REAL ESTATE INVESTING MADE SIMPLE

DISCLAIMER

This is a preliminary presentation/document that does not constitute an offer to sell nor the solicitation of an offer to buy any security. Such an offer may only be made pursuant to the Fund’s Confidential Private Offering Memorandum and related exhibits and enclosures (the POM), which should be carefully reviewed. The information provided herein is qualified in its entirety by reference to the information, terms, risks and conditions presented in the POM and the Fund’s investment strategies may vary in the future. To obtain a POM, please contact Avalon Investment Group at general@theavaloninvestmentgroup.com This summary is for informational purposes only and is not an offer to provide any investment advisory services. The contents are based on information from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. Past performance and recommendations of any Avalon principal are not a guarantee of future success. This summary is being furnished on a confidential basis to a limited number of prospective investors who are “accredited investors” according to the SEC Regulation D 506b and may not be used or reproduced for any purpose.

Avalon Investment Group © 2022 2

Our goal is to provide investors with lucrative returns while protecting their capital from market corrections.

We accomplish this task by investing in recession-resistant real estate assets and creating value from the ground up with new construction of multifamily real estate in the Salt Lake City metropolitan area.

Avalon Investment Group © 2022 3

THE TEAM

JORDAN ATKIN

Project Manager

CARSON TUCKER

Managing Director

JARED WEST

Investor Relations

PORTER FOULGER

Investor Relations

• Founder and Managing Director of TAG SLC, LLC.

• Overseen more than 1900 multi family units in the Utah Market.

• Has developed relations with key players in multi-family developments

• Substantial experience with land play, value-add and development projects.

• Expertise in underwriting commercial projects.

• Co-Founder and Managing Director of Avalon Investment Group, LP.

• Bachelor’s Degree of Economics from Utah Valley University.

• Extensive background in banking and finance industry.

• Years of management and sales experience.

• Owner and Director of Sales at Modern & Main Real Estate

• Licensed Utah Real Estate Agent

• Design and Architecture expertise

• Years of experience analyzing factors and market data for the Utah housing market

• Comprehensive understanding of trends and projected growth in Utah.

• +10 years of Strategy/Analytics Consulting

• MBA from the University of Colorado at Denver

• East Bay Commercial Real Estate

• Solution Development, Team Development, Collaboration, Process Improvement, Advisor

• Expertise in data science and machine learning

Principals have combined over 30 years of finance, investment, and real estate experience, and are experts in the SLC real estate market.

Avalon Investment Group © 2022 4

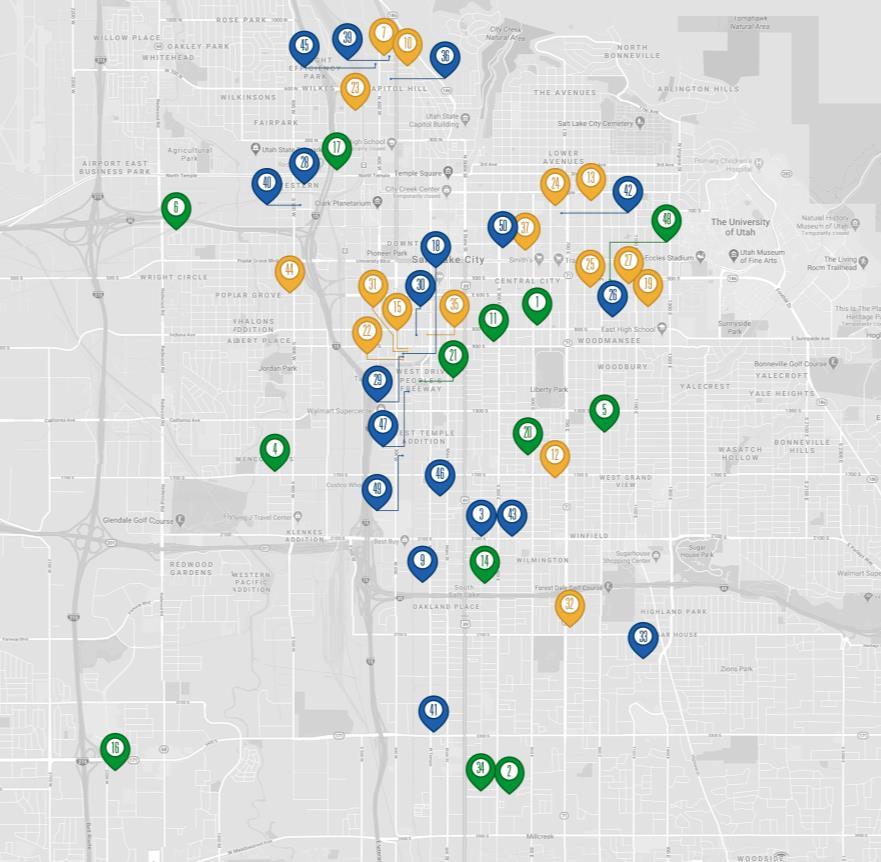

AVALON PARTNERSHIPS

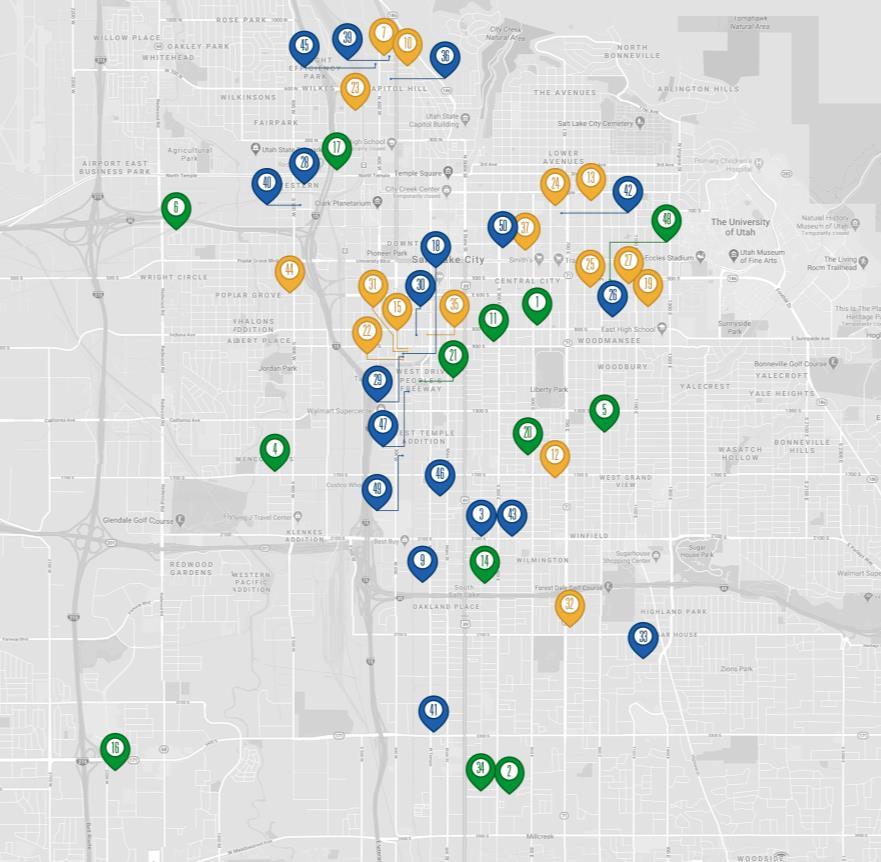

Avalon has partnered with TAG SLC to help scale TAG’s business and allow them to focus on what they do best: Source Deals

TAG Projects since 2016

Avalon’s Co-Founder started TAG SLC in 2010 and has established relationships, tax knowledge, and has spent significant resources screening thousands of assets

Avalon partners are experts in SLC real estate, fund management & investor relations with an advisory board consisting of decades of added experience

These relationships among other partnerships give Avalon an instant advantage to provide robust yet safeguarded returns

Under Construction or CompleteValue Add Proposed Development

Avalon Investment Group © 2022 5

SENIOR ADVISORS

Sunny Yang & Sokkie choing Active Advisors / Capital Raisers

With 25 years of commercial real estate experience, Sunny & Sokkie created the Red Door Group and offer a wealth of knowledge and resources to help Avalon provide investors a seamless experience

David van blerkom Expert Investor

• 30 years Finance/Institutional Sales/Hedge Funds

• Focus on building client relationships based on trust

• Client service emphasizing integrity, attention to detail, and follow through

• Invested in 10+ real estate projects

• Assists Avalon with financial model analysis and investor relations

Our Senior Advisors are Passionate and excited about Avalon

Providing added experience and resources to progress the fund for improved returns

Avalon Investment Group © 2022 6

Avalon Investment Group © 2022 7 INVESTMENT DETAILS INVESTMENT STRATEGY Create value through new construction in high-demand and underserved areas INVESTMENT TYPE Multifamily, Multi-Property Fund (3-5 Properties) ASSET CLASS Class A (New Construction), (A-B Locations) FUND MANAGER Avalon GP DEVELOPER TAG SLC (not exclusive) FUND SIZE $30 Million PROJECTED HOLD PERIOD 7 Years LOCATION OF ASSETS Salt Lake City Metro Area DISTRIBUTION WATERFALL TO INVESTORS • 8% Preferred Return • Followed by an 80/20 split (80% to Investor) • Followed by 60/40 if over 25% IRR is reached (only applies to returns over 25%) • 2% Management fee PROJECTED EQUITY MULTIPLE 2X PROJECTED ANNUALIZED INTERNAL RATE OF RETURN 17% to investor DISTRIBUTION AND REPORTING TIMING Quarterly distributions once returns are achieved (reports every quarter) MINIMUM INVESTMENT $100,000

Avalon Investment Group © 2022 8 RECENTLY COMPLETED PROJECTS BY TAG Cost Exit IRR | Multiplier 850/856 S West Temple $6,135,000 (2M invested) $8,216,000 34.6% | 2.11x 945 S Washington $2,712,200 (760K invested) $3,300,000 24.5% | 2.02x 365 W Reed $4,700,250 (1.175M invested) $5,500,000 17.9% | 1.73x Avg Past Project Returns 25% | 2x

PROPERTY HIGHLIGHTS

Avalon Investment Group © 2022 9 EXAMPLE PROJECT: L’ORIOL PLAZA (IN PROGRESS) 324 S 400 E SLC, UT 84101 Type Podium 5 over 1 Projected IRR 18% No. of Units 60 Land Acquisition Cost $4.8 M Avg Sq Ft / Unit 1,242 Total Projected Cost $36 M ($456 / SF) Avg Monthly Rent $3,238 ($2.61 / SF) Stabilized Value $42.9 M

Includes 60 condo-style apartments and approx. 4,237 square feet of amenity space 74,490 square feet of rentable space Exterior finishes will be composed of stone and glass, giving the building a modern and high-end look Expected 24 months of construction, another 6 months to lease Monthly income approximately $194K in rent

PROPERTY HIGHLIGHTS

Avalon Investment Group © 2022 10 EXAMPLE PROJECT: 27 CHICAGO STREET 27 Chicago St. SLC, UT 84104 (Land acquired) Type Podium 5 over 1 Projected IRR 20% No. of Units 49 Land Acquisition Cost $700K Avg Sq Ft / Unit 454 Total Projected Cost $9M Avg Monthly Rent $1,064 ($2.34 / SF) Stabilized Value $11.9M

Includes 49 apartments within .33-miles of a major transit corridor 24,995 square feet of rentable space Small units appeal to those working downtown and the Gateway Unit rents are affordable - and more competitive than most of what is available in the market

Avalon Investment Group © 2022 11 FUND AND DEVELOPMENT TIMELINE 12 months 24 months 6 months Construction Stabilize Asset Dispose of Asset Distribute Returns QuarterlyCapital Call Architecture & Engineering Plans Due Diligence Deal Sourcing 6-12 months 3-6 months12-24 months 6-12 months 3-6 months12-24 months Initial Project Project #2 Projects #3-5 7 Years

Avalon Investment Group © 2022 12 1.93% 1.95 1.96 1.73 1.72 1.66 1.79 1.5 1.6 1.7 1.8 1.9 2 2,800,000 2,900,000 3,000,000 3,100,000 3,200,000 3,300,000 3,400,000 2015 2016 2017 2018 2019 2020 2021 % Population Growth Total Population (Millions) State Population Estimate % Annual Growth 3,003,792 3,062,384 3,122,477 3,176,342 3,343,5523,284,8233,231,108 WHY SALT LAKE CITY Source: https://gardner.utah.edu/wp-content/uploads/UPC-Estimates-Dec2021.pdf *Ranking includes District of Columbia Source: Census Bureau (Graphic by Christopher Cherrington | The Salt Lake Tribune) Source: Utah Population Committee, Kem C. Gardner Policy Institute (2015-2021) Figure 2: Utah’s Population and Annual Growth Rates, 2015-2021 Growth leads as the fastest-growing state in the U.S.* Percentage increase in population, 2010,2020 1. Utah 18.4 2. Idaho 17.3 3. Texas 15.9 4. North Dakota 15.8 5. Nevada 15.0 6. Colorado 14.8 7. District of Columbia 14.6 8. Washington 14.6 9. Florida 14.6 10. Arizona 11.9 However, availability for multifamily units is extremely low, creating: • Ever-increasing demand and value for multifamily real estate • CAP rates are consistently better for new development 35K+ new residents moved into Utah over the last year Salt Lake City, especially, is experiencing consistent growth along with necessary infrastructure

general@theavaloninvestmentgroup.com 925.997.7241 www.TheAvalonInvestmentGroup.com THANK YOU