Sort Your Pension Plans Now for a Better Retirement Retiring Early Your Guide to

1. Introduction

Welcome to our latest Pension Guide eBook! With the help of pension specialists, PensionBee, we’re going to help you navigate the confusing world of retirement financial planning.

From understanding the what, why, and how of pensions right through to planning your retirement income, we’ve got you covered.

So, grab a cuppa (and a biscuit – go on), sit back, and let us give you the confidence to plan a comfortable retirement.

ABOUT PENSIONBEE

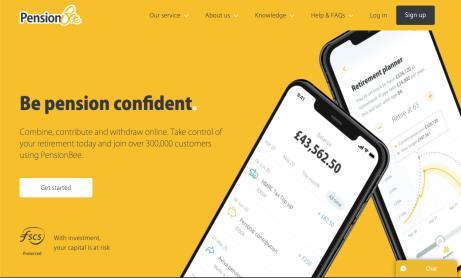

PensionBee is the UK’s leading online pension provider, enabling customers to interact with their savings through its unique combination of smart technology and dedicated customer service.

Since it was founded in 2014 by Romi Savova, PensionBee has been a challenger in an industry ripe for disruption. It has grown rapidly by helping consumers to solve the challenges they face when it comes to locating, combining and managing their pension savings.

PensionBee uses its proprietary technology and Open APIs to allow customers to manage their pension, view their live balance, make contributions and withdrawals online and with the help of a smart calculator to plan their saving. It now counts over 100,000 active customers aged 18-80, and over £1 billion in assets under administration.

2. Why You Need a Personal Pension

We’ve all heard about the State Pension – and you may think that your National Insurance each month goes towards a huge retirement pot… but it doesn’t!

Your National Insurance contributions ARE vital to make sure you’re eligible for the State Pension. However, what you pay in doesn’t always reflect what you’ll get back – it’s not like your contributions go into a separate retirement pot just for you. National Insurance pays for all sorts of things, of which the State Pension is just one part.

There’s a cap to the State Pension, too. So, no matter how much you pay in National Insurance, there’s only so much you’ll get back in retirement. To get the full entitlement, you need 35 years’ full National Insurance contributions. At the moment, the full State Pension is £175.20 a week (£9110.40 a year). The amount does adjust with inflation, however it’s easy to see that’s not enough to live on.

The State Pension age is ever-rising, too. At the moment, if you’re not already claiming it, you’ll need to wait until you’re 66, though this is set to rise to 67 and then 68. You can claim a personal pension much earlier, at the age of 55 right now (which goes up to the age of 57 in 2028).

So, a personal pension can help tide you over for a full decade before the State Pension kicks in!

Workplace vs Personal Pension

Private pensions are any that aren’t the State Pension. You can have a workplace pension or a personal pension, or a combination!

Workplace pensions are run by your employer. You give up some of your pretax salary (a legal minimum of 5% of your salary at time of writing) and your employer also puts in an extra amount (a minimum of 3%). The Government also gives you tax relief. So, let’s say you pay £40, your employer must put in £30, and you get £10 tax relief. That means for your £40 sacrificed from your salary that month, you’ve saved £80 into your pension!

These are fantastic schemes, and since auto-enrolment is now mandatory for employers, it’s really easy to join the pension scheme. You can opt-out, but we always encourage you not to if you can avoid it – because it’s such an efficient way to save for retirement. You’re getting free money into your pension!

Personal pensions are those you choose to set up – or old workplace ones you choose to keep going. Your employer doesn’t contribute to them (although an old employer may have done so in the past). People often have more personal pension funds than they realise.

Changing jobs often means changing pension plans – and your old pension won’t automatically transfer into your new one.

You might also choose to set up your own pension fund, such as a SIPP, especially if you’re self-employed.

3. Don’t Let Your Pension Scare You!

Pensions are boring. (Unless you’re money nerds like us). But, they’re really, REALLY important to sort out as early as possible.

Retirement can seem ages away, especially when you’re in your 20s, 30s, even 40s. However, early planning and pension saving helps you build a bigger retirement pot with the same amount of investment (thanks to compound interest).

We’ve written about this a lot – including that pensions can be set up as soon as you’re born. Pensions for babies are tax-efficient inheritance planning vehicles for parents, and help you boost your child’s all-important retirement fund, too.

Start small

• Check your current workplace pension scheme. Think about increasing your contributions by one or two percent if you can.

• Search for old workplace pensions that you’ve forgotten about.

• Research personal pension plans to find one with low fees and that invests in funds you’re happy to put your money into.

• Look at ways of making extra money on the side to pay into your personal pension plan.

• Talk to an independent pension advisor about your retirement plans (especially if you’re planning to retire in the next ten years).

• Consider consolidating your pensions for easier management and to make sure fund fees aren’t eating your profit (more on that later!).

• Review your pension annual statements to make sure your money is working hard for your future (see Chapter 5 for more info).

Get Professional Advice

Don’t leave it late to sort your pension, though!

Those under 50 can seek advice from pension specialists – always make sure they’re registered with the Financial Conduct Authority first, to avoid getting drawn into a scam or poor advice.

Don’t let your pension planning overwhelm you! Take small, easy steps to plan your retirement and you’ll see that, actually, it’s not as scary as it might seem at first.

Remember, too, that it’s always worth speaking to a specialist pensions advisor if you need guidance. If you’re age 50 or over, you can speak to Pension Wise for guidance as a starting point.

4. Get Your Retirement Savings Sorted

Do you know how much is already in your pension fund? Perhaps you’ve got old savings accounts or Premium Bonds you’ve forgotten about, too!

Let’s walk through the steps you need to take to get your retirement savings sorted…

STEP 1: Find ALL of your pensions and savings accounts

There’s an estimated £19 BILLION in forgotten pensions just sitting there each year. It’s easy to forget to update your details with a provider when you move home or change jobs. Use the Pension Tracing Service to track down your old pensions, and get in touch with the providers to update your details and get a pension statement.

The same goes for lost savings accounts, too. If your circumstances have changed (such as divorce), or simply lots of time has passed, it’s not unusual to have forgotten savings accounts languishing somewhere, too. My Lost Account is a free service to track down old bank accounts.

STEP 2: Add up your assets

Retirement savings aren’t just about what’s in your pension pot and bank accounts. Do you own property? Have a valuable collection or precious antiques? Perhaps you’ve got some investments in stocks and shares.

All of these things contribute to your potential retirement savings. Spreading your investments and retirement income plans across several platforms is the best way to secure a reliable income when you stop working. Property, for example, can bring you rental income if you have a second home, while investing in stocks means time for compound returns on dividends.

STEP 3: Shop around for the best rates

Savings accounts, Cash ISAs, and mortgages all have one thing in common: the value varies between providers all the time. So, instead of putting your money into these things and forgetting about it, it’s important to shop around each year to always get the best value.

Your home mortgage, for example, could be coming up to the end of the fixed term. If that’s the case, now’s a really good time to remortgage – that means moving provider for a better deal. Interest rates are at an historic low, so moving provider could shave thousands of pounds off the total you owe over the lifetime of your mortgage. This means there’s extra capital to put elsewhere – such as into your pension or other assets –for a more comfortable retirement. Take a look here for a cheaper mortgage that could literally save you thousands over time.

Consider fixed term bank accounts for savings

Cash ISAs are the best long-term savings goal if you want a tax-free lump sum to go with your pension. The rates are shockingly low right now – but if you fix your savings for two, three, or five years, the interest is better.

Retirement planning involves long-term saving – so you’re likely to be better off with a stocks and shares ISA or two. We explain it in more detail in this article.

Remember also to have an easy access savings account for your day-to-day emergency fund – your short-term savings needed for the immediate future, too.

Lifetime ISAs

We like to mention Lifetime ISAs here. They’re not suitable for everyone, but they’re a good tool to get a tax-free 25% boost on your retirement savings. Anyone aged 18-39 can open one, and you’ll pay up to £4,000 a year into it until you’re 50. Then, you can’t take the funds out until your 60th birthday – so it has ten years of lovely compound interest before you access it.

LISAs come with a 25% Government bonus. So, if you save your full £4,000 each year, that’s an extra £1,000 tax-free bonus. Every year! You can choose a cash or stocks and shares LISA, too, depending on your risk level.

The only time you can access the funds before you turn 60 is to use the savings in your LISA to pay towards the house deposit of your first property. Otherwise, accessing funds early comes with a hefty 5% penalty (and no Government bonus).

Why diversify your retirement investments?

A personal pension should be your starting point for any retirement planning. However, like any investment, there’s no guarantee how much will be in your pot when it’s time to access it. Pension funds are invested in the stock market – which goes up and down all the time – so it’s a good idea to have a range of investments elsewhere.

You can also use other assets to start an earlier retirement or have a more comfortable later life. Pensions are taxed after the first 25%, while other investments are tax-free (such as savings in an ISA).

Physical assets, such as gold, collectible items, and antiques, can be sold for lump sum cash injections, too. This is particularly useful if, as now, the stock market is a bit wobbly and you need extra income. Assets hold value unlike digital currency, so holding some will help you secure your financial situation whatever the economy is doing.

Divorce and Pensions

If you’re currently undergoing a divorce, it’s vital that you check your pension entitlements. Many spouses don’t realise they could be eligible for some of their partner’s pension pot as part of their financial settlement. This is particularly important if, for example, you took time out of work to be the primary caregiver to children while the other spouse continued to work full-time.

There are several ways of doing this, so speak to your solicitor to make sure you’re going the best route for your personal situation.

5. Understand Your

Pension Statements

Your pension statement tells you how much is currently in your pension pot, your fund and management fees, and gives a projection of what your fund could be worth in the future.

Our PensionBee experts explain how to use your pension statements to make sure your retirement fund is performing as best as can be.

Reimagining the pension statement

Each year, millions of pension savers receive chunky envelopes containing their annual pension statement through the post. Unfortunately, these statements are often lengthy, full of jargon and complex to understand. According to the Financial Conduct Authority’s 2017 Financial Lives Survey, only 52% of defined contribution pension savers read their statement, and only 23% say they understand it ‘very well’.

In response, the government announced the Simpler Annual Statement in 2018. This more streamlined format aimed to help savers better understand their pension, provide clarity around fees and allow people to start to compare their different pots. However, since its launch, only a couple of pension providers have adopted a simpler statement, with PensionBee, the UK’s leading online pension provider, being the first.

Earlier this year, PensionBee took things a step further. As well as providing its customers with a digital annual statement they could access online anytime, they shortened their statement to three pages. They also displayed their management fee in pounds and pence instead of a percentage (the only provider to do so), empowering savers to compare fees across all their pots.

PensionBee has proved that annual statements don’t have to be complicated.

We can only hope that other providers follow their lead!

6. Consolidate Your Pensions

Consolidating your pensions means putting them all together in one fund. It’s easier to do than you might think - and could save you considerable money (meaning a bigger retirement pot!).

Romi Savova, Chief Executive of PensionBee, the UK’s leading online pension provider, explains the benefits of combining your pensions, and the scenarios where it might be best to leave your savings where they are.

Do you have more than one pension?

These days, it’s a legal requirement for companies to auto-enrol new employees into a workplace pension. And with the average person working for 11 different companies during their career, according to estimates from the DWP, there’s a good chance you or someone you know could have up to a dozen different pensions by the time they retire!

It might sound like a good idea to have lots of pensions. After all, it shows you’ve been saving your hard-earned money for retirement throughout your career. But the reality is that having lots of smaller pensions can create a range of problems.

Is having more than one pension a bad thing?

If you’ve got more than one pension, ask yourself the following questions:

• How much are my pensions currently worth?

• Am I on track to reach my retirement savings goal?

• How much did my pension providers charge me in fees last year?

If the answer to any of those questions is “I don’t know” then you’ve just experienced the first problem of having lots of pensionsthey’re difficult to keep on top of.

What’s worse is that many people end up losing track of their old pensions altogether. It’s not surprising - remembering whether you even received a pension from a company you worked for 40 years ago is hard enough, let alone recalling who the provider was or how much you paid into it.

As a result, it’s estimated that there are more than 1.6 million ‘lost’ pension pots worth over £19 billion - that’s almost £12,000 per pension!

Not having a firm grip on all your pensions can be costly. That’s because each pension provider charges a different management fee for each of their plans. These fees might not be competitive - particularly if you’ve left your pension with the same provider for many years. And many of them charge extra fees on top of that. These might include:

• Fund fees (used to pay for the management of each fund in your portfolio)

• Platform fees (if you use an online platform to manage your investments)

• Inactivity fees (charged if you stop making contributions to your pension)

The result is that you might be paying over the odds without realising it. But even worse than this upfront cost, high fees can significantly erode your pension returns over time. In fact, a Which? study showed that reducing your annual pension fees from 2% to 1% could boost your pension by over 20% at the point of retirement.

Finally, the time will come when you want to access your retirement savings. And that can be tricky when you have lots of them. First, you’ll need to decide what to do with them:

• Take out a 25% tax-free lump sum

• Drawdown some of the money and leave the rest invested

• Use the money to buy an annuity

Each option has its own tax implications. Some of your pension withdrawals are taxfree and some aren’t. In addition, the taxable amount you take out is factored into your annual taxable income and this could put you in a higher income tax bracket.

So you see, having lots of pensions can be complicated, time consuming, and costly. But fear not! You don’t have to be stuck with them...

How can consolidating your pensions help?

Pension consolidation is the process of moving your old pensions into a new one. It’s simple and some providers, like PensionBee, allow you to do it online. There are plenty of benefits:

• You’ll know exactly how much you’ve saved

• You’ll see what you need to do to reach your long-term savings goal

• It’ll be much easier to know how much you’re paying in fees

Of course, the obvious benefit is that having all your retirement savings in one place will make keeping track of your pension far easier. And should you want to make any changes, there’s just one point of contact.

Deciding what to do with your savings once you reach retirement will also be much easier. No matter whether you buy an annuity to guarantee an income for the rest of your life, or you simply want to draw down a small amount each month while leaving the rest to grow, you’ll only have to make one instruction. Understanding your tax liabilities will be much simpler, too.

Is pension consolidation suitable for everyone? There are some important checks to make before committing to consolidating your pensions. You’ll want to find out whether any of your existing pensions have:

• Exit fees (charged on moving your money away from the provider)

• Special benefits (such as a guaranteed annuity rate)

• A requirement to take advice (generally applies to defined benefit or similar pensions worth over £30,000)

These days, pension providers won’t usually charge an exit fee. But a few still do, and there’s a much higher chance you’ll need to pay an exit fee if you took out an older-style pension before 2001. Fortunately, some exit fees for over-55s are capped at 1% of the value of your pension pot, thanks to new Government legislation.

If you’re lucky enough to have a defined benefit pension (also known as a 'final salary' pension) worth more than £30,000, then you must seek independent advice from a Financial Conduct Authority authorised advisor before transferring it.

This legal requirement was introduced to make sure savers are fully aware of any benefits they’d be giving up, as it’s usually better to leave these pensions alone.

How to consolidate your pensions

Consolidating your pensions shouldn’t be too complicated, but it does first require tracking down your old pensions and gathering information such as your pension provider name and policy number. If you can’t find these details, try contacting your old employer or using the government’s pension tracing tool at: findpensioncontacts.service.gov.uk

Once you’ve made the relevant checks and have decided to consolidate your old pensions into a new one, you’ll first need to contact your existing provider(s) and ask for a ‘cash equivalent transfer value’.

This is the final amount they’ll transfer to a new pension after any fees have been deducted. You’ll have three options:

• Open a new pension and individually transfer your old pensions

• Hire a pension advisor to manage the process for you

• Use a pension consolidation service to manage the process for you

If you take the DIY approach, you’ll need to search around for a suitable pension plan and open an account. Then you can ask your new provider to transfer your old pensions to it. Fortunately, many providers manage transfers digitally which means the process shouldn’t take longer than 12 weeks (unfortunately, a minority still rely on sending signed documents back and forth which can significantly delay things).

The downside of the DIY approach is that you’ll be very involved in the process and will have to deal with any challenges that come up. So, you might consider hiring an independent pension advisor to do it for you. But of course, this doesn’t come free of charge.

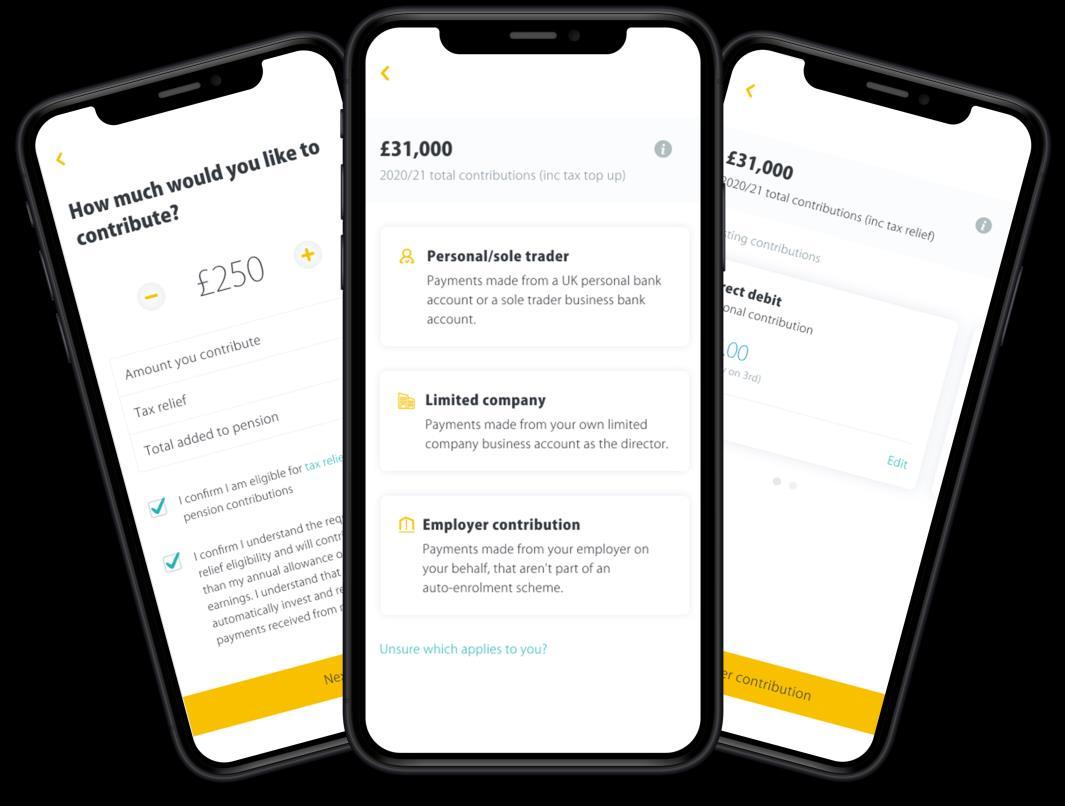

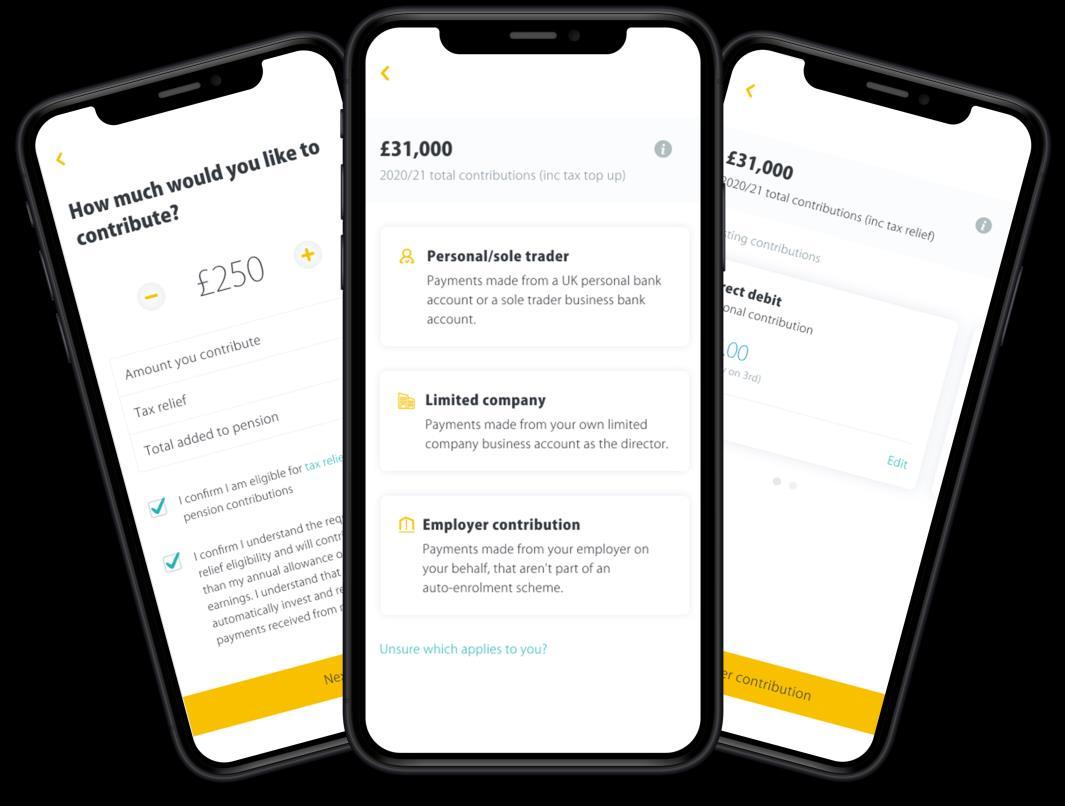

Finally, you could use a service like PensionBee which specialises in pension consolidation. PensionBee offers a range of good-value plans from the world’s largest money managers (including BlackRock, HSBC, Legal & General, and State Street Global Advisors) and it will handle the whole transfer process for you free of charge. Plus, with PensionBee you can manage your pension entirely online, accessing your balance and adding contributions through the secure app.

PensionBee is a pension provider that helps you combine, contribute and withdraw from your pension online.

Visit http://www.pensionbee.com/for more details.

Capital at risk, as with any investment. Speak to an independent advisor before making a decision.

Capital at risk, as with any investment. Speak to an independent advisor before making a decision.

7. Your Checklist for Approaching Retirement

So, you know you need to be on top of your pension and other retirement investments, but how to do it methodically?

Well here’s a checklist of what you should do to prepare for retirement as you move towards it…

STEP 1: Give yourself a financial health check

This is a good thing to do whatever age you are, but it gets more important as you move into your 40s, 50s and 60s. A good first starting point is to get your pensions and investments together to see how much in total you have saved up over that period. A lot of people find that there is a bit of a gap between how much they’ve saved and how much they will need to afford the lifestyle they want going forward. This means it’s time to work at building up your investments and making sure you have maximised what you can do in terms of your pension.

STEP 2: Check that you’re on course to get the full State Pension

Your State Pension comes from National Insurance contributions (as long as you’ve contributed to National Insurance for at least 35 years). You can check your contributions here: https://www.gov.uk/check-nationalinsurance-record.

Currently the maximum that you can get from the State pension is £175.20 per week. This will be on top of any personal pension that you save for either independently or through work. You can confirm your State Pension age at the Government’s website https://www.gov.uk/state-pension-age

STEP 3: Check that your contact information is up to date

Have you moved or changed your name recently? What about your email address and phone number? Speak to your pension provider and find out how they plan to communicate changes with you, to avoid a repeat of the scandal caused by bad Government handling of the WASPI women’s State Pension changes a few years ago.

STEP 4: See how much you are currently contributing to your company pension

You may notice money coming out of your salary every month for your pension, but do you know what percentage of your wages that represents? If it’s low, like 5% or 7%, could you afford to sacrifice more for your future? This is particularly important if your employer matches your pension contributions over the legal 3% minimum. Speak to HR about it.

STEP 5: Can you put more into ISAs?

These act as an addition to your pension. Aim for stocks and shares ISAs rather than Cash ISAs as they tend to better over the long-term. Take a look at our article about equities ISAs and how to invest in them.

STEP 6: Consider using bonuses or commission as a pension booster

When you get a bonus or commission payment, ask your employer to use it to make a one-off pension boost through their payroll system. This helps you contribute to your pension more without noticing the difference!

STEP 7: Complete your “Expression of wish’ in your pension details

This tells your pension company who you’d like your savings to go to if you die before you retire. At the same time, update your will. The more clear and legal ways you make your wishes known, the easier it will be for your inheritors to get the money and the less they will have to pay lawyers.

STEP 8: Be scam aware

It’s illegal for companies to cold call you about your pension savings. Be aware of anyone calling you claiming to be from a pension provider. If you’re offered a free pension review or an investment opportunity over the phone and out of the blue – hang up the phone and tell ActionFraud about it.

Many pension specialists will offer free pension reviews. However, they will ONLY do this if you contact them first to ask for that service. If anyone contacts you by phone, letter, or email about your pension – without you requesting them to – don’t reply!

STEP 9: Get genuine free help

Pension Wise is a government service that gives information about the different ways that you can take money from your pension savings. If you’re over 50 and want to understand your options visit their website Pensionwise.gov.uk.

STEP 10: Trace old pensions

Changing jobs every few years is becoming the norm – so how do you keep track of all your pension pots? Hunt out any paperwork you have from former employers and get in touch with their pension providers to see how much you have. If you’re not sure, use the free Pensions Tracing Service at Gov.uk You could also use a financial advisor to do this for you. It will cost but it’s better to pay someone to do it than not to do it at all!

STEP 11: Consider consolidating your pensions

If you are someone with lots of pensions with different providers, consider transferring them all into your current provider. This is particularly important for women who are more likely to have had a number of different jobs – many part-time –than men.

Moving pensions can be complicated so it’s best to pay a financial advisor to do this for you. Find a recommended advisor near you through VouchedFor. In fact, you can get a totally free financial assessment through them!

STEP 12: Check your State Pension application date

If you are in your mid-60s and planning on retiring soon, be aware that you don’t automatically get your State Pension. You need to apply for it. Find out how at the Government’s website:

https://www.gov.uk/get-state-pension.

When you withdraw your pension

The fact that we’re allowed to withdraw some or all of our personal/company pensions at age 55 (or 57 as it will be in 2028) doesn’t mean that we have to. In fact, it can be useful to keep the money in there for a few more years to give it time to grow further.

We’re living for longer and need more money than before to pay for our big retirements, so putting it off for a bit and letting our investments grow for a few more years will really help later on.

Also, get some advice before you actually take any money out of your pot. A lot of people think that 25% is how much you should withdraw when you can access your pension because 25% is tax free. But pulling out 25% depletes their savings in one go.

It’s better to take out only as much money as you need when you need to spend it. The less you withdraw, the less you pay in tax each year. Just draw down small amounts so that you keep your income within the lower earnings brackets and pay less tax overall.

It's the same with the State Pension. You don’t have to take it at 66 (or 67, 68 or whatever age it is moved to by the time you get to that stage). You can defer it and you might get more money for doing so (depending on your circumstances). See more about how to do that at https://www.gov.uk/deferring-state-pension.

8. Avoiding Pension Scams

The worst thing that can happen is that you’ve saved all your adult life for a comfortable retirement… then your funds disappear. Pension scams are rife – especially as fraudsters become increasingly digitally savvy.

Since 2015, you’re allowed to move your pension funds around as you wish. You also no longer have to take an annuity at retirement with your current provider – instead, you can choose from different providers and a range of drawdown options. However, these freedoms have opened the door to pension scams.

In fact, you might think you could spot a pension scam a mile off. However, it’s surprisingly easy to be taken in!

COMMON SCAM 1: Release Your Pension Early

With the exception of a tiny minority of people who may have something called a ‘protected early pension age’, you can’t take your money from your pension until you’re at least 55 years old without a hefty tax penalty. Protected early pension ages are really rare – and your provider will be able to tell you if you’ve got one of those policies.

For most people, schemes that offer to take money from your pension early are pure scams. They’re often called a ‘savings advance’ or ‘pensions loophole’. You’re offered money in return for transferring your pension fund to the scammer’s fake fund. These accounts are often overseas too, making it very difficult to get your money back.

Not only will these people charge a fee around 20% - 30% to release your money, but HMRC will tax over half the amount you release, too! So, you’re not getting your money, you’re reducing your final pension pot, AND you’re slapped with a massive tax bill.

COMMON SCAM 2: Reviewing Your Pension For Free

This is one that catches a lot of people out. That’s because you can get free pension reviews as a legitimate way to make sure your retirement pot is in the best place.

However, some scams will contact you out of the blue to ask for your detailed financial information. Others will seem legitimate – but then ask you to transfer your fund ‘for review’.

Many use the names of companies that would NEVER contact you out of the blue – such as Pension Wise (the Government service) or Money Advice Service.

You’re entitled to shop around pension providers both while you’re paying into it and then when you’re deciding your retirement options. However, anyone contacting you without your permission, asking for your financial details or to transfer your pension ‘for review’, should be avoided and reported.

How to spot a potential pension scam

Digitally savvy fraudsters now use social media, email, and fake websites to make their ‘services’ seem legitimate. It’s easier than ever to be drawn into a pension scam, so watch out for these red flags:

• Asking for your financial details out of the blue

• Requesting you transfer your pension fund for either an advance or review

• Promises of releasing your pension before the age of 55

• Anyone offering a ‘loan’, ‘cashback’ or ‘advance’ on your pension

• Pushy advisors forcing you to make a fast decision

• Anyone saying you can ‘sell’ your pension

• Being contacted by a pension company without you first requesting that they do so (even if they seem to be backed by Government, like Pension Wise)

Visit

scam-man.com to play a quick game by PensionBee that teaches you about pension scams!

How to check if a pension provider or advisor is legitimate

Before approaching any potential pension provider or independent advisor, make sure they’re legitimate, too. It’s so easy to create a professional-looking website these days that it’s essential to check they’re a real provider first!

• Check the FCA register for their details – if they’re not registered, walk away (fast!)

• Check the company director names on Companies House

• Visit the FCA ScamSmart Warning List to find out if they’re on it

• Make sure the URL of the website is the same as the one on the Google search listing (scammers can use legitimate-looking URLs that then redirect to their website instead)

• Look at third party review sites like TrustPilot to check reviews first

• Ask friends and family for recommendations or if they’ve heard of the provider

• Check for wording like ‘pension loophole’, ‘early release’, or ‘savings advance’ on their website – these are scams!

What to do if you’ve been targeted by a pension scammer

If you’ve been contacted by a potential scammer, report them. Get in touch with Action Fraud:

• Call 0300 123 2040

• Use their online reporting form

If you think it’s too late and you’ve already been scammed:

• Contact your pension provider as they may be able to stop a transfer that hasn’t gone through yet

• Get in touch with the Pensions Advisory Service for extra help

• Report to Action Fraud

• Report the details to the FCA to prevent other people getting scammed, too

• Talk to your local police station about reporting the fraud as a crime if you can prove it is fraudulent

It’s also well worth remembering that, if you’ve been the subject of a scam, fraudsters are more likely to contact you again in the future.

Try

to change your information

such as email addresses and passwords

to protect your online identity. Be aware of anyone contacting you who offers to get your money back or ‘buy back the investment’ for a fee – that’s fraud!

9. How to Manage Your Money Flow in Retirement

When you finally approach retirement, there are lots of different options you can take to get an income from your pension.

Annuity

This is where you buy a policy that guarantees a set income. Most people opt for lifetime annuities, but you can also go for a set term such as five years. After that time, you can choose to buy another annuity with the remainder of your pension fund, or take a different option like drawdown.

Annuities used to be the only option you could take. They’re still suitable for some people as they give you a set income every month. You can shop around for rates to make sure you’re getting a good deal.

Annuities have fallen out of favour as other options like flexible drawdown have come onto the scene. They also don’t always guarantee you a good rate – you could buy an annuity now, and miss out on better rates a few years or even months later. However, if you’re in ill health or have lifestyle choices like being a smoker, you can get a premium on your annuity that boosts your income.

Flexible drawdown

This is exactly how it sounds: you take the money as and when you need it. It means you can keep your pension fund invested, to maximise the opportunity for increased growth through ongoing investments.

You can claim 25% of your pension taxfree. That means you could get 25% taxfree on each regular income payment if you opt for a regular drawdown-only option. Your provider pays your drawdown through Pay As You Earn (PAYE) and you get a payslip just as you would when you worked.

Cash lump sums

Another option is to only take lump sums from your pension fund when you need them. Again, this is a good way to keep as much of your money invested as possible to allow for continued growth.

However, both cash lump sums and flexible drawdown leave you vulnerable if your investments dip. You could have less than planned in your pot for later retirement if this happens.

Combined annuity and drawdown

A recent combination that more people are considering is a combination of both an annuity and drawdown. The annuity gives you a guaranteed income, while the flexible drawdown means you can access more money when you need it.

It also helps to protect against both the changing rates of annuities (where you may miss better deals) and dips in the market lowering the value of your drawdown pot.

Combined lump sum and drawdown

Currently the most popular option, many choose to opt for an initial lump sum at the start and then a flexible drawdown when they need a cash boost.

The initial lump sum, if it’s 25% of your total pension fund, can be taken tax-free. Or, you can choose to be taxed on 75% of each withdrawal instead (meaning 25% of each payment is tax-free).

Other retirement income

Your pension isn’t the only form of retirement income you could receive. It’s important to line up alternatives to your pension in the decades before retirement.

Diversifying your retirement income helps guarantee a comfortable retirement where your money is less likely to run out. It also protects against things like changes in the stock market, which could mean you end up with less in your pension pot than you initially planned.

• State Pension

Remember, this isn’t enough to live on! However, the State Pension can help to top up your income once you reach State Pension age. At the moment, that’s age 66 – but in the future it could be 67, 68, or even older.

• ISA Savings

Individual Savings Accounts (ISAs) come in various formats. You can pay up to a certain amount into them each year –currently, that’s £20,000. Anything you take out of your ISA in retirement is taxfree, unlike your pension.

That means you can withdraw large lump sums without penalties if you want to do something like invest in a buy-to-let property as you reach retirement.

There’s also no age limit (except for Lifetime ISAs, which is a minimum age of 60). So, you can take out your money whenever you like!

You can have lots of different types of ISA, too. If you have more than one type, you have to choose each year which one you want to pay into. For example, if you have two cash ISAs, you can only contribute to one of them in that year.

ISA types include:

• Cash ISAs – lower interest rates but often easy access and ‘safe’ – you won’t lose any money

• Stocks and Shares ISAs – also called equities ISAs, your money is invested in the stock market so it’s more risk but could reap better rewards

• Innovative Finance ISAs – riskier than equities ISAs but offer a unique opportunity to gain returns of around 12%

• Lifetime ISAs – come with a 25% Government bonus, with a maximum pay in of £4,000 a year –but can’t be access until you’re 60

Having one of some or all types of ISA helps you spread the risk of your savings while giving your money an opportunity to develop great returns over time. Ideally, you should pay into your ISAs with a long-term view (i.e., don’t draw on them until retirement) to maximise compound interest returns.

Physical Assets

Some people choose to invest in physical assets as part of their retirement income plan. This gives them something to sell when the time is right for a cash boost. Some things, like property, could be subject to Capital Gains Tax if you sell for a big profit.

Gold coins, jewellery, and bullion – as well as diamonds – are a common physical asset investment. Even when the banks are a bit wobbly, you can always sell these because they hold an intrinsic value, unlike digital currencies.

Other people choose to invest in things like art, antiques, musical instruments, whiskey, wine, and even collectible toys like Lego. If you’ve got the space to store things like this, go for it!

Property

A common option for many is to opt for a buy-to-let property. If you choose the property carefully, checking that it’s likely to have short empty periods and will be popular with renters, it can be a steady income.

You may need to pay tax on rental income if it, combined with your pension income, takes you over the Personal Allowance threshold (currently £12,500 a year).

Part-time work

Some people prefer a phased retirement instead of going the whole hog to start with. You might want to work longer than age 55 or 60 anyway –in fact, most people opt to do this as it gives your pension more time to grow.

Part-time work is a great way to live a less stressful life without giving up the income you’re used to. Your current job might be ideal for moving to part-time hours – or, you could opt for a new job altogether. In fact, many over-50s choose to set up a new business for the first time, too!

Remember that, if you continue working but draw on your pension at the same time, you could be taxed on your income if it goes over the Personal Allowance threshold.

This is why it’s important to spend time doing the sums before you decide which steps you want to take for your retirement!

PensionBee’s top 5 drawdown tips

When the time comes to start withdrawing your pension it should be simple and stress-free. PensionBee, the UK’s leading online pension provider, has compiled five questions you should consider before accessing your pension.

● Accessing your pension early?

While 55 is the legal age at which you can draw down, remember your pension needs to last your full retirement. The earlier you retire, the more of your pension you’ll want to keep invested in order to benefit from potential future growth.

● Thinking about taking 25% tax-free?

Bear in mind you’ll need to pay income tax on all future drawdowns, unless your annual earnings (including your pension) are below the tax-free Personal Allowance of £12,500.

● How much do you really need?

The exact moment you access your pension can have a big impact on your ultimate retirement income. If you withdraw a significant amount of money during a downturn, for example, when your pension balance is lower, you might struggle to recoup your savings as quickly.

● Unsure whether to buy an annuity?

Annuities guarantee an income for life, but annuity rates are currently very low. Speaking with a financial advisor could help you weigh up your options effectively.

● Have more than one pension?

Managing multiple pensions can be tricky and result in an inefficient investment strategy and overpaying unnecessary fees. Consider using a specialist like PensionBee to combine your old pensions into one easy-tomanage plan for easy drawdown.

Remember: pensions are investments. That means capital is at risk. Always seek independent financial advice before making a decision.

10. Need Help Right Now?

As you can see, deciding what to do with your pension is really important to think about sooner rather than later. From consolidating your pensions to knowing how much income you need to last your retirement, it’s a big subject to think about.

The good news is there are lots of places where you can find extra information to help you make those all-important retirement planning decisions.

Gov.uk – the Government’s information site which has a whole section on pensions and retirement

Pensionwise.gov.uk – the free advisory service for people over 50 wondering about retirement

PensionsAdvisoryservice.org.uk – backed by the Government, it’s full of information about pensions for people of any age (not just over 50s)

Ageuk.org.uk – information and reports about pensions and retirement

Which.co.uk – A consumer-focused website with lots of pensions and retirement info

Moneyadviceservice.org.uk – Free and impartial advice about all things money, including retirement, inheritance tax, and pensions

Citizens Advice Bureau – Info about your rights for all sorts of things from pensions to accessing benefits when you’re older Of course, there’s also plenty of information about retirement planning, earning side incomes to boost your retirement pot, and all things finance over on MoneyMagpie.com

PensionBee are here to help with your pension consolidation plans too – check the next page for an exclusive offer!

Get a £100 pension contribution when you combine your pensions with PensionBee.

PensionBee is the UK’s leading online pension provider, allowing you to combine, contribute and withdraw from your pension at home or on the go.

• Get your own dedicated account manager who’ll support you with your pension transfers and answer any questions you might have.

• Choose from a range of pension plans from the world’s biggest money managers including BlackRock, HSBC, Legal & General, and State Street Global Advisors.

• Manage your pension online or from the secure and easy-to-use PensionBee app, including a real-time performance tracker and a powerful retirement savings planner.

To get your £100 pension contribution, sign up to PensionBee for free at pensionbee.com/moneymagpie

Or call us on 020 3457 8444 to talk through your options.

Capital at risk. PensionBee is authorised and regulated by the Financial Conduct Authority (744931)

Thank you. Sort Your Pension Plans Now for a Better Retirement