2 minute read

YOU ASKED, THEY ANSWERED

Tina BeaumontGoddard, NHBF director of membership says: Chair renters or space/ room renters are self-employed stylists, barbers, beauty therapists, nail technicians or similar. These individuals will be supplying services directly to their own clients and will conduct all or part of their businesses from within your premises.

Chair/space/room renting is a very different relationship to having employees and if not operated properly HMRC (and others) might see through this. While it remains impossible to set down a clear set of criteria against which an individual’s employment status can be defined, HMRC has published guidance on the intent and general principles of establishing a business relationship between the salon owner and self-employed contractor, rather than that of employer and employee (see Resources). The NHBF also has a range of agreements and resources available to Members.

Advertisement

Written agreements

Not working to the agreement can be just as harmful (if not more) than not having one at all.

Issues to consider

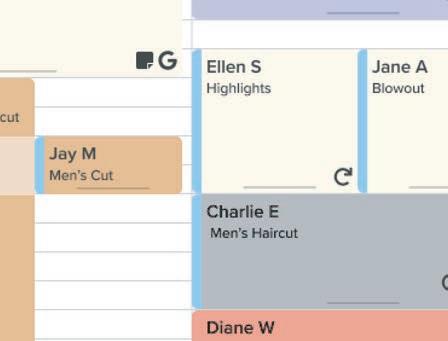

● Chair renters can choose their own working hours, what they wear, and can set their own prices, whereas your employees will be expected to adhere to the terms of their employment contract and the salons policies and procedures. This could cause issues if you have a mixture of employees and chair/space/room renters within your salon or barbershop.

● As a salon or barbershop owner you will no longer have complete control of your own branding, image and marketing activities, as the chair renters will be doing their own marketing.

● You cannot expect your chair renter to train your new employees or apprentices, they can also not be expected to manage the salon or salon team.

● You cannot expect chair renters to maintain your salon or barbershop standards by taking part in any training or continual professional development you may provide to your employees.

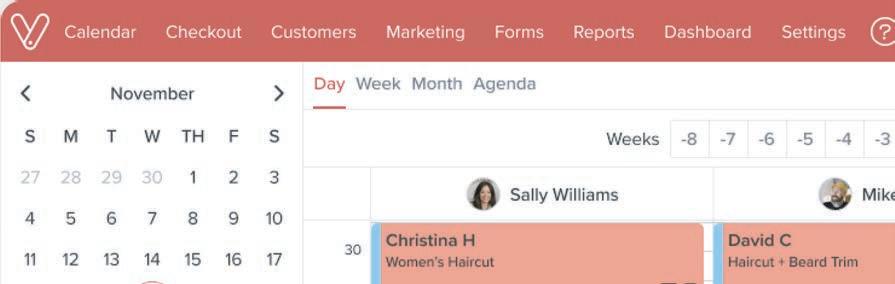

● You should also consider the impact of data protection – if client data is being exchanged between both parties (for instance, data stored on salon software) they should ensure their privacy policies are updated to reflect this. Clients need to be aware of how their data is being used.

More than 60% of hair and beauty salons in the UK operate a selfemployed model in some capacity

There should be a clear written agreement between the salon or barbershop owner and the self-employed individual that accurately reflects the actual working practice. Both business owners should be able to understand the impact of the agreement they are signing as this will reflect what both parties should be doing in practice. The agreement will only be effective if it is a true reflection of the relationship.

If in doubt, it’s important to seek legal advice from an employment lawyer regarding employment status and tax status advice from a tax advisor.

Resources

● HMRC VAT Taxable Personal Manual: bit.ly/VAT-taxable-person-manual

● NHBF Chair, space and room renting for salon owners guide: nhbf.co.uk/chair-renting-guide

● NHBF Self-employed chair/space/room renters checklist: nhbf.co.uk/chairrenting-checklist