7 minute read

Social

COMMENT

Zaib Shadani Founder and managing director of PR and Video production agency Shadani Consulting

Going viral

Here are three successful viral campaigns to take inspiration from

23.4

million+

posts to-date and no signs of dying down

02

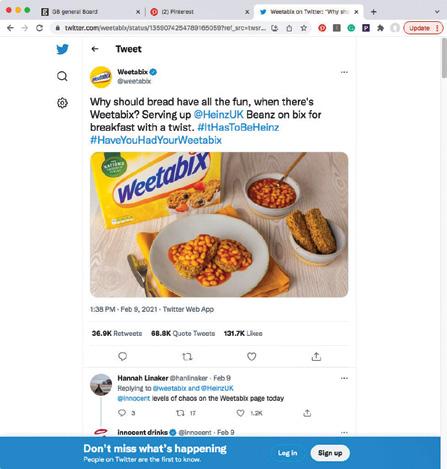

WEETABIX AND BAKED BEANS Weetabix caused a national uproar when it suggested that there was a new way to eat breakfast. The post from Weetabix’s Twitter account, featuring an image of Weetabix covered in Heinz Baked Beans, with the caption: “Why should bread have all the fun, when there’s Weetabix? Serving up @HeinzUK Beanz on bix for breakfast with a twist,” set Twitter ablaze with reactions from millions of people, including major brands such as Dominos, Amazon and YouTube, all weighing in with their opinions and trying to insert themselves into a trending debate.

Every marketer’s dream is to have content go viral. Not only does it help increase sales, but it also enables brands to have more recall, visibility and awareness. There are no rules on how to make content go viral, but there are a few tips and tricks that can increase the chances. Viral campaigns can’t be forced, they happen organically and are the result of connecting with audiences on a personal level. If you are timely, relevant and authentic, with a dash of individuality, uniqueness and good storytelling, your chances are much higher on achieving success. Here are three of my favorite campaigns that show us exactly how it’s done.

01

APPLE’S #SHOTONIPHONE CAMPAIGN Apple launched its #ShotOniPhone campaign on Instagram in March 2015 and no one could have predicted the endurance and far-reaching success of the campaign. The campaign urges users to show off their iPhone’s camera features via the hashtag and the best images are displayed on Apple’s Instagram account, its website and on billboards around the world. Even now, in 2022, the hashtag remains popular and is going strong, with over 23.4 million posts to-date and no signs of dying down.

Apple has also been able to capitalise on the popularity of user-generated content (UGC) through its #ShotOniPhone hashtag and continues to encourage people to share their photos and experiences. It comes on the back of a simple hashtag with an even simpler premise. A good UGC campaign is one of the most cost-effective and strategic ways to secure brand awareness and ensure a continuing roster of content with zero investment in its creation. This is one of the most successful viral campaigns for Apple and demonstrates the longevity of a campaign that has truly connected with audiences.

131,000+

likes

68,000 +

The genius of this campaign was the fact that everyone had an opinion and arguably, not since pineapple on pizza has there been such a polarising debate. Even Piers Morgan jumped on the bandwagon and tried it out on live television. With more than 131,000 likes and 68,000 retweets, even people who were not aware of the breakfast cereal became aware of the controversy and as a consequence, the brand itself – demonstrating the tremendous power of a campaign going viral.

03

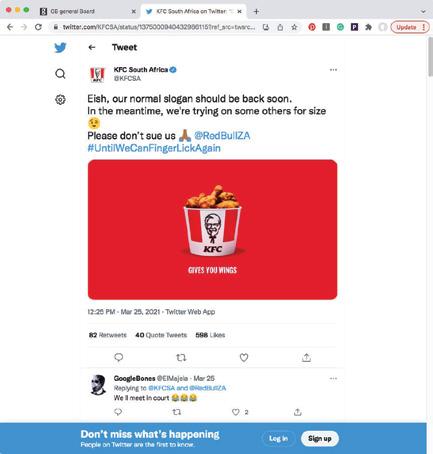

KFC TAGLINE CAMPAIGN During Covid-19, KFC’s slogan of ‘Finger lickin’ good’ came under scrutiny for being insensitive to the needs of the times. But KFC South Africa’s social media team turned the challenging situation into marketing gold by taking a unique and humourous approach – they decided to “borrow” other brands’ taglines such as using Red Bull’s famous tagline of ‘Gives You Wings’ under a bucket of KFC chicken.

By tagging the brands that the team was ‘borrowing’ the taglines from, KFC ensured that it kept the conversation going while engaging in cross-brand promotion. Most importantly, the strategy ensured that the brand was top of mind for its humour, rather than other reasons. KFC also took it further with its hashtag of #UntilWeCanFingerLickAgain, asking followers to suggest which other slogans would work best, leading to a number of fun and ridiculous comments. This created more momentum and added life to an already successful viral campaign. ANALYSIS

Changing carts

The how and where of consumer spending is transforming, driven by digital trends, writes Aarti Nagraj

No one anticipated at the start of the pandemic in early 2020 that we would be at this point in 2022. The global economy has seen tumultuous change, with consumer habits and preferences morphing rapidly to adapt with this evolution.

One major trend that has undeniably touched most of us – if not all of us – is the shift to digital. While the pandemic did play a huge role in leading to that change, digital is managing to maintain part of that stickiness, especially in retail, even as the world gradually learns to live with the Covid

88%

of countries saw a surge in the subscription of things in 2021

crisis. Shopping online is no longer a fad, or something done as a last resort – it is the preferred option for many consumers, mainly youngsters.

In its recently released Economy 2022 report, the Mastercard Economics Institute found that up to 20 per cent of the digital shift in retail is set to remain. “Digital agility has been a key factor for stronger revenues throughout the pandemic. At the core of this digital shift has been e-commerce,” it said. While during the pandemic’s peak in 2020, the global share of online spend was roughly 4.3 percentage points above the pre-crisis trend, it did drop to 0.3 percentage points as of September 2021 as people broke out from lockdowns and rushed back to physical stores.

“Overall spending levels for both in-person and online spend remain at unprecedented highs, and the big question as we head into 2022 will be how the composition of online spend settles following the unwind in savings and fade in fiscal support,” the report stated. It found that the share of online transactions increased more in countries with higher pre-pandemic levels of digital maturity, further widening the digital divide globally.

Looking at the UAE, the online share of spend in the retail sector is on par with the pre-pandemic trend, the report found. It also highlighted another new model gaining traction in the country and globally.

“With the global shift to digital showing significant momentum, we discovered a growing trend: the rise in e-commerce subscriptions, such as wine clubs, weekly grocery delivery and clothing. According to our analysis of the subscription economy

IN THE UAE...

Dhs295bn

Excess savings expected

1.5x

increased factor of retail subscriptions as a share of total spend from 2020 to 2021 across 32 markets, nearly 88 per cent of countries saw a surge in the subscription of things in 2021 compared to the previous year,” the report added.

This new model was prominent among car companies, virtual workout partners, bike rentals and pet services. In the UAE, retail subscription share of total spend increased by a factor of 1.5x from 2020 to 2021.

“I think that even before the pandemic, people were creating businesses online first, and then in store, and that’s just a trend that’s been accelerated because of the crisis,” Bricklin Dwyer, Mastercard’s chief economist and head of the Mastercard Economics Institute tells Gulf Business. “So because the supply of everything is just shifting online, it’s going to drive a lot of that demand to be stickier. I think that right now we are going to see some of that over-rotation which is, ‘let’s get back out there, let’s have brunch with friends etc’, but then we are going to cut that proportion of spending back.”

The Mastercard report also anticipates major movement this year in terms of consumer saving and spending. “The biggest shift to watch in 2022 will be in household savings – and its potential impact on consumer spending. Fueled by stimulus funds, households have been saving more than they typically do as they have paid down debt, invested, or just put money in the bank. How quickly consumers return to old saving habits is critical for understanding the growth outlook. Notably, the global household savings rate almost doubled in 2020-2021 compared to before the pandemic,” it stated.

Consumer spending of built-up savings could contribute an additional three percentage points to global GDP growth in 2022. In the UAE, excess savings are expected to reach about Dhs295bn. “How quickly or slowly consumers spend from their savings will have a ripple effect on the global economy,” the report said.

“Globally, economic growth, vaccine advances and digital transformations that have made businesses large and small more resilient, continue to shape the future. It is against this backdrop that we anticipate consumer demand – and spending power – to grow and the experience economy to reemerge next year,” Dwyer added.