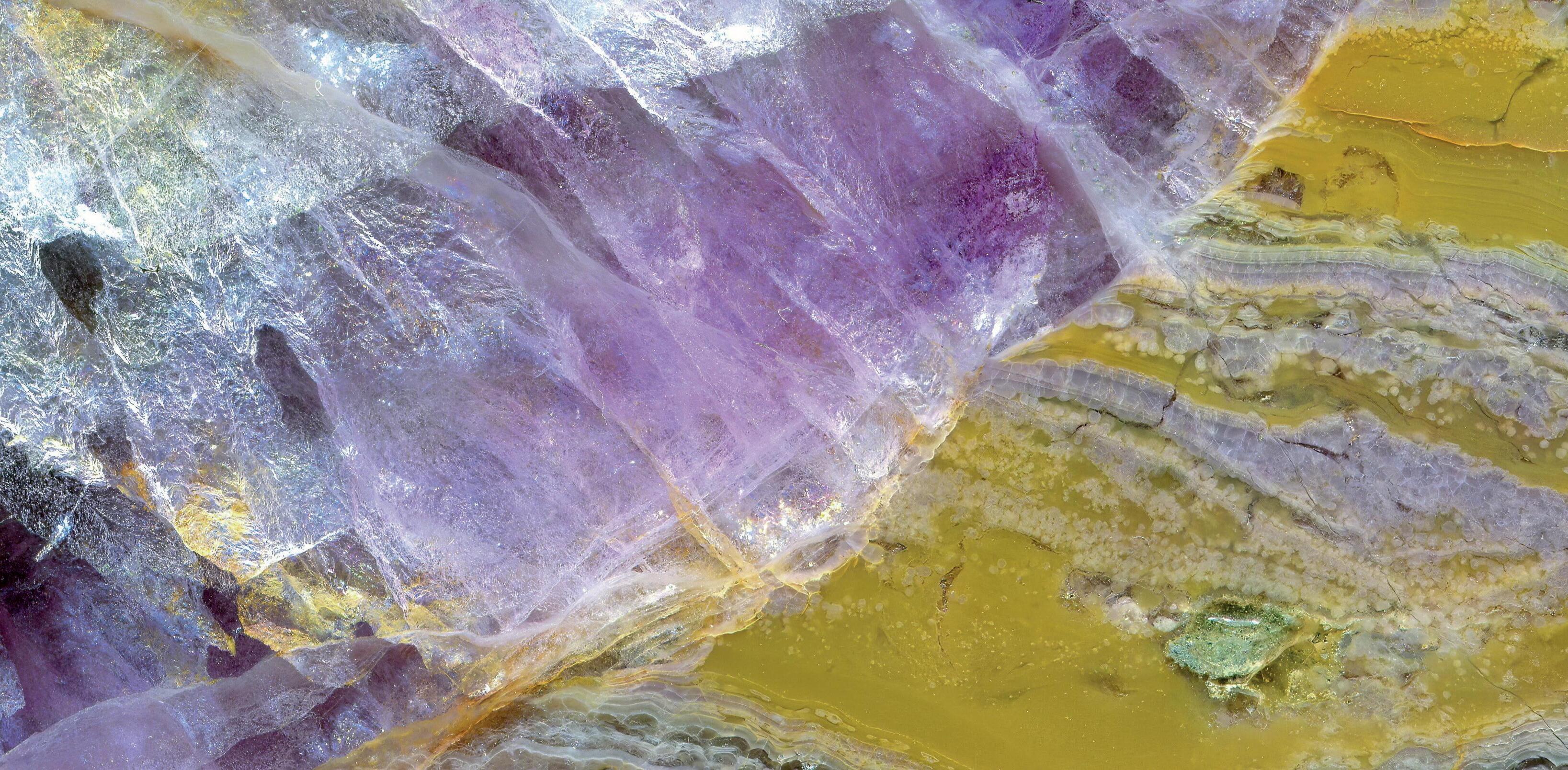

Collateral damage?

Unlocking the potential of intangible assets

Unlocking the potential of intangible assets

Whether they’re fitting a new kitchen, looking to improve a property’s energy e ciency or refurbishing one that already has a high EPC rating, our refurbishment buy to let o ering could tick all the boxes.

Standard refurbishment

Refurbishment work to make a property habitable, such as installing a new kitchen or bathroom.

Energy e ciency refurbishment

Refurbishment which includes some element of energy e ciency, such as fitting a new boiler or double glazing.

EPC C+ refurbishment

Refurbishment of a property already EPC C or above, of if awarded a C rating following work.

KIERAN JONES Editor & Feature Writer

33 Eastcheap | London | EC3M 1DT Kieran.Jones@nacfb.org.uk

JENNY BARRETT Communications Consultant

33 Eastcheap | London | EC3M 1DT Jenny.Barrett@nacfb.org.uk

LAURA MILLS Graphic Designer 33 Eastcheap | London | EC3M 1DT Laura.Mills@nacfb.org.uk

MAGAZINE ADVERTISING

T 02071 010359 Magazine@nacfb.org.uk

MACKMAN

Design & Production

T 01787 388038 mackman.co.uk

The year is now in full swing. Here at the NACFB, it’s all hands on deck as the Association ramps-up activity and heralds a new era of collaboration. You’ll have seen early signs of the direction the trade body is moving in, and I am pleased to say these are entirely positive developments.

The developments are primarily cultural ones; representing a new way of thinking about what NACFB membership means for brokers and how our Members can share this meaning with all organisations they encounter. You can find out more on the news page of this issue, but we’ll also be sharing further details and information in the coming months.

We’re also ramping-up our events activities. The NACFB Commercial Finance Expo returns next month, the NACFB Summer Party the month after, and – as you read this in May – submissions remain open for the NACFB Commercial Broker Awards. The latter’s ceremony will be hosted in Manchester this September for the first time, and we hope to recognise much broking excellence on the day.

We also find ourselves in the thick end of Consumer Duty activities. Most milestones are now behind us, but there is still plenty to be done ahead of July’s final deadline. My colleague James Hinch shares his update in this issue also.

The cover feature examines something of personal interest to me, the use of intangible assets as collateral. I firmly believe that with enough impetus, using non-physical assets as commercial loan collateral could well unlock new levels of funding for UK SMEs. Within these pages I outline my case but watch this space also.

Activity here at NACFB towers is going ten to a dozen, energy is high, and momentum pushes ahead. All we do here, every event, every email, each article and discussion is only ever undertaken with one thing in mind: serving in the best interests of the intermediary-led lending community. Thank you for your continued support.

Association updates for May 2023

The NACFB is to roll out a reframed review process for Members. The new NACFB Assurance Consultation repositions the Association’s established Minimum Standards Review (MSR) and is designed to empower each Member with bespoke certification and documentation that attests to their professional integrity.

Upon completion of an NACFB assurance process, Member firms will be presented with an ‘assurance kit’ containing:

• An exclusive new logo to display throughout their business;

• A custom assurance certificate;

• A bespoke document that can be shared with borrower clients, outlining why they should partner with the NACFB Member;

• An NACFB Member Assurance Overview which they can give to lenders, collating high-level and commonly requested information designed to save brokers from having to frequently reshare business data with their entire panel.

As with the current MSR process, each firm’s Assurance Consultation will be carried out by a Member of the NACFB team and the reframed process will be phased in over the coming months, initially through new applicants. The change follows feedback from the trade body’s Members who wanted to be able to assure both clients and lenders

alike that their NACFB membership embodied the gold standard for intermediary professionalism.

Commenting on the Association’s new era of greater empowerment for Members, NACFB Chair Paul Goodman, said: “The transition for existing Members will be seamless; they will soon benefit from the advantages of being able to demonstrate much more easily and clearly what being part of the NACFB community means.

“SME clients and commercial lenders alike seek assurance that the intermediaries they partner with can demonstrate business integrity, a robustness of processes, and regulatory adherence. The NACFB is providing exactly this, in a manner that empowers Members whilst bolstering the trade body’s growing national reputation for excellence,” Paul added.

NACFB managing director, Norman Chambers, said: “The development is primarily a cultural one; a new way of thinking about what NACFB membership means for brokers and how our Members can share this meaning with all organisations they encounter.

“Within the Association we can attest to the professionalism of our membership, but for some, there was a perception that we were acting as a quasi-regulator. However, those who partnered with our team quickly understood the value that the reviews brought. We also recognised that we needed to do a better job of empowering our Members to tell this story through the lens of their own business,” Norman added.

Brokers to be issued with tailored certification to empower their business

After a seemingly unending run of bad news for British business, it’s a huge relief to see a break in the clouds.

With the worst of the fallout from the mini-budget passing, the forecasts are looking kinder (albeit still not brilliant), and global conditions are either stable or improving. We are, of course, still in a very difficult period and some businesses are being put through the wringer as a result – I wouldn’t dare dismiss their difficulties – but it’s worth appreciating that the long-term view currently appears to be changing for the better.

At the macro level, a hopeful picture quickly emerges with the Bank of England expecting inflation to drop to 4% by year-end and the Office for Budget Responsibility predicting 2.9%. Lenders are starting to relax and re-enter important markets as a result, which should encourage more investment and activity. While experts point, too, to property prices finally beginning to stabilise as we head into 2024.

It bears repeating that the economy is still set to struggle, but how long have UK businesses been waiting for few green shoots? Now that it’s happening, banks have a responsibility to respond.

We have to capitalise on this nascent positivity and the continued resilience of the SME community to help them take confident steps forward. For Allica Bank, we’ve made a significant adjustment to our credit appetite and pricing, helping us lend more to more businesses. This includes:

• Doubling our commercial mortgage limit from £5 million to £10 million and increasing our loan-to-value on prime owner-occupied commercial mortgages.

• Easing our stress-testing requirements for variable rate loans and lowering our Debt Service Cover Requirements (DCSR) across all products.

The hope is that by taking these actions Allica Bank can help you and your clients take advantage of a period of relative calm and get the UK back on a path to growth.

After too many years of instability – and acknowledging that there’s still a long way to go – this is an exciting moment for SMEs, and me personally. Britain’s businesses have had more than enough to overcome, and now it’s time for banks and lenders to step up and help them make the most out of improving conditions. The economy is far from a full recovery yet. But there’s plenty we can do to get Britain’s businesses moving towards a brighter future.

You see we adapted ‘quick’ to ‘click’ because we’re both ‘quick’ but also online where you ‘click’ on things?

Well, what we lack in wordplay we more than make up for in hassle-free bridging applications with instant quotes, enquiries in 10 clicks and Heads of Terms in minutes.

Mortgages made simple

Search | LendInvest

Connect with your local BDM

Second charge lending rose 21% to £135 million in March compared to February, according to Loans Warehouse. However, the firm’s Secured Loan Index, which reports data from lenders in the sector shows the March loan total is 6.5% down on a year ago, while first-quarter lending tumbled 16% below the first three months of last year. Loan completions lifted 18%, while average completion times improved by just over half a day to 13.62 days. The figures show a 2% increase in high LTV lending, at 85% and over.

Helena Morrissey, who campaigns for female inclusion within company management, says the Confederation of British Industry (CBI) is “finished” after it admitted failing to fire staff who sexually harassed female workers. While some staff at the lobby group have been dismissed over the misconduct, Baroness Morrissey said the actions were “too little, too late.” Asked on the BBC’s Today Programme whether she thought the CBI is finished, she said: “I do I’m afraid.”

The Government borrowed less than expected last year, with the difference between spending and tax income estimated at £139.2 billion in the year to 31st March. The amount borrowed last year was equivalent to 5.5% of the value of the UK economy, the highest percentage since 2014, excluding the pandemic. However, it comes in lower than the £152 billion predicted by the Office for Budget Responsibility. Office for National Statistics data shows that the Government borrowed £21.5 billion in March, the second-highest March figure since records began in 1993.

The FCA has announced a series of measures to step up the fight against money laundering through the Post Office, saying that while banks have made “good progress,” there is still work to do. Banks have been asked to reduce the deposit limit at the Post Office to below the existing £20,000 limit per transaction. They have also been asked to upskill staff to spot patterns of suspicious activity and improve intelligence sharing. The FCA will also test the safeguards put in place.

Britain’s economy has been handed a vote of confidence, with ratings agency S&P Global upgrading the UK’s credit outlook to ‘stable’ from ‘negative’. This reverses a downgrade issued in the wake of September’s mini-Budget. S&P said: “The Government’s decision to abandon most of the unfunded budgetary measures proposed in September 2022 has bolstered the fiscal outlook.” S&P also reaffirmed its AA rating on UK debt and predicts that the UK’s economic output will shrink by 0.5% this year, before growing by an average of 1.6% a year between 2024 and 2026.

The FCA is to clamp down on excessive insurance rates for people living in blocks of flats, warning that intervention was needed to prevent abuses of brokers’ commissions. The move follows a review after the 2017 Grenfell Tower fire, which led to large increases in building insurance costs. Policies have become far more expensive, particularly for people living in cladded buildings, and increases in brokers’ fees have exceeded the rise in costs over the same period.

The Government’s Digital Markets, Competition and Consumer Bill will seek to stop companies such as Meta, Alphabet, Amazon and Apple stifling competition. If passed into law, the Competition and Markets Authority (CMA) will gain new powers over companies that are deemed to have strategic market status and could stop acquisitions that eliminate smaller firms before they can develop a new service or product that poses a threat to more established players.

Consumers have been warned over the “plague” of claims management firms targeting people who may have been mis-sold a car finance deal. Data from the Financial Ombudsman Service (FOS) shows there were 11,452 complaints about motor finance deals in the twelve months to March 31st, up from 6,128 in the previous financial year. The proportion of claims relating to commission, fees and charges on these products increased from 1,472 in 2021/22 to 5,658 in 2022/23. 90% of the complaints covering 2022/23 have been brought by third-party representatives.

Buy-to-let investors in the capital are selling up at the fastest rate in the country, according to Zoopla, which said a combination of rising mortgage costs and low rental yields has hit their profitability. Of the homes listed for sale in London in Q1, 26% were previously let out. This compares to an average of 11% across the rest of the UK. Moneyfacts analysis shows that buy-to-let fixed rates have doubled in the last year. The 2017 changes to tax reliefs are thought to be a contributing factor to the decline.

The latest flash PMI survey from S&P Global and the Chartered Institute of Procurement and Supply shows an uptick in activity in April, with consumers shrugging off inflationary pressures to spend more on travel, leisure and entertainment. The PMI rose from 52.2 in March to 53.9 in April, the highest level for 12 months, but robust levels of service sector activity were offset by a sharp fall in manufacturing output. Manufacturers said that their customers were looking to cut down their stock levels.

6.99% 7.15%

5 yeAR FIXED RATE

75%

Interest Only 5 yeAR FIXED RATE | 65% LTV

United Trust Bank (UTB) has surpassed £1 billion of lending through its asset finance division. The milestone was reached at the end of March this year and follows a strong performance last year.

In 2022 the NACFB Patron delivered a third consecutive year of record-breaking originations, increasing new asset finance lending by 42% year-on-year and growing its loan book by 55%.

The performance is all the more impressive given the funder successfully integrated a new technology platform into its asset finance operations whilst maintaining high volumes of new lending.

Nathan Mollett, head of asset finance at UTB commented: “This is a significant milestone for UTB’s asset finance business achieved by supporting SMEs as they overcome the challenges of an unpredictable economy shaken by high inflation and the war in Ukraine.”

UTB delivered loan book growth of 55% last year and cites communication with brokers as its key differentiator. The NACFB Patron is known for valuing brokers’ input.

“With ambitious plans for the future, our new technology platform already delivering real benefits, and the best asset finance team in the business, I don’t think it will be long before we lend our next billion,” Nathan added as well as thanking brokers for their continued support.

New data from Time Finance has shown the growing popularity of invoice finance amongst the B2B business community, with demand predicted to rise throughout the year as SMEs set out to stabilise their finances.

The insight shows that invoice finance is ranked highest amongst alternative finance solutions, with 32% of financial intermediaries stating that invoice finance will be the most popular service to support cashflow this year. The data forms part of a large-scale review conducted by Time Finance to understand the financial challenges facing businesses.

As part of the review, the NACFB Patron also shed light on the impact of late customer payments, finding that SMEs are owed an average of £250,000 in unpaid invoices and some are waiting up to 120 days for payments to come through.

Phil Chesham, managing director of invoice finance, commented: “We are seeing a real uplift in businesses that come to us for invoice finance, and this is definitely a trend we expect to see continue throughout 2023.”

At face value Phil said that the uptick was an indicator of the cashflow challenges that businesses are experiencing, as well as a sign that more businesses are discovering the real value of invoice finance.

Specialist property lending, such as bridging loans and development finance, is usually provided on short terms. However, it is most effective when it’s built on long-term relationships and expertise.

Cases are often complex, with numerous factors to consider, and open communication is paramount to ensure a borrower’s requirements are met. This means working with a lender that asks the right questions at the right time and has the confidence to provide quick decisions with clarity and certainty.

At Alternative Bridging Corporation, we’ve been providing specialist lending to the property industry, business community and homeowners for more than 30 years, which means we have acquired more than our fair share of experience and expertise.

Over the last three decades, as our business has grown to help an increasing number of brokers and their clients, we’ve kept a resolute focus on maintaining a short chain of command and this means we are able to make swift decisions, whilst also being able to consider more complex cases.

Our team of directors and executives work under one roof, so brokers don’t have to wait for an eternity while their application sits in limbo and we can often provide alternative solutions for customers, even when other lenders have said “no”.

This depth of experience means we understand that service has to be number one on our agenda. With this in mind, we have invested in a growing team of business development managers, case managers and underwriters and, for our development customers we have a team of experienced asset managers. Calling on their expertise, we are able to work through complications that may provide a roadblock for other lenders. They are also on hand throughout the period of the loan, and afterwards, if necessary, to provide ongoing service and reassurance.

It’s this collaborative approach that means many of the brokers we work with, choose to work with Alternative Bridging again and again – building long-term relationships that can help to make the process even easier.

Three decades of working collaboratively with brokers has also informed our product development, providing first-hand knowledge of the challenges that investors and developers face and the types of solutions brokers need to better serve their clients. As well as our

“

We’ve kept a resolute focus on maintaining a short chain of command

Short-term lending built on long-term expertise

range of bridging, refurbishment and development finance loans, we have also launched some more innovative solutions to target specific borrower needs.

The Alternative Overdraft, for example, provides a flexible drawdown facility that can be secured by a first charge over commercial or residential property and a second charge over residential properties. It provides multiple drawdowns on demand which can be repaid or reduced and redrawn again and again. Interest is only charged on the balance that is outstanding and can be serviced or accrued.

This type of drawdown facility means that funds are available to call upon as and when they are needed avoiding the time and expense of setting up multiple bridging loans and it provides a flexible source of working capital that our customers frequently use for site acquisitions and property auction purchases or to fund work-in-progress.

Most recently, we have responded to the slowing property market with the launch of PartX Property Finance, which provides a pre-approved part exchange facility for developers to expedite sales and chain breaks on new home developments.

This type of part exchange property finance is good for developers, enabling them to complete a sale swiftly at full value. It’s a win-win situation for the owners of the part exchange property, who are able to sell their property and complete the purchase of their dream home without waiting to find a buyer. And it provides brokers with an additional financial tool they can use to help their clients.

PartX Property Finance can provide extra funds for light refurbishments for developers who want to make improvements to the part exchanged property to maximise its resale potential. The terms are agreed at outset, with all due diligence completed in advance, meaning the loan can be completed quickly and easily when it’s needed, using a short form of valuation, title insurance and a standard legal charge.

The immediate outlook for the economic environment may be uncertain, but the long-term dynamics for the property market remain strong and, as the old adage says, where there is challenge, there is opportunity. As one of the most experienced lenders in our sector, we are able to recognise this opportunity and will continue to support our brokers and their clients, with the products and service they need to make the most of it.

“

This type of drawdown facility means that funds are available to call upon as and when they are needed avoiding the time and expense of setting up multiple bridging loans

Regulated brokers should now be aware of the Financial Conduct Authority’s (FCA) new regulatory framework, the Consumer Duty. The aim of the Duty is simple, to ensure that financial firms put the needs of their customers first and deliver fair outcomes. The Consumer Duty is a response to concerns that financial services companies have not always acted in the best interests of their customers, resulting in consumers being sold products or services that were not appropriate for their needs or that they did not fully understand. In some cases, this has led to financial harm, which has damaged consumer trust in the industry.

One of the key requirements of the FCA’s Consumer Duty, one which came into effect last month on 30th April, was that distributors of financial products should be in receipt of key information about the financial products they provide. This includes understanding the characteristics of the product or service and identifying the target market, whilst considering the needs, characteristics, and objectives of any customers with characteristics of vulnerability. This information should also help the distributor identify the intended distribution

strategy and help them to ensure the product or service will be distributed in accordance with the target market.

The NACFB is monitoring the status of information sharing between lenders and brokers and will reassess overall industry readiness in the coming weeks. Many lenders and manufacturers operating

“

The NACFB is monitoring the status of information sharing between lenders and brokers and will reassess overall industry readiness in the coming weeks

in other professional service sectors have hosted this information on their websites, akin to a privacy notice, and shared their URLs with those acting in a distributor capacity. The NACFB recognises that this approach is the simplest and most effective way to meet requirements and would help to ensure a greater level of consistency across the intermediary-led lending community.

Where a broker is unable to obtain the necessary information from a lender, they should consider if other information can be used. The FCA expects brokers who fall in scope of the Duty to take reasonable steps to obtain sufficient product information from all lenders whether they fall in or out of scope of the Duty. This will enable them to understand the key features, thus supporting compliance with the ‘product and service’ and ‘price and value’ outcomes when engaging with retail customers. This is especially relevant to those acting in a credit broking capacity, who may be subject to the Duty when undertaking regulated activity for a regulated credit product for which the lender does not fall in scope due to an exemption or exclusion.

The FCA has made it clear that unless there are regulatory requirements or contracts that require it, firms are responsible only for their own activities and do not need to oversee the actions of other firms in the distribution chain. This means that brokers may face challenges when lenders fail to provide the necessary information about their products.

The requirement for distributors to use reasonable steps to gain the information needed is a key element of the Consumer Duty. By ensuring that financial firms have a thorough understanding of their customers’ needs and circumstances, the regulator is seeking to improve outcomes for consumers and improve trust in the financial services sector.

The implementation of the new regulations may pose challenges for financial firms. Compliance with the Consumer Duty does require some investment in resource to ensure that firms have a thorough understanding of their customers’ needs and circumstances.

The Consumer Duty represents a positive development for the financial services industry. By promoting greater transparency and accountability, the FCA is seeking to improve outcomes for consumers and increase trust in the industry. While the implementation of the new regulations may pose challenges for financial firms, those finance professionals empowered with the right understanding, and with the right information from the right people will be well-positioned to succeed in the new regulatory environment.

The NACFB Consumer Duty hub remains a one stop shop for all matters relating to the new regulation. Any and all updates throughout these advanced stages can be found there. Resources include a timeline of key milestones from both the NACFB and the regulator, a growing knowledge bank of analysis and feature articles, as well as a directory of all upcoming Consumer Duty events.

Find out more at nacfb.org/consumer-duty

Compliance with the Consumer Duty does require some investment of resource to ensure that firms have a thorough understanding of their customers’ needs and circumstancesKelly Saliger Vice-President Chartered Institute of Trade Mark Attorneys

Any business, including SMEs, can have Intellectual Property. According to Kelly Saliger, it is best to think about, obtain clearance, and protect your IP as early as possible. The gold standard approach for trade marks is to conduct clearance and registrability searches in countries of interest. This means thinking ‘is the mark registrable’ (i.e. not descriptive) and ‘can the mark be registered’ (i.e. confirming there is nobody already operating in the same space using a similar or identical trade mark which would prevent your business launching). Assuming the answer to both questions is ‘yes’, you can move to registering your trade mark.

What are the main advantages for small businesses in protecting their IP?

The benefits of registration include a note in the public domain of your intention to use a brand and puts a date against it. A registration allows others doing searches to become aware of your business and hopefully keep away from the trade mark and brand you are using. Other benefits

include more cost-efficient enforcement, i.e. when you are trying to stop someone else using a brand that is too similar to yours, and adding value to your overall business. Registration can also be helpful when it comes to commercialising your business by way of licence.

What are the downsides of not protecting IP?

You might find you are infringing someone else’s brand or IP. In some cases, you might need to re-brand entirely or pay out damages to rectify the IP harm. Re-branding is particularly problematic if you use your trade mark on products. Registered (protected) IP is also more cost efficient to enforce.

What exactly can be protected?

• Trade marks – branding elements such as a logo or name

• Patents – inventions and how something works

• Copyright – original artistic work

• Designs – appearance of products

Although you do receive a limited amount of protection without registering, trade marks, designs, and patents benefit from registration in the UK and need to be

registered with the UK Intellectual Property Office. Trade marks can be renewed indefinitely, while patents and designs in the UK have a set time limit attached.

Trade marks are territorial – and when registered in the UK only cover the UK. Other countries have similar systems in place, but you will need to apply to each country to seek protection. Copyright is slightly different in that you do not need to formally register your work to claim copyright, although there are important steps you should take to document your creation.

Is obtaining protection easy or do small businesses need a lawyer?

Some aspects are easier than others. If you can, we recommend seeking professional support from a Chartered Trade Mark Attorney to clear, register, and maintain your intellectual property. They can advise on what trade marks and other IP should be protected and how, as well as provide commercial and strategic advice to help you accurately reflect your business and its plans.

Are there any tax benefits to IP protection?

Yes, depending on your business these might include relief available from research and development activities or a reduction in corporation tax by way of a Patent Box.

stretches from professional services and technology to manufacturing and agriculture.

No matter where we are in the economic cycle, it is imperative that we support businesses in the right way. Our purpose as a bank is to help businesses and communities thrive – something we must do in a sustainable and safe way.

As we proceed through the second quarter of 2023, still with the spectre of a rising base rate, businesses face a quandary: lock in their assets to let them grow relatively risk free in a high yield account, or use their dry powder for investing in an economic upswing. There is no ideal answer, as what suits one business won’t fit another. But it’s clear where policy lies.

Following the Budget in March and the announcements around both full expensing and the permanent extension of the £1 million limit to the Annual Investment Allowance, in my opinion, it’s obvious that businesses are being given a nudge – or even a shove – to invest in growth. The confidence of business, and by extension brokers and lenders, is vital as the economy grows once more. It is a time to invest, but businesses will want to make smart choices.

Asset finance is vital to the growth of the UK economy, and brokers are the go-to choice for thousands of businesses looking to invest in their operations – whether that is in machinery, plant or land. In 2021, NatWest continued to grow in this space, with our brokers providing us with thousands of deals where we were able to support both small and large businesses into the millions.

But success like that can only continue through the teamwork we enjoy with our broker base. And those relationships depend on the service and help we provide as a bank offering a comprehensive range of lending products alongside multi-sector expertise that

Understandably in the current climate, some businesses find it difficult to get loans. In some cases, businesses have not factored in the rising cost pressures which can be witnessed throughout the economy, such as interest servicing costs, energy costs, staff costs or indeed supply chain pressures. All these elements put pressure on cash flow and profitability, which, in turn, influences businesses’ ability to secure credit.

There are some sectoral pressures as well. For example, in real estate, yields are being challenged as interest rates rise, and in leisure, rising food costs and pressure on disposable incomes are a specific challenge. But in any sector the strong operators will continue to do well.

What business can look forward to at the end of July is regulation called Consumer Duty coming into effect. This sets higher and clearer standards of consumer protection across financial services and places the onus on lenders to put their customers’ needs first when considering price and fair value exchange. In this regard, we are working with our brokers and the NACFB to ensure a smooth transition to this new regulation which marries with our wider approach to the broker network. Each intermediary is designated a local business development manager who is on hand for face-to-face meetings and to offer sectoral expertise to suit the nuances of any deal. We back this up with support from asset finance specialist Lombard and their team of expert BDMs.

As a market leader, Lombard’s extensive list of products is available to our broker network, and so is their in-depth knowledge of how each product may help a business.

Aside from reach and scope, we are also keen to make doing business easy for our brokers. In this vein, our Broker Portal helps brokers get near-instant quotes 24/7 on deals worth between £50,000 and

£750,000 and we are working on improvements to streamline the quote process even further.

The result, we believe, are market-leading outcomes for businesses and brokers. Innovation doesn’t sleep, and it certainly doesn’t slow down when the economy does. For those businesses that choose to invest in the future, together with our broker network, we’re ready.

Joining our Broker Panel, you’re joining a community. You’ll get direct access to our Broker Portal, which makes getting a decision simpler than ever. And you can count on extra support building your own brand from our team of business and broker development managers. You’ll also get free access to our Business Builder programme – digital and event -based learning built with businesses like yours in mind.

Email brokerteam@natwest.com to join

In the late 1870s, the American inventor and visionary Thomas Edison developed and patented the first commercially successful incandescent light bulb. His was arguably the definitive light bulb moment.

However, Edison’s journey to acclaim wasn’t an easy one. Faced with significant challenges in developing the bulb into mass production and distribution – as manufacturing costs were simply too high – he lacked the necessary funding to launch a large-scale operation.

To address this issue, Edison turned to a group of investors, including the wealthy banker J.P. Morgan, for financing, but they were understandably reluctant to place their capital into a new and largely unproven venture. To reassure them, Edison used his patent on the light bulb as collateral for the loan. This essentially meant that if he failed to repay the loan, the investors would assume ownership of the patent and its associated royalties.

With the financing finally in place, Edison founded the Edison Electric Light Company in 1878, which later merged with several other companies to form the General Electric Company in 1892. Edison remained involved with the company throughout his life, and his contributions to the development of the incandescent bulb played a key role in its success. Today, General Electric is worth north of $100 billion.

Edison’s use of non-physical, or intangible assets, to guarantee his loan unlocked a remarkable pathway that would hitherto have been

denied to him. It was a candle – or indeed light bulb – in the dark. But why then, in the UK at least, is it considerably harder for burgeoning enterprises to use their fixed intangible assets as collateral to arrive at their own light bulb moment?

Currently, the most common types of collateral used by UK SMEs when taking out a commercial loan are property, equipment, inventory, accounts receivable, and personal guarantees. Such asset types are relatively easy to see, to touch, to define – and fundamentally – to value. Generally, commercial lenders place a strong reliance on such traditional forms of collateral. But as these more typical underlying assets are becoming less central to many SMEs’ value propositions, a fundamental market issue is emerging.

Intangible assets are those assets lacking physical substance. Examples of modern intangible fixed assets include patents, trade marks, copyrights, talent, research, branding, customer lists, and software. Some of these assets may still be recognised on a company’s

“ The world of intangible assets is comparatively more difficult to see, touch, define – and yes – value

balance sheet but are typically measured at cost or at a revalued amount. The world of intangible assets is comparatively more difficult to see, touch, define – and yes – value.

According to OECD findings, over the last five years investments in intangible assets have outstripped investments in their tangible counterparts. In the UK, for instance, estimates suggest that intangible assets can account for up to 80% of a modern firm’s value. It seems then that a major review of commercial loan collateral is long overdue.

Enter, Steve Blackwood. 34-year-old Steve lives in Hertfordshire with his long-term partner and two cats. Steve was furloughed from his central London job in construction recruitment during the pandemic. He used his newfound time wisely and, in pursuit of his very own light bulb moment, sharpened his coding skills from his dining room table to develop a mobile app for the housebuilding industry. The app proved popular, and Steve wanted to invest further in the product banking on the notion that the brand, the source code, the trade marks, and his knowledge combined made his venture a worthy one. He possessed an instinctive reluctance to take on vast credit card debt and he lacked the connections to entertain family loans and viable equity options. Steve approached his bank and despite its utility as a key driver of the

business’ value, his IP-rich proposition was not easily collateralised and ultimately of limited usefulness in securing external financing.

This barrier for potential borrowers like Steve is most apparent in debt funding solutions. In the early stages of their life cycle, such firms rely heavily on external equity funding, often combined with grants, whilst debt is rarely seen as a viable funding option. Usually, equity sources can be complemented by debt financing only when firms like Steve’s have sufficiently matured and moved more decisively into profitable trading. Better availability of debt-based finance during this phase though could well help unlock more growth and might have enabled Steve to further invest and innovate. There is clear market failure and wider systemic issues at play. But why?

The reasons are myriad but incorporate a complex blend of a lack of valuation standards for such assets, the difficulties in obtaining effective security over intangibles, as well as redeployment concerns and the absence of liquid secondary markets. For the purposes of this article, we’ll centre our focus on the issues surrounding valuation.

For commercial lenders to underwrite loans against IP and other intangibles, a certain level of confidence and comfort in their

“

According to OECD findings, over the last five years investments in intangible assets have outstripped investments in their tangible counterparts

established values is necessary. At present, however, no single viable standard approach to valuing intangibles exists. Owing to the absence of a single agreed-upon method, valuation outcomes can vary significantly depending on the process used, making the values of different intangibles inherently incomparable. Nearly all lenders are cautious in attributing accurate values to intangibles they want to take as collateral since their valuations often underestimate the actual worth, factoring in a considerable amount of risk into their disposal values. The possibility of different valuation outcomes may also create conflicts of interest in the accurate determination of valuations.

The value of intangible assets can also be volatile over time, unlike their tangible counterparts that usually depreciate. Tangible asset valuation methods typically incorporate the effects of age and condition on future value predictions, but applying these methods to intangibles presents real challenges. Technical obsolescence is also more challenging to accommodate. Here also a lack of insurance policies covering losses of intangibles creates substantial risk in their valuation compared to physical assets, which are more easily covered against theft, fire, and other forms of damage.

Valuers in the UK can – and should – be seeking to adapt their frameworks to accommodate intangible assets as collateral in commercial finance transactions but will require the valuation community to be more flexible, knowledgeable, and communicative in their approaches.

The industry should now be exploring how it can better adapt policies to accommodate intangible asset collateral against SME

borrowing. It is unlikely that, without changes to regulations, banks will be able to reduce the amount of capital they need to hold for a loan secured by IP. Of course, a bank may still take intangibles as collateral should it choose to do so but the loan would be treated as having zero security value for the calculation of regulatory capital. This means that the bank will have to price the loan as if it were unsecured to achieve an acceptable return on equity, in which case the IP would not reduce the cost of credit for the borrower.

Over the last few years, the NACFB has been privately and publicly pushing for developments in this area. The trade body has long-since recognised the need for a more dynamic approach to loan collateral. In correspondence to both HM Treasury and the British Business Bank, the NACFB has proposed the establishing of an ‘Intangible Asset Guarantee Scheme’ – one backed by the state or a state-adjacent agency. We know this is a topic on their radar, as HM Treasury representatives have subsequently engaged with the Association on the issue. Guarantees provided by the state or by state-backed organisations have featured in all countries where intangibles-backed financing schemes have been implemented. State-backed guarantee programmes help develop confidence in the use of intangibles for financing and can reassure lenders of the values ultimately attributed to them.

Light bulb moments are rare, but given the right backing and resource, they really can change the world. Whilst not every small business can have the same seismic impacts as Edison, the cold reality is that far too many are prevented from ever having the opportunity to get that far. For the Steve’s of this world, and the commercial intermediaries that he will in time engage with, there is an untapped opportunity in waiting, one where a proactive approach could help keep bulbs flickering across the UK.

For commercial lenders to underwrite loans against IP and other intangibles, a certain level of confidence and comfort in their established values is necessary

Construction activity continues to be under pressure. Most parts of the UK saw a weakening in project starts during the three months to February. The North East and the South East were relative bright spots with starts up on the previous quarter although still down compared to a year ago.

Scotland alongside Yorkshire and the Humber both experienced the worst declines in project starts. Wales, Northern Ireland, the East Midlands, West Midlands, and the North West also suffered falls against both the preceding three months and the previous year.

According to the National House Building Council (NHBC), positive data relating to homes registered to be built in the first two months of 2023 show some signs that developers are starting to feel more confident about the market following the uncertainty that existed at the end of 2022.

The 20% increase in construction material costs seen in 2022 will not be repeated in 2023 but nevertheless, inflation may still remain a headwind, particularly for SME house builders who have less ability to forward order and store materials.

However, according to our clients, the availability of most construction materials has improved in the first quarter of 2023 and delivery times are approaching normal for most materials. Some clients are even reporting a reduction in prices for certain materials such as timber which was unthinkable in 2022.

The materials requiring high energy use in their production process will continue to remain under pressure due to the sustained high cost of energy, notwithstanding the recent easing in energy prices. However, most clients now feel more positive about cost inflation and a recent National Housing Federation (NHF) survey also indicated that developers consider moderate cost rises now to be manageable as we move into Q2 2023.

In the construction industry, the availability of skilled workers remains tight as we move into Q2 2023 with inflationary pressures on workersʼ own income being such that some construction companies have been struggling to maintain a steady workforce. This can result in extensions to building programmes and in turn, impact the overall cost. The challenge for SME house builders is the shortage of skilled workers. According to the Federation of Master Builders (FMB), 44% of SMEs reported difficulty in recruiting carpenters, and 42% reported difficulty in recruiting bricklayers.

In reaction, developers are typically lining up the next development early in order to provide a seamless transition of their labour to keep them on.

44% of SMEs reported difficulty in recruiting carpenters, and 42% reported difficulty in recruiting bricklayers

Construction activity challenges despite some market confidence

Richard Hamlin Director First Merchant

Richard Hamlin Director First Merchant

It’s a confusing picture. The headlines seem to be ever full of news of the tough times facing our nation’s hospitality businesses. But at the same time it is so busy in some restaurants and pubs that booking a table on a Thursday or Friday evening is near impossible.

One thing we can be clear about is that there are great opportunities for finance brokers. The hospitality sector provides us with an endless number of clients needing either restructuring or expansion finance. Whether your speciality is bridging, development, buy-to-let or asset finance, I would urge you to consider paying some attention to the thousands of businesses in the leisure, entertainment and hospitality industry.

According to the trade body, UK Hospitality, the sector creates £130 billion in economic activity and generates £39 billion of tax for the Exchequer, funding vital services. Employing some 3.2 million people, it represents 10% of UK employment, 6% of businesses and 5% of GDP. In fact, hospitality is the third largest private sector employer in the UK; double the size of financial services and bigger than automotive, pharmaceuticals and aerospace combined.

At our recent brunch seminar for finance brokers, our guest speakers spoke more about opportunity than challenge. Eighty brokers, mainly

Members of the NACFB, were given some insights into the marketplace and how finance professionals can get involved.

The good news about financing hospitality businesses is that there are several ways to achieve a result including traditional high street bank loans, merchant services, asset finance and the First Merchant solutions – but I’ll come on to these… The not so good news is that many traditional lenders are still very cautious about leisure. This means that finance brokers can play an important role in navigating funding routes and sourcing credit.

Brokers who are interested in breaking into this market could start by making contact with leisure businesses in their area and those who provide support such as accountants and business estate agents. However, a faster route to success might be to examine one’s existing client base and letting all of them know that reliable facilities for leisure and hospitality businesses can be sourced even for leaseholds. Brokers should also ask their clients to pass on this information to friends and business contacts.

“ Almost all finance brokers are already dealing with clients in hospitality – but this might not be obvious on the face of it

In my experience, almost all finance brokers are already dealing with clients in hospitality – but this might not be obvious on the face of it. Time and again we hear of the families of those who operate pubs, restaurants and nightclubs also being owners of vast buy-to-let portfolios.

The variety of subsequent enquiries that come in, either from existing clients or new contacts, will range from requests for small working capital loans through to multi-million-pound projects. What many of these enquiries are likely to have in common is that the businesses operate from shorthold leasehold premises, a feature which immediately excludes them from being supported by many lenders.

Merchant services might be a good solution, but it can be hard to tell how much it will cost in the long run and this type of finance can be difficult to exit, especially on borrowing for VAT for example. And that’s where First Merchant comes in; we specialise in lending to leasehold businesses (under 25 years) for any business purpose. Our principal clients are pubs, restaurants, hotels, fast food outlets and nightclubs and we have helped many expand from a single unit to a sizeable group. We also assist leasehold operators to buy the freehold of their premises which can be a life-changing event.

How and where can we help? We lend exclusively to well-established limited companies which trade in high footfall areas with a geographical bias to London and the South East. Assuming these criteria are met, brokers should ascertain the annual rent being paid and the average weekly turnover. We really like to get under the bonnet of the business and would encourage brokers to do the same as much can be ascertained from seeing how a business is managed. Is the bookkeeping meticulous? Is the premises in good order? If there are multiple premises, are they operated as separate companies to mitigate risk?

Another element to consider carefully is legal representation. In our experience, it is crucial that the borrower’s solicitor is experienced in commercial leases. A good commercial solicitor can really help to speed a deal through.

Getting a leasehold business deal over the line can open other avenues to brokers – insurance, pensions, asset finance, refinance (further down the line), perhaps a buy-to-let mortgage or two. The opportunities are there for intermediaries who take the time to investigate, and perhaps more importantly, start talking to clients. So, what are you waiting for?

Book your seat at the table today.

“

It is crucial that the borrower’s solicitor is experienced in commercial leases

The current lending picture to start-ups and small and medium size enterprises (SMEs) in the Midlands is not as bright as we’d like. Talking with the team at ART Business Loans, we discovered a common thread; that we are seeing a substantial downturn in the appetite of the banks to support small businesses with their finance needs. We’ve also received similar feedback from many in our broker network who are also suggesting that, as is common in difficult times, the financing gap appears more prevalent for early-stage businesses and those seeking smaller amounts, typically below £250,000.

As readers will no doubt know, the 2008 banking crisis led to the emergence of the alternative finance market. Many of these providers joined in the delivery of the Government’s guaranteed business loans schemes which were launched in response to the COVID-19 pandemic; however, it appears even their appetite to provide finance at smaller levels has also diminished.

Against this backdrop we are seeing a major change in the availability of finance. Businesses across all sectors which survived the pandemic and are now seeking growth finance are being hampered by a combination of factors that include:

• Reduction in the appetite of lenders

• Increase in the cost of borrowing following base rate rises

• Businesses’ existing borrowing levels. This is especially the case where businesses may have borrowed for the first time during COVID

• Personal guarantees being required again which was not the case in the earlier COVID schemes

• Some sectors being shunned by lenders especially hospitality and retail.

What has also been critical for many businesses in the West Midlands and elsewhere is that lots of these loans were taken over a shorter term because the downturn in trade from COVID was not expected to last for such a long period. Unfortunately, as we all know, other factors such as war in Ukraine and Brexit have compounded and lengthened the downturn, so that now, we are beginning to see attempts by SMEs to refinance that debt to a longer term. To be successful, these businesses must be able to show current profitability and future growth prospects and it’s clear that brokers will have an important role in establishing both serviceability and appropriate packages of finance.

Of course, that’s harder for start-ups although recently we were able to help one local business with a proposition for a new US burger bar. The business was very well researched, and the market and location were clear. So far, initial trading results have been very encouraging.

For brokers who are struggling to place these loans with the banks and alternative lenders, going down the Community Development Finance Institution (CDFI) route is worth considering. CDFIs like ART Business Loans now make up a large proportion of the lenders accredited to provide Recovery Loan Scheme finance. The British Business Bank is due to publish these scheme loan results shortly, and we do expect to see a downturn in the uptake of the RLS.

Most CDFIs provide loans up to £150,000 although some do go to £250,000. They can lend as an additional source of finance rather than an alternative to the banks and funds can be used alone or in those circumstances where a package of more appropriate finance is required.

Although the cost of funding has increased substantially post COVID, provided that a business can provide evidence of serviceability for all their existing and proposed borrowings I am confident that funding will be found to support, albeit most likely based upon current experience from a variety of sources.

Any market will have its ups and downs and buy-to-let often peaks and troughs more dramatically than the core residential market. 2022 was a fantastic year as landlords, supported by their brokers, took the opportunity of five-year fixed rates at c.3% to ‘fill their boots’. This is borne out by UK Finance data which recorded buy-to-let completions of £55 billion which is significantly above the medium run average of between £42 billion and £45 billion.

Back in February, headlines in the press forecast a 23% reduction in buy-to-let activity for 2023. This was unhelpful and came at a time when brokers were still recovering from the interest rate mayhem of the autumn which meant that their landlord clients were not proactively engaging with the new norm of higher interest rates.

Initial efforts by lenders to ‘trade off lower interest rates with higher completion fees’ were initially greeted by landlords with scepticism but now, with finer tuned product ranges, landlords realise these efforts could allow them to fit within lenders’ stress tests and even borrow more.

The expectation that Bank Rate will stop rising soon coupled with a more promising economic outlook in the second half of the year should start to improve fixed rate pricing as we head towards 2024. This situation explains the sudden resurgence of two-year fixed rate

buy-to-let products as landlords expect to find better priced five-year money in 2025.

Also looking back to late 2022, landlords were fixing nearly 90% of their loans on five-year rates and early numbers for 2023 already show this reduced to c.70%, which, inevitably this will also generate higher refinancing activity in 2025.

Of course, challenges and uncertainties for landlords will still dominate the headlines and I believe that their main attention will be focused on three areas:

1. Section 21 - As a general election approaches in the autumn of next year, all political parties will ramp up the rhetoric to gain electoral

“

The caricature of a landlord being either a ‘dinner party investor’ at one end of the spectrum or a large corporate at the other has long since disappeared

The resilience of the buy-to-let market

support and the softening of current proposals will be necessary to avoid a further exodus of disenchanted landlords from the market.

2. EPC regulations to grade C - The draft Minimum Energy Performance of Buildings Bill shows the date that rental properties must have a minimum EPC C rating for new tenants as 31st December 2025 with a secondary deadline of 31st December 2028 for existing tenancies. Inaccurate reporting refers to the first deadline as simply 2025 but in reality, that translates as from 2026 and 2029 respectively, although there have been recent indications that the first stage will move out to a later date in 2026. Further, on 28th March this year, The Daily Telegraph suggested that a single date at the end of 2028 for all buy-to-let properties was now being considered. Whatever the actual date or dates eventually set, the effect is that landlords could have to spend thousands of pounds to make their properties more energy efficient in order to help reduce the nation’s carbon footprint. This will mean that many will need to borrow more to upgrade their properties – an opportunity for brokers and lenders alike.

3. HMO licensing - Local authorities continue to widen their HMO reach which raises landlords’ costs, and this has yet to translate into improved rental housing. Fines up to £30,000 can be levied and tenants can reclaim rent back to the point of default or incorrect licensing.

The buy-to-let market will only be resilient if landlords are resilient and believe in its future. The withdrawal of Help to Buy will leave many renters unable to become homeowners for longer and whilst the cost-of-living crisis is very real for landlords and tenants alike, the upward pressure on rents will continue. In 2022, rents rose by 12% according to Zoopla and expectations for this year are for a 5% increase which is underpinned by low void ratios and pro-active management.

The caricature of a landlord being either a ‘dinner party investor’ at one end of the spectrum or a large corporate at the other has long since disappeared and has been replaced by small to medium sized landlord portfolios predominantly owned under limited company structures (heading towards 75%) with well-prepared financials and bank reserves befitting well-run businesses. Their resilience will be even stronger in the coming months as so many of them locked into those 3% interest rates in the middle months of 2022.

The role of brokers and lenders to continue supporting buy-to-let landlords, and thereby the Private Rental Sector (PRS), is fundamental in an era where our governments of whatever hue will not have the capacity or conviction to make good rental housing shortfalls with significant numbers of social housing units.

“

All political parties will ramp up the rhetoric to gain electoral support and the softening of current proposals will be necessary to avoid a further exodus of disenchanted landlords

Brokers know that poor credit ratings can impact directly on their clients’ borrowing, trade credit, working capital and tendering opportunities. Unfortunately, as the cost-of-living crisis bites, many SMEs in the UK have seen their credit scores and limits plummet, causing them to miss out on millions in trade credit and restricting business growth when they need it most. It will come as no surprise then to know just how important it is for these small businesses to keep their credit profiles up to date.

What is surprising however, is that there are two little known facts about business credit scores: the first is how much they can change within a 12-month period; and the second is how quickly even a slight drop in score can start to impact on day-to-day operations. It is common for problems with credit ratings to creep up unannounced, usually only surfacing when a business is prevented from doing something as a result – such as applying for finance.

There are five main credit reference agencies (CRAs) in the UK and all limited companies and limited liability partnerships (LLPs) are rated using their respective algorithms. The scoring methodology for each agency is different, but all utilise data from Companies House, alongside payment data collected to evaluate how suppliers are paid against agreed credit terms.

It is during the credit-checking process that a specific issue can occur for businesses; where the time lag of filing their annual accounts can mean that their scores do not always reflect the current strength and success of the business. Add to this the general uncertainty around what to do about bad credit terms as well as the threat of sector

downgrades in the current economic environment, and the picture can seem bleak.

But there are sectors that are booming. As an example, construction could be thriving, but as firms try to scale up and exploit the opportunity that is homebuilding, many have found that their damaged credit ratings are holding them back. For these businesses, including property developers, ratings can be low for several different reasons:

• Limited accounting data filed

• Late invoice payments

• Pandemic business interruption issues

• Director changes

• Audit partner comments and material uncertainty statements.

As brokers know, the construction sector is working capital intensive and having a poor rating can seriously hinder the ability to purchase stock and raw materials, it can negatively impact supplier terms, and crucially it can prevent developers from obtaining property finance –all critical factors in running a successful construction business.

An optimised credit rating can enhance the opportunities available, reduce the interest rates offered by finance providers and have an instant, positive impact on working capital.

A healthy business is good news for brokers too. Whilst intermediaries are not responsible for keeping clients’ credit profiles up to date, they can be instrumental in ensuring that clients keep on top of things. Clients can manage their own profiles with each of the CRAs, or work with an agency like Lightbulb Credit who can manage the credit profiles for them. It’s not expensive. It saves time. It cuts out nasty surprises. And can lead to a win-win for all parties.

Accessibility is another key topic. OZEV is being asked to pre-emptively set out how it intends to enforce its new reliability standards and ensure open data can be used to demonstrate the accessibility of chargepoints, virtual queuing and the booking of charger slots.

The UK fleet sector is hugely diverse. It is made up of the trucks taking parts to our factories and stock to our supermarkets. It is the vans delivering parcels to our SMEs and plumbers to our houses; the cars delivering key workers to their place of work and holidaymakers to their destinations.

It would be fair to say that the fleet sector is vital to both society and the UK economy, and with the government keen to end the sale of new petrol and diesel vehicles by 2030, much attention is now being placed on what the country’s electric vehicle (EV) charging infrastructure will look like. What is clear, is that the rollout is increasingly being devolved to local government and the BVRLA is keen to support these authorities as they try to meet the varied charging needs of electric fleets.

Fleet operators look closely at the miles travelled, how quick a turnaround time is needed for a vehicle, and where vehicles are stored, or charging is required. All these different elements need to be considered to ensure fleet charging needs can be accommodated.

The BVRLA’s Fleet Charging Guide 2023 looks in detail at the most challenging use cases, including rental operations at airports and the HGV transition to zero emissions. It contains recommendations not only to local authorities, but also to the energy sector and Office for Zero Emission Vehicles (OZEV).

An example of this is regarding power distribution. Firms may find that there is not enough electricity supply at their site, so recommendations to the energy sector – Distribution Network Operators (DNOs) and their trade body the Energy Networks Association (ENA) and Ofgem –are aimed at getting them to recognise the cost and the process involved with grid connections. This poses a direct challenge for most fleet operators.

The BVRLA is asking local authorities to consider how they can work more effectively with the fleet sector to understand their needs and ensure that charging infrastructure is suitable for all users and all vehicle types. We are recommending that local authorities work with the DNOs, chargepoint operators, fleets, regional transport boards and other stakeholders to promote regular engagement and sharing of data.

Our Fleet Friendly Charging Index, an online tool launched in March, details the progress of individual local authorities in developing EV infrastructure strategies and presents a picture of how ‘fleet friendly’ current EV infrastructure plans are at a local level across the UK. The results show that 68% have plans completed or in development, but only 3% have considered the fleet sector. At this point in time, few local authorities are thinking about the needs of the fleet sector beyond the vehicles they directly manage.

The BVRLA is engaging with local authorities, sub-national transport bodies and the Local Government Association as well as working with other stakeholders such as OZEV and the energy sector to make progress.

“

Few local authorities are thinking about the needs of the fleet sector beyond the vehicles they directly manage

Catherine Bowen Senior Policy Advisor BVRLA

As part of our mission to revolutionise SME banking in the UK, Recognise Bank is announcing a range of initiatives following crucial broker partner feedback and an extensive review of over £1 billion in new loan enquiries received since the bank was launched.

The initiatives are designed to tackle some of the key reasons why deals are delayed during the application process and include innovative ways to further increase efficiency and achieve a quicker time to loan completion.

We periodically review our lending parameters, gathering intelligence from various data sources including information on declined loans and garnering broker and customer input to understand how we can better support SMEs, and provide loans tailored to each borrower’s circumstances.

As a result, it’s now much easier for borrowers to access the funding they need within their own affordability range as we have extended amortisation and interest only periods, and revised the stress testing requirements on specific products to reflect the interest rate curve.

Other enhancements underway include expanding our product range to support SMEs with their asset finance lending requirements.

We recently announced a further £25 million capital investment in Recognise Bank, which is great news because it shows continued support and confidence for the Bank and our strategy, and also allows us to continue to do what we do best – empowering SMEs to reach their financial objectives.

“ We periodically review our lending parameters, gathering intelligence from various data sources including information on declined loans and garnering broker and customer input...

Norman Director, Lending Strategy and Propositions

It has been a turbulent year for the SME community and the wider economy. The Bank of England Base Rate has jumped from a record low of 0.10% at the start of December 2021 to 4.25% (at the time of writing), with a knock-on effect to the cost of borrowing for many businesses. This has been compounded by increased energy prices and high inflation pushing up costs of doing business for many companies, while also dampening demand from consumers feeling the pinch.

According to the February results of Recognise Bank’s customer satisfaction for brokers and borrowers, our rating of 91% is well above the industry average and we have a fast growing reputation for quick decisions, flexibility and speed to completion whilst balancing innovative technology and relationship banking. However, feedback indicates that we are now in a completely different marketplace that requires a fresh and an even more supportive approach from lenders. That is why we have recently reviewed our product mix and our processes, listening to important commentary from brokers and borrowers. We have used that insight to improve our customer service and journeys and ensure that our lending proposition meets the needs of our customers and supports our broker partners during these challenging times.

A sensible, pragmatic change that will help speed up certain deals, especially within the growing short-term lending and residential portfolio refinance markets, is the implementation of dual representation. In specific cases, this could save time and money

by allowing one law firm to represent both the borrower and the bank on an application.

To offer borrowers more flexibility and potential to reduce drawdown times, Recognise Bank has also introduced the option of title indemnity insurance for suitable applications. And in our back office, we have made further improvements to our existing technology to digitise processes and make the collection, distribution and signing of documentation faster and pain free.

Another recent change we have implemented is partnering with VAS Panel to provide valuation panel management services, speeding up the property valuation process, and ultimately the approval of loans, giving more confidence to broker partners placing business with the Bank.

These are changes that not only benefit borrowers, but they are also improvements that acknowledge the expert help brokers offer their customers. By working together, we can provide SMEs with the support they need to quickly find the right funding solution for them.

Together these changes will make huge improvements to the service we offer to existing customers and the new SMEs we are looking to help. We will continue to seek feedback and enhance our product and service proposition, creating a seamless journey for our broker partners and their clients. Ensuring quick lending decisions and fast access to funds continues to build stronger relationships with small businesses – the lifeblood of the UK economy who need the support of a bank like Recognise now more than ever before.

Iset up my business after 25 years’ industry experience of being employed to provide funding for customers that were looking to purchase commercial or director vehicles. At the time, the market was flourishing. The stock of both new and used commercial vehicles was plentiful with price competition throughout the UK supplier network. I had a large customer base of construction, couriers and haulage customers. My team and I were very busy.

This continued through the first 12 months of the pandemic, but as time passed the stock reduced throughout the supplier network, manufacturers closed or cancelled orders for new commercial vehicles and discounts provided on the vehicles were removed. Supply and demand economics kicked in and prices increased for both new and used commercial vehicles, as did fuel costs. It was a very hard time for business – my clients’ and my own.

I started to think about diversifying our offering. Diversification was not a new idea for me but before the pandemic, it was just one of those things that was always on the back burner.

Being able to adapt in difficult times is a key skill. It was a journey we had not been on before and we knew from the off that there was much to be learnt. To start, we made a plan to contact all of our existing customers to ascertain their situation and potential requirements including whether they needed any support for requests for payment

holidays. Then we hit the phones. Despite the circumstances, it was great to be doing something proactive, it gave us focus and our clients really appreciated the support. Many relationships were strengthened as a result of those calls.

Next on our action plan, we became accredited advisers for the government’s CBILS (Coronavirus Business Interruption Loan Scheme) and the RLS (Recovery Loan Scheme). This gave us the ability to help the businesses most in need during the pandemic. Post pandemic, when these government incentives were no longer available, we remained fully accredited which meant we could extend our services to provide the superseding loan schemes. For example, we recently supported an established business with an unsecured business loan of £100,000 to purchase stock.

As the country began its economic recovery, we took the time to call all of our clients again to find out about their new circumstances and potential financing needs. One client, who owns a courier company,

Many relationships were strengthened as a result of those calls

How one brokerage successfully expanded its offering

told us about their desire to add another van to the fleet so that they could service requests for couriering items to an area they did not cover. Another van would enable the business to add a new route to their service, and so increase revenue. Of course, we were happy to source the necessary finance.

Another way in which we diversified our offering was to create partnerships with other businesses. For example, we have partnered with an accountant who can help our clients to provide up-to-date management information to support their applications.

Social media has been another key element that has been instrumental in helping our business increase revenue post-pandemic. In fact, we have had an amazing response. It helps us to stay in touch with existing

Introducing our Alternative Term Loan, an interest only loan up to £2M. If you’re looking to provide a flexible, fast-paced loan to your clients, take the alternative route.

clients and reach out to potential new customers, many of whom have contacted us directly off the back of our posts.

For us diversification has really worked. We are still focused on the new and used vehicle financing arena but have added to our offering including refinancing and invoice factoring (with the ability to draw down on day one of B2B invoices instead of having to wait for 31 days). We have also branched out into secured and unsecured business loans to help clients expand and grow their operations.

We have taken on more staff including a young, aspiring apprentice. It’s hard work and we’re learning all the time. But it’s an exciting time for the business and us as individuals. And we’re not stopping, our plan is to continue to diversify, so watch this space.

Declan Burton-Clark Account Executive Playter

Declan Burton-Clark Account Executive Playter

As an Australian now residing in the UK, my foundational finance knowledge was largely acquired back home. Here I am part of a thriving lending team, but I started life as a broker, so I’m well placed to understand the dynamics and nuances from both sides of the aisle.

Commercial finance broking in Australia and in the UK is actually very similar. Fundamentally, clients operate in the same industries, with similar lenders and products as well as aggregators and industry bodies.

The main difference I have noticed is the makeup of the broker market itself. In Australia, most of the market focuses on residential mortgages, and until a few years ago there were almost no specialised commercial brokers, this was especially true for cash flow specialists for SMEs.

Early on, I worked out I was not going to be able to be all things to all people, and that the best way for me to operate was to develop a niche I could become highly knowledgeable in. I decided on cash flow lending, but I made sure I had relationships with lenders and providers who had products my clients would need, so I could be helpful to them funding their assets and commercial property purchases.

These lessons helped inform Playter’s offering, as I discovered that the key to securing transactions was to make sure the customer experience was as quick as possible, and minimally invasive. Lenders that had slow turnaround times or required cumbersome documentation gathering to make an assessment often resulted in the client looking elsewhere.

Within trade and debtor finance, my clients had common complaints. They would bemoan credit assessments that extend to reviewing their creditors and debtors instead of based upon their underlying strengths. Often disbursement would take place in a disclosed manner, whereby

the clients creditors discovered they are using finance (clients don’t want other people paying their bills!).

Also, for many, credit limits were based on the outstanding creditor or debtor book, placing a heavy emphasis on concentration risk, with interest collected by the lender by discounting the value of the invoice. Further, the requirement for personal guarantees, debentures on businesses and property security inhibited some clients. I noticed that I tended to prefer products where I as a broker had more control over the process and was less reliant on feedback or responses from an account manager.

Playter hopes to have created the antithesis to these problems. By using a simple assessment model based upon open banking and account connection, one that can be turned around quickly and does not involve an assessment of the client’s creditors or debtors. We also allow our clients to use us on a non-disclosed basis, and they do not pay us by discounting invoices, but through a simple monthly subscription based on a flat fee.

Our aim is to create a broker dashboard allowing for easy distribution by our broker partners, and I believe my experience – based upon universal business truths – will underpin our offering going forward.

“

In Australia, most of the market focuses on residential mortgages, and until a few years ago there were almost no specialised commercial brokers