profession. Ryan has served on the Board of Directors for UtahRealEstate. com for the past nine years, sitting as the Chairperson for three. UtahRealEstate.com is one of the largest multiple listing services in the United States and is consistently ranked by Swanepoel’s T360 as one of the top 20 in the country (out of more than 500 organizations).

“His dedication and commitment to UtahRealEstate.com is hard to match,” said DeAnna Robbins, 2011 president of the Salt Lake Board of Realtors® and a director at UtahRealEstate. com. “He is a strong and effective leader, not just locally but nationally. He has helped to grow the MLS and provide innovative services to our agents and clients.”

“As an MLS Director, Ryan helped make UtahRealEstate.com one of the top-ranked MLSs in the country,” said Brad Bjelke, CEO of UtahRealEstate.com. “He is never afraid to face a controversial topic, and he looks out for what is best for the MLS, the Realtor®, and the consumer. I am proud of his work on our Board and even prouder to call him a friend!”

Ryan has served as president of the Salt Lake Board of Realtors® and as president of the Utah Association of Realtors®. He has also worked for many years on the UAR Forms Committee. At the local level Ryan teaches several continuing education classes to Board members. He has given thousands of hours of his time. Because of this, Ryan has made the real estate profession a better place to do business.

Ryan was principal broker at Kirkham Real Estate from 1995 to 2015. Since 2015, he has been managing broker of Summit Sotheby’s International Realty Salt Lake, where he works closely with 50 agents. “He’s one of the most respected and evenhanded brokers in the industry,” according to his brother, Adam Kirkham. “His work ethic is unmatched. He knows contracts inside and out.”

Ryan is married to Jodi. They are proud parents to seven children and have one grandchild.

Kelly Hannah was 13 years old when he saw The Great Salt Lake for the first time. Back then, the lake spanned 3,300 miles and marked an elevation of 4,212 feet above sea level. Its shores nearly reached to what is now I-80. Today, the lake has shrunk to less than one-third of that size. One cause is surging population growth that has diverted water from rivers that feed The Great Salt Lake. Severe drought has compounded the problem. ”The consequences of a shrinking lake will be felt by everyone,” said Kelly. The dry lakebed is already leading to dust plumes that compromise air quality. The shrinking lake means fewer lake-effect storms that give snow to Utah’s ski resorts.

Thousands of people in the mineral-extraction industry are employed because of The Great Salt Lake. “Every single individual along the Wasatch Front and in Utah has a vested interest in a solution,” Kelly said. “It’s our problem to solve and we have the capacity to solve it.”

The mission of Friends of Great Salt Lake is to preserve and protect The Great Salt Lake ecosystem. Friends of Great Salt Lake has been advocating for the health of the lake and its ecosystem since 1994. Kelly joined its Board of Directors in 2019 and currently serves as chair of the Arts and Sciences Committee, which oversees two areas: The Alfred Lambourne Arts Program and The Doyle W. Stephens Research Program. Offering awards and scholarships within each program, Friends of Great Salt Lake empowers artists and scientists in their exploration and advocacy for the lake.

When Tiani Shoemaker was 31, she found herself divorced and with three children under the age of 10. “For the first time in my life I experienced significant challenges,” she said. “Financially, I was negotiating paying my bills. I cut my gym membership and wouldn’t go out to lunch. I was working and taking care of a baby. I was surviving on the bare necessities and trying to keep a roof over my head.” Her 12-year experience as a single mother inspired her to start Little Miracles, an organization that serves single-parent families. Little Miracles helps families by making their living situations a little brighter. Projects may include supplying new furniture, painting, providing a Christmas tree during the holidays, or a doing a complete home makeover. Since its inception in 2013, the organization has brought together 2,500 volunteers to help 137 families. “I just wanted to do something that helped other people because I knew what it was like,” Tiani said. “Little Miracles is a connection as much as anything else. We connect single parents with other single parents, children with children.” Little Miracles has been featured by local news stations, People Magazine, and even Mike Rowe’s

Centrally located in the Salt Lake Valley, this townhomes community offers 2- and 3story floor plans ranging from 1800-2150 square feet.

QUICK MOVE-INS AVAILABLE: 2- and 3-story units, both interior and exterior Starting in the $420s

55-plus community located near shopping, entertainment, and majorthoroughfares. Fully landscaped yards and snow removal included.

QUICK MOVE-INS AVAILABLE: Rambler-style homes ranging from 2902-3505 square feet Starting in the $650s

Custom-desgined homes in the heart of the Heber Valley. Maintenance-free living with fully landscaped yard and snow removal.

QUICK MOVE-INS AVAILABLE: Single-family homes ranging from 4219-4575 square feet Starting in the $1.1 millions

Tech firms offering instant cash to home sellers touted simpler, quicker transactions. But the model is floundering in the housing downturn.

When iBuyers emerged a few years ago, they made bold promises to revolutionize the homebuying and selling process with instant cash offers and a pick-your-closingdate transaction model. But many of these iBuyers are facing setbacks amid a slowing housing market; some are pulling back and pivoting their business—or even shutting down.

Redfin shuttered its iBuying arm, RedfinNow, in November, while Opendoor, the largest iBuyer, announced $1 billion in losses in the third quarter and FlyHomes reduced its workforce by nearly 40%. Zillow Offers, which was another giant in the iBuyer space, closed in 2021. Redfin CEO Glenn Kelman says his company’s move was a “strategic decision” to refocus on its core real estate business.

The iBuyers that remain in the market reportedly are taking on significantly fewer purchases and making less-enticing offers to sellers. “The iBuyer model remains unproven,” said Kurt Carlton, president and co-founder of New Western, a company that buys and sells properties for home flippers and investors. “It may return with some real utility, but I don’t think the recent overabundance of cash in the venture capital markets was a healthy dynamic for these models. They certainly didn’t seem to provide the urgency and door-die grit that often drives real innovation. Now the capital markets have shifted to a ‘profits over promises’ expectation, and many of the iBuyers have found themselves running out of time.”

“The purest iBuyers are essentially pivoting to become more like listing agents,” Carlton said, “showing just how challenging it is to disrupt the current industry standard.”

Despite promises to disrupt the industry, iBuyers have accounted for a small number of transactions: 1% of sellers sold their home through an iBuyer in the past year, according to National Association of Realtors® data. Some markets saw more activity than others, such as Phoenix, where iBuying accounted for nearly 10% of sales, according to data from Parcl Labs, a company that tracks iBuyer activity.

Parcl’s research shows iBuyers in the Phoenix area currently hold about $1 billion in housing inventory, said Jason Lewris, co-founder of Parcl Labs. As the market slows, iBuyers are slashing prices by more than 2% every two weeks to unload properties quickly. “As more pressure builds for iBuyers to exit their positions, they will likely become more aggressive in their pricing,” Lewris said. “This will continue a downward spiral until prices reach a point where demand enters to stabilize it.”

Many iBuyers also are reducing their purchases. Opendoor reportedly scaled back its homebuying activity by 45% in the third quarter compared to a year earlier and shut down its mortgage business. The company announced layoffs of 18% of its workforce this fall, and CEO and co-founder Eric Wu said this month that he plans to step down.

Offerpad, another iBuyer, said it slowed the pace of its purchases by 33% in the third quarter compared to a year prior. Nevertheless, “despite the current market volatility, I firmly believe technology-enabled solutions that simplify the homeownership experience will define the future of real estate,” Offerpad CEO and chairman Brian Bair said in a statement.

Still, some iBuyers are expanding into other areas while slowing or halting home purchases. Offerpad is beta testing its “My Way” program, which enables home buyers to renovate prior to moving in and roll the costs into their mortgage.

Opendoor is investing in a new program, Opendoor Exclusives, a marketplace for buyers to view off-market homes on a first-come, first-served basis. (Opendoor skirts MLS rules for off-market listings because the company owns its listings.) Homeowners who sell with Opendoor can either request an instant offer or list on Opendoor Exclusives for 14 days to generate buyer interest. Opendoor aims for 30% of its total business to come through the Exclusives marketplace by the end of 2023.

“This is a big shift in their model,” said Mike DelPrete, a real estate technology strategist who authored The 2022 iBuyer Report. “The proposition of iBuying has always been about speed, certainty and simplicity.” But speed is at risk with Opendoor Exclusives, DelPrete noted, because it doesn’t use the instant offer model. “And it’s less simple. It’s more complex to explain and understand than just pressing a ‘sell’ button.”

Will other iBuyers choose to innovate or retreat from the market? Tech startups like New Western are focusing on niche markets, like managing fix-and-flip properties. “When others are retreating, we’re advancing,” Carlton said, adding that there are 15 million vacant homes in the U.S. that could be rehabbed and returned to the marketplace to help address inventory shortages.

“I’m hoping this more challenging funding environment will drive real innovation to improve the homebuying and selling experience,” Carlton said. “The current market is challenging, and I think the old saying holds true that ‘necessity is the mother of invention.’ It’s hard to tell if iBuying will fade into a niche alternative or evolve into a different approach that proves viable.”

Melissa Dittman Tracey is a contributing editor for Realtor® Magazine. Reprinted from Realtor® Magazine Online, December 2022, with permission of the National Association of Realtors®. Copyright 2022. All rights reserved.

National Association of Realtors® Chief Executive Officer Bob Goldberg joined White House officials and industry representatives in November to discuss the Biden administration’s response to housing supply and affordability constraints affecting the country. NAR President Kenny Parcell followed up the meeting with a letter to White House officials outlining numerous priorities the trade association believes would help address these ongoing challenges.

“When it comes to affordability, the administration has several tools it can use now to reduce costs, especially in higher-cost markets where housing options continue to diminish,” said Parcell, a Realtor® from Spanish Fork, Utah, and broker-owner of Equity Real Estate Utah.

“Reducing fees for first time homebuyers, providing more Housing Choice Vouchers, and providing incentives for more housing providers to participate in that program would provide direct and immediate support for renters and aspiring homeowners.

“NAR continues to stress that government must invest in boosting our nation’s housing supply if we are to make housing affordable in the long run. We need to invest in new construction, make zoning reforms, and provide tax incentives to spur more housing investment and conversion of unused commercial space into residential units.”

On Capitol Hill, NAR is working to advance the Neighborhood Homes Investment

The Salt Lake Board of Realtors® held its annual Holiday Social at The Grand America Hotel on Dec. 1. Rob Ockey was installed as the 2023 President. The event included several Realtor® Service Awards. Dave Frederickson was honored as the 2022 Realtor® of the Year. John Gonzales received the Affiliate of the Year. Kelly Hannah and Tiani Shoemaker Clyde were recognized as this year’s Good Neighbor recipients. Ryan Kirkham was presented the President’s Award. More than 300 Realtors® received the Distinguished Service Award. The 2023 Board of Directors was also installed.

Salt Lake County home sales took a dive in October, falling 46% compared to sales in October 2021. There were 841 closings, down from 1,555 a year earlier. Single-family home sales accounted for 72% of all sales in the county during the month.

The Salt Lake median sales price for all housing types was $519,000 in October, up 8% from a year ago. The median single-family home price was $580,000, down 12% from its peak of $650,000 in May, but up 6% year-over-year. The median price per square foot for all housing types was $244.62, up 6% from October 2021.

New listings in Salt Lake County fell to 1,289 in October, down 20% from 1,618 a year ago. Under contract listings fell to 1,396, down 41% compared to 2,355 under contract listings in October 2021. The median cumulative days on market increased to 33, up from 8 days a year earlier.

In neighboring Davis County, there were 298 homes sold in October, down 29% from 417 closings in October 2021. The median sold price was $499,000, up 4% from $479,900 a year earlier.

Nationally, Year-over-year, sales dropped by 28.4% (down from 6.19 million in October 2021).

“More potential homebuyers were squeezed out from qualifying for a mortgage in October as mortgage rates climbed higher,” said NAR Chief Economist Lawrence Yun. “The impact is greater in expensive areas of the country and in markets that witnessed significant home price gains in recent years.”

First-time buyers were responsible for 28% of sales in October, down from 29% in both September 2022 and October 2021. NAR’s 2022 Profile of Home Buyers and Sellers – released earlier this month4 – found that the annual share of first-time buyers was 26%, the lowest since NAR began tracking the data.

All-cash sales accounted for 26% of transactions across the nation in October, up from 22% in September and 24% in October 2021. 10. In Salt Lake County, all-cash sales accounted for 15% of transactions in October, up from 14% in October 2021.

Distressed sales – foreclosures and short sales – represented 1% of sales in October, down from 2% in September and identical to October 2021.

According to Freddie Mac, the average commitment rate for a 30-year, conventional, fixed-rate mortgage was 6.90% in October, up from 6.11% in September. The average commitment rate across all of 2021 was 2.96%.

“Mortgage rates have come down since peaking in mid-November, so home sales may be close to reaching the bottom in the current housing cycle,” Yun said.

“For consumers looking to buy or sell a home, having a Realtor® by their side to navigate one of the more challenging and complex markets we’ve seen in some time will be essential to successfully completing transactions,” said NAR President Kenny Parcell, a Realtor® from Spanish Fork, Utah, and broker-owner of Equity Real Estate Utah. “Realtors® understand local market conditions and provide timely and trusted advice, from listing to closing.”

Act and the Affordable Housing Credit Improvement Act, two pieces of legislation it argues would increase affordable housing options. The former would mobilize private investment to build and rehabilitate 500,000 affordable homes over the next decade, and the latter would improve the Low-Income Housing Tax Credit.

Administration officials and representatives from various real estate groups specifically discussed several measures to promote housing opportunity: reductions in the Federal Housing Administration’s Mortgage Interest Premium and the Government Sponsored Enterprises’ (GSE’s) guarantee fees; efforts to expand and improve the Section 8 Housing Choice Voucher Program to assist tenants; and support for the Department of Housing and Urban Development’s affirmative fair housing initiatives NAR has advocated on behalf of each proposal.

In the meeting, NAR stressed its continued opposition to proposals that some have advanced to place rent caps on GSE-backed rental properties, which it contends would be detrimental for renters, small businesses, and housing providers. In the letter to administration officials, Parcell wrote that proposals to place control or stabilization measures on rental properties backed by Fannie Mae and Freddie Mac

– which represent a significant share of the market –would cause considerable harm to the rental housing sector in America.

“Such policies would drive housing providers from the market – especially smaller, ‘mom-and-pop’ landlords who own just a few units and are unable to absorb rising costs that increase at a rate higher than rents do,” Parcell said.

NAR will continue to engage with the administration and other industry groups to advance reasonable market solutions that result in the greatest benefit for Americans and the economy, promote fair housing and racial equity, and support underserved communities.

“Amid mounting, ongoing concerns about rising inflation and escalating mortgage rates, NAR greatly appreciates the ongoing opportunities the administration has afforded to industry leaders, housing advocates, and civil rights leaders to collaborate with administration officials on ways to tackle these consumer and market obstacles,” Parcell concluded.

The National Association of Realtors® is America’s largest trade association, representing more than 1.5 million members involved in all aspects of the residential and commercial real estate industries.

We’re honored to have these distinguished Realtors as part of our C21 Everest family!

D.R. Horton, America’s largest homebuilder, is also Utah's premier builder of amenity driven communities. Enjoy spacious floorplans designed for family gatherings and entertainment. We have move-in-ready homes available across the valley. Help your buyers celebrate the holidays in a new home!

Congratulations to our Windermere agents who have received the 2022 Distinguished Service Award. We thank you for your participation and service to our industry.

Connie Elliott

Peter Clark

Jim Bringhurst

Lisa Jungemann

Amy Dobbs

Shawnee Cooper

Lana Ames

Sarah McNamara

Scott Steadman

Lisa Dimond

Mimi Sinclair Grady Kohler

Abbey Drummond

Laurann TurnerLisa Woodbury

Jessica Despain

Thomas Fowler

Lori Anderson

Adam Frenza

Connie Elliott

Peter Clark

Jim Bringhurst

Lisa Jungemann

Amy Dobbs

Shawnee Cooper

Lana Ames

Sarah McNamara

Scott Steadman

Lisa Dimond

Mimi Sinclair Grady Kohler

Abbey Drummond

Laurann TurnerLisa Woodbury

Jessica Despain

Thomas Fowler

Lori Anderson

Adam Frenza