P. 26 Using Your Voice on Capitol Hill P. 34 Saving for College A NARFE PUBLICATION FOR FEDERAL EMPLOYEES AND RETIREES August 2023 VOLUME 99 ★ NUMBER 6

to all discounts: Residents under a Life Care Agreement are not eligible for the discounts. These discounts do not apply to any room, board or services which are paid for all or in part by any state or federally funded program. Discounts are available to members and their family members, including spouse, adult children, siblings, parents, grandparents, and corresponding in-law or step adult children, siblings, parents, and grandparents through current spouse. Subject to availability. Further restrictions may apply.

brookdale.com A great m e for NARFE members Experience a senior living lifestyle that features restaurant-style dining, housekeeping, 712925 HVS monthly fee/basic service rate* 7.5 OFF SENIOR LIVING: % OFF 10 service rate** % IN-HOME SERVICES: DISCOUNTED RATES VARY BY COMMUNITY*** SHORT-TERM STAY: For more information, call (866) 787-9775 or visit brookdale.com/NARFE. ©2022 Brookdale Senior Living Inc. All rights reserved. BROOKDALE SENIOR LIVING is a registered trademark of Brookdale Senior Living Inc. *Discount is only applicable to new residents of a Brookdale independent living,

living, or memory care community admitting under an executed residency agreement. Discount applies only to the monthly fee/basic service rate, excluding care costs and other fees and is calculated based on the initial monthly fee/basic service rate. **Discount is only applicable to new clients of personal assistance services

a

an

service agreement. ***Discount is only applicable to new residents of a Brookdale

or

an

respite agreement. Discount applies to the daily rate.

assisted

by

Brookdale agency under

executed

assisted living

memory care community admitting under

executed

Applicable

NARFE MAGAZINE www.NARFE.org 1 P. 26 Using Your Voice on Capitol P. 34 Saving for College Contents AUGUST 2023 PAGE 26 COVER STORY FEATURE PAGE 34 Special Feature 51 NARFE 2022 Financial Statements Washington Watch 8 NARFE Submits Comments on PSHB Interim Final Rule 9 Biden Signs Debt Limit and Budget Deal Into Law 10 Steady Progress Continues in Fight to Repeal WEP, GPO 11 Senate Committee Advances Legislation to Fix Retirement Error for CBP Officers 12 OPM Renews FLTCIP Contract with John Hancock, Premium Increases to Come 14 Bill Tracker Columns 4 From the President 24 Benefits Brief 44 Managing Money Departments 6 NARFE Online 20 Questions & Answers 21 Countdown to COLA 46 NARFE News 62 NARFE Perks 64 The Way We Worked ON THE COVER Illustration by TGD P. 26 Using Your Voice on Capitol Hill P. 34 Saving for College A NARFE PUBLICATION AND RETIREES ★ SAVING FOR COLLEGE How students, parents and grandparents can meet the rising costs of higher education while minimizing taxes. USING YOUR VOICE ON CAPITOL HILL Grassroots advocacy strategies to get your point across and make a difference. Connect with us! Visit us online at www.narfe.org Like us on Facebook NARFE National Headquarters Follow us on Twitter @narfehq Follow us on LinkedIn NARFE

EDITORIAL DIRECTOR

Jenn Rafael

CREATIVE SERVICES MANAGER

Beth Bedard

CONTENT MANAGER

Matt Sanderson

ADDITIONAL GRAPHIC DESIGN

TGD

EDITORIAL BOARD

William Shackelford, Kathryn E. Hensley, Johann De Castro

CONTACT US

NARFE Magazine

606 North Washington St. Alexandria, VA 22314-1914 Phone: 703-838-7760 Fax: 703-838-7781

Editorial: communications@narfe.org

Advertising Sales: Francine Garner advertising@narfe.org

NARFE FOR THE VISUALLY IMPAIRED

ON THE TELEPHONE: This publication can be heard on the telephone by persons who have trouble seeing or reading the print edition. For more information, contact the National Federation of the Blind NFBNEWSLINE® service at 866-504-7300 or go to www.nfbnewsline.org.

ON DIGITAL AUDIO: Issues of NARFE Magazine are also available in audio format through the National Library Service for the Blind and Physically Handicapped (NLS). For availability, call 202-727-2142 or your local NLS service provider.

The Association, since July 1970, has been classified by the IRS as a tax-exempt labor organization [not a union]; however, dues and gifts or contributions to the Association are not deductible as charitable contributions for income tax purposes.

NATIONAL OFFICERS

WILLIAM SHACKELFORD

President; natpres@narfe.org

KATHRYN E. HENSLEY Secretary/Treasurer; natsectreas@narfe.org

INTERIM CHIEF OF STAFF

JOHANN DE CASTRO jdecastro@narfe.org

REGIONAL VICE PRESIDENTS

REGION I Jeff Anliker (Connecticut, Maine, Massachusetts, New Hampshire, New York, Rhode Island and Vermont)

Tel: 413-813-8136

Email: jeff.anliker@outlook.com

REGION II Larry Walton (Delaware, District of Columbia, Maryland, New Jersey and Pennsylvania)

Tel: 443-831-1791

Email: rvp2@narfe.org

REGION III Lynn Harper (Alabama, Florida, Georgia, Mississippi, South Carolina and Puerto Rico)

Tel: 478-951-3260

Email: lynn_harper@msn.com

REGION IV Robert L. Helfrich (Illinois, Indiana, Michigan, Ohio and Wisconsin)

Tel: 317-501-1700

Email: rlhelfrich@yahoo.com

REGION V Cindy Reneé Blythe (Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota and South Dakota)

TO JOIN NARFE, RENEW YOUR MEMBERSHIP OR FIND A LOCAL CHAPTER: CALL (TOLL-FREE) 800-456-8410 OR GO TO www.narfe.org

TO CHANGE YOUR ADDRESS, PHONE NUMBER OR EMAIL LISTING: CALL (TOLL-FREE) 800-456-8410 EMAIL memberrecords@narfe.org OR GO TO www.narfe.org, log in and click on “My Account”

TO REACH A FEDERAL BENEFITS SPECIALIST: EMAIL fedbenefits@narfe.org

NARFE HEADQUARTERS

606 N. Washington St. Alexandria, VA 22314

703-838-7760

Hours of operation: Monday-Friday, 8 a.m.-5 p.m. ET

Tel: 785-256-1450

Email: mrsdocbusyb@yahoo.com

REGION VI Marshall L. Richards (Arkansas, Louisiana, Oklahoma, Republic of Panama and Texas)

Tel: 903-660-2784

Email: pappysdad@cobridge.tv

REGION VII Sharon Reese (Arizona, Colorado, New Mexico, Utah and Wyoming)

Tel: 575-649-6035

Email: rvp7@narfe.org

REGION VIII Robert H. Ruskamp (California, Hawaii, Nevada and Republic of Philippines)

Tel: 703-628-3234

Email: ruskampr@gmail.com

REGION IX Steven Roy (Alaska, Idaho, Montana, Oregon and Washington)

Tel: 425-344-3926

Email: stevenroy1@yahoo.com

REGION X Robert Allen (Kentucky, North Carolina, Tennessee, Virginia and West Virginia)

Tel: 757-404-3880

Email: rvp10@narfe.org

NARFE Magazine (ISSN 1948-4453) is published monthly except in February and July by the National Active and Retired Federal Employees Association (NARFE), 606 N. Washington St., Alexandria, VA 22314. Periodicals postage paid at Alexandria, VA, and additional mailing offices. Members: Annual dues includes subscription. Nonmember subscription rate $48. Postmaster: Send address change to: NARFE Attn: Member Records, 606 N. Washington St., Alexandria, VA 22314. To ensure prompt delivery, members should also forward changes of address without delay. Because of the volume involved, NARFE cannot acknowledge nor be responsible for unsolicited pictures and manuscripts, although every reasonable precaution is taken. All submissions become the property of NARFE. Copyright © 2023, NARFE. Advertisements in the magazine are not endorsements of products and/or services by NARFE, unless officially stated in the ad. We shall accept advertising on the same basis as other reputable publications: that is, we shall not knowingly permit a dishonest advertisement to appear in NARFE Magazine, but at the same time we will not undertake to guarantee the reliability of our advertisers.

2 NARFE MAGAZINE AUGUST 2023

2023

6

AUGUST

VOLUME 99 ★ NUMBER

There are great savings options for federal retirees

Can you switch and save?

If you didn’t change your health plan when you became eligible for Medicare, now could be the time to switch and save. Contact us to learn more about Aetna® plans designed for federal retirees

Plans o�ered through the Federal Employees Health Bene�ts (FEHB) Program:

Aetna Medicare Advantage

• $0 deductibles and copays

• Prescriptions for as little as $2 from our preferred pharmacies

• Low premiums

• $1200 annual reduction in Medicare Part B premium for each eligible member

• SilverSneakers® at no extra cost

Aetna Direct

• A fund to help pay prescription costs or your Medicare Part B premium

• $0 deductibles and copays

• $6 generic prescriptions from our preferred pharmacies

Why not connect live with us and learn more about your health plan options? Connect with our team at AetnaFedsLive.com and you can:

Or use our retiree portal at AetnaFeds.com/retireeplans to explore at your own pace.

Ready to enroll? If you’re eligible:

Enroll online at RetireeFEHB.OPM.gov Or call the O �ce of Personnel Management (OPM) Retirement Information Center at 1- 88 8-767-6738 (TTY: 711).

Aetna Medicare is a PPO plan with a Medicare contract. Enrollment in our plans depends on contract renewal. See Evidence of Coverage for a complete description of plan bene�ts, exclusions, limitations and conditions of coverage. Plan features and availability may vary by ser vice area. SilverSneakers is a registered trademark of Tivity Health, Inc. ©2021 Tivity Health, Inc. All rights reserved. Health insurance plans are o�ered and /or underwritten by Aetna Life Insurance Company (Aetna). This is a brief description of the features of this Aetna health insurance plan. Before making a decision, please read the plan’s applicable federal brochure(s). All bene�ts are subject to the de�nitions, limitations and exclusions set forth in the federal brochure. Plan features and availability may vary by location and are subject to change. Aetna does not provide care or guarantee access to health services. For more information about Aetna plans, refer to AetnaFeds.com/RetireePlans ©202

3 Aetna Inc. Y00 01_GRP_4009_3488_2021_M 19.12.345.1 A (9/21)

Chat online Schedule a one-on-one consultation Attend live webinars

NARFE’S MISSION STATEMENT

To support legislation and regulations beneficial to federal civilian employees and annuitants and potential annuitants under any federal civilian retirement system and to oppose those detrimental to their interests.

To promote the general welfare of federal civilian employees and annuitants and potential annuitants, to advise and assist them with respect to their rights under retirement, health and other employee and retiree benefits laws and regulations, and to represent their interests before appropriate authorities.

To cooperate with other organizations and associations in furtherance of these general objectives.

August Is for NARFE Advocacy

To many, the month of August is the most important time on the NARFE calendar. Originally designated as “NARFE Lobby Month” and during election years “Meet Your Candidates Month,” this is the time we can expect to see our members of Congress without traveling to their Capitol Hill offices in Washington.

Many representatives and senators use the August congressional recess to return to their local “grassroots” offices. As such, NARFE designates August as Grassroots Advocacy Month. Many lawmakers will conduct town-hall-style meetings all over their districts or states. These events provide the best chance for constituents to let their elected representatives know what is important to them, and they provide you with the opportunity to make certain that elected officials know about and understand NARFE’s concerns. The most important thing is to tell them how the issues affect you specifically.

Many of you have already had virtual contact with your members of Congress or their staff by participating in LEGcon23, our legislative training conference. At LEGcon, you received training over two days that can also be beneficial to prepare you for face-to-face meetings with lawmakers during the August recess.

NARFE chapters are always looking for a good program for the chapter meeting. Although some of our chapters take the summer off, hosting a “Meet Your Representative” event could prove extremely valuable. Members of Congress are always looking for opportunities to greet constituents, so be sure to invite them to meetings in August. A chapter could invite all the NARFE members in the congressional district, or several nearby chapters, and also open it up to the public. And don’t forget to notify local media about the upcoming meeting. Not only

would members get to hear the views of those who represent them, but NARFE could also garner some positive publicity for putting on the program.

There’s never been a more critical time to speak out. I urge you during NARFE’s Grassroots Advocacy Month to continue to use the vast resources on NARFE’s advocacy webpage, and be sure to articulate how issues affect you personally. Regardless of the meeting method, the same general principles apply—have a concise, effective message; keep it simple; tell your story; and have a clear “ask.” Don’t forget to keep your conversation local, with state- and district-specific information. After the meeting, send a thank you note and include any necessary follow-up information.

We are building on the progress from the last Congress to rally even more congressional support for repeal or reform of WEP and GPO. As of June 22, there were 284 House cosponsors of the repeal bill, H.R. 82. We’re going to keep the pressure on Congress to act. We’re incrementally gaining support for the Equal COLA Act, H.R. 866, to provide FERS retirees with a full COLA when inflation is high. And NARFE continues to push for improvements to OPM customer service, relief from federal long-term care premium increases, ensuring FEHB plans benefit from prescription drug cost savings. Please visit our website’s advocacy section to learn more.

I encourage you to continue contacting your representatives through NARFE’s Legislative Action Center. As leaders, I also hope you will engage in regular grasstops advocacy throughout the year by responding to calls to action in NARFE Voices. As they listen to the issues affecting constituents, it’s important that they hear your voice, and NARFE’s voice. Silence is not golden but consent!

Thank you,

WILLIAM SHACKELFORD NARFE NATIONAL PRESIDENT

4 NARFE MAGAZINE AUGUST 2023

From the President

natpres@narfe.org

Smile, you’re covered

GEHA provides access to almost 400,000 dental provider locations and comprehensive services. And with no in-network deductibles, we’re making sure federal retirees have everything they need to start their next chapter with a smile.

DENTAL BENEFITS for Federal Retirees Explore which plan works best for you at geha.com/Dental © 2023 Government Employees Health Association, Inc. All rights reserved. SP-ADS-0423-001

SAVE MONEY WITH NARFE PERKS

WHETHER you are planning your next vacation or move, buying a gift or planning for retirement, members can save money on everyday purchases with special discounts from our Affinity Partners. Visit www.narfe.org/perks or see p. 62.

Stay Informed About News That Matters to You

Want to stay on top of key federal news and benefits information?

Subscribe to NARFE Daily News Clips.

This newsletter features breaking news and informative articles from various outlets curated just for NARFE members, as well as NARFE media

statements, op-eds and more. NARFE Daily News Clips is delivered to inboxes weekday mornings. To join the mailing list, visit www.narfe.org/clips.

TSP UPDATE ONLINE

Get the most recent monthly and annual Thrift Savings Plan returns (G, F, C, S, I and L Funds) online at www.narfe.org/tsp-funds

TRACKING RETIREMENT CLAIMS

MISS A WEBINAR?

Catch up on past NARFE Federal Benefits Institute presentations in NARFE’s webinar archive, where you’ll find videos, slides and transcripts of question-and-answer sessions for webinars dating back to January 2019. View them at www.narfe.org/webinar-archive.

CONNECT ON FEDHUB

If you haven’t checked out NARFE’s new online community yet, what are you waiting for? NARFE designed FEDHub to support your federal journey, leveraging the knowledge and value of our entire community—all that’s missing is you.

Join the conversation at fedhub.narfe.org/quick-start-guide.

Find out how many retirement claims OPM Retirement Services receives and processes each month, with average processing times and total inventory, at www.narfe.org/opm-processing.

6 NARFE MAGAZINE AUGUST 2023 NARFE

Finally, the Perfect 3-in-1 Chair

The Journey Perfect Sleep Chair® is a reading and TV watching chair, a powerful lift chair, and the absolute best sleep chair! It delivers a personalized comfort solution with its independent back and footrests — reclining to exactly the right degree … raising your feet and legs just where you want them … and supporting your head and shoulders properly — all at the touch of a button. When you can’t lie down in bed and get a good

night’s sleep due to heartburn, hip or back aches, or dozens of other ailments and worries, you would give anything for a comfortable chair to sleep in. That’s why we designed the Journey Perfect Sleep Chair — fully loaded with every feature you need and nothing you don’t. It’s an unbelievable way to give your body the rest, relaxation, and therapeutic comfort it deserves.

Overstuffed, biscuitstyle back, generous seat, and oversized armrests cradle your entire body in comfort.

Built-in heat and massage helps stress melt away.

Easy, touch-of-a-button operation with secure battery backup in case of a power outage.

White Glove Delivery! Skilled professionals will deliver and set up your chair. No fuss. No worries.

Powerful lift mechanism tilts the entire chair forward so you can stand up easily without exerting energy.

Independent, zerogravity movement feels like you’re floating on air while your feet, legs and back are all fully supported.

bedding product

or defective, at our option

repair it or replace it. © 2023 Journey Health & Lifestyle. Available in a variety of colors, fabrics and sizes. CHESTNUT BURGUNDY LIGHT GRAY TAN SADDLE CHOCOLATE CHOCOLATE BLUE DuraLux™ and MicroLux™ Microfiber NEW MiraLux™ Leather

Because each Perfect Sleep Chair is a made-to-order

it cannot be returned, but if it arrives damaged

we will

Infinite Reclining Positions! (even lay-flat) CALL TODAY! 1-888-871-8999 Don’t face another sleepless night. Please mention code 120038 when ordering. Choose the size, fabric and color that fits your home. enjoying life never gets old™ 46641

NARFE Submits Comments on PSHB Interim Final Rule

In April, the Office of Personnel Management (OPM) published its interim final rule establishing the Postal Service Health Benefits (PSHB) program. The rule outlined how PSHB will be created and provided important dates for OPM, insurance carriers and all other stakeholders assisting in the creation of PSHB before it is set to begin in January 2025. The rule largely follows the specifics set in the Postal Service Reform Act of 2022, with some discretion left to OPM to administer the program.

NARFE submitted a comment letter to OPM in response to the interim final rule highlighting areas in need of clarification, providing questions gathered from NARFE members and detailing actions that OPM can take to provide a more seamless transition to PSHB for postal workers and annuitants. The letter encouraged OPM to limit insurance plan changes to prevent disruptions to enrollee coverage and requested hardship exceptions to maintain coverage for postal employees and annuitants covered by some smaller plans, such as health maintenance organization (HMO) plans, that may decline to offer PSHB plans. The letter

also requested further details on the six-month special enrollment period for Medicare Part B and requested OPM to encourage carriers to provide reimbursement accounts to cover Medicare-related costs (as

some FEHB plans already do). The letter is posted on NARFE’s website and NARFE will share responses from OPM once they become available.

Based on the rule, the PSHB, like FEHB, will be operated by the Office of Personnel Management, and, to the greatest extent practicable, the program will offer a PSHB plan from each FEHB carrier that has a plan with 1,500 or more Postal Service employees or annuitants enrolled in 2023. OPM may exempt certain HMO plans from this requirement, and the PSHB will be permitted to include plans offered by other carriers as deemed appropriate by OPM.

AUGUST MONTH ACTION ALERT: SOCIAL SECURITY FAIRNESS ACT OF 2023

Visit NARFE’s Legislative Action Center at www.narfe.org to send a message to your lawmakers urging them to cosponsor the Social Security Fairness Act of 2023, H.R. 82/S. 597. This bill would repeal the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO) policies that unfairly reduce Social Security benefits for federal, state and local civil servant retirees who earned a pension from their civil service career separate from benefits earned from employment covered by Social Security.

8 NARFE MAGAZINE AUGUST 2023 Washington Watch

MYTH VS. REALITY

MYTH: Postal annuitants who drop Medicare Part B, or are not enrolled, will not receive health benefits via the new, parallel set of plans offered via the new Postal Service Health Benefit (PSHB) program in 2025.

REALITY: Per the Postal Service Reform Act of 2022, all postal annuitants, regardless of Medicare Part B enrollment, will receive federal retiree health benefits under the umbrella of the PSHB starting in January 2025. PSHB plans will generally provide equivalent benefits and cost sharing, per law, to the same Federal Employee Health Benefits (FEHB) program plans offered by the same carrier, but will offer different premiums based on the new postal risk pool (and cost savings accrued via partial Medicare integration). Postal employees age 64 and older as of 1/1/25 and postal annuitants will not be required to enroll in Medicare Part B if they are not already covered.

PSHB plans must include self only, self plus one, and self and family plan options. In the initial contract year, 2025, PSHB carriers must offer plans that have coverage with equivalent benefits and cost-sharing to the FEHB plans offered by that carrier, except as needed to integrate with Medicare Part D prescription drug coverage. Additionally, OPM will create a centralized enrollment system allowing PSHB enrollees to make coverage decisions through an online portal. Persons unable to access the online portal will be able to make enrollment decisions over the phone, by fax or by mail. The interim rule

also outlines important dates for the implementation of the program, such as the launch of a health benefits education program beginning October 2023, the beginning of the sixmonth Medicare Part B special enrollment period in April 2024, the publishing of PSHB plan rate and benefits for 2025 in September of 2024 and the first open season, running November 11 through December 9, 2024.

Importantly, anyone who is a postal annuitant as of January 1, 2025, or a postal employee age 64 as of January 1, 2025, and not already enrolled in Medicare Part B will not be required to enroll in Part B as a condition of

receiving health benefits through the PSHB program. Family members of such postal workers and annuitants are also exempt from the Part B enrollment requirement. Medicare-eligible postal annuitants and family members who are not already enrolled in Medicare Part B will have a six-month special enrollment period, beginning April 1, 2024, to enroll in Part B penalty free.

NARFE will continue to monitor the creation of PSHB and advocate for postal workers and annuitants as more information becomes available.

—BY ROSS APTER, DIRECTOR, LEGISLATIVE AND POLITICAL AFFAIRS

Biden Signs Debt Limit and Budget Deal Into Law

President Biden and Speaker Kevin McCarthy reached an agreement in late May to raise the federal government’s debt limit and set caps on annual government funding levels for the next two fiscal years. It was signed into law June 3.

The debt limit suspension runs through January 1, 2025, past the next congressional and presidential elections.

The law also allows for a 3.3% increase in defense spending (up from $858.4 billion to $886.3 billion, matching the amount in President Biden’s budget) for fiscal year 2024. It caps

nondefense spending that is authorized via annual funding bills at $703.7 billion, a 5.4% cut compared to the current fiscal year (2023). However, according to both sides, there’s an unwritten agreement to repurpose unspent COVID-19 relief funds, adjust amounts dedicated to the Internal Revenue Service, and rescind unused budget authority within other mandatory spending programs to permit the total level for nondefense discretionary spending to remain roughly even to the current fiscal year. For fiscal year 2025, annual defense and

nondefense spending would increase about 1% from the fiscal year 2024 level.

The law also provides a mechanism to lessen the likelihood of a government shutdown, allowing for a continuing resolution with 1% across-the-board cuts if lawmakers fail to pass, by the end of the calendar year, the annual funding bills consistent with the budget caps in the bill. This provides an incentive for defense hawks to support passage of nondefense appropriations, or otherwise

NARFE MAGAZINE www.NARFE.org 9

SEE BUDGET ON P. 10

NARFE GRASSROOTS ADVOCACY

LEARN MORE about how you can take action to protect your earned pay and benefits by reviewing NARFE Grassroots materials at www.narfe.org/advocacy

Steady Progress Continues in Fight to Repeal WEP, GPO

The Social Security Fairness Act of 2023, H.R. 82/S. 597, which would fully repeal the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO), is closing in on a supermajority of support in the House of Representatives.

As of press time, H.R. 82, introduced by Reps. Garret Graves, R-LA, and Abigail Spanberger, D-VA, in the House had reached 284 cosponsors, marking a significant milestone in the 118th Congress for NARFE’s fight to pass the bill into law. H.R. 82 is now only 6 cosponsors shy of the 290 cosponsors needed to trigger the House Consensus Calendar rule process that would require either committee advancement

or a floor vote. At the same time last session, the House bill had just 167 cosponsors. As of June 22, H.R. 82 had the third most cosponsors of any bill in Congress.

The Senate companion, S. 597, introduced by Sens. Sherrod Brown, D-OH, and Susan Collins, R-ME, had 44 cosponsors as of June 22, reflecting steady progress in both chambers.

NARFE needs the continued support of its members to advance this legislation. Are you affected by the WEP and GPO, and want to join our efforts? We still need to accumulate more cosponsors to push the bill to a vote. Visit NARFE’s Legislative Action Center at www.narfe.org/ advocacy and click “Legislative

Action Center” to send your lawmaker a letter asking them to cosponsor this bill to finally repeal the WEP and GPO. Just type in your address and our system will choose the pertinent letter for you to send to your lawmaker in the House and Senate.

The WEP and GPO both penalize individuals who have dedicated their careers to public service and their spouses by taking away the Social Security benefits they have earned. The WEP affects more than 2 million beneficiaries, while the GPO affects more than 723,000 people, 48% of whom are widows/widowers and 52 percent of whom are spouses.

—BY ROSS APTER, DIRECTOR, LEGISLATIVE AND POLITICAL AFFAIRS

face a substantial decrease in defense spending from the agreed-upon caps.

Finally, the law includes additional policy provisions: adjustments to work requirement rules (and exemptions) for the Supplemental Nutrition Assistance Program, some reforms to streamline environmental permitting

for energy projects, and a statutory prohibition on extending the suspension of student loan repayments beyond this summer (when the administration had planned to end its pause).

The good news for NARFE is that the debt limit and budget deal stayed clear of federal retirement and health benefits. And with the threat of default off the table, federal retirement

annuities and Social Security benefits will continue to be delivered.

The House passed the bill, H.R. 3746, the Fiscal Responsibility Act of 2023, by a vote of 314-117 on May 31, followed by Senate passage via a 63-36 vote on June 1, with significant bipartisan support in both chambers.

—JOHN HATTON, STAFF VICE PRESIDENT, POLICY AND PROGRAMS

10 NARFE MAGAZINE AUGUST 2023 Washington Watch

BUDGET FROM P.9

Senate Committee Advances Legislation to Fix Retirement Error for CBP Officers

In May, the Senate Committee on Homeland Security and Governmental Affairs (HSGAC) favorably reported the U.S. Customs and Border Protection Officer Retirement Technical Corrections Act, S. 311. The bill would make good on promised enhanced retirement benefits for more than 1,000 Customs and Border Protection (CBP) officers who saw their benefits reversed after a technical error was discovered. The bill received approval by all senators present.

In 2007, a law was passed making CBP officers eligible for enhanced law enforcement officer retirement as a tradeoff for mandatory retirement at age 57, increased retirement

contributions, and a 20-year service requirement. A

THE BILL WOULD MAKE GOOD ON PROMISED ENHANCED RETIREMENT BENEFITS FOR MORE THAN 1,000 CUSTOMS AND BORDER PROTECTION (CBP) OFFICERS WHO SAW THEIR BENEFITS REVERSED AFTER A TECHNICAL ERROR WAS DISCOVERED.

transitional system was put in place for the new retirement

CONTRIBUTE TO

Contribute monthly through your annuity or by credit card. Get started at narfe.org/pac-sustainer

OR

Make a one-time contribution:

q $25 – Basic lapel pin

q $50 – Bronze lapel pin

q $100 – Silver lapel pin

q $250 – Gold lapel pin

q $500 – Platinum lapel pin

q Other: _________

Contribution totals are cumulative for the 2023-2024 election cycle

n No pin for me. I’d like 100 percent of my contribution to go to NARFE-PAC.

Mail coupon and/or check payable to NARFE-PAC to: NARFE-PAC

system for any officer hired before and serving on July 6, 2008. These officers could retire before 20 years of service under the new retirement system, receive a proportional enhanced retirement benefit for their post-July 2008 work, and were not bound by the mandatory retirement age. However, CBP erroneously told officers who were hired before July 6, 2008, but with later start dates, that they would also be eligible for the proportional enhanced benefit without needing to work for 20 years.

In 2020, CBP discovered this error and required the more than 1,000 CBP officers

SEE

NARFE Member #:

Name: Address: City: State: ZIP:

Occupation: Employer:

q Charge my credit card

q MasterCard q VISA q Discover q AMEX

Card #:

Exp. Date: _____ /_________ mm yyyy

Name on Card:

Signature:

Date:

To comply with federal law, we must use our best efforts to obtain, maintain and submit the name, mailing address, occupation and name of employer of individuals whose contributions exceed $200 each calendar year. NARFE-PAC is for the benefit of political candidates and activities on a national level. NARFE members have the right to refuse to contribute without reprisal, and NARFE will neither favor nor disadvantage anyone based on the amount of a contribution or failure to make a voluntary contribution. The suggested amounts are only suggestions and not enforceable. Only members of NARFE may contribute to the PAC. Contributions from non-members will be returned. NARFE-PAC contributions are not deductible for federal income tax purposes.

NARFE MAGAZINE www.NARFE.org 11

contributors of $10 or more receive a sustainer lapel pin

Monthly

Budget & Finance | 606 North Washington St. | Alexandria, VA

22314

ERROR ON P.12

LEGISLATIVE RESOURCES

NARFE NewsLine – A weekly newsletter that goes out to NARFE members on Tuesdays and includes weekly recaps of legislative news, compiled by NARFE’s advocacy and communications teams.

LEGISLATIVE ACTION CENTER – A one-stop site to send a letter to Congress, and more, at www.narfe.org

OPM Renews FLTCIP Contract with John Hancock, Premium Increases to Come

Effective May 1, 2023, the Office of Personnel Management (OPM) extended its contract with John Hancock to provide insurance coverage to all Federal Long Term Care Insurance Program (FLTCIP) enrollees. Although OPM solicited multiple bids, John Hancock remained the sole bidder. The program administrator, Long Term Care Partners LLC, has mailed notice of this action to enrollees.

Per the extended contract, most enrollees should expect to face a premium increase effective January 1, 2024. In September 2023, each enrollee will be offered personalized options that will include accepting the premium rate increase to maintain current coverage or to decrease coverage to reduce the impact of any

increase. OPM indicated that premium increases would be phased in over three years

For historical reference, premium increases in 2016 averaged 83 percent and were as high as 126 percent, while premium increases in 2009 were as high as 25 percent. It’s possible that the range and average for premium increases presented to enrollees in 2023 will exceed those amounts.

that straddled the July 6 date to reach the 20-year work requirement, even though these employees had been paying the higher retirement contributions for more than a decade and making retirement decisions based on what they were told when hired.

As a result, Sens. Gary Peters, D-MI, and Josh

for some coverage options. No additional information on the premium increases or personalized options is available currently. Notably, OPM did not disclose the range of the premium increases nor the average premium increase, which it has done in the past.

NARFE previously requested that OPM provide a partial refund option in addition to the other options it will provide to maintain premium levels (and reduce coverage), but OPM has declined to do so. NARFE is now pursuing legislative options to provide premium relief, as options for administrative relief have passed. We will continue to update members on this issue as developments arise.

—JOHN HATTON, STAFF VICE PRESIDENT, POLICY AND PROGRAMS

Hawley, R-MO, reintroduced the U.S. Customs and Border Protection Officer Retirement Technical Corrections Act, to make good on what the officers were promised. The bill would require CBP to identify the officers affected by the error and grant them the enhanced benefits they were promised. The legislation would also retroactively change the annuities of those

eligible who retired prior to enactment. It would also grant the Department of Homeland Security the authority to waive maximum entry age requirements for eligible officers.

The U.S. Customs and Border Protection Officer Retirement Technical Corrections Act now awaits further action by the full Senate.

—BY SETH ICKES, POLITICAL ASSOCIATE

12 NARFE MAGAZINE AUGUST 2023 Washington Watch

ERROR FROM P.11

OPM INDICATED THAT PREMIUM INCREASES WOULD BE PHASED IN OVER THREE YEARS FOR SOME COVERAGE OPTIONS.

Features:

• Members of Congress by state delegation, with color photos, biographical data and congressional district maps.

• Members’ contact information, including addresses, phone and fax numbers, website addresses, social media contacts, district offices and key staffers.

• Complete listings of committees, subcommittees and leadership.

• Contact information for the White House, Cabinet, Supreme Court and federal agencies.

Be a stronger advocate with NARFE’s Congressional Directory at your fingertips

Order online at www.narfe.org/directory Order

Name

Address City State ZIP

Member ID# (as it appears on NARFE Magazine label)

o Check (payable to NARFE)

o Charge my credit card

Card #

MasterCard

Exp. Date / (mm) (yy)

Name on card (print)

Signature Date

Quantity $25 each (includes shipping and handling)

VA sales tax

VA residents add 6% tax ($1.50) per book

Total cost

Please allow 3-4 weeks for delivery. Call NARFE’s Advocacy Department at 800-456-8410, option 3, to order by phone.

10/29/08 11:21:34 AM

National Active and Retired Federal Employees Association

CONGRESSIONAL DIRECTORY 118th Congress 2023-2024 NARFE’s CONGRESSIONAL DIRECTORY FOR THE 118 th CONGRESS (2023-2024)

your copy of the new CONGRESSIONAL DIRECTORY today!

o

o

o

o

VISA

Discover

AMEX

Only $25

to: NARFE Congressional Directory

Alexandria,

Mail

606 N. Washington Street

VA 22314-1914

NARFE BILL TRACKER

THE NARFE BILL TRACKER IS YOUR MONTHLY GUIDE TO LEGISLATION NARFE IS FOLLOWING. CHECK BACK EACH ISSUE FOR UPDATES.

H.R.159/S.59: Chance to Compete Act of 2023 / Rep. Virginia Foxx, R-NC / Sen. Kyrsten Sinema, I-AZ

Cosponsors:

H.R. 159: 3 (D) 2 (R)

S. 59: 1 (D) 2 (R) 0 (I)

H.R. 1002/S. 399: Saving the Civil Service Act / Rep. Gerry Connolly, D-VA / Sen. Tim Kaine, D-VA

Cosponsors:

H.R. 1002: 11 (D) 2 (R)

S. 399: 14 (D) 0 (R) 1 (I)

Implements merit-based reforms to the civil service hiring system that replace degree-based hiring with skills- and competencybased hiring.

Passed the House under suspension of the rules 1/24/2023

Referred to the Senate Committee on Homeland Security and Governmental Affairs 1/24/2023

FEDERAL PERSONNEL POLICY

H.R. 1487: The Strengthening the Office of Personnel Management Reform Act / Rep. Gerry Connolly, D-VA

Cosponsors:

H.R. 1487: 1 (D) 0 (R)

Prevents any position in the federal competitive service, created after September 30, 2020, from being reclassified into the excepted service, outside the protection of merit system rules without the express consent of Congress. The bill also requires the consent of an employee to be reclassified, mandates reporting of conversions to the Office of Personnel Management, and places caps on the number of employees converted to the excepted service via Schedule C.

Codifies several recommendations for OPM by the National Academy of Public Administration (NAPA), such as clarifying that OPM stands at the center of federal civilian human resource management and ensuring the director of OPM possesses human capital and leadership expertise.

Referred to the House Committee on Oversight and Accountability 2/15/2023

Referred to the Senate Committee on Homeland Security and Governmental Affairs 2/14/2023

H.R. 3115/S. 1496: Public Service Reform Act / Rep. Chip Roy, R-TX / Sen. Rick Scott, R-FL

Cosponsors:

H.R. 3115: 0 (D) 14 (R)

S. 1496: 0 (D) 1 (R) 0 (I)

Would make all federal employees at-will and enable workers to be removed for good cause, bad cause or no cause at all. The legislation would also abolish the Merit System Protections Board and limit removal appeals to claims of whistleblower retaliation and Equal Employment Opportunity Commission complaints before the US Court of Appeals.

Referred to the House Committee on Oversight and Accountability 3/9/2023

Referred to the House Committee on Oversight and Accountability 5/5/2023

Referred to the Senate Committee on Homeland Security and Governmental Affairs 5/9/2023

14 NARFE MAGAZINE AUGUST 2023

NARFE’s Position: Support Oppose No position

ISSUE BILL NUMBER / NAME / SPONSOR WHAT BILL WOULD DO LATEST ACTION(S)

Low to no Cost Hearing Aids for Active & Retired Federal Employees* (888) 847-6150 or visit fed.starthearing.com/NARFE ©2023 Start Hearing, Inc. All rights reserved 6/23 TJAD3260-00-EN-SH Start Hearing and the Start Hearing logo are registered trademarks of Start Hearing, Inc. *Based on $2500 covered hearing aid allowance. Your current health plan may or may not include a hearing aid allowance. Please contact Start Hearing to find out more. **Professional service fees may apply. Better hearing begins with your Start Hearing benefits: Access to a nationwide network of 3,000+ hearing professionals 60-day risk-free trial period FREE Deluxe Warranty Plan, including loss and damage** Today’s latest technology, including rechargeable hearing aids ...and more! Contact us today to see if you qualify for a $2500 allowance towards hearing aids

NARFE BILL TRACKER

THE NARFE BILL TRACKER IS YOUR MONTHLY GUIDE TO LEGISLATION NARFE IS FOLLOWING. CHECK BACK EACH ISSUE FOR UPDATES.

H.R. 82/S. 597: The Social Security Fairness Act / Rep. Garret Graves, R-LA / Sen. Sherrod Brown, D-OH

Repeals both the Government Pension Offset (GPO) and the Windfall Elimination Provision (WEP).

Referred to the House Committee on Ways and Means. 1/9/2023

SOCIAL SECURITY

Cosponsors:

H.R. 82: 197 (D) 87 (R)

S. 597: 36 (D) 5 (R) 3 (I)

H.R. 716: The Fair COLA for Seniors Act / Rep. John Garamendi, D-CA

Cosponsors:

H.R. 716: 28 (D) 0 (R)

Requires Social Security and federal retirement programs to use the Consumer Price Index for the Elderly (CPI-E) to calculate cost-of-living adjustments (COLAs) to retirement benefits.

Referred to the Senate Committee on Finance 3/1/2023

FEDERAL ANNUITIES

H.R. 866: The Equal COLA Act / Rep. Gerry Connolly, D-VA

Cosponsors:

H.R. 866: 24 (D) 2 (R)

H.R. 536/ S. 124: The Federal Adjustment of Income Rates (FAIR) Act / Rep. Gerry Connolly, D-VA / Sen. Brian Schatz, D-HI

Cosponsors:

H.R. 536: 67 (D) 1(R)

S. 124: 19 (D) 0 (R) 1 (I)

H.R. 856/ S. 274: Comprehensive Paid Leave for Federal Employees Act / Rep. Don Beyer, D-VA / Sen Brian Schatz, D-HI

Provides Federal Employees Retirement System (FERS) retirees with the same annual cost-of-living adjustment (COLA) as Civil Serve Retirement System (CSRS) retirees.

Provides federal employees with an 8.7 percent average pay raise in 2024.

Referred to the House Committees on Ways and Means, Veterans’ Affairs, Oversight and Accountability, and Armed Services 2/1/2023

Referred to the House Committee on Oversight and Accountability 2/8/2023

FEDERAL COMPENSATION

Cosponsors:

H.R. 856: 33 (D) 2 (R) S.274: 9 (D) 0 (R) 1 (I)

Extends paid leave to federal and postal employees for all conditions covered by the Family and Medical Leave Act (FMLA).

Referred to the House Committee on Oversight and Accountability 1/26/2023

Referred to the Senate Committee on Homeland Security and Governmental Affairs 1/26/2023

Referred to the House Committee on Oversight and Accountability, Veteran’s Affairs and House Administration 2/7/2023

Referred to the Senate Committee on Homeland Security and Governmental Affairs 2/7/2023

H.R. 1301/ S. 640: Federal Employees Civil Relief Act / Rep. Derek Kilmer, D-WA / Sen. Brian Schatz, D-HI

Cosponsors:

H.R. 1301: 2 (D) 0 (R) S. 640 15 (D) 0 (R) 1 (I)

Protects federal workers and contractors from a variety of civil financial penalties during a lapse in appropriations or a breach of the debt ceiling.

Referred to the House Committees on Oversight and Accountability, Financial Services, Ways and Means, Judiciary, Education and Workforce, and House Administration. 3/1/2023

Referred to the Senate Committee on Finance 3/2/2023

NARFE’s Position: Support Oppose No position

16 NARFE MAGAZINE AUGUST 2023

ISSUE BILL NUMBER / NAME / SPONSOR WHAT BILL WOULD DO LATEST ACTION(S)

More Than Just Hearing Aids

Blue Cross and Blue Shield Service Benefit Plan members get a full hearing care package when they use their allowance through TruHearing®

The TruHearing Program Includes:

Personalized Care

Guidance and assistance from a TruHearing Hearing Consultant

Professional exam from a local, licensed provider

1 year of follow-up visits for fitting and adjustments to ensure you’re completely satisfied with your hearing aids

Next-Generation Sound Devices for Your Lifestyle

The latest chips and algorithms combine to make speech clearer, even in the most challenging environments

Advanced sensors automatically adjust to the noise around you for better clarity and natural sound

New models include sound enhancement technology to make your voice sound more natural to you

1 The Service Benefit Plan will pay a hearing aid benefit for Standard and Basic Options up to $2,500 total every 5 calendar years for adults age 22 and over, and up to $2,500 total per calendar year for members up to age 22. FEP Blue Focus does not have a hearing aid benefit. Do not rely on this communication piece alone for complete benefit information. All benefits are subject to the definitions, limitations, and exclusions in the Blue Cross and Blue Shield Service Benefit Plan brochure. The Blue365® Discount Program offers access to savings on items that you may purchase directly from independent vendors, which may be different from items covered under the Service Benefit Plan or any other applicable federal healthcare program. For hearing aids, acupuncture, chiropractic and vision services, you must exhaust your Service Benefit Plan benefit first before accessing the savings of the Blue365®

Bluetooth connectivity for streaming your favorite music, TV and phone calls straight to your ears3

A wide variety of rechargeable models that keep a charge for an entire day4

Options to match your lifestyle including virtually undetectable devices

Discount Program. To find out what is covered under your policy, contact the customer service number on the back of your member ID card. The products and services described herein are neither offered nor guaranteed under any local Blue company’s contract with the Medicare program. These items are not subject to the Medicare appeal process. Any disputes regarding these products and services are not subject to the Disputed Claims process. Blue Cross Blue Shield Association (BCBSA) may receive payments from Blue365 vendors. Neither the Service Benefit Plan, nor any local Blue company recommends, endorses, warrants or guarantees any specific Blue365 vendor or item. The Service Benefit Plan reserves the right to change, modify, or terminate any item and vendors made available through Blue365, at any time.

Find this and other great deals on www.fepblue.org/blue365

2 Price shown does not include cost of comprehensive hearing exam. Examination and testing for prescribing of hearing aids is covered under the Service Benefit Plan. The member should confirm that the provider rendering the hearing exam is a Preferred provider. If the provider is Non-preferred, the member may be charged a maximum fee of $45 for the exam, and the member may need to submit a claim for reimbursement. Must be a Service Benefit Plan member to access TruHearing discounted pricing. TruHearing is offered through Blue365, which provides exclusive health and wellness deals and is a program of Blue Cross Blue Shield Association, an association of independent Blue Cross and Blue Shield companies. The Blue Cross® and Blue Shield® words and symbols, Federal Employee Program®, FEP® and Blue365® are all trademarks owned by Blue Cross Blue Shield Association.

3 Smartphone compatible hearing aids connect directly to iPhone®, iPad®, and iPod® Touch devices. Connectivity also available to many Android® phones with use of an accessory. 4 Rechargeable features may not be available in all models and styles. All content ©2021 TruHearing, Inc. All Rights Reserved. TruHearing® is a registered trademark of TruHearing, Inc. All other trademarks, product names, and company names are the property of their respective owners. Listed benefit amount may differ from customer's actual benefit. Actual customer payment will vary. Follow-up provider visits included for one year following hearing aid purchase. Hearing aid repairs, and replacements subject to provider and manufacturer fees. For questions regarding fees, contact TruHearing customer service. FEP_NARFE_AD_0221

TruHearing is an independent company that provides discounts on hearing aids. Prices and products subject to change. For more information, visit TruHearing.com Rechargeable | Listed products are smartphone compatible3 SAMPLE PRODUCT AVERAGE RETAIL PRICE TRUHEARING PRICE ALLOWANCE (UP TO $2,500)1 YOU PAY2 TruHearing® Advanced $5,440 $2,500 –$2,500 $0 Widex Moment® 220 $3,320 $2,500 –$2,500 $0 ReSound ONE™ 5 $3,496 $2,590 –$2,500 $90 Signia® Styletto® 3X $5,166 $2,700 –$2,500 $200 Oticon More® 3 $6,750 $3,050 –$2,500 $550 Starkey® Livio® 2400 $5,704 $4,100 –$2,500 $1,600 Phonak® P-R90 $7,328 $4,390 –$2,500 $1,890 Call TruHearing today and start saving! Call 1-877-360-2432 | For TTY, dial 711 Example Savings (per pair) Made Available Through:

Q&A

FERS DISABILITY RETIREMENT

QI retired with a disability retirement under FERS just over 15 years ago. Upon reaching my 62nd birthday, it’s my understanding that OPM will automatically recompute my annuity as if I had been working the entire time. Can you explain that?

AAs a FERS employee, if you were approved by OPM for a disability retirement and did not meet the age and service requirement to qualify for a full, unreduced age-based retirement upon separation, then you would have received 60% of your high-3 average salary for the first 12 months of your retirement (offset by 100% of any Social Security disability benefits you might have received), and beginning the 13th month, your disability retirement would have been reduced to 40% of your high-3 average salary (offset by 60% of any Social Security disability benefits you might have received).

Upon reaching the age of 62, OPM automatically recomputes your FERS disability retirement using the regular

FERS computation formula by considering the amount of federal service that was already creditable under FERS prior to your separation and then adds the amount of service you would have had if you had continued your federal career up until the day before your 62nd birthday. They also consider your unused sick leave balance upon separation to possibly increase the length of service used in this recalculation. OPM also recomputes your high-3 average salary based on the cost-of-living adjustments that were previously applied to your retirement.

The regular FERS formula states that you receive at least 1% of your high-3 average salary for all years and months of creditable service in the computation of your FERS annuity. But for

THE FOLLOWING QUESTIONS & ANSWERS were compiled by NARFE’s Federal Benefits Institute experts. NARFE does not provide legal, financial planning or tax advice or assistance.

disability annuitants who have at least 20 years of service credit in the automatic recalculation at 62, they receive 1.1% of their high-3 average salary for all their years and months of creditable service.

For example, if you only had two years of FERS service upon separation for a disability retirement and 15 years later reached age 62, the automatic recalculation of your annuity would equate to 17% of your recalculated high-3 average salary (i.e., 17 years x 1% = 17%).

But if you had five years of FERS service upon separation for a disability retirement and reached the age of 62 fifteen years later, the automatic recalculation of your annuity would equate to 22% of your recalculated high-3 average salary (i.e., 20 years x 1.1% = 22%).

Note for Special Category employees: An additional annuity accrual rate—1.7%—will generally be included in the computation of the earned annuity if an employee has performed service as a law enforcement officer,

20 NARFE MAGAZINE AUGUST 2023

EMPLOYMENT

firefighter, nuclear materials courier, Customs and Border Protection officer, member of the Supreme Court Police, member of the Capitol Police or air traffic controller. The 1.7% annuity accrual rate will be applied to all such service up to 20 years.

Please refer to chapters 60 and 61 of the CSRS/FERS Handbook for more information about disability retirement. Visit https://www.narfe.org/ csrsfers-handbook

SICK LEAVE AND RETIREMENT

QI’m thinking about retiring soon. How can I determine how many hours of sick leave will be used in the computation of my retirement and how many will be forfeited if I don’t use them before I separate?

AIf you are eligible for an immediate retirement, which is defined as one that begins to accrue no later than one month after you leave federal service, then your service will be increased by the days of unused sick leave to your credit on the date of retirement. OPM will receive your final sick leave balance from your agency payroll office; upon converting your unused hours into years, months, and days, OPM will increase the length of service by this amount in the computation of your annuity.

To determine the number of sick leave hours that will be used in the computation of your annuity, you will need to make a projection of your final leave balance. First, find your current sick leave balance on your most recent Statement of Earnings and Leave (SEL). Secondly, using a payroll calendar and beginning with the very next pay period, count how many full pay periods you have left between the pay period reflected on your SEL

and the date of your separation for retirement. Don’t count your final pay period unless you expect to work the full 80 hours; your final leave accrual is not pro-rated. A full-time employee earns four hours of sick leave for every full pay period worked. Multiply the number of remaining full pay periods by four and add that number to your current sick leave balance. This will be your projected sick leave balance (deduct any sick leave that will be used).

Use the Sick Leave chart on page 51 of Chapter 50 of the CSRS & FERS Handbook at https://www.narfe.org/csrsfershandbook to convert your projected sick leave balance into months and days. Keep in mind that 2087 hours equals one year of service credit.

For example, if someone projected to have a maximum of 2,450 hours upon separation, they would subtract 2,087 from 2,450 and take the remaining 363 hours and convert them to two months and three days,

COUNTDOWN TO COLA

according to the sick leave chart. When the hours fall between two numbers on the chart, round up to the next higher number on the chart and use that to determine the number of months and days. Sick leave of 2,450 hours is equal to one year, two months and three days of service credit.

You won’t be able to determine the “leftover” days until you add your sick leave to your service that you will have on the date of retirement. For example, if you had 21 years, three months and 15 days of creditable service and added one year, two months and three days of unused sick leave, that would equal 22 years, five months and 18 days. The 18 days are “leftover” since OPM will only use whole years and months to calculate your retirement. Using the sick leave chart mentioned above, find the 18 days under the column labeled “DAYS” on the left side of the chart; to the right of 18 days you will find 104 hours. In this example, 104 hours of sick leave could

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 0.22%in May 2023. To calculate the 2024 cost-of-living adjustment (COLA), the 2023 third-quarter indices will be averaged and compared with the 2022 third-quarter average of 291.901.

The percentage increase determines the COLA. May’s index, 298.382, is up 2.2% from the base.

The CPI represents purchases of food and beverages, housing, apparel, transportation, medical care, recreation, education and communication, and other goods and services.

For FECA COLA updates, visit narfe.org and search for FECA.

NARFE MAGAZINE www.NARFE.org 21

MONTH CPI-W Monthly % Change % Change from 291.901 OCTOBER 2022 293.003 0.40 0.38 NOVEMBER 292.495 -0.17 0.20 DECEMBER 291.051 -0.49 -0.29 JANUARY 2023 293.565 0.90 0.57 FEBRUARY 295.057 0.50 1.10 MARCH 296.021 0.33 1.40 APRIL 297.730 0.58 2.0 MAY 298.382 0.22 2.2 JUNE JULY AUGUST SEPTEMBER

potentially be used before the date of retirement without affecting the computation of their annuity. Of course, there are rules that govern the use of sick leave. Your agency retirement officer should be able to assist you with this calculation when you request your final retirement estimate.

RETIREMENT

CHANGING VOLUNTARY WITHHOLDINGS WITH OPM

QHow do I change the voluntary withholdings from my annuity payment?

AIf you use a computer and have access to the internet, the easiest method for making any changes to your voluntary withholdings from your annuity payment would be to access your account via OPM’s Services Online at https:// www.servicesonline.opm.gov/

Access to Services Online requires enrolling in Login.gov, which is the government’s secure login tool. Once you register your Services Online account with Login.gov, you will use your Login.gov credentials to sign-in to Services Online. To learn more about Services Online and how to log in using Login.gov, review the steps at https://narfe.org/qa-sol-login.

You can use OPM’s Retirement Services Online to:

• Start, change, or stop Federal and State income tax withholdings.

• Request a duplicate tax filing statement (1099R).

• Change your Personal Identification Number (PIN) for accessing OPM’s automated systems.

• Establish, change, or stop an allotment to an organization.

• Change your mailing address.

• Start direct deposit of your payment or change the account or financial institution to which your payment is sent.

• Establish, change, or stop a checking or savings allotment; and

• View a statement describing your annuity payment. You may also contact OPM by phone if you can’t find an answer to your question on OPM.gov or if you can’t sign in to OPM Retirement Services Online to manage your annuity account. Phone:1-888-767-6738

TTY: 711

Hours: Monday through Friday, 7:40 a.m. to 5 p.m. ET Closed on federal holidays. The busiest time is between 10:30 a.m. and 1:30 p.m. ET. Near the middle of the month, OPM generally authorizes payments that are due for the first business day of the following month. Therefore, if you want a change to be reflected in your next payment, you will need to submit your request as early in the month as possible.

REDUCTION TO ANNUITY AT AGE 62

QI’m a retired CSRS Offset employee. When I reach 62, OPM will apply a reduction to my annuity because I’ll be eligible for Social Security at that time. Since I have less than 30 years of substantial earnings under Social Security, my SSA benefit will be reduced by the WEP. When OPM computes the offset to my annuity, will they use the unreduced SSA benefit amount payable OR will they use the SSA benefit amount payable after it’s reduced for the WEP?

AAs a CSRS Offset annuitant, you are correct that OPM will apply an offset (reduction) to your annuity

when you become eligible for Social Security at 62, whether you decide to claim your Social Security retirement benefit at that time or not. It will be up to you to decide if you want to begin Social Security payments at age 62. It is important to consider all the factors that may influence your decision to file for Social Security including:

• The permanent reduction for filing for Social Security before your full retirement age or FRA (65 to 67, depending on your year of birth; 67 for those born in 1960 or later).

• The delayed credits available for claiming Social Security retirement benefits after reaching your FRA.

• Dependents who may be eligible to receive benefits based on your work record.

• Your health and life expectancy.

• Whether you plan to continue working or become reemployed. There is an earnings limit until you’ve reached your FRA.

The information that OPM obtains from the Social Security Administration (SSA) is used to compute the offset to your annuity and it should be based on the amount of Social Security potentially payable after it has been reduced by the Windfall Elimination Provision (WEP). Learn more about the WEP on at www.narfe.org/ssa-wep.

Although OPM will apply the offset reduction to your annuity at age 62, OPM will not apply any further reduction to your annuity once you begin drawing the larger benefit from Social Security later should you decide to delay your application for Social Security benefits. Use the WEP Online Calculator to estimate your Social Security benefit with using the modified WEP formula at www.narfe.org/wep-calc.

22 NARFE MAGAZINE AUGUST 2023 Questions & Answers

If you have provided a spousal survivor benefit, keep in mind that your spouse’s survivor annuity may also be subject to a reduction due to the offset unless they are entitled to a larger Social Security benefit based on their own work record or unless they are affected by the Government Pension Offset (GPO). If affected, the GPO may have eliminated their right to a Social Security survivor benefit based on your work record. To learn more about the GPO, visit www.narfe.org/ssa-gpo.

MEDICARE, FEHB AND TRICARE

QI’m a civil service annuitant and a military retiree. TRICARE requires enrollment in Medicare Parts A & B to qualify for TRICARE For Life at age 65. I’m thinking about canceling my

FEHB coverage. If I cancel FEHB, will I have the option to reenroll later if desired?

AYou may permanently cancel your FEHB coverage as an annuitant at any time, but unless you’re canceling to be covered under a spouse’s FEHB plan, you won’t be able to reenroll into the FEHB program later. The option you should use if you have TRICARE coverage is to suspend your FEHB enrollment, rather than canceling your coverage. If you want to reenroll into the FEHB program, you can do so later during any future open season. You are permitted to suspend FEHB coverage at any time.

You would use option D on the RI 79-9 form (Health Benefits Cancellation/Suspension

Confirmation), which allows suspension of FEHB to use TRICARE, TRICARE for Life, Peace Corps, or CHAMPVA. Find the form at www.narfe.org/ri79-9

Return the form to OPM using the address below:

U.S. Office of Personnel Management, Retirement Benefits Branch, P.O. Box 17, Washington, DC 20044

If you don’t have access to the internet, you can also call OPM’s Retirement Information Office at 1-888-767-6738 and request that they mail the form to you.

To obtain an answer to a federal benefits question, NARFE members should call 800-456-8410 and select option 2 for the Federal Benefits Institute; send the question by postal mail to NARFE Headquarters, ATTN: Federal Benefits; or submit it by email to fedbenefits@narfe.org.

NARFE MAGAZINE www.NARFE.org 23

Breathlessness or fatigue ü *Not valid on previous purchases. Not valid with any other offers or discounts. Not valid on refurbished models. Only valid towards purchase of a NEW Acorn Stairlift directly from the manufacturer. $275 discount will be applied to new orders. Please mention this ad when calling. AZ ROC 278722, CA 942619, MN LC670698, OK 50110, OR CCB 198506, RI 88, WA ACORNSI894OB, WV WV049654, MA HIC169936, NJ 13VH07752300, PA PA101967, CT ELV 0425003-R5, AK 134057, HIC.0656293 Joint pain in the knees, feet or back ü AMERICA’S NUMBER ONE STAIRLIFT. 1-866-706-8534 Mobility or balance issues ü ACCREDITED BUSINESS A+ Rating AN ACORN STAIRLIFT IS THE SAFEST WAY TO USE THE STAIRS FOR THOSE WITH: Plus receive your FREE stairlift buying guide, info kit & DVD! DON’T WAIT, CALL TODAY! CALL TO SAVE! SPECIAL OFFER SAVE $275.00* SPRING 2020_02_NARFE_Apr_HHoriz.indd 1 2/12/20 9:51 AM

Understand Your Options for Long-Term Care

Long-term care involves a variety of services to help people live as independently and safely as possible when they can no longer perform everyday activities on their own. Most long-term care is provided at home by unpaid family members and friends. It can also be in a facility such as a nursing home or in the community, such as in an adult day care center.

Long-term care can be expensive, and the cost is often paid with personal funds, including pensions, savings, and investments such as the TSP. According to the National Institute on Aging, https:// www.nia.nih.gov/, Americans spend billions of dollars a year on various services that provide supervision and assistance to individuals who need personal care. Another source of funding is government health insurance programs, such as Medicaid (Medicare and FEHB does not cover long-term care but may cover some costs of short-term care in a skilled care facility after a hospital stay.) Veterans may be able to receive long-term care in a variety of settings and information is available at https://www.va.gov/healthcare/about-va-health-benefits/ long-term-care/ or by calling 1-800-698-2411.

New applications for the Federal Long Term Care Insurance Program (FLTCIP) have been suspended as of December 2022, to allow time to assess current benefit offerings while establishing reasonable premium rates that will reflect the cost of the benefits that will be provided. Current enrollees’ coverage status

will not change if premiums are paid. For those in a claim status, there is no change to coverage or the claims reimbursement process if benefits have not been exhausted. The FLTCIP website states the suspension will remain in effect for 24 months unless OPM issues a subsequent notice to end or extend the suspension. Learn more about FLTCIP at www.ltcfeds.com

If you are in the market for long-term care insurance coverage, you may purchase long-term care policies through a financial planner, an insurance broker or agent. When shopping for LTC insurance, it is important to understand the following terms:

• Elimination period. This is a waiting period from qualifying for long-term care benefits until the policy begins to cover the cost of care. This can be as short as 30 days or as much as 180 days. The cost of care will be paid out of pocket during this period.

• Benefit period. This is the length of time benefits will be paid. This could be as little as two years or as much as five years or even longer. Unlimited policies are very expensive and may be hard to find in a new policy.

• Daily benefit. This is the maximum amount the policy will pay for care per day. If the actual cost is less than the daily benefit amount, the length of coverage may be extended beyond the benefit period.

• Increasing payment. Some policies will offer an “increasing payment” feature to help offset the rising cost of care. This feature will allow the benefits to increase at a certain rate (i.e., 3%, 5%, etc.) every year automatically without a corresponding rate increase. There are also policies that offer the option to periodically purchase increasing benefits when the cost of care has increased. Along with your age at the time of purchase, these factors will determine the cost of your long-term care policy. You will also be subject to medical underwriting to qualify for a policy.

You may also cover some long-term care costs through a rider attached to a life insurance policy. This is different from a stand-alone long-term care policy as the benefits are directly tied to the amount of life insurance and, when used as a long-term care benefit, will reduce the insurance payout. For example, monthly benefits providing for a residential facility are typically based on a percentage of the life insurance amount. A $100,000 policy with a 2% benefit would give you $2,000 a month. A

24 NARFE MAGAZINE AUGUST 2023 Benefits Brief

monthly benefit for home health care, when covered under the rider, is usually half of the nursing home benefit. One such policy is offered through Worldwide Assurance for Employees of Public Agencies (WAEPA). Information can be found at https://www.waepa.org/products/ chronic-illness-rider/.

It is important to consider the need for long-term care planning when the following demographic statistics show that:

• There were 55.7 million adults age 65+ living in the U.S. in 2020. This included 30.8 million women and 24.8 million men.

• America’s older population has grown by 38% since 2010, compared to an increase of 2% for the under-65 population.

• There were 104,819 people aged 100 and older in 2020—more than triple the number in 1980 (32,194). Not everyone needs or can qualify or afford longterm care insurance, however, it is important to consider long-term care planning when planning for your life after retirement.

To succeed in your federal career, you honed skills related to your job. As a retiree, you can follow your interests wherever they lead— with Osher at JHU, learning is limitless. Our Fall 2023 schedule can take you from Latin America to the Mayans and from films of Alaska to Music Along the Silk Road. From Bob Dylan to the history of rock ‘n’ roll. For a course catalog, call 667-208-8691, email osher@jhu.edu or visit osher.jhu.edu.

NARFE MAGAZINE www.NARFE.org 25

Lifelong Learning

—MICHELE BOLLIER IS A RETIREMENT AND BENEFITS SPECIALIST WITH RETIRE FEDERAL.

Experience Builds Careers.

Expands Horizons.

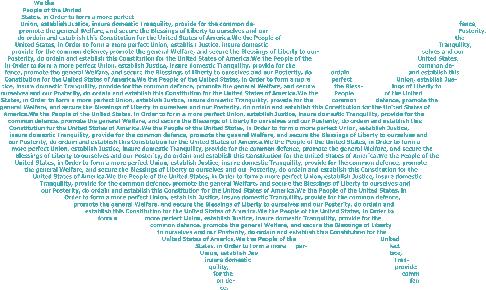

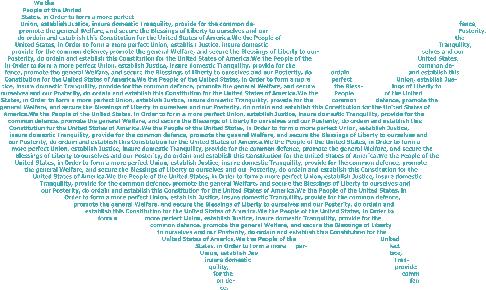

Using Your Voice on Capitol Hill:

Grassroots Advocacy Strategies to Get Your Point Across and Make a Difference

BY BRADFORD FITCH

BY BRADFORD FITCH

26 NARFE MAGAZINE AUGUST 2023

First Amendment to the United States Constitution

NARFE MAGAZINE www.NARFE.org 27

“Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof; or abridging the freedom of speech, or of the press; or the right of the people peaceably to assemble, and to petition the government for a redress of grievances.”

Just prior to his retirement after 37 years as “the face of small business” in Washington, D.C., Dan Danner, President of the National Federation of Independent Business, was asked how lobbying had changed most during his time in our nation’s capital. One of the biggest changes, he said, was the growth of grassroots advocacy. “Putting a real face on complicated issues,” Danner said. “Real people on Main Street saying, ‘I’m Betty’s Flowers, this is why this is important to me.’ That’s even more important now from a lobbying standpoint. To understand back home, be back home, and do things back in the districts, and let [lawmakers] know what people on Main Street back home are thinking,” he said.

Much of these new grassroots efforts have come in the form of mass email campaigns from associations, nonprofits, and companies. As it has become easier to contact Congress the volume of email to Capitol Hill has exploded, and a growing gap has emerged between the opinions of elected officials and of citizens as to the nature and value of these interactions. For the most part, Congress values these exchanges with constituents, while citizens question whether their engagement really makes a difference. According to a July 2016 Rasmussen survey, only 11% of the voters surveyed thought the average member of Congress listens to the constituents he or she represents. Yet, as research from the Congressional Management Foundation shows, when congressional staff were asked what advocacy factors influence an “undecided” lawmaker, 94% said an “in-person visit from a constituent” would have some or a lot of influence and 92% said an “individualized email message” from a constituent would. Despite the haranguing of mainstream media to the contrary, and popular culture insisting that citizen voices are muted in Washington, research shows that constituents remain significant factors to legislators’ decision-making.

The cynical view would hold that enhanced power by constituents who participate with like-

28 NARFE MAGAZINE AUGUST 2023

First Amendment scholars tend to focus more on the freedoms of religion, speech, and press than on the right of citizens to petition government for a redress of grievances, but that right is no less fundamental to the mechanism of our democracy. Even more than the voting booth, it is where the connection lives between citizens and those who represent them in government. However, the mechanics of the right to petition have transformed in the last three decades.

minded others in organized groups (e.g., “special interests”) would skew lawmakers’ decision-making process and lead to worse policy outcomes. But in fact, congressional staff reported that they appreciate a well-prepared constituent, as it makes it easier to understand the implications of public policy on those they represent. Better policy decisions are made through better citizen advocacy. Yet this is not the first research to document the potential for strong bonds between the government and the governed. In 1978 political scientist Richard Fenno wrote a seminal work on Congress, “Home Style: House Members in Their Districts.” For over 110 days, he traveled with 18 members of Congress in their districts, listening to the constituents who talked to legislators, and interviewing the legislators about their views. Fenno observed the importance of the relationship between members of Congress and their constituents, and the value legislators place on building those relationships. He also noted that relationship building was not a cavalier undertaking.

“The more accessible they are, House members believe, the more will their constituents be encouraged to feel that they can communicate with the congressman when and if they wish…However, this kind of assurance is not obtained by one-shot

NARFE MAGAZINE www.NARFE.org 29

“Access and the assurance of access, communication and the assurance of communication – these are the irreducible underpinnings of representation.”

11 %

When congressional staff were asked what advocacy factors influence an “undecided” lawmaker:

94%

92%

of the voters surveyed thought the average member of Congress listens to the constituents he or she represents said an “in-person visit from a constituent” would have some or a lot of influence said an “individualized email message” from a constituent have some or a lot of influence

offers. It is created over a long time and underwritten by trust. Access and the assurance of access, communication and the assurance of communication – these are the irreducible underpinnings of representation.”

While Fenno’s research is decades old, it offers timeless insight for America, which is confirmed by this report. If citizens, the organizers of grassroots campaigns, and Congress can re-learn these “irreducible underpinnings” in the age of the internet, then perhaps part of the essential element of trust between citizens and Congress could be restored.

To Congress, it is often the best way for legislators to understand the impact of their decisions on citizens. This kind of “retail-level democracy” is how Fenno described how trust is built with elected officials. Regrettably, many citizens are ill-prepared for these important interactions. If you choose to connect with a legislator, here are some suggestions that congressional staff report they experience somewhat or very frequently in meetings with constituents.

Unhappy to Meet With Staffer. Sometimes the Senator or Representative is not available, the Scheduler will often set up a meeting with a staffer. Sometimes the meeting will be with a staffer, even if it was on the legislator’s schedule, due to a lastminute schedule change. Meeting with a staffer does not mean the legislator does not care about the meeting or the issue. It simply means the he or she is not available, and the office wants to accommodate the group. Congressional aides are knowledgeable and have the trust of the legislator, so a meeting with them can be as effective as a meeting with

30 NARFE MAGAZINE AUGUST 2023

The Luxe Scooter from Journey incorporates state-of-the-art features for performance and pizazz.

• 35 Mile range

• Up to 13 MPH

• Delivered fully assembled

• Plenty of convenient storage

Perfect for:

• Around your community or all around town

• Festivals and County Fairs

• Parks and Zoos

• RVing

• … and anywhere you want to get around without relying on others

If you’ve always thought scooters need to be clunky, boring and unsightly… think again. Someone’s finally designed a scooter that has the look, feel and style of a luxury sports car. Now anyone, regardless of age, can ride in style and recapture the independence and excitement that comes with going wherever they want whenever they want.

It all begins with the distinctive design. Engineers spent years reimagining the scooter from the pavement up. The chrome alloy wheels provide performance and stability. The sturdy frame is designed to stand up to years of use. Best of all, the comfortable seat and ergonomic controls give the driver precision control over the vehicle in all conditions. This is one scooter you’ll be proud to drive.

Want to find out more about this amazing mobility technology? Knowledgeable product experts are ready to answer your questions and to tell you how you can be driving your own Luxe scooter in a matter of days. Call now!

when

1-888-655-2234 Please mention code 120037

ordering.

If you like to go unnoticed when you are out and about… this is not the scooter for you!

86001 ACCREDITED BUSINESS A+ enjoying life never gets old™ The Ultimate Scooting Experience

➤ ➤ ➤ Capture the excitement of a luxury sports car… with a scooter! ➤ ➤ ➤ ➤ ➤ ➤ luxe

the legislator. “A meeting with staff can be very beneficial and much more likely to happen. There is only one congressman with only so many minutes in his day. There are usually three to five legislative staffers with more availability than the member,” said one House Scheduler.