8 minute read

THE FUTURE OF MaaS

June 2020 // Issue 15 www.infrastructuremagazine.com.au 44

The FUTURE OF MaaS

Advertisement

by Yale Z Wong, Research Associate at the Institute of Transport and Logistics Studies (ITLS) at the University of Sydney Business School.

Before COVID-19 took centre stage, “Mobility as a Service” (MaaS) was very much the hottest topic in the transportation sector.

For a long time, this term was virtually unheard of beyond select circles of entrepreneurs in Scandinavia, but in 2017, it entered the Australian lexicon in earnest to become a catch-all of innovation. More and more companies purport to be involved with MaaS, regardless of actual activities undertaken (in our latest book, we identified more than 43 MaaS schemes launched to date in Europe, Asia and Australasia).

Governments and politicians associate themselves with trials; think tanks, consultancies and industry suppliers release white papers by the month; whilst academics and researchers jump on the bandwagon to offer thought leadership and to influence debate.

Amidst the hype and conjecture, what is required is clarity in the definition and rationale for MaaS, so that it does not become a “solution in search of a problem”. It is important to revisit some of the key topics of contention – around the design of MaaS products for consumers, as well as the service delivery models most likely to take hold. We also need to look at the future outlook for MaaS in a post-Coronavirus world.

RATIONALE FOR MAAS

MaaS is built on the ideal of the wholesale integration of transport services to cater for people’s every mobility need and, in doing so, provide an alternative to private vehicle ownership.

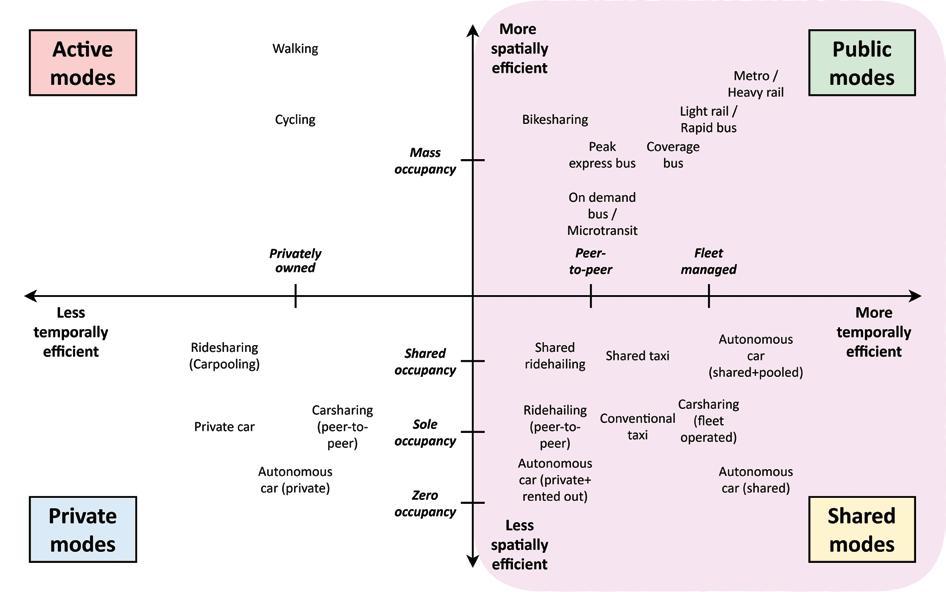

The modal efficiency framework offers a powerful illustration for how temporally efficient modes (meaning modes which are not privately-owned, but rather operate as part of a fleet) are integrated across a range of spatial efficiencies (representing passengers carried per unit area). These dimensions are depicted by the two axes in the diagram (Figure 1), whilst the shaded purple (two right quadrants) show how MaaS combines public transport with shared modes provided by transportation network companies (TNCs), like ride hailing, car sharing and bike sharing (plus a number of emerging modes linked to autonomous technologies).

Ideally, MaaS offers seamless integration and deploys the most appropriate mode for each geographic context. This may mean a more personalised, door-to-door service in a suburban setting which then connects to high capacity mass transit

Figure 2: Individually tailored mobility packages offered by MaaS Global’s Whim in Helsinki, Finland. MaaS plans are defined by price (monthly subscriptions or PAYG) and mobility entitlements for each mode.

trunk corridors into dense urban areas.

MaaS provides not only the integration between physical modes, but also across the mobility journey chain by digitally unifying trip creation, purchase and delivery via a one-stop travel management platform. In doing so, travellers face reduced physical, cognitive and affective (i.e. emotional) effort when preparing for and undertaking a journey.

Many commentators have also suggested that this provision and awareness of information can be used to drive travel behaviour change – linked to the idea of ‘nudging’ through price signals – towards more environmentally friendly and efficient modes of travel. The ability to do so has clear links with how MaaS products are designed for consumers.

SUBSCRIPTION OR PAY-AS-YOU-GO (PAYG) BUNDLES

A core element of the MaaS proposition concerns how different modes are bundled together for customers. The idea, drawn on telecommunications plans which bring together different services like calls, text and internet access, is to offer mobility packages which grant users a defined volume of access to each mode, each with a specified level of service (for example, pickups within five minutes).

The quantity of each mode might be defined in terms of hours or kilometres of service (see Figure 2 for examples from MaaS Global’s Whim product in Helsinki, Finland – one of the earliest commercial offerings available). MaaS packages may be sold as subscriptions (over weekly or monthly periods) or offered as a pay-as-you-go (PAYG) option, and may be tailored by age, occupation or location to suit different market segments. Bundling is a mechanism to repackage existing services together with new services to create more attractive ways for people to access mobility.

While a lot of research has been conducted around how to design MaaS products (or bundles) which are attractive to different customer segments, one of the key elements of contention remain as to whether to offer these as subscriptions or PAYG plans.

In our Sydney MaaS trial, we found that subscription plans were selected by 44 per cent of trial participants, whilst the remainder opted for PAYG, similar to other survey-based findings in the literature. The trial also found significant heterogeneity in participant preferences with the commitment to a subscription appearing to be a burden for some and a relief for others (known as the ‘flat rate’ effect). The preference for PAYG further calls into question what the value add of MaaS is for PAYG customers beyond the access to a better journey planner.

It calls into question whether people will be willing to pay for access to mobile applications that are already free (though usually supported by a premium model), and what the lack of appeal of subscription plans might mean to the MaaS service provider and government who may be looking to use MaaS to ‘nudge’ travel behaviour e.g. to encourage peak spreading and thereby reduce crowding and congestion.

GOVERNMENT OR PRIVATE SECTOR: WHO TAKES THE LEAD?

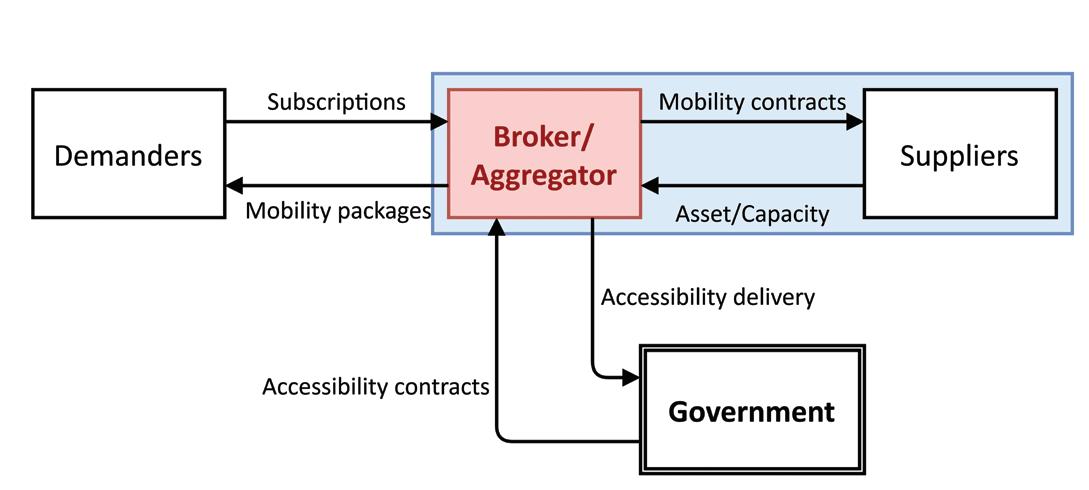

The discussion of societal objectives necessitates a consideration of government in a future MaaS ecosystem. A critical stakeholder in the MaaS ecosystem is the mobility broker/aggregator (Figure 3) who brings together suppliers of the transport asset/capacity (e.g. public transport operators, TNCs) with the demanders or end users who consume the transport service. The broker, as a third-party intermediary, value adds through the provision of a digital MaaS platform and bundled mobility products. However, should the government or the private sector take on this broker/ aggregator role?

While some researchers have advocated for a government agency or quasi-government entity (including a public transport authority) to assume this broker function, others have suggested that transport operators or technology providers might be better placed to undertake this role.

Figure 3: A likely service delivery ecosystem for MaaS, comprising the new function for a mobility broker aggregating different suppliers and delivering integrated service to demanders. The government will need to redefine its relationship with incumbent transport operators, affecting the design of contracts and the viability of existing business models.

A government broker is a particularly challenging proposition since it might not only lack the incentive to innovate, but also cause a potential conflict of interest, especially where both public and private operators exist as is the case in Australia. In Australia (and most other Western economies), governments are increasingly removing themselves from service provision, rather only involving themselves at arm’s length. They are better positioned to play a regulatory function to ensure a ‘level’ playing field (including setting common standards) for different MaaS operators to compete. Government might still provide seed funding or act as a catalyst for innovation, as is the case in NSW through its Future Transport agenda.

COVID-19 AND WHAT IT MEANS FOR THE FUTURE OF SERVICE PROVIDERS AND MaaS

The COVID-19 pandemic has demanded an urgent operational response from transport service providers. We have seen micromobility modes like Lime e-scooters being withdrawn (due to sanitation concerns), as well as the suspension of shared ride hailing services like UberPool. Whilst budgets are redeployed to run essential services, it is also important to consider the strategic and financial consequences for the transportation sector that the pandemic will bring.

Most urban public transport in Australia is operated by private companies under gross cost contracts to the government, meaning that operators are paid per kilometre of service delivered, rather than the number of passengers carried. For this reason, it is the commercially-operated TNCs providing shared modes that are facing increasing financial pressures.

These companies are subsidised by their shareholders, but how sustainable this may be amidst a global credit crunch and broader questions surrounding the future of work and the need to travel remains to be seen. It may be the case that TNCs will need to realign their business model with revenue streams shifting from the consumer to the government (Via is an example of the latter, built on public-private partnerships, which has performed well in the crisis so far).

While the financial viability of individual service providers is important, so too is that of MaaS brokers/aggregators, which as startup enterprises, face a different set of challenges. The onset of COVID-19 has seen MaaS Global’s customers shift their subscriptions to bundles with a greater focus on active modes, like bike sharing. If medical experts are correct and the pandemic lives on for many years, we may see MaaS providers partner with health authorities to offer up their products as geolocation tools to aid contact tracing efforts. This will require a more generic, scaled-up usage of MaaS products, including when one travels by private car. Concerns around data sharing and privacy considerations may arise but there are clearly overriding public interest (health) objectives in play.

More widespread adoption of MaaS will also serve as a network management tool to optimise demand and supply (and by extension, enable social distancing guidelines to be met). Many of these visions and capabilities are true to the original intent and aspirations for MaaS.