2 minute read

Experts: U.S. Debt Demands a Long-term Plan

Congress must make tough decisions to bring down the debt, which has ballooned to 98% of GDP.

By Stacey Moncrieff

The 2023 Realtors® Legislative Meetings kicked off with a lively discussion on the debt-limit debate. Congress will reach a compromise—or create dire consequences for the economy and U.S. standing in the world, said two economists speaking at Federal Legislative & Political Forum, “How Banking and Institutional Investors are Influencing the American Dream of Homeownership.”

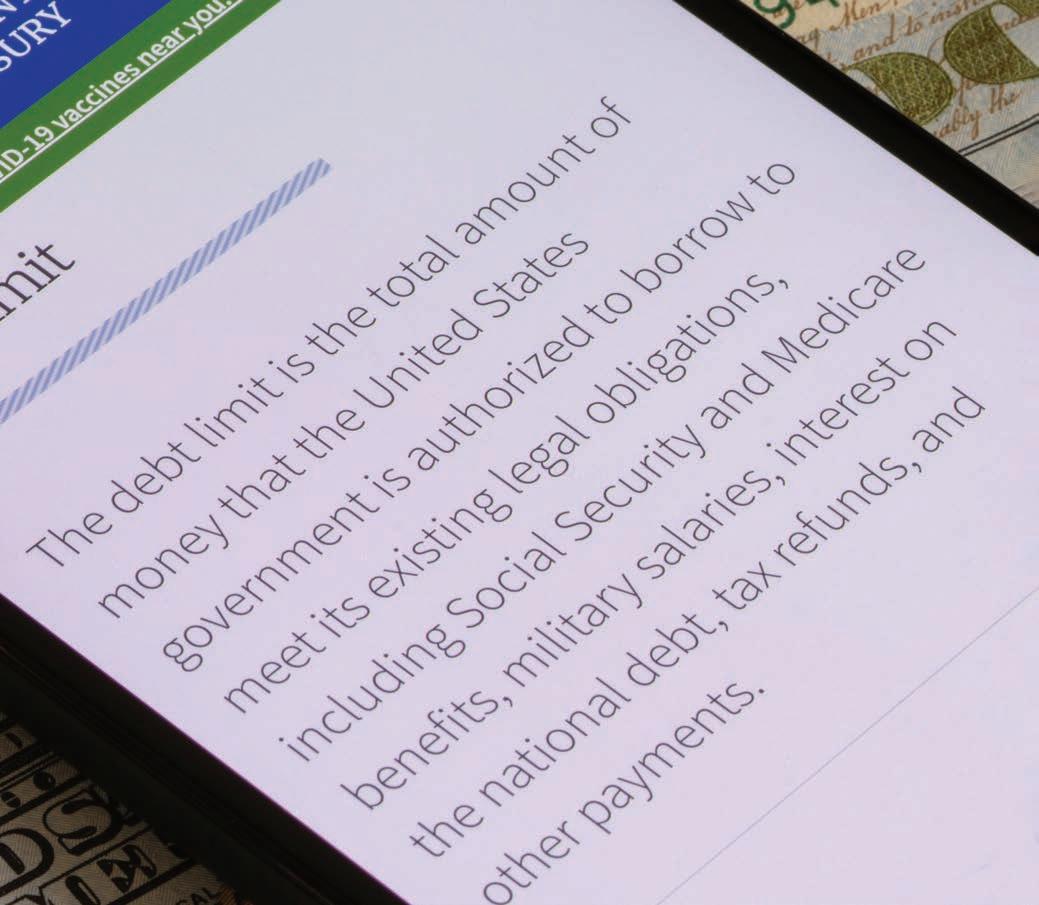

If a debt-ceiling resolution isn’t reached, “everything shuts down,” said Dana Peterson, chief economist for The Conference Board, a New York–based think tank for business leaders. That would cut 6 percentage points from GDP, ensuring a recession and driving up borrowing costs. “I don’t want to live through that. Let’s hope our policymakers in Washington don’t want to live through that,” she said.

“We’ve seen this movie many times,” said Doug Holtz-

Eakin, former director of the Congressional Budget Office. Agreement is likely to come in two stages, he said. “We’ll see a short-term debt limit increase until Sept. 30, and then there will be another round as they finally sort this out.”

Long term, Peterson and Holtz-Eakin said, Congress will have to come to make tough decisions to bring down the debt, which has ballooned to 98% of GDP.

“There needs to be a national conversation about our problem, and our problem is not the process. Our problem is debt,” said Peterson. “And the conversation needs to extend beyond a decade. We can’t solve it in a decade. We need to think about a 20- to 30-year solution.”

“We’ve got to take on entitlements,” said Holtz-Eakins. Medicare and Social Security are responsible for one-third of the debt obligation, he said, and dealing with that will “free up money for things we need in the 21st century.”

Peterson and Holtz-Eakin opined on a wide range of topics:

On high-profile bank failures: “These were three to four banks overexposed to one industry,” Peterson said, adding “most Americans’ savings are perfectly safe.” But a loosening of regulation on small- and mid-sized banks in 2018 led to poor risk management at these institutions. “No one likes regulation, but we need guard rails,” she said.

On the impact of institutional investors on housing supply: “I think it is a tremendous threat,” Peterson said. “More than 70 million millennials turning 40 want to buy a home and can’t.” Holtz-Eakin added, “I can’t figure out, economy wide, how big a deal these institutional investors are,” but whatever their impact, the fight against inflation is making it worse. “The Fed launched higher rates at a time [of] record low inventory. There isn’t a level playing field in competing with these investors right now. We need to focus during the next decade on getting greater housing supply, period.”

On inflation: “The Federal Reserve is doing what it needs to do,” said Holtz-Eakin. “Once you let inflation get embedded in the economy, you have no other choices.” But both said they expect rate hikes to end soon. Slowing rental rate growth, which doesn’t show up in inflation data right away, should help cool inflation, Peterson added.

Peterson and Holtz-Eakin offered advice on advocating for important housing policy issues. “Housing is roughly 5-6% of GDP, but then if you add all the things that people put into a house or around a house and the taxes they pay—all those things contribute to the economy and their communities. Those are the things you should focus on,” Peterson said.

“It’s important to come with facts,” Holtz-Eakin added. “It is in [policymakers’] political interest for [people] to have better access to the American dream. There’s a great track record there that has to be redocumented for another generation of lawmakers.”

Stacey Moncrieff is executive editor of publications for the National Association of Realtors® and editor in chief of Realtor® Magazine.