Broker

Business Bank:

Fund:

is

Financial Planning

JENNY BARRETT

The NACFB is very lucky to have a long list of willing contributors to share their insight, knowledge, and experiences within these pages. Each year, we run articles from over a hundred organisations, and Commercial Broker magazine is all the better for it.

When we meet with these contributors, one of the first questions they ask about writing is whether the NACFB has a forward features list or editorial calendar of content and overarching themes. It’s a valid question, and we have tried to establish projected content frameworks in the past, but it falls apart every time. Why? Because for each of the last five years the news agenda and the lending landscape have been regularly side swiped by relatively unforeseen events.

And we find ourselves building towards another such event now, so what use would a cover article blind to the unfolding crisis be for our membership? Instead, this month I’m keen to examine such unfathomably meaty topics. I’ll be exploring the economic climate from the macro level, and drawing lines right down to the micro, navigating the complex web of current market forces.

All too often I seek to view trading conditions through the lens of just our community of lenders, brokers, and the clients they serve. I believe we would be doing a disservice to them if for once we didn’t take a step back and see our sector within its broader context – because ahead of a predicted winter bite, being forearmed is forewarned.

This issue also shares the news of the NACFB’s Broker Academy, we’ve been thrilled with its reception and look forward to revealing more details in the coming weeks. Finally, a big congratulations to the winners at last month’s Commercial Broker Awards, and the very best of luck to all those shortlisted at next month’s Patron Awards & Gala Dinner. I look forward to toasting to the successes of our collaboration with you all.

Request

Group

(other than

business

the NatWest Group Climate and

only. Security may be

Available to UK customers for business

and less than £10m. Subject to status, eligibility and

for

Climate is a key part of the UK’s business agenda, from infrastructure and software to renewable energy.

Association to welcome its first 12 students this month

This month, the NACFB launches a Broker Academy that will reward successful participants with a formal NACFB Certificate in Commercial Finance Broking (CertCFB) qualification. Designed by experts, the Academy will expand the knowledge and professionalism of both new and established brokers as well as creating future industry leaders.

Developed alongside the Chartered Management Institute (CMI) and delivered in partnership with In Professional Development, students who successfully complete the course will receive a Level 3 NACFB Certification in Commercial Finance Broking (CertCFB).

The course adopts a blended learning approach, combining virtual classroom sessions with digital learning modules. The modules will feature a combination of product knowledge seminars covering the full spectrum of commercial lending activity, as well as sales negotiation skills workshops. Each student will also have access to a pool of NACFB mentors who will provide support, guidance, and steering throughout their learning journey.

The NACFB Academy’s first graduates will receive their recognised NACFB-backed qualification at the trade body’s Commercial Broker Awards 2023. The Academy has been made possible thanks to the direct support of NACFB lender Patrons, Allica Bank,

Cambridge & Counties, Haydock Finance, Lloyds Bank, Market Financial Solutions, NatWest, Shawbrook Bank, Together, United Trust Bank, and YBS Commercial.

Commenting on the Academy’s launch, NACFB Chair Paul Goodman said: “We are extremely pleased to officially launch the Broker Academy and welcome its first twelve students. We are also incredibly proud to launch the Academy with the endorsement of some of the industry’s biggest commercial lenders.”

“The NACFB Broker Academy forms a central tenet of the Association’s ongoing commitment to raising standards, improving quality, and nurturing new talent,” Paul added.

NACFB board director, Steve Olejnik, who has led the Academy’s development, said: “When starting a career in our industry many come straight out of education, some start in a mid or back-office role, whilst others typically work their way up the banking ladder before crossing over into broking. This new course aims to build upon these pathways by imparting key product knowledge as well as standardising professional expectations.”

To find out more about the NACFB Broker Academy – as well as registering your interest in signing-up for the next round of intakes – please contact the team via academy@nacfb.org.uk

With nearly 50 years’ lending experience and partnerships with trusted solicitors, you can rely on a fast, straightforward decision for your bridging cases – no matter the loan size or how complex your clients’ circumstances.

Large-scale refurbishments and redevelopments

Multiple property purchases and

projects and development

can deliver funds quickly for:

do they plan to finance these projects? In my opinion, we’ll see a growing number of business owners refinancing their existing assets.

A significant proportion of our asset finance brokers identified this growing demand, too, with many requesting that Allica Bank launch a refinancing option to meet it. I’m pleased to say we did exactly that in Q3.

It’s no doubt going to be a time of tough decisions for business owners in Q4. Just as pandemic restrictions finally began to feel like a thing of the past, climbing interest rates, soaring energy prices, and rising inflation reared their heads.

But there are plenty of reasons to remain optimistic. British businesses have proven time and time again – whether it’s a pandemic or ongoing inflationary pressures – their resilience and bullishness in the face of adversity. And I see no reason why they won’t do so again in Q4 and into the new year.

In particular, I expect a rush from business owners to combat cost increases by improving efficiencies, increasing their sustainability and boosting productivity.

An Allica Bank broker survey earlier this year that polled 61 of our asset finance broker panel suggested the same. It revealed that over three quarters had seen an increase in the number of clients raising finance to improve their sustainability. Of those, 70% said the aim was to upgrade their machinery or buy electric vehicles. And this was before the true extent of the energy crisis had been widely recognised.

But, as businesses divert cash reserves to immediate needs, how

The expertise of the broker community will play a central role in how businesses respond to these challenges. Many business owners may not have refinanced before, while others might need to explore their options with a lender that is a bit more flexible than their traditional provider. A broad knowledge of the market will be key here, and those brokers well-versed in funding sustainability-led projects will be able to add real value.

It’s especially true in times of adversity that business owners put their faith in the broker community. I have no doubt that NACFB Members will step up to the plate, as they have done many times before, to repay that faith. And Allica Bank will do all we can to support you both.

“

In my opinion, we’ll see a growing number of business owners refinancing their existing assets

By the end of October 2022, firms’ boards should have agreed their implementation plans for the FCA’s new Consumer Duty. According to NACFB senior compliance officer, Charlotte Mathieson, firms must be able to evidence they have scrutinised and challenged the plans to ensure they are deliverable and robust. Firms should expect to be asked to share the plans, board papers and minutes with supervisors and be challenged on their contents. She said: “A comprehensive package of support for NACFB Members is available from the compliance team.”

Business Secretary Jacob Rees-Mogg has hinted the government could merge the UK’s financial services regulators which could enable greater accountability. During the Conservative leadership campaign, Prime Minister Liz Truss suggested she wanted to roll the Financial Conduct Authority, the Bank of England’s Prudential Regulation Authority and Payment Systems Regulator into one body. The Government is currently moving the Financial Services and Markets Bill through parliament and Mr Rees-Mogg has suggested that it could be amended to include the merger of regulators.

Chancellor Kwasi Kwarteng, under pressure to rebuild shattered investor confidence in the new government's economic agenda, brought forward the publication date for fiscal plans and economic forecasts to Monday 31st October – on Halloween. His plan had previously only been due out on 23rd November – two months after he triggered a rout in British bonds by announcing a “mini-budget” that included £45 billion of tax cuts but no details on how they would be funded

Brokers believe the FCA may have to intervene in the mortgage lending market for years to come, says a report in the FT Adviser. The regulator has already entered into talks with lenders amid fears the daily repricing of mortgage interest rates has stretched many borrowers too far. Brokers fear that borrowers with 1% deals who face renewals in the next two years will come up against an environment that many lenders’ stress tests will not have taken into account

Nearly £30 billion has been wiped off the value of FTSE 250 stocks in the past quarter, with this the third quarter in a row that the overall value has fallen. The FTSE 250 ended September 10% lower than at the start of the month, the worst month for mid-cap companies since March 2020. Jason Hollands of Evelyn Partners, said: “Medium-sized and smaller UK companies, which have a greater exposure to the UK domestic economy, have been battered as the outlook has deteriorated.”

The Federation of Small Businesses (FSB) has expressed concern that interest rate rises could “pile financial pressure on thousands of small businesses who are mired in debt,” including those with debt from emergency COVID loans and commercial mortgages. On loans, SME lending specialist Andy Holgate said that as debt matures and needs refinancing, it will become more expensive and harder for SMEs to service as they will not be offered the same level of debt resulting in a larger number of insolvencies.

Inflation across countries that use the euro hit a record high of 10% in September, up from the 9.1% recorded in August. The Eurostat data shows price growth in the eurozone outpaced the 9.7% predicted by analysts. According to Reuters, September’s inflation reading will heighten expectations of a steep interest rate hike from the European Central Bank in October. ING economist Bert Colijn said: “The September reading for inflation is ugly across the board with all broad categories experiencing accelerating inflation.”

The Bank of England raised interest rates from 1.75% to 2.25% in September and indicated that Britain’s economy is now in recession. It is the Bank’s seventh rate rise in a row and takes borrowing costs to their highest level since 2008. The Monetary Policy Committee judged that the risks of inflationary pressures becoming entrenched outweighed the short-term dangers to the economy. Previously, the Bank expected the economy to grow between July and September, but it now believes it will shrink by 0.1%.

A 1.25% rise in National Insurance contributions will be reversed from 6th November, says Chancellor Kwasi Kwarteng. A planned levy to fund health and social care will also be scrapped and be taken from general taxation instead. The Treasury said the change would save nearly 28 million people an average of £330 per year.

It added that most employees would get the tax cut in November, with some getting it in December or January “depending on the complexity of their employer’s payroll software”.

of a sharp fall in output over the next three months. A net balance of -4% of companies said output fell in the three months to September, compared with -7% the month before. A balance of -17% of businesses expect output to fall at a faster rate in the next three months. Anna Leach, CBI deputy chief economist, said that the outlook looked increasingly challenging for the sector.

10. UK manufacturers cut growth forecasts

A monthly survey of manufacturers by the CBI and Accenture has warned

The founder of small business network and business support provider Enterprise Nation has offered suggestions on how the Chancellor could help small businesses. Reported in The Daily Mail, Emma Jones said that Kwasi Kwarteng needed to provide small businesses with a radical plan for growth. She suggested that he should restart export programmes to boost overseas expansion, sort out the late payment problem, and increase spending with small businesses. Ms Jones also said that initiatives to support small firms needed to be consistent.

Reward Finance Group has helped boost the region’s economy by providing £5.2 million of funding to SMEs in the first year of launching in the Midlands. The funds will enable the businesses to unlock growth potential, create new jobs or navigate through a difficult trading period.

Experiencing unprecedented growth since opening its Birmingham office 12 months ago, the NACFB Patron has tripled its headcount and is looking to further build on its success and expand its broker network in the year ahead.

The company attributes its rapid success to straightforward and flexible lending products, speed of delivery, and the confidence of an increasing number of SME-size companies to build their businesses post-pandemic.

The NACFB Patron also acknowledges the leadership of Birmingham office’s Steph Brown, who Reward views as one of the most experienced and well-connected people in the commercial finance market. Steph has 30 years’ experience and is using her local market expertise at Reward to support SMEs with a range of funding needs.

Commenting, Nick Smith, group managing director said: “It’s largely down to Steph and her team developing a deep understanding of our clients’ business needs, ability to move at pace and flexible approach to finding the right finance solution.”

Haydock Finance has announced a new organisational structure and made appointments to their sales support team.

The team is headed up by sales support manager, Corinne Birkett, who has over 22 years of asset finance experience. Her responsibilities include the development of customer journey processes and communications. Corinne supervises a team of sales support co-ordinators who work closely with the NACFB Patron’s regional broker managers and their broker network.

Tracey Hindle and Nicola Ince are established members of this team and have contributed to improving the efficiency of deal turnround times and building stronger broker relationships. New to the team, Gabby Clancy is the third sales support co-ordinator to be appointed. Gabby’s experience in financial administration and customer service has been a welcome addition to the team.

Commenting, Corinne said: “With new business levels rapidly increasing, sales support plays a critical role in driving interdepartmental collaboration and providing support throughout the entire transactional process, from proposal to pay-out.” She said that Haydock is constantly striving to deliver an industry leading service and her team are passionate about exceeding customer expectations.

Gabby said: “I am thrilled to be part of the team and utilise my experience to provide support to Haydock’s regional broker managers.”

Hodge has launched a refurbishment bridge finance product for experienced developers that will assist with updating existing properties and support the completion of the refurbishment process more easily. The product can be used where structural changes or revised planning consent are not required and is available to individuals, partnerships, LLPs, corporate entities, limited companies and PLCs.

Gareth Davies, head of development finance at the NACFB Patron, said: “We realise that sometimes finding the budget to overhaul a property or to simply fit new kitchens or improve bathrooms can be challenging, so this new refurbishment product is perfect for developers looking for that extra financial funding to complete their refurbishments to a high standard and achieve the highest yields possible.”

The refurbishment bridge product is available up to a maximum of 75% LTGDV and where the cost of refurbishment is less than 20% of the total costs of the project. Loans are available between £500,000 and £5 million with a term of up to 24 months.

The launch is the latest in a series that Hodge has added to its portfolio over the last few months, as it continues working to support property developers at every stage of a project.

Hampshire Trust Bank (HTB) has secured an ENABLE Build guarantee via the British Business Bank and The Department for Levelling Up, Housing and Communities (DLUHC). It follows the NACFB Patron’s previous ENABLE Guarantee, agreed in 2017, which has so far provided £342 million in SME housebuilder funding and supported the building of 1,547 new housing units.

The new guarantee means HTB can continue to grow its support to small business housebuilders across the UK. The British Business Bank’s ENABLE Build is a variant of its ENABLE Guarantee programme and targets SME housebuilders by reducing the amount of capital required to be held against such lending by the participating bank.

Under both the ENABLE Guarantee and ENABLE Build programmes, the UK government takes on a portion of the lender’s risk on a portfolio of loans to smaller businesses, in return for a fee. In the 12 months to March 2022 the ENABLE Build programme supported over £330 million of lending to more than 130 small housebuilders.

Alex Upton, managing director – development finance at HTB said: “We are confident that HTB will be able to support an increased number of SME housebuilders to improve housing supply, create employment and stimulate local economies across the country.”

With fast access to funds, we can help businesses ease restricting cashflow due to rising costs and respond quickly to market changes.

Our straightforward finance options and quick decisions on lending, enable customers to react with confidence in their own marketplaces.

Speak to us today, we’re here to help.

After more than three decades as a broker, David Whittaker had nearly seen it all in the buy-to-let market, both good and bad.

During that time, it had always puzzled him why intermediary-only lenders regularly built their propositions without apparent consideration for their clients – mortgage brokers.

So, he thought, why not use his experience as a buy-to-let mortgage adviser to build a lender that put the broker right at the heart of everything it did?

That’s how Keystone was born – or reborn, to be more accurate – in September 2018.

The specialist buy-to-let lender’s roots go all the way back to 2006, when it was established in partnership with Bradford & Bingley.

However, during the credit crunch the brand was paused – like many others – before returning in 2012 after securing funding lines with Aldermore first and then Paratus. In 2018 Keystone’s senior management team, including myself and sales and marketing director Phil Riches, relaunched the brand.

It was, as David once told a leading mortgage trade magazine, our opportunity to “put up or shut up”– and Keystone hasn’t looked back since. In the four years since we relaunched, we have passed £900 million in lending, issued our first ever securitisation and grown our headcount to more than 100 people.

While our growth has been rapid, we have always maintained that it should not come at the expense of our service. That is why I am proud to say that our offer-to-valuation and offer-to-completion times have reduced by 29% and 15%, respectively, in the past year, my first as managing director.

The breadth and choice of our product range has also improved significantly, and now includes both standard and specialist buy-to-let, holiday lets and ex-pat loans, all of which come with flexible criteria and are underwritten on an individual basis.

We are also proud to say we were one of the first lenders to offer

green mortgages, offering a discounted rate on properties with an EPC rating of at least a C, and we remain one of the few specialist lenders with a product transfer product set.

Brokers wanting to place cases with us will usually first speak with one of our vastly experienced business development managers, who are always on the road and have expert knowledge of our criteria. From there, brokers have a choice about how and when they interact with us. Our internal sales team is always on hand to deal with phone enquiries or, if brokers prefer, we have a webchat facility that operates out of hours.

Our bespoke, cloud-based system is incredibly flexible, allowing brokers to upload cases from any device at any time.

Our underwriting team is happy to work with brokers to ensure cases progress and use our system to leave notes and actions, ensuring advisers and their clients are fully informed throughout the entire process.

While we are very proud of the progress we have made in developing a specialist lender with brokers at the very heart of its proposition, we know there is more to be done. Market conditions are challenging and will remain so over the coming year, so we will be doing everything we can to ensure we make life easy for brokers. That is why we are doubling down on service delivery over the next year, ensuring that our turnaround times continue to fall and our broker satisfaction scores continue to rise.

To demonstrate our commitment to that, we have recently signed a lease on a second office, allowing us to potentially double the size of our broker-facing and service teams. We will also continue work in tandem with brokers to continually improve our bespoke system and to ensure it keeps delivering efficiencies in our processes. We also pledge to remain competitive in the market, regardless of market conditions. At the time of writing, we were in the process of launching our second-ever securitisation.

While Keystone was set up with a view to do things differently, we are aware that we must continue to evolve to ensure we offer what brokers want. Over the coming year we will be touching base regularly with many of you to ensure we do just that. After all, Keystone was set up as a lender for brokers built by a broker.

“

We are aware that we must continue to evolve to ensure we offer what brokers want

Revenue bands will be introduced requiring Principal Firms to report the anticipated AR revenue from regulated and financial non regulated activities during the first year of appointment. This annual reporting will also be required for existing AR relationships.

The Appointed Representative’s regime isn’t working as well as the FCA would like. The regulator has identified a wide range of harm across all the sectors where Principals and ARs operate and has gone so far as to question the adequacy of Principals’ due diligence prior to appointing an AR and cited poor on-going oversight and control.

The ramifications of these findings could be huge, especially as the FCA estimates it regulates some 3,400 Principal Firms who are responsible for around 37,000 ARs (including Introducer ARs).

In an effort to shore up the regime, on 3rd August, the regulator published its long-awaited Policy Statement PS22/11 detailing improvements which must be implemented by 8th December this year. They affect all Principal Firms who hold AR relationships, those who intend to have ARs in the future and ARs themselves.

The pre notification period for new AR appointments has been reduced from 60 calendar days to 30 calendar days.

Principals are being given more time to annually report AR complaints and revenue data. The FCA has increased from up to 30 business days after the Principal Firm’s accounting reference date, to up to 60 business days.

Principals will be required to disclose the nature of the financial arrangement between them and the AR including regulatory hosting services. Principals will be required to notify the FCA of their intention to begin providing regulatory hosting services at least 60 calendar days prior to providing these services.

Principal firms will be required to conduct a self-assessment style review on their ARs at least annually. These reviews are to be signed off by the Principals’ governing body. The reviews can be conducted by responsible individuals with a suitable degree of knowledge, with significant issues being escalated to the governing body.

A Section 165 data request will be issued requiring firms to submit new data items to the FCA for existing ARs. Principals will have 60 days after receiving the data request to complete the data and submit them to the regulator. Firms with 10 ARs or more, should complete an Excel spreadsheet. The data the FCA will request is made clear within PS22/11 so firms can begin to prepare for this immediately to ensure they have enough time to meet the deadline.

The Section 165 will be sent via email to all Principals with active ARs or IARs, so it is important that firms keep contact details accurate and up to date.

Principals will be required to notify the regulator at least 10 calendar days prior to any changes in the type of regulated activity engaged in by an AR.

An AR and IAR pre-notification period will be set at 30 calendar days. Where an approved persons application is required, the AR will be able to conduct the regulated activities after the individual has been approved.

Changes will be made to the information displayed on the Financial Services Register to make it more accessible to consumers.

The FCA also expects Principal firms to enhance their oversight for the onboarding of ARs and for existing AR relationships. This will include having appropriate systems, controls, and resources in place to monitor and assess:

• The fitness and propriety of senior management within the AR firm

• The growth of an AR

• The risk of harm to market integrity and customers

Further, firms are expected to have clarity on the circumstances where they should terminate an AR relationship and assist ARs with an orderly wind down.

It’s a long list with a tight implementation period, especially as firms are already under considerable pressure to meet the four implementation deadlines of the new Consumer Duty. Some transitional arrangements have been put in place to provide firms with more time to comply with certain new rules, particularly those firms who are required to submit data on an on-going basis along with annual AR self-assessments. Ultimately though, the regime improvements could have a considerable knock-on effect on both the Principal Firms and the ARs.

Principal Firms may have to find more resources – both human and financial – to adequately implement the improvements. This could lead to some questioning whether they want to continue with this business model at all, although we anticipate that some may choose a less drastic path such that they limit the size and number of ARs in their network. Principals should also expect greater FCA intervention and enforcement actions, particularly relating to accountability for the actions of their ARs and the efficacy of their own systems and controls for managing the risks presented by the ARs.

For the ARs, this increased regulation may result in many of them exiting the market as the reason for being an AR erodes. After all, what’s the point in being an AR at all, if they can’t be distinguished from a directly authorised firm?

NACFB Members who are affected by the new AR regime can get guidance and implementation support from the NACFB compliance team as part of their membership. Contact compliance@nacfb.org.uk

“

What’s the point in being an AR at all, if they can’t be distinguished from a directly authorised firm?

September was a month like no other for the government, the Bank of England, the economy, UK plc and the people. A highly experienced economist and economic development strategist at business intelligence tech company, Red Flag Alert, we asked Nicola for her opinion on what’s going on.

The new government has challenged some of the fiscal policies introduced by Boris Johnson and Rishi Sunak. In your opinion, what are the drivers behind this approach?

The drivers are a combination of global headwinds but also a clear difference in beliefs about the sources of growth in the British economy. Whereas the Sunak Treasury became persuaded by the need for stimulus during the pandemic and committed to high levels of spending, at the time of writing, Liz Truss and Kwasi Kwarteng are trying to balance ideological positions against both parliamentary and internal party realities. It is far from clear

where this will settle between September’s mini-budget and the next fiscal event in November.

Many market commentators have described some of the new government’s early initiatives as a gamble – why?

Dr Nicola Headlam Chief Economist & Head of Public Sector Red Flag Alert &Running the economy is hard. Running the economy when you fundamentally believe that “the state” ought not to play too activist a role is even harder. This is a quandary for many who have low tax instincts. By any conventional measure the sums being discussed to tackle the energy crisis are eye-watering. Tens or even hundreds of billions in unplanned expenditure are hard to justify in conventional terms and have led to market volatility.

How might the recent run on the pound (GBP) directly affect SMEs?

SMEs are being hit by a panoply of unfortunate events all at the same time. Currency fluctuations add to a general sense of unease and a worsening picture. At Red Flag Alert we support many SMEs in monitoring their supply chains as contagion can travel fast if core suppliers or customers are picking up unusual

debts, there’s a churn in directors or falling liquidity. Forewarned is forearmed and the run on sterling serves to increase uncertainty. That SMEs live within VUCA (volatility, uncertainty, complexity and ambiguity) operating environments, they can be earlier into distress than larger corporates.

Why is the US dollar (USD) so important to the UK economy and how does it impact SMEs?

Commodities priced in dollars immediately respond to fluctuations in exchange rates. Energy intensive businesses have the price of energy to contend with and as petrol prices are passed on very directly, the transport and logistics costs of doing business are exceeding business plans immediately. Costs being passed to SMEs put pressure on margins, and ultimately on hiring and firing decisions.

Apart from increases in the Bank Rate, what other levers can be meaningfully pulled to help combat rising costs?

A clear partnership between government and the Bank of England and a lack of surprises on either side!

Policies are shaky and the pound is weak, can the UK stand firm on its feet?

Though the economic climate is constantly shifting, Funding Circle is still here for small businesses

Jeremy Crinall Head of UK Introducer Partnerships Funding Circle

Over the past two years, small businesses have shown great resilience. Whether in their agility to adapt to new restrictions, overcoming supply chain hurdles or keeping up with ever-changing demand, they’ve risen to challenges, great and small.

Now, as inflation, base interest rates and energy costs all chart upwards, the economy is facing an uncertain future. To meet these new challenges, small businesses may need access to fast, affordable finance — and at Funding Circle, we’re here to provide the support they need to thrive.

Small and medium sized businesses are the backbone of the UK economy. In 2021, our SME borrowers contributed £7.2 billion to GDP and supported over 100,000 jobs. They also provide invaluable services, support their local communities and develop new products. That’s why it’s our mission to help them thrive.

We were founded in the aftermath of the 2008 recession to give businesses better access to finance. Unlike other lenders, because we lend exclusively to SMEs, we’re committed to helping them as best we can. Since 2010, we’ve supported 130,000 businesses with

more than £14.5 billion in finance, and we’re still here to help SMEs access the finance they need.

To help us continue to serve SMEs, we’ve widened our product offering so we can lend to businesses we might not have been able to help previously. With our new short-term loans, we’re able to support younger businesses which have been trading for one to two years, as well as businesses that weren’t eligible for our longer-term Funding Circle business loans. These new loans are offered at fixed rates, just like our longer-term loans, so SMEs can have the stability they need to plan with confidence.

We’ve also continued to invest in our in-house support teams, who are now able to not only help answer any questions businesses might have but can also help find the right finance

“In 2021, our SME borrowers contributed £7.2 billion to GDP and supported over 100,000 jobs

This more streamlined approach should enable us to say yes to even more businesses moving forward — and to remain a crucial lending partner for our ever-growing introducer community

Here’s some examples of the businesses we’ve supported through our introducer community so far.

Industry: Company training Loan size: £5,000

Loan purpose: Expanding their operations

How we helped: With the help of a short-term loan, this business was able to set up the training sessions they host online so they could reach more customers.

Industry: Flooring Loan size: £32,000

Loan purpose: Hiring staff

solution. We’ll continue to assess businesses based on their merits, and base any offer around what businesses can afford now, so they aren’t tied to future growth to meet repayments.

To empower our introducers even further and provide them with a more tailored service, we’ve updated the way our team operates. Each of our introducers will now get their own Business Development Executive (BDE), who will be their single point of contact for any applications submitted to us, as well as an assigned Business Development Manager (BDM).

We hope that, by implementing these changes, we’ll be able to strengthen the relationships we have with our introducers and speed up response times. This more streamlined approach should enable us to say yes to even more businesses moving forward — and to remain a crucial lending partner for our ever-growing introducer community.

How we helped: This business received an offer instantly, had their documents completed the following day and received the funding they needed to hire staff just a few hours later.

Industry: Transportation Loan size: £100,000

Loan purpose: Growth

How we helped: Looking for a loan to hire and train up new members of their team, this business had the funds in their account less than a week after they applied.

Industry: Education

Loan size: £145,000

Loan purpose: Growth and working capital

Why they’re noteworthy: Having previously taken out an RLS loan, this business topped up their finances with a business loan – and settled their existing loan to take advantage of a lower interest rate.

“

Weeks ahead of Halloween, the UK received something of an unseasonable fright. After a ‘fiscal event’ that was more trick than treat, the markets plunged into freefall. What followed was a hair-raising run on sterling, a sharp rise in bond yields and a stinging public rebuke from the IMF, as financial markets reacted negatively to unfunded tax cuts that favoured the rich and an energy package that is bigger than both the 2008 bank bail-out and 2019 furlough scheme.

Were it not for the Bank of England’s intervening to buy bonds to support prices, there would have been pension fund companies declaring bankruptcy, as their liabilities would have been greater than their assets. Such a ‘doom loop’ of falling assets would have forced pension funds to sell assets to raise cash to compensate, but as buyers dried up, prices fell. Thus, they were mere hours away from being dead and buried before the Bank of England stepped in.

Just what had brought us to this point? How on earth do we move beyond it, and how will this volatility impact a small business community already feeling the pinch?

When tasked with writing a monthly feature for Commercial Broker, I am reminded that assessing macroeconomic activity can be viewed as academic or fanciful, with most of the NACFB membership concerned with matters closer to the micro end of the spectrum. However, I believe it would not be very responsible on this occasion to ignore the complex web of conflicting forces in the commercial broking market. The commercial lending sector doesn’t operate in a vacuum, and, as evidenced by events of late, an unexpected fright can reverberate widely.

We shan’t focus too much on the who’s and how’s of Chancellor Kwasi Kwarteng's first mini-budget because, by now, there is near universal agreement that it resolutely spiked the punchbowl. The reaction to it – and the chain of events that followed – is of more interest, for seldom can you draw such a short and direct line between political decisions and real-life consequences. The crux of the concern for

many, including the IMF and a few global rating agencies, was the apparent shift in economic policy displayed by the new administration compared with that of the last 12 years of Conservative governments.

The package of measures aimed to boost economic growth by cutting taxes and regulations, funded by vast government borrowing and included a proposal to scrap the top 45% income tax rate paid on earnings above £150,000 a year. But the plan triggered a crisis of investor confidence in the government, jolting global markets to such an extent that the Bank of England had to intervene with a £65 billion program to shore up the bond market. Even as it succeeded at this, the damage had been done. Bond yields were significantly higher, raising mortgage rates and immediately impacting the many thousands who were refixing or entering new deals.

The resultant – and somewhat inevitable – government U-turn followed immense pressure from the market and conservative backbenchers. It represented an embarrassing climb down from what should have been a flagship policy. Chancellor Kwarteng said the proposal to slash the top rate – which made up about £2 billion out of the overall £45 billion tax-cutting plan – had: “…become a distraction from our overriding mission to tackle the challenges facing our country.” An array of investors and economists welcomed the reversal but cautioned that the government needed to go further still.

The government had been due to release another fiscal statement with the full scale of borrowing and debt-cutting plans in late November – but this has been brought forward to the 31st October – where at least the next set of tricks and treats will enjoy a more familiar Halloween backdrop.

The crux of the concern for many, including the IMF and a few global rating agencies, was the apparent shift in economic policy displayed by the new administration

“

Perhaps not unreasonably, as both party leaders took to their respective conference stages, there was a central theme to their headline addresses, the drive for economic growth, something that all parties want. But Britain’s economy is expected to remain weak or be in a mild recession until 2024, which is likely to leave the UK’s output level below its pre-COVID peak seen in Q4 2019. Despite relatively low unemployment and high job vacancies, business investment, households, and businesses will struggle with soaring costs.

September saw a significant decline in key indicators of economic activity, with confidence among company bosses over the growth outlook collapsing to the lowest level since the pandemic and consumer confidence at 1974 lows. In a downbeat assessment, analysts at Deutsche Bank said UK GDP was due to take until 2024 to return to the level of December 2019 before the pandemic struck, raising the prospect of five years of stagnation.

The Prime Minister used her speech to the Conservative party conference in Birmingham to argue that her government would prioritise “Growth, growth, growth” while attacking what she called an “anti-growth coalition” that could hold the country back. The Prime Minister continued her push to break the “high-tax, low-growth cycle” by offering lower taxes and scrapping regulations to encourage companies to invest more in the UK economy and households to spend more.

I wrote in detail about soaring energy prices in last month’s issue. Still, with weaker global growth since Russia’s war in Ukraine began, the Bank of England forecasted in its August monetary report that the UK economy will shrink for five consecutive quarters starting in Q4 this year.

Highlighting the risks to the economy with inflation at a 40-year high, the British Chambers of Commerce (BCC) also shared that

more than three-quarters of companies it surveyed had not increased investment in the last quarter. The BCC outlined a sharp drop in business confidence in the past three months in its study, though this was before the government announced its energy support package and mini-budget plans. However, worryingly, as many as four in 10 firms said in that report that they thought their profitability would fall in the next 12 months.

Shevaun Haviland, the director general of the BCC, said that, while the government’s support measures were welcome, ministers urgently needed to present more detail on how their policies would support firms to expand. “Our findings paint a worrying picture of the state of affairs at many UK firms. Almost every key business indicator is trending downwards – sounding alarm bells across all sectors and regions,” she said.

It is a testament to the continued resilience of small businesses that they have been repaying bank debt over the last five years. Bank of England figures show the annual growth rate of lending to SMEs is negative, with small firms making net debt repayments of close to £1 billion in March alone. Lending to big corporates, by contrast, has increased significantly since the start of the year. According to the FSB’s Small Business Index, fewer than one in 10 small firms applied for finance in Q1 2022, the lowest proportion since SBI records began. The share that saw applications approved (43%) was also at a record low.

Against this landscape, NACFB Members will likely see an increase in distressed borrowing over the next six months as by-standing SMEs become more likely to be entangled in the complex web of macroeconomic forces. Commercial finance intermediaries of all specialisms should now seek to partner with existing clients and enterprises with high levels of debt and work with them to lengthen loan terms and consolidate where possible.

Now is the time when Members can be adding real value to their clients. By restructuring existing debt and examining alternative debt structures, finance professionals can help shore up their

“

Seldom can you draw such a short and direct line between political decisions and real-life consequences

clients in the short to medium term, enabling them to ride out periods of economic turmoil and return to growth.

The tussle at the top

Prime Minister Liz Truss and her Chancellor were asking the country to believe the most significant obstacle between the economy and growth was excessive taxation and too much regulation. But the financial markets and the IMF begged to differ and disagreed with their approach.

What was presented was a plan explicitly at odds with the Bank of England’s policy position of keeping inflation down. They had raised interest rates and initiated a ‘quantitative tightening’ round to slow the economy. That required taking money out of the system – quite the opposite of the government’s efforts to spur growth by cutting taxes and thereby hoping to stimulate growth. This means the Bank of England will raise interest rates at its next meeting by more than it would otherwise. Historically, it is not unusual for the mix of fiscal and monetary policy to differ. But we have had a loose monetary and loose fiscal policy stance for 14 years, and we have grown accustomed to it.

Sharply higher price inflation at 40-year highs has now changed this mix, with the policy priority for the Bank of England to reduce inflation. It must now raise interest rates to do that and meet its legal mandate to keep price inflation low and table at around a 2% annual rate in the medium term. Its role is not to do the government’s bidding on monetary policy. This is why it was made independent in 1997 with a mandate from the government to act at arm’s length. This was thought – and still is by financial markets and investors worldwide – as the best way to add credibility to monetary policy, free of political influence.

Any move by the government to change this would result in a deep

financial, international investor, and political crisis that would dwarf any seen thus far, and the Bank would not be able to help as it would have been hamstrung. Moreover, it would require an act of Parliament, and many Conservative MPs would never vote for such a thing, never mind the implacable opposition of MPs from every other party.

For a government that needs to borrow money from international investors to fund its energy plans and tax cuts, it would be political suicide to change the Bank of England’s remit. That is because the view widely held amongst academics and financial market practitioners is that low and stable inflation aids growth and promotes employment. That is because it gives certainty to investors planning for the longer term and protects those on low incomes from the debilitating effects of inflation.

Therefore, we are in for a future of loose fiscal and tight monetary policy. That is something that businesses and households will have to get used to for the first time in decades, and it may be a difficult adjustment. But we must start now.

“

We are in for a future of loose fiscal and tight monetary policy. That is something that businesses and households will have to get used to for the first time in decades

“

Intermediaries of all specialisms should now seek to partner with existing clients and enterprises with high levels of debt and work with them to lengthen loan terms

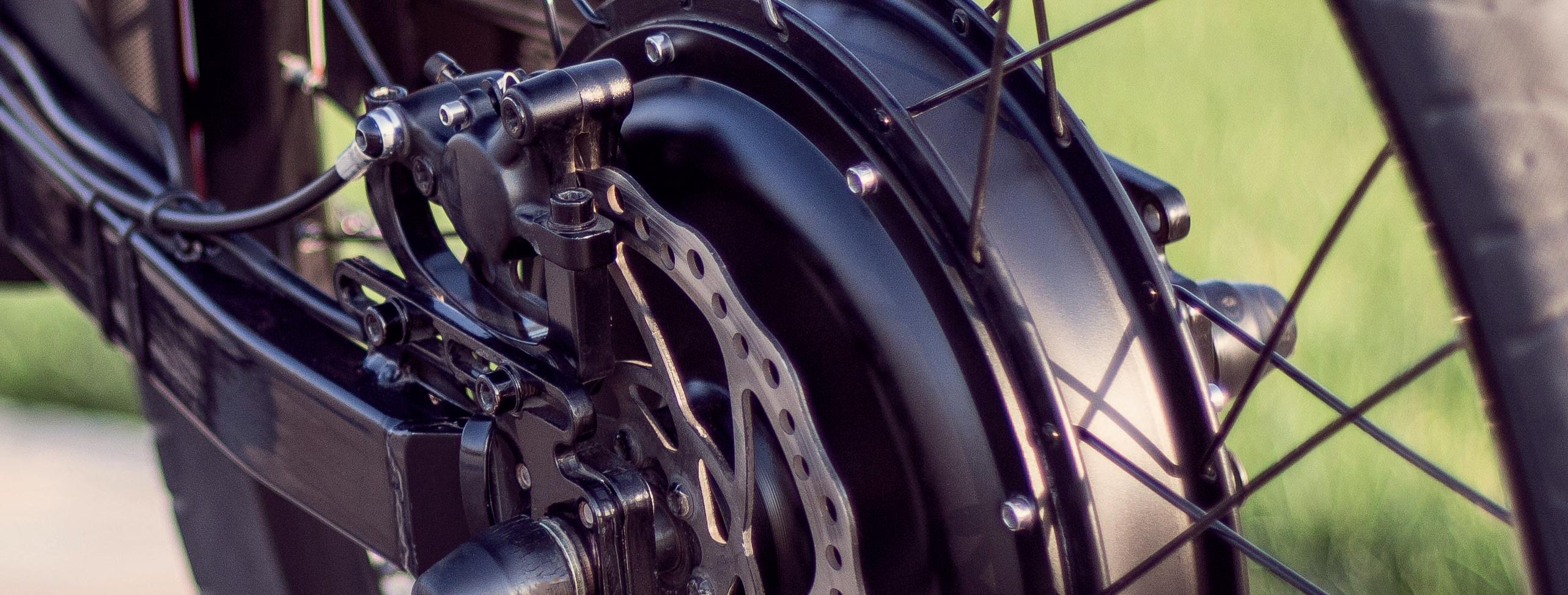

vans, reducing congestion and pollution. Spend time in any modern city and you’ll see that PMVs, in the form of light electric cargo vehicles, e-bikes and scooters, hoverboards and other innovations, are already here.

The micromobility sector offers a chance to make cities cleaner and greener as well as nicer places to live, work and play. It represents a substantial industrial opportunity for the UK.

The world faces significant challenges as increasing urbanisation brings with it more congestion and pollution. Throw in the need to decarbonise economies, and we need new thinking about how people and freight move from place to place. Switching from the internal combustion engine (ICE) to electric vehicles (EVs) can address some of these challenges, such as pollution, but not all. As car makers address concerns on range anxiety, so EVs get larger and heavier, which increases total lifetime emissions.

Public transport forms part of the answer, helping to move people long distances efficiently. But such systems can’t get passengers or parcels where they want to go with the precision offered by a car or van.

Powered micro vehicles (PMVs) offer a low-emission option with enough benefits to encourage drivers out of traditional cars and

Over the last few years, demand for such vehicles has grown steadily, attracting entrepreneurs and finance. The whole sector received a boost from the pandemic, as consumers favoured the social distancing of an e-scooter or bike to overcrowded buses and trains. There has been a proliferation of new developments in the sector and there are plenty more on the way. Many of these vehicles have been designed and built in the UK.

But there is a major problem. At the moment, a lot of these vehicles are illegal. Most PMVs can’t legally be used on UK roads because they are classed as motor vehicles, meaning they must

“

With its rich automotive and manufacturing heritage, the UK will be well placed to take advantage of this boom

Unlocking a low-carbon opportunity

Start-ups may continue to head overseas to other countries where a more certain regulatory framework makes investment decisions easier

meet requirements that are difficult to reconcile with the design of the vehicles. The junior transport minister, Trudy Harrison, acknowledged the need to update regulations. “These vehicles can have a transformative impact on transport across our cities, towns and villages,” she said. “But we face the challenge of integrating these new vehicles into an existing transport network.”

The intention is to create a new category of vehicle that can flex to encompass future types of micromobility vehicles. A flexible regulatory framework will ensure that vehicles are regulated to improve safety not just for the users of the vehicles, but also for other road users and pedestrians.

There is a strong desire that this transport revolution doesn’t ignore the needs of minorities and those with disabilities. Sales data presented by Halfords showed the existing market for e-scooters to be heavily biased towards young men, often on lower incomes; while e-bikes are more likely to be purchased by older, wealthier men. Making sure that future frameworks and policies are equitable for all users is vital.

Until the UK regulatory environment is resolved, start-ups may continue to head overseas to other countries where a more certain regulatory framework makes investment decisions easier. The full weight of private equity, for example, is not yet open to the sector in the UK, largely because it is difficult to accurately predict demand and market size.

The cost of having to hire private land to run real-world tests is another factor driving start-ups overseas, with many firms already having offshored manufacturing. This matters because making things in less carbon-conscious emerging markets and shipping them back to the UK seriously impacts their green credentials.

WMG analysis shows that the equivalent manufacturing footprint of a typical car could make 14 scooters in China, while manufacturing in the UK, with its greener energy mix and a lack of shipping, you could make 40 scooters for the same footprint. The UK has a highly skilled and adaptable industrial base that is well set to offer the facilities needed to manufacture many of these vehicles.

An extremely strong materials science base is also available to help develop the lighter composites (such as thermoplastics) that can reduce weight and emissions further.

The micromobility market presents a huge opportunity for established players and new entrants that can be visionary and seize the chance.

Legislative change, including the creation of a new legal category of vehicle, is needed to bring clarity and certainty to the market and help to unlock public and private investment in infrastructure and vehicle innovation. With its rich automotive and manufacturing heritage, the UK will be well placed to take advantage of this boom.

Rob Hulse Head of Channel Development SME Capital

Rob Hulse Head of Channel Development SME Capital

and transaction overviews. Key to the transaction’s success is the management team’s ability to transition from managers to entrepreneurs.

Amanagement buyout (MBO) is the process in which a company’s key management team acquires all or part of the company they manage. In an MBO transaction, the management team believes they can use their expertise to grow the business, improve its operations, and generate a return on their investment. It is a type of leveraged buyout (LBO) and can sometimes be referred to as a leveraged management buyout (LMBO).

MBOs often come about when the owner of a business is looking to retire or perhaps a majority shareholder wants to exit. Maintaining a real passion for the future of the business they are usually keen to see the future of the business and staff remain intact and in safe hands. An MBO therefore is an attractive alternative to a trade sale.

The hallmarks of a business that would facilitate a successful MBO include a strong, committed management team with a complementary blend of skills. It must also maintain a robust track record of profitability, cash generation and good prospects alongside a vendor who is pragmatic on price and realistic about the need to assist with vendor finance. Any deal structure can be funded and supported by the future cash flows of the company.

A management buyout takes time, and the role of the broker involves more than just sourcing the right finance. For brokers with clients who are planning an MBO, there are a number of important factors to research and consider to ensure that the transaction is successful:

• Assess feasibility: The feasibility of funding will be assessed based on the financials, people, products, customers and market dynamics. Therefore, it is crucial to work closely with your client to gather high quality information for them, such as financial statements, trade debtor reports, business

• Be open and transparent: Ensure your client is open and transparent with executives and shareholders on the plans and cut key employees in on the deal (share the equity). Keeping key people in the business and rewarding their loyalty will help build and solidify that bond as the business grows.

• Understanding the business’ value: To make a deal work, all parties must be open, transparent, and willing to invest time and resources. You should help your client develop a thorough understanding of the value of their business through financial modelling and valuation, involving the right people/advisers where required. This sensitive analysis and business modelling focuses on the debt structure and preparation of forecasts that include the affordability of a debt facility and will likely include tax implications.

• Line up the finance: Get your client’s financing all lined up. Approaching suitable funders for your client and evaluating offers is an important role for the broker. Remember, this is where SME Capital can help, so do get in touch with us to discuss the deal. Once a funder is appointed, terms will be agreed and after satisfactory due diligence, lawyers will have the paperwork drawn up and the transaction will be completed.

• Stay focused on daily operations too: Make sure your client doesn't neglect the operations of the business while working on the deal. Remind them to remain friendly and continue to form strong employee and customer retention plans.

• Develop a communications plan: Once the change of ownership takes place, your client should have a solid media and press communications plan in place to reassure customers of the strength of the new management. The communications should focus on growth and the exciting new opportunities to come for the business.

To save wasted time, misunderstandings, and some uncomfortable surprises further down the line, there are some questions and considerations that you can ask your client upfront, gathering information that your chosen lender(s) will need to know to be able to finance the project and back the developer.

The reply to the question, “What RIBA stage is your project at?” will either lead to a detailed discussion with a developer on what they have done to date in preparation to start construction or help with the flow and direction of information required.

There are incredibly talented builders who are very capable

of building amazing properties but there is a distinct difference between good builders and capable developers. Those capable developers should have a firm grasp of the many different requirements needed to bring a project to life.

The RIBA (Royal Institute of British Architects) Plan of Work is a widely accepted industry standard framework that comprises eight separate work stages that each address a required phase of a construction project’s progression, each stage can be used as both a process map and a management tool.

A developer that knows exactly where they are on the RIBA stages in the development project will give some comfort as to

their technical expertise, understanding of project management and experience.

Most of the more in-depth, detailed questions are based around RIBA Stages 4 and 5, including the technical design information required to manufacture and construct the project and commissioning the work to completion.

The table below gives a checklist of some initial questions to ask and considerations. This checklist allows you to collate information up-front, understand the project and get a sense of the developer’s competencies, saving you time in the long run. If you don’t think that the borrower or project feels right, the lender probably won’t either.

Is planning in place – in outline or detail?

Are there pre-commencement planning conditions, if so, have they been discharged?

Are there any conditions on planning that could be onerous or add time or cost?

Who has prepared the costs?

Do they have the right experience or qualifications?

Is there cost certainty? Large provisional sums may indicate that costs are not fixed and may give concern, especially in the current environment.

Does the level of consistency make sense?

Is there a proposed build programme and how has this has been estimated and by whom?

Consideration should be given to:

• Ground conditions (this may affect the type of foundations required and therefore impact cost and time);

• Utilities (are applications submitted and when, has the developer checked for capacity issues from the grid?);

• Neighbourly matters such as party walls and rights to light, these can have significant time and cost implications if not addressed early;

• If a contractor is being used, ensure all warranties are in place and the contractor has a good track record.

Ensure all design team members are appointed and appropriate warranties are in place.

Do they intend to use a main contractor or use another route?

If contracted, does the contractor have a good track record?

Where are they in the contract and tender process?

What type of contract is being proposed? A JCT (Joints Contract Tribunal) design and build is where the total cost of constructing the works is set out in a contract and a single main contractor has design responsibility. This would be a preferable option for most developments.

If the contract is already in place, are all the collateral warranties in place?

Head of Commercial Banking

Reliance Bank

according to a report conducted by Charities Aid Foundation. The research reveals that between January and April 2022, 57% of people said they donated or sponsored someone in the previous 12 months, compared to 65% in 2019. This could be due to the move towards a cashless society, inflation, and the cost-of-living crisis.

ince 2015, over 4,300 banks and building society branches have closed – putting people’s ability to withdraw and deposit cash at risk. But research indicates that as many as one in five adults would struggle to cope without cash, while seven in ten small businesses believe cash is important to the future of our high streets. Clearly, cash still matters.

With the evolution of technology in the payment and banking sectors, such as the rise of digital wallets, contactless payments, and biometric payments, exchanging money is easier, swifter and more convenient than ever before.

While there are clear advantages to using digital payment methods, transitioning to a completely cashless society could isolate different groups and industries, including the elderly, those who are more vulnerable, and charities.

The COVID pandemic accelerated the move towards a cashless society, with many businesses only accepting card payments. According to the Bank of England, transactional cash use has fallen from over 50% of payments in 2010 to only 17% of all payments in 2020.

Charities have certainly felt the impact of this, but it is not all doom and gloom. Here are four ways that a cashless society has impacted charity donations, both for the better and worse:

• 73% of charities report that street donations are declining because people are less likely to carry cash, according to Barclay’s The Future of Giving report.

• The number of donors has declined over the past few years,

• Digital wallets used by donors have significantly increased year-on-year. In fact, digital wallets account for a fifth of monthly online donation payments and nearly half (43%) of all one-off donations are made online, according to a report by goDonate.

• Consumers who donate via contactless technology are willing to donate significantly larger amounts than those using cash. The goDonate study also reveals that the average one-off donation value increased by 7% in the past year to £51.97.

In the Charity Finance Banking Survey, 15% of charities in 2021 have a bank loan, compared to 11% of charities in 2017.

We’ve noticed that charities and social enterprises are needing commercial finance to fund projects to support their recipients. Not only this, but they have also started to review their supply chain and seek to use a socially responsible lender such as Reliance Bank, to demonstrate that they use suppliers that are consistent with their purpose.

“

Seven in ten small businesses believe cash is important to the future of our high streets

Warren Ralls Managing Director, UK Network British Business Bank

Warren Ralls Managing Director, UK Network British Business Bank

businesses. By contrast, Yorkshire and the Humber accounts for just 1.5% of equity investment and 4.9% of private debt activity while hosting 7.2% of the business population.

London also still dominates growth finance more generally, accounting for 62% of equity investment and 35% of private debt investment. This is despite only having 19% of the UK’s small business population.

The British Business Bank works hard to support smaller businesses across the UK whether they are starting up, scaling up or looking to stay ahead.

Working through a host of delivery partners, from high street banks and venture capital funds to business angels and non-bank finance providers, the Bank is currently supporting over £10.8 billion of finance to more than 93,000 businesses.

As well as increasing both the volume and diversity of finance available to the UK’s 5.6 million smaller businesses, a key objective for the Bank is to encourage and enable them to seek the finance best suited to their needs.

Our first annual Regions and Nations Tracker found that core debt products are the most used form of external finance in all regions and nations of the UK. Equity finance is rarer but is particularly suited to businesses with the potential for rapid growth.

London, the South-East, the North-West and the East of England in total account for 86% of equity deals, despite hosting just 55% of

We recognise that it’s important to make sure that growth and funding is spread across the country, particularly in areas where historically, funding gaps have been more prominent or stark.

We also know from our research and the outreach work undertaken by our UK network of relationship managers that each area has different characteristics and needs.

The Bank is currently supporting over £10.8 billion of finance to more than 93,000 businesses

“

That is why we’re running a Business Finance Week from 7th-11th November, with the aim of helping smaller businesses across the UK gain awareness and understanding of the different funding options available, so they can access the right finance for them at the right time.

During Business Finance Week, we will be offering bespoke in-person, hybrid and virtual events as part of a varied programme that will take place across the week throughout the UK. Please look out for our publicity and share as widely as possible with your networks.

The British Business Bank also has an objective to identify and help reduce regional imbalances in access to finance for smaller businesses across the UK. In 2020/21, the Bank committed £943 million to businesses outside of London.

We currently provide dedicated support for specific regions through three regional funds: The Northern Powerhouse Investment Fund (NPIF), the Midlands Engine Investment Fund (MEIF), and the Cornwall and Isles of Scilly Fund (CIOSIF).

These funds have already delivered over £1 billion of public and private sector funding to smaller businesses in those regions, helping to address regional funding gaps, including 1,033 businesses benefitting from the NPIF since its inception five years ago. The government recognised the success of these interventions at the 2021 Spending Review through a £1.6 billion commitment to a next

generation of funds. This includes £660 million for the NPIF including an expansion into the North-East of England, £400 million for the MEIF, and £200 million to provide a new fund for businesses in the South-West of England, building on the CIOSIF. For the first time, the Bank will also operate funds dedicated to the devolved nations, with £150 million to provide a new fund for Scotland, £130 million for Wales and £70 million to expand provision in Northern Ireland.

In addition to our three regional funds, in 2018 British Business Investments, a commercial subsidiary of the British Business Bank, launched the Regional Angels Programme, designed to help reduce regional imbalances in access to early-stage equity finance for smaller businesses across the UK.

We continue to strive to have a diverse portfolio of delivery partners that we work with across the UK. Through the new iteration of our Recovery Loan Scheme, we are doing just that, with lenders of different types across different regions. The current list of accredited lenders can be found on our website, and we expect to add many more in the weeks to come. We are grateful for the key role that NACFB Members play in helping businesses source finance and in making referrals to participating lenders.

We know we must do more to keep increasing the capital available to businesses across the country and help create a more level playing field, so all businesses have the same opportunities to achieve financial success.

Alan Fletcher Partnership Director Invest & Fund

Alan Fletcher Partnership Director Invest & Fund

Fiscal tightening, contracting monetary policy, high-rate environments, ʻworrying macro picture’, geopolitics, these terms and phrases have bombarded us over the last few months and they all impact how and where investors choose to invest. So too does access to information, which helps investors to take informed choices. But is there too much information out there? To paraphrase The Paradox of Choice by world-renowned psychologist Barry Schwarz, “The more choice we have, the more paralysing and confusing life becomes ”

So, if too much choice is bad, and even world-level banking aficionados can’t agree on what to do, how will the retail investor fare?

I can only present our opinion, which will be one of many, but hopefully, this will at least attempt to demystify some of the above. The reasoning behind the current macro picture is substantial and varied and has far too much nuance to unpack here; however, the outcome is the same. Uncertainty creates concern, and concern creates an aversion to risk and subsequently associated risk assets.

No doubt, investors seek a balanced and risk-adjusted portfolio; enough risk exposure to grow wealth without taking on so much that it becomes intolerable. When unpacking P2P as an asset class, there are three interesting points to consider.

Many economists and speculators believe that soaring house prices fuelled by cheap money is coming to a rapid end and that it won’t be an economic reality in a high-rate environment. That may be accurate, but that isn’t what makes the housing market such an attractive bedrock of investment potential; the attractiveness comes from the asset’s ability to store value over time. Aside from the equity shock and subsequent rebound since the 2008 financial crisis, house prices in the UK have been tracking upwards since the late 1970s, since they began to be commoditised on a large scale. This is because assets tend to be valued based on scarcity or utility, and houses have the latter to the ultimate extent. The robustness displayed over the last 50 years underpins the P2P asset class because there is a constant requirement for new homes, therein the fixed correlation between utility and value.

Should a downturn marginally decrease the asset value, to a certain extent, the scheme’s profit margins would initially absorb losses and protect returns. At Invest & Fund, this situation is orchestrated by the fact that the projects we back have a high level of competency, our clients are experienced, and the margins they work off are substantial.

When choosing a P2P platform, not only should investors consider asset class and performance, they should take into account the skills and expertise of the provider’s team. For example, at Invest & Fund, our team of dedicated experts have relevant careers spanning decades. We have also returned over £118 million of capital and interest to lenders with zero losses, showing the rigour that governs our business.

Tanya Elmaz, Together’s Head of Intermediary Sales for Commercial Finance, says: “With upcoming minimum EPC rating requirements set to meet sustainability targets, many properties could become redundant and their value could plummet. Giving landlords access to smart finance options could help your clients futureproof their portfolio.”

“New government rules surrounding EPC ratings are due to come into effect in 2025, which will require landlords to take more responsibility for the energy efficiency of their rental properties.

“Anything which improves the conditions for tenants in rental accommodation and the positive environmental impact is progress. However, the impact this could have on landlords and their existing stock of underachieving properties is proving to be of concern to many.

“A large number of these properties – many of which are older, popular characterful buildings – could become too expensive to bring in line with the new regulations, which may see them at risk of becoming redundant. This poses a number of issues.

“Firstly, it would greatly impact the value of these assets and expected return on investment for landlords. This could affect their ability to keep up repayments on their buy-tolet mortgages if their income is depleted. Secondly, having unused buildings – particularly given the current shortage of housing in the UK – would actually be environmentally, economically and socially unsustainable.

“With 60% of the UK’s current housing stock still rated D or below, the scale of the challenge is clear. In this issue of NACFB’s Commerical Broker magazine, we explore how bridging finance can help landlords meet the Government’s targets to support the sustainability and energy efficiency of the UK’s rental properties. And why, for landlords and property investors, we’re making access to finance as straightforward as possible.

“I’ve invited Lorenzo Satchell, our Specialist Account Manager in the South, to explain the upcoming changes, and how bridging finance could support the nation’s landlords in bringing older properties up to date.”

Tanya Elmaz Head of Intermediary Sales for Commercial Finance

To help the UK achieve its carbon reduction targets and improve energy efficiency standards, the Government introduced the Energy Performance Certificate (EPC) almost 15 years ago. Whenever a property in the UK is sold or rented out, it must have a certificate showing its energy efficiency performance based on factors such as insulation, heating and how much energy it uses.

A property will get an overall rating on a scale running from A to G. A is the best, and G is the least efficient. Generally speaking, older properties have lower ratings because they lack (for instance) cavity wall insulation or double glazing unless these have been retro-fitted.

The proposed Minimum Energy Standards for rented properties will shift from an E rating to a C rating under the new rules, and making changes isn’t optional. The new regulations will be introduced for new tenancies first from 2025, followed by all tenancies from 2028.

If a landlord’s property is found to fall short of the required rating, they could face a fine of up to £30,000. Plus they’ll have an unlettable property on their hands, which will mean a property standing empty – and a loss of rental income for the owner.

Lorenzo Satchell, Together’s Regional Account Manager – London and the South.

“Older properties have always been a favourite with buy-to-let landlords, whether it’s two-up, two-down

terraces offering the perfect first home for young professionals or larger Victorian villas prime for converting into houses in multiple occupation (HMOs).

“But where older properties may offer more room for development (and potentially a greater return on investment), new regulations around energy ratings may mean older rental properties suddenly look far less attractive to the landlord looking for a good return.

“While data shows that homes built before 1900 generally have an E rating or lower, all is not lost if your client does have older homes in their portfolio, or has their eye on a historic property. With a little time and money, older homes can be brought up to the required standard, and the improvements they make could even make their property more attractive to potential tenants.

“If they’re adding to their portfolio and don’t have sitting tenants, improvements that increase the energy efficiency of a property – like installing a new boiler and double glazing – can be lumped in with other renovation work and factored into any potential borrowing, all in one go. Plus, if they’re considering liquidating some of their stock over the next few years, a property with a better EPC rating is likely to attract a better price and more attention from buyers who aren’t up for renovating themselves.

We’re also seeing more first-time landlords taking an interest in older properties. Those currently renting in London, for example, might not have the deposit (or the income) available to purchase an expensive first home in the city, but can afford a property which is suitable to let further afield. We’ve experienced cases recently where these first-time landlords decide to purchase a property they can add value to (such as an older building with a low EPC rating) and let it out for a while, providing them with a second income and the opportunity to

grow their deposit for their own home in London in the future.

“While insights suggest a lot of landlords are buying new builds which already meet the energy efficiency standards instead of holding out for a doer-upper at auction, there are challenges, in both availability and yield.

“Landlords buying off plan, or choosing an almost-new property that’s ready to move into, are competing not only with other landlords but with private homebuyers who don’t have an appetite for DIY, and will most likely pay a premium for the convenience. And with prices continuing to rise, it’s unlikely that the yield on a new rental property will be as strong.

“Let’s not forget we’re talking about sustainability here too. Ensuring older properties are still usable and don’t become redundant means these buildings aren’t going to waste, which could potentially prevent more Greenfield land being built on. Furthermore, it means cities with a high supply of period properties – like the host of Victorian buildings which can be found around London, Leeds and Liverpool, for example – can remain vibrant communities for future generations to enjoy.”

“According to the latest research, landlords cited the cost and accessing the right finance as some of the biggest barriers to achieving a C rating across their existing portfolio. Many have also raised concerns over the loss of rental income whilst work is being completed.

“Making less intrusive improvements, like adding cavity wall insulation or switching to LED lighting, could provide one solution. It would mean your landlord clients don’t have to uproot existing trustworthy

tenants, whilst moving in the right direction towards hitting the 2025 requirements.

“However, making the necessary changes to rental accommodation can still be costly – particularly as research puts the average upgrade bill at £6,000 to £10,000 per building.

“Whether your client is looking to do some general upgrades and include energy efficiency measures into the cost, or need to do a whole raft of improvements just to bring their property up to scratch, short term funding like a bridging loan could prove the right solution. Securing a bridging loan against a rental property, or another property in their portfolio could allow them to make the necessary investment (if they’ll need less than 12 months to complete the required work). After they’ve made the improvements, and potentially increased the value of the property, you could help them refinance onto a new buy-to-let mortgage.