35 minute read

New year resolutions

Leading brands throw weight behind Road Transport Expo – the industry’s newest and best show

Top players on board for RTX

Advertisement

By Hayley Pink

Road Transport Expo (RTX) is heading into the new year with a fantastic line-up of exhibitors confirmed for the three-day summer extravaganza promising to be “all about the truck”.

More than 60 leading brands are already on board for the brandnew industry event taking place from 30 June to 2 July at Stoneleigh Park, Warwickshire, with plenty more in the pipeline.

From truck and trailer manufacturers, through to specialist technology and equipment firms for all types of HGV operation, RTX will bring you everything you need to run your fleet in a single venue.

It will also feature topical seminars and workshops, alongside more than 10 different exhibition zones (see box), live demonstrations, ride and drive opportunities, show and racing truck displays, and much more.

“We have been delighted with the enthusiastic industry response to the Road Transport Expo,” explained Road Transport Media divisional director Vic Bunby.

“It is gearing up to be an unmissable event for anyone who works in the road transport sector and we are looking forward to sharing regular updates with you as the show preparation progresses.”

Free ticket registrations will open at the end of this month, so make sure to check out the dedicated show website at roadtransportexpo.co.uk and register your interest to receive information as soon as it is released.

Everything you need – under one roof!

RTX aims to have something on offer for all road haulage divisions, from city deliveries through to specialist tankers and recovery vehicles. Take a look below to see those zones already confirmed, with more likely to be added as the show grows.

n Urban zone, in association with Freight in the City Expo n Tipper zone, in association with Tip-Ex n Tanker zone, in association with Tank-Ex n Trailer zone n Waste and recycling zone n Cranes and materials handling zone n Heavy haulage zone, in association with Heavy Torque n Recovery zone, in association with On Scene n Convoy in the Park and truck racing zone n Used trucks and auction zone

VOX POP What are your new year business resolutions?

Charlie Shiels, CEO, ArrowXL

The biggest item on our wish list for 2022 is a review of the C1 entitlement to allow car drivers to drive 3.5-7.49-tonne vehicles. The change in 1997 has had a devastating effect on the driver population and it needs to be addressed. A mild winter would be a massive bonus too!

Our immediate priorities focus on continuing to look after our people in terms of their physical and mental health. The last 22 months have had a massive toll on everyone's well-being, regardless of role or position in our company.

The global supply chain issues have also had a huge impact on operations. The requirement to plan for operational stability is massively impacted by stock shortages, disruption and availability.

Caroline Green, chief executive, Pallet-Track

My immediate priority is to ensure that our team stay safe and well and the business continues to operate as efficiently as possible given unpredictable absences and the resulting uncertainty around manpower planning.

Perpetuating the optimism of our team as we start the new year is key. Volumes have started high and we need to continue to deliver high levels of service.

The past two years’ lockdowns have impacted our ability to meet our members and customers face-to-face and my burning hope is that we can get back to a more ‘normal’ situation as soon as possible. The use of video conferencing has been absolutely invaluable, but nothing can build relationships like meeting in person.

Bob Terris, chairman, Meachers

Our objective is to continue with the progress made in 2021 and to further increase employee pay rates, in addition to the three increases given since June 2021. We also want to complete the replacement of equipment still in AFS livery acquired in March 2021, continue to increase charges on a six-monthly basis in addition to fuel surcharges and look for another acquisition on the freight forwarding side

Kevin Buchanan, group CEO, Pall-Ex

Our principal objectives are to deliver market-leading service, be the employer of choice, supply market-leading technology and sustain a market-leading brand position and sales performance. We will also develop partner relationships and look to achieve financial performance in line with shareholder expectations. All these areas have significant investments planned.

Lesley O’Brien, director, Freightlink Europe

We intend to build on our massive growth in 2021. Not only does quality service rely upon quality equipment– replacement delivery dates is a current issue – but our transport and office teams are our most important asset.

One immediate focus is therefore to strengthen our driver workforce, minimising reliance on any agency workers, whilst strengthening relations and collaborating with those driver agencies who are committed to providing quality drivers and service.

These are sadly few and far between. I shall certainly be lobbying for the regulation of driver agencies.

Moreton Cullimore, MD, Cullimore Group

For the construction-linked side of our transport it’s all about being mindful of costs. Adverse weather means at this time of year we see a dip in volume of sales on aggregates and concrete which makes those vehicles less busy. So it’s about control of costs and working as effectively as possible and trying to grab those extra loads where possible.

We’ve also got to prepare for the very busy period in the few weeks before Easter – or as soon as the weather breaks.

Top tips on how to avoid an unwelcome date with your traffic commissioner at a public inquiry Keeping your nose clean

By Charlotte Hunt

As we begin the new year in the hope that 2022 will allow ‘business as normal’ – at least within the parameters of the new normal we are now accustomed to – it seems wise to look at some of the common pitfalls seen at public inquiries (PIs) in 2021 for any lessons that can be learned.

PIs continued to run throughout last year, with attendance being required in person, virtually, or some mix of the two. It is anticipated that a mix of remote and in-person hearings will continue to be used. The DVSA has, helpfully, been able to attend virtually, as is commonplace in the criminal courts for police officers.

Notification of changes

One issue that arises frequently is failure to notify the traffic commissioner (TC) of any material changes. These could be anything from a change of financial circumstances to altered maintenance arrangements.

This seemingly simple undertaking remains a point of confusion and is often shown to be out of mind for operators during periods of change or disruption.

Material changes must be notified to the TC within 28 days, however. Failure to do so is a breach of an operator’s undertaking and could result in regulatory action. For peace of mind and additional security, it is sensible to send any postal notification via recorded delivery and to keep a copy for your records.

Regularly going back to basics and reviewing the core undertakings under which your licence is held (and can be taken away) is also a helpful exercise to ensure you comply with your key responsibilities and obligations.

Financial standing

The pandemic has provided both growth opportunities and challenges for operators. Those servicing certain industries have seen a decrease in work that is only now starting to improve.

Whatever their situation, operators must ensure they maintain the appropriate financial standing for their licence type and number of vehicles authorised, or risk facing regulatory action. The availability of finance is a continuing obligation throughout the lifetime of a licence.

For operators who find themselves in difficulty, a useful tool is the ability to apply for a period of grace. Some operators have missed out on proactively seeking this, with another event resulting in a call-up to PI during which it comes to light that the required levels have fallen.

Reminding yourself to regularly monitor the ‘available’ amount and making sure you understand the calculation and the definition of ‘available’ will allow operators to adhere to the undertaking and also gives them the opportunity to request a period of grace without risk of regulatory action.

Bridge strikes

It is incumbent on any operator to ensure its vehicles are operated without unacceptable risks to road safety, including the need to prevent bridge strikes.

Back in 2020, the senior TC wrote to all operators, but bridge strikes continue to put many operators in the inquiry room, sometimes alongside drivers and conjoined with a driver conduct hearing.

Appropriate route planning is important, alongside ensuring any sat-nav system is fit for purpose within a commercial fleet and can warn drivers of all the critical points on routes.

Equally, ensuring systems are up to date with the appropriate road network information and height restrictions is key to maintaining compliance. But operators must not fall into the trap of using sat-nav equipment as a substitute for route planning.

Risk-based approach

You will often hear TCs discuss taking a risk-based approach. Each business has different combinations of vehicles, work types and drivers, and therefore come with a unique set of risks – so building awareness of these risks and understanding how to protect against them is critical.

No operation is perfect, but you can use any challenges or problems as opportunities to learn and test your own systems.

You do not want to be in a situation where the worst happens and there was a risk that you knew about, but failed to take action over. ■ Charlotte Hunt is a solicitor at

Weightmans

Viewpoint Better the devil you know?

Steve Hobson Editor Motor Transport

If like me you are thoroughly bored of ‘Partygate’ – the media’s obsession with whether or not Boris Johnson knew of/approved/attended a couple of gettogethers in No 10 during lockdown – then maybe we should think again. With a huge majority in Parliament, does it really matter if the Tories ditch the PM like they did with Teresa May and replace him with someone else? Well it might.

Whatever his faults, Boris is a serial election winner and with Labour leader Kier Starmer’s poll rating now ahead of the PM it is not inconceivable that ditching Boris over an ill-timed party could open the door to a Labour election victory in 2024 or even sooner.

The transport industry is hardly a fan of current transport secretary Grant Shapps and his public falling out with former RHA chief executive Richard Burnett is widely believed to be a major factor in the latter’s departure last year.

Shapps claims to have introduced no fewer than 32 measures to address the HGV driver shortage, including reducing the waiting list for HGV driving tests from 55,000 to 9,000 and creating 4,700 temporary visas for EU drivers to work in the food industry. The education department is also putting £34m into HGV driver training bootcamps.

Whether any of these will actually address the fundamental reasons behind the driver shortage remains to be seen – more important issues such as driver pay and conditions are not within Shapps’ or any other government minister’s remit.

But would you prefer current shadow transport secretary Louise Haigh MP, a former Unite shop steward and a young rising star of the Labour party, to take charge of the DfT? We don’t know her stance on key issues like the driver shortage as she has only been in post a couple of months, but sometimes maybe it is a case of better the devil you know.

Weighing up the benefits of freeports

Sophie Said Partner Menzies

Sean Turner VAT specialist Menzies

In March 2021, the government announced eight prospective freeport locations, all due to be operational by the end of the year – though not all of the low-tax, low-regulation zones are open for business yet. Among the first to open was Teesside, which started operating on 19 November; while Freeport East, which includes the Port of Felixstowe and Harwich International, is due to start operating in the near future.

For transport and logistics businesses, it is important to weigh up the pros and cons of relocating to a freeport, for example in terms of the flow of goods in and out of any specific area.

Freight forwarders already working with customers near one of the nominated freeport locations could benefit by creating a facility within the ‘zone’, facilitating the import of goods into the country for processing or manufacture, ready for re-export if necessary, without incurring significant tax and customs duty liabilities.

However, there are other costs to bear in mind: many businesses have already had to invest in additional staff and training to comply with new Border Operating Model procedures and rules of origin requirements following Brexit, for instance.

With more freeports now coming online, freight forwarders must decide what to do now. From 1 January, they could no longer take advantage of the delayed declarations procedure for imports of non-controlled goods from the EU, and as well as being ready to make full frontier declarations, those firms that have yet to submit supplementary declarations for any delayed declarations over the past year will have to do so within 175 days of import.

Completing customs declarations in a freeport should be less of an administrative burden than doing them outside, and the government has published guidance to assist companies in their preparations. But operators should consider what other benefits locating in a freeport could bring them in the form of enhanced capital allowances and other tax reliefs.

Weighing up the benefits of locating in a freeport is not a straightforward matter and businesses may need to seek professional advice. They might benefit from more tax relief and allowances, lower tariffs and reduced red tape, but they will also need a robust customer base with links to the site to generate sustainable revenues for the long term.

Got something to say?

The newspaper for transport operators

To contact us: Tel: 020 8912 +4 digits or email: name.surname@roadtransport.com

Editor Head of content Steve Hobson 2161 Tim Wallace2158

Events and projects editor

Hayley Pink 2165 Group production manager Isabel Burton Layout & copy editor Nick Shepherd Senior display sales executive Barnaby Goodman-Smith 2128 Event sales Tim George 0755 7677758 Classified and recruitment advertising rtmclassified@roadtransport.com

Sales director Emma Rowland 07900 691137

Divisional director MT Awards Managing director

Vic Bunby 2121 Katy Matthews 2152 Andy Salter 2171

Editorial office Road Transport Media, First Floor, Chancery House, St Nicholas Way, Sutton, Surrey SM1 1JB 020 8912 2170

Free copies MT is available free to specified licensed operators under the publisher’s terms of control. For details, email mtsccqueries@roadtransport.com, or call 01772 426705

Subscriptions

Email:customercare@dvvsubs.com Quadrant Subscription Services, Rockwood House, Perrymount Road, Haywards Heath, West Sussex RH16 3DH

Rates UK £156/year.Cheques made payable to Motor Transport. Apply online at mtssubs.com

Registered at the Post Office as a newspaper

Published by

DVV Media International Ltd ©2022 DVV Media International Ltd

ISSN 0027-206 X

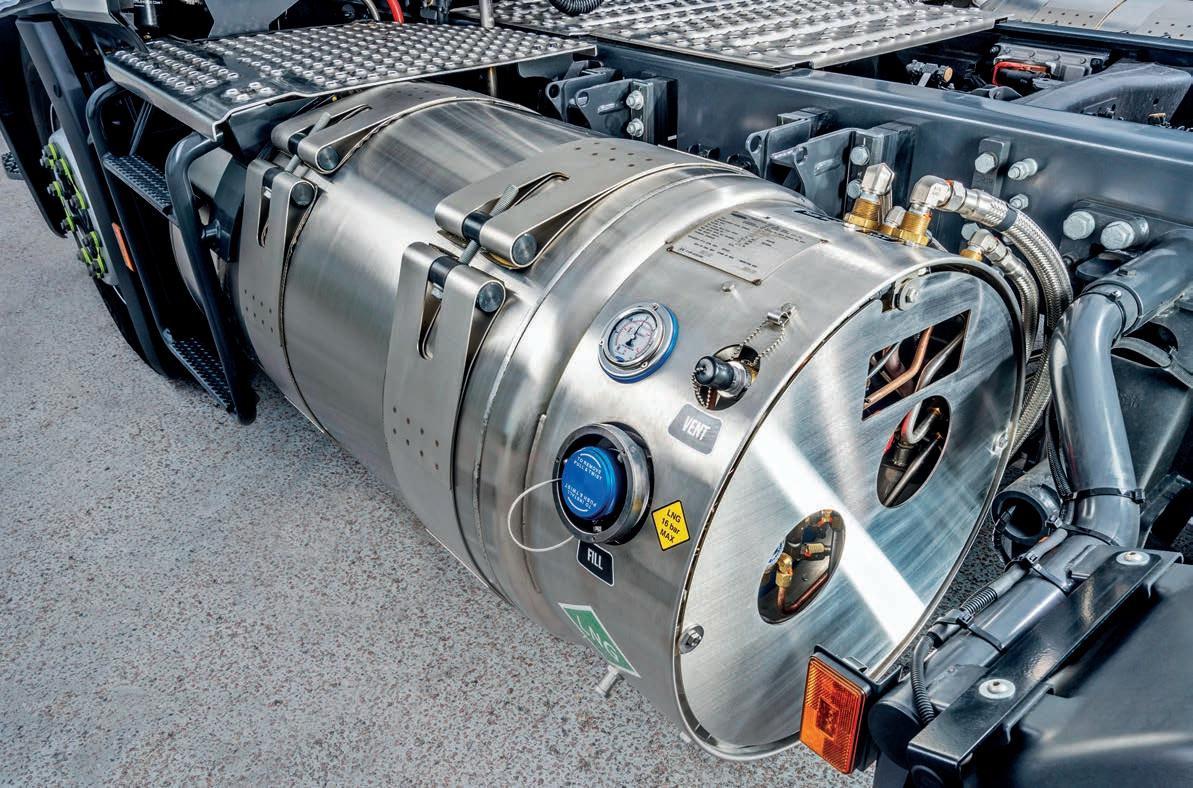

Hitting the gas? Hitting the gas?

CNG and LNG have been around for many years but operators who CNG and LNG have been around for many years but operators who have gone the gas route may be wondering if it was really worth it, as have gone the gas route may be wondering if it was really worth it, as costs remain high and other alternatives look set to take over. costs remain high and other alternatives look set to take over. Steve Banner reportsSteve Banner reports

With zero-emission battery-electric trucks going into service in modest but steadily growing numbers, hauliers who have instead opted for CNG (compressed natural gas) or LNG (lique ed natural gas) as environmentally friendly fuels might be forgiven for wondering if they friendly fuels might be forgiven for wondering if they have blundered.

DAF’s unveiling of a prototype XF that runs on that runs on hydrogen as a combustion fuel is hydrogen as a combustion fuel is unlikely to allay their concerns. Nor is Daimler Truck’s plan to start delivering hydrogen fuel cell trucks to UK customers from 2025.

To these developments can be added rising interest in HVO – hydrotreated vegetable oil – as a direct replacement for fossil diesel.

It is made from waste products such as animal fats. Using it cuts well-to-wheel CO2 emissions by 90% or more, say its advocates, and requires no engine requires no engine modifications.

As if all this were not enough, clean transport campaign group Transport & Environment has produced a report arguing that LNG trucks are no better for the climate than their diesel-powered counterparts; and pollute the atmosphere to a far greater extent than the manufacturers producing them claim. the manufacturers producing them claim.

In response, the Natural and bio Gas Vehicle Association Europe has issued a point-by-point rebuttal

Iveco sells Daily and Eurocargo models that can run on CNG along with versions of X-WAY and S-WAY that

Scania offers a wide range of CNG and LNG models, and has just unveiled a 6x2 LNG tractor unit.

FILL ’EM UP: Gasrec should have 18 refuelling sites in place by the end of 2022, of which half will be public-access

PUMPING IT:

Scania offers a wide range of gas models, including a new 6x2 LNG tractor of its findings, arguing that they are not a valid assessment of trucks primarily designed for long-haul work. “Nobody is arguing that gas vehicles should be used on urban distribution,” observes independent transport industry consultant and former senior Iveco executive Martin Flach.

Not all manufacturers market LNG and CNG vehicles in the UK.

Iveco sells Daily and Eurocargo models that can run on CNG along with versions of X-WAY and S-WAY that can use either of the fuels. Amazon is taking delivery of 1,064 CNG S-WAY tractor units for use around Europe.

Volvo markets FHs and FMs with 420hp and 460hp engines that can run on LNG in the UK, but nothing that can use CNG. Asda has recently taken delivery of 202 FH LNG tractor units.

Scania offers a wide range of CNG and LNG models, and has just unveiled a 6x2 LNG tractor unit.

Food for thought

The environmental credentials of both fuels depend on the feed stocks used to produce them, and how sustainable they are. Bio-CNG and bio-LNG made from products such as food waste and agricultural waste have a strong green story to tell, argues Jorge Asensio Lopez, UK medium and heavy country product manager and alternative propulsions lead at Iveco. “Biomethane fuels unlock the door to a well-to-wheel reduction in CO2 emissions of anywhere from 80% to 120%, which means they can be carbonnegative,” he contends. “Furthermore, if you are

using methane from farm slurry pits, then you are avoiding methane slip.” This is where unburned methane escapes into the atmosphere.

“Particulates are down by up to 90%, while NO2 is down by from 80% to 85%,” he adds. NO2 – nitrogen dioxide – is one of a group of harmful gases known as nitrogen oxides (NOx).

Some businesses are using their own waste to power their trucks. By-products from the distilling process are being used to help produce the CNG that fuels three Iveco tractor units hauling Glenfiddich malt whisky, for instance.

What AdBlue?

Engines powered by bio-CNG or bio-LNG do not require AdBlue to help control their emissions. Gasrec, which supplies the fuels and builds refuelling stations that can dispense them, makes the point that they are also around 50% quieter than diesels; good news for driver stress levels, and for out-of-hours delivery work.

Bio-LNG’s CO2 story is less impressive than bio-CNG’s, admits Asensio Lopez, because it has to be delivered by tanker to the haulier’s premises – the tanker might be diesel-powered – and energy is required to keep it cold. It should be stored at -162C and protective clothing, including gloves, a face mask and goggles, should be used when it is being dispensed.

Bio-CNG is injected into the gas network, with the equivalent volume of gas drawn off by the user. Both it and bio-LNG are far less likely to be pilfered than diesel.

Bio-LNG’s greater energy density means that a 4x2 tractor unit operating at 40 tonnes using it can typically travel 1,600km before it needs refuelling, says Asensio Lopez. With bio-CNG the range drops to 500km to 600km, he adds.

Run a 6x2 on bio-LNG at 44 tonnes and the range between fuelling stops is likely to be around 750km, he suggests.

Much depends on the tank configuration and capacity however. The aforementioned Scania 6x2 unit is equipped with a pair of LNG tanks, says UK sales director Vincente Connolly; 187 litres/73kg on the offside, and 313 litres/122kg on the nearside. “Our trials show that distances in excess of 640km are achievable,” he comments.

Operating a viable 6x2 unit on bio-CNG used to be impossible because there was insufficient space for the tanks. Light but strong composite tanks at a pressure of up to 250 bar are now available, however, which can deliver a range of up to 700km.

All the ranges are of course much longer than those claimed for battery-electric trucks.

The availability of bio-CNG and bio-LNG at publicly accessible locations is limited. Asensio Lopez knows of eight that offer the former and a mere two that offer the latter, with none in Scotland, Wales or the west of England at the time of writing.

Changing picture

However the picture is changing. With seven sites already in operation, CNG Fuels is about to open what it says will be the world’s largest public-access biomethane refuelling station at Avonmouth. It will be capable of replenishing 80 trucks per hour from 14 high-speed dispensers, says the company.

CNG Fuels is also opening a public-access biomethane refuelling station near Glasgow. Says sales and business development director Peter Eaton: “We should have 14 stations by the end of 2022; we’ll be opening one a month in 2023; and a further 12 in 2024.”

Gasrec chief commercial officer James Westcott says: “By the end of 2022 we’ll have 18 refuelling sites. ➜ 14

WASTE NOT, WANT NOT:

(Inset) By-products from the distilling process are being used to help produce the CNG that fuels three Iveco tractor units hauling Glenfiddich malt whisky

Half will be open-access, while half will be at operators’ depots.”

Gasrec is building one for Ocado which is scheduled to open in 2022, and will be used to refuel the 10 CNG tractor units already operating from the site at Dordon, near Tamworth in Staffordshire.

Ocado Group fleet operations manager Graham Thomas comments: “We’re committed to transitioning away from diesel and the new facility will allow us to get more gas trucks on the road.”

Food supplier Moy Park has ordered 50 bio-LNG 6x2 Stralis tractor units from Iveco. Logistics director Hugh Nicholson says: “This is a huge step forward in transitioning our core fleet of 120 tractor units to gas by 2023.

“Our in-house trials have demonstrated that vehicles running on biomethane reduce CO2 emissions by more than 80%.”

Other biomethane users include baker Warburtons, parcels giant Hermes, Royal Mail and John Lewis.

Doing the sums

Hauliers contemplating installing their own refuelling points will find that they do not come cheap, although the cost can be offset by selling biogas to other operators who have gone the bio-CNG/bio-LNG route. A bio-LNG facility can leave you with a bill totalling £300,000 to £400,000 or more, while a bio-CNG set-up could cost up to £1m. “You may be able to fund these facilities as part of the price you pay for the gas you use though,” says Flach.

At 24.7p, the litre-equivalent duty rate on biomethane is significantly lower than the 57.95p-per-litre rate levied on both fossil diesel and biodiesel. Says Roadgas marketing director Becky Rix: “The differential is to be maintained until 2032.”

The duty concession has undoubtedly contributed to keeping biomethane price-competitive. In recent times bio-CNG has been 30% to 40% cheaper than diesel, with bio-LNG delivering almost as healthy a cost-saving.

Biomethane is not immune from global trends in gas prices however, which have been climbing ever upwards.

“The price of bio-CNG has doubled since last April,” one haulier told MT. “It’s now costing me more than diesel and I’m having to go back to customers and talk

GAS GUZZLERS: Though gas attracts smaller rates of duty, rising prices have left some vehicle operators needing to talk to customers about a gas price escalator to them about a gas price escalator.”

Diesel and biomethane prices have been at parity over the past couple of months, admits Eaton, but he believes the situation is temporary.

“We’re in the midst of a global energy crisis, and it’s not something we’ve been able to avoid,” he observes. “If you look at futures prices for 2022 though, it looks as though diesel prices will continue to be high but biomethane will come back down to where it was, with the 30% to 40% saving returning.

“From March/April of next year we should be back to where we were.”

Should biomethane prices remain at peak levels for many months to come, then it will of course extend the break-even point for trucks that run on it beyond the first or second year of ownership that has been regularly cited to date. The capital cost of such trucks remains high. A gaspowered Iveco costs around 20% more than its diesel equivalent, admits Asensio Lopez, and the uncertainty over residual values mean that it is usually written down to zero.

It also requires more servicing than a diesel. “Intervals are set at 90,000km compared with 150,000km,” he says. “Our gas engines are spark-ignition so the spark plugs needed changing, and the oil needs changing more regularly than a diesel’s oil.

“You also have to think about safety, and ensure there are no leaks in the system,” he adds.

Volvo’s LNG trucks employ compression ignition. “As a consequence they’re pretty much the same as a normal diesel truck so far as maintenance is concerned,” says a Volvo spokesman.

The higher cost of Asda’s Volvo FH LNGs means that the supermarket giant will be running most of them for 12 months longer than their diesel counterparts.

Asensio Lopez believes that bio-CNG and bio-LNG trucks are likely to be around for the next 10 to 20 years, by which point hydrogen may have become more of a mainstream option, either as a combustion fuel or in conjunction with fuel cells. CNG Fuels is already planning to allocate space for public-access hydrogen refuelling for trucks by 2025 to prepare fleets for a multi-fuel future. ■

Making moves

The double-whammy of Brexit and Covid-19 has forced a host of operational changes on Hellmann Worldwide Logistics. Steve Hobson got the lowdown from the firm’s UK head of road and rail Lee Costello

Although the UK completed its exit from the EU back in January 2020, the reverberations are still being felt for international operators like Hellmann Worldwide Logistics UK. In response, it has invested heavily in its customs brokerage capability for its own customers and third-party shippers, and has seen seismic shifts in its European groupage business in particular.

Lee Costello joined Hellmann as UK head of road and rail in May 2021 with 30 years’ experience in contract logistics and land transport, mainly with other German companies, as well as 17 years with the overland division of Swiss-based Kuehne+Nagel.

“The UK market has been impacted by a number of events – Brexit, Covid-19, driver shortages and the semiconductor shortage, which has led to a 14-month waiting list for new vehicles,” he says. “This is all starting to take its toll – while everyone talks about the driver shortage, I’m not sure we have the lorries to put them in.”

Hellmann carries just about any type of ambient product on its international groupage services and the export market has seen a sharp reduction in volumes since Brexit. The international groupage market (import and export) has fallen by 30% to 40%, and the freight leaving the country is in larger, less frequent consignments.

“We have customers moving away from a model of frequent dispatch direct to country,” Costello says. “We were collecting from customers every day, whatever they had for Europe, and it was very much scheduled runs into the EU with good transit times and a regular service.

“Export volumes have gone down, but the biggest change for our industry has been the patterns in the way it is shipped. Export customers are coming away from daily departures of small amounts of pallets to consolidated shipments.

“Rather than sending one pallet every day, where because of Brexit they would have to pay customs charges and go through the whole administration process of customs clearance every day, their supply model is now based on sending a consolidated load to one country in the EU where they have legal representation.

“They then clear one movement and release it for free circulation within the EU and carry out pan-European distribution from that point. So we are seeing a shift from daily small volumes into LTL and FTL movements, which impacts the groupage lines and vehicle utilisation.

“This in turn is putting more pressure on the number of vehicles needed to leave and come into the country.”

Adapt and survive

Hellmann’s scale and large presence on the continent means it has been able to offer the flexibility exporters require.

“We are still going as many times in the week, but are now mixing LTL with groupage and doing delivery offtrailer on the way to our European hubs. The frequency of our service is the same, there are just more drops and there is a different mix of freight,” says Costello. “The type of vehicle we use is quite country-specific. The Germans like drawbars, which gives us the ability to swap trailers in different depots. That works well because Germany is such a large market with so many injection points. The rest of Europe is very much on the 4m high, 13.6m mega trailer with tractors running a lower wheel height.”

As a pan-European operator, Hellmann is well placed to provide customers with the right routes of this new model.

“We work extensively with our customers remodelling their supply chains to find the best and most cost-effective solution,” says Costello. “It all depends where their product is going. For example, if we have a customer where 70% of their product is going to France and 30% to Germany, Italy, Portugal and the rest of the EU, it is more cost-effective to ship everything to France and have domestic distribution for 70% of the product and panEuropean distribution for the rest.

“The advantage of Hellmann is that we are a member of a number of European networks and have partnerships with large established carriers within countries.”

Home comforts

Since 2014, Hellmann has partnered with Pallet-Track to provide a European distribution service for the pallet network’s UK members.

“Being part of Pallet-Track, and being its European provider, we work very closely with its 80-plus members,” says Costello. “That enables domestic and European shipments to be collected on one vehicle. There is a larger take-up of that service now through necessity and there is a big advantage for Pallet-Track in having Hellmann as part of the group. We are seeing some great solutions being built with customers.”

Most of the single points of entry into the EU are unsurprisingly in France, Benelux and Germany, the latter being Hellmann’s home turf and its largest market. The company also has a base in Barcelona from where it covers the whole of Spain and a road operation in Poland.

“Those three are our largest markets and in France, Italy and Benelux we have well-established partnerships,” says Costello. “That goes both ways and we are the agent in the UK. Hellmann is moving to consolidated deliveries to the UK and then looking for break-bulk shipment of parcels, or they send one trailer a week and then have distribution around the UK. The transit times are affected, but it is time versus the cost of multiple customs clearances per day.”

The number of UK hauliers with international licences has been in steady decline for many years, and Brexit has seen more operators withdraw from the market.

“There are fewer players in the groupage market as this has slowly reduced over time,” says Costello. “The vast majority of the line hauls between depots are run by European carriers. The 15% of road freight movements managed by UK companies is either project work, full load or dedicated specialist work.”

Even before Brexit the UK had a large imbalance in its visible trade with Europe, meaning foreign vehicles bringing loads in can carry exports at backload rates, making it difficult for UK-based international operators to compete.

“It is a backload market and we have to keep our rates within that range,” says Costello. “Our main competitors are the likes of DSV, Europa, K+N and Dacher.”

PAPER CHASE: Customs woes have driven an increase in consolidated shipments, says Costello

Domestic help wanted

While UK domestic hauliers are struggling to find enough drivers, the appeal of long-distance international driving remains, but these jobs are scarce.

“We have seen a large number of EU drivers leave our shores after Brexit,” says Costello. “Changes in EU minimum wages and restriction on how long drivers can operate away from their base has resulted in drivers returning to their home countries to work. This has further contributed to the UK driver shortage.”

To help ease the shortage the government has temporarily extended cabotage until 30 April 2022 to allow unlimited movements of foreign HGVs within Great Britain for up to 14 days after arriving in the UK on a laden international journey. This is a move the RHA has called “cabotage sabotage” of UK hauliers – but is something Costello welcomes.

“That affects our full-load and part-load business, which we do extensively on a chartered basis and on our own equipment,” he says. “Short term it will help and I welcome any action from government to reduce the driver shortage, whether that be training or welfare to make it a career of choice. I support relaxation of cabotage on a short-term basis. We have dedicated ourselves in 18 months to growing our relationships with our European partners to increase our capacity.

Bigger picture

“To help the domestic shortage I don’t think it’s a bad thing, although I understand why the RHA are totally against it. They see it as a shortcut when it comes to taxes, minimum wages, etc.

“But if you pick up the phone to any local haulier, they can’t help us with a full load, so what’s the alternative short term? They aren’t losing business – they can’t do it anyway because there isn’t a vehicle to be found.

“Short term it a good option and enables us to offer our customers a solution within a reasonable lead time.” The capacity shortage tightened as Christmas 2021 approached and it seemed almost certain that something would have to give.

“Everyone was concentrating on the supermarkets to make sure we had everything on the shelves,” says Costello. “But it isn’t just food that keeps the country going, it is every sector. Toilet roll and turkey are important, but if we don’t do something drastic like relax cabotage there will be impacts on all supply chains.”

To secure Christmas shifts, some retailers were offering high wages and even signing-on bonuses to drivers, which had knock-on effects on other operators.

“What we used to find was that the agency driver market was always impacted at Christmas as the supermarkets could offer better wages. So all the agency drivers would go and work for the supermarkets and we would struggle to get temporary labour,” says Costello. “What we are seeing now is drivers being tempted away by large increases in salary – and not just for peak.” n

TWO YEARS ON, BREXIT STILL CAUSING CUSTOMS DELAYS

There are some delays with customs clearances as shippers are still getting to grips with post-Brexit procedures and paperwork.

“Delays in clearance are still absolutely having an impact,” says Costello. “That is impacting more on the full-load, direct delivery market rather than scheduled groupage lanes which have settled down now. Most people are now using inland clearance so the trucks don’t get affected – it just causes a lot of administration and hold-ups in the last mile.”

In the early days of Brexit when there was a lot of confusion about customs documentation among shippers, groupage loads could be held up if just one consignment had problems with paperwork.

“Historically that used to happen when people were using border clearance, but the majority including Hellmann with AEO [Authorised Economic Operator] status and inland clearance get round that because we can clear on-trailer,” says Costello. “Our depots and hubs are bonded so we can drop the freight, so not everyone is affected by the guilty party who has to have their goods held while we sort out any irregularities.”

Hellmann has made a substantial investment in its customs brokerage division to help it and its customers cope with Brexit.

“We are now working as a third-party broker as much as for our carried freight,” says Costello. “We are finding a lot of customers with smaller shipments struggling in that space. We now have over 60 dedicated specialists in that team so we can offer a service to customers even though we are not moving their freight.”