service takes off P.20 SUSTAINABLE INVESTING GCC investors go green

GOING BEYOND

DIEZ EXECUTIVE CHAIRMAN, DR MOHAMMED AL ZAROONI ON POWERING DUBAI'S NEXT FREE ZONE EVOLUTION

P.32 TECH SAVVY: UAE BANKING FEDERATION’S JAMAL SALEH ON THE RAPID GROWTH OF DIGITAL LENDING SOLUTIONS

14 - 18 OCT 2024

THE LARGEST TECH & AI SHOW IN THE WORLD

G lo ba l Col la boration to Forg e a Future

Connecting you to new business opportunities in the world’s most profitable digital ecosystems

200,000 +

6,500 + Countries 180 + Tech Executives

Ex hib it ors

Unlocking Dubai’s economic potential

Dr Mohammed Al Zarooni, executive chairman of DIEZ, explains how the authority is a crucial contributor to Dubai’s economic growth

Investment outlook: Q4 and beyond Equities, bonds and commodities, here’s what to expect this quarter from the region’s markets

Jamal Saleh,

director general of

the UAE Banks Federation

The rise of banking-as-a-service From low-cost accounts to microloans, BaaS platforms are helping bridge financial gaps

The world’s next IPO hotbed

Al Ramz Capital’s Amer Halawi on how GCC states are pulling out all the stops to attract investors

Forging ahead with tech innovation

Mashreq Bank’s Joel van Dusen says that increasingly banks are looking at fintechs as partners rather than competitors

Nedbank Private Wealth eyes UAE growth

With Dubai at the centre of its expansion plans, Nedbank Private Wealth is poised to meet the needs of UAE’s HNWIs

HEAD OFFICE: Media One Tower, Dubai Media City, PO Box 2331, Dubai, UAE, Tel: +971 4 427 3000, Fax: +971 4 428 2260, motivate@motivate.ae

DUBAI MEDIA CITY: SD 2-94, 2nd Floor, Building 2, Dubai, UAE, Tel: +971 4 390 3550, Fax: +971 4 390 4845

ABU DHABI: PO Box 43072, UAE, Tel: +971 2 677 2005, Fax: +971 2 677 0124, motivate-adh@motivate.ae

SAUDI ARABIA: Regus Offices No. 455 - 456, 4th Floor, Hamad Tower, King Fahad Road, Al Olaya, Riyadh, KSA, Tel: +966 11 834 3595 / +966 11 834 3596, motivate@motivate.ae

LONDON: Acre House, 11/15 William Road, London NW1 3ER, UK, motivateuk@motivate.ae

Cover: Freddie N. Colinares

Editor-in-chief

Obaid Humaid Al Tayer

Managing partner and group editor

Ian Fairservice

Chief commercial officer

Anthony Milne anthony@motivate.ae

Publisher Manish Chopra manish.chopra@motivate.ae

EDITORIAL

Group editor

Gareth van Zyl

Gareth.Vanzyl@motivate.ae

Editor Neesha Salian neesha@motivate.ae

Senior feature writer Kudakwashe Muzoriwa Kudakwashe.Muzoriwa@motivate.ae

Senior art director

Freddie N. Colinares freddie@motivate.ae

PRODUCTION

General manager – production S Sunil Kumar

Production manager Binu Purandaran

Production supervisor Venita Pinto

SALES & MARKETING

Senior sales manager Sangeetha J S Sangeetha.js@motivate.ae

Digital sales director

Mario Saaiby mario.saaiby@motivate.ae

Group marketing manager Joelle AlBeaino joelle.albeaino@motivate.ae

BEYOND THE

AI BOOM:

WHAT LIES AHEAD

ARTIFICIAL INTELLIGENCE FUELLED A REMARKABLE EQUITIES RALLY EARLIER THIS YEAR, BUT ITS MOMENTUM IS NOW SLOWING. AS TRADERS RETURN FROM THE SUMMER BREAK, ATTENTION IS SHIFTING TO WHAT WILL DRIVE THE MARKETS IN Q4 2024

Artificial intelligence was the primary driver behind the global equities rally earlier this year; however, its momentum is now showing signs of slowing. As market participants returned from the summer break, their attention shifted to the key question for Q4 2024: What will be the next force driving the markets? The focus has turned to potential shifts in monetary policy,

VIJAY VALECHA CHIEF INVESTMENT OFFICER CENTURY FINANCIAL

particularly in the US. This is especially relevant for the Gulf Cooperation Council (GCC) countries, where five out of six nations – excluding Kuwait – peg their monetary policies to the US, making them highly sensitive to interest rate changes.

Lower interest rates generally give emerging markets central banks more leeway to manoeuver domestic growth. Historically, from June 2019, when the US Federal Reserve (Fed) began its rate cut cycle, till February 2022, when the Fed started hiking interest rates, the DFM (Dubai Financial Market) General Index witnessed a gain of 9.4 per cent; during the same period, the Tadawul All Shares Index saw an increase of around 14 per cent. Furthermore, emerging market equities have delivered positive performance

THE END OF FED HIKING CYCLES TENDS TO BE POSITIVE FOR EMERGING MARKETS (EM)

SOURCE: FactSet, Federal Reserve, MSCI, J.P. Morgan Asset Management. The 2022-2023 cycle assumes that the last hike of the cycle was in July 2023. Past performance is not a reliable indicator of

24 months after the last Fed rate hike in four of the past five Fed rate cycles, boasting an average return of 29 per cent versus the developed market performance of 17 per cent.

RATE GAMES:

MONETARY SHIFTS IN FLUX

Rising inflation, owing to the economic stimulus provided during Covid-19 and the strong labour market, resulted in central banks across the globe increasing interest rates; however, currently given that disinflationary pressures can be witnessed.

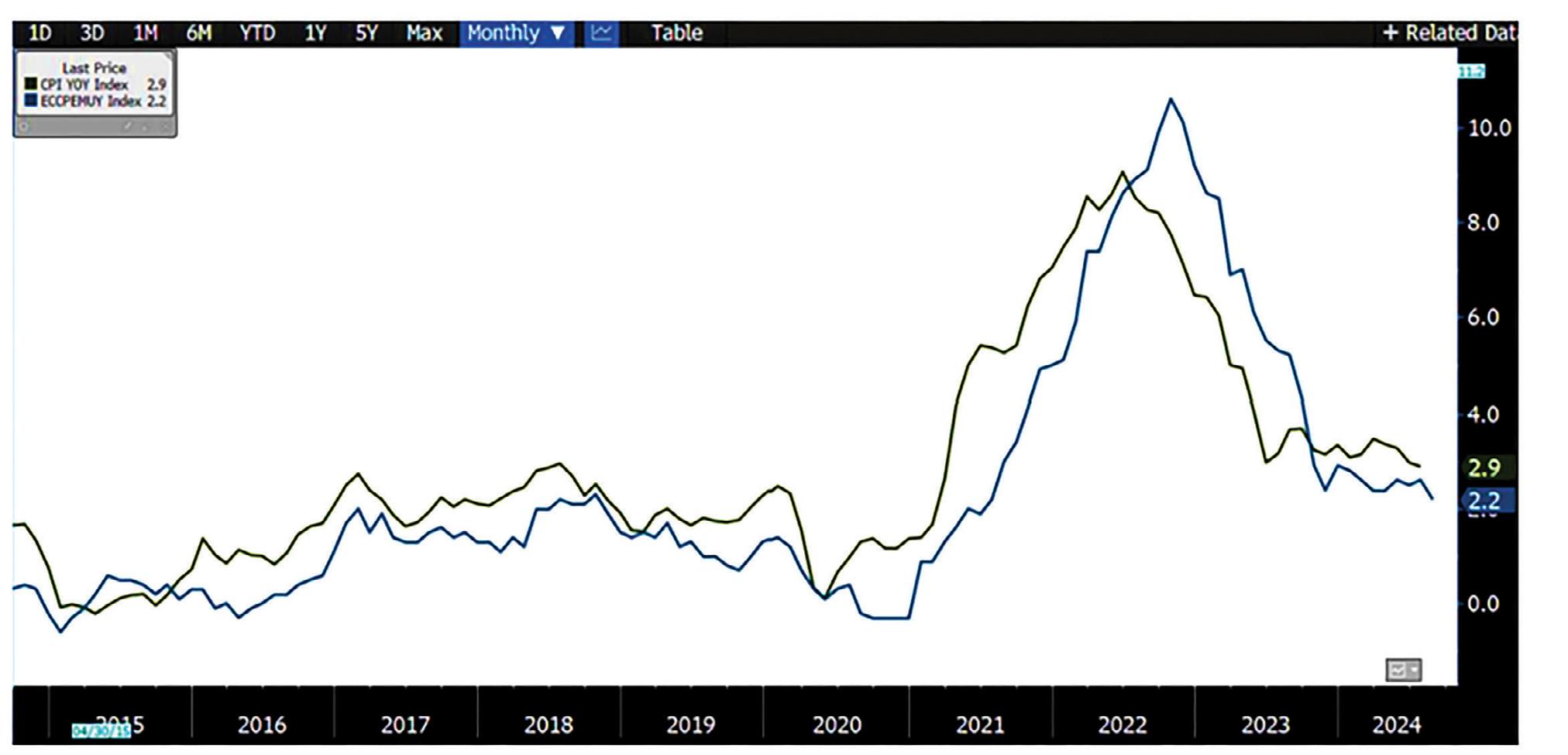

Inflation in both the US and the Eurozone has dramatically fallen from a peak of 9.1 per cent and 10.6 per cent, respectively. Currently, the US consumer price index (CPI) stands at 2.9 per cent while the European CPI is at 2.2 per cent, which raises another crucial monetary policy question –What about the interest rate?

Inflation in both the US and the Eurozone has sharply declined from their respective peaks of 9.1 per cent and 10.6 per cent. Currently, the US CPI stands at 2.9 per cent, while the European CPI has fallen to 2.2 per cent. This dramatic drop raises a key question for monetary policy: What happens next with interest rates? As inflation cools, central banks may face the challenge of determining whether to maintain current rates to ensure stability or begin easing to support growth, a decision that could significantly impact global financial markets.

For this, we need to understand real policy rates, which is the difference between the benchmark interest rate and inflation. The US real policy rate is 2.88 per cent compared to Core PCE, the Fed’s preferred

US AND EUROZONE HEADLINE INFLATION

Source: Bloomberg

inflation gauge. In Europe, the actual policy rate is comparatively less at 1.30 per cent. Real rates indicate the legroom available with central banks to reduce the rates. Unless there is a recession, there will be little appetite to cut rates below inflation and take them to negative territory. So, in other words, the Fed has the maximum legroom to cut rates by 2.88 per cent, while the European Central Bank (ECB) can cut at the maximum by 1.30 per cent. Little wonder the ECB statement sounded hawkish after the latest policy meeting on September 12.

Q4 2024 OUTLOOK

EQUITIES

In Q2 2024, the outlook for the equities market remains constructive amid continued economic strength and Fed rate cuts. However, shortterm volatility surges are also expected owing to the upcoming US. elections. Another factor that might add to short-term volatility is the introduction of corporate tax. Though this was also reflected to some extent in the recent Q2 earnings, in the long term, historically, it can be

witnessed that rising taxes have led to increased equities prices; this can mainly be attributed to the increased government spending that boosts the economy in turn leading to higher corporate earnings.

From a geopolitical standpoint however, the volatility remains minimal, given Israel’s precarious situation and the reluctance of both Iran and Washington to escalate into a broader crisis, especially with the US approaching a presidential election, the chances of a regional crisis seem lower. That said, earnings growth is also expected to remain strong, continuing the ongoing momentum.

Looking at initial public offering (IPO) activity over the past two years, IPO activity in the UAE and across the GCC has steadily increased. In the first half of 2024 alone, there were 23 IPOs with a combined deal value

of $3.785 bn. Companies such as Dr. Soliman Abdel Kader Fakeeh Hospital Company, Alef Education, Parkin Company, and Spinneys made notable stock market debuts this year. The top three IPOs accounted for 45 per cent of the total proceeds during this period.

Looking ahead, food delivery company Talabat is anticipated to go public on the Dubai market in Q4 of this year. UAE retail powerhouse LuLu Group is also expected to launch its IPO in late October or early November, with a dual listing on ADX (Abu Dhabi Securities Exchange) and Tadawul. It is projected to rise between $1.5 bn and $1.85 bn. This activity highlights the GCC region’s growing appeal as a vibrant investment market and offers opportunities to gain exposure to leading companies through IPOs. In the UAE, with regard

In the UAE, with regard to the drivers of growth, the growth in tourism and population is expected to be the primary factor. Historical data indicates that Dubai typically sees more overnight tourist arrivals in the second half of the year compared to the first , with only one exception during the Covid-19 pandemic.

H1 2024

H2 2023

H1 2023 H2 2022 H1 2022 H2 2021 H1 2021 H2 2020 H1 2020

2019 H1 2019

to the drivers of growth, the growth in tourism and population is expected to be the primary factor. Historical data indicates that Dubai typically sees more overnight tourist arrivals in the second half of the year compared to the first, with only one exception during the Covid-19 pandemic. This pattern is primarily due to the favorable climate in the UAE from October to January when many Western tourists seek warmer destinations.

Additionally, in line with this, the UAE currently sees a wave of new expats and foreigners wanting to make this city their primary home. The rise in the new resident population is further acting as a significant tailwind for the UAE’s economic growth.

BONDS

Looking at the bonds market, the GCC bond and sukuk market issued $86 bn in the first half of 2024, almost equivalent to $91 bn issued over the entire year of 2023. Saudi and UAE happen to be the most active sukuk issuers, and looking ahead, the trend is expected to continue into Q4 2024 and beyond, as GCC countries’ projected growth in issuances in the latter half of 2024 finds its roots in the current environment of weak oil

prices and its reliance on oil prices to maintain fiscal breakeven or surpluses. With flat oil prices translating to modest fiscal surpluses or even deficits for GCC sovereigns, the stage is set for an expansion in supply. Furthermore, with the region’s ambitious diversification plans to move away from oil dependency suggest the continuance of government spending in hopes of building top-tier industries attracting global attention and trade opportunities, suggesting further reasons to support growing bonds and sukuk issuances.

COMMODITIES

When looking at commodities, commodities generally tend to do well in a low-interest rate environment, resulting in a weaker dollar.

Gold has seen a stellar performance, rising more than 25 per cent year-to-date; looking ahead, the same is expected to continue, owing to anticipated rate cuts, robust demand through central bank purchases, growing ETF inflows, and ongoing geopolitical concerns from the Russia-Ukraine crises and the Middle East. Looking at silver, although silver benefits from the main driving factors behind gold, the latter is also affected by its application

SHORT-TERM PAIN,

as an industrial metal. Nonetheless, silver is expected to remain bullish into the next few quarters as the silver market’s global supply deficit is likely to widen in 2024, supported by a 2 per cent growth in demand led by industrial consumption, while supply is expected to decline by 1 per cent. However, a significant downturn is expected in crude, at its latest revision of its global oil demand forecast, OPEC+ reduced expectations by 3.79 per cent and 2.24 per cent for 2024 and 2025, respectively. The downward adjustments reflect a broader trend of slowing global economic activity, diminishing fuel consumption in China, and emerging signs of decelerating job growth in the US. These factors, along with strong non-OPEC supply growth, constrain any upward momentum in prices. Moreover, the ratio between the 100 gallons of gasoline as compared to a barrel of WTI crude oil, indicating the profit margin for refineries stood at 2.814, which fell from a 52-week high of 3.398 and is close to the 52-week low of 2.583. This implies the probability of the ratio having room to increase, suggesting potential outperformance of gasoline against WTI, thus boosting the profit margins of refineries.

GAIN

In conclusion, though the uncertainties around the Middle East geopolitical tensions, the US elections, and corporate tax are expected to inflict some short-term volatility, in the long term, the markets are expected to face an upward trajectory, supported by investor interest, regional development goals, and fiscal strategies, with equities and precious metals expected to reap the highest benefits.

MONICA CHHABRA SENIOR RESEARCH ANALYST, TECHVISION FROST & SULLIVAN

BANKING-AS-A-SERVICE THE RISE OF

TO FULLY REALISE THE POTENTIAL OF BAAS, OVERCOMING CHALLENGES RELATED TO OUTDATED CORE SYSTEMS AND REGULATORY COMPLIANCE IS ESSENTIAL

Banking-as-a-service (BaaS) is reshaping the financial industry by allowing companies to integrate banking functions into their offerings through application programming interfaces (APIs). This enables businesses to provide services like payments, loans, and digital wallets without needing to operate as a traditional bank. Through these integrations, companies enhance user experience by making financial tools more accessible directly within their platforms. Partnerships between banks, fintech startups, and technology providers are crucial in the BaaS ecosystem, facilitating the integration of advanced payment solutions and personalised financial instruments. However, the handling of sensitive financial data and maintaining regulatory compliance are key challenges that must be addressed for the continued growth of BaaS.

BaaS plays a pivotal role in driving financial inclusion, particularly in underserved communities.

By offering flexible digital banking services like low-cost accounts and microloans, BaaS platforms bridge financial gaps and enable greater economic participation.

THE FUTURE OF BAAS IN THE GCC LOOKS PROMISING, DRIVEN BY ADVANCEMENTS IN

REGULATORY TECHNOLOGIES (REGTECH), QUANTUM COMPUTING, AND 5G/6G TECHNOLOGY

INVESTMENTS IN QUANTUM COMPUTING AND NATIONWIDE ADOPTION OF 5G WILL FURTHER ENHANCE TRANSACTION SPEED AND SECURITY

BAAS AND FINANCIAL INCLUSION

BaaS plays a pivotal role in driving financial inclusion, particularly in underserved communities. By offering flexible digital banking services like low-cost accounts and microloans, BaaS platforms bridge financial gaps and enable greater economic participation. Companies such as Chime and Revolut are leading this movement by providing services with no minimum balances or monthly fees, specifically catering to marginalised populations.

CHALLENGES IN BAAS IMPLEMENTATION

Traditional banks face significant hurdles when implementing BaaS due to outdated core systems that are incompatible with modern technologies. These legacy systems make it difficult to integrate new services, posing operational challenges. Furthermore,

ensuring regulatory compliance is a major obstacle, as organisations must adhere to strict data security and anti-money laundering regulations, which require ongoing legal oversight.

Seamless integration between enterprise platforms and BaaS infrastructure providers is another critical challenge, demanding careful planning and technical expertise to prevent disruptions.

KEY BENEFITS OF AUTOMATION

Automation brings several advantages to the BaaS ecosystem, including:

• Increased efficiency: Automation streamlines processes like customer onboarding, reducing manual errors and operational costs.

• Enhanced accuracy: Automated systems ensure compliance with regulatory standards and minimise human errors.

• Scalability: Automated platforms can handle increased transaction volumes without added costs or labour.

• Improved customer experience: Automated services provide faster response times and more personalised support through chatbots and AI.

• Cost reduction: By optimising repetitive tasks, automation significantly reduces operational costs, allowing BaaS providers to offer more competitive pricing.

INNOVATION DRIVING BAAS

Several key technologies are

propelling the growth of BaaS:

• Cloud computing: Provides scalability and flexibility for banks and fintech companies to implement BaaS solutions efficiently.

• Blockchain technology: Enhances security and transparency in transactions, reducing fraud risks and improving operations.

• Artificial intelligence (AI): Drives predictive analytics, improves fraud detection, and enables automated customer support.

• Microservices architecture: Breaks down complex banking functions into smaller services, fostering agility and faster deployment of new features.

• APIs: Allow seamless integration between banking platforms and third-party applications, expanding service offerings and interoperability.

• API gateways: Manage and secure API traffic, ensuring smooth and secure interactions between BaaS providers and clients.

ENHANCING CUSTOMER EXPERIENCE

BaaS is democratising financial services by allowing non-bank companies to offer core banking features, creating more competition and innovation in the sector. This development enables thirdparty providers to focus on specific customer needs, resulting in more tailored and

The UAE is leading the GCC in BaaS adoption, with significant investments in fintech and digital banking innovation. Financial hubs like Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM) have implemented supportive frameworks for fintech growth.

accessible financial solutions. By offering simplified business payments or lending processes, BaaS allows fintechs to deliver user-friendly products that meet evolving customer expectations.

REGIONAL TRENDS IN THE GCC

The UAE is leading the GCC in BaaS adoption, with significant investments in fintech and digital banking innovation. Financial hubs like Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM) have implemented supportive frameworks for fintech growth. Banks such as

Emirates NBD and Abu Dhabi Commercial Bank are also partnering with fintech firms to drive BaaS solutions.

Saudi Arabia is making strides with BaaS as well, supported by the Saudi Central Bank’s efforts to promote financial technology through initiatives like the Financial Sector Development Program, part of Vision 2030. This has led to increased interest from local and international fintech companies in entering the Saudi market.

EMERGING OPPORTUNITIES

The future of BaaS in the GCC looks promising, driven by

advancements in regulatory technologies (regtech), quantum computing, and 5G/6G technology. Investments in quantum computing and nationwide adoption of 5G will further enhance transaction speed and security. Additionally, the growing emphasis on environmental, social, and governance (ESG) issues will push for more eco-friendly banking options in the region. As BaaS continues to evolve, it is expected to expand into areas like wealth management and insurance, further transforming the financial services landscape in the GCC.

COMPARING INVESTMENT FUNDS: MENA VERSUS THE REST

MENA FUNDS HAVE SHOWN ROBUST PERFORMANCE, PARTICULARLY IN THE ENERGY SECTOR, DRIVEN BY THE REGION’S ABUNDANT NATURAL RESOURCES

prevalence of Sharia-compliant funds, which adhere to Islamic law and appeal to Muslim investors. In addition, government-backed initiatives and economic diversification plans, like Saudi Arabia’s Vision 2030, are driving significant growth and innovation in the region.

Internationally, established markets like the US, UK, and Japan offer a wide range of investment opportunities. These markets benefit from advanced financial infrastructures and extensive diversification options across various sectors, including technology, healthcare, and consumer goods.

Emerging markets such as China, India, and Brazil also present compelling investment opportunities with high growth potential. A recent UNCTAD report shows that global FDI hit $1.37tn in 2023, with steady investments made in major economies such as the US, UK, and Japan. The primary advantage of international investment funds is their ability to provide broad geographical and sectoral diversification, reducing the risk associated with investing in a single region or industry.

PERFORMANCE AND

RISK ANALYSIS

MENA funds have shown robust performance, particularly in the energy sector, driven by the region’s abundant natural resources. A recent report by KPMG highlights that MENA funds, particularly in the energy sector, have shown strong performance, with Saudi Arabia’s energy sector achieving a high Financial Performance Index score of 98.24, driven by demand for energy services. However, MENA funds can be subject to higher volatility due to geopolitical uncertainties. International funds, on the other hand, offer more stable returns due to diversified

portfolios spread across multiple regions and sectors. Nonetheless, they are not immune to economic fluctuations, political changes, and currency risks.

REGULATORY ENVIRONMENT AND INVESTOR PROTECTION

MENA countries have been improving their regulatory frameworks to attract foreign investment, ensuring greater transparency and investor protection. However, regulatory standards can vary significantly across the region. International markets, especially those in developed countries, typically have well-established regulatory bodies that provide robust investor protection and ensure market integrity. This difference can impact fund performance, and the level of risk investors are willing to accept.

INVESTOR PREFERENCES AND BEHAVIOUR

In the MENA region, there is a strong preference for Shariacompliant funds and investments aligned with regional economic goals. Data from S&P Global suggests that the preference for Sharia-compliant funds and investments aligned with regional economic goals is driven by cultural and religious considerations, with Islamic finance assets expected

$1.37tn

A RECENT UNCTAD REPORT SHOWS THAT GLOBAL FDI HIT IN 2023, WITH STEADY INVESTMENTS MADE IN MAJOR ECONOMIES SUCH AS THE US, UK AND JAPAN

to reach $3.69tn by 2024, up from $2.88tn in 2019.

Conversely, international investors often seek diversification and exposure to high-growth sectors in developed and emerging markets. Understanding these preferences is crucial for fund managers looking to attract and retain investors from different parts of the world.

TECHNOLOGICAL INNOVATION AND SUSTAINABILITY INITIATIVES

Countries like the UAE are investing heavily in renewable energy projects, smart cities, and fintech, aiming to reduce dependency on oil and foster sustainable economic growth. These initiatives are

The MENA region has become an attractive destination for investment due to its vibrant economic landscape. Key markets such as the UAE, Saudi Arabia, and Qatar are leading the charge, particularly in sectors like energy, real estate, and technology.

attracting environmentally conscious investors and those looking to capitalise on the region’s technological advancements. Internationally, investment funds are also prioritising ESG (environmental, social, and governance) criteria, with a growing number of funds dedicated to green technology, sustainable agriculture, and clean energy. This global shift towards sustainability is reshaping the investment landscape, offering new opportunities for growth and impact.

ROLE OF SOVEREIGN WEALTH FUNDS

Saudi Arabia and the UAE have established large sovereign wealth funds (SWFs), such as the Public Investment Fund (PIF) and the Abu Dhabi Investment Authority (ADIA), which are influential in driving economic development and diversification. These funds invest both domestically and internationally, providing a bridge between MENA and global investment opportunities.

With $10.2bn in investments made in H1 2024, the PIF topped the list of state-owned investors worldwide according to a report by the consultancy Global SWF.

Saudi Arabia and the UAE have established large sovereign wealth funds ( SWFs), such as the Public Investment Fund (PIF) and the Abu Dhabi Investment Authority (ADIA), which are influential in driving economic development and diversification.

Abu Dhabi-based funds, including ADIA, ADQ, and Mubadala, were also top GCC investors, collectively investing $38.2bn across 58 deals, highlighting strong regional investment activity.

In contrast, international SWFs, such as those from Norway and China, are known for their diversified global portfolios, investing in a wide range of sectors and regions to optimise returns and manage risks.

OPPORTUNE TIME TO ESTABLISH INVESTMENT FUNDS IN MENA

While both MENA and international investment funds offer unique opportunities, the importance of operating within a regulated framework cannot be overstated. For private

ABU DHABI-BASED FUNDS, INCLUDING ADIA, ADQ, AND MUBADALA, WERE ALSO TOP GCC INVESTORS, COLLECTIVELY INVESTING

$38. 2bn

sector players in the MENA region, there is a significant advantage in not only participating in existing regulated funds but also in establishing their own investment funds within these frameworks. Through creating their own regulated investment funds, private sector companies can tailor their portfolios to align with their strategic goals, whether that be focusing on high-growth sectors like technology, mega real estate development and renewable energy or ensuring compliance with Sharia principles. This approach allows businesses to leverage their industry expertise, enhance their market influence, and attract both local and international investors who value transparency and governance. Operating within regulated structures not only mitigates risks but also builds investor confidence, which is crucial for sustainable growth. As the MENA region continues to evolve and diversify, the private sector has a unique opportunity to drive this evolution by establishing their own funds. This will enable them to capitalise on regional opportunities while contributing to the stability and maturation of the financial markets. By taking this route, they can secure a stronger position in the global investment landscape and foster long-term economic growth.

FROM EXCLUSIVE TO INCLUSIVE

UNLOCKING UNTAPPED CUSTOMER DEMOGRAPHICS WITH DIGITAL WEALTH MANAGEMENT

By next year, the number of dollar millionaires in the Middle East is set to top 330,000 – a near 30 per cent increase from 2020 levels. The region’s affluent individuals are also proving to be avid investors. Headlines through 2024 have regularly emphasised the eyewatering

amounts being poured into real estate, and even relatively newfangled assets like cryptocurrencies – the latter evidenced in the fact that nearly three-quarters of UAE residents have invested in Bitcoin. It therefore comes as a surprise that in a region with growing wealth and a healthy

appetite for investing, the Middle East’s wealth management sector is largely underdeveloped. True, high-networth-individuals (HNWIs), and family offices are actively served by the region’s financial institutions. However, the larger segment of the population remains

IN JUST THE LAST DECADE, DUBAI HAS WITNESSED A 78 PER CENT INCREASE IN INDIVIDUALS WITH LIQUID INVESTMENT WEALTH OF $1 M OR MORE

unpenetrated. This strategy does of course boil down to economics – the top 10 per cent of income earners hold more than 60 per cent of the total regional income. It has therefore made sense for service providers to maintain a narrow focus. A consequence of this has been an underwhelming level of digitalisation – after all, if HNWIs almost exclusively rely on dedicated wealth managers, then why pour funds into developing digital systems?

WINDS OF CHANGE

Today, however, there are new market factors at play. In just the last decade, Dubai has witnessed a 78 per cent increase in individuals with liquid investment wealth of $1m or more. While not in the same league as their ultra-high net worth

counterparts, these potential investors represent a significant opportunity. Moreover, over the next five-10 years, globally, we’ll witness the largest transfer of wealth in the history of mankind. More than $60tn in assets will be passed to a new generation, a group that’s a radical departure from those who came before.

Simply put, the current, manual, labour-intensive approach to wealth management cannot scale to accommodate the wants and needs of these emerging customer segments. Even today, investing in a mutual fund, or opening an investment account requires visiting a branch. Casting aside consideration for the staggering workforce investment that would be required to onboard thousands of retail investors in this manner, is this even likely to be their preference?

If the region’s financial institutions hope to realise the new revenue streams these underserved segments represent, they must figure out how to economically serve them. Doing so will first require an understanding of what it takes to effectively (and efficiently) cater to the wealth management needs of different client groups.

MAKING SENSE OF SEGMENTS

Broadly speaking, it makes sense to divide potential clients into three segments. Retail customers, with assets under $1.5m, are the largest and perhaps most untapped of the lot. Given that volume dictates success here, serving these customers while controlling costs, will require empowering them to self-serve as much as possible. Keep in mind however that many in this group will be making their first forays into

the world of investing. So, offering them as much educational material as possible will go a long way, as will virtual ‘hand holding’ by heavily customising offerings based on effective segmentation and behaviour analysis.

Moving up the range, between $1.5m to $5m, we have ‘affluent’ investors. They are discerning of the experiences they receive and expect a premium level of service. While the greater percustomer revenue warrants the added level of engagement, it doesn’t translate to investing countless sunk hours. The solution then is to invest heavily in digitising workflows and streamlining processes through automation. To offer them the ‘human touch’ without overleveraging relationship managers, create a platform that delivers a ‘hybrid’ approach. This would present them with all the information they need digitally, while offering channels such as live chat and virtual calls, to conveniently connect them to dedicated relationship managers without the need for in-person meetings.

Finally, let’s re-examine HNIs, the one segment that has thus far been the prime focus of the region’s wealth management endeavours, to understand why even here there is scope for improvement. While the hightouch, human-centric nature of client servicing will undoubtedly remain a hallmark of this segment, digitisation will still bring considerable value. Take investing’s many procedural tasks

– collecting documents, getting questionnaires answered, presenting investment proposals and so on. While customers may welcome in-person meetings to discuss investments and performance, they certainly won’t appreciate having to be physically present for mundane tasks such as signing an agreement or having documents scanned. Moreover, across segments, digitalisation also doesn’t just translate to better customer experiences. It enables employees to be more effective – whether that’s responding faster and more professionally or identifying opportunities for cross-selling and up-selling.

DIGITAL, DEMYSTIFIED

The region’s banks have recognised the value of digitalising their core operations, evidenced by the 52 per cent growth the digital banking sector saw between just 2021 and mid-2023. Stopping here though would be leaving opportunity on the table. To seize the opportunity that digital wealth management presents, banks should first look for an engagement banking platform that can be layered on top of existing investments. This would enable them to play to their strengths and unlock the full potential of existing investments. For example, most banks would have already invested in industry-leading CRM systems, which are powerful tools for segmentation.

Moving up the range, between $1.5m to $5m, we have ‘a ffluent’ investors. They are discerning of the experiences they receive and expect a premium level of service. While the greater per-customer revenue warrants the added level of engagement, it doesn’t translate to investing countless sunk hours.

Augmenting this with an engagement platform would empower them to take the next logical step and push personalised offers based on data they already own.

ACHIEVING AGILITY WITH A HYBRID APPROACH

To effectively cater to diverse investor segments – whether retail customers or high-networth individuals – banks need a flexible approach that balances speed and adaptability. Leveraging engagement platforms allows banks to deploy out-of-the-box solutions quickly while retaining the ability to customise specific features for unique market needs. For instance, banks can implement automated portfolio management and rebalancing for retail customers or offer advanced trading and order management systems for high-net-worth clients. This hybrid buy-plus-build approach empowers banks to deliver competitive offerings rapidly while maintaining the agility to evolve and create tailored experiences.

VALUE FOR ALL

We are currently witnessing a shift in the definition of wealth, and along with this, shifts in the behaviours and preferences that financial institutions have come to expect from their customers. What was once reserved for an elite few, now had the potential to deliver value on a never seen before scale. Not only is this to the benefit of customers, but banks too have an unprecedented opportunity to unlock the potential of thus far untapped demographics. Trading legacy paradigms, for modern, scalable digital wealth management unpins success in this endeavour. Those that adapt will thrive, and like the investors they serve, see their profits grow.

WHAT WAS ONCE RESERVED FOR AN ELITE FEW, NOW HAD THE POTENTIAL TO DELIVER VALUE ON A NEVER SEEN BEFORE SCALE

LEADING THE PUSH FOR GREEN FINANCING

THE GCC REGION’S ADOPTION OF SUSTAINABLE FINANCE SIGNALS A PARADIGM SHIFT, PRIORITISING ENVIRONMENTAL SUSTAINABILITY

Green finance presents a massive untapped opportunity for GCC countries, with estimates suggesting that investments in sustainable projects could contribute up to $2tn to the region’s GDP by the end of the decade.

“The massive investment underway across the GCC in renewable energy, green hydrogen, and other sustainable projects requires substantial amounts of financing, both debt and equity, which suggests that the sector will continue to grow in the coming years,” PwC said in a report in April.

The hosting of the United Nations Climate Change Conference (COP28) in the UAE in 2023 highlighted the urgency of sustainable finance as delegates grappled with the significant gap between climate funding needs and current commitments.

Sustainable finance’s two major objectives are to manage sustainability-related risks for the financial industry and enable the shift of investments from unsustainable to sustainable economic activities.

S&P Global predicted a challenging 2024 for borrowers, citing tighter financing and

softening economic conditions. However, the growing emphasis on decarbonisation could boost the green, social, sustainability, and sustainability-linked bond (GSSSB) market closer to the $1tn mark.

Meanwhile, Islamic and sustainable finance share common ground, and both markets are expanding, with sustainable sukuk emerging as a significant part of the annual sukuk

PIONEERING SUSTAINABLE

Sustainable finance in the GCC gained traction in the early 2000s, driven by the increase in environmental and social awareness, growing corporate social responsibility, and the emergence of innovative sustainable investment products.

KPMG said that sustainable finance has grown significantly globally and in the Gulf region due to the increase in awareness of the environmental challenges the Gulf region faces and mounting pressure to act.

Due to climate hazards, the Middle East faces a heightened risk of desertification, biodiversity loss, drought, and water scarcity. However, GCC countries are actively pursuing economic diversification and sustainability initiatives to mitigate these challenges and ensure a more resilient future.

Earlier in 2024, Oman unveiled its sustainable finance framework to help the Gulf state reduce its heavy reliance on fossil fuels and attract environmental, social, and governance investors. The sultanate will leverage the framework to issue sustainable finance instruments such as green, social, and sustainability bonds, loans, and sukuk – Islamic bonds – whose

proceeds will be used to fund and re-finance renewable energy projects.

Saudi Arabia followed suit in March by laying out plans to issue green finance instruments. The kingdom seeks to raise money for environmentally friendly projects and a transition away from fossil fuels, which are the backbone of the country’s economy.

“The transformation towards a low-carbon economy is an opportunity to redefine the way we live, work, and interact with our planet,” said KPMG.

Companies domiciled in the GCC region, including Saudi Arabia’s Public Investment Fund, Dubai Islamic Bank, Abu Dhabi’s Etihad Rail, Qatar National Bank, and Bahrain’s Bapco Energies, have adopted green finance frameworks.

The sustainable finance frameworks enable these firms to issue debt linked to environmentally friendly projects, such as green bonds.

The momentum in the Middle East’s issuance of green bonds continues in 2024, as evidenced by Qatar’s issuance of $2.5bn debut green bonds in May and Sharjah’s second sustainable bond issuance in February.

Over the years, sustainable bond issuance has spanned a wide range of entities, including banks – Dubai Islamic Bank, Abu Dhabi Commercial Bank, and Al Rajhi; corporates – Masdar, DP World, TAQA, and Aldar; and sovereign wealth funds – Mubadala and PIF. There was a broader range of issuers in the UAE, but Saudi Arabia is catching up.

ISLAMIC FINANCE & SUKUKS

The $3tn Islamic finance industry continues on its growth trajectory path, with global sukuk issuance projected to reach between $200bn

and $210bn in 2024, beating last year’s total of just under $200bn.

“Following rapid growth in 2023, with record issuance of $10.6bn, we expect continued growth in the environmental, social, and governance (ESG) sukuk market, thanks to strong investor demand and increasing interest from countries willing to diversify their funding base,” Moody’s said in a report in September.

The COP28’s UAE Consensus highlights the opportunities offered by Islamic finance and sukuk to finance initiatives related to climate action.

Shariah-compliant financial instruments, while not mutually exclusive from ESG investing, provide a framework that aligns with the social and ethical values of sustainable investing, offering investors in the Middle East and Southeast East the opportunity to adopt more conscious and responsible investment strategies.

ESG sukuk volumes reached a record $6bn in H1 2024, driven by issuance from the UAE, Indonesia, and Saudi Arabia. Proceeds from ESG-linked

Companies domiciled in the GCC region, including Saudi Arabia’s Public Investment Fund, Dubai Islamic Bank, Abu Dhabi’s Etihad Rail, Qatar National Bank, and Bahrain’s Bapco Energies, have adopted green finance frameworks.

THE MOMENTUM IN THE MIDDLE EAST’S ISSUANCE OF GREEN BONDS CONTINUES IN 2024, AS EVIDENCED BY QATAR’S ISSUANCE OF

$2.5BN

DEBUT GREEN BONDS IN MAY AND SHARJAH’S SECOND SUSTAINABLE BOND ISSUANCE IN FEBRUARY

sukuk typically support investments in renewable energy or other environmental assets such as solar parks, biogas plants, wind energy projects, and renewable transmission and infrastructure projects.

Industry analysts expect green sukuk issuance to accelerate in the coming years, supported by both government and private-sector issuers. Several companies and financial institutions in the Gulf region, including Saudi Arabia’s Al Rajhi Bank, Qatar International Islamic Bank, Dubai Islamic Bank PJSC, and Aldar Investment Properties, issued their first green sukuk in 2024.

GCC countries have adopted various policies and regulations to support sustainable finance, including guidelines for green bonds, environmental risk assessments for financing, and sustainability reporting requirements for companies, according to PwC.

Going forward, Saudi Arabia, as a G20 member, and UAE, as a recent G20 recurring invitee, are expected to continue making significant contributions to sustainable finance efforts in the region as other GCC countries are making efforts to adapt quickly.

SITUS TAX STRATEGIES FOR GLOBAL INVESTORS

IF YOU HAVE PROPERTY HOLDINGS OR SIGNIFICANT OFFSHORE INVESTMENTS, SITUS TAX COULD HAVE SIGNIFICANT IMPLICATIONS FOR YOUR ESTATE AND FINANCIAL GAINS

While international investments offer great potential, they also come with complex tax implications. One such consideration is Situs tax, a lesser-known but significant tax levied on assets based on their location rather than the owner’s residency. We explore the implications

Investing internationally is a great way to tap into new markets and diversify your assets. However, it also means dealing with different tax laws. One critical yet often overlooked aspect is Situs tax, a tax based on the location of an asset rather than the residency of its owner. If you have property holdings or a significant offshore share portfolio, your estate or financial gains could

be subjected to tax liabilities, potentially reducing the value of these investments and creating additional complexities for your beneficiaries.

WHAT IS SITUS TAX?

Situs tax is a type of taxation levied on assets based on their location rather than the holder’s residence. It commonly applies to real estate and financial assets such as stocks and bonds, but can also include intangible assets like intellectual property and trademarks, and high-value personal property items such as art, jewellery and collectibles.

It’s common in the US and the UK, but it’s also something you’ll find in many other countries, including Canada, Australia, and several European nations.

Each country has its own set of rules and tax rates, so it’s really important to familiarise yourself with the specific regulations of each jurisdiction where you have investments to ensure you’re complying with local laws and optimising your tax planning to avoid any surprises.

IMPACT OF SITUS TAX

If you own property or financial assets in a country with Situs tax regulations, you’ll be required to pay taxes to that country irrespective of your place of residence. This can result in a substantial tax bill and lower returns than expected after settling liabilities.

It can also complicate your estate planning strategies. Without proper planning, your beneficiaries could inherit less than anticipated due to the tax burden and the detailed documentation and extended timelines common when dealing with international tax authorities could slow down the process of settling your estate.

It’s critical to stay informed about the tax laws and any changes in the countries where your assets are located. Tax regulations can change, and staying compliant requires ongoing attention.

COSTS AND JURISDICTIONAL VARIANCE

Each country has a different approach, with variations in assets included and taxation thresholds but the costs of Situs tax can be significant. For example, in the US, estate taxes are imposed on estates exceeding $60,000, with rates reaching up to 40 per cent. This tax affects not only real estate but also financial assets like stocks and bonds. If a non-resident owns a house in California or stocks in an American company, these assets would be subject to US estate tax upon the owner’s

death. Additionally, income from these assets, such as rental income or dividends, may also be taxed.

In the UK, Situs tax is applied to estates with a combined value exceeding £325,000, with tax rates also reaching up to 40 per cent. This tax impacts real estate, financial assets, and certain intangible assets like intellectual property. For instance, an international investor owning a flat in London or shares in a UK-based company would face significant tax liabilities on these assets. A UK domiciled individual’s worldwide estate is subject to IHT, regardless of whether or not the individual is resident in the UK. However, a non-domiciled individual is generally only taxed on their UK situs assets. IHT is levied on death at a standard rate of 40 per cent on the value of the estate that exceeds the nil rate band. These tax rules can substantially affect the net returns from international investments. Investors should consider these potential liabilities when planning their strategies, as these taxes can reduce overall profitability and complicate estate planning.

IMPLICATIONS FOR UAE INVESTORS

Given the UAE’s relatively taxfree environment, understanding these jurisdictional variances is crucial for UAE investors. Common scenarios include owning property or shares in the US or UK, where Situs tax would apply. For example, a UAE investor with a rental property in New York must consider US estate tax implications. Similarly, owning shares in a UK company could subject the investor to UK inheritance tax laws.

One fortunate aspect is that the UAE has an extensive double taxation treaty network with over 140 countries, including the UK, which helps to

Even if your share portfolio isn’t currently close to the values that trigger Situs tax, it’s wise to plan ahead. Your investments may well remain active for many years, and Situs tax could become applicable down the line.

clarify tax obligations and offer relief in cases where double taxation might occur. However, the specifics of these agreements vary by country, so it’s important to understand how each treaty impacts your individual tax situation.

STRATEGIC MANAGEMENT OF SITUS TAX LIABILITIES

Mitigating Situs tax liabilities can be straightforward with the right strategies. If you’re planning on acquiring investments which would be treated as Situs, you should consider doing so through entities which shield the underlying assets.

One effective method is using legal structures like trusts or endowments which not only help protect your assets but also offer significant tax efficiencies. By moving assets into a trust, you can often defer or reduce tax liabilities, which can be a gamechanger for your estate planning.

Investing within an endowment structure or a unit trust is a particularly savvy strategy for avoiding Situs tax on a share portfolio. The five-year restriction period attached to an endowment shouldn’t burden the investor either since direct offshore and share portfolios are generally seen as higher-risk investments that should be held for at least seven to ten years.

During this period, an investor is allowed one surrender and one interest-free loan, adding flexibility. Moreover, investors with higher marginal tax rates benefit from these endowments, as they are taxed according to

the five-fund approach at a lower income tax and capital gains tax rate.

Even if your share portfolio isn’t currently close to the values that trigger Situs tax, it’s wise to plan ahead. Your investments may well remain active for many years, and Situs tax could become applicable down the line. Transferring your existing share portfolio into an endowment will create a capital gains tax implication, but it can be beneficial to do this now. By selling out now, buying the same shares within the endowment structure, and splitting the transactions between the current and next tax year, you might lower your taxable capital gain altogether. Also, using these structures not only reduces possible estate taxes at death but also simplifies and speeds up the process of winding up the estate.

Early planning is key. Restructure your investments well before any significant life events, such as retirement or transferring assets to heirs. This proactive approach ensures you maximise the benefits of trusts and other legal structures, keeping your tax liabilities as low as possible.

A BIT OF PLANNING GOES A LONG WAY

Consulting with a tax professional experienced in international tax law is highly recommended. They can provide personalised advice and help implement strategies tailored to your specific situation, ensuring you effectively manage your Situs tax liabilities. A proactive approach not only protects your investments but also ensures you’re maximising your returns and simplifying the process for the future.

UNLOCKING DUBAI’S ECONOMIC POTENTIAL

HIS EXCELLENCY DR MOHAMMED AL ZAROONI, EXECUTIVE CHAIRMAN OF DIEZ , SAYS THE AUTHORITY IS INTEGRATING AI AND SMART CITY SOLUTIONS , REINFORCING ITS POSITION AS A CRUCIAL CONTRIBUTOR TO DUBAI’S ECONOMIC GROWTH

WORDS KUDAKWASHE MUZORIWA

COVER STORY DIEZ

Dubai’s strategic location, coupled with its world-class infrastructure, businessfriendly policies, and stable economy, has made it a highly attractive destination for global investors. Its tax-advantaged environment and proximity to both Eastern and Western markets offer numerous advantages.

The global hub for business and tourism unveiled an ambitious $8.7tn (Dhs32tn) economic plan in January. Dubbed the Dubai Economic Agenda (D33), the initiative seeks to solidify the emirate’s status as a strategic economic gateway by doubling foreign trade and investment over the next decade.

Dubai, home to more than 28 economic free zones, has embarked on reforms to enhance economic competitiveness, GDP growth, and stability while promoting economic diversity.

The economic free zones have significantly contributed to growth and entrepreneurship by creating a favourable business environment. To strengthen Dubai’s position as a global economic hub and attract more investments, His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, created the Dubai Integrated Economic Zones Authority (DIEZ) in 2021, consolidating and integrating the products and services of Dubai Airport Free Zone (DAFZ), Dubai Silicon Oasis (DSO), and Dubai CommerCity, a joint venture between DIEZ and Al Wasl Properties.

His excellency Dr Mohammed Al Zarooni, executive chairman of DIEZ, emphasises that the three economic free zones play a crucial role in diversifying the economy, fostering

innovation, and boosting growth, which aligns with the D33 initiative.

“The DIEZ plays a strategic role in the realisation of the D33, which aims to double the size of Dubai’s economy over the next decade. DIEZ’s three integrated economic zones – Dubai Airport Freezone, Dubai Silicon Oasis, and Dubai CommerCity – are key contributors toward this agenda and play a unique role in consolidating Dubai’s position among the top three economic cities in the world,” says Al Zarooni.

While DAFZ offers seamless global connectivity, thanks to its strategic location adjacent to Dubai International Airport (DXB), DSO has been instrumental in driving innovation in the emirate as the Dubai CommerCity is positioning the city as a global hub for digital commerce and supporting the region’s growing e-commerce market.

“Since its establishment in 2021, DIEZ has significantly evolved to align with the Dubai Economic Agenda. We have launched several initiatives, including Oraseya Capital, which is our venture capital arm, to support startups and SMEs,” explains Al Zarooni.

“Our focus has expanded to include the integration of AI and smart city solutions, further enhancing operational efficiency and sustainability. These efforts have solidified DIEZ’s role as a key player in Dubai’s economic landscape, driving innovation, economic diversification, and sustainable growth.”

A MODEL OF MODERN ECONOMY

Historically, oil exploration and production have been the cornerstones of GCC economies. However, the region is now actively diversifying its economy and exploring new growth avenues beyond its traditional reliance on fossil fuels.

Among the GCC region’s oil-producing states, Dubai stands out as the most successful in diversifying its economy. Since the 1970s, the emirate has made significant strides in transforming itself into a thriving global hub with a promising economic future. “By fostering a business-friendly ecosystem and continuously improving our services, we ensure that Dubai remains an attractive destination for global investors, thereby boosting the emirate’s investment attractiveness,” says Al Zarooni.

He emphasises that DIEZ is advancing Dubai’s global competitiveness through a unique approach. “Our strategic pillars “excel, grow, and enrich” are designed to

create a delightful experience for customers and investors,” Al Zarooni reveals.

Through its three economic zones, the authority offers a range of incentives, including tax exemptions, 100 per cent foreign ownership, and streamlined business setup processes. These factors make it easier for international businesses to establish a presence in Dubai.

DIEZ’s supportive regulatory environment, sustainable business practices, and state-of-the-art infrastructure attract foreign direct investment (FDI). DIEZ also plays a major role in contributing to Dubai’s non-oil trade — in 2023 it registered Dhs282bn, marking a 33 per cent growth compared to 2022.

Dubai’s allure as a global investment destination has surged, attracting a remarkable 1,070 Greenfield FDI projects in 2023. This represents a threefold increase in its global share of such projects over the past three years, climbing from 1.7 per cent in 2019 to a record 6 per cent last year.

Meanwhile, DIEZ registered an 18 per cent growth in half-year net profit, 12 per cent in revenue, and 7 per cent in operating profit in the first half of 2024, amid a 4 per cent increase in the number of companies operating in its free zones. These companies now employ more than 78,000 specialised employees, reflecting a 12 percent growth from the previous year.

“DAFZ enhances Dubai’s non-oil economy by attracting global businesses and facilitating international trade, making it a hub for logistics and commerce. DSO, as a science and technology hub that drives innovation under the Dubai 2040 Urban Master Plan, fosters innovation and serves as a testbed that supports startups and tech companies in further advancing the implementation of smart city solutions. Dubai CommerCity is the first dedicated digital commerce-free zone in the region. It boosts the digital economy by providing tailored digital commerce enablement services for online commerce,” says a proud Al Zarooni.

“These zones drive economic diversification, innovation, and growth, aligning perfectly with the D33 agenda,” he adds.

Earlier in 2024, the authority unveiled its new strategy, which aims to solidify Dubai’s position as a leading regional and global

LAST YEAR, DUBAI ATTRACTED 1,070 GLOBAL GREENFIELD FDI PROJECTS,

investment hub across all sectors. Al Zarooni says the strategy revolves around three strategic pillars “excel, grow, and enrich”.

The fourth cohort of SANDBOX, an accelerator programme focused on supporting the growth of tech startups, recently concluded with seven startups securing investments from Oraseya Capital. Each of these startups received $150,000 (Dhs570,000) following their impressive performance in the program, which attracted a significant pool of over 1,500 applicants.

In September, Oraseya Capital led a Series A funding round for Podeo, the world’s largest podcast distribution platform, where the platform raised $5.4m to support podcasters in overcoming the discoverability challenge.

“Oraseya Capital is a key contributor to the UAE’s goal of nurturing 20 unicorns by 2031. With a venture capital fund of Dhs500m ($136m), Oraseya Capital provides crucial financial support to tech startups from the pre-seed to Series B stages,” explains Al Zarooni.

“Our involvement goes beyond funding. We offer guidance and resources to help startups navigate their growth journey. Oraseya aims to create a collaborative environment where entrepreneurs can exchange ideas and access resources.”

A THRIVING BUSINESS ECOSYSTEM

The success of Dubai’s economic free zones has been instrumental in the city’s transformation into a global hub for business and tourism. The specialised economic zones offer incentives and benefits that attract foreign investment, foster a diverse range of industries, and contribute to the emirate’s overall sustainable growth.

SINCE ITS ESTABLISHMENT IN 2021, DIEZ HAS SIGNIFICANTLY EVOLVED TO ALIGN WITH THE DUBAI ECONOMIC AGENDA. WE HAVE LAUNCHED SEVERAL INITIATIVES, INCLUDING ORASEYA CAPITAL, WHICH IS OUR VENTURE CAPITAL ARM, TO SUPPORT STARTUPS AND SMES.”

“Through its three dynamic economic zones, DIEZ has established itself as a global hub for innovation and business, attracting key international collaborations, particularly in sectors such as e-commerce, logistics, and technology,” shares Al Zarooni.

“DIEZ also collaborates with global businesses across various sectors to drive innovation and economic growth.”

EMERGING TRENDS SUCH AS THE INTEGRATION OF AI IN VARIOUS INDUSTRIES, THE RISE OF E-COMMERCE, AND THE FOCUS ON SUSTAINABILITY WILL SECURE DUBAI’S POSITION AS A PREMIER REGIONAL AND GLOBAL INVESTMENT DESTINATION.”

Dubai’s free zones have become a cornerstone of the UAE’s thriving business ecosystem, attracting companies from around the world. Offering 100 per cent foreign ownership and full repatriation of profits, these zones provide international investors with unmatched freedom and flexibility.

Setting up a business in a free zone is streamlined and efficient. Through “one-stop-shop” services, entrepreneurs can easily navigate the registration and licensing process. This simplified entry, combined with tailored packages for small to medium enterprises (SMEs) and startups, has led to a boom in innovation and entrepreneurship in Dubai and across the UAE.

The sector-specific focus of many free zones is another key factor in the success of DIEZ’s free zones.

In addition to a supportive business environment, free zones offer world-class infrastructure. Whether it is the strategic location, world-class logistics support, and seamless connectivity in DAFZ, the high-tech facilities in DSO or the warehousing solutions in Dubai CommerCity, businesses have access to the tools they need to scale quickly. DIEZ and Aramex commenced pilot testing of Aramex’s autonomous robot delivery system at Dubai Silicon Oasis in June as part of the authority’s broader ecosystem designed to foster innovation and entrepreneurship.

Al Zarooni notes that the authority collaborates with global and local businesses to co-create solutions that address critical challenges. He notes that the DIEZ is involved in the MIT DesignX Dubai Accelerator, MIT’s inaugural accelerator programme in the Middle East that seeks to support the creation of innovative enterprises, and the AI Smart Pedestrian Crossing System across DSO with Derq.

Al Zarooni emphasised that collaborations across the e-commerce, logistics, and tech sectors highlight DIEZ’s role as a key enabler of global business expansion. “This provides a strategic base for companies to access new markets, innovate, and scale their operations.”

Moreover, economic zones such as DAFZ have transformed the city into one of the world’s leading trading hubs. Founded

in 1996, DAFZ’s prime location adjacent to DXB offers businesses seamless access to global markets, making it ideal for companies involved in logistics, aviation, and international trade.

“DAFZ has partnered with the 2024 edition of Red Bull Basement, aligning with the free zone’s commitment to elevating UAE innovators on a global stage,” says Al Zarooni. “DAFZ will directly support teams participating in the event by awarding the first – and second–place winners membership in its innovative startup program, Scality, which will enable them to establish and grow their businesses in the region.”

DSO is providing a tech-friendly environment for startups and established tech giants alike, fostering a vibrant, innovative environment.

“We work closely with agencies such as the Roads and Transport Authority in Dubai to host the tests for the Industry Leaders category under the Dubai World Congress for Self-Driving Transport, the first event of its kind in the Middle East,” says Al Zarooni.

“These partnerships and initiatives play an important role in driving the city’s transformation into a model smart city and a global hub of technological excellence while encouraging a vibrant startup ecosystem.”

Strategically located near airports and other major transport hubs, Dubai’s free zones provide businesses with unparalleled access to regional and international markets.

With a strong emphasis on sustainability, talent attraction, and regulatory flexibility, Dubai’s free zones have not only contributed to the UAE’s economic growth but have positioned it as a global business leader for the future.

DIEZ AT A GLANCE

78,000 EMPLOYEES 12% YEAR-ON-YEAR GROWTH

ESTABLISHING DUBAI’S GLOBAL PRESENCE

Though special economic zones have been a global feature since the 1950s, the GCC region is witnessing a renewed emphasis on free zones, with many undergoing significant updates to their mandates, positioning, and value propositions to drive economic diversification.

The GCC states remain relatively insulated from the slowing global economy, and continued government investments in line with the economic diversification goals are fueling growth.

“Emerging trends such as the integration of AI in various industries, the rise of e-commerce, and the focus on sustainability will secure Dubai’s position as a premier regional and global investment destination,” says a confident Al Zarooni.

Dubai’s ambition is limitless, and its success story will continue to serve as a model for cities aiming to create a bright future for their future generations. Many emerging market countries are increasingly adopting the UAE’s economic model, especially Dubai.

“Other countries can adopt several best practices from DIEZ to enhance their economic ecosystems. Creating specialised economic zones can attract diverse industries and drive economic growth,” Al Zarooni says, adding that streamlining business setup and regulatory frameworks will make it easier for businesses to establish themselves and operate.

He believes strategic initiatives and global collaborations will further enhance Dubai’s attractiveness to investors, ensuring continued economic growth and development.

Moving forward, Al Zarooni emphasises that DIEZ remains committed to integrating sustainable practices and smart city solutions into its operations and future developments. “Our sustainability goals not only enhance our operational efficiency but contribute to a sustainable future for Dubai, aligning with the city’s vision of becoming the world’s most future-ready city.”

A MODEL FOR FREE TRADE AND AMBITION

THE UAE’S EXTENSIVE NETWORK OF OVER 44 FREE ZONES HAS POSITIONED THE COUNTRY AS A LEADER IN DEVELOPMENT AND SPECIAL ECONOMIC ZONES. THESE HAVE BEEN INSTRUMENTAL IN ATTRACTING FOREIGN INVESTMENT AND FOSTERING ECONOMIC DIVERSIFICATION

100% FOREIGN OWNERSHIP

100% REPATRIATION OF CAPITAL AND PROFITS

FAST AND EASY BUSINESS SET-UP PROCEDURES

DEVELOPED BUSINESS COMMUNITIES

NUMEROUS OPTIONS AT COMPETITIVE COSTS

100% EXEMPTION FROM CUSTOMS DUTY

EASY REGIONAL, GLOBAL MARKET ACCESS

MODERN AND SOPHISTICATED INFRASTRUCTURE

THE WORLD’S NEXT IPO HOTBED

AMER HALAWI, THE HEAD OF RESEARCH AT AL RAMZ

CAPITAL, TELLS GULF BUSINESS THAT GCC STATES ARE VYING FOR FINANCIAL INFLOWS, AND GOVERNMENTS ARE PULLING OUT ALL THE STOPS TO ATTRACT INVESTORS

By Kudakwashe Muzoriwa

The GCC’s robust economy has positioned the region as a beacon of hope in a challenging global initial public offering (IPO) in 2024. This trend has continued so far this year, with companies in the Middle East region raising $3.84bn from 24 offerings in H1 2024, according to the latest data from EY.

The region’s IPO pipeline remains robust, with an additional 16 private companies and seven funds intending to list on the MENA exchanges in 2024 across various sectors in the GCC region.

Saudi Arabia’s Riyad Capital, United International Holding Company, and Arabian Mills For Food Products Company, among others, have obtained approval from the kingdom’s capital market regulator. Saudi Arabia leads with 14 announced IPOs, followed by one company in the UAE. Beyond the Gulf region, Go Bus in Egypt also announced plans to list on the local exchange.

Here, Halawi gives insight into GCC’s equity market dynamics, the medium-term outlook for the IPO landscape, and initiatives being implemented to boost investor interest and listings.

GCC countries have bucked a global decline in listings. What factors are contributing to the resilience of the GCC IPO market amid this decline?

The GCC has been in a “rebirth” of sorts since the Covid-19 pandemic. Oil price is supportive at around $80 per barrel, with many credible economists expecting higher prices on the back of an upcoming commodity supercycle. The Saudi giant is waking up to a new economic and social reality. Infrastructure spending is unparalleled, with over $1tn dollars in the pipeline, and the energy transition is at play. I have dubbed this the regional ‘economic miracle’. Also, and more importantly, there is a more comprehensive, top-down realisation across the region that the

migration from emerging to more mature economies requires solid capital markets. GCC countries are now focused on equity issuances and IPOs to offer a broader, deeper, more compelling investment ecosystem through more investible instruments. Mind you, it’s not only about equities but also about fixed income, where bond issuances have been soaring from private and public entities alike. In other words, the Gulf region is competing to attract global capital, and what better way than to offer attractive new investment opportunities in the form of IPOs? All the while, new issuances have been mostly successful and lucrative, which fuels a virtuous cycle.

How do you see the IPO landscape evolving in the region over the next six months?

Considering the fundamental drivers above, and in the absence of a global shock such as a recession or a precipitous collapse in the price of oil, we see no reason for this trend to slow down.

IPO proceeds have totalled nearly $45bn since 2021, which is equivalent to a whopping Dhs165bn. This is quite substantial, even though the momentum is down from the peak of 2022. PwC said 13 IPOs raised $2.6bn in the second quarter of 2024 alone, up nearly 45 per cent compared to the corresponding period a year ago. Similarly, Sukuk activity is becoming noticeable with more than $10bn issued in the context of the compelling interest rate environments. Finally, we should not forget the secondary issuances, which totalled about $12bn from two companies alone – Saudi Aramco and ADNOC drilling. Altogether, one can safely say that primary activity in the GCC is healthy and should continue at a sustained pace.

Which emerging trends and sectors do you expect to shape listing activity in the GCC region?

Three main trends are emerging. Firstly, we are seeing a shift in asset class from equities to fixed income. The latest data from PwC shows that bond issuances exceeded equity issuances last quarter by a factor of four to one.

Secondly, this IPO tidal wave started in 2021 with mostly government-related names to kick it off. Now, we see more private companies of smaller size hit the market. This is especially true in the UAE, where the transmission mechanism from public to private is now taking place.

Thirdly, we are seeing more diverse sectors hit the market. This was already the case with the Saudi bigger sibling and is now a reality in the UAE. IPOs of industrial companies in petrochemicals (ADNOC) or utilities (Dewa and Empower) are giving way to smaller, technology-driven businesses such as Bayanat, Presight, Alef, or Phoenix, or even consumer stocks such as Spinneys or the muchanticipated LuLu Group.

Overall, the three main trends going forward should consist of diversification of asset classes, attracting a larger number of private businesses, and diversification of sectors, especially in technology and the energy transition.

How are the regulations and initiatives introduced by GCC states influencing local listings and attracting foreign investments?

GCC states are competing for financial flows. This means that they are doing everything to appear most attractive to potential investors. This includes promoting their stock markets through local and international roadshows or conferences or stepping up the online experience so that potential investors can open an account online nearinstantly and trade immediately.

The IPO subscription process has become frighteningly lean, where one can place large-size orders online in seconds. Other initiatives include the bundling of regional exchanges through hubs such as Tabadul, which allows seamless, one-stop, regional trading access. We should also mention the push for more research, more research access, and more transparency and disclosure on the part of issuers and regulators.

With all this and every exchange or company leader’s wish to reach the coveted MSCI inclusion grail, we point out that much remains to be done. Encouraging as it looks so far, the stock market journey is more akin to a marathon for issuers, investors, and regulators, with patience and diligence the real name of the game. Much has been achieved, yet much more remains to be done.

Today, for example, 80 per cent of listed companies in the GCC are research orphans with virtually no coverage, which speaks a lot about the need for more and better financial information. Other areas for improvement

include liquidity and traceability, the possibility of shorting stocks, and the wider availability of derivative products to enrich and enliven the offering and trading.

Lastly, as with every other sector out there, there should come a time for mergers and acquisitions, where bringing exchanges together will allow greater scale, better synergies, and boost efficiency.

How is investor sentiment towards listings in the Gulf region, particularly in Saudi Arabia and the UAE?

I would use a single metric to gauge investor sentiment – subscription levels to new issuances. This is a standard measure of how many dollars have been subscribed for every dollar on offer.

The numbers have been staggering, with multiples in the dozens, sometimes reaching 100 times. For example, an IPO where $1bn are offered could be over-subscribed one hundred times, therefore fetching up to $100bn in subscriptions in the order book and resulting in very small allocations in the end for every subscriber.

Retail investors must physically wire the money from their bank accounts to another account dedicated to the subscription, which means that money changes hands in very large amounts.

Large oversubscriptions equate to investor appetite. So far, investor appetite has been Gargantuan and is likely to remain so in the current context of high liquidity. This would change if market sentiment suddenly turned negative.

THE GCC HAS BEEN IN A “REBIRTH” OF SORTS SINCE THE COVID-19 PANDEMIC. OIL PRICE IS SUPPORTIVE AT AROUND $80 PER BARREL, WITH MANY CREDIBLE ECONOMISTS EXPECTING HIGHER PRICES ON THE BACK OF AN UPCOMING COMMODITY SUPERCYCLE.”

What opportunities do you see for local and international investors in the GCC IPO market?

Investors have had the chance to invest in IPOs and to make money nearly systematically. If new issuances continue and the market remains up-trending, there should be more opportunities for investors.

The slight reservation is that, with so much appetite and so much success, allocations can be rather small in the end, which means that IPO subscriptions do not end up tilting the balance of wealth. In other words, IPOs are not a way to get rich fast, as some might believe. Stock market wealth comes with diligence and patience.

DIGITAL LENDING ECOSYSTEM BUILDING A ROBUST

JAMAL SALEH, DIRECTOR GENERAL OF THE UAE BANKS FEDERATION (UBF), EMPHASISES THE NEED FOR A ROBUST AND INCLUSIVE DIGITAL LENDING ECOSYSTEM IN THE UAE TO SUPPORT ECONOMIC GROWTH AND FINANCIAL INCLUSION

IBy Neesha Salian

n this interview with Gulf Business, UBF’s DG Jamal

Saleh highlights the significant strides made by the UAE banking sector in embracing digital solutions and the potential of digital lending to bridge the financial gap for underbanked populations.

Saleh shares that the UAE’s regulatory framework, coupled with technological advancements, has created a favourable environment for the growth of digital lending. He emphasises the importance of collaboration between traditional banks and fintech companies in driving innovation and ensuring the safe and responsible use of digital lending platforms.

How is the UAE banking sector evolving to support the growth of digital lending solutions?

The UAE banking sector is undergoing a significant transformation to embrace digital lending solutions in Pic: Getty

response to the evolving demands of the end-users. With increased adoption of fintech and digital banking solutions and a favourable ecosystem for buy-nowpay-later (BNPL) and deferred payment options in e-commerce, much more personalisation is happening in the segment.

That said, customers increasingly demand more convenient, accessible, and personalised digital financial solutions. With further advancements in automating processes and improving risk assessment practices through artificial intelligence (AI), machine learning, and big data analytics, banks and financial service providers will be able to provide faster loan approvals, improved interest rates, and seamless application workflows.

A key driving force behind the robust growth in diversified lending services and the financial inclusion that has been achieved as a result of these has been the Central Bank of the UAE’s (CBUAE) FinTech & Digital Transformation Strategy, which aims to implement effective and balanced regulations and robust digital infrastructure that foster innovation in the financial sector, including initiatives that promote fintech and digital payments. This regulatory support has created a favourable environment for the growth of digital lending solutions.

What steps are being taken to build an inclusive ecosystem for digital lending in the UAE?

Building an inclusive ecosystem for digital lending in the UAE is being achieved by collaboration among various stakeholders, including banks, fintech companies, regulators, and technology providers. Our UBF member banks, under the direct supervision of CBUAE, are developing user-friendly digital platforms and collaborating with fintech companies to leverage their expertise in technology and innovation. Some of the steps being taken to create a robust and inclusive ecosystem include the recently introduced regulatory sandboxes that allow fintech companies to test new products and services in a controlled environment. At the same time, open banking initiatives are being perused, and banks and fintech companies are working together to develop data-sharing agreements to enable improved

risk assessment and enable more personalised lending decisions.

In what ways do you see digital lending helping to bridge the financial gap for underbanked or underserved population in the UAE?

Digital lending solutions offer a promising avenue to bridge the financial gap for the underbanked/ underserved population. Unlike traditional lending, digital lending platforms make it simpler

SOME OF THE STEPS BEING TAKEN TO CREATE A ROBUST AND INCLUSIVE ECOSYSTEM INCLUDE THE RECENTLY INTRODUCED REGULATORY SANDBOXES THAT ALLOW FINTECH COMPANIES TO TEST NEW PRODUCTS AND SERVICES IN A CONTROLLED ENVIRONMENT.”

and easier to access credit. For individuals with limited credit history, digital lending can provide an opportunity to build a credit history. Meanwhile, digital financing provides financing access to SMEs that not only address immediate finance challenges but also pave the way for a more inclusive and sustainable future for small and medium-sized businesses. With online shopping sales expected to reach $9.2bn in 2026, UAE’s flourishing e-commerce market presents a significant opportunity for embedded finance solutions like BNPL options and integrated payment gateways.

How can digital lending solutions contribute to financial inclusion and economic growth in the region?

By providing access to credit, digital lending provides individuals with flexible financing options that may support them to start a business, invest

ONLINE SHOPPING SALES EXPECTED TO REACH

$9.2BN IN 2026

EMERGING TECHNOLOGIES LIKE AI AND BLOCKCHAIN WILL BE INSTRUMENTAL IN SHAPING THE FUTURE OF DIGITAL LENDING