REALTOR November 2022 Salt Lake Magazine ® 2022 Profile of Home Buyers and Sellers p. 20

Relocating is a chance to put down new roots. When your Clients move into a David Weekley home, they can rest easy knowing that every detail will be just as they dreamed — both with their home and with their experience. Their Sales Consultant, Personal BuilderSM and Design Consultant will guide them through every step of the journey, and our industry-leading Warranty will ensure that your Clients are taken care of long after closing. With regular Team calls and their own personal website, your Clients will be kept up-to-date whether they’re across the country or around the corner. That’s The Weekley Way!

See a David Weekley

Consultant for details. Prices, plans, dimensions, features, specifications, materials, and availability of homes or communities are subject to change without notice or obligation. Illustrations are artist’s depictions only and may differ from completed improvements. Copyright © 2022 David Weekley Homes - All Rights Reserved. Salt Lake City, UT (SLC-22-003852) Ask about our current financing incentives! Homes from the high $500s to $1 million+ in the Salt Lake City area 385-479-8791

David Weekley Homeowners Kimber & Robert Ballam and a David Weekley Homes Builder

Homes Sales

Choosing SecurityNational Mortgage Company gives your clients the support of an incredible team, whether your clients are buying their first home, second home or refinancing, we make the home loan process simple. Our goal is to give your clients an advantage in today’s unique market.

Customer Service is Our Cornerstone WHY SNMC IS DIFFERENT Turning

This is not a commitment to make a loan. Loans are subject to borrower and property qualifications. Contact loan originator listed for an accurate, personalized quote. Interest rates and program guidelines are subject to change without notice. WWW.SNMC.COM

Houses into Homes®

Salt L ake REALTOR® Magazineslrealtors.com The Salt Lake REALTOR® (ISSN 2153 2141) is published monthly by Mills Publishing, located at 772 E. 3300 South, Suite 200 Salt Lake City, Utah 84106. Periodicals Postage Paid at Salt Lake City, UT. POSTMASTER: Send address changes to: The Salt Lake REALTOR,® 772 E. 3300 South, Suite 200 Salt Lake City, Utah 84106-4618. November 2022 volume 82 number 11 This Magazine is Self-Supporting Salt Lake Realtor® Magazine is self-supporting. The advertisers in this magazine pay for all production and distribution costs. Help support this magazine by advertising. For advertising rates, please contact Mills Publishing at 801.467.9419. The paper used in Salt Lake Realtor Magazine comes from trees in managed timberlands. These trees are planted and grown specifically to make paper and do not come from parks or wilderness areas. In addition, a portion of this magazine is printed from recycled paper. Table of Contents slrealtors.com Features 10 Some Bidding Wars Remain Because of Limited Inventory Melissa Dittmann Tracey 12 CRM Clean-Up Time Lee Nelson 14 The Home-Improvement Boom Isn’t Over Yet Justin Lahart and Jinjoo Lee 18 Home Prices Higher Than a Year Ago, But Down from Peak The Salt Lake Board of Realtors® 20 Share of First-Time Home Buyers is Smaller, Older Than Ever Before The National Association of Realtors® 26 Realtor® Safety Summit Columns 7 More Buyers and Sellers Rely on a Professional Realtor® Steve Perry – President’s Message Departments 8 Happenings 8 In the News 28 Housing Watch 4 | Salt Lake Realtor ® | November 2022 On the Cover: Cover Photo: weedezign ©/Adobe Stock 12 CRM Clean-Up Time 10 Some Bidding Wars Remain Because of Limited Inventory 14 The Home-Improvement Boom Isn’t Over Yet tostphoto ©/Adobe Stock Angelov ©/Adobe Stock didesign ©/Adobe Stock

CEDAR CITY (435) 602.4141 kanab (435) 602.4141 park city (801) 671.6158 st. george (801) 671.6158 MIDVALE (801) 703.6553 farmington (801) 209.6654 draper (801) 633.1990 vernal (801) 724.4953 Each franchise independently owned and operated.

1.

•

•

•

SERVING SERVE US ALL THOSE WHO

3. WE’RE CLOSE FRIENDS WITH THE MILITARY COMMUNITY

• Proud partner of the USO, working in association with the USO Pathfinder® program

• Our employee resource group, VetNet, supports and encourages each other through shared experiences, recruitment, career development and professional growth

2. WE DESIGNED MORTGAGES FOR

•

•

1.Savings, if any, vary based on the consumer’s credit profile, interest rate availability, and other factors. Contact Guaranteed Rate for current rates. Restrictions apply.

2.Waived $1,440.00 lender fee available for VA loans that have a triggered RESPA app date as of January 1, 2022 through December 31, 2022 at 11:59pm EST. This offer does not extend to Housing Finance Agency loans. ‘Triggered RESPA’ in accordance with Regulation X, is defined as lender receipt of all six pieces of information received in a secure format; applicant name, property address, home value, loan amount, income and SSN. Not all borrowers will be approved. Borrower’s interest rate will depend upon the specific characteristics of borrower’s loan transaction, credit profile and other criteria.Offer not available from anyd/b/a or operations that do not operate under the Guaranteed Rate name. Restrictions apply.

3.Down payment requirements subject to conforming county loan limits and remaining balance of borrower’s VA entitlement. Loan amounts that exceed the conforming county loan limits will require a down payment. Must be an eligible Veteran.

FOR BROKER-DEALER OR AGENT USE ONLY —Not for public dissemination. May not be distributed, reprinted or shown to the public in oral, written or electronic form as sales material. Guaranteed Rateis a private corporation organized under the laws of the State of Delaware. It has no affiliation with the US Department of Housing and Urban Development, the US Department of Veterans Affairs, the Nevada Department of Veterans Services, the US Department of Agriculture, or any other government agency. No compensation can be received for advising or assisting another person with a matter relating to veterans’ benefits except as authorized under Title 38 of the United States Code. United Service Organizations, Inc. (USO) is a non-profit 501 (c)(3) organization (EIN/Tax ID: 13-1610451) and is not part of the Department of Defense (DoD).

of

(866)-934-7283

Mortgage Licensee #20973

N.

Chicago, IL 60613

Licensed by the New Hampshire Banking Department, Lic #13931-MB • NJ: 3940 N Ravenswood, Chicago, IL 60613, (866)-934-7283, Licensed by the N.J. Department of Banking and Insurance • NY: Licensed Mortgage Banker - NYS Department of Financial Services • OH: MB 804160, 3940 N. Ravenswood Ave., Chicago, IL 60613 • OR: 3940 N. Ravenswood Ave., Chicago, IL 60613 • RI: Rhode Island Licensed Lender • TX: 3940 N Ravenswood, Chicago, IL 60613, (866)-934-7283 • WA: Consumer Loan Company License CL-2611.Guaranteed Rate, Inc.; NMLS #2611; For licensing information, visit nmlsconsumeraccess.org. Conditions may apply. Guaranteed Rate is an Equal Opportunity Employer that welcomes and encourages all applicants to apply regardless of age, race, sex, religion, color, national origin, disability, veteran status, sexual orientation, gender identity and/or expression, marital or parental status, ancestry, citizenship status, pregnancy or other reason prohibited by law. (20221020-1174234)

Happy Veterans Day! Here are three ways we’re supporting our Veteran and active-duty clients and employees: Now more than ever, you need to work with the best.

WE

WHERE

1

BRING THE SAVINGS

IT COUNTS

Waived lender fee on VA loan options when they choose us (Savings of $1,440)2

No down payment requirement on VA loan options3

No monthly mortgage insurance requirement on VA loan options

YOUR

MILITARY CLIENTS

Simple Digital Mortgage experience tailored to U.S. military buyers and owners

Rate, Inc.; NMLS #2611; For licensing information visit nmlsconsumeraccess.org. Equal Housing Lender. Conditions may apply

• CA: Licensed

Oversight under the California Residential Mortgage

Experienced, dedicated VA Loan processing team Guaranteed

• AR: 3940 N Ravenswood, Chicago, IL 60613, (866)-934-7283 • AZ: 14811 N. Kierland Blvd., Ste. 100, Scottsdale, AZ, 85254, Mortgage Banker License #0907078

by the Department of Business

Lending Act • CO: Regulated by the Division

Real Estate,

• GA: Residential

• MA: Mortgage Lender & Mortgage Broker License #MC2611 • ME: Supervised Lender License #SLM11302 • MS: 3940

Ravenswood Ave.,

• NH:

Jenni Barber

Berkshire Hathaway

Morelza Boratzuk RealtyPath

More Buyers and Sellers Rely on a Professional Realtor ®

A 2022 report by the National Association of Realtors® states that 86% of buyers and sellers needed the help of a real estate professional to find the right home and negotiate terms of sale. Just 10% of sellers sold via For-Sale-By-Owner (FSBO). One percent of sellers turned to iBuyers.

The annual report has been a leading industry source of trusted insight into consumer behavior for nearly four decades. NAR first administered the survey in 1981 with just 59 questions. In 2022, the survey contained 129 questions.

Carlye Webb Summit Sotheby’s

One thing that consistently stands out in each report is the overwhelming response by buyers and sellers to hire a Realtor®. It’s no surprise.

Real estate transactions are technical and complicated. They require a great deal of expertise. In fact, “There are a minimum of 87 possible legal documents amounting to hundreds of pages of forms, notices, agreements, disclosures, and contracts that may or may not be applicable in your purchase or sale,” said Curtis Bullock, attorney and CEO of the Salt Lake Board of Realtors®.

“I’ve observed way too much frustration over the years – headache, liability and lost money – when people try to figure this out on their own or don’t have an experienced professional at their side,” Bullock added. “Realtors® are trained on “if, when, and how” to use any one of the 87 different legal documents in a variety of different circumstances.”

Some of those 87 documents deal with earnest money deposits, change orders, back-up offers, short-term lease agreements, and closing costs addendum.

The NAR report further stated that for 47% of recent buyers, the first step they took in the home buying-process was to look online at properties for sale, while 18% of buyers first contacted a real estate agent.

Twelve percent of buyers purchased a new home, and 88% of buyers purchased a previously-owned home.

The Salt Lake Board of REALTORS® is pledged to the letter and spirit of U.S. policy for the achievement of equal housing opportunity throughout the nation. We encourage and support the affirmative advertising and marketing program in which there are no barriers to obtaining housing because of race, color, religion, sex, handicap, familial status, or national origin.

The Salt Lake REALTOR is the monthly magazine of the Salt Lake Board of REALTORS . Opinions expressed by writers and persons quoted in articles are their own and do not necessarily reflect positions of the Salt Lake Board of REALTORS®

Permission will be granted in most cases, upon written request, to reprint or reproduce articles and photographs in this issue, provided proper credit is given to The Salt Lake REALTOR as well as to any writers and photographers whose names appear with the articles and photographs. While unsolicited original manuscripts and photographs related to the real estate profession are welcome, no payment is made for their use in the publication.

Views and opinions expressed in the editorial and advertising content of the The Salt Lake REALTOR are not necessarily endorsed by the Salt Lake Board of REALTORS . However, advertisers do make publication of this magazine possible, so consideration of products and services listed is greatly appreciated.

OFFICIAL PUBLICATION OF THE SALT LAKE BOARD OF REALTORS ®

REALTOR is a registered mark which identifies a professional in real estate who subscribes to a strict Code of Ethics as a member of the NATIONAL ASSOCIATION OF REALTORS

Buyers typically searched for 10 weeks, looked at a median of five homes in person, and viewed four homes online. The number of weeks searching for a home grew from eight weeks, as reported in the 2020 and 2021 reports.

Going forward, buyers and sellers will continue to rely on the expertise of Realtors® to guide them through the complex process of the real estate transaction.

Steve Perry President

November 2022 | Salt Lake Realtor ® | 7

October 2005

Graphic Design Ken Magleby Patrick Witmer Office Administrator Cynthia Bell Snow Sales Staff Paula Bell Paul Nicholas Managing Editor Dave Anderton Publisher Mills Publishing, Inc. www.millspub.com President Dan Miller Art Director Jackie Medina Advertising information may be obtained by calling

467-9419 or by visiting www.millspub.com

(801)

Salt L ake

®

slrealtors.com

Salt Lake Board: (801) 542-8840 e-mail: dave@saltlakeboard.com Web Site: www.slrealtors.com

REALTOR

Magazine

Vice President

President

CEO

President Steve Perry Presidio Real Estate First

Rob Ockey Century 21 Everest Second Vice President Dawn Stevens Presidio Real Estate Treasurer Claire Larson Woodside Homes Past

Matt Ulrich Ulrich Realtors®

Curtis Bullock Directors

Hannah Cutler Coldwell Banker Laura Fidler Summit Sotheby’s Amy Gibbons Keller Williams

Jennifer Gilchrist Utah Key Real Estate Tony Ketterling Equity Real Estate

John Lucky Berkshire Hathaway Jodie Osofsky Signature Real Estate Utah

Janice Smith Coldwell Banker

Happenings In the News

Utah Has Third Lowest Residential Electricity Rate

Utah has the third lowest average residential electricity rate of all states, according to the U.S. Energy Information Administration. Utahns paid 11.43 cents per kilowatt hour (kWh) in August, a 4% increase compared to 11.01 cents a year earlier. Utah’s average residential monthly electricity cost was $102.53. Washington had the lowest electricity rate at 10.37 cents per kWh. Idaho came in second place at 10.76 per kWh. Hawaii had the most expensive electricity at 45.73 cents per kWh. Utah’s non-renewable energy resources (coal, natural gas, and crude oil) account for more than 94% of the state’s energy production, keeping electricity prices low.

Property Taxes on the Rise

Utah is the No. 2 state predicted to have the greatest property tax increase in five years, or by 2027, according to a new report by HomeAdvisor. With appreciation, the average annual property taxes in Utah will jump from a median payment of $1,837 in 2021 to $2,224 next year. In five years, the median payment will reach $3,693. Five states, including Utah, are predicted to see property tax payments increase over 90%. When it comes to the states with the lowest property tax rates, Hawaii, Alabama, Colorado, and Louisiana reign supreme. States with the highest property tax rates include New Jersey, Illinois, Connecticut, and New Hampshire.

Kenny Parcell, a Realtor® from Salem, Utah, was installed as the 2023 president of the National Association of Realtors® on Nov. 10. Kenny is broker/ owner of Equity Real Estate Utah and has sold more than 3,200 homes during his 24-year career. At the national level, Kenny served as NAR’s Vice President of Government Affairs in 2018. He was the Realtor® Party RPAC Fundraising Liaison in 2017, Regional Vice President for Region 11 (Arizona, Colorado, Nevada, New Mexico, Utah, Wyoming) in 2016, and Realtor® Party Director in 2015. Kenny was also the Realtor® Party Member Involvement Liaison in 2013 and the Information, Communication, and Business Development Liaison in 2012. Kenny served as president of the Utah Central Association of Realtors® in 2008 and as the president of the Utah Association of Realtors® in 2011. Kenny is the third Utahn to serve as NAR president. Russ Booth served as NAR president in 1997. Al Mansell was the 2005 NAR president.

Al Rickard, certified master inspector, has been serving as the 2022 president of the Utah Real Estate Inspectors Guild (UREIG). The association, organized in 2013, is a statewide resource for Utah home inspectors. The group is made up of approximately 100 inspectors and affiliate contractors. Rickard is responsible for overseeing activities, training, and continuing education for all inspectors and their affiliate members. Rickard has been an affiliate member of the Salt Lake Board of Realtors® since 2001 and was awarded Affiliate of the Year by the Board in 2013. With his daughter, Jolene Lehman, Al founded All Points Inspection in 2000.

8 | Salt Lake Realtor ® | November 2022

Andrii Yalanskyi ©/Adobe Stock

trongnguyen ©/Adobe Stock

Montebello @ Liberty Village (Salt Lake County)

Centrally located in the Salt Lake Valley, this townhomes community offers 2- and 3story floor plans ranging from 1800-2150 square feet.

QUICK MOVE-INS AVAILABLE: 2- and 3-story units, both interior and exterior Starting in the $450s

Parker Place (West Jordan)

55-plus community located near shopping, entertainment, and majorthoroughfares. Fully landscaped yards and snow removal included.

QUICK MOVE-INS AVAILABLE: Rambler-style homes ranging from 2902-3505 square feet Starting in the $650s

The Crossings at Lake Creek (Heber)

Custom-desgined homes in the heart of the Heber Valley. Maintenance-free living with fully landscaped yard and snow removal.

QUICK MOVE-INS AVAILABLE: Single-family homes ranging from 4219-4575 square feet Starting in the $1.1 millions

4.0% BAC on select

us for full details!

homes Contact

(801) 573-7722 • LibertyHomes.com

LIBERTY HOMES

Some Bidding Wars Remain Because of Limited Inventory

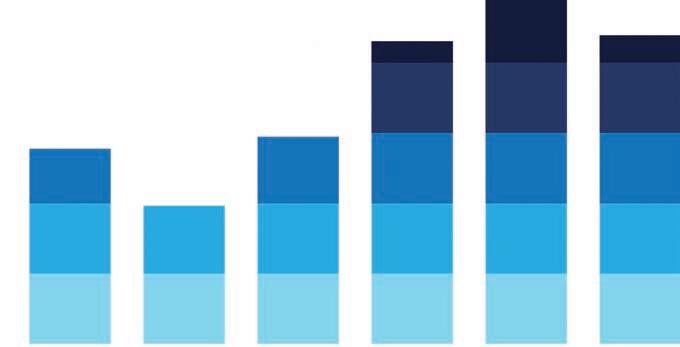

Nationally, more than a quarter of homes on the market are

By Melissa Dittmann Tracey

There’s some encouraging news in NAR’s latest housing report, though sales of existing home are still falling amid economic uncertainty.

Home sales continued sliding in September as home buyers retreat from the market amid near-7% mortgage rates and mounting recession fears. Total existinghome sales—comprising transactions for single-family homes, townhomes, condos and co-ops—dropped 1.5% in September compared to August and were down nearly 24% year over year, the National Association of Realtors® reported.

Meanwhile, the Commerce Department reported in October that housing construction is significantly waning, and home builders warn of more pullbacks ahead. Plus, mortgage applications to purchase a home plunged 38% last week from the same time a year ago, the Mortgage Bankers Association reported.

“The housing sector continues to undergo an adjustment due to the continuous rise in interest rates,

selling above list price.

which eclipsed 6% for 30-year fixed mortgages in September and are now approaching 7%,” NAR Chief Economist Lawrence Yun said. “Expensive regions of the country are especially feeling the pinch and seeing larger declines in sales.”

However, despite weaker sales, bidding wars remain strong because of limited inventory. More than a quarter of homes on the market are selling above list price, Yun said. “The current lack of supply underscores the vast contrast with the previous market downturn from 2008 to 2010, when inventory levels were four times higher than they are today,” he added.

Further, home prices are proving resilient against the market slowdown. The median price for an existing home across all housing types was $384,800 in September, up 8.4% compared to a year ago. All four major regions of the U.S. saw prices climb. Still, the median home price has fallen from a record high of $413,800 in June. NAR notes that the decline follows typical seasonal trends.

10 | Salt Lake Realtor ® | November 2022

tostphoto ©/Adobe Stock

Borrowing costs are one of the biggest challenges home buyers are facing. “Repeat buyers who have equity to roll into a home purchase are in a much better position than first-time buyers who are facing not only higher prices and rising mortgage rates—but also challenges saving for a down payment,” said Lisa Sturtevant, chief economist for Bright MLS. “Sellers are also on the sidelines during this transitioning housing market. Sellers are often buyers, so rising borrowing costs also impact their decisions.”

The following are some additional key indicators from NAR’s September housing report: Time on market inched up, though 70% of homes still sold in less than a month. Properties typically were on the market for 19 days, up from 16 days in August and 17 days year over year.

earlier. Investors and second-home buyers tend to make up the biggest bulk of cash sales, which accounted for 22% of transactions.

Foreclosures and short sales ticked up slightly but still made up a small portion of the housing market at 2% of sales. That’s up from 1% in August.

Here’s a closer look at how existing-home sales fared across the country in September:

Northeast: Sales fell 1.6% from August, reaching an annual rate of 610,000. That’s down 18.7% from a year earlier. Median price: $418,500, an increase of 8.3% year over year.

Midwest: Sales dropped 1.7% from August, reaching an annual rate of 1.14 million. That’s down 19.7% from a year ago. Median price: $281,500, up 6.9% year over

South: Sales fell 1.9% from August, reaching an annual rate of 2.08 million. That’s down 23.8% from a year ago. Median price: $351,700, up 11.8% year over year.

West: Sales held steady compared to August, maintaining an annual rate of 880,000. However, existing-home sales are down 31.3% from a year ago. Median price: $595,400, up 7.1% year over year.

November 2022 | Salt Lake Realtor ® | 11

Lifetime Servicing Multiple Loan Types No Down Payment Options LEARN MORE AT UFIRSTCU.COM We’ve Got You Covered HOME LOANS BUILD, BUY, REFI Federally insured by NCUA. Loans subject to credit approval. See current rates and terms.NMLS #654272 EQUAL HOUSING LENDER

CRM Clean-Up Time

Prevent your marketing from ending up in people’s spam folders.

By Lee Nelson

Your customer contact list needs work? Here’s how to get it in shape.

You’ve built up your contacts lists, but things seem in disarray. You’re getting more bounce backs on your email campaigns, and people aren’t responding.

“If real estate agents don’t clean up their list often, they are wasting marketing resources,” said Nia Pearson, founder of the consulting firm Marketing 4 Real Results, a Los Angeles–based marketing agency that provides coaching, consulting, and implementation services to real estate professionals.

Customer relations management solutions, or CRMs, can be complicated and offer advanced tools. But you can take a few basic steps to organize information and eliminate problems. These steps should lead to more effective communication with clients and better response rates, which can help your bottom line.

Why It’s Necessary

Cleaning up outdated addresses helps prevent your marketing from ending up in people’s spam folders.

“If you’re flagged for sending emails all the time to outdated addresses, at some point, your mailings are called spam,” said Andy Velkme, CIPS, senior vice president at Caton Commercial Real Estate Group in Naperville, Ill., and chair of the Global Business Council for the Illinois Realtors®.

And updating your CRM isn’t just about deleting incorrect or nonresponsive contacts. It’s also about making sure the contact information you retain is accurate and complete. “If details are inaccurate, there is no way to add value for clients,” Pearson said.

With added detail, she said, you can quickly connect sellers and buyers based on specific needs outlined in your CRM notes. You also have the ability to create more meaningful relationships as you document such things as family milestones and career changes.

Beginning the Cleanup

Bee Gault, transaction coordinator at Due South Destination and Real Estate Services LLC in Chicago, recommends a best practice of collecting accurate

12 | Salt Lake Realtor ® | November 2022

client information and preferences at the time of an initial discussion or proposal. But since information and circumstances are always changing, you need a systematic way to up- date your CRM database. It doesn’t have to be overwhelming. Take it step-by-step, experts say.

Step 1

Download a full report of all contacts. Identify duplicate data and remove it, Pearson said. Be sure to confirm the last contact method to ensure you are deleting the older information. It’s not a bad practice to reach out via phone or text to confirm data details before getting rid of any information.

Step 2

Create subcategories, groups or tags to easily define sets of customers. Segmentation can be based on personas like buyer or seller, customer or client, buy or lease, first-home buyer or investor, homeowner or lessor, partner or vendor. Gault goes further, identifying contacts by category such as price point, ZIP code, hobby, neighbor, profession or trade, and more. The more detail, the better you’ll be at generating new business through niche marketing, she said, “because you’ll have the ability to craft very specific marketing communications.”

Step 3

Check the performance of your emails. Note which are being opened and which aren’t. “If they aren’t being consistently opened, check those contacts,” Velkme said. “Is the address outdated or misspelled? Is the person or company not there anymore? Research and remove all bounce backs.”

Step 4

Set a task for yourself to call each contact soon. Pearson suggests setting a time limit of 30–60 days to check in on them and get updated information.

Step 5

Before deleting a contact, consider moving the contact to an inactive status. “Prospects in an inactive status require very minimal touch points per year,” Pearson said. “By saving the contact, you have an opportunity in the future to reengage. Be sure to add an inactive tag to prevent these contacts from receiving unwanted emails and unsubscribing altogether from further communication.”

Step 6

Set ongoing maintenance goals. Sample goals might be contacting everyone on your list at least once annually for updates or getting new contacts added within 24 hours. Gault recommends checking your list every 30 days against the National Do Not Call Registry.

The overall time needed to organize your contacts will vary depending on the number in your database. “The average time to clean up each contact should be about 3 minutes,” Pearson added. That means about 25 hours for every 500 contacts.

Not doing this leads to lost opportunities, Velkme said.

If you send emails to 100 prospects but only 70 get through because of outdated addresses or misspellings, “a lot of what you think you’re accomplishing isn’t getting done,” he said. “You are missing out on those 30.”

Holiday Task: Reengagement Time

The end of the calendar year is a good time to calls to each person in your CRM, Nia Pearson said. “This is a good time to ask contacts about their preferred communication method, wedding anniversaries and births of children or grandchildren.”

Pearson and Bee Gault agree that the old-school method of picking up a phone remains the best.

“If it’s a commercial client, stop by the place of business,” Gault said. “Real estate professionals are competing with platforms as a service. Our competitive advantage is our humanity.”

Reprinted from Realtor® Magazine Online, October 2022, with permission of the National Association of Realtors®. Copyright 2022. All rights reserved.

November 2022 | Salt Lake Realtor ® | 13

Angelov ©/Adobe Stock

The Home-Improvement Boom Isn’t Over Yet

The

By Justin Lahart and Jinjoo Lee

America’s housing market is getting hammered, and that seems like it should chill the boom in home renovation. But, even though spending seems sure to slow, there is reason to think it might not buckle.

The rapid ascent in mortgage rates has turned the switch on housing from hot to cold. The number of previously owned, or existing, homes sold last month was down a seasonally adjusted 24% from a year earlier, according to the National Association of Realtors. With Freddie Mac this week reporting that the average rate on a 30-year mortgage reached 7.08%—the highest since 2002—the strains on

housing affordability are only becoming more severe. The drop in home sales takes away a couple of big reasons people fix up their houses. Those looking to sell often spend money on improvements in hopes of making the sales process go more smoothly or fetching a higher price. Recent buyers often spend money on improvements as well to make their newly-purchased homes better fit their wants and needs. Researchers at Harvard’s Joint Center for Housing Studies weight existing home sales heavily in their forecasts of spending on home improvement and maintenance expenditures.

14 | Salt Lake Realtor ® | November 2022

didesign ©/Adobe Stock

housing market has turned from hot to freezing cold, but spending on home renovation appears well insulated for now.

Due to limited rights, this story is only available in the print issue of the Salt Lake Realtor magazine. A copy of this article is available on the Wall Street Journal website but charges may apply.

But rising mortgage rates and fewer moves alone don’t necessarily translate to lower home renovation demand. In Lowe’s last earnings call, Chief Executive Marvin Ellison pointed to the mid-1990s, when home improvement spending grew despite rising interest rates and a slowdown in housing turnover. There are other factors to consider beyond home sales. The Harvard JCHS forecasting model also includes sales at building supply stores, remodeling permits, gross domestic product and the Conference Board’s index of leading economic indicators—itself an amalgam of data such as weekly jobless claims and manufacturing orders—as its inputs.

“It’s not easy or clear-cut,” says JCHS senior research associate Abbe Will. “We see headwinds, but there are tailwinds too.”

The JCHS model forecasts that maintenance and improvement spending will grow by 6.5% over the 12-months ending in the third quarter of 2023 versus a year earlier—a sharp deceleration from the 17.8% growth registered during the comparable period that ended in the third quarter of this year, but growth nonetheless. Similarly, a survey conducted by the National Association of Home Builders shows optimism among home remodelers is still running high.

Home improvement companies themselves remain bullish even after two years of pandemic-fed growth. Mr. Ellison said in the Lowe’s earnings call that the three factors that have historically correlated most with demand for the company’s products— home price appreciation, age of housing stock and disposable personal income—remain strong. Home Depot CEO Ted Decker said at a conference last month that customers remain “very healthy,” estimating that U.S. home values have gone up $8 trillion to $9 trillion over the last two years.

Paint seller Sherwin-Williams, which reported earnings more recently, said it continues to see strong demand from professional customers but was more cautious about 2023, noting that new residential demand is likely to slow. “Our base case in this environment remains to prepare for the worst and hope for the best,” CEO John Morikis said.

One source of underlying demand for home improvement is that, thanks in part to years of underwhelming construction activity, American homes are getting old. The median age of an owner-occupied home in 2021 was 40 years, according to the Census Bureau, compared with 29 years in 2000.

“The aging home continues to require more remodeling, more updates,” Sherwin-Williams’ Mr.

November 2022 | Salt Lake Realtor ® | 15

Susie Martindale Masters Utah Real Estate is an award-winning brokerage specializing in residential, condominiums, new construction, land, and commercial. With an average of 19.5 years combined experience, we are best poised to navigate the ever-changing Utah real estate market. Masters Utah Real Estate is comprised of highly skilled, productive, and ethical real estate professionals who are hard-working and give unparalleled service. From first-time home buyers to highend residential, our team handles it all. Same ExpertiseNew Name, EXPERIENCE MATTERS, EXPECT THE BEST! Visit www.mastersutah.com for more info about joining our team! Broker/Owner susie@susiemartindale.com 801-558-7301 www.susiemartindale.com 7070 South 2300 East Salt Lake City, UT 84121 Due to limited rights, this story is only available in the print issue of the Salt Lake Realtor magazine. A copy of this article is available on the Wall Street Journal website but charges may apply.

Morikis said on the company’s earnings call on Tuesday.

Homes aren’t all that is aging: According to the Census Bureau, 56 million people, or 17% of the U.S. population, were 65 or older as of last year. By 2030 that cohort will rise to 73 million. Many aim to “age in place.” For some that entails moving into a more suitable home, but for others it means remodeling to fit their needs.

The recently passed Inflation Reduction Act includes fresh incentives for remodelers, including tax credits and rebates for a variety of energy-saving home improvements, such as replacing windows, putting up solar panels and installing electric heat pumps. All those perks run through at least 2032.

Homeowners also have the wherewithal to keep spending on their homes. Scot Ciccarelli, a retail analyst at Truist Securities, points out in a recent report that nearly 40% of homes in the U.S. are owned outright, and most of the rest have a mortgage locked in low rates.

True, slipping home prices can put a damper on that: A Federal Housing Finance Agency home price index was 1.3% below its June peak in August, though that still put

it 12% higher than a year earlier and 112% higher than a decade ago. If prices register pronounced declines, then people might conclude the returns on their homeimprovement investments won’t be worth it.

But the most important tailwind for homeimprovement spending now might be the job market. Wages are on the upswing, and for many homeowners with fixed mortgages income gains are outstripping housing costs so people worry less that they will come to regret having spent money to fix up their home. That would all change in a weaker job market. If Federal Reserve rate increases slow the economy to the point that it starts shedding jobs, the impulse will be to save, not spend. In that case it could be Katie bar the door, because people can’t afford replacing it.

Reprinted by permission of The Wall Street Journal, Copyright 2022 Dow Jones & Company, Inc. All Rights Reserved Worldwide. License number 5419440242165. Write to Justin Lahart at justin.lahart@wsj.com and Jinjoo Lee at jinjoo.lee@wsj.com.

16 | Salt Lake Realtor ® | November 2022

Due to limited rights, this story is only available in the print issue of the Salt Lake Realtor magazine. A copy of this article is available on the Wall Street Journal website but charges may apply.

Image licensed by Ingram Image

Lowest Rate = HAPPY Buyers! -APRs up to .934% LOWER! $500,000 Apples-To-Apples Lender Comparison on 11/1/2022 LendRight Mortgage A Top Utah Broker Large Utah Credit Union A Premier Direct Lender Large National Lender Rate 6.500% 6.750% 6.875% 6.990% 7.125% APR 6.534% 6.786% 6.920% 7.076% 7.468% Lender Fees & Points $1,125 $1,400 $4,345 $3,804 $10,625 P&I Payment $3,160 $3,243 $3,285 $3,323 $3,369 Save Up To: $209 every month $2,508 every year $75,240 Life of Loan Interest Savings -LendRight’s lower rates mean larger qualifying loan amounts & higher max purchase prices. -Get the LOWEST price, or get a $100 Amazon gift card*. Lendrightmortgage.com Variables for all quotes: $500,000 purchase loan, SFR, primary residence, 60% LTV, 760+ FICO, 30-YR fixed-rate conventional loan on 30 day lock All quotes obtained on 11/1/2022 *Gift card terms/conditions: 1. Provide detailed quote from any lender showing better same day pricing. 2. Lock rate and provide the locked loan estimate within three days 3. Provide signed CD from closing that matches the locked LE. Offer valid only on matching Conventional, FHA, VA, USDA loans with lock periods of 90 days or less. NMLS 1817019 Lowest Rate = HAPPY Buyers! -APRs up to .934% LOWER! -Up to $9,500 Lower Lender Fees

By The

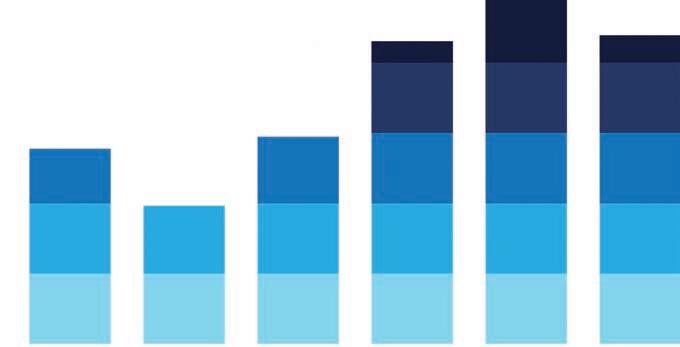

Salt Lake County home prices are moderating since the Federal Reserve earlier this year began raising interest rates.

The median price of a single-family home sold in the third quarter settled at $590,000, up 9% compared to the median price in the third quarter of 2021. However, the price is down 7% compared to a median price of $637,000 (revised figure) in the second quarter, when prices peaked.

At $599,900, Utah County had the highest home prices along the five-county Wasatch Front region in the July through September period. Davis County had the No. 3 highest median price at $540,000, a 9% rise over

last year’s third quarter. Tooele County had a median price of $470,000. Weber County showed the greatest housing affordability at a median price of $435,600.

“Higher mortgage interest rates have definitely slowed house sales,” said Dejan Eskic, chief economist for the Salt Lake Board of Realtors®. “Active listings are taking roughly a month to sell instead of a week. The good news for buyers is that sellers are offering more concessions. There are more houses to choose from in the process and it is much easier to get a home under contract.”

Some builders and sellers are offering 2-1 buydowns, a type of financing that lowers the interest rate on

18 | Salt Lake Realtor ® | November 2022

Andy Dean ©/Adobe Stock

Home Prices Higher Than a Year Ago, But Down from Peak

Active listings are taking roughly a month to sell instead of a week. The good news for buyers is that sellers are offering more concessions.

Salt Lake Board of Realtors®

a mortgage for the first two years before it rises to the regular, permanent rate. Home buyers are also negotiating home repairs and asking sellers to pay for home warranties.

As of Nov. 2, roughly one in three listings on UtahRealEstate.com were under contract. The ratio of under contract listings to total listings today is similar to 2019, before the pandemic. Under contract listings mean a seller has accepted an offer on the property, but the sale is not final.

Single-family home sales in Salt Lake County fell to 2,331 in the third quarter, down 30% compared to 3,336 sales in the third quarter of 2021. Single-family home sales also dropped in other Wasatch Front counties. Condominium sales saw bigger percentage declines. In Salt Lake County, condo sales fell 34%. Tooele County was down 43%. Davis County slid 24%. Utah and Weber counties witnessed only negligible declines at 1% for each county.

Nationally, despite weaker sales, multiple offers are still occurring with more than a quarter of homes selling above list price due to limited inventory, according to the National Association of Realtors®. The current lack of supply underscores the vast contrast with the previous major market downturn from 2008 to 2010, when inventory levels were four times higher than they are

today. In Utah, there is a deficit of approximately 30,000 housing units.

About the Salt Lake Board of Realtors®

The Salt Lake Board of Realtors® is the Wasatch Front›s voice of real estate and the No. 1 source for housing market information. The Salt Lake Board of Realtors® is the largest shareholder of UtahRealEstate.com, one of the leading Multiple Listing Services (MLS) in the United States. Since 1917, the Salt Lake Board of Realtors® has been a leader in promoting homeownership and protecting private property rights. The Salt Lake Board of Realtors® empowers its members to better serve the public by providing continuing education, advocacy, and a professional code of ethics.

About UtahRealEstate.com

UtahRealEstate.com is where real estate listings originate, and it is the official property information platform for real estate professionals in the state of Utah. We proudly serve approximately 96% of all Realtors® in the state of Utah, according to T3 Sixty 2021 Real Estate Almanac. UtahRealEstate.com operates one of the largest Multiple Listing Services (MLS) in the United States.

Full Complement of Title Products & Services Integrated Platform, Secure Infrastructure & Remote Deposits Access to Free Farming Software Industry Relevant CE Classes 1-on-1 Coaching: Brand & Online Market Positioning TRULYTeam YOUR REAL ESTATE BUSINESS PARTNER 6965 S Union Park Center, STE 180 Cottonwood Heights, UT 84047 (801) 996-7456 6 5 W 200 N, STE 1 Spanish Fork, UT 84660 (385) 200-3552 9 089 S 1300 W, STE 120 West Jordan, UT 84088 (385) 215-8480 1680 W Hwy 40, STE 108 Vernal, Utah 84078 (435) 261-2253 2180 S 1300 E, STE 130 Salt Lake City, UT 84106 (801) 505-0178 1481 E 5600 S, STE E101 South Ogden, UT 84403 (385) 205-5560 NEW OFFICE! for Our Clients & Customers this Year!

Share of First-Time Home Buyers is Smaller, Older Than Ever Before

By The National Association of Realtors®

When compared to a year ago, the share of first-time home buyers dropped to a record low, while the age of a typical first-time buyer increased to an all-time high. The median distance buyers moved from their previous homes more than tripled from the distance registered the previous four years as the shares of homes purchased in small towns and rural areas reached record highs.

Housing affordability and inventory challenges significantly impacted when, where and how consumers purchased homes, according to the National Association of Realtors®’ 2022 Profile of Home Buyers and Sellers, an annual report released in November and published since 1981, which analyzes the demographics, preferences and experiences of buyers and sellers across America.

“It’s not surprising that the share of first-time buyers shrank to the lowest level ever recorded given the housing market’s combination of historically low inventory, persistently high home prices and rapidly escalating interest rates,” said Jessica Lautz, NAR vice president of demographics and behavioral insights.

“Those who have housing equity hold the cards and they’ve fared very well in the current real estate market. First-time buyers are older as a result of saving for down payments for longer periods of time or relying on a generational transfer of wealth to propel them into homeownership.”

First-time buyers made up only 26% of all buyers, down from 34% last year and a peak of 50% in 2010 during the First-Time Home Buyer Tax Credit. The age of the typical first-time buyer was 36 years – up from 33 years one year

20 | Salt Lake Realtor ® | November 2022

First-time buyers made up only 26% of all buyers, down from 34% last year and a peak of 50% in 2010.

fizkes ©/Adobe Stock

ago – and the typical repeat buyer’s age climbed to 59 years from 56 years in 2021. Both ages are the highest in the history of the data set. The median expected home tenure for first-time buyers was 18 years, the highest ever recorded and up from 10 years in 2021.

The median distance between the home that recent buyers purchased and the home from which they moved was 50 miles, the highest ever recorded. From 2018 through 2021, the median distance moved was just 15 miles.

Lautz noted that several reasons were behind the decisions among last year’s buyers to seek homes farther distances away from their previous residences.

“Family support systems still prevailed as a motivating factor when moving and in neighborhood choice,” Lautz said. “For others, housing affordability was a driving factor to seek homes in areas farther away. For many, remote work decisions were formalized in the last year, providing clarity for employees to permanently move to more distant areas.”

The shares of buyers who purchased homes in small towns (29%) and rural areas (19%) were the highest ever recorded, while the shares of homes purchased in suburban (39%) and urban (10%) locations declined from one year ago.

The most common type of home purchased continued to be the detached single-family home, which made up 79% of all homes purchased, slightly down from 82% last year. Eight percent of recent buyers purchased mobile or manufactured homes.

Townhomes continued to be the most common among first-time home buyers compared to repeat buyers. Single female and single male buyers were more likely to purchase a townhouse or condo than married couples and unmarried couples. Among buyers with children under the age of 18 in the home, 86% purchased a detached single-family home, as opposed to 77% of buyers who had no children in their home.

Since 1981, the Profile of Home Buyers and Sellers has been tracking data on the type of homes purchased. In 1981, 76% of home buyers purchased detached singlefamily homes, 16% bought condos and 8% bought townhomes. In 1985, the share of detached singlefamily homes purchased was at its highest at 88% and in 2007 it was at its lowest at 74%. For most of the 1980s and 1990s, detached single-family homes ranged in the low to mid 80 percentiles. From 2005 through 2012, the share of detached single-family homes sold ranged in the mid to high 70 percentiles. Since 2007, condo sales have steadily decreased from 11% and made up 2% of sales this year.

November 2022 | Salt Lake Realtor ® | 21

The typical home purchased was built in 1986, which is a significant change from 1993 the previous year.

In terms of the share of home buyers by race, White Americans accounted for 88% of all buyers, followed by Hispanic Americans at 8%, Black Americans at 3%, and Asian Americans at 2%. The shares for White and Hispanic Americans increased from a year ago –82% and 7%, respectively – while the shares of Black and Asian American buyers declined – both down from 6%.

“Housing affordability and limited inventory impacted the buying power of all buyers, however, the greatest impact was felt by Black and Asian Americans, as both groups saw a shrinking share of home buyers,” Lautz said. “Conversely, White and Hispanic Americans experienced gains in buyer shares. Population growth among Hispanic Americans likely drove the increase, while many White Americans are repeat buyers with housing equity that allows them to make easier trades in today’s market.”

The median number of weeks that buyers searched for a

home was 10, an increase from eight weeks in 2020 and 2021. Home buyers typically purchased their homes for 100% of the asking price, with 28% purchasing for more than asking price.

Seventy-eight percent of recent buyers financed their home purchase, down from 87% last year and driven by the increased share of repeat buyers who paid all cash. The typical down payments for first-time and repeat buyers were 6% and 17%, respectively.

The median age of home sellers was 60 years, up from 56 years one year ago. Sellers typically lived in their home for 10 years before selling. While that was an increase from eight years the previous year, it’s the same tenure reported in 2019 and 2020.

Continuing a long-standing trend, the overwhelming majority of buyers (86%) and sellers (87%) hired a real estate agent or broker to purchase or sell their homes. Nine in 10 buyers said that they were very satisfied with their agent’s knowledge of the purchase process (90%), and their agent’s honesty, integrity and knowledge of the real estate market (89%). Eighty-nine percent

22 | Salt Lake Realtor ® | November 2022

Image licensed by Ingram Image

of buyers and 85% of sellers said that they would recommend their agent to others.

“During challenging and changing market conditions, one thing that’s calming and constant is the assurance that comes from a Realtor® being in your corner through every step of the home transaction,” said NAR President Leslie Rouda Smith, a Realtor® from Plano, Texas, and a broker associate at Dave Perry-Miller Real Estate in Dallas. “Consumers can rely on Realtors®’ unmatched work ethic, trusted guidance and objectivity to help manage the complexities associated with the home buying and selling process.”

The median household income for 2021 of home buyers slipped this year to $88,000 compared to $102,000 in last year’s report. The share of married couples increased slightly to 61% this year, up from 60%. The share of single females fell slightly to 17%, and single males held steady at 9% from 9% the past four years. Unmarried couples rose slightly to 10% this year from 9% the previous three years. Dual incomes from married couples tend to have stronger purchasing power than single buyers.

The Profile of Home Buyers and Sellers report has collected data on household composition since 1981 when the share of married couples accounted for 73% of all homes purchased, single females purchased 11% of homes, and single males 10%. The share of married couples peaked at 81% in 1985, then has steadily declined over the years. In 2010, the share of married couples was at a low point at 58% of all homes purchased. Single females remained above 20% from 2005 to 2010, at which point the share started to decline, hovering at 16% from 2012 through 2014. The share of single male buyers hit a 35-year peak in 2010 at 12% before steadily declining to 7% in 2017, but has been increasing to previous levels seen from 2012 to 2015.

Thirty-one percent of all buyers had children under the age of 18 living at home, the lowest share since 1981 but holding steady from 31% last year. Fourteen percent of home buyers purchased a multi-generational home—a home that had adult siblings, adult children over the age of 18, parents, and/or grandparents in the household— an increase from 11% last year. The top reasons for purchasing a multigenerational home were to take care of aging parents (21%), wanted a larger home that multiple incomes could afford together (21%), children over the age of 18 moving back home (17%), and children over the age of 18 never left home (16%).

About NAR’s Profile of Home Buyers and Sellers

In July 2022, NAR mailed a 129-question survey using a random sample weighted to be representative of sales on a geographic basis to 153,045 recent home buyers. The recent home buyers had to have purchased a primary residence home between July 2021 and June 2022. Respondents had the option to fill out the survey via hard copy or online. The online survey was available

in English and Spanish. A total of 4,854 responses were received from primary residence buyers. After accounting for undeliverable questionnaires, the survey had an adjusted response rate of 3.2%. The sample at the 95% confidence level has a confidence interval of plus-or-minus 1.41%.

The National Association of Realtors® is America’s largest trade association, representing more than 1.5 million members involved in all aspects of the residential and commercial real estate industries. The 2022 edition of NAR’s Profile of Home Buyers and Sellers continues the longest-running series of national housing data evaluating the demographics, preferences and experiences of recent buyers and sellers. Results are representative of owner-occupants and do not include investors or vacation homes.

Statement of Ownership, Management and Circulation

1. Location of known Office of Publication: 772 E. 3300 S., Suite 200, Salt Lake City, Utah 84106

2. Location of known Headquarters of General Business offices of the Publisher: 772 E. 3300 S., Suite 200, Salt Lake City, Utah 84106

3. Publisher: Mills Publishing, Inc., 772 E. 3300 S., Suite 200, Salt Lake City, Utah 84106

4. Editor: Dave Anderton, Salt Lake Board of Realtors, 230 W. Towne Ridge Parkway, Suite 200, Sandy, Utah 84070

5. Owner: Salt Lake Board of Realtors, 230 W. Towne Ridge Parkway, Suite 200, Sandy, Utah 84070 6. Known bondholders, mortgages, and other security holders owning or hold ing 1 percent or more of total amount of bonds, mortgages or other secu rities: None.

24 | Salt Lake Realtor ® | November 2022

7.

Average No. Copies Each Issue During Preceding 12 Months Copies of Single Issue Published Nearest to Filing Date A. Total Numbers of Copies Printed 9,906 9,515 1. Mailed Outside-County Paid Subscriptions 2,700 2,561 2. Mailed In-County Paid Subscriptions 7,131 6,854 3. Paid Distribution Outside the Mails, including Sales Through Dealers and Carriers, Street Vendors, Counter Sales, and Other Paid Distribution Outside USPS 0 0 4. Paid Distribution by Other Classes of Mail 0 0 C. Total Paid Distribution 9,831 9,415 1. Free or Nominal Rate Outside-County Copies 0 0 2. Free or Nominal Rate In-County Copies 0 0 3. Free or Nominal Rate Copies Mailed at Other Classes through the USPS 50 50 4. Free or Nominal Rate Distribution Outside the Mail 50 50 E. Total Free or Nominal Rate Distribution 0 0 F. Total Distribution 9,931 9,515 G. Copies Not Distributed 0 0 H. TOTAL 0 0 I. Percent Paid 99% 99% 8. I certify that all statements above are correct and complete. Dan

10/14/2022

Extent and nature of circulation:

Miller, President of Mills Publishing, Inc.

Realtor® Safety Summit

The Salt Lake Board of Realtors® hosted a Realtor® Safety Summit on Oct. 27 featuring Dale Anderson, an expert in responding to workplace violence and former police officer. Approximately 150 members took part in the four-hour CE course. The National Association of Realtors® provides a Realtor Safety Program to address the dangers Realtors® face every day. Realtors® most often reported feeling unsafe during a showing (41%) and while meeting a new client for the first time at a secluded location/ property (32%), according to the 2021 Member Safety Report. The goal of the Realtor® Safety Program is to reduce the number of safety incidents that occur in the industry, so every Realtor® comes home safely to his or her family every night. You can find more information at nar.realtor/safety.

26 | Salt Lake Realtor ® | November 2022

November 2022 | Salt Lake Realtor ® | 27

Photos: Dave Anderton

SEPTEMBER

HOUSING WATCH

Rising Interest Rates Slowing Home Sales

Existing home sales in September fell to 1,067 units in Salt Lake County, 31% less than 1,546 sales in September 2021. Year-over sales have fallen the past 16 months. However, since the Federal Reserve began aggressively raising its benchmark interest rate earlier this year home sales have shown a dramatic slowdown.

In the last week of October, the 30-year fixed-rate mortgage averaged 7.08%, according to Freddie Mac. It was the first time mortgage rates broke 7% since April 2002. A year ago, at this time, the 30-year FRM averaged 3.14 percent.

“As inflation endures, consumers are seeing higher costs at every turn, causing further declines in consumer confidence this month,” said Sam Khater, Freddie Mac’s Chief Economist. “In fact, many potential homebuyers are choosing to wait and see where the housing market will end up, pushing demand and home prices further downward.”

In Salt Lake County, the inventory of homes for sale increased to nearly 3,000 listings, up 69% from 1,690 listings a year earlier. As of Oct. 27, there were 10,360 active listings statewide on UtahRealEstate.com, that’s roughly the same number of listings as there were at the same time in 2018 and 2019, before the pandemic.

Properties in Salt Lake County typically remained on the market for 35 days in September, up from 16 days in September 2021.

The median price of all housing types sold in Salt Lake County in September was $521,000, up 6% from $490,000 a year ago. In neighboring Davis County, the median home price was $500,000, up 6% from $470,000 last year.

Single-family median home prices have fallen month-over-month in Salt Lake County. In May, prices peaked at $650,000. In September, the median price had fallen 7% to $607,000. Still, homeowners are sitting on a significant amount of equity. Single-family home prices increased nearly 65% between March 2020, when the pandemic shutdowns went into effect, until May of this year.

Nationally, total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums, and co-ops, fell 24% year-over-year.

“Despite weaker sales, multiple offers are still occurring with more than a quarter of homes selling above list price due to limited inventory,” said NAR Chief Economist Lawrence Yun. “The current lack of supply underscores the vast contrast with the previous major market downturn from 2008 to 2010, when inventory levels were four times higher than they are today.”

All-cash sales accounted for 22% of transactions in September, down from 24% in August and 23% in September 2021.

Individual investors or second-home buyers, who make up many cash sales, purchased 15% of homes in September, down from 16% in August, but up from 13% in September 2021. Distressed sales – foreclosures and short sales –represented 2% of sales in September, a marginal increase from 1% in August 2022 and September 2021.

28 | Salt Lake Realtor ® | November 2022

November 2022 | Salt Lake Realtor ® | 29

WE WANT TO BE YOUR GOLDEN GOOSE

Opportunity Builder.

represents commissions paid by D.R.

for

ending

must

client

their

visit to the

and client must not have previously registered on the D.R.

website

estate license

the date of registration and buyer close

escrow. In the event more

the client’s broker. WE’VE PAID $10,963,847 IN AGENT COMMISSIONS SO FAR THIS YEAR

D.R. Horton, America’s largest homebuilder, is now developing 18 communities across northern, central and southern Utah.* Learn more about us at drhorton.com/utah D.R. Horton is an Equal Housing

*Amount

Horton Utah

the 9-month period

9/30/2022. Broker Referral Program rules apply. Broker

accompany

on

first

D.R. Horton sales office

Horton

or called the D.R. Horton Buyer Resource Center. Broker must hold a valid Utah real

as of

of

than one broker registers the same client, the broker confirmed by the client at the time of contract shall be conclusively deemed

Select individual and team offices are still open. Connect with us today for your private tour. Daybreak. All in, for NEW OFFICE OPENING WINTER 2023 winutah.com/joinus MONICA DRAPER 435.313.7905