29 minute read

Bathrooms

from Sleeper 104

BCA Research point out that this will force central banks to stop tightening. They believe the BoE is exceptionally constrained and will be among the first to halt its tightening. A stop to interest rate rises will be welcome news for real estate investors. The doomsters often ignore rebalancing factors like this.

It is certainly an uncertain outlook, to paraphrase Hilton’s Nassetta. But for the hotel sector, I am still struggling to see it being as bad as seems the growing consensus.

But we do have a sharp slowdown in dealmaking in the near term. Many investors are waiting until autumn to see whether to proceed.

A key challenge is the cost of debt. Although the actual increases are modest in nominal terms, relatively, they are huge and represent a step change from the dozen years of ultra-loose monetary policy.

In real terms, thanks to soaring inflation, rates are still negative but if inflation comes back to target, by 2024 we will have positive real interest rates. This forces a major rethink on deal structures. It is no wonder that dealmakers are taking a pause.

But they will not be able to prevaricate for long. The benefit of a return to positive interest rates is the likely undoing of the zombie companies and a consequent rise in stock availability. These flawed capital structures had been propped up by cheap debt, and lenders will now be forced to take action.

As well as debt proving a known unknown, asset prices are also a source of uncertainty. Ultra-loose monetary policy has created an asset price bubble that may still pop as quantitative easing is unwound.

Property investments built around income as well as capital value on exit look a sounder bet than a pure capital value play. The symbiotic relationship between opco and propco looks even more crucial. This reality will stimulate interest in hospitality and the broader operational real estate market.

Accor launches fresh restructure

Hotel group Accor has announced a restructuring around two business divisions, aiming to simplify its structure and demonstrate its attractiveness to business partners.

The regrouping will see the brands and properties split under either the economy, midscale and premium division, or as luxury and lifestyle. It will be carried out by Chairman and CEO Sebastien Bazin and the current executive team, under a renewed board mandate.

“Changing our organisational structure is a natural step in the transformation initiated several years ago, which turned Accor into an asset-light group that is more agile and efficient, with a global profile and which has become a key player in luxury and lifestyle,” said Bazin.

“By evolving from a generalist to a multispecialist model, our aim is to further improve Accor’s appeal in the eyes of talents, owners, partners and investors. We capitalise on our leadership positions to accelerate our development, better focus talents and expertise, and improve our performance.”

The economy, midscale and premium division will operate out of four regional offices in Paris, São Paulo, Singapore and Shanghai. The idea is that this division focuses on efficient processes, being lean and market driven.

Luxury and lifestyle, meanwhile, will be further divided under four brand lines: Raffles and Orient Express, Fairmont, Sofitel and MGallery, and Ennismore. In contrast, this division will be brand-driven, aiming to be agile and delivering a more tailored offering. It will operate out of brand offices in the US, Paris, London and Dubai.

Announcement of the restructure, which goes live in October, came just ahead of the group’s second quarter results, in which Accor revealed its RevPAR is already ahead of 2019 levels. Revenues were up to EUR1,725m, with a positive EUR205m EBITDA. “This marked rebound was in all regions and for all of our brands,” according to Bazin. “The summer will confirm these trends and the fall promises to be strong with the recovery of major seminars and conventions.” He has pencilled in an expectation of full year EBITDA beating EUR550m.

In common with other reporting hotel groups, stronger room rates have offset lower average occupancy than in 2019. The best performing region, southern Europe, saw average 59.4% occupancy in the first half, 8.8% lower than 2019, while across the whole portfolio occupancy averaged 54.6%, 12.8% below 2019.

Bazin said Accor’s transformation to asset light is 93% complete, with some Australian assets still to be disposed of. “That is behind us - well executed, and well timed.” Out of 5,300 hotels globally, Accor now owns just 114. He painted the new initiative as a fourth step in the transformation. First came “get light, get broad, get fit” and now “get focused” - calling on the team to focus, simplify and expand.

The group opened 85 hotels in the first half of the year, and expects full year system growth for 2022 of 3.5%. Bazin noted that the first quarter had been frustrating with few deals signed, but progress is accelerating the pace of signings.

The quarter also saw Accor announce the disposal of a 10.8% stake in its Ennismore division to a Qatari consortium for EUR185m. The transaction will leave Accor as majority 62.2% stakeholder. Bazin said Accor had spent recent years fully acquiring brands in lifestyle, which it had previously taken a minority stake in: “We wanted to consolidate what is a very interesting segment, and probably the fastest growing segment in the industry.”

Quizzed as to why they would then sell a stake in Ennismore, Bazin explained that it was an opportunity too good to turn down. “We were called by Middle Eastern investors who not only see the growth, but see also the interest for their countries to diversify into that segment. People knocked on the door, we decided to engage with them precisely because they wanted to participate in a more active manner, with further resources notably.

“By doing it, you kill two birds with one stone. You prove a very high valuation, probably far larger than the investor community was looking at… and also it’s time for Accor to prove to the world that what we’ve been conducting is of great value. And two, it’s because of them investing, and proving the value, then we have access to outside capital to faster and further grow Ennismore.”

HA PERSPECTIVE

By Chris Bown: Accor never disappoints in doing things differently from everyone else. Most other hotel groups did their slimming down and restructuring during the pandemic, and are now counting the benefits of those actions as business bounces back. Accor, meanwhile, is still shaking things up and reinventing itself again. Time will tell whether this adds another level of profitability on top - or simply muddies the operational waters, and confuses potential partners.

As ever with Accor, there are plenty of moving parts, with Bazin covering off investment in hotel distribution technology companies and dark kitchens in his extensive remarks as he answered analyst questions. But the most promising opportunity looks to be the Ennismore brand grouping. If Middle Eastern investors and Chinese development partners can really get behind this exciting portfolio of lifestyle brands, then Accor could suddenly look a lot more interesting.

HA PERSPECTIVE

By Andrew Sangster: Accor has tried harder than any other global major hotel company to transform itself. At times, it has seemed like the class nerd that has tried everything groovy to be good at, from sport to music, but keeps failing to win friends. She is brilliant at maths but doesn’t want to accept it as she wants to play with the cool kids.

At Accor, its brilliance is its power brands, notably Ibis and Novotel. They might be uncool but they have the capacity to dominate Europe. And as any school kid finds out on entering the job market, maths will usually make you much more money than music or sport. And so Accor once again spins the reorganisation wheel, this time calling it Turbo, with full details revealed in October. Will this time be different to the myriad other efforts at change? In my view, it seems the most credible shift yet but it is also most likely the last chance Chairman and CEO Sebastien Bazin will get.

The two divisions are not simply a separation between select-service and full-service / luxury. In with Ibis and Novotel comes the upscale (or premium, as Accor dubs it) brands of Pullman, Swissotel and Movenpick.

Similarly, it is hard to argue that the likes of The Hoxton and Jo&Joe, which are in the luxury and lifestyle division, are full-service. Where the distinction comes is most notably in the preference for management or franchise, with management the preference for luxury and lifestyle, and franchise for economy, midscale and premium.

There is also a differentiation being made in approach: L&L is all about brand identity, attracting talent and experiences; E,M&P is about “accelerated development” and “the industrialisation of our operating model”.

Bazin made a good pitch at the half-year results presentation, claiming that Turbo is the culmination of a transformation journey. The switch to asset light was dubbed Get Light; followed by Get Broad, the acquisition of FRHI, Movenpick, SBE and so on; a reset has subsequently been underway, apparently, dubbed Get Fit; and now it is time for Get Focused, or Turbo, which will bring upskilling, simplification and faster expansion.

Quite where certain forays, notably in digital when Bazin dressed up like Steve Jobs, including black polo neck and bare feet, now fit into this transformation journey is not clear. Perhaps it was part of the upskilling. Accor currently lists 54 brands on its website, some of which were part of the digital and related pushes (remember augmented hospitality?). These brands include the likes of D-Edge, John Paul and Onefinestay.

Many analysts are already baking in a future split, with the “processed” hospitality of E,M&P separating from the “tailored” hospitality of L&L. I’m not so sure this is so clear cut that Ibis does not need to be agile and brand driven and only be lean and market driven. The main issue, I would argue, is that L&L (and all the other digital stuff that was to be stuffed into the SPAC) has been too much of a distraction for management.

Perhaps evidence for that came in the financials for the first half. Despite record revenues, profit disappointed. Accor has a reputation for being one of the toughest managers on costs and it needs to double down on living up to this.

My bet is that the pressure to separate will be too much, with Bazin retiring as the group CEO when the deal is announced in a year or two. Current deputy CEO (and CFO) Jean-Jacques Morin will step up as CEO of E,M&P with Guarav Bhushan the obvious pick to take the reins at L&L.

During the conference call, Bazin emphasised how the two divisions would operate autonomously with only a sliver of overhead. This makes it all too easy to separate them.

City analysts were underwhelmed by Accor’s numbers. Morgan Stanley lowered its price target when the analysts had been expecting to raise them. Bernstein, a long-time bull of Accor, acknowledged the numbers were a setback but the analysts retained an outperform with expectations that 2023 will finally see better news. Accor’s share price was down almost double digits on publication of the results.

Next year ought to be a much better year for Accor. It now looks to have the right tools and the right approach. The class nerd may finally find her calling. But if it disappoints again, more radical corporate action will be likely.

Hotel Analyst is the news analysis service for those involved with financing hotel property or hotel operating companies.

COMFORT WITH INTEGRITY

HOSPITALITY SLEEP SOLUTIONS

Carbon Neutral, 100% sustainable and recyclable

1. 2.

3.

Performance benchmarking for the global hospitality industry

1. New York City

June 2022 saw the US hotel industry report its highest monthly room rates on record, reaching USD155.04, a 15.3% increase on June 2019. Of the top 25 markets, New York City experienced the highest occupancy at 83.7%, which is 13.6 percentage points above the national average. As both a business and leisure destination, the city outperformed on ADR and RevPAR metrics too. Occupancy 83.7% ADR USD298.88 RevPAR USD250.05

2. London

After a slower recovery than regional UK – due in part to a heavy reliance on business travel – London’s hotel market is finally making a comeback. According to preliminary data from STR, the city’s hotels reported their highest monthly room rates on record in June, with ADR and RevPAR both showing significant improvement from the previous high in April. Occupancy 83.1% ADR GBP209.00 RevPAR GBP173.60

3. Riyadh

While RevPAR recovery in the Middle East was higher than any other global region at year-end 2021, there remains variation between markets. For June 2022, Riyadh reported month-over-month RevPAR declines, though at SAR328.17, this is higher than the pre-pandemic comparable. In fact, the Saudi Arabian capital performed better across all three metrics in comparison to June 2019. Occupancy 56.5% ADR SAR580.61 RevPAR SAR328.17

4. Melbourne

Melbourne’s hotel industry is also back on the recovery track according to preliminary June data, with stronger performance than the previous month. Hotels in the coastal city saw 29 days of occupancy above 50%, averaging at 61.1%. While demand continues to strengthen each month, occupancy growth has been somewhat muted due to increased supply. Occupancy 61.1% ADR AUD210.54 RevPAR AUD128.72

STR provides premium data benchmarking, analytics and marketplace insights for global hospitality sectors.

© Erik Lefvander

Innovating Comfort Since 1926

Almost a century after its inception, Swedish bedmaker DUX continues to deliver comfort through a marriage of craftsmanship and innovation.

Words: Ben Thomas

When Swedish chocolatier Efraim Ljung travelled to Chicago for a business trip in 1924, little did he know that after returning to Malmö, his focus would soon shift from confectionery to a bedmaking business, now run by his four great-grandchildren.

As the story goes, Ljung – who suffered from rheumatism and often had problems sleeping – woke up feeling invigorated after a tranquil night’s rest at his Chicago hotel, and overcome by curiosity, used a penknife to cut open the mattress and see what was inside. The answer was a network of flexible steel springs, and while Ljung carefully sewed the fabric back together, the memory stuck vividly in his mind.

From that moment on, his attention shifted from chocolate to mattresses, and he began experimenting with steel springs of varying strengths and elasticity. Two years later came the first-ever DUX bed, with an innovative spring system that reacted to pressure and weight through thousands of interlocking coils. The same comfort-driven approach was later applied to furniture, with Ljung’s son Erik bringing the designs of fellow Swede Bruno Mathsson to life during the 1960s and 70s. Amongst the pieces produced, the Jetson and Pernilla 69 remain in the collection today, channelling a distinctly Scandinavian style.

Since then, the family has continued Efraim’s philosophy, building on his ideas to develop products that deliver comfort, performance and longevity. “The core vision has always been to produce the very best in comfort and craftsmanship,” says fourth generation CEO Henrik Ljung on a tour of the brand’s factory in Sösdala, where a small team of artisans are busy handcrafting chairs and tables for hospitality and retail clients worldwide. “We are proud of our age-old methods,” Ljung continues. “However, this does not mean that we are disregarding new technologies, far from it.”

Technology plays a greater role in Porto, where DUX has been manufacturing beds and upholstery for over 30 years, using CAD software and CNC cutting machines as well as snipping large amounts of fabric by hand. This combination of heritage and innovation has led to the launch of industry-firsts like a replaceable top pad and the Pascal system, comprising interchangeable spring cassettes that enable a bed’s firmness to be adjusted as required. Named after French mathematician and scientist Blaise Pascal, the patented system sees springs arranged to suit the body’s three comfort zones – shoulders, hips and legs – with each customisable using a soft, medium, firm or extra-firm cassette. For hotels, this not only means beds can be tailored to individual guests, but also prolongs their life should the springs become worn or start to sag, with only part of the system replaced rather than the entire mattress. “We have evolved our offer to meet changing customer needs,” Ljung explains. “Today, we are focusing more on sustainability and protecting the environment.”

The component-based nature of DUX products, together with the materials used to craft them, feeds into this notion of preserving the planet through the creation of a product that stands the test of time. The bed bases, for instance, are constructed with timber harvested from northern Sweden, where bitter cold winters produce a slow growth, hardwearing pine, while Swedish steel, hevea latex and high thread-count cotton is used for the continuouscoil, filling and upholstery of its mattresses.

Such credentials, in addition to the level of comfort and personalisation offered across the DUX range – from the low-profile DUX 1001 to the luxurious DUX Xclusive with its additional lumbar support adjustment – has seen the company work on prestigious hotel projects including Burj Al Arab in Dubai and Grand Hôtel Stockholm, as well as boutique properties like The Audo in Copenhagen and Pater Noster in its native Sweden, where guests can drift off under the stars in a bespoke outdoor bed.

“The hotel sector is extremely important to us and we’re proud of our collaborations,” says Head of Next Gen Kevin Slade, who reveals that 14 years ago, the group even opened its own hotel in Malmö to gain a better understanding of what it means to be an operator. Today, The DUXIANA acts as an incubator for ideas, honouring the past while teasing products of the future, some of which will be unveiled in issue 106. Stay tuned. www.duxiana.com

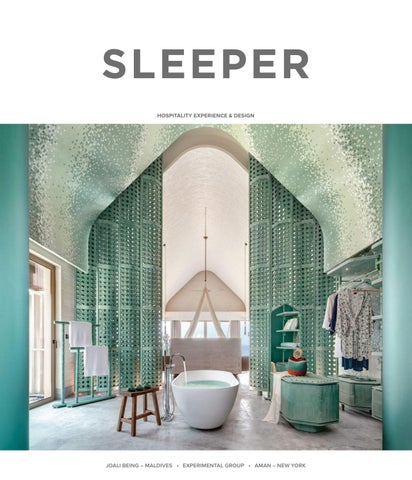

SPOTLIGHT BATHROOMS

From luxuriously long showers to taps absentmindedly left running, the bathroom has often been regarded as the most wasteful part of a hotel, particularly in terms of water usage. With a hotel’s sustainability credentials becoming increasingly important to discerning guests when booking trips, designers are constantly on the lookout for products that satisfy environmental demands without compromising style.

Japanese bathroom brand Toto is tackling the issue head on by creating automatic taps with self-powered microsensors to activate water flow, as well as new Eco Cap technology that adds air to the water stream to reduce consumption whilst maintaining pressure. On a similar mission, ceramic manufacturer Duravit offers High Efficiency Toilets that use 1.28 gallons or fewer per flush. Alternatively, Laufen’s Save! Urine Separation Toilet takes a step towards sustainable wastewater management by preserving the nutrients in urine, reusing them in agriculture, and at the same time protecting the environment from harmful substances.

But stopping guests from using excessive amounts of water won’t stop global warming. Instead, manufacturers are beginning to embark on greener approaches to business, examining the impact of their operations on the environment, from carbon emissions to waste materials. Together with Veolia Water Technologies, Roca Group has established two new production processes – one for vitreous china and another for faucets – to reduce water stress in the areas where it operates and preserve the resource by optimising its circular use. The water efficiency plan will be piloted at two factories in Morocco and Turkey as part of a global plan to audit the integrated water cycle throughout its manufacturing facilities.

Meanwhile, other brands are taking their sustainability goals company-wide. For example, Hansgrohe’s German sites are now climate-neutral in terms of direct emissions and energy consumption, with a view to achieve climate neutrality across all international sites by the end of the year. The operation will be no easy feat, as Head of Innovation & Sustainability Steffen Erath explains: “This process is costly and requires a lot of effort, but compensating for climate damage would probably cost us more.”

One way in which recycling can be mutually beneficial to both companies and the environment is to repurpose waste materials, as kitchen and bathroom brand Kohler has demonstrated with its WasteLab programme. Developed with the planet in mind, the scheme turns landfill-bound materials left over from the manufacturing process into functional products. From 2019 through 2021, sales of WasteLab tiles have diverted more than 54,000 pounds of waste from landfills, exemplifying the group’s commitment to achieving net-zero waste to landfill by 2035.

Ultimately, the key to sustainability within product manufacturing is transparency, something that sanitary brand Grohe is looking to improve across its portfolio. In order to provide customers with comparable data on the environmental impact of products throughout their lifecycle, the company will release Environmental Production Declarations for more than 600 products – including hand showers, flush plates and basins – by the end of October. A move that could be a catalyst for industry-wide change.

1. 2.

3. 4.

1. Geberit Hotel Guest Experience Report

Bathroom designer and manufacturer Geberit has launched its 2022 Hotel Guest Experience Report in collaboration with some of the UK’s leading architects and design pioneers. The publication explores the challenges and opportunities facing hotels today and covers an array of topics from design and technology to comfort and wellness. Sophie Weston, Channel Marketing Manager, comments: “We are delighted to have teamed up with some of the industry’s leading names to share the issues and market trends that will help shape the hospitality world across 2022 and beyond. We hope that this insight will drive new and rewarding customer experiences for hoteliers.” www.geberit.co.uk/guestreport

2.Crown International Styx, Aveto, Isere

Styx, Aveto and Isere are the new, deep black accessory collections by OS&E company Crown International, which combines craftsmanship with the latest technology. Comprising toilet-roll holders, soap baskets and towel bars amongst other amenities, the fixtures can add intrigue to a design scheme by bringing a pop of glamour and warmth without distracting from the overall design. Whether a bathroom has a more contemporary feel or leans towards a traditional aesthetic, black fittings can be used as a centrepiece or a complementary addition, giving designers the opportunity to create spaces that blend drama and luxury. www.crowninternational.com

3. Acquabella Miowa

Spanish bathroom manufacturer Acquabella’s new Miowa bathroom worktop series made its debut at Salone del Mobile in June. Featuring a practical integrated tower rail, the countertop is made from Acquabella’s unique soft-totouch, anti-bacterial Dolotek surface. Formed from a resin and dolomite stone, the result is a pure white, material that is UV resistant, easy to clean, and resistant to thermal shock. The clean lines of the Moiwa countertop – available in different sizes: 810, 910, 1010 and 1210mm – establishes an ambiance that transmits tranquillity and hygiene in the bathroom, while the reflective qualities of its white finish brings extra light to vanity areas. www.acquabella.com

4. CDUK PaperStone

CDUK has launched PaperStone, a sustainable material manufactured using FSC-certified recycled paper and natural petroleum-free phenolic resin with organic pigments. The surface features a unique, textured effect that creates a natural warmth and can be specified in a range of earthy hues and tones; selected colours are crafted from 100% FSC recycled paper and cardboard. PaperStone is hardwearing, and can handle temperatures up to 180° without showing any superficial changes, while it is also impact-, water- and stain-resistant – all properties ideal for a range of applications, including washrooms that require rigorous cleaning. www.cdukltd.co.uk

Q&A

Sebastian Herkner Duravit

Following the launch of his Zencha range for Duravit, designer Sebastian Herkner discusses the Japanese rituals, materials and craftsmanship that inspired the bathroom collection.

Attention to detail and the desire to imbue products with additional value are key facets of your work. How did you apply this approach to the development of Zencha? The Zencha series once again highlights our understanding of authentic materials and the desire to evoke emotions. Inspired by the traditional Japanese tea ceremony along with inner reflection and slowing things down, the low-key design – available in three colour worlds – focuses on details such as a delicate, curved washbasin edge. This was inspired in turn by delicate teacups that nestle in the hand. For us, it was important to engender an ambience in the bathroom where we can recharge our batteries in the morning and enjoy some me-time in the evening.

What impact do authentic materials have on Zencha? For me, it’s crucial to use authentic materials like wood, ceramic, and glass. With this design we also introduced a textured glass that plays with light, shade and reflections. In my mind, this authenticity created a sense of harmony that runs throughout the collection. Everyone can interpret Zencha for themselves. As the designer I provide the stage, but the user chooses how to dance on it.

How did the design process of the new collection progress? We started discussions with Duravit three years ago and very quickly agreed on the story we wanted to tell. Working closely with the Hornberg plant for ceramics and Schenkenzell for furniture, we developed the entire collection comprising washbasins, bathtubs, mirrors and furniture. This was the first time we had developed a bathroom ceramic series and relied to a large extent on the vast knowledge, willingness and openness of the employees. It was important for us to project the delicate elegance of the gentle, outwardly curving washbasin edge onto the furniture. The gentle frames of the storage furniture are once again testament to Duravit’s technical excellence.

How important is it for designers to make use of the freedom given to them by manufacturers? As a designer, it’s a privilege for a company to give you the freedom and trust to develop a new vision and language for them. Zencha is my interpretation of Duravit and shows how I want a bathroom to be. However, ultimately such a development involves cooperation from both sides.

www.duravit.com

1.

1. Gessi Origini

Gessi has launched Origini, a collection comprising five triads of colours, materials and finishes, each inspired by a different character and personality. The range offers the inspiration and freedom to create the most intimate wellness space according to the personality of the user. For romantics, Warm is a monochrome triad with a warm dominant, made up of super-matte powder, warm bronze and dark bronze finishes. It is conceived for those who regenerate by creating a private space in a bathroom, possibly with a bathtub, where visual contrasts are lowered to enhance tactile and olfactory perceptions. The Neutral triad, comprising a mix of matte greige clay, brushed finox, brushed nickel and polished nickel finishes, is conceived for city dwellers and those who never stop. Defined by glossy ochre, matte black and satin brass – ideal for an energising shower – Accent follows a graphic pattern that allows the space to be subdivided by strongly characterising the different elements. Designed with traditionalists in mind meanwhile, Materic combines terracotta, shiny dark metal and brushed copper to define a multi-material ambience and complement wood, ceramics and resin. Finally, Nature is a chromatic portrait reflective of those who draw energy from nature, featuring black brushed metal, chrome and matte Agave green. www.gessi.com

2.

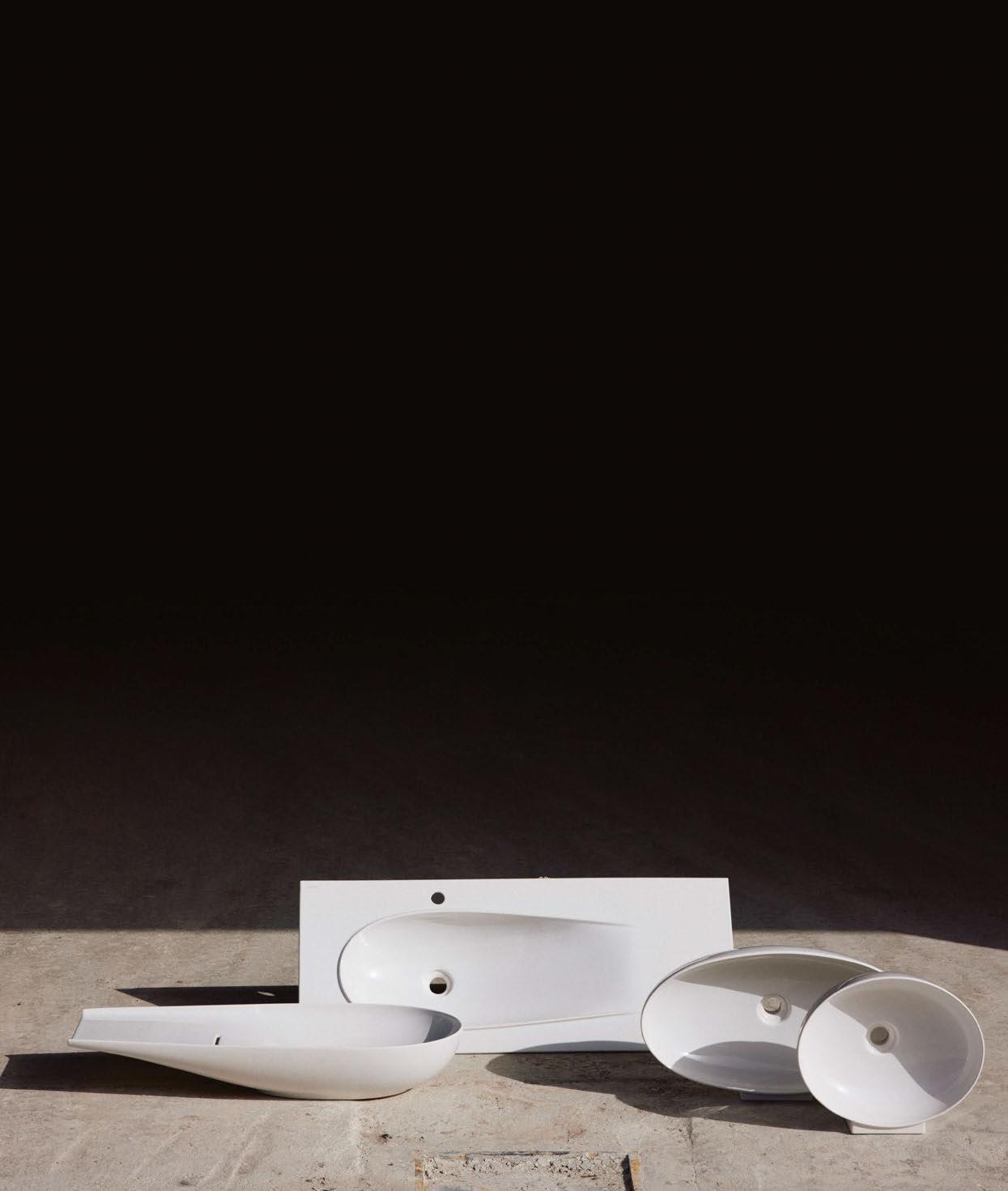

2. HIMACS Bathroom Inspiration

Dutch designer and founder of Not Only White, Marike Andeweg, has long been considered one of the leading trendsetters for bathroom concepts that meet the demands of emotion and function in equal measure. Andeweg has also been a longstanding collaborator of HIMACS, using the properties of the Solid Surface material to design basins and bathroom accessories for her brand. HIMACS and Marike Andeweg have combined their expertise once again to create the new Bathroom Inspiration brochure, a useful guide – based around four key trends – on how to choose designer styles and inspirations for a bathroom using HIMACS products. Blurring Borders recognises that the bathroom is taking over roles that were traditionally assigned to living rooms and bedrooms. As such, it is now a sanctuary that requires forms and materials to provide homeliness without compromising its original function. Barefoot Luxury is an ode to slow living, alluding to a less-is-more approach by focusing on the quality of materials and surfaces. And Japandi is a fusion of Zen style and Scandinavian design, recognising that calm and focus are becoming increasingly important in a fast-paced world full of distractions. Finally, Emotional Shades is a celebration of light, acknowleding that an emotional world can be achieved within a bathroom with expert advice from a designer. www.himacs.eu

1. 2.

3. 4.

1. Vola RS11

In response to the global pandemic and a focus on hygeine, Vola has launched the RS11 as part of a new series of dispensers designed to make sanitation as inviting as possible. The RS11 dispenser is available in three configurations – freestanding, wall-mounted and table-mounted – to suit any environment. Comprising a wellproportioned one-litre capacity cylinder, the device is adaptable for dispensing hand sanitiser gel, foam and soap, as well as being easy to clean and refill. The extruded aluminium cylinder, available in black or white, is also resistant to fingerprints. Each option is available in the full range of 27 Vola colours and is powered by rechargeable batteries. www.vola.com

2. Axor Conscious Showers

Combining a generous shower head with a powerful water spray, Axor’s Conscious Showers ensure that water is used sparingly without compromising the showering experience. Envisioned by Phoenix Design Studio, the range includes the rectangular Overhead Shower 245/185 and two round design variants, the Overhead Shower 220 and the Overhead Shower 245. In the EcoSmart+ variant, the Axor Conscious Shower reduces the flow rate to less than six litres per minute, though this has no impact on the user. The minimalist design of the showers also means they can suit a wide range of different styles and can be combined with other Axor collections. www.axor-design.com

3. TF Design Edge

The modern, minimalist simplicity of the Edge Bath collection by TF Design is now available in a neutral matte colourway that can be paired with a variety of décors, complementing the warmth of natural light timber as well as stone floors and sandy beach vibes. Handmade using a resin material, the wider Edge Bath range comprises tableware, serving pieces, barware, decorative accessories and furniture – all of which feature clean lines and sleek finishes that create a modern solution for bathroom, poolside, desktop and outdoor use. TF Design products can be found at luxury hotels, restaurants, private jets and yachts, in addition to residential projects. www.tf.design

4. RAK Ceramics Metamorfosi

Creating a virtually seamless, durable mural, Metamorfosi from sanitaryware brand RAK Ceramics is a decorative porcelain surface that will make an eyecatching impression on any bathroom. The large-format surface is available in two sizes - 120x260cm and 120x120cm – and draws inspiration from the colours and shapes found in nature, responding to a demand for biophilic interiors with a highly durable and splash-resistant solution. The series comes in several design options – nine colours and 11 decors to be exact – which are then transferred onto large-format brushed resin porcelain stoneware slabs to create striking wall decorations. www.rakceramics.com

2. 3.

4.

1.

1. Roca Ona

Inspired by the Mediterranean Sea, Ona offers a wide range of timeless designs with soft shapes and geometric lines. Developed by the Roca Design Centre team in collaboration with Noa Design Studio and Benedito Design, the bathroom collection comprises basins and furniture, brassware, baths, accessories, WCs and bidets. Ona brassware is available in Classic Chrome, Titanium Black and Rose Gold in Everlux, Roca’s PVD solution completed in-house within its brassware factories. Everlux provides a resistant finish that is ideal for hospitality, while for larger projects, a number of custom finishes are also a possibility using the same technology. www.roca.com

2. Roman Brushed Brass and Nickel

Roman has launched two new finishes – brushed brass and brushed nickel – for its Select Wetroom Panel range, joining the existing chrome and matte black; the latter is sandblasted to give a consistent and smooth lustre. The appeal and elegance of the brushed brass remain timeless, with brushed nickel fixtures becoming increasingly popular amongst architects and designers in luxury bathroom design. Made in the UK, Roman’s Wetroom Panel options can be fitted to its low-level shower trays or straight to floor to create a true wetroom. All size options are available in 8mm and 10mm glass, with three sizes of flipper panel and one fixed version on offer. www.roman-showers.com

3. Kohler Occasion

Inspired by the high fashion and effortless glamour of Hollywood’s Golden Age, Kohler’s Occasion faucet collection is characterised by chamfered edges and the subtle flare of its base. A fine balance between facets, angles and edges further invites an interplay of light that draws the eye, while transitional design elements allow the faucets to blend seamlessly into a variety of bathroom aesthetics – traditional or contemporary. The cohesive style of the collection meanwhile marries the pieces across the sink, showering and bathing areas. Available globally, the Occasion range comprises a variety of lavatory faucets, together with bathing, showering and accessories. www.kohlercompany.com

4. SV Casa Argo

Developed by accessories designer and stylist Susanna Valerio, SV Casa has supplied guestroom, bathroom, F&B and spa accessories to over 320 of the world’s iconic hotels. The Argo collection is a timeless and elegant bathroom set made from solid bronze with signature grooves. The pieces are heavy and rich of character, as every piece is handcast by the group’s master artisans. SV Casa also provides complete customisation and bespoke collection designs at no extra cost, understanding that every project is different. To craft its creations, the manufacturer works with a variety of materials including stone, shell, lacquer, polyresin, wood, metal, glass and wood. www.svinternationaldesign.com