2 minute read

JSPL eyes 7.5 million tons output in FY21

Sumit Maitra

Jindal Steel & Power is likely to produce 7.5 million tons of steel in FY21, up from 6.5 mt in FY20. With revival of demand in the domestic market, the efficient steel maker is producing more value-added products which will continue to drive rise in operating profits.

Advertisement

“In the first half we could produce 3.5 mt. In H2, we would be in line, producing another 3.8 mt. That would be about 7.3 mt (for the FY21), may be even more and would try to achieve 7.5 mt as a whole,” managing director V R Sharma told analysts during a conference call following the September quarter results.

During the second quarter of FY’21, the company on a standalone basis reported highest ever steel production volumes (including pig iron) at 1.84 mt and sales of 1.93 mt.

The second quarter has been good for JSPL achieving highest ever EBIDTA, sales turnover and production. While the flat prices rallied during the quarter, long prices were largely range bound during the monsoons, though overall better on a sequential basis.

On back of increased volumes and marginal increase in realisations, JSPL standalone reported gross revenue of `8,667 crore. Increasing efficiencies and lower raw material costs helped JSPL standalone post it’s reported highest ever EBITDA at `2,435 crore, up 33 percent on quarter.

During 2QFY21, production of pellets was 2.01 mt. The company recorded external pellet sales of 0.73 mt during 2QFY21.

JSPL has been producing 4,000 tons/day from its Angul DRI plant and is planning to ramp up to 6,000 t/day. Blast furnace is running at 10,000 t/day and will soon ramp up to 11,000t/day.

Exports tapering off

JSPL’s steel exports fell by 17.8 percent on quarter to 740,000 tons in the second quarter as the company concentrated on domestic value added product instead of exports of low-value semis.

With revival in domestic demand, JSPL is cutting down on exports, which will come down to 20 percent of total produce in November from a high of 70 percent during the initial period of lockdown.

“Exports were 32 percent in October which will come down to just about 20 percent, (a level) which will be maintained till the end of the year,” he said. JSPL was

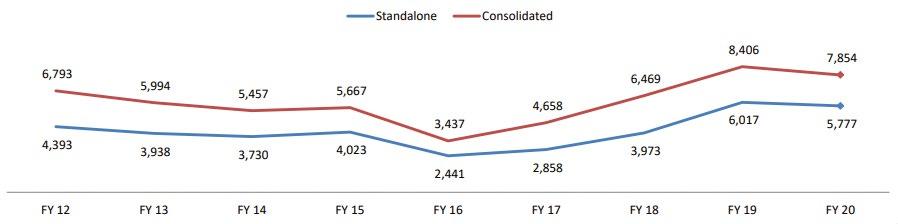

EBIDTA (Rs. in cr) primarily selling semis. Now, such exports have stopped and are being converted into finished products.

“We are currently exporting plates to Europe, beams to Europe and South Africa, rails to neighbourhood countries like Sri Lanka and Bangladesh, transmission equipments to Saudi Arabia,” Sharma said.

Rising profitability

JSPL did some reengineering and could reduce costs, resulting in higher EBIDTA, Sharma told analysts. Profitability would improve further with fall in prices of inputs like coking coal.

Coking coal prices have gone down, from $128 to $104 FOB in during October and that has encouraged JSPL to do forward booking till February at that price level.

Once the prices start going up after December, we will reap the benefits,” Sharma said. Standalone steel EBITDA per ton of steel was `12,000 plus, primarily due to availability of old, paid-for iron ore stock from Sarada mines.

Shadeed operation in Oman is now being reported as discontinued operations, pending completion of sale execution. Excluding Oman, EBITDA stood at `2700 crore for the quarter.

Demand revival

“Demand in sectors like auto and infrastructure has picked up. Due to investment by the government in infrastructure projects like pipelines, storage tanks, shipbuilding and railways. These are some of the areas we are reaping the benefits,” Sharma told analysts during a conference call.