A MOTOR TRANSPORT SUPPLEMENT IN PARTNERSHIP WITH

A MOTOR TRANSPORT SUPPLEMENT IN PARTNERSHIP WITH

6

Keynote presentation

Justin Laney, fleet manager at John Lewis Partnership, calls on truck manufacturers to make carbon-zero vehicles last longer and on the government to provide better support in terms of policy and regulation

Summit news

Scania sets itself the goal of ensuring 50% of the trucks it sells by 2030 run on electric power; DPD initiative includes plan to move line-haul fleet to hydrotreated vegetable oil and its delivery vans to electric

Panel debates

Industry experts chew over three key areas that must be settled for successful road freight decarbonisation: the reality of the sector’s progress to date; who will really foot the bill; and how quickly the UK’s refuelling infrastructure can provide the support the move to cleaner vehicles will depend on

Industry workshops

Delegates roll their sleeves up to work out the detail of road freight decarbonisation in four separate workshops looking at energy and infrastructure; cleaner commercial vehicles; the role of technology in helping to reduce carbon emissions; and what the carbon-zero freight and supply chain sector of the future will look like

18

Freight Carbon Zero

A new information source is launched to provide news and guidance to fleets looking to decarbonise their operations, brought to you by the team behind Motor Transport

Welcome W

elcome to this special report on the inaugural Decarbonisation Summit, held in Liverpool in November by Motor Transport and Freight Carbon Zero.

The road freight transport industry now has just 18 years to wean itself off fossil fuels. But the deadlines to end sales of non-zero-emission trucks (2035 for vehicles of 26 tonnes GVW and under; 2040 for larger trucks) were only announced at COP26 in Glasgow last year, leaving just three buying cycles before the most radical change this industry has seen since the switch from horse and cart.

This industry proved in the Covid-19 pandemic how flexible and resilient it can be, but this shift is so seismic and so fast that it seems almost impossible. Yes, the zero-emissions trucks are out there – but they are little more than prototypes and still eye-wateringly expensive. And construction of the infrastructure to refuel them has barely begun.

The danger here is that operators still struggling with Brexit and rising costs due to the Russian invasion of Ukraine will just say it can’t be done and hope diesel somehow gets a reprieve. But this is unlikely as UK politicians remain committed to net zero by 2050.

What is clear is that decarbonisation of road transport will require collaboration on a massive scale. Customers, operators, vehicle manufacturers, energy companies and government will all need to join forces to find new ways of working and funding to build this new world order. The public has got used to a transport and delivery sector that services our comfortable lifestyle at the lowest possible cost. They will not be understanding if service levels suffer or costs suddenly double.

© 2022 DVV Media International Ltd Published by DVV Media International Ltd, First Floor, Chancery House, St Nicholas Way, Sutton, Surrey SM1 1JB motortransport.co.uk

Printed by William Gibbons

CONTENTS/WELCOME MOTOR TRANSPORT DECARBONISATION SUMMIT 3

Supplement editor Andy Salter

Contributors Steve Hobson, Hayley Tayler

Group production manager Isabel Burton

Production editor Robin Meczes

4

8

12

CONTENTS

Main cover image: Shutterstock

Steve Hobson Editor Motor Transport

Planning the journey

Chaired by BBC News broadcaster Huw Edwards, the keynote presentation at the Motor Transport Decarbonisation Summit 2022 was given by Justin Laney, fleet manager at John Lewis Partnership.

“I think it’s absolutely crucial that the UK grabs this opportunity and creates these new industries around clean transport, be that clean drivetrains, batteries, or clean vehicles,” said Laney. “There are also opportunities here to improve the lives of the people driving our vehicles through better working conditions in vehicles that are quieter and smoother, as alternative fuel vehicles give us the opportunity to focus on productivity and working conditions.”

Laney said John Lewis Partnership was committed to becoming zero carbon by 2035. “All our cars, vans and light trucks will be electric by 2030. By then, all the heavy-duty long-distance trucks will be running on biomethane. We currently have about 350 out of a total of 600 trucks running on that fuel, with another 50 coming in later this year.”

Key to making the business case for carbon-zero vehicles is to make the vehicles last longer, Laney told the delegates. “The business case is going to work best if you can make vehicles and batteries to give a 10-year service life,” he confirmed.

Turning to state assistance, Laney said he was encouraged by the level of engagement from the government, but that there were still a number of areas where intervention was needed, like the 4.25 tonne derogation on electric vans which should be adopted for the long term.

He also urged regulators to look at decoupling renewable energy costs from fossil fuel costs. “Right now, the cost of green electricity from biomethane is pegged to fossil fuel prices. So when things go crazy in Ukraine, the cost of green electricity goes up, even though the cost of wind has stayed the same,” he said. He also called for a review of costs and speed of infrastructure development and installation, noting: “People don’t buy vehicles until the infrastructure is in place.”

150 delegates came together for the inaugural Motor Transport Decarbonisation Summit, run in partnership with bp, Dawsongroup, Scania and The Algorithm People, to discuss the challenges associated with decarbonisation of road freight

Summing up, Laney welcomed the announcement of the Zero Emission Road Freight Demonstrations (ZERFD), which will be an important step in developing the case for carbon-zero technology, but went on to request that the government focus on a single energy solution – a view not universally shared by all attendees.

Responding for the government, Bob Moran, head of decarbonisation strategy at the DfT, reiterated its commitment to the phase-out of diesel trucks by 2035 (up to 26 tonnes GVW) and 2040 (all trucks), adding that the ZERFD trials would be essential to understanding the infrastructure needs to support carbon-zero trucks. “We don’t need to trial the on-vehicle technology,” he said, explaining the purpose of the demonstrations.

“We need to know what the infrastructure looks like, where it needs to be, and how it operates with big fleets running 24/7 logistics operations.

SETTING THE SCENE:

“We’ll work out together how the vehicles function in commercial operations, so we know where to install charging and refuelling infrastructure and build confidence and speed in its mass rollout.

“We’ll publish the data and we’ll publish a plan for infrastructure too. The phase-out dates [of diesel trucks] are not going to shift to the right. We will regulate to ensure they are delivered.” ■

4 MOTOR TRANSPORT DECARBONISATION SUMMIT

Nearly

KEYNOTE PRESENTATION

(Top) Justin Laney of John Lewis Partnership and (bottom) Bob Moran of the DfT

The big changes ahead come with the potential for big risks, big capital outlay and big mistakes. But we are investing in the future. Our leasing and contract hire services: • Provide you with easy and flexible access to emerging technologies • Avoid financial risk and costly mistakes • Protect your capital • Allow operational testing • Keep pace with changing legislation and compliance Transition your fleet to zero emissions without the capital cost and risks of ownership. 0800 032 9766 | contactus@dawsongroup.co.uk | dgtt.co.uk Dawsongroup | truck and trailer HELPING BUSINESSES ON THE ROAD TO RISK-FREE ZERO EMISSIONS

Scania aims for

ability, battery technology and charging infrastructure] playing together. That’s why we believe that [our targets] will be a reality. But it will not happen everywhere at the same time.”

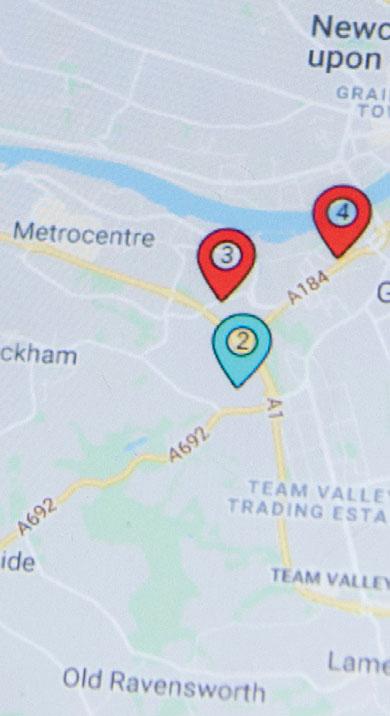

Scania’s head of eTruck Mobility, Peter Forsberg, told delegates that while the number of electric truck sales was less than 1,000 this year, the company had set targets for 10% of its new truck sales to be electric by 2025 and that half of its truck sales would be electrified by 2030.

“This is not just a guess or hope,” Forsberg said. “Every discussion I’ve heard today talks about sustainability; it comes from the government, it comes from the transport buyer. There is a strong push to be more sustainable right now. Furthermore, the key conditions are coming into place now with battery development optimised for heavy-duty trucks and we can see the technology around the charging capacity improving. We are on track for megawatt charging capacity.

“We see those three areas [the drive for sustain-

Forsberg also sounded an alarm bell for the UK warning that the nation was falling behind the rest of Europe in its electric vehicle and infrastructure roll-out.

Presenting an overview of the electric vehicle landscape across the continent, he said: “[Our] map [right] is a snapshot of how we view the potential for electrification with different markets in Europe.

“The key takeaway is that Europe will be the leader when it comes to electrification globally –that we see for sure. Great Britain is red here, light red. Before the summer, we had also Spain light red, but now Spain has introduced quite good incentives for making [electrification] happen. So then we see that the potential has increased. We are also seeing improvements when it comes to customer orders.”

Forsberg went on to highlight the work Sweden is doing to accelerate the rollout of an EV charging

DPD SHIFTS LINE-HAUL FLEET TO HVO AND DELIVERY VANS TO ELECTRIC

DPD is one of the leading parcel companies in the UK, running a fleet of vans and long-haul trucks on an intensive operation throughout Europe.

Olly Craughan, the company’s head of sustainability, outlined its Science Based Target Initiative (SBTI) – which commits it to net zero by 2040 and to reducing carbon emissions by 43% by 2030 – and the measures the business is taking on that path.

“When I took up this position in 2019, we had 149 electric vehicles delivering 1.3 million parcels,” he said, explaining the staggering uptake

of electric vehicles in the fleet. “We now have nearly 3,000 electric vehicles on fleet and they will deliver over 30 million parcels this year.”

Furthermore, Craughan said, the company has not bought a dieselpowered final-mile vehicle since June 2020 and has pledged to deliver all-electric up to 3.5 tonnes GVW in the final mile in 30 towns and cities in the UK. “That includes London,” he said. “So by the end of next year, London within the ultra-low emission zone will be delivered all-electric. That’s over 100,000 parcels a day delivered by just over 1,000 vehicles. By the end

of next year (2023) we will have 4,000 electric vans on fleet serving those 30 towns and cities and our fleet will be 100% electric in the final mile by 2030.”

One of the main themes of the conference, fuelling infrastructure, was a concern for the business, admitted Craughan. “[Ours is] a self-employed fleet and they want to take the vehicles home,” he said. “We pay for home charging, but as the vehicle size has grown, obviously it can’t be parked on a driveway. We’ve had to look at other public charging solutions.

SUMMIT NEWS 6 MOTOR TRANSPORT DECARBONISATION SUMMIT

AIMING HIGH: Scania head of eTruck Mobility Peter Forsberg

Swedish manufacturer plans major push into electric truck sales by end of this decade, but warns UK is falling behind in its infrastructure

50% EV sales

network and explained more about Scania’s involvement (through parent company Traton) in the CV Charging Europe initiative to develop a network of 1,700 truck charging points across Europe by 2027. “Charging is the main – maybe the most crucial – part of all the services and solutions around the vehicle to make decarbonisation happen,” he commented.

There are three distinct areas of charging requirement for freight operators, Forsberg added. These are depot charging, destination charging and public charging, and all three have a very important use case for operators. “We are building a portfolio of products with hardware in different performance levels to be able to fit the needs of that particular customer and also future-proof the investment in charging infrastructure,” he said.

“As part of the CV Charging Europe joint venture, we are investing to build the charging network all over Europe. We have a CEO and a management team working on the strategy right now, agreeing where to start building the network. We want to show, together with Volvo and Daimler, that this is the future and it is possible today.” ■

“We have recently started a trial with First Bus,” he continued. “They are electrifying their depots and are in

the process of investing a lot of money, and half the time it won’t be utilised. Buses are charging overnight when no one’s being shipped around in the bus. Our drivers can utilise the charging infrastructure in the day.”

For the heavy truck line-haul fleet, DPD is shifting to HVO [hydrotreated vegetable oil] as a diesel substitute as a short-term measure to reduce CO2 emissions. “The line-haul fleet is responsible for about 38% of our entire emissions,” Craughan said. “So it’s huge. We’ve just trialled HVO and will deploy this month to 60% of our line-haul fleet, with the remaining

40% by the end of next year.

“By deploying to 60% we will save 80,000 tonnes of CO2 a year based on our 2021 emissions. There are no infrastructure issues as we’re just draining down our diesel tanks and then filling them up with HVO, and we don’t need to invest in new vehicles.

“It is a really easy way to reduce your emissions, although it is still going to cost millions more a year to fuel the fleet compared to diesel.

“But we will not reach our net-zero targets by continuing to use HVO,” he stated. “We will need to go electric to achieve that.”

MOTOR TRANSPORT DECARBONISATION SUMMIT 7

NET ZERO IN FOCUS: DPD head of sustainability Olly Craughan

Session 1: The state we’re in

In a session exploring the reality of industry’s progress to date in transitioning to a net-zero future, three expert panellists brought their knowledge to the table.

Philip Fjeld, CEO at biomethane supplier CNG Fuels, told delegates that last year’s COP26 summit in Glasgow significantly shifted the urgency for operators to aim for net zero.

“Companies previously were saying it’ll be fine for us if we can be fully net zero by 2035 or 2040. We’ve now got large corporates coming to us and saying we’ve got very ambitious targets; we want to be 50% there by 2025 and we want to be 100% there by 2030.”

His view was echoed by Sam Clarke, chief vehicle officer at sustainable energy firm Gridserve, who has also seen a change in mood towards decarbonisation targets.

“Just a short couple of years ago the conversation around battery electric trucks would have been laughed at – ‘forget it, the technology is not there’. Now, almost every single major haulier or supermarket or e-commerce provider – all of them have said yes, we need to start looking at this and do it now.

“It doesn’t mean we can boil the ocean; it doesn’t mean they convert everything to electric on day one. But every single one of them wanted to see this transition and mechanism by which we can get things moving, because we’re running desperately out of time.

“So we’ve got to utilise the technologies that are [already] available and get them on the roads –today.”

Customer focus

Providing an operator perspective, Zach Burns, international sustainability supervisor at UPS, agreed that COP26 had produced a real step-change in customer attitudes towards decarbonisation.

“All of a sudden, the questions that were being asked were not ‘do you have carbon goals?’ but more about drilling down into what plans different companies had,” he said.

This, in turn, has spurred the logistics sector to keenly focus on how it will achieve the challenging sustainability goals it has set itself. “In terms of the state we’re in, you cannot deny the will that is

Talking point

A series of lively panel debates on the main stage tackled several key topics that are integral to the road freight sector’s decarbonisation ambitions

here to do that. And speaking quite frankly, that is absolutely fantastic,” said Burns.

However, he warned that time was running out, with the latest climate change reports making for “very stark” reading. It is therefore vital for logistics companies to examine how they plan to reach their targets.

Elephant in the room

Despite the healthy appetite to decarbonise, however, the question of financing the move away from fossil fuels remains unsolved.

“I think the big challenge we’ve all got in this room is how can you transition to net zero and stay cost competitive with your diesel baseline,” said Fjeld. “Because if you can’t, then people will just stick with diesel. And they will wait until 2035 or 2040.

“So the big elephant in the room is total cost of ownership. If we can’t achieve that, then we will have a huge problem.”

Collaboration and “a lot of innovation” across industry will be the way forward, he told delegates at the event, because the scale of the challenge is too large to be solved by grant funds or subsidies alone.

Gridserve’s Clarke added to the topic: “I think we can agree we can’t grant-fund a way out of this. But we can grow and fund our way into it.”

PANEL DEBATES 8 MOTOR TRANSPORT DECARBONISATION SUMMIT

The latest round of government Zero Emission Road Freight trials and funding will play a vital role in the transition to alternative fuels and supporting an emerging market, he explained.

Clarke also believes that total cost of ownership is key for making the financial aspects of new technology work for businesses.

“I think people probably understand the logic of total cost of ownership, but this doesn’t mean there’s a silver bullet out there,” he noted. “But at least we’re starting to see where the calculations are coming from.”

Operators are now beginning to look at costs differently to those of a traditional diesel, rather than simply performing a like-for-like comparison, he added.

“I think this has made a difference, because people are really starting to understand more innovative and creative ways of still being commercially viable, but doing it in a sustainable way.”

Picking a winner

Knowing which fuel to back when it comes to future-proofing your fleet is a tough choice for any operator, given the significant investment required when bringing new technology into a business.

The government has made clear its zero-tailpipe emissions target for all new trucks by 2040, but all panellists agreed that a technology-neutral approach

was needed in the here and now.

“Technology agnosticism, at least at the moment, is going to be essential,” said Burns. “Because no one technology is going to get us to the point the government has set down in terms of restrictions by 2035 and 2040.”

That might mean switching to biomethane today to rapidly decarbonise your fleet with an eye to the future electrification of long haul, or looking outside the box to new ways to deliver the last mile, or exploring total cost of ownership for the assets you can switch now, he said.

“All of that has to be considered,” he commented. “And it’s going to have to be considered very rapidly to ensure that we move and get to a point where we can get to these middling milestones in the run-up to, for example, 2050.”

Session 2: The economics of freight decarbonisation – who pays?

John Fletcher, MD of truck and trailer at Dawsongroup, which owns 30,000 assets in the UK, said his customers recognised the need to electrify their fleets but were held back by cost and the lack of recharging infrastructure.

“Our job is to join up with vehicle manufacturers and energy providers to provide all-round funding for this process,” he said. “We expect ➜ 10

CHEWING IT OVER: (Left to right) Conference chair Huw Edwards, Philip Fjeld of CNG Fuels, Zach Burns of UPS and Sam Clarke of Gridserve

MOTOR TRANSPORT DECARBONISATION SUMMIT 9

COUNTING THE COST:

electric vehicles to last longer than diesel trucks but the reality is that a lot of our customers are working on relatively short contracts, so the ownership model doesn’t really work.

“We have to create an eco-system for these trucks and find what the next markets are for them, whether that’s breaking them and finding an alternative use for the batteries or whatever it is going to be.”

Fletcher said the transport industry was “ready to go and keen to get hold of the trucks” and Dawsongroup would play its part in enabling operators to fund these vehicles. But he emphasised that “trucks are only one part of it and the infrastructure that follows is absolutely essential”.

Alan Lewis, technical director at the Amsterdambased Smart Freight Centre – a global not-for-profit organisation dedicated to a more efficient and zero-emission global logistics sector that works with shippers as well as carriers – said that when the centre began its work “shippers were pretty aloof and not engaged”.

“That has so changed now,” he said. “The majority of our members are shippers and they are driven by carbon targets which are probably faster than those set by government. They are under a lot of pressure and that is driving down through the

market. The projects we are setting up now pull together demand on a collaborative, non-competitive basis among shippers and logistics service providers.

“The idea then drives the demand through to carriers and vehicle manufacturers and fuel suppliers through buying alliances.”

Session 3: Feel the Power – focus on the energy ecosystem

After lunch, our panel session dived into the energy demand debate, exploring operators’ future needs against current provision.

“Go early” was some candid advice from National Grid’s head of future markets Graeme Cooper to delegates wanting a timeframe for grid upgrades to support in-depot charging infrastructure for electric commercial vehicles.

Five years ago, a typical year would see 35 grid connection applications, Cooper explained, but this has risen to 400 in the past six months.

He cited the example of Western Power Distribution, which serves Cornwall, Devon, South Wales and an area across the Midlands.

“They are going from 200 grid connections a day, but by about 2028, they’ll be making 2,000

10 MOTOR TRANSPORT DECARBONISATION SUMMIT PANEL DEBATES

(Top to bottom) John Fletcher of Dawsongroup and Alan Lewis of Smart Freight Centre

grid connections a day,” Cooper predicted.

He added: “So if you know what the answer is (and the asset is going to be good for 40 years as this is the design life of most of the kit), be at the front of the queue, not the back. It is only getting more challenging.”

Regulator Ofgem is also changing the way demand connections and distribution are charged from next April, Cooper explained, which should make it less costly for connecting customers to upgrade.

However, he urged operators not to delay talking to their distribution network operators, as the new charging methodology could be factored into any future deals.

Public-access hubs

Tyseley Energy Park in Birmingham is the UK’s first multi-fuel, open-access, low and zero-carbon refuelling station. It can be used by commercial vehicles, including vans and HGVs, and provides compressed natural gas (CNG), biofuels, hydrogen and electric charging. It forms part of Birmingham City Council’s Transport Plan to support the rollout of cleaner vehicles across the city and is used for refuelling the council’s hydrogen buses.

“We’re available for fleets to use en route,” said David Horsfall, director at Tyseley. “And we believe this type of refuelling station, which we’ve built over the past eight years, is the type of site that you need to scale across the country.”

A possible synergy for the multi-fuel hub model might be found with the launch of new freeports across the UK, including one in Liverpool, suggested panel chair Andy Salter, MD at summit organiser DVV International.

Giles Jones from Liverpool City Freeport welcomed the idea: “Absolutely, I think [Tyseley] is a model that others can follow.

“We would be keen for freeports to house some of these and we’d be really interested in looking at

POWER PLAYERS: (Left to right) Graeme Cooper of National Grid, David Horsfall of Tyseley, panel chair Andy Salter of DVV International, and Giles Jones of Liverpool City Freeport

this in more detail and seeing how we could bring it to the Liverpool City region.”

He added that alongside freeports being promoted as a great platform for investment in the UK, they were also coupled with a strong decarbonisation agenda. “Marrying the two things together could be a real opportunity,” he noted.

Liverpool is one of eight proposed freeport sites in the UK – special geographic zones where different tax and customs terms apply to attract businesses and investment.

Looking ahead

How energy providers will cope with future logistics models, the changing shape of freight movements and the continued digitalisation of the sector was also explored by the panel.

Tyseley Energy Park has already tapped into the benefits of using digital technology to predict demand.

“Our process will look at a digital twin for the area,” said Horsfall. “We will map the infrastructure and we’ll start playing scenarios with that digital twin about the optimum use of assets.

“I think we’re in a world where there is that need to be increasingly efficient and digitalisation will be critical to that.”

National Grid’s Cooper also urged delegates to embrace the benefits of digital technology to ensure operators get the most from their in-depot charging infrastructure in the future.

“Think cleverly. If you’ve got an expensive grid connection in your depot, what happens when the trucks aren’t there? Effectively, it’s a stranded asset.

“So work with somebody else in the energy space to maybe stick a battery there, or a local solar farm to share your grid connection, but connect it digitally. You get what you want, when you need it, but you sweat the asset for other uses.

“Don’t just think about the stuff on rubber tires. Think about the whole ecosystem.” ■

MOTOR TRANSPORT DECARBONISATION SUMMIT 11

Working out our

series of interactive discussion workshops gave delegates the opportunity to share their observations and insights on the road to net zero. Hosted by event partners bp, Dawsongroup, Scania and The Algorithm People, the sessions were facilitated by the specialist team at consultancy WSP. Here we present a round-up of the main points…

Energy & Infrastructure – hosted by bp

Duncan Yellen, head of hydrogen mobility at bp since September and before that MD of ITM Motive, has been building hydrogen refuelling capacity in the UK for four years. He said the “dream” was to have hydrogen trucks running on UK roads that performed the same and refuelled as quickly as diesel vehicles.

Part of this dream is multi-fuel fuelling hubs that would offer battery charging, hydrogen and for the immediate future biofuels in one place, such as the Tyseley Refuelling Station in Birmingham. “There is one at Tyseley – it is coming but it is a long journey,” said Yellen. “We [bp] have committed by 2025 to a network of multi-fuel hubs around the UK. But no one can do this alone. The power of everyone working together is immense.”

The problem of building refuelling infrastructure

too far ahead of demand still haunts the hydrogen dream however – Shell has been forced to close two hydrogen filling stations at Gatwick and Cobham in South East England due to lack of use.

There are also concerns about the low efficiency of hydrogen fuel cells compared with batteries when it comes to converting electrical energy into motive power, but Yellen argued that with a “constrained UK grid it makes sense to make green hydrogen” for storage when there is spare generating capacity.

“Asking about the efficiency of fuel cells is the wrong question,” he said. “We are seeing wind energy being pushed off the grid half the time in Scotland. A fuel cell may be only 40% efficient but it is better than zero.”

Graeme Cooper, head of future markets at National Grid, agreed. “It is not binary – we will need everything,” he said. “Wind turbines are only 36% efficient – but we still do it.”

Cooper said that in the next 11 to 12 years there would be 160GW of clean electricity gener-

INDUSTRY WORKSHOPS 12 MOTOR TRANSPORT DECARBONISATION SUMMIT

A

➜ 14

road to net zero

MOTOR TRANSPORT DECARBONISATION SUMMIT 13

Photo: Shutterstock

Supported by

ation wanting to come on stream. This compares with just 60GW now.

“When you get that much green electricity on the system, what do we do with it?” he asked. “We will have to channel it. We can’t get to a clean grid without hydrogen.”

He argued that it was better to use green hydrogen made from renewable electricity to displace grey hydrogen made using fossil fuels in industrial applications rather than “waste it” in road transport, and told the workshop audience of truck operators that they should speed up their transition to electric vehicles: “With 160GW of green electricity coming on in the next 11 years, you had better get a wiggle on if you want to consume it.”

Cooper also predicted that smart battery electric vehicle chargers would make better use of surplus off-peak renewable electricity. “Smart chargers will only charge the vehicle off-peak,” he said. “Surplus green electricity on the grid will trigger devices such as vehicle chargers to use it.

“We will also need batteries to provide flexibility everywhere.”

Operators in the audience pointed out that the cost of hydrogen trucks was still prohibitive for most of them and was preventing quicker adoption.

Yellen agreed that both battery electric and hydrogen trucks were expensive at the moment and said bp was working with the vehicle OEMs to find ways to make them more affordable. But he acknowledged: “Zero-emission vehicles will be more expensive than diesel for quite a few years yet.”

Roel Vissers, director of strategic partnerships at recently formed CV Charging Europe, an

Amsterdam-based joint venture between Daimler Truck, Traton and the Volvo Group, said the goal was to have 1,700 electric truck charging points across Europe in the next five years. The first site will be in the Netherlands, but Vissers said it would soon have its first facility in the UK.

He said there was still a lot of hesitancy among truck operators who were “waiting to see what will happen” but the joint venture was “well funded by its shareholders” and so in a good position to “break this chicken-and-egg discussion”.

The partnership is focused purely on charging battery electric vehicles. “Use hydrogen in industry, not transport,” Vissers urged.

Vehicles – hosted by Scania

Karima Haji is the transformation director at Scania UK and posed a number of questions to delegates attending the Vehicles workshop at the summit, exploring their concerns around decarbonisation and the solutions they are already considering.

A number of issues were raised by the attendees, particularly uncertainties about which was the right asset and fuel type for their operations and the ability to pass the additional cost of the new vehicle types on to their customers. One well-known fleet operator gave an example of contracts it is fulfilling on behalf of automotive OEMs, where the client was not prepared to pay anything extra for having their goods carried by low-carbon vehicles. “They just wanted the cheapest solution,” he

14 MOTOR TRANSPORT DECARBONISATION SUMMIT INDUSTRY WORKSHOPS

stated. “If the OEMs themselves aren’t prepared to invest in this, what hope do we have?”

John Lucy, director of Liverpool Freeport and former head of international transport at the RHA, said there was a real risk of a two-tier haulage market evolving in the UK if customers weren’t prepared to pay more for goods being carried by low-carbon vehicles.

“The diesel fleets will be able to undercut the clean fleets, which will have a big impact on the sector and curtail investment,” he warned.

The operators in the room encouraged vehicle manufacturers to offer a broader range of support beyond the vehicle itself, including longer-term deals and warranties. Vincente Connolly, sales director at Scania UK, said the company was ready to supply net-zero vehicles to the market and had a range of solutions on offer to support customers.

The single biggest enabler to decarbonising road freight was the development of infrastructure, which required collaboration and information sharing between all parties, the workshop agreed. This would require detailed modelling of vehicle requirements and specifications based on operational requirements, location and duty cycle.

It was clear there was not a one-size-fits-all solution and that operators will have to develop plans to deal with new levels of uncertainty. However, given that operators in the workshop said they needed clarity and certainty to help them make investment decisions, this would seem to be a mismatch.

That said, the clarity of operators appears to depend on the scale of the business and market they are working within. Last-mile urban delivery

operators are more likely to have a clear plan (although the EV charging network remains a concern), according to attendees, while organisations operating larger vehicles in urban centres – waste collection and urban rigids, for example – are less certain because of the inconsistency of local authority restrictions/transport strategies. Heavy-duty haulage is the most unclear, given the uncertainty over range, infrastructure, fuel types and expected vehicle lifecycles.

Operations – hosted by The Algorithm People

Colin Ferguson is CEO of The Algorithm People and in introducing the workshop attendees to the session he explained how routeing and scheduling optimisation can play a major role in ➜ 16

MOTOR TRANSPORT DECARBONISATION SUMMIT 15

INDUSTRY WORKSHOPS

improving fleet efficiency and assisting operators in their journey to decarbonisation.

There are huge efficiency gains to be made right now which will have an impact on carbon emissions, he explained, without having to invest in new vehicles or infrastructure.

The use of technology in driving change in the sector and accelerating the journey to carbon zero was widely accepted by the group. One operator commented: “Vehicle telematics used to be considered a major innovation, but it is now commonplace across many fleets. We now have to harness the power of data and digital for the future and that will require a new skill set.”

Artificial intelligence is on the horizon, but the sector is conservative and there was frustration that the current age and demographic profile of the industry was standing in the way of innovation and progress. There is a hope, shared by the workshop, that tech-savvy younger people will embrace such advances and expect technology to be at the forefront of the decarbonisation agenda for all organisations.

David Coombes, CEO at Skills Group, was keen for all industry stakeholders to engage with schools and colleges to ensure the rights skills were being nurtured at the colleges and the industry had the right resources for the future. “There is a serious willingness by the colleges to engage with industry to tune their courses to the needs of employers,” he said.

While skills and resources were an issue, the workshop participants raised concerns about engagement from the board of senior management within many organisations. “Decarbonisation is

on the boardroom agenda, but I’d have concerns the board is sufficiently engaged to deliver,” one participant commented.

New horizons – hosted by Dawsongroup

This workshop, hosted by Dawsongroup Truck and Trailer managing director John Fletcher, gave attendees the opportunity to explore what the carbon-zero freight and supply chain sector will look like in the future.

A consensus emerged across this popular group that the urban delivery sector was ahead on innovation while large, road-based vehicles (of whatever fuel type) would continue to be the main way of transporting goods over longer distances overland.

“Many solutions have so far focused on the lastmile of delivery,” said one participant. “But we need more innovation in the inter-urban space.”

Collaboration and resource sharing are oft-cited bedfellows on the road to decarbonisation and this workshop considered the realities of this for the sector.

“Sharing of resources is challenging in a competitive industry,” explained one well-known truck operator. “Increasing costs may drive the need for collaboration and some companies are starting to do this, but progress is slow. Collaboration may be more possible for localised clusters of companies with specialist products.”

“For genuine collaboration to happen, there may need to be a major change of mindset about

16 MOTOR TRANSPORT DECARBONISATION SUMMIT

how goods/products are delivered,” added an industry supplier attending the session. “We can see it is happening at a limited scale in some places where there are consolidation hubs. However, operational requirements and customer demands tend to take precedence and reduce the likelihood of collaboration. It isn’t clear how much this is likely to change in the future.

“There are two big challenges in relation to collaboration. Where do the responsibility and liability for any goods being transported rest? And how would any carbon benefits be quantified and attributed to the participating parties?”

There was general concern raised around carbon monitoring and reporting, with the lack of a standardised approach building a degree of mistrust between organisations. The purpose of the data being collected and presented needs to be understood and a more coherent and consistent approach to the way data are presented would help. This may require a third-party assurance system, said one participant. Providing the appropriate metrics at the right level of granularity will be important and will depend on the size and scale of the business.

The group agreed technology was advancing fast, and certainly faster than the pace of legislation. “We can’t let the perfect be the enemy of the good,” said one participant. “And we need to make progress now. For example, charging infrastructure is not keeping up with the pace of demand. We just need to get on with installing it or the rate of change will not be quick enough.”

One representative from Evri echoed this sentiment and said that the business case needed to be

proven first. Charge times especially are key as longer periods of downtime result in the need for a larger fleet, which adds extra pressure when the vehicles already come at a premium.

“We can’t afford to go backwards in terms of service provision to make the numbers work, it is a highly competitive market,” said this contributor.

The discussion then moved on to the consideration given to the expectations of customers, the wider costs of delivery operations and what customers are willing to pay for.

Customers are still very price sensitive, the group agreed – and that is a major factor in their decisions. As the impacts of climate change become more frequent and severe, customers may start to demand action from the sector. But the proportion of people prepared to pay more to meet the costs of that is not clear at the moment. ■

MOTOR TRANSPORT DECARBONISATION SUMMIT 17

Freight Carbon Zero takes off

Freight Carbon Zero is a new website and newsletter resource from the team behind Motor Transport that is dedicated to assisting the commercial vehicle and road freight sector in its journey to decarbonisation. The new brand joins Commercial Motor, Motor Transport, Truck & Driver and Transport News in our portfolio of magazines and websites serving the UK’s road freight sector, and consists of a weekly newsletter, website, occasional podcast and webinar series.

“Freight Carbon Zero represents a major step forward for us as a group,” explained MT’s divisional director, Vic Bunby. “The industry’s journey to carbon zero is going to completely change the face of the sector and there are some big decisions for all those involved. We believe it is essential to provide trusted, independent information to help

guide the decision-making process.”

The project is being led by former Commercial Motor editor and current MD of DVV Media International (the parent company of Motor Transport), Andy Salter.

“I have been involved in the commercial vehicle and road freight sector all my working career and it is clear the tectonic plates of the industry are going to shift as the sector decarbonises,” he said. “Freight Carbon Zero will endeavour to give all those involved in the industry a resource to keep up to date with the latest developments.

“There is so much that needs to be done to move the sector to a carbon-zero future, with some big challenges and tough decisions ahead. Not only has the industry got a completely new generation of trucks to develop, but we have to work out how those vehicles are going to be powered, serviced and maintained, driven and operated – all while transitioning from diesel and making sure the logistics supply chain keeps working.”

Phase one of the project starts with a news and information service breaking all the latest news about the decarbonisation of the commercial vehicle and road freight sector worldwide. Sign up to the newsletter and website today by following the link in the QR code (above left).

Next year, we will add a number of tools aimed at assisting business decision-making as companies seek to adapt to a carbon-zero future, including updates on vehicle procurement, fuelling infrastructure and carbon reporting. ■

18 MOTOR TRANSPORT DECARBONISATION SUMMIT

FREIGHT CARBON ZERO

A new

information resource

including a

newsletter, website,

podcasts and webinars has been unveiled by the publisher of Motor Transport recently to help companies make the right decisions in their quest to cut carbon emissions

Get

use our optimiser! W D www.thealgorithmpeople.co.uk

wiser…

Electrification changes everything but our promise

You’ve always been able to rely on Scania for a complete tailor-made solution for your business – and that’s not going to change.

With electrified solutions there are new pieces to the puzzle that may seem complex, like charging infrastructure, and environmental incentives, but you don’t have to figure it out on your own.

We promise to be by your side every step of the way. From initial operations analysis

and planning, through implementation to long term ongoing operation – ensuring you have a charging solution that can scale as your fleet grows.

With Scania, you will get an electrified solution that not only makes sense for the environment, but also your business. So if you have the drivers, our solution covers the rest. And that’s a promise you can count on.

VISIT SCANIA.CO.UK TO LEARN MORE ABOUT SCANIA’S ELECTRIC SOLUTIONS

A MOTOR TRANSPORT SUPPLEMENT IN PARTNERSHIP WITH

A MOTOR TRANSPORT SUPPLEMENT IN PARTNERSHIP WITH