Kicking

31

it time for inheritance tax to be abolished? 38

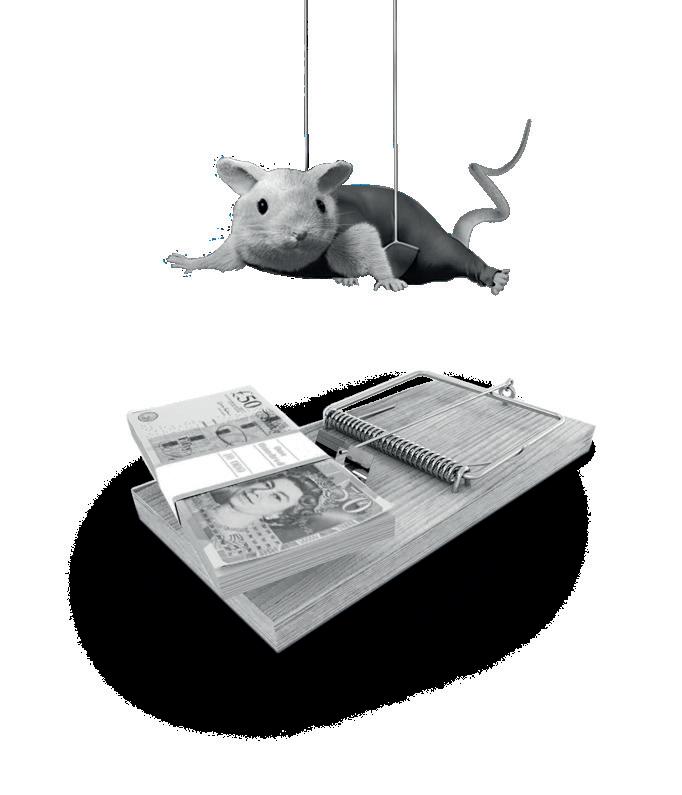

DEATH DUTY CALLS Is

Issue 105 NOVEMBER / DECEMBER 2022 BACK TO FACTOR Why brokers should reconsider offering invoice factoring 40 50 IN GOOD FAITH IGNORANCE IS NOT BLISS

the risks of taking on a personal guarantee

to consider when lending to spiritual and religious groups

magazine

COMMERCIAL

the can Pushing budgetary tightening down the road

Understanding

What

The award-winning

for the National Association of Commercial Finance Brokers Broker

Features

Lloyds Bank: Transforming the broker experience 24-26 Prof. Trevor Williams: Kicking the can

NACFB: Mutual benefits

Tower Street Finance: Death duty calls

Swishfund: Going for green

Industry Insight

Time Finance: A growth journey

Paragon Bank: Back to factor

Triodos Bank UK: In good faith

Haydock Finance: Culture club

Opinion & Commentary

Cornerstone Finance Group: Catching the wave

Reward Finance Group: Operational resilience

iwoca: Going with the flow

Purbeck Personal Guarantee Insurance: Ignorance is not bliss

NACFB: Patron Awards 2022 winners

Five minutes with: Joela Jenvey, Head of National Accounts, Landbay

Information

34 NACFB News 4 Note from Norman Chambers 6 Updates from the Association 8 Note from headline sponsor, Allica Bank 10 Industry news round-up 12-14 Membership news In this issue Contents NACFB | 3 Ask the Expert 20 Recruitment & Employment Confederation: Caught short Partner Profile 16-17 Method: On the panel Compliance Update 18-19 NACFB: Could do better 44

28

34

Special

22-23

31-32

36

38-39

40

42

50

44

46

48

50

52

54

Editor & Feature Writer 33

Sub-editor & Feature Writer 33

LAURA MILLS Graphic Designer 33

MAGAZINE ADVERTISING T

MACKMAN Design & Production T 01787

Further

KIERAN JONES

Eastcheap | London | EC3M 1DT Kieran.Jones@nacfb.org.uk JENNY BARRETT

Eastcheap | London | EC3M 1DT Jenny.Barrett@nacfb.org.uk

Eastcheap | London | EC3M 1DT Laura.Mills@nacfb.org.uk

02071 010359 Magazine@nacfb.org.uk

388038 mackman.co.uk

Norman’s Note

How is it nearly the end of 2022 already? The year in which the NACFB celebrated its 30th anniversary has flown by, and we’ve been busier than ever.

Our community continues to grow. We now have more than 1,000 Member firms, over 160 Patron lenders, and an ever-increasing number of carefully selected Partner service providers.

Our presence and views are also being sought by those who can effect change. This year, the Association took its seat on the government’s Business Finance Council, which is jointly chaired by the BEIS Secretary of State and the Economic Secretary to the Treasury. Here, the NACFB sits alongside UK Finance, the British Business Bank, the ICAEW, major lenders and providers of alternative finance to explore ways that will ensure that SMEs can access finance now and in future – whatever that looks like.

Norman Chambers Managing Director | NACFB

We’ve been busy closer to home too with a sell-out NACFB Expo swiftly followed by a 30th birthday summer party, a series of regional events, the Commercial Broker Awards, the Patron Awards & Gala Dinner, as well as launching our Broker Academy, Consumer Duty hub, and the NACFB Mutual. We also sent out the annual survey which now goes to Patrons as well as Members – the results will be revealed in January’s issue.

Looking ahead, 2023 will be just as busy with a strategy that seeks to expand the membership, improve training and qualifications within the industry, build the NACFB brand, extend our reach and influence, and ensure the Association remains at the forefront of high-level conversations.

I will, of course, keep you updated. In the meantime, I wish you all a very merry Christmas and a peaceful, prosperous New Year.

Welcome 4 | NACFB

Join the broker panel of the UK’s best business bank* *Source: NACFB award for Best Business Bank (2021) Email: brokerteam@natwest.com Our broker team could help open doors. Lots of them.

NACFB expands Consumer Duty support

The NACFB has launched a Consumer Duty hub providing a suite of free resources for both the Association’s Members and Patrons to use.

The FCA’s Consumer Duty represents one of the biggest shifts in regulation for 30 years, and all regulated firms – regardless of their size or scope – must adapt their operating culture to meet the regulator’s revised expectations.

The first deadline (Monday 31st October) has passed, and all firms should by now have confirmed their Consumer Duty implementation plan.

Consumer Duty hub

The Association’s Consumer Duty hub hosts three key resources to ensure future deadlines are met, providing firms with a practical working knowledge, alongside the materials, documents, and a range of other solutions to ensure all regulatory thresholds are met.

In addition to template documentation and online learning modules, the NACFB compliance team have also hosted virtual Consumer Duty clinics to provide insight, steering, and mentoring throughout all phases of the regulatory embedding.

The NACFB’s head of compliance, James Hinch, said: “The process of embracing Consumer Duty is a journey – one we are at the very beginning of. We strongly encourage all Members to become

enthusiastic early adopters, to help bolster and maintain the trade body’s kitemark of quality.”

Patron lender support

Two-thirds of the UK’s banks and building societies are not yet Consumer Duty compliant and two in ten say they will not become compliant before April, the original date set by the FCA. According to the survey findings from Moneyhub, 11% of senior decision makers said they didn’t know anything at all about the new regulations.

To help address this – and to complement the Association’s support for Member firms – the NACFB created a Consumer Duty Toolkit for lender Patrons. Complete with an implementation framework and comprehensive guidance on how to assess and manage remedial activities, the kit will help lenders to clearly demonstrate that the Duty is being properly considered and applied. Crucially, the toolkit also provides steering on how to measure the four outcomes of the Duty.

Developed to work ‘out of the box’, the toolkit can be easily tailored to fit most commercial lending business models. Patrons can purchase the NACFB Consumer Duty Toolkit by contacting the NACFB compliance team, who remain on hand to both Members and Patrons to discuss key aspects and answer any questions.

Access the NACFB Consumer Duty hub at nacfb.org/consumer-duty and contact the compliance team via compliance@nacfb.org.uk

Association

December

updates for November &

2022

6 | NACFB NACFB News

Dedicated Support, Personal Touch

Focused on helping to get the deal done, our sales support team are here to make things happen. As a liaison between your regional broker manager and Haydock’s credit and operations departments, Corinne and her team keep their eyes firmly on your deal as it moves through our system, providing the support required for deal completion. Meet Our Team

FOR INTERMEDIARY USE ONLY. Haydock Finance Ltd is authorised and regulated by the Financial Conduct Authority. Financial Services Register no. 722545. Sales Support Team: 01254 685850 or email salessupport@haydockfinance.co.uk

TRACEY HINDLE GABBY CLANCY

CORINNE BIRKETT SALES SUPPORT MANAGER

NICOLA INCE

Ever ready

Helping Britain’s SMEs fight through a recession

Gareth Anderson Head of Business Management Allica Bank

Soaring inflation, energy costs, interest rates, and a recession on the horizon… business owners are, understandably, worried.

A recent survey Allica Bank conducted of 150 established SME owners (businesses with between 10-100 staff) paints a pretty stark picture, too. Its aim was to understand SMEs’ worries and expectations for the next 12 months in the face of a recession. To put it lightly, the results were sobering:

• 41% of SMEs expect to either shut their doors permanently, conduct mass redundancies, or close locations

• 39% fear their business will be fatally or critically impacted by a recession

• 43% will have to borrow to stay afloat

This is a critical juncture for Britain’s SMEs, who remain the beating heart of the UK economy. Having survived the challenges of the pandemic, even those not in that 41% will find pushing against the tide of economic pressures tough. As one SME owner recently told us: “We have tried hard to find ways to minimise the impact on our business, but the situation is so challenging that these kinds of measures alone may not be enough for many SMEs.”

So, how can we – as brokers and banks – step up to help business owners increase resilience, reduce risk, and improve diversification?

First of all, we need to be brave in continuing to support their growth and investment plans. A recession doesn’t have to be a red line for funding. In fact, if we look back to 2008, we can see that between 20-30% of businesses were still able to grow their sales. Allica Bank intends to do just that, forecasting to lend £3 billion between 2022 and 2024.

Brokers can provide a crucial lifeline, too, by taking the time to help clients identify, quantify, and mitigate their immediate and longer-term anticipated funding risks. This kind of proactive expert scenario planning is broker-client relationship management at its best, and it’s in times of stress that it becomes most crucial.

I have no doubt that the SME community will once again prove its resilience in 2023. As critical financial partners to SMEs, banks and brokers have an opportunity to step up and provide some much-needed relief from the stresses of economic uncertainty and inspire the confidence businesses need to continue to invest and innovate. Together, I believe we can ease the fears of that 41% and keep the UK’s SME community thriving.

8 | NACFB

our Sponsor

Note from

“

A recession doesn’t have to be a red line for funding

Industry News

1. Consumer Duty costs the biggest problem

Advisers have cited regulatory costs as their greatest concern regarding client harm, according to NextWealth’s latest Consumer Duty report. Some 77% of advisers were wary this could cause foreseeable harm to both their clients and investors more broadly. Gathering evidence to show they are doing the right thing was found to be the biggest gap for financial advice firms with only half confident that they would be able to calculate the expected total cost a consumer would pay.

3. Small businesses not inspired by Hunt

Chancellor Jeremy Hunt opted for the appearance of fiscal stability and “lacked the vision for a brighter future that small businesses needed to see,” said Emma Jones, founder of Enterprise Nation commenting on the Autumn Statement. Lamenting the lack of attention paid to start-ups, she said the best governments engage with entrepreneurs and that the tax changes would make it harder for smaller businesses. She hoped they would not be forgotten again when Hunt delivers his first Budget in spring next year.

4. Stamp duty cut to end 31st March 2025

Stamp duty cuts announced in Kwasi Kwarteng’s mini-Budget will remain in place but only until 31st March 2025. The threshold at which stamp duty applies was lifted from £125,000 to £250,000, while the threshold for first-time buyers increased from £300,000 to £425,000. In his Autumn Statement, Chancellor Jeremy Hunt said that the existing threshold was currently supporting the housing market by boosting transactions at a time when the economy needs it most prompting some to call for stamp duty reform.

5. New car PCP costs rise by more than 40%

Monthly payments on new car finance contracts have risen by more than 40% on some models since 2019, according to research by What Car?. A comparison of typical finance deals between five models currently on sale, compared to 2019, found average monthly personal contract purchase (PCP) payments had risen by at least 22.4% across the sample models. All models had also recorded at least an 11.0% rise in list prices, plus interest rates had risen in all examples – and even tripled for one.

6. Buy-to-let loan sizes drop as rates rise

Loan sizes offered to buy-to-let borrowers have plummeted in the last six months, according to research by Mortgage Broker Tools (MBT), which compared the loan sizes available based on typical calculations for three different tiers of rental payments. Rising rates have pushed up stress tests and negated the benefit of stressing rental income at pay rate. MBT chief executive Tanya Toumadj said that landlords may be tempted to take an uncompetitive product transfer which could prove an expensive mistake.

2. Landlord sales likely following CGT crackdown

A reduction in the tax-exempt allowance on capital gains could lead to landlords selling properties to avoid facing higher tax bills. From April 2023, the point at which capital gains are taxed will reduce to £6,000 from £12,300. It is expected that the impact will be felt more keenly by those with smaller investment portfolios. Chris Etherington of RSM said this could result in a “rush of people looking to accelerate sales of assets to benefit from the current exemption levels.”

7. Inflation hits 11.1% in October

Inflation hit 11.1% in October, Office for National Statistics (ONS) data has shown, up from 10.1% in September. The jump came with gas and electricity prices climbing and food price inflation hitting 16.2% in the year to October. Looking ahead, Martin Beck, chief economic adviser to the EY Item Club, said he “wouldn't be surprised if inflation falls to close to 2% by the turn of 2023 and 2024, substantially easing the current squeeze on spending power faced by consumers.”

10 | NACFB

4 Industry News

2

Finance for those on a mission At Shawbrook, we combine flexible products with practical decision-making and a personal service to support SMEs and property investors. Whether your client is looking to acquire business critical equipment or to expand their property portfolio, our creative funding solutions can help them to complete their mission. Scan me for further information Get in touch Asset Finance 0345 604 0976 businessinfo@shawbrook.co.uk Real Estate 0330 123 4521 cm.broker@shawbrook.co.uk

Membership News

OSB Group has announced a package of targeted measures to support buy-to-let landlords seeking to improve the sustainability of their investment properties.

The Landlord Leaders report, commissioned by the intermediary-only NACFB Patron, which comprises Precise Mortgages, Kent Reliance for Intermediaries and InterBay, revealed that 44% of brokers believe the biggest challenge facing their landlord clients today is complying with new environmental requirements, while landlords themselves cited this as their second biggest concern, after tenant affordability due to the rising cost of living.

The research found that professional landlords, who derive their main income from lettings, were more likely to already be upgrading their property portfolios to make them more environmentally friendly and are far more positive about the future of the buy-to-let sector than their part-time counterparts. It also discovered that both brokers and landlords were looking to lenders to offer more than the green financing currently on the market to fund property improvements.

Andy Golding, group chief executive, OSB Group, said: “There is an opportunity for the industry to rise to this new challenge and help support both professional and part-time landlords to ensure the industry thrives and continues to focus on its tenants.”

Fleximize’s SME Outlook Report 2022 has revealed that most UK SME owners are confident about the future and consider themselves financially resilient – despite confirming they will likely be looking to find ways to cut existing business costs, revising pricing and consider lending options.

From the SMEs surveyed by the NACFB Patron, 54% confirmed they would be looking to make cuts within their business, with renegotiation with suppliers the most common approach, followed closely by making cuts in technology/software and reducing production expenditure.

With rising costs starting to put the squeeze on businesses, increasing prices has become an inevitability, with 92% of SMEs reporting that they will pass on costs to the customers – with a one to 10% increment being the most likely increase in pricing change.

To accommodate cash flow concerns, 64% of businesses were considering borrowing money to maintain steady levels, expand their business or simply survive the recession.

Peter Tuvey, CEO, said: “Despite their optimism, SMEs are acutely aware that they will have to take steps to continue to thrive within the current economic climate, and more support will be needed from private and public organisations across the country.”

12 | NACFB Membership News

OSB Group pledges £50m to help landlords with energy efficiency

Fleximize: UK SME outlook remains optimistic despite prudence

Love consistency? Love certainty? Love support? #LovetoLend Let’s talk! For more information, contact us on 0161 817 7480 or hello@romafinance.co.uk. romafinance.co.uk Bridging | Refurbishment | Auction | Conversion Development | Developer Exit | Buy-to-Let | HMO MUFB | Holiday Let | Serviced Accomodation

Membership News

Pollen Street pens

£50m facility with Tower Street Finance

Pollen Street Capital has signed a £50 million senior secured credit facility with Tower Street Finance. Pollen Street’s facility will support the NACFB Patron’s future growth ambitions in the UK.

Tower Street Finance is a regulated provider of innovative lending products for the probate sector. The firm helps both customers and practitioners who require financial solutions throughout the probate process.

Pollen Street’s facility will support Tower Street’s future growth ambitions in the UK. The deal provides funding to enable many more customers and practitioners to navigate the financial challenges of probate.

Robert Husband, CEO of Tower Street Finance, said: “I am delighted to have secured this new funding facility with Pollen Street Capital and would like to thank Matthew, Connor, Paul and the team for their support. Securing this backing ensures we have the funds in place to underpin our ambitious growth strategy and reaffirms our position as the leading provider of probate lending solutions in the UK.”

Mercantile Trust to accept automated bridging valuations

Mercantile Trust has introduced automated valuation models (AVMs) into its bridging loan process. AVMs are now available on residential bridging up to £100,000 and a maximum loan to value (LTV) of 75%, subject to confidence score and criteria. Unlike other bridging lenders which allow the use of AVMs, they are available with Mercantile Trust in England, Scotland, Wales and Northern Ireland.

The NACFB Patron shared that the broker controls when the AVM is run so they know very early on in the process if a traditional valuation is needed.

The introduction of AVMs complements other enhancements Mercantile Trust unveiled during 2022, including in-house and free legal support on refinance applications. For those who require rapid finance, these changes collectively make bridging even more attractive, as they enable cases to be processed more quickly than normal.

Maeve Ward, director of commercial operations at Mercantile Trust, commented: “We are committed to investing in technology and streamlining our existing processes to provide a platform that brokers can rely on to transact at speed. They can also be confident that they are partnering with a lender which offers flexibility and certainty of funding.”

14 | NACFB

Membership News

Buy-to-let. Better.

Discover why more intermediaries are choosing to partner with us.

We’re not just another lender. We’re an award-winning team, building a company we love.

Choose Landbay and you’ll find experts at the end of the line, smart technology designed for you, and fast decisions you can count on.

Quality

On the panel

surveyor management

Stephen Henman Managing Director Method

We’re living in uncertain – some might say volatile –times. Individuals and businesses are feeling the crunch brought about by the cost-of-living crisis. Even the UK’s commercial lending industry is tightening its belt. Much is being done to make systems and services that little bit more cost-effective. Here at Method, we’re doing all we can to support that endeavour to ensure that lenders keep lending and brokers continue to facilitate the introductions.

If you’ve not come across us before, we like to think of ourselves as industry leaders in valuation and development monitoring panel management and procurement. We already work with many of the NACFB’s Patron lenders and Member brokers.

For lenders, we ensure that valuations are procured from the most appropriate and best qualified providers. This helps to align lenders’ valuation requirements with lending policies and minimise the risk to their loan book. For brokers, Method provides a fast and reliable way to obtain the valuation they need to support their clients’ loan applications.

is the logical choice

The value of valuations

Of course, the role of the surveyor is the most important part of any valuation journey. It’s their expertise that the lender relies on to make sound lending decisions and it’s their reputation and Professional Indemnity Insurance (PII) that’s on the line. It’s because of this that we believe the surveyor should be the significant financial beneficiary in the valuation transaction – not the panel manager. That’s not to say we don’t charge fees, we do, but quite rightly it’s only a small proportion of the total valuation cost. If you’re currently using a panel manager that charges a significant proportion, you should ask why.

We support a growing panel of around 200 valuation practices, ranging from large national surveying companies to smaller regional and local firms. For them, the cost of providing valuations has never been higher. As brokers will recognise, PII premiums continue to rise, along with wages, rents, operating costs, even petrol; it’s no surprise that valuations aren’t getting cheaper.

Transparency and fixed fees are important

Method’s pricing strategy is simple. We don’t take a cut of the surveyor’s fee and can give certainty at the outset of the final fee to our lender and broker clients and their borrowers.

Our fees are fixed. By this we mean that the amount Method receives for processing an instruction isn’t linked to the property value, how

16 | NACFB Partner Profile

urgent an instruction is, or the amount that the valuer receives. It’s totally transparent and fairly represents the work needed to process the application.

Keeping costs low

We use technology to support and enhance our personally delivered customer service. Wherever technology can do something more efficiently and quickly, with fewer errors, we take that route.

Our technology means that, not only are our instructions processed accurately with minimum errors, but we have fewer mouths to feed so our costs can be kept to a minimum. We haven’t got dozens of staff to handle instructions because we don’t need them, it’s a business designed to be highly efficient for the benefit of its stakeholders.

We’re a volume business. We make money on the instructions we process and the additional services that lenders choose to take from us to improve their processes.

Supporting lenders

Using the Method system lenders can rest assured that only the providers which meet their criteria are given the opportunity to

quote or undertake a valuation or carry out independent monitoring services. Available to use as a full panel management service, or simply when extra coverage is needed, our cloud-based technology is not only cost effective but also reduces the costs for borrowers.

Supporting brokers

At Method we know that speed, efficiency and accuracy are essential when progressing loan applications. Our service seamlessly connects brokers to surveyors that meet the lenders’ requirements. It takes the hassle out of requesting quotes, instructing surveyors, and receiving valuation reports. And our packager portal allows brokers to get valuations on the lender’s behalf to save time, while ensuring that the valuer instructed meets the necessary criteria.

Occasionally, we are asked why we don’t pay some of Method’s fees in commission to the brokers we value so much. The answer is that we deliberately keep the fees we add to a transaction to a minimum for the benefit of the borrower.

Quite simply, our fees are already amongst the lowest in the market so if we were to pay commission it would be passed to the borrower. We don’t think that’s right or fair. We do however offer great service at a price we’re happy to justify and of that we are incredibly proud.

NACFB | 17

“ We ensure that valuations are procured from the most appropriate and best qualified providers

Could do better

Raising competency through targeted training

James Hinch Head of Compliance NACFB

NACFB Member firms will be familiar with our Minimum Standards Reviews (MSRs). Undertaken annually, they help us to confirm that Member firms are working with us to meet a set of pre-defined professional standards – standards which demonstrate competency to clients, lenders and the regulator.

Recent analysis of MSR data, revealed that 22% of all firms that have undertaken a review were shown to be lacking in training and competence schemes. Worryingly, 20% of firms do not conduct any formal training at all. So why is this, and what can the NACFB compliance team do to support all Member firms to undertake training annually?

First, let me set the scene. When a Member of the NACFB compliance team conducts an MSR, we always consider the size, scope and complexity of the firm and its business arrangements, and tailor our responses accordingly.

For example, it would not be reasonable to expect a single person business to create and maintain a detailed training and competence

framework policy. We would, however, expect the person to demonstrate they had access to relevant training that they were completing on an annual basis.

When we asked the 22% why they did not have adequate training schemes in place, most said that other than carrying out basic lender product research, they didn’t realise they needed to do anything further. The 20% of firms which we identified did no formal training at all said either, they didn’t see a need for it or, they considered any training outside of understanding lenders’ products and services was extraneous.

Competence is key

From our perspective, more than 93% of all NACFB Member firms are authorised and regulated by the Financial Conduct Authority (FCA) and the regulator expects a high level of competence from all employees within a regulated entity. This is set out in the FCA Handbook under Senior Management Arrangements, Systems and Controls (SYSC).

As such senior managers at Member firms should ensure that all employees understand and maintain a working knowledge of any and all regulatory requirements which form part of their job role.

The financial services regulatory environment is fast-moving, under constant review and ever evolving, so it is vital that employees stay abreast of the latest rules and guidelines. Ensuring that staff are

Compliance

18 | NACFB

“

The portal hosts more than 100 modules, covering courses to enhance understanding of FCA rules and guidelines as well as HR and health and safety requirements

well-trained and kept up to date affords the brokerage a level of protection, reducing the risk of legal and regulatory breaches which can have serious consequences, and provide comfort knowing that the right steps are being taken. Remember, a breach can impact a firm in the form of fines, suspensions from conducting further regulated activities, reputational damage, or worst case, it can lead to legal action.

The idea that regulated firms are required to train their employees to ensure competency is hardly a new concept and the introduction of the Consumer Duty demonstrates that the FCA intends to ramp-up firms’ obligations in this regard.

So, if some firms really are ignorant of their responsibilities, then as an Association we have a duty to raise awareness of the requirements. Here’s an outline of what we’re already doing…

NACFB learning portal

Included within the membership fee, Members can login to their NACFB account to access our learning portal. This platform helps firms to train staff and delivers actionable management insights. It also enables employees to meet their compliance requirements, from training to attestations, disclosures, approvals and reporting – all in one place.

The portal hosts more than 100 modules, covering courses to enhance

understanding of FCA rules and guidelines as well as HR and health and safety requirements. Accessible at any time, the learning is delivered in bite-sized chunks so that Members can fit study easily into their working day. Crucially, the courses have been designed using a scenario-based approach, using real world examples to support understanding, rather than an archaic and historic ‘read and regurgitate’ approach.

The platform can also be used to record other learning opportunities offered by the NACFB or further afield. This is a particularly useful facility for those who like to keep a tally of their hours for CPD purposes.

Doing more

Clearly, providing access to training isn’t enough for some individuals and firms who perhaps need more encouragement. So, we often send out reminders in the NACFB Morning Briefing and when engaging directly with Members. But we are conscious that we perhaps need to do more and that’s where our community comes in. How do you think we can encourage all Member firms to implement training schemes which meet the requirements of the regulator and help to raise standards? All ideas will be warmly welcomed and seriously considered. Get in touch too, if you want to find out more about how the platform works or want to add more staff. As usual, the compliance team can be contacted via compliance@nacfb.org.uk

NACFB | 19

How can SMEs overcome labour and skills shortages?

Patrick Milnes Campaign Advisor Recruitment & Employment Confederation

The UK is caught in the middle of unprecedented labour and skills shortages. This scarcity was the focus of the Recruitment & Employment Confederation’s (REC) recent report ʻOvercoming Shortages’. We asked Patrick Milnes to elaborate.

What is causing the shortage?

Caught short Q

This problem has been bubbling away for the last few years, issues like the baby boomer generation retiring early, the impact of the pandemic, inefficiencies in our skills system, and years of sub-optimal performance in business investment have exacerbated it further.

Which industries are most acutely affected?

Shortages are visible in almost all sectors and regions but some industries, like health and social care, driving and logistics, retail and hospitality have felt the effects more than others.

Are SMEs suffering?

SMEs have been hit even harder by shortages

than their larger counterparts, as often they don’t have the resources available to fund bespoke recruitment or retention strategies. Particularly the case for newer skills such as digital, our research shows that digital skills shortages amongst SMEs are creating a £85 billion productivity gap.

What are SMEs doing to retain staff?

What government support is available to SMEs?

&

SMEs may need to consider different approaches to those they have used in the past. Simply offering higher salaries isn’t necessarily enough to attract talent, with many workers considering flexible working arrangements, wider benefits packages, and an employer’s culture and values just as important when it comes to choosing who to work for.

What are SMEs doing to attract new talent?

We all know diversity matters in business – a diverse workforce has the proven benefit of increasing productivity. But shortages are another reason to consider hiring from different talent pools and widening usual recruitment practices. By considering candidates from marginalised groups, for example those with disabilities, the neurodivergent or older workers, companies can expand the skills and talent available.

The government’s Help to Grow scheme offers funding for leadership and digital skills that can be accessed by small businesses. Skills Bootcamps offer short-term, flexible training courses to individuals in sectors including driving, construction, digital and green. These bootcamps come with a guaranteed interview at the end of the training, and SMEs can partner with training providers to access the newly trained candidates. Apprenticeship Levy funding is also open to SMEs; however, this is quite restrictive in how it can be used. The REC has called for the levy to be expanded into a broader apprenticeship and learning levy so that the funds do not go to waste.

A

When might the UK expect to recover?

Labour and skills shortages are not going to disappear without concerted effort from both businesses and government. It’s not the job of the HR team to fix this, nor can one government department do this in isolation. The fix only comes about if we create a long-term, sustainable future workforce strategy together. That’s what will ensure we’ve got the right people, with the right skills, in the right jobs, at the right time.

20 | NACFB Ask the Expert

rate mortgages for property investors • For residential and commercial properties • Capital & Interest, and Interest Only options available • LTV up to 75% for residential and 70% for commercial • Fixed rates for 2 or 3 years Ready to work with Redwood Bank? redwoodbank.co.uk | 0330 053 6067 brokers@redwoodbank.co.uk Property secured on a loan may be repossessed if repayments are not maintained. All information correct as at 04/11/2022. Visit our website for further information and full terms and conditions. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Fixed

Advertising Feature

Transforming the broker experience

Helping brokers deliver for their clients

Keith Softly Head of CB Intermediaries Commercial Banking Lloyds Bank

This year has been far from straightforward for brokers and their clients, but talking to brokers during times of uncertainty, and tuning into what’s important to them, remains our priority.

Building that insight has driven our ‘Broker 360’ programme, where we’ve hosted lots of face-to-face and virtual broker roundtables. We’ve also used technology to capture feedback across all our product lines. Our priority is to understand how we can improve the broker experience, support your operations, and protect your reputation with clients.

Sector-focused specialists

That focus has underpinned our move from having a regional approach to specialist sector teams, which now provides a streamlined entry point for every broker. By bringing all our intermediated products into one strategic channel, you can benefit from consistent access to multi-product solutions that, in turn, serve to help diversify your own revenue streams.

With our specialist sector teams dedicated to healthcare, real estate, and trading businesses, we can give you and your clients an in-depth understanding of the challenges and opportunities that exist. While 2022 has seen more disruption than anticipated, some sectors have naturally proved more resilient. Healthcare, for example, has seen continued progress off the back of pent-up demand in the sector.

Meanwhile, we’ve invested in training our Business Development Managers. So we can offer tailored support to help manufacturers and other trading businesses remove risk from their supply chains and invest in a longer-term future.

Relationship-driven approach

It comes back to those strong relationships, and being there to support you when, how and wherever needed. That might mean supporting you on joint visits to clients or working closely to structure transactions.

By investing in innovative tools like our broker portal, we hope to transform the broker experience, making it predictable, straightforward, and informative, so that you can best serve your clients.

Clients are building stronger relationships with brokers, resulting in more repeat business. It means they need a broker with a complete view of the market and the options available. Combining technology with sector specialism, deep experience, and access to multi-product solutions, is essential to helping brokers deliver on that need.

Support through times of uncertainty

Funding options, strong communication, and fast processing are particularly important in times of uncertainty, and we are here to help as a through-the-cycle lender. Extended order lead times and secondhand values that are higher than usual have had a significant impact on asset finance markets. We’re seeing clients get more organised around their buying programmes as a result. Brokers, therefore, need us to be responsive and work with them to make sure there’s headroom built into credit lines to support any changes.

Special Feature

22 | NACFB

“

We are committed to supporting brokers as they and their clients navigate the challenges that will bring

Investing in the future

As we look ahead to 2023, we will continue to add value to client and broker relationships by investing in our people. But we’re also investing in technology across areas like automating credit decisionmaking, so we can improve time to cash and help brokers take their transactions out to the market more quickly.

We recognise that there are still unknowns around the UK and global economies; issues such as inflation, interest rates, energy prices, and supply chains won’t go away overnight. We are committed to supporting brokers as they and their clients navigate the challenges that will bring.

Let’s not forget, though, that the market offers opportunities too. Innovative solutions, such as our 40-year Partially Amortising Loan for the real estate sector and our Clean Growth Financing Initiative for sustainable businesses, are designed to this end.

We want to be out there in 2023, spending more time with our brokers to help convert these opportunities. Brokers know us for the consistency of our relationships, for being a through-the-cycle lender, and as an institution whose support they can count on. That’s not about to change.

All lending is subject to status. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under Registration Number 119278.

Working with Commercial brokers

In a country that’s always changing, banks and brokers need to work together to help businesses grow. That’s why we offer the breadth of finance and level of service you and your clients can trust.

lloydsbank.com/businessintermediaries

By the side of business

By the side of business

Kicking the can

Pushing budgetary tightening down the road

Special Feature

Prof. Trevor Williams Chief Economist TW Consultancy

Framed as a budget to shrink debt and control inflation

Jeremy Hunt’s statement in the fifth fiscal event of this year essentially left most of the heavy lifting to 2025 and beyond. Of the measures announced, some three quarters were spending cuts, and just one quarter were tax increases. Of the £61.7 billion fiscal tightening announced up to 2027/28, only £19 billion occurs before 2024/25.

That implies that beyond 2025 most of the tightening will come from tax increases but spending will also be cut. Still, over-tightening fiscal policy during a recession should be kept to a minimum. And the Budget did include tax rises for the wealthier alongside benefit increases for the poorest. However, it has political implications as it leaves the bulk of fiscal tightening after the next general election.

The Budget forecasts make for grim reading over the next couple of years, with the contraction in GDP forecast to be 1.4% in 2023 and 2% in total between now and the end of next year.

OBR made clear its view of the Budget

The OBR could not be more explicit about the budget measures’ economic impact: “Despite £100 billion in government support, living standards will fall 7% over the next two years. £60 billion in tax rises and spending cuts will arrest the rise in debt by the mid-2020s but will still leave the debt stock £400 billion higher than at the end of their March 2020 forecast. A doubling of interest rates will push the UK’s debt interest burden to an all-time high, leaving public finances more vulnerable to future shocks and shifts in financial market sentiment.”

Thus, further action or faster economic growth is required to reduce the debt burden. But a combination of higher energy costs, the reduction in real spending for households and businesses from higher inflation and higher interest rates will push the economy into a downturn that will last until 2024. Economic output will not surpass the pre-pandemic output peak until Q1 2025.

As the OBR pointed out, this means a 7% fall in living standards over the coming few years as unemployment rises, and inflation exceeds income leaving the worst hit to standards of living not experienced since 1948. Given this forecast, the economic assumptions beyond 2024 are difficult to reconcile, with GDP forecast growth of 2.6% per annum from 2006 to 2028.

Productivity is key to UK recovery

It’s challenging to see where the pick-up in economic growth will come from in the years ahead without supply side reforms. Uncertainty has hit private sector business investment. The government plans to freeze

its capital spending, which is effectively a big cut compared to previous plans, after severe reductions between 2010 and 2018. Unemployment will rise, but little in the Budget has been done to reduce labour force inactivity rates, which would also help boost productivity. In short, there is little new thinking about how supply-side reform can drive UK economic growth.

Looking at OBR forecasts for the UK’s long-term potential growth suggests that productivity will struggle to recover when growth in the labour force is stagnant or slowing and business investment recovers, which means that long-term growth drivers are barely shifting.

But the credibility of this Budget must also be seen in the context of the last six months of three different governments and five significant fiscal events. They started with Rishi Sunak’s Budget as Chancellor in March this year and ended with the 17th of November’s Autumn Statement with Sunak as Prime Minister. So, much can change in a short time. And there was some excellent news featured in the forecasts from the OBR, like that inflation will fall significantly – and by turning negative in 2024 – implying that interest rates could come down very rapidly indeed.

Long-term interest rates should also dramatically fall if inflation performs as is forecast. That will ease the burden on businesses and households and help growth adjust upward. Rate cuts will be the catalyst that kick starts the economic recovery.

Servicing the government’s debt burden too will fall dramatically if long-term interest rates were to decline, leaving more for spending on some of the social challenges, particularly from an ageing population that the UK will face as it looks towards the 2030s.

The war in Ukraine could come to a quicker end, and energy prices could fall more sharply than currently priced in futures markets. The UK’s relationship with its key trading partners in Europe could be reset, boosting economic activity. There could be planning reform for housing and business development, which could also lift UK economic growth, particularly if combined with reform of skills and apprenticeships, R&D and new infrastructure investments that drive the next generation of technological innovations.

Lack of skilled and unskilled labour could be a factor holding back productivity, as is reduced access to our largest trading partners. As the OBR points out, UK trade intensity has declined.

NACFB | 25

Economic output will not surpass the pre-pandemic output peak until Q1 2025

“

Unemployment remains low

But forecasts in the last decade have shown us that things can change quite rapidly, and we can’t always assume that it’s for the negative. There are opportunities for change which may not appear very apparent now but are still possible if the right policy decisions are made.

We know, for instance, that the pace of technological change is rapid, which means that some of the costs of seizing some of the opportunities to meet the challenges of today may well be cheaper and coincide with the need to grow productivity. Moreover, an ageing population carries some potential benefits: a rise in savings rates is likely – based on Japan’s experience – as more people save ahead of reaching retirement age.

That implies more funds available both for governments to use productively and for the private sector to borrow more cheaply as a rising savings supply reduces the cost of borrowing. Suppose significant amounts of that money are used to invest in growth-enhancing technologies and opportunities. Ageing also limits the rise in

unemployment since there will be a shortage of critical workers across a range of industries, limiting the hit to employment income in the aftermath of the recession.

Recovery helped by structural factors and lower interest rates

Indeed, the challenge of meeting net zero implies that investments are crucial in emissions-reducing technologies. If emissions per unit of GDP fall in the way that energy intensity as a share of GDP has fallen in the last 40 years in the UK and the world, then there are plenty of efficiency gains to be made. For example, reducing the energy loss from UK homes, investing in efficient emissions production capabilities, and like activities.

The multitude of UK SMEs up and down the country will be crucial in delivering those beneficial outcomes. However, these are all long-term trends; in the short term, the challenge is getting through the next few years. Here, there is some hope that the fall in price inflation should lead to an equally sharp fall in interest rate, which helps SMEs to start the long process of recovery.

26 | NACFB

There is little new thinking about how supply-side reform can drive UK economic growth

“

Up to 75% LTV available Expanded acceptable asset classes No maximum loan size Product and criteria information correct at time of print (21.11.22)

Mutual benefits

PI cover built by Members for Members

Paul Goodman Chair NACFB

I’m sure you all felt the pain of the increased cost of PI cover in 2021. Upon investigation the NACFB found that the number of insurers offering Professional Indemnity Insurance cover had fallen dramatically. Further, those remaining in the market had increased excesses and reduced the provision of cover compared to previous policies.

We took action and founded the NACFB Mutual to provide our valued Members with the appropriate levels of cover they required. In addition, because of the Minimum Standards Reviews undertaken by the Association, NACFB Members were deemed to carry a lower risk profile than many non-Members and the NACFB Mutual’s pricing was able to reflect this benchmark of professionalism.

What sets the NACFB Mutual apart?

• Members own the Mutual, control the Mutual, and benefit from the Mutual’s profitability. If you pay premiums to another insurer, it is gone forever. By buying cover from the NACFB Mutual, you have the opportunity to share in the Mutual profit by way of future distribution to you the Members.

• Savings of up to 30% on your quoted renewal premium.

• A policy of providing bespoke cover at competitive prices to NACFB Mutual Members.

• The fee for managing the NACFB Mutual is built into the price, so no additional commission is paid to insurance brokers, retaining the funds for the Members’ benefit.

With the competitive pricing being offered by the NACFB Mutual we have noted that other insurers have now started to reduce premiums in an attempt to keep you. However, longer term the external market could revert back to significant premium increases. The NACFB Mutual will always try to ensure that our prices remain reasonable.

This is your Mutual built by Members for Members

Successfully established earlier this year, the NACFB Mutual has already achieved the backing of the Association of Financial Mutuals (AFM). This accreditation endorses the credence of the NACFB Mutual as the PI provider of choice for all the Association’s Members.

The NACFB Mutual, is managed by the Mutual Management specialists of Tower Insurance (not to be confused with Towergate). The Mutual has been structured to cater for all claims in a “typical year” from pooled Member funds. To protect itself and its Members from unexpected severity or frequency of losses, the Mutual insures this excess exposure through Wimsure backed by Aquilano Insurance. Aquilano are AM Best rated, the largest credit rating agency in the world specialising in the insurance industry and AM Best find Aquilano’s risk-adjusted capitalisation to be at “a very strong level”. Adding confidence that the NACFB Mutual is financially secure and appropriately protected.

We pride ourselves on our NACFB brand being widely known, recognised, and understood. We hope that NACFB Mutual continues to show you how the NACFB endeavours to help you and your business thrive.

“This is your Mutual built by Members for Members

28 | NACFB Special Feature

Special

LDS removes sales risk, opening up access to finance, reassuring developers, lenders and brokers in uncertain times. Remove Uncertainty reigns across almost every component of the housing market, especially new build, which is even more acute for SME housebuilders. Scan the QR code to find out how LDS removes uncertainty and is the catalyst to bring forward much needed new housing in all market conditions. Info@LDSyoursite.com 0333 006 7799 uncertainty Get an instant Sales Guarantee at LDSyoursite.com

FOR INTERMEDIARY USE ONLY T&Cs will apply, subject to status and affordability. Any asset used as security may be at risk if you do not repay any debt secured on it. Aldermore Bank PLC is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (Financial Services Register number: 204503). Registered Office: Apex Plaza, Forbury Road, Reading, RG1 1AX. Registered in England. Company No. 947662. Invoice Finance, Commercial Mortgages, Property Development, Buy-To-Let Mortgages and Asset Finance lending to limited companies are not regulated by the Financial Conduct Authority or Prudential Regulation Authority. Asset Finance lending where an exemption within the Financial Services and Markets Act 2000 (Regulated Activities) Order 2001 applies, is exempt from regulation by the Financial Conduct Authority or Prudential Regulation Authority. Find out more at aldermore.co.uk/assetfinance Asset finance delivered with extensive expertise. • Funding a wide range of sectors • Dedicated support with extensive expertise • Online end-to-end deal system • Straightforward products and innovative solutions • Broker support training We back you to get the assets your clients need.

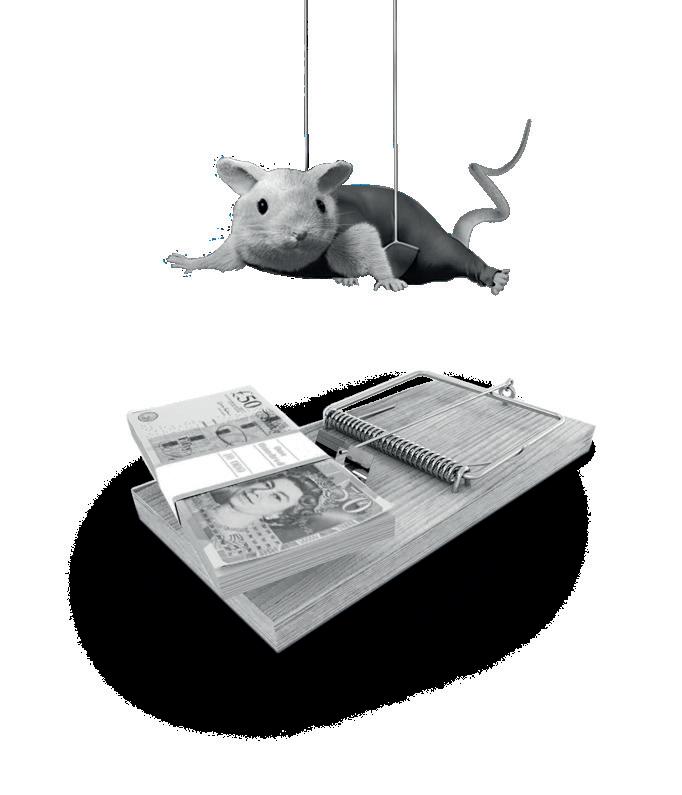

Death duty calls

Should inheritance tax be abolished?

Richard Davies Business Development Director Tower Street Finance

Inheritance Tax (IHT) is a tax on the estate of someone who has died. It is a largely unpopular levy and an emotive topic. Sometimes viewed as a hindrance to wealth creation, when times are tough, many campaign for its abolition. It’s perhaps no surprise then, that as the UK looks down the path of recession, the call for IHT to be done away with is back on the agenda.

Death duties were first introduced into the UK as far back as 1694 although the more modern-day IHT was established in 1894 when the government of the day needed to raise funds to fill a £4 million deficit (sounds familiar). After WWII, the duty was increased from 60% to 80% to help rebuild the country. The highest percentage rate reached was 85% in 1969. Ultimately this settled down to 40% in 1986 with the introduction of the Inheritance Tax we know today. The rate hasn’t changed since then.

Why is IHT unpopular?

Dissenters say that IHT amounts to double taxation. The assets being taxed have been bought with funds that have likely been earned and taxed already.

The counter argument to this stance relates to property. Increases in property prices have not been ‘earned’ in the traditional sense

and could be considered akin to ‘profit’. Given that property prices have almost doubled since the IHT threshold was last changed, it’s a valid challenge.

The other reason IHT is unpopular is because of the frustrating way in which the law works. HMRC requires the Executor of an Estate to pay the IHT to get the Grant of Probate. A Grant of Probate is needed for the Executor to get control of the Estate assets, creating a classic ‘chicken and egg’ situation – the Executor needs to sell the assets to pay the IHT, but they must pay the IHT to get control of the assets.

Just a tax on the rich?

Surprisingly, only around one in twenty (5%) estates in the UK pay IHT, up from one in twenty-five (4%) before the pandemic. The threshold for paying any IHT is £325,000, although this can stretch to as much as £1 million for a married couple if they leave their main property to direct descendants. As such, it is seen very much as a tax on the rich, a viewpoint that is reinforced by the fact that London and the Southeast account for almost 50% of IHT takings across the UK.

However, since 2009 IHT allowances have been frozen (previously to 2026, but more recently until April 2028 in the Autumn Statement) which means that an even greater number of estates will incur IHT going forward. Given the astronomical increases in property prices over the last decade, some would argue that IHT is no longer just a tax on the rich.

Why might a Conservative government abolish IHT?

For the most part, IHT is levied on an older and wealthier generation,

Special Feature

NACFB | 31

particularly those in the Southeast of England – a demographic which is heavily represented within the Conservative Party membership. So theoretically, abolishing IHT could prove popular with traditional Tory voters, especially with an election due in just over two years’ time.

However, it is widely known that Rishi Sunak, the new Prime Minister (at time of writing), is anti the abolition of IHT, although this summer he hinted that he might consider amending the rate. But the summer was a long time ago in politics!

The £6 billion that IHT generates in tax receipts might seem an eye-wateringly large amount to most but some in government believe that it is a reasonably small amount in the grand scheme of things. They think that losing this income stream could lead to more wealth creation throughout the country. Treasury minister, Andrew Griffith recently suggested that abolishing IHT would be his ‘top choice’ for a tax to abolish.

However, the counter to this argument is to look at what happened

in early October when the then Chancellor Kwasi Kwarteng suggested abolishing the 45% tax rate to aid wealth creation – there was so much backlash about benefiting the rich when the less well-off need help with the cost-of-living crisis that the decision was reversed. Some might say that abolishing IHT would suffer the same reaction amongst the general public. However, this must be balanced against the prediction that, with allowances being frozen to April 2028, over 1 in 10 estates may be paying IHT by then.

Where do we stand?

We suspect that given recent government turmoil and the need to calm the money markets, abolishing a tax that affects the rich more than the poor will be a long way down on the new Prime Minister’s agenda.

It is clear to most that every penny counts. Removing IHT at a loss of £6 billion would not play well with people who are struggling to make ends meet during the cost-of-living crisis. Let’s face it, £6 billion could help a lot of people stay warm this winter.

“ 32 | NACFB

Removing IHT at a loss of £6 billion would not play well with people who are struggling to make ends meet during the cost-of-living crisis

We make the complex simple

Common-sense lending since 1974

The Rubik’s Cube was invented in 1974 by Erno Rubik. The very same year we delivered our first common-sense loan.

And with more than 83,000 hours’ experience solving complex bridging loan cases, you can rely on us for a fast, straightforward decision.

Get in touch on 0161 933 7101.

Going for green

Connecting environmental responsibility and credit worthiness

Andrew Jackson Managing Director Swishfund

In 2020, Swishfund became the first alternative lender to be carbon negative, and asked itself whether environmentally responsible businesses are more creditworthy? Jumping in feet first, we decided to offer APR discounts to carbon neutral customers and those in renewables.

We believe that the climate change movement has got it wrong. Too much emphasis is placed on education, and not enough on making environmental responsibility economically attractive.

Every lender worth their salt has a risk-based pricing model to standardise offers and reduce bias. If a strong link could be made between creditworthiness and environmental responsibility, this should be baked into the pricing model. The finance an environmentally responsible SME then receives should become cheaper, and this would create a virtuous circle.

The benefits of being environmentally responsible are not only for the UK government’s climate change commitment, but also help protect against transition risk relating to climate change. For example, suppliers to government-backed projects need to submit carbon reduction plans as part of the procurement process – and any business that is not thinking about carbon reduction is going to find it difficult to win or renew those contracts. In view of the worsening climate crisis, there will only be increasing requirements on banks, industry and local government.

Earlier this year, we teamed up with 4most Risk Consultancy and Meckon to win a grant from Innovate UK to build a SME Green Score, and to connect that score with creditworthiness.

After two months of research, the new dataset was applied to

4most’s proprietary knowledge elicitation process, where an expert panel assessed SMEs through a series of paired comparisons. This rank-ordered the SMEs in terms of their relative riskiness. A logistic regression analysis showed how the variables interacted and determined the most predictive factors.

By September a first-of-its-kind SME green credit score prototype had been built. It showed that a green score is weakly correlated with current credit bureau credit ratings. This indicates that the SME green credit scorecard is capturing information that is overlooked and not found in conventional SME credit risk assessment.

We found that the most predictive factors of climate risk include emissions intensity; vehicle energy sources; a self-reported assessment of the impact of climate change on the business model; and whether Scope 1 and 2 emissions have been assessed or considered.

Lenders are currently missing out on this additional insight and are limiting the opportunity to offer informed risk-based finance. We continue to believe that putting money back in the pockets of SMEs will be fundamental to sustainable, long-term financing decisions and to supporting the transition to a low carbon economy.

34 | NACFB Special Feature

Special

“

Putting money back in the pockets of SMEs will be fundamental to sustainable, long-term financing decisions and to supporting the transition to a low carbon economy

loanapplication

you

your

Start a beneficial relationship Simply email us and one of our team will be directly in touch contact@sancus.com > Ground up, 1 to 50 units > Major structural renovation > Office to residential conversion > Residential | Semi-commercial | Mixed Use sancus.com UK | IRELAND | JERSEY | GUERNSEY | GIBRALTAR Relationship focused Development Finance

Development by

Indicativecriteriaonly,each

isconsideredonitsmerits.SancusLending(UK)LtdisregulatedbytheFCA,firmreference number 593992. Risk Warning: If

are co-funding you could lose part or all of

capital. Indicated returns, unless otherwise stated are shown before any provision for bad debts and may be subject to tax. Sancus do not provide private mortgages. Sancus Lending (UK) Limited (company number 7534003), registered office 3rd Floor, The News Building, 3 London Bridge Street, London, SE1 9SG. Authorised and regulated by the FCA (FRN: 593992). Part of Sancus Group Holdings Limited which is registered in Guernsey.

A growth journey

Using asset based lending to find a way

Sharon Bryden Director of Commercial Loans & Asset Based Lending Time Finance

In an autumn that has so far seen three Prime Ministers in just two months, a focus on building a stable road to recovery for the UK’s economy has fallen by the wayside. Uncertainty for what lies ahead and what support measures will be available to help stimulate economic growth continues to ripple through business communities. In a recent survey, we found that almost half of UK business owners feel uncertain about their future and 73% are calling for tailored financial support.

But the notion that soon-to-be introduced Government support will miraculously patch the widening gaps in the financial landscape is a scenario that businesses simply cannot rely on. And financial intermediaries will know first-hand the hurdles involved when securing finance in the current economic climate, as some lenders tighten their purse strings, and their appetite becomes more and more restrictive. We understand that businesses need a funder they can rely on and a solution which creates confidence. Solutions like asset based lending (ABL) can do just that.

Agility, flexibility and a holistic view to delivering funding solutions will be the key to unlocking business potential and driving business success. Current figures see inflation surpassing a 40-year high and rising costs continue to be the main worry keeping business owners awake at night. This only re-affirms the need for targeted financial support.

Unlocking working capital

ABL is an ideal solution, helping businesses to unlock working capital from the assets already within their business and giving them the financial freedom to not only manage the everyday expenditure of running a business but to also confidently invest in the future.

As we near the end of 2022, SMEs will now be looking within to really consider what lies in store for their business in the next year and what can help them get there. Do they seek to simply balance the books, dedicate their efforts into a new growth strategy or invest in new product lines?

Flexibility in assets

ABL has the potential to harness businesses with a self-sufficient plan that really hands the reins back to them. By unlocking serious working capital from within the business, ABL can make investment plans a reality as we move into new year financial planning.

Working in conjunction with an invoice finance facility, ABL could release funds otherwise tied up in a number of business assets, from invoices, to commercial property, plant and machinery as well as stock. Providing a typically higher level of working capital, businesses are given the fuel needed to drive their plans forward.

Helping with every stage of a business’ growth journey, ABL has the potential to fund key business opportunities from management buy-outs, to management buy-ins, as well as mergers and acquisitions. This makes for a more reliable and tailored solution for many firms with flexible or unpredicted growth plans.

Industry Insight 36 | NACFB

Back to factor

The return of invoice factoring

Adrian Taylor Head of Invoice Finance Paragon Bank

In recent years, the use of invoice factoring has been less popular compared to invoice discounting. Industry figures show that around 25% fewer companies use factoring than five years ago, but with current economic trends, could now be the time for SMEs to reconsider?

Both types of invoice finance help companies to raise money quickly, support cashflow and protect against bad debts.

Businesses which choose invoice factoring benefit from the provision of cashflow funding and credit control support.

For those who opt for invoice discounting, responsibility for managing the ledger sits with the business which means that customers tend not to know that an invoice finance provider is involved, and the rates are often cheaper. It’s an attractive proposition but it is not always the best solution for the business.

Historically, invoice discounting was restricted to those businesses demonstrating good levels of profitability, a robust balance sheet and a dedicated in-house accounts team. Even today, it is essential that the business can provide reporting information reliably and in a timely manner. Delays and inaccuracies often result in funding

interruption. Also, if funding reserves are adjusted only once each month there can be a sudden imposition of reserves, again impacting available funding. Such complexities are not a feature of factoring.

For smaller businesses, factoring could be a more appropriate solution because the provider takes on credit control responsibilities leaving the business owner to concentrate on trading activity. Also, many providers offer fixed-cost facilities for just a few hundred pounds each month which is far more cost-effective than if the business were to employ someone directly.

Given all the benefits of factoring why have so many SMEs moved over to invoice discounting?

Some business owners may argue that, in the past, they have suffered poor experiences using a factoring-based funding service. This really highlights the importance of choosing the factoring provider carefully. Obviously, many decisions are based on cost or funding formulae, but brokers should also be prepared to have a discussion with clients about their credit control expectations. It is hugely important to try to match what the provider offers with what the client expects. For example, regular engagement with the dedicated credit controller will enable the fostering of a positive relationship with debtors and any concerns over being too lenient or overly firm can be managed effectively – but only if dialogue is possible.

When sourcing factoring providers for clients, brokers should also consider how the provider handles queries that come to light during routine credit control duties. Some providers will automatically dispute the invoices and reduce the level of funding available, whereas

38 | NACFB

Industry Insight

others will engage with the business to agree a period of time to work through the query so that it can be quickly resolved or established to be unfounded.

I am a strong advocate of factoring services but if we are to encourage more businesses to revisit this form of finance, it requires the provider to recognise that quality of service is as, if not more, important than price. Here at Paragon, our commitment to genuine service levels includes a low ratio of clients to staff, as well as sufficient time for our staff to frequently and meaningfully engage with the businesses we support.

Factoring also requires the support of intermediaries. If providers can demonstrate to brokers that their offer puts relationships and dialogue at the heart of the arrangement, brokers will add factoring back into their toolkit of solutions.

Factoring remains a dynamic product to supply SMEs with the working capital they need to trade and grow. And when care is taken to select a provider based upon their service characteristics, it not only delivers tremendously efficient support to the business, it’s a win for broker and lender too.

Getting commercial finance doesn’t have to be this tricky. 020 8349 5190 | alternativebridging.co.uk

In good faith

Lending to spiritual and religious groups

Here at Triodos, we also look at how organisations support and engage with their wider communities, including non-members. A useful example of a Philosophy of Life customer that does just that is Jubilee Church Hull, which has developed a programme of activities that proactively reaches out to local people. Its support for the whole city includes a morning drop in providing laundry and shower facilities for those sleeping on the streets.

Lending to faith-based organisations (what we refer to as the Philosophy of Life sector) has its own unique challenges and is an area in which brokers often turn to us for support.

For brokers, a common obstacle when arranging lending is the changeable nature of income for these groups. For example, churches often rely on donations, tithings and grants, which will naturally fluctuate from one year to the next and can be vulnerable to shifts in membership levels. This can prove challenging for most high street banks and so brokers can struggle to find support for organisations with this level of unpredictability.

Banks that specialise in lending to faith-based organisations will understand how best to arrange support for these groups and will be more comfortable with the nature of their income streams.

Reasons for loan requests

The most common reason why faith-based organisations would need a loan is for real estate – whether that’s to purchase new buildings or to renovate an existing property. For instance, they might be expanding geographically, or they could be retrofitting a premises as part of their plans for transitioning to net zero.

For brokers, an important part of finding the right lending partner for a client in the faith-based sector is to consider the scope of their values and ethos.

Faith-based organisations are often mindful of protecting people and the planet and lenders operating in this sector may need to see that these groups are operating in a non-coercive manner, they respect people’s freedom (for example with regards to LGBTQ+ rights), allow people to leave and are tolerant of other faiths.

Mission aligned partners

Like businesses or charities, many faith-based groups are seeking to align their own lending with their commitment to improving society. They are supporting important action to combat the climate crisis and its impacts, increasing their sustainability commitments in dayto-day operations and searching for finance that enables them to make even more of a positive difference.

In these challenging economic times, brokers may struggle to arrange a loan for organisations with donation-based cash flows. However, by broadening the scope of their lending partners, it’s possible to find a solution for clients in this sector that fits with their values while offering the flexibility they need.

40 | NACFB

Industry Insight

“

An important part of finding the right lending partner for a client in the faith-based sector is to consider the scope of their values and ethos

Phillip Bate Business Lending Team Lead Triodos Bank UK

Seeing eye-to-eye. It’s

builds successful relationships and we pride ourselves on it. Asset finance Property finance Specialist car finance Savings For intermediary use only. Cambridge & Counties Bank Limited. Registered office: Charnwood Court, 5B New Walk, Leicester LE1 6TE United Kingdom. Registered number 07972522. Registered in England and Wales. We are authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Financial Services Register No: 579415 Let’s talk. 0344 225 3939 info@ccbank.co.uk ccbank.co.uk/pride

honest communication

our brokers

At Cambridge & Counties

you’ll

experienced

businesses

customer satisfaction scores

customer

application

what

Open,

with

is always at the forefront of our beliefs.

Bank,

find an

front-line team who understand that no two

are the same, which is why we manually underwrite every deal. Our outstanding

demonstrate that we stand out from the crowd by going the extra mile, from understanding

needs to supporting them through the

process and beyond.

Culture club

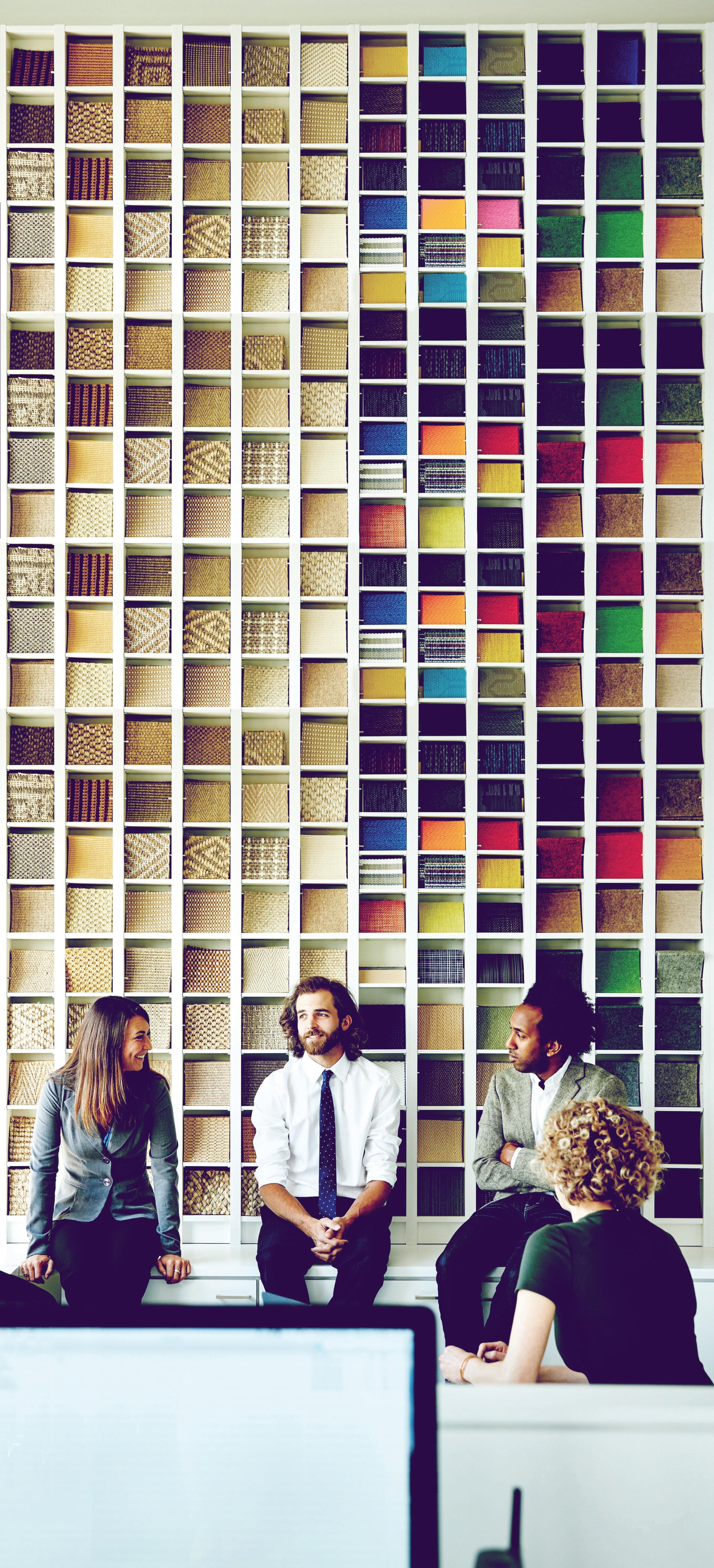

Acompany’s culture is strongly linked to the success of the business. Building a successful team is much more than just bringing together a group of people with the right skills and experience. More than ever, the phrase ‘company culture’ should be placed at the centre of any workplace with organisations working towards a collection of shared values, goals and beliefs, while providing employees with a sense of purpose and belonging.

This year, we held our largest recruitment drive, resulting in the workforce increasing by 28%. Haydock’s culture has played an integral part in this process having a strong link with our ability to attract and retain our employees.

A company’s onboarding process is strongly impacted by culture as new employees experience the organisation with fresh eyes. To support new recruits, some organisations show an induction video which provides insight into each department while capturing the values and personalities of team members.

Learning and development is a key driver of employee engagement. Providing individuals and teams with ongoing skills enhancement can have a significant impact on motivation and loyalty. Valuing continual learning is an important aspect of a company’s ethos and this is where culture and upskilling are intertwined. In the commercial finance sector, offering staff the opportunity to enrol in industry-related training – both in-house and by external providers – is just one way to support career progression. Personal development programmes, which take a more holistic approach, should also be considered.

Some employers use personality tests, including using Myers-Briggs Type Indicator, which identify a person’s personality type, strengths

in the workplace

and preferences. This can provide individuals and their employers with a greater self-understanding and insight into how their actions are perceived by others. It also delivers insight into how to interact and persuade effectively.

Creating a strong company culture goes beyond attracting and retaining employees, it is also supporting individuals whilst at work. At Haydock, we have made supporting mental health and wellbeing a priority. A variety of workshops have been delivered to offer guidance on stress, diet, nutrition and menopause plus stretching and movement. We also organised a wellbeing event which provided a hands-on unique, sensory experience.

A great way to test the strength of a company’s culture is to conduct a staff survey. This can reveal deep insights into how employees are truly feeling. We run an anonymous survey once a year and cover a range of topics including goals, communication, role and wellbeing. The results can identify the areas where the culture is successfully engaging the workforce plus flag any areas of concern.

A strong company culture will set the foundations for employee engagement and staff retention and will have a significant impact on your organisation’s longevity and growth.

42 | NACFB

Industry Insight

Creating a sense of purpose and belonging

“

Valuing continual learning is an important aspect of a company’s ethos and this is where culture and upskilling are intertwined

Debbie Hallam HR & Facilities Manager Haydock Finance

Tailored solutions for your business

With over 150 years of asset-based lending experience combined, our team has the knowledge and expertise to support Hire Purchase, Leasing and Refinancing requirements, helping businesses grow, develop and reach their true potential.

Our promise to you:

• Service – We provide outstanding customer support, with e cient turnaround times so our brokers trust us to get their deals over the line.

• Flexibility – We understand that every business is unique, so we tailor our solutions and remain flexible in our approach.

• Relationships – We work to create strong relationships built on trust, knowledge and expertise.

For more information, get in touch with our asset finance experts on 0345 120 2007.

interbayassetfinance.co.uk

Information correct at time of print (21.11.22)

Catching the wave

A bigger splash through trade finance

Mark Collings International Finance Consultant

Mark Collings International Finance Consultant

Cornerstone Finance Group

Cornerstone Finance Group