BOOM BANG A BANG

The Indispensable Guide to Finances for Turbo

Couples

Contents

1. Introduction

2. The costs of saying goodbye to singledom

3. Have we fallen out of love with the joint account?

4. What’s your money personality? (And how to manage different types)

5. Living apart together, or moving in? Cohabiting finances contemplated

6. Dealing with STDs…Sexually Transmitted Debts!

7. Should you prep a Pre-Nup (even if you don’t plan to marry)?

8. Get ready for the Octopus Family

9. Why you MUST make a will - and keep it updated

1. Introduction

If you’re reading this, chances are you’re one of the 22% (that’s 10 million!) of UK adults in a new relationship or about to enter one*.

Congratulations! It’s an exciting, roller-coaster ride and we’re here to help you with one of the more practical aspects of coupling up: money!

We’ve partnered with HyperJar to bring you plenty of hints and tips about managing your new financial situation now you’re happily coupled up.

*HyperJar and MoneyMagpie survey, Feb 2021

In the last year, some of us here at HyperJar experienced what we might call ‘fast-tracked relationships’. When lockdown eased last Summer, a few Hinge or Bumble dates got more serious, more quickly than expected. Suddenly, things went from ‘forming a bubble’ to ‘finding the one’.

Our new couples found themselves faced with a lot of money questions. According to the research we commissioned, they weren’t alone.

And the idea for this guide was born.

Money matters. A lot. We spend most of our time earning it, then spending it on ourselves and the people we love.

2. The costs of saying goodbye to singledom

While being part of a couple means you get to share costs – and, of course, memories – there’s a greater financial impact than you may have considered.

Looking Good

-

Estimated Cost: £50 a week

When we start dating someone, it’s natural to want to look our best for them. That means gym memberships, clothes, haircuts, and let’s just say ‘other grooming’. Factor these costs in when you start dating – or you could be in for an expensive surprise when you check your bank account!

Going Out (Or Staying In) –

Estimated Cost: £35 a week

Lockdown has put the kibosh on the more glam dating options. But once we’re able to do more than Zoom, a reminder that IRL dating can be expensive.

A cinema date is over £40 if you include travel and snacks. Dinner afterwards is easily £40 spent – or more. If you fancy some live music or a night at the theatre, tickets are far more expensive than the cinema – so you can see how it all adds up.

Want to be the savvier saver in the couple? Look for discount codes, special menus or book tickets online to save money.

Extra Social Engagements - Estimated Cost: £25 a week

When lockdown is over, you’ll find that suddenly coupled means you’re suddenly a Plus One, too. Every wedding, bar mitzvah, engagement party, birthday party, or family gathering on your partner’s schedule becomes an extended invite for you, too.

That’s a lot of extra new clothes, travel, and gifts you’ll need to factor into your expenses!

An account like HyperJar is good for setting aside money in Jars for gifts, with extra rewards from their shopping partners for planning ahead.

Different Spending Habits - Estimated Cost: Who Knows?!

As you’ll see later in our money personalities chapter, different spending habits mean you could end up with a bigger bill than you’re used to.

If you’re the one who chooses the second-cheapest wine on the menu, but your partner likes the priceiest… well, you’ll need to either talk it out or be prepared to spend more.

Check out our Money Personalities chapter for more!

Schedule Changes - Estimated Cost: £20 a week

You might love your off-peak gym membership or cinema tickets – but when your social life involves your new partner, things could change.

This is especially true if they have children: school times and holidays have a big impact on when you can do things. If, for example, you want to take your new squeeze on holiday – you’ll need to factor in school holidays, babysitting costs, and other responsibilities.

With all that said and done, there are plenty of financial advantages to coupling up, too. You get to share the cost of boring things like bills – but also can chip in with your new extended family to celebrate events, go on holiday, or plan fun (and memorable) day trips together.

3. Have we fallen out of love the joint account?

Relationships are defined by sharing. But we all have our limits – there are some things you might not want to share, even with your beloved. Your stash of Diptyque candles. That £50 splurge moisturiser. Their hideous rug. But what about money?

The joint bank account was once an exciting ‘together forever’ rite of passage with some obvious advantages: a straightforward, formal way of sharing money and living costs.

But the joint account has issues that can make it feel out of step with modern life. It creates a formal financial link that means you impact each other’s credit score. If the account becomes overdrawn, you’re both responsible for the debt.

Times Are Changing

As you go down the age bands, attitudes to joint accounts change. A survey of almost 4,000 British women* showed that 31% of 16 -54s had actively chosen not to share financial assets with their significant other.

Couples are getting together later in life; women have more financial, professional and social autonomy; and everyone wants to retain more independence over their money. Relationships are more equal, and also more fluid.

* Conducted by Netwealth

How HyperJar Solves the Joint Account Conundrum

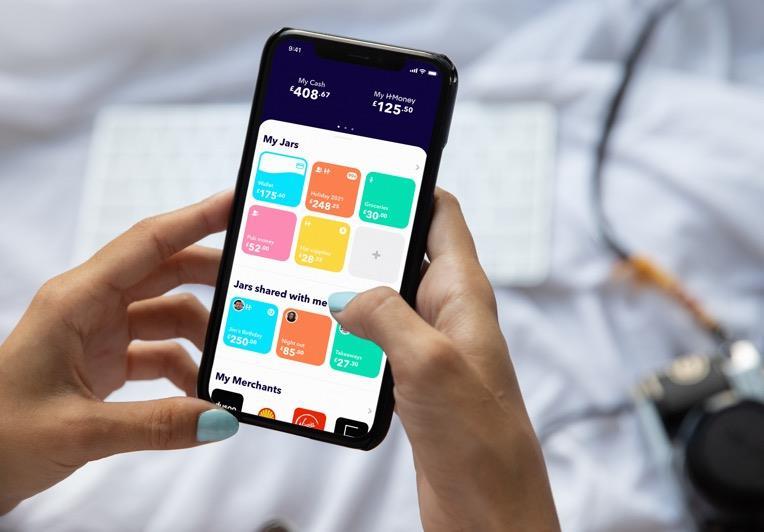

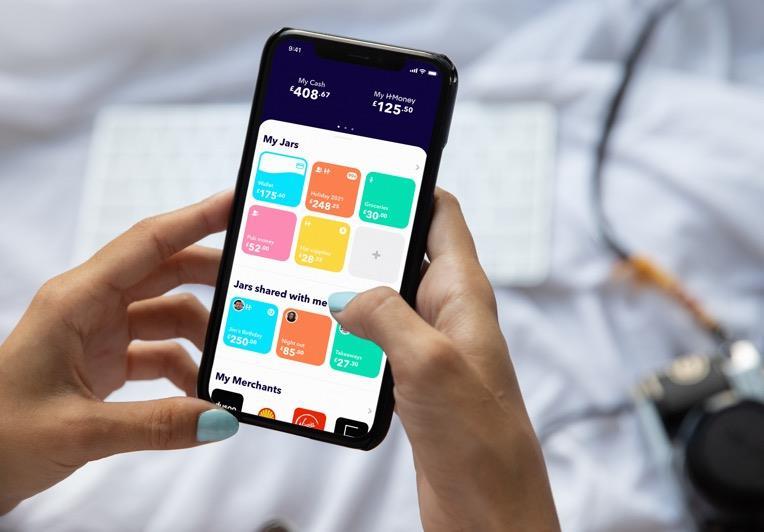

HyperJar’s mobile account works like a digitised version of jam-jar budgeting. You can create multiple mini-accounts, all connected to the same card, and spend directly from any of them.

These mini-accounts are shown as jars in the HyperJar app. By dividing your regular spending money between them you can customise your account around your own priorities – whether it’s paying for essentials, or some nicer things like saving towards a holiday. Money organised uniquely around your own life.

And of course, most of our lives at some point involve relationships. Planning and spending with other people. That’s why any jar can become a ‘Shared Jar’: invite anyone on HyperJar to pay into it and spend from it.

Instant, hassle- and commitment-free joint accounts – which you can use for just the parts of your life you want to share with another person. Maybe that’s the groceries...or nights out...or kids’ stuff...or a weekend in Paris.

When you want to pool money for something - but not everything. A less formal, more flexible kind of commitment: joint access, not ownership.

* Conducted by Netwealth

4. What’s your

money personality type?

Some of us are spenders, others savers – and a few are middling. Coupling up with a similar money type is much easier, as you share the same attitudes to finances. However, if both of you are big spenders, that could cause its own problems!

Here’s our breakdown of money personalities – which one are you?

Save a penny, spend a pound

You plan your pennies, love coupons and discounts, and shop around for better deals on your suppliers and contracts.

However, when something catches your eye, or you need to pay out for a larger purchase, you’re ready to spend.

This is the best money personality: it’s balanced, thrifty, but not frugal or restrictive. Saving those pennies means you have more to spend when the time comes. When you’re in a relationship with a penny saver, you’ll know they will pay their way – and possibly help you learn some good financial habits, too.

Spend now, worry later

You see it, you want it, you buy it.

Credit cards and loans are familiar territory for you – and you’d rather enjoy things now than worry about future debt.

This can be a dangerous money personality – especially when you’re suddenly coupled. You might be tempted to spend even more than usual to impress your new partner or insist on taking holidays you can’t really afford to, just so you can spend time with them.

If you’re coupled up with a spend now, worry later type, it’s really important you find ways to share money without formally linking yourself.

This is because you don’t want to become responsible for any debts they rack up.

Options like HyperJar offer a great middle ground – you can share jars for saving up and spending together, but won’t have your credit scores linked.

Scrimp everything, spend never

Anyone who has ever been unemployed or reliant on state benefits is likely to have a mindset similar to this. When you’re not sure if you’re going to have to choose between heating or eating that week, a thrifty mindset is essential. However, it can mean you miss out on great opportunities.

You might feel your money is ‘safest’ in a cash savings account – when, in fact, an investment ISA could make your cash work harder. When you’re coupled with a scrimper, it can be tricky to persuade them to splash out on things that are important to you. Try to demonstrate how you save in other ways (such as using coupons and discounts) to balance out your spending.

You might think mismatched money personalities don’t really matter. However, two big spenders could be on the road to debt. Two scrimpers means you won’t enjoy little luxuries together now and then. A scrimper dating a big saver can lead to huge arguments, too.

It’s also worth thinking about how the extended family is involved in money decisions. Those used to being single, for example, may be far more comfortable splashing out on big purchases or luxuries. A single parent, however, will know that children come with a lot of hidden costs – which a singleton big spender won’t have considered.

If you discover your new partner is a different money personality to you, don’t fret. It just means you need to find a middle ground with them to make sure neither of you feels under financial stress because of the way you spend money together.

5. Living apart, together –or cohabiting?

You might not be ready to move in together yet – or, like many, you’re considering moving in sooner than expected because ongoing lockdowns mean you can’t see each other any other way. Whether you’re living apart, considering the Big Move, or already under the same roof, here are the things you need to consider when it comes to cohabiting and money.

Financial Pros of Living Together

Aside from the obvious comfort of living together – getting to see each other all the time – there are some financial advantages, too.

• You can share the cost of your bills – including broadband, TV and music subscriptions

• Sharing costs means having more to save – and that means holidays and fun dates!

• Rent or mortgage costs can go down – or you can afford a larger home together

• Things like grocery bills are cheaper per person (being single is expensive)

Financial Pitfalls of Living Together

As with anything, where there are upsides there are also downsides. Make sure you weigh these up when thinking about living with your new partner.

• If one income reduces, the burden of costs falls on the other partner

• Living together may affect your eligibility for means-tested benefits

• You may need to move to a larger home – especially if children are involved

• Financially linking through a joint account can damage your credit score (more on that later)

If you’re thinking about moving in together – or already have – it could be worth writing up a pre-nup or official agreement about money (even if you don’t plan to get married in the future).

6. Dealing with STDs (Sexually Transmitted Debt!)

It’s silent, it’s insidious and you usually don’t know about it until it’s too late. It’s a Sexually Transmitted Debt. Your partner’s debt can be a nasty blow to a new, or even a long-standing, relationship. But there are ways you can protect yourself from it or deal with it if you suddenly find that you’ve caught it.

What is an STD?

A ‘sexually transmitted debt’ is where you find that you are affected by your partner’s debts – the ones they omitted to mention to you before you got together, or while you are together.

It can also be a shock to the system to find that the person with whom you’ve just applied for a loan has two County Court Judgements (CCJs) against their name which now prevents you from taking out the mortgage you were hoping for.

Their debt is my debt

Many couples are made up of a saver and a spender. That can work fine so long as you are open with each other and the saver can keep the spender in check.

However, when the spender gets into debt, and doesn’t tell their partner until it’s too late – then it can drag both down. The single best thing you can do when it comes to couple finances is to talk. Have as many open conversations about money and debt as you can.

If you’re planning to get married

Debt your fiancé took on before you got hitched won’t become your debt once the vows are exchanged. The only time you would have to share it is if the debt is in both your names.

If, for example, you bought a sofa on hire purchase together, took out a joint mortgage, or went for a bank loan together. If your partner has debt out in their name only, you won’t be responsible for paying it back if they decide to skip the country.

If you take on joint debt with your spouse, however, then you may be liable if your partner doesn’t keep up with their part of the repayment.

If you’re cohabiting

The rules apply in the same way if you’re cohabiting. If your partner has debt that is in their name only then that doesn’t affect you. However, if you take out a loan together, or even open a joint bank account to pay the bills, you are then financially connected.

So: you don’t have to be married to catch an STD. Once your names are financially linked, such as sharing car finance or applying for a mortgage together, you can ‘catch’ the debt!

Till mortgage us do part

If you want to take out a mortgage together you need to know if your partner has a poor credit rating or been rejected by other lenders before you apply.

So, before you start the form-filling for a mortgage or any type of loan, check both your credit reports. It’s free to do and absolutely vital before you agree to joining them on any type of credit agreement.

When you’re linked on a mortgage – or any type of loan or credit agreement –you’re liable for the full cost. That means if your partner stops paying their share, you have to stump up the full amount – or your own credit rating will go down as the default is marked for both of you.

How can you protect yourself financially?

Keep separate bank accounts – whether or not you’re married. If you’re confident it’s OK to financially link to your partner (i.e., they don’t have bad credit), set up a joint account just for the big bills you both pay, like rent, a mortgage or car loan.

This way, even though you are liable to pay part of any joint account debts, at least you will have a chance to stop your partner from spending your money and, therefore, putting you both in a worse situation.

The HyperJar Alternative

A smart alternative to formal financial ties is to set up jars on HyperJar for your household bills, particularly if you’re cohabiting or in a new relationship.

Setting up jars for things like groceries and takeaways – and even holidays - will not create any formal financial connection between you as there is no credit check. This is practical and helpful for married couples, too.

What happens if you split?

If you split up and your credit record has been messed up by your ex’s financial problems you need to make a request to the credit agencies such as Experian to make sure that they disassociate you from your former partner in financial terms.

These credit referencing agencies allow you to add an explanation to your record of where the debt problems came from and how you are no longer associated with this individual.

So if your partner skipped the country with all your cash, or didn’t pay their half of the mortgage for two years leading to your repossession, you can spill the beans!

7. Should you do a

Pre-Nup

(even if you don’t plan to marry)?

So, you have ‘had the discussion’ and decided you can bear each other after all. In fact, you’re going to get hitched. Great! Now for something else thoroughly unromantic: a pre-nuptial agreement (or a pre-Civil Partnership Agreement).

In the USA, ‘pre-nups’ are far more common than here, but then they are also legally recognised. Britain’s pre-marital agreements are not legally binding but, with the number of divorces increasing, they are often used as a basis for a settlement.

In fact, there have been hints from the Government that such agreements should have more legal standing - not least because of the potential cut in the Legal Aid bill. That would make them more in line with the rest of Europe, where pre-nups have been widely recognised for some years. Right now, it could prove persuasive to a court when a separating couple is arguing about who promised what to whom - but it's usually only when the marriage has been comparatively short and there are no children involved.

Pros

• It records what each person brings to the marriage

• Can raise ‘debatable’ issues like education of children and lifestyle that might have been buried in the run-up to the wedding

• Mental stability for both parties

• Keeps the in-laws happy

• Can reduce the time involved in divorce cases

Cons

• Challenges the idea of living ‘happily ever after’, which can be stressful for everyone involved

• Can be a complex and costly process

• Not yet enforced by British courts

Pre-nups could be essential if you’re about to enter a second marriage (they have a higher divorce rate than first marriages) and want to safeguard inherited family money, your business, or your children from a previous relationship.

If you’re cohabiting

Why are we talking about pre-nups when you’ve only just decided you might move in together?!

Well, if you’re making the big move, it’s important to consider something similar. It also lays the ground rules should the relationship develop and you do go on to marry.

It’s even more important if you’re planning to buy property together. And if you plan to have a child, you need to protect their interests if you split up.

As cohabitees, you don’t have access to each other’s cash or assets once you split. But, if you’ve bought a place together, or set up a business together, had children or other major ‘life-joining’ events, it really helps if you have some agreement beforehand as to what you will do if you go your separate ways.

It's also helpful to have a cohabitation agreement for day-to-day living together even if you don’t separate. In your agreement, include elements such as:

• How you pay rent, mortgage or household bills

• Finances, for example what happens to joint bank accounts

• Property and assets – owned before or bought while living together

• Arrangements for children

• Pets

• Next of kin rights

Things to consider in your agreement when you’re suddenly coupled up and living together:

Who pays what?

Will you split each bill evenly? What about one-off costs? Will you pool your money together? One common dispute is when one partner earns more – do you pay for things 50/50, or proportionally, based on your earning? Have the conversations!

How can you save money?

If you both have similar subscriptions – such as Netflix, Amazon Prime, or Spotify –it is worth combining them to save money. You could each save a lot each month –a great opportunity to save for joint goals…weekends away, longer holidays or just a slightly fancier date night. Sharing costs gives you more cash to squirrel away!

Who pays for the children?

The new extended families we see today can get very complicated. If one partner has children – but the other doesn’t – differences in spending priorities can cause a clash.

Or, where both have children from a previous relationship, handling expenses between new and former partners can get muddled. Make sure you have a clear plan for treating all children involved.

What protection is in place?

You need a written agreement about how you’re going to share money. That doesn’t sound romantic at all, we know – but it’s essential for protecting you (and your children) if things don’t turn out well later down the line.

For example, if you’re renting a place, make sure you’re not liable for the entire rent but, instead, just your half. Do this by asking your landlord for separate tenancies – not a joint tenancy.

What’s their debt history?

If your partner has a bad credit score or owes a lot of money, don’t formally link yourselves financially. It’s entirely possible to have a happy relationship without joint accounts – and HyperJar can help! – so it’s important you know your partner’s financial situation.

A lot of these issues, and how to approach them, depend on your money personality. Two different money personalities could have a tougher time to wrangle together a new financial approach as a couple.

That’s why it’s important to consider writing everything down to make sure you both stick to the agreement.

8. Preparing for your Octopus Family expenditure

First up: what is an Octopus Family?! Well, these days the nonnuclear family is very common. It’s not so much 2.4 children as 3 children and step-children, exes, ex-in-laws, grandparents, and other extended family! In our survey with HyperJar, we discovered the average Octopus Family now has 10 members. But 9% of us – that’s around 5 million people – have 15 or more in our multi-tentacled network .

So now you’re suddenly coupled up, you need to budget for some new expenses.

Even if your new partner doesn’t have children, you’re ‘inheriting’ their social network. That means you’re going to factor in:

• Family birthdays for in-laws, grandparents, even cousins and nieces and nephews

• Special occasions like Christmas, Easter, Eid, or other festivals

• Big events such as weddings of friends and family, hen or stag parties, and christenings

• Holidays with family or friends (if your new network are the type to do group trips)

And that’s not including the new birthday, Christmas, Valentine’s, anniversary events with your new partner, either!

When you start to add up all the extra Christmas presents for the in-laws, children in the family, and events like birthdays, it quickly adds up.

Let’s also not forget that your newly extended network means you might also have extended-extended networks when children are involved. Your partner’s ex, for example: if you’re on good terms, that adds additional potential expense for gifts, day trips together, or even holidays (if you’re on REALLY good terms!).

In our survey with HyperJar, we discovered the average ‘Octopus family’ now has 10 members because of their Octopus family. The good news is that you can easily share the burden of these costs with your partner – it’s their family, too.

You don’t need to get a joint account to share expenses like this, either. HyperJar lets you share jars for joint expenses without formally financially linking sharers –and up to one hundred people can contribute to a jar! That’s means your group trips or Granny’s 80th surprise party no longer mean one person fronting the cost. You all chip in and the cost is evenly spread.

How to navigate extra family expenses

First, establish a baseline with your partner. What do THEY usually do with their extended family? Are they a gift-card-at-Christmas type of person? Or do they do presents for all sorts of occasions?

Knowing how your partner deals with their extended family expenses will help you work out where you need to budget – and where you don’t need to worry. It’s also a great way to get to know your new partner in more depth. Understanding their familial relationships and how they approach special occasions is a good way to discover more about them.

Some people, for example, hate celebrating birthdays and refuse to give (or receive) lots of gifts. Others might be the opposite – and have an entire ‘birthday week’ of events and celebrations. The financial implications are very different for these two approaches.

When you’ve learned your partner’s approach, talk to them about which members of your new Octopus Family are most important to them. Do they adore their niece or nephew – but not really celebrate events with their siblings?

Doing this helps you whittle down which events and occasions you need to budget for –and the ones you can let go.

Save together for Octopus Family events

Of course, you shouldn’t be expected to bear the brunt of these new costs. You might be the one with the existing extended family, too – so keep that in mind if your partner comes from a small family!

Sharing the cost is the best way to avoid arguments. You can also:

• Set a budget for annual events like Christmas

• Agree to spend up to a certain limit on individual birthday gifts

• Split the cost on larger gifts or evens with other family members

• Find ways to save money elsewhere – such as one less takeaway each month

– so you’re not feeling hugely out of pocket

• Set up a HyperJar account!

9. Why you must make a will (and update it)

A worrying number of UK adults don’t have a will – 59% to be precise (according to Canada Life research in September 2020). When you start dating someone new, a will is unlikely to be the thing you think about.

However, someone new in your life is a new person to consider when it comes to inheritance. This is particularly important if you have children from a previous relationship, too.

A will is very important if you’re living with your new partner. Contrary to popular belief, ‘common law marriage’ doesn’t exist. That means you could live together for twenty years – but if one of you dies, the other one has no claim on your estate. When property and children are involved, you can see how that makes it even more complicated!

Making a will isn’t difficult – but it’s worth it to make sure the right people inherit from your estate. It offers your new partner protections (if you want to include them) but it also offers your family and children protection, too. For example, you might want your money held in trust for your children should you die – and if your partner isn’t responsible with money, you can assign a different person to manage that trust to make sure your children get what you wanted to leave them.

HyperJar is a simple, digital account that helps you spend life better!

You get a free debit card account, organised around managing money in virtual jars. It’s like a to-do list for everyday spending money, with three unique features.

1. Divide your money between Jars for things like food, clothes, holidays - remember them? - and nights out, then pay from each Jar directly by linking it to the account’s prepaid Mastercard. It’s the ultimate money organisation tool.

2. Share any of your Jars instantly with others. For romantic nights a deux, decidedly less romantic bill splitting for flatmates, or for couples who are definitely ‘together’ but not yet ready for a joint bank account. Or, just a group of friends saving up for a holiday together. You can even leave notes, reminders or inspiration for each other inside the Jars – like a WhatsApp group, but for money.

3. HyperJar customers who are happy to commit money ahead of spending with our partners on the app get an Annual Growth Rate on every penny, as well as ad hoc awards and rate boosts. It’s a way to save now, buy later, and a guaranteed way to grow spending power with brands like Shell, Virgin Wines, Boden and Dyson.

Head to our website for the full list of partners featured on the app. We’re starting to add small, independent businesses too – so you can commit and grow your spending power with local companies close to your heart.

Download HyperJar from your favourite app store here