Insight A B i- monthly Online Magazine NC Association of REALTORS ® Lending a Helping Hand Getting Homebuyers Through the Mortgage Process

Cover Story

Discover how to get homebuyers through the mortgage process and prep them for the new lending dynamics and hurdles in a changing lending landscape.

Can I Talk to the Real Estate Appraiser?

You have been told that you cannot talk to the appraiser under any circumstances because it is against the law...well, that is simply not true.

Strong Voice and Clear Message

Hundreds of NCAR members convened in Raleigh with a strong and clear message, do no harm to housing, during the tax reform discussions.

TABLE OF CONTENTS President’s Message Events Calendar Editor’s Desk By the Numbers Inside NC REALTORS® Closing Thoughts In Every Issue 2 3 4 4 13 22 Features 6 8 10 Political Action Committee Government Affairs The Forms Guy Departments 12 16 20 May 2013

By PATRICE wILLETTS PRESIDENT

So Much to Talk About

ThiS SpRiNg hAS BEEN A BuSy TiME fOR uS ALL! i hAvE SO MuCh TO TALk ABOuT ThAT iT’S ChALLENgiNg TO dECidE whERE TO BEgiN fiRST ANd fOREMOST, i wOuLd LikE TO SAy ThANk yOu TO ALL ThE NCAR MEMBERS whO TOOk TiME OuT Of ThEiR BuSy SChEduLES TO ATTENd ThE LEgiSLATivE dAy iN RALEigh ON ApRiL 24Th. iT wAS A hugE SuCCESS. SOME Of yOu dROvE iN fOR ThE dAy, OR hiREd A vAN, ANd OThERS wERE ThERE fOR ThREE dAyS. AgAiN, ThANk yOu!

Speaker Thom Tillis took the time to address the group at our rally, as did many other elected officials. Our issues are so important this year, that our NAR President Gary Thomas attended our Legislative Day event. He also did a few radio and TV interviews on behalf of our issues. Tax Reform is front and center in Raleigh. NCAR is in favor of a fair and balanced reform that will bring jobs to North Carolina, and we are encouraged by the fact that we are at the table during conversations and are asked for our opinion. As much as we want to help to bring about reform, we cannot support a reform package that relies heavily on the property owners and real estate industry of North Carolina for revenue. Please visit Taxreformfacts.org, “Like” us on Facebook, and send the link to your sphere of influence. Watch for the commercials and start the conversation in your local communities. This is the perfect opportunity to reach out to your sphere.

As a REALTOR® for over 25 years, I have a pretty good contact list of past clients. They still watch the mailbox every year for the anniversary card I send celebrating the day they purchased their property.

If you were in attendance at the Board of Directors meeting on April 23rd, you enjoyed a slice of delicious cake. The celebration was to declare April 23rd “Donna Peterson Day.” For 38 years, Donna has been with NCAR, working to serve you the member. Next time you see Donna, please tell her how much we appreciate all she does.

This month, we will be in Washington DC for the NAR Midyear Meetings. REALTORS® from across the nation, and beyond, will be attending committee meetings and sitting in on forums and briefings to listen and learn about the issues facing our industry and property ownership. Directors representing their associations will work to bring the messages back home. We then spend a day visiting with our elected officials. The highlight for me this year will be the opportunity to place a wreath at the Tomb of the Unknown Soldier at Arlington National Cemetery on behalf of NCAR. If you plan on attending you should arrive at the site by 5:20 pm on Monday, May 13th.

Thank you for all you do on behalf of your clients, your industry and your associations. Please continue to work to Protect and Promote Property Rights and Ownership in North Carolina. Keep the dialogue going on the importance of the survival of the Mortgage Interest Deduction at both the state and national levels, as well as the ability to write off your property taxes. These items are the foundation to our industry. No one should vote to take away the rewards of homeownership. Let’s work to keep communities strong.

Sincerely,

Patrice Willetts

PRESIDENT’S MESSAGE

2 INSIGHT May 2013

Key Dates in the Coming Months

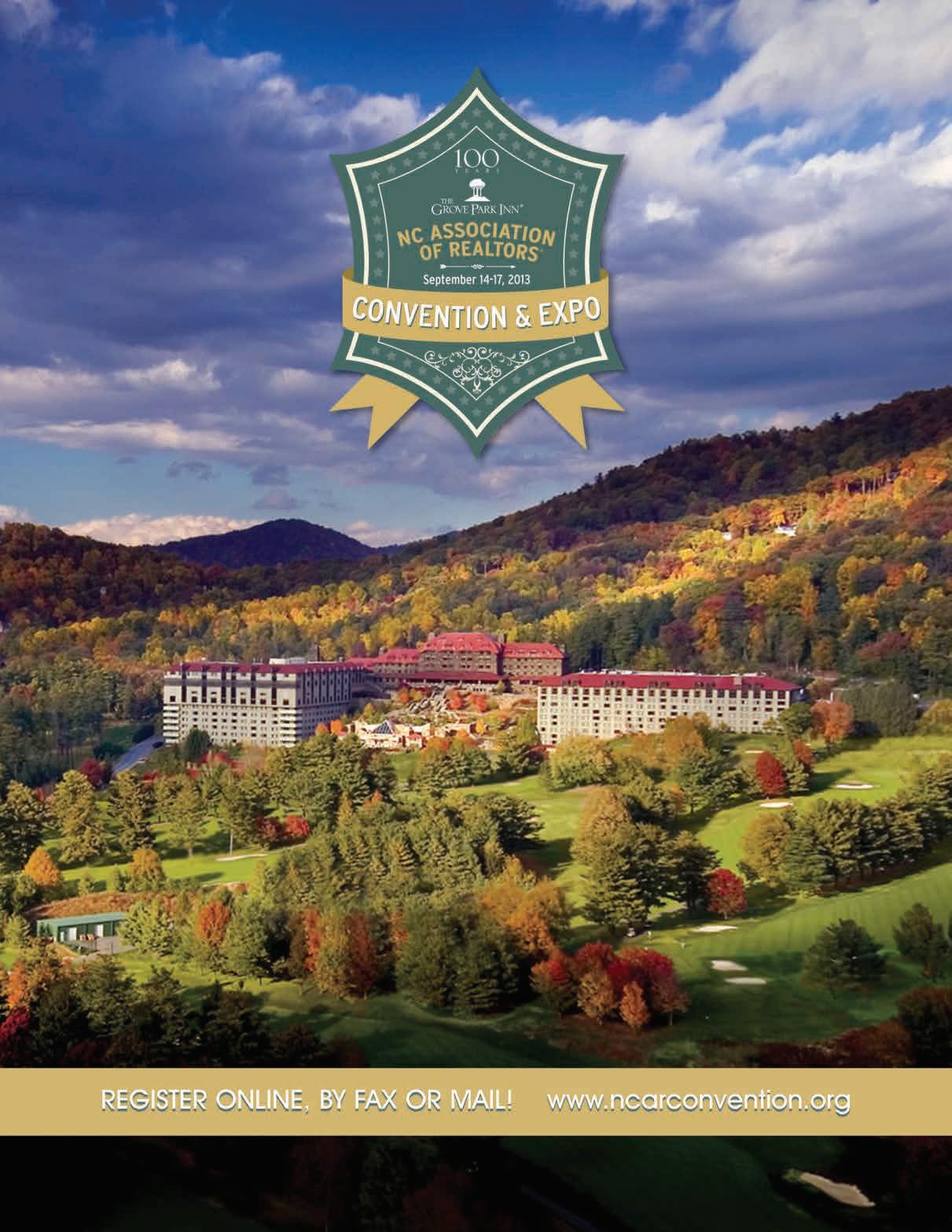

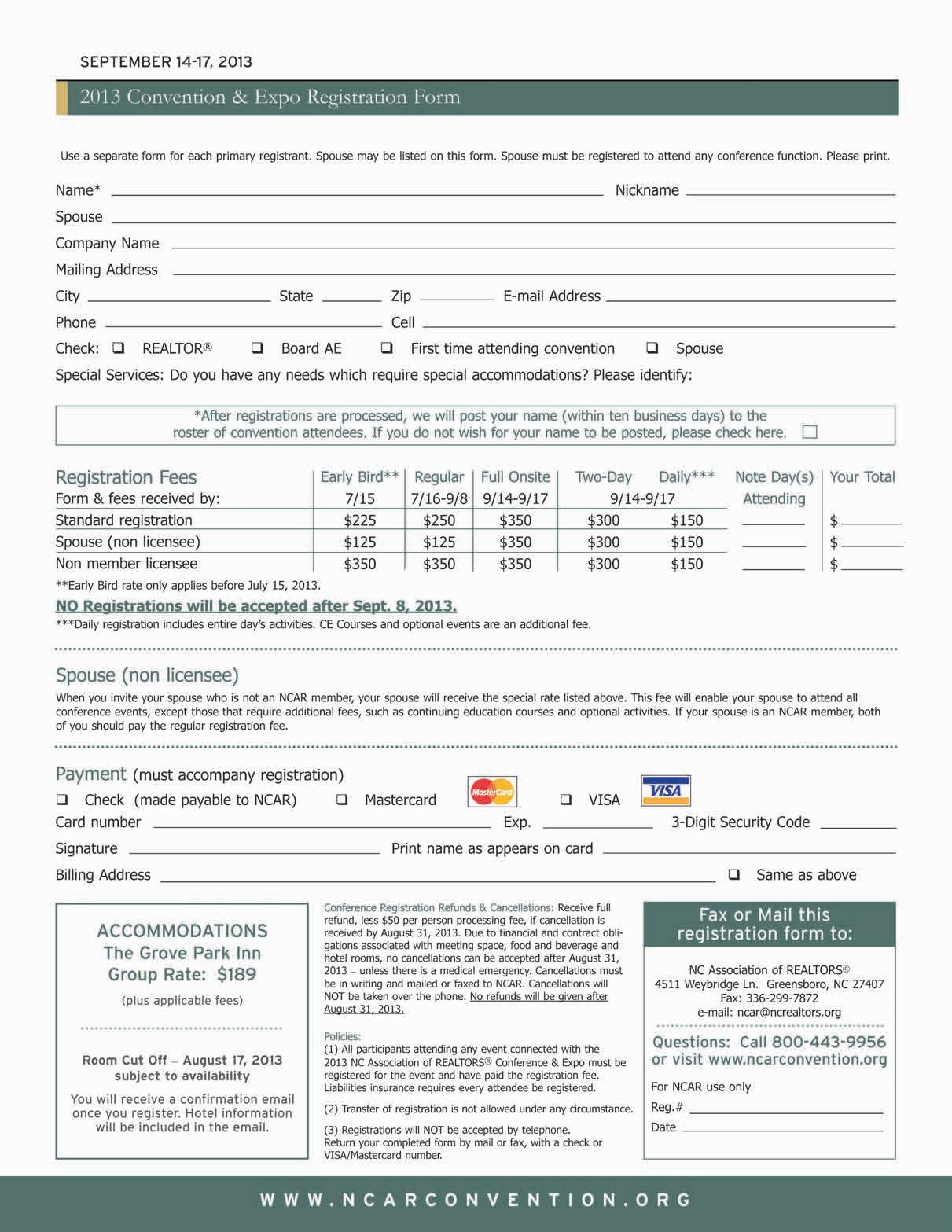

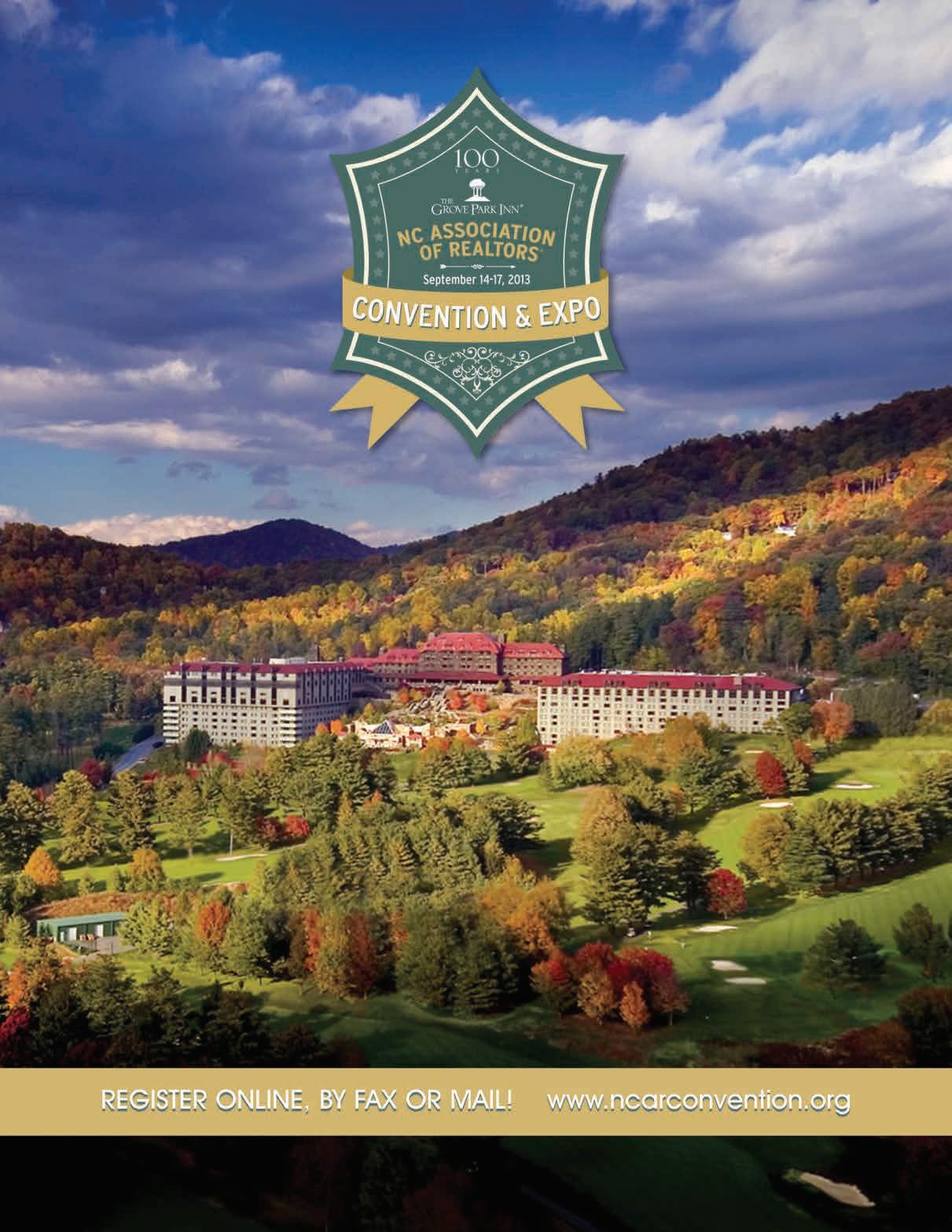

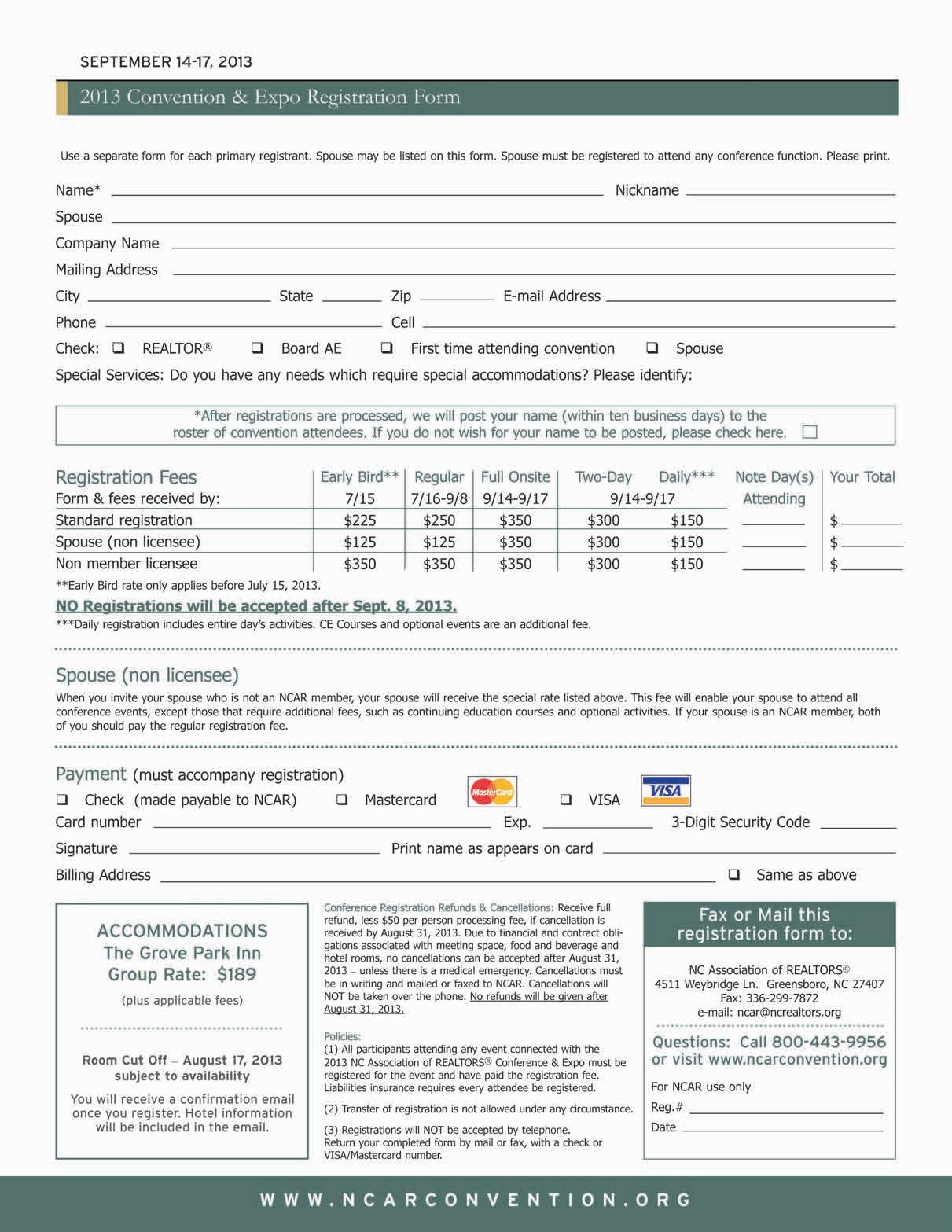

May 2 Managing Single-Family Homes & Supply Small Investment Properties May 6 GRI 301: Residential Construction Raleigh May 7 GRI 304: Property Management Raleigh May 13-17 NAR Midyear Meetings Washington May 18 Appraisal Laws and Rules Greensboro June 5-6 Seniors Real Estate Specialist Pittsboro July 16 Real Estate Summit Cary July 21-23 Regional AE Conference Asheville Aug. 5 GRI 204: Trends in Real Estate Greensboro Aug. 6 GRI 203: Legal Issues Greensboro Aug. 21 GRI 104: Tax Planning Raleigh Aug. 22 GRI 302: Residential RE Investing Raleigh Aug. 26-27 NAR Leadership Summit Chicago Sept. 14-17 NC REALTORS® Convention & Expo Asheville Oct. 9 GRI 201: Business Planning Charlotte Oct. 10 GRI 202: Business Ethics Charlotte Oct. 21 GRI 301: Residential Construction Wilmington Oct. 22 GRI 304: Property Management Wilmington Nov. 6-11 NAR Conference & Expo San Francisco Nov. 6 GRI 101: Residential Financing Raleigh Nov. 7 GRI 102: Creating Listing Strategies Raleigh Nov. 18 GRI 303: Pricing Residential Properties Charlotte Nov. 19 GRI 103: From Contract to Closing Charlotte Visit www.ncrealtors.org for more information and the latest Events Calendar. EVENTS CALENDAR INSIGHT May 2013 3

By BLAIR wILBuRN EDITOR

Cheers to New Beginnings

ThERE’S A MOMENT AT ThE BEgiNNiNg Of ANyThiNg NEw whERE ANTiCipATiON BuiLdS fOR whAT’S TO COME. ChANgE CAN BE ExhiLARATiNg ANd, OfTENTiMES, A NEw OppORTuNiTy iS LikE BEiNg givEN A BLANk CANvAS

As I sit down to write my first editor’s note for Insight, I feel a flurry of excitement. Ask anyone who knows me, and they will assure you that I love to communicate. Talk, write, email, share – and talk some more… it’s in my nature.

While transitioning into my new role at NCAR, I have been amazed at what I’ve learned - not only about the shifts we are experiencing in the real estate industry, but the exciting things occurring within this organization and among our REALTOR® members across the state.

Week after week, our electronic communication efforts

The numbers tell the story.

36.7 In millions, the number of tax filers claiming a deduction for their mortgage interest in 2010 (the tax year for which the most complete data are available).

63 Percentage of those claiming the MID in 2010 who earned less than $100,000. 91 percent of claimers that same year earned less than $200,000 in adjusted gross income (AGI).

$184,300 The national median existing-home price for all housing types in March, which represents an amount that is 11.8% higher than in March 2012.

62 The median number of days on the market for all homes in March, down from 74 days in February.

3.57 National percent average for a 30-year, conventional fixed-rate mortgage in March, according to Freddie Mac. That number reflects a decrease from the 3.95 reported in March 2012.

$85,700 The median annual earnings of investment-home buyers in 2012. These homebuyers had a median age of 45 and typically bought a home within 21 miles of their primary residence.

share statistics of a growing housing market. Our event registration numbers are up from last year. Advertisers and sponsors are calling us again because they are seeing the economic improvements firsthand and know our members are looking for the best products and services around to assist in their growing businesses.

We are no different than any other membership-based organization in that our sole purpose of existence is to serve our members. We constantly strive to do better and find new ways to add value to your membership experience. The way we communicate with you is a vital part of that relationship.

Our goal is to continue a dialogue with you and to bring you the latest industry news, trends, and especially, to help celebrate your successes! I look forward to finding new and innovative ways to connect with you throughout 2013 and beyond.

Cheers to new beginnings! v

4 INSIGHT May 2013 EDITOR’S DESK

Lending a Helping Hand

How to get homebuyers through the mortgage process and prep them for the new lending dynamics and hurdles.

Cathy Burns knows that the homebuyers she’s working with are dealing with a lending landscape that’s changed significantly over the last few years. Not only are some buyers grappling with their own credit and financial challenges due to job losses, foreclosures, and bankruptcies, but lenders have also tightened their standards when it comes to doling out mortgages.

North Carolina REALTORS® like Burns, broker-owner of Cathy Burns Real Estate in Charlotte, have found themselves providing more education, support, and assistance during the financing phase of the home purchase.

“We’re not mortgage experts, but we are definitely working more closely with buyers who need extra support and help when obtaining financing,” says Burns, who has run into the biggest challenges when working with buyers who recently completed short sales on their previous homes. She also has a steady flow of buyers who are on standby — waiting for their credit and/or financial pictures to improve before they can get qualified for mortgages.

“I have a pair of buyers who have been in my database since 2011, waiting for their situation to improve,” says Burns. “Two years later, they just signed a purchase contract on a home.”

The Financial Realities

Burns isn’t alone. REALTORS® nationwide have come to grips with the fact that mortgages have become increasingly elusive over the last couple of years. Credit requirements are more stringent, appraisals are coming in below negotiated values, and the payments and fees related to lending (private mortgage insurance, for example) are higher than ever. Sure mortgage interest rates are low, but what good does that do when the qualifying process has become more difficult for the typical homebuyer?

To successfully shepherd clients through a process that’s never been “easy” by any standards, agents and brokers are making sure buyers know what to expect before they even start looking for properties. A good starting point is to advise buyers to get a lender preapproval before previewing any homes. “The pre-approval gives us a good idea of where the buyer stands,” says Burns, who also spends more time “listening” to buyers and keeping an ear out for any financial issues that may come up later in the process.

“If you pay close attention to what your buyers are telling you, it’s not difficult to pick up on problem areas — like poor credit scores, bankruptcies, foreclosures, etc. — that could prevent buyers from getting the mortgage funding that they need,” says Burns.

6 INSIGHT May 2013

All the Right Moves

Richard Booth, a 16-year mortgage banker in Neptune, N.J., says the once “fairly simple” process of getting a borrower approved for a mortgage has changed dramatically over the last three years. “With all of the changes that have transpired with Fannie Mae, Freddie Mac, and the FHA, the market has become extremely competitive for buyers in search of financing,” says Booth. “Those buyers really need to have their ducks in a row before they even begin the borrowing process.”

NC REALTORS® looking to guide buyers through a smooth financing process should start talking about mortgages before they start searching the MLS for homes to view with those buyers. “Have them sit down with a mortgage banker and run their credit before they even look at their first house,” advises Booth. This will give buyers time to clean up any improprieties or errors on their reports in advance and it will give you insights into their “finance-ability,” so to speak.

“Agents should do as much due diligence upfront as possible to weed out credit issues, down payment challenges, or other problems, and to make sure the buyer is qualified before they start showing homes,” says Booth. “It doesn’t do REALTORS® any good to waste their valuable time showing homes if the borrower ultimately can’t get financing.”

Issues like gift money that’s being used for down payments — an area that REALTORS® didn’t typically address in the booming real estate market — should also be discussed in advance with the buyer. That’s because the gift money will likely need to be “seasoned” for at least three months prior to closing (according to the individual lender’s standards). Other issues to address with buyers include gathering the down payment money (a key obstacle for many buyers) and requirements for self-employed individuals (most lenders require the borrower to provide tax returns for the past two years). “These are just a few of the different funding facets,” says Booth, “that need to be buttoned up well before the home search even starts.” v

Financing Success Tips

Mortgage professional Richard Booth offers these tips to REALTORS® who are looking to lend a helping hand to buyers in need of financial help:

m Find an independent, NMLS-licensed loan officer. Bank loan officers are not required to be licensed and are exempt from the testing and education requirements that their independent counterparts are required to have and maintain annually. Independents also have more loan options because they work with several lenders.

m Have your clients meet with a loan officer long before they start the house hunt to discuss and resolve credit, down payment, and related issues.

m Start gathering necessary paperwork early (such as two years’ worth of 1040s, a 30-day cycle of pay stubs, and so forth) to help your buyer get pre-approved for a loan.

m Discuss housing counseling and applicable government assistance programs with your buyer.

m If your buyer is self-employed, explain the additional paperwork that he or she will have to present in order to get a loan.

m Explain the Good Faith Estimate and Truth in Lending documents, lock-process, and dangers of quoting rates in a rapidly changing market (where the numbers can change from day to day, thus impacting the amount of money that a homebuyer can borrow).

m Explain that issues arise during the financing aspect of the sales process, but that you will be there to resolve them from application to closing.

m Always under-promise and over-deliver.

INSIGHT May 2013 7

NC REALTORS® looking to guide buyers through a smooth financing process should start talking about mortgages before they start searching the MLS for homes to view with those buyers.

By VIC KNIGHT CERTIFIED GENERAL APPRAISER VICE-CHAIR NC REAL ESTATE COMMISSION

Can I Talk to the Real Estate Appraiser?

AppRAiSER iNdEpENdENCE iS ThE LAw uNdER dOdd-fRANk (wALL STREET REfORM ANd CONSuMER pROTECTiON ACT), ANd ThERE ARE CERTAiN CiRCuMSTANCES whERE A BROkER CAN CONTACT & TALk TO ThE AppRAiSER

NAR conducted a survey in September 2012 and found that 11% of REALTORS® had a contract canceled because the appraised value was lower than the contract sales price, 9% reported a delay in the scheduled closing and 15% indicated the purchase price was renegotiated at closing due to the appraised value being lower than the original contract sales price.

Although showings are rising, contracts are being written, and purchase prices appear to be increasing, appraised values sometimes do not match the contract price. You have a good offer on your listing and believe you have provided the seller with competent information from your CMA, which properly prices the property to sell at the most probable sales price for the subject property in the current market. Then, the appraisal comes back lower than the original contract price.

You have been told that you cannot talk to the appraiser under any circumstances because it is against the law. Well, that is simply not true. There is no prohibition against real estate brokers contacting appraisers about a mortgage loan appraisal when they have questions or concerns.

Brokers are allowed to contact appraisers and provide additional property information, including a copy of the sales contract for purchase transactions. Brokers may not intimidate or bribe an appraiser and an appraiser may not disclose confidential information about the appraisal or the appraisal assignment at any time. The language of Dodd-Frank is specifically as follows:

“The requirements of subsection (b) shall not be construed as prohibiting a mortgage lender, mortgage broker, mortgage banker, real estate broker, appraisal management company, employee of an appraisal management company, consumer, or any other person with an interest in a real estate transaction from asking an appraiser to undertake 1 or more of the following:

(1) Consider additional, appropriate property information, including the consideration of additional comparable properties to make or support an appraisal.

(2) Provide further detail, substantiation, or explanation for the appraiser’s value conclusion.

(3) Correct errors in the appraisal report.”

Although this language does address the issues that brokers can ask an appraiser to consider, note that it does not allow a full blown “conversation” or “discussion” with the appraiser. The implication is that the flow of information is essentially one-way, from the broker to the appraiser. A broker can NOT anticipate there will be any substantial “conversation” or “discussion” about the appraisal or its conclusions.

Dodd-Frank does not provide for any other form of communication between the broker and the appraiser.

Appraisers Are Subject to Increased Regulation

The housing market is certainly complex and so is the appraisal process. The national housing market downturn brought numerous regulatory changes to the real estate industry, including the entire appraisal process and those who provide appraisal services. The Dodd-Frank Wall Street Reform and Consumer Protection Act was signed into law

G u EST COL u MNIST

8 INSIGHT May 2013

by President Obama in 2010. Dodd-Frank “sunsetted” the Home Valuation Code of Conduct (HVCC) and required the Federal Reserve to amend the appraisal independence rules. The interim final rule became effective April 1, 2011 and applies to all consumer credit transactions secured by a consumer’s principal dwelling. Fannie Mae and Freddie Mac servicing guidelines now reflect this rule. In addition, state laws and regulations require appraisers to comply with the Uniform Standards of Professional Appraisal Practice (USPAP).

Dodd-Frank contains provisions about the function and regulation of appraisal management companies (AMCs). AMCs remove the administrative processes of appraisal management from the lender’s control. For a fee, the AMC recruits appraisers, contracts with them to perform appraisals, manages the appraisal process, pays the appraisers and reviews their work. The regulations prevent mortgage brokers or real estate agents from selecting or paying an appraiser if the appraiser’s report will be used for lending purposes. Based on DoddFrank, AMCs have sometimes instructed appraisers to significantly limit their interaction with interested parties to the transaction. This has caused much of the confusion on what type of contact and talk can be held with appraisers.

(continued on page 10)

10 Tips Brokers Can Utilize to Help the Appraisal Process:

w Don’t put restrictions on the appraiser in making an appointment to inspect the property. If your MLS utilizes an appointment system, use it. You will be notified of the appraiser’s site inspection.

w If an appraiser calls, be responsive and provide as much information as needed. Return the call promptly even if your listing has closed. You are the expert source of info on your listing, and the appraiser may not be aware of the hidden features or upgrades.

w Be as descriptive as possible in MLS about your listing. Include ample photos and documents.

w Don’t use or reference tax records as your “source” of information. Do the proper leg-work on your listing; it builds significant long-term credibility among your peers and local appraisers.

w Distinguish “Above-Grade” Living Area from “Below-Grade” Living Area in your MLS, particularly the quality of finish in “Below-Grade” Living Area, Attics, Bonus Rooms, Decks, Porches, etc.

w Provide an “Appraisers Package” in advance and have it available at the property when the appraiser is inspecting the property, or meet the appraiser at the property so you can answer any questions, inform them of the unique features of the property or neighborhood, and allow the appraiser the space and time to complete their inspection (Appraisers Package could include: Plats, Surveys, Deeds, Covenants, HOA Documents, Floor Plans, Specifications, Inspection Reports, neighborhood details, recent similar quality comparables, detailed list & dates of upgrades and remodels, photos, etc).

w Provide a fully executed copy of the purchase contract, including all addenda.

w Explain to the seller or buyer that the role of the appraiser is not to confirm the sales price but to provide the lender an independent opinion of the value of the underlying collateral. Provide the seller or buyer a copy of the brochure developed by The Appraisal Foundation entitled “A Guide to Understanding a Residential Appraisal,” available for download at www.realtor.org/appraisal/aguide-to-understanding-a-residential-appraisal - 2013-03-28.

w REALTORS® and consumers can be present during the appraisal inspection. Make sure all parties allow the appraiser the space and time to complete their appraisal inspection.

w Make sure the property condition (inside and outside) is the best possible for the appraisal inspection, and inform the seller that interior and exterior photos will be taken by the appraiser.

INSIGHT May 2013 9

For many years the National Association of REALTORS® has spoken out for an “independent appraisal process” for licensed and certified appraisal professionals. In 2012 NAR adopted the “Responsible Valuation Policy” outlining NAR’s position on valuing and pricing property. This NAR Policy can be found at www.realtor.org/appraisal/responsible-valuation-policy.

What Can Appraisers Discuss After the Report Has Been Sent to the Lender/Client?

Once an appraisal assignment is completed and sent to the client, the Uniform Standards of Professional Appraisal Practice (USPAP) prohibit an appraiser from discussing the results of the report with anyone other than the client who ordered the appraisal, or parties designated by the client. In order to ask an appraiser to correct errors in the appraisal report, a broker must use the client, typically the lender, as an intermediary. The client may choose to provide additional data to the appraiser for consideration. The language from USPAP’s Ethics Rule is as follows:

“An appraiser must not disclose 1) confidential information; or 2) assignment [appraisal] results to anyone other than:

w the client;

w persons specifically authorized by the client;

w state appraiser regulatory agencies;

w third parties as may be authorized by due process of law; or

w a duly authorized professional peer review committee except when such disclosure to a committee would violate applicable law or regulation.

What Can Brokers Do to Help the Process?

First, recognize that the appraiser’s function is to develop an independent and impartial opinion of the value of the property for the lender (the appraiser’s client) to determine what the value of the underlying collateral is for the lender to base their financial lending decision on.

There are many things brokers and sellers can do to put the property that is the subject of the appraisal in the best position possible for the most favorable appraised value outcome. The most important is providing as much accurate, current and detailed information on the subject property as possible. Most of that information can easily be provided through the local MLS, which is not only beneficial to the appraiser of the subject property, but equally beneficial when the appraiser uses that same information as a future comparable. Potential

homebuyers also benefit from the information during their search process. This is the first opportunity for the listing broker to provide accurate, current and detailed information about the subject property as well as the broker’s unique knowledge of the local real estate market through supporting information and documentation on the subject property.

An example would be when the subject property has extensive “energy efficiency” amenities, “green” or other similar “high-performance” characteristics. It would be appropriate that the lender is informed, in advance, that a properly qualified appraiser who is proficient in appraising “green” properties should be selected. Some MLS systems provide for energy efficiency details and certifications that can be incorporated directly into the listing information as an integral part of the listing data. Take advantage of this feature.

Another thing brokers can do easily to help the overall appraisal process is to incorporate as many photographs as the local MLS system will allow. Include not only a front photo, but also a rear photo and possibly a street or other neighborhood amenity photo, in addition to photos of all the major rooms and all the special features of the property. According to NAR, those listings with more detailed photos of the property sell much more quickly than those which have few or no photographs. An accurate, detailed MLS listing is vital to all interested parties, including the appraiser. The more details the better.

NOTE: As of March 1, 2013 there were 3,498 licensed and certified appraisers in North Carolina.

NOTE: The Appraisal Subcommittee (ASC) of Congress has been charged with implementing the Consumer Financial Protection Bureau (CFPB), which gives consumers an information resource to help complainants determine the appropriate legal authority to receive their complaint involving allegations of non-compliance with USPAP or appraisal independence requirements. Access the Hotline at http://refermyappraisalcomplaint.asc.gov/ or by calling toll free (877) 739-0096. v

10 INSIGHT May 2013

“

(continued from page 9)

There are many things brokers and sellers can do to put the property that is the subject of the appraisal in the best position possible for the most favorable appraised value outcome.

”

By KRISTIN MILLER RPAC MANAGER

By KRISTIN MILLER RPAC MANAGER

Investing in RPAC is a Win-Win for Everyone…

yOuR 2013 RpAC CONTRiBuTiON iS AN iNvESTMENT iN

BOTh yOu ANd yOuR iNduSTRy’S fuTuRE. ThiS yEAR, ThE NORTh CAROLiNA RpAC TRuSTEES BROughT

BACk ThE highLy SuCCESSfuL RpAC TEChNOLOgy

RAffLE TO ENCOuRAgE EvEN MORE MEMBERS TO iNvEST iN ThEiR BuSiNESS

The raffle had a kick off date of October 18th, 2012 and ran through the end of March. This year’s grand prize was a 13” MacBook Pro with Retina Display. Twenty other prizes were generously donated by local members and associations, including technology items such as three iPads, a Kindle Fire, an iPod, a computer tablet and an array of gift cards.

The NC RPAC Trustees encouraged members to invest early by allowing any $25 investment through March 31st to be entered into the drawing. In addition, for each additional $25 investment, the member’s name was to be entered again with a maximum of 10 entries, or $250. With the help of all the local Association Executives and RPAC Chairmen, entries totaled 5,198 and raised $129,950 for NC RPAC.

Hear from some of this year’s raffle winners about why they invest in RPAC:

“ The support from RPAC is always obvious and it’s an honor to have won this laptop. I expect it to be one of my primary tools for my listing presentations. ”

— Eric Olson, Raleigh: grand prize winner of the 13” MacBook Pro

“ RPAC is very important for both REALTORS® and our clients. Actually, that goes for anyone who is interested in a growing economy. Housing is important not only because it represents where we live and enjoy time with our families, but a vibrant housing market is a critical component of a robust economy. RPAC is the voice of all who want our politicians to make choices that support individual property rights and home ownership for as many Americans as possible. I’m proud to be a supporter of RPAC. I’ll use my iPad to present clients with important information regarding their home buying and selling decisions. ”

— Bob Fortner, Wake Forest: iPad winner

“ I support RPAC because they support us as REALTORS® I know they are fighting to help make our job easier each and every way they can. ”

— Lynn Bulman, Elizabeth City: iPad winner

“

I am delighted to see the amount of money donated to RPAC. Our “voice” will continue to be heard through our PAC and I will use my iTunes gift card to download a new Real Estate App to my iPhone.”

— Marie Leonard-Hampton, Salisbury: iTunes gift card

Even though the RPAC Technology raffle has come to an end, you can still contribute to RPAC this year and help us reach our goal of $460,185. So far, 4,200 members have contributed over $196,000 to RPAC, which means we are almost halfway to achieving our goal. Remember, we count on strength in numbers – it’s not what you give, it’s that you give. North Carolina RPAC is the best investment you’ll ever make in your business and yourself. Help us show just how strong NCAR and NC RPAC are with an investment today! Please go to www.ncrealtors.org and log-in to invest!

A full list of the winners can be found on the NCAR website by visiting www.ncrealtors.org or email kmiller@ncrealtors. org for more information. v

Apply to be an RPAC Trustee

The RPAC Trustees are taking applications for candidates for Regions 1, 8 and 10 for three-year terms. In addition, they are also accepting applications for one (1) At-Large position for a three-year term. Elections will be held at the NCAR Board of Directors meeting in September for Regional Trustees and At-Large positions will be appointed in October by the incoming 2014 RPAC chairman. For more information and an application form, please email kmiller@ncrealtors.org. The deadline for applications is Friday, July 12th.

12 INSIGHT May 2013 POLITICAL ACTION COMMITTEE

Service Corporation BOD Needs You

The NC Association of REALTORS®’ Service Corporation Board of Directors is now accepting applications for three director positions. Directors will serve three-year terms starting January 1, 2014. Elections will be held at the annual meeting of shareholders during the 2013 NC Association of REALTORS® Convention and Expo on September 14-17 in Asheville. Directors are responsible for governance of the Service Corporation, which includes fiduciary responsibility and general oversight of all business operations for the REALTOR® Partner Program. The Partner Program offers discounted products and services to NCAR members. The nominating committee will accept applications through July 1, 2013. Interested members should contact Sarah Beth Coggin at 336-217-1047 or sbcoggin@ncrealtors.org to receive an application. v

INSIGHT May 2013 13

By CADy THOMAS DIRECTOR OF GOVERNMENT AFFAIRS

By CADy THOMAS DIRECTOR OF GOVERNMENT AFFAIRS

Strong Voice and Clear Message

NCAR MEMBERS dESCENdEd upON RALEigh wiTh A STRONg vOiCE ANd CLEAR MESSAgE – dO NO hARM TO hOuSiNg duRiNg ThE TAx REfORM diSCuSSiONS

wiTh A LARgER TuRN OuT ThiS yEAR ThAN iN ThE pAST, OuR MEMBERS TACkLEd ThE TOugh iSSuES wiTh LEgiSLATORS ANd ENjOyEd A LiTTLE fuN, TOO

We had many local boards take advantage of the van and bus travel reimbursement from NCAR, some for the first time. We were thrilled to see one of our smaller boards, Roanoke Valley Lake Gaston, bring a group of members this year. We also had buses from High Point, Brunswick County, Fayetteville, the Outer Banks, Charlotte and Durham who brought their largest crowd ever!

Senate President Pro Temp Phil Berger (R-Rockingham) spoke to members at our Legislative Forum on Tuesday and then many senators and representatives, including House Speaker Thom Tillis (R-Mecklenburg), spoke to our members Wednesday morning before venturing out to talk to members of their own district. NAR President Gary Thomas also joined us to share some statistics about various housing and the real estate economy, including the mortgage interest deduction.

The legislative talking points focused on various issues of importance for our members and their clients this year. REALTORS® shared their concerns about local government control issues that overstep their statutory authority and shared support for House Bill 150 reiterating that local governments cannot control aesthetic elements of development and zoning and for House Bill 773 which restricts local governments from enacting rental registration and inspection programs except for areas which are truly blighted. REALTORS® also expressed their continued support of the Housing Trust Fund and asked for a general fund appropriation this year in the amount of $10 million.

First and foremost, the members advocated on behalf of the real estate industry and consumers with regard to tax reform. The NC REALTORS® message continues to be the same: North Carolina needs to approach tax reform in a way that does not harm our overall economy or hurt our housing’s fragile recovery. “We need to continue to send our message that the goal of tax reform is a good one, but paying for it by

increasing the tax burden on homeowners and the housing industry is counterproductive to North Carolina’s economic revitalization,” stated 2013 NCAR Legislative Chair Mark Zimmerman.

Stay informed about the tax reform discussion on the NCAR advocacy website, www.TaxReformFacts.org. It is important to understand how tax reform proposals will impact our economy and property owners throughout the state. The site is part of a strategic campaign, which includes targeted online ads in key parts of the state, to engage the public in our conversation. Our Facebook page has received a lot of notice and we encourage you to stop by daily to see the discussion.

Thank you to all that were able to join us in Raleigh this year and we hope to see even more REALTORS® walking the halls of the North Carolina General Assembly in 2014! v

Roanoke Valley Lake Gaston Board of REALTORS® which has about 150 members and is one of our smaller boards, took advantage of the travel reimbursement to attend the Legislative Day in Raleigh for the first time and had a great turn out!

16 INSIGHT May 2013 GOVERNMENT AFFAIRS

Members from the Charlotte Regional REALTOR® Association and NAR President Gary Thomas with House Speaker Thom Tillis, Representative Bill Brawley and Representative Charles Jeter.

We Want Your Input

Your RCA Forms Committee has been hard at work making substantive and technical updates to the Commercial Series of Forms (500 series), so be on the lookout for changes to several of the forms when the revised forms are published July 1, 2013. The next topic for the RCA Forms Committee will be to focus on improved functionality of the forms in their electronic environment. For example, we have already received comments regarding certain fields that do not auto populate from the master input to their appropriate place in the forms, we have had suggestions to expand certain blanks/fields to allow more input, and the suggestion that the form only show/print the signature lines actually used and to permit more than 2 signature lines.

We want your input to make this process as responsive to member needs as possible. While there may be some programming limitations on what can be affected, we want to make sure that we receive and attempt to address as many suggestions or issues as possible. If you have had functionality issues working with the forms or if you have suggestions for how they can mechanically work better (like the examples above), please submit your input. Please be as specific as you can so that we can clearly identify what needs to be addressed. You can make submittals by e-mail to Kay Bailey at NCAR (kbailey@ncrealtors.org) by May 15, 2013.

INSIGHT May 2013 17 Diamond The North Carolina Association of REALTORS® Would Like to Thank Our Sponsors... America’s preferred home warranty, inc CoreLogic MarketLinx wilde Law firm, pLLC zipLogix Silver Gold Platinum

By wILL MARTIN GENERAL COuNSEL

By wILL MARTIN GENERAL COuNSEL

Jude “Liens” on Forms Guy

Dear Forms Guy: I just overheard this really smart broker say that they’ve changed all the laws about how to get a lien on someone’s property if they don’t pay for labor or materials provided to the property. It kind of freaked me out. Is she right?

Sincerely, Jude

Dear Jude: Yes, that’s right. Effective April 1st, a significant change to North Carolina’s mechanics’ lien law took effect.

Sincerely, Forms Guy

Jude: So am I going to have to learn all about all the new lien law? It sounds so complicated. OMG! Help!

Forms Guy: Hey Jude, don’t be afraid. A real estate agent should become generally familiar with the new law; however, the identification and proper handling of potential liens on property that is the subject of a real estate transaction has been and will continue to be the responsibility of the closing attorney.

Jude: Whew! That’s good to hear. Can you give me a general idea of how the new law will work?

Forms Guy: Sure. As a short refresher, the mechanics’ lien laws that were in effect prior to April 1st permitted persons who supplied labor, materials or certain services to property that was being improved to file a claim of lien on the property to secure payment of what was owed to them. These liens could be filed after a property was transferred and yet “relate back” to a date before the transfer that the labor, materials or services were first provided. Such “hidden” liens would not show up on a title search. As a result, a seller was required to furnish at settlement an affidavit verifying that any person entitled to claim the benefit of such a lien had been paid in full.

Jude: Those kind of claims were covered by the buyer’s title insurance policy, right?

Forms Guy: Title insurance policies typically provided coverage against such liens, and for many years the title companies paid off occasional mechanics’ liens as a cost of business. However, when the recession hit the construction industry, title insurers experienced a significant increase in title insurance claims resulting from hidden liens. As a result, the title insurance industry successfully lobbied for changes to the lien law.

Jude: So does this new law replace the existing lien law?

Forms Guy: The new lien law applies to projects to improve real property for which the anticipated cost of the project at the time the building permit is issued is $30,000.00 or more. However, the new law will not apply to improvements to an existing single-family residential dwelling unit that is used by the owner as a residence. The lien law that existed prior to April 1st will still apply to projects that aren’t subject to the new law.

Jude: So how is the new law going to work?

Forms Guy: The new law is designed to protect buyers and title insurance companies from liens filed after a title policy is issued and the property is transferred by requiring potential lien claimants to provide notice of their involvement on a project before the property is transferred. Notice must be given to a “lien agent” who the owner of the property being improved will be required to designate. The lien agent will be a title insurance company chosen from among a list of registered lien agents that will be maintained by the Department of Insurance.

Jude: How will the designation process work and how will potential lien claimants know who to notify?

Forms Guy: The title insurance industry in North Carolina has collaborated on the development of a web site at www. liensnc.com which will enable a lien agent to be designated online. The owner will be required to give notice of the lien agent’s contact information, either by posting the information on the project site or by providing the information to a potential lien claimant on request. Lien claimants will be able to use the web site to notify the lien agent of their claims. The attorney closing a transaction subject to the new law will be able to search the web site to get the names of any persons who have notified the lien agent of their potential lien. The attorney will require all such persons to sign a lien waiver confirming that they have been paid in full. The claim of any potential lien claimant who refuses to sign a lien waiver will need to be addressed before the closing can take place.

Jude: You said that the new law won’t apply to improve-

FORMS G uy 20 INSIGHT May 2013

ments to an existing single-family residential dwelling unit that is used by the owner as a residence. When will it apply?

Forms Guy: The great majority of real estate transactions that will be subject to the new law will involve sales of new construction and sales by investors who have purchased and made significant improvements to the property being sold. It is important to understand, as I mentioned before, that the existing lien law will continue to apply to the sale of an existing single-family residential dwelling unit used by the owner as a residence.

Jude: Will real estate agents be expected to figure out whether the new lien law will apply to a property being sold?

Forms Guy: As I said at the beginning of our conversation, a real estate agent should become generally familiar with the new law. In most instances, it will be very clear whether the new or existing lien law will apply and whether a lien agent should or should not be designated. In some instances, it may not be so clear. In those situations, questions about whether the law will apply and if so, how it will work, should be answered by a North Carolina real property lawyer.

Jude: Are there going to be changes to NCAR’s forms because of the new law?

Forms Guy: Work is currently underway to identify and address any changes that may need to be made to NCAR’s standard forms as a result of the new law. Any changes likely will become effective this coming July 1st. Additional information will be made available on any changes that may be approved as soon as possible.

Jude: Thanks, Forms Guy. I was sad but you’ve made it better.

Forms Guy: Guy: Sure, Jude. Don’t carry the world on your shoulders. Call me anytime! v

person’s first initial and last name@ncrealtors.org. Our fax number is 336-299-7872.

Administrative Andrea Bushnell Executive Vice President 336-808-4220

Bryan Jenkins Chief Financial Officer 336-294-3112

Denise Daly

Membership Records Coordinator/Bookkeeper 336-808-4223

Sherry Harris Administrative Assistant 336-808-4230

Amanda Lowe Accounting Assistant 336-217-1048

Phyllis Lycan Accountant 336-808-4224

Donna Peterson Executive Assistant 336-808-4221

Sarah Beth Coggin Partners Program Manager 336-217-1047

Communications & Marketing Blair Wilburn Director of Communications and Marketing 336-808-4228

Samantha Ashburn Electronic Communications Manager 336-808-4226

Professional Development Ellie Edwards Director of Professional Development 336-808-4231

Monica Huckaby Professional Development Coordinator 336-217-1051

Legislative Cady Thomas Director of Government Affairs 919-573-0996

Dominic Palvisak Political Specialist 919-573-0984

Kristin Miller RPAC Manager 919-573-0995

Nicole Arnold Shared Local GAD 336-808-4237

Legal Will Martin General Counsel 336-808-4238

Kay Bailey Legal Assistant 336-808-4235

Events Mandy Lowe Director of Events 336-808-4236

Keri Epps-Rashad Meeting Planner and EXPO Manager 336-217-1049

Contact Will Martin at wmartin@ncrealtors.org if you have a question or a suggested topic of discussion for The Forms Guy

Contact Us: Members of the NC REALTORS® staff can be reached Monday through Friday during regular business hours of 8:30 a.m. to 5 p.m. at 336-294-1415 or via email using the

INSIGHT May 2013 21

By ANDREA BuSHNELL EXECuTIVE VICE PRESIDENT

Change is (Once Again) in the Air

With change comes opportunity. NCAR has experienced a few staff transitions. We wish each departing staff member (David McGowan, Julie Woodson, Barbara West and Kevin Brafford) the best in their new, and very exciting, endeavors. At the same time we are gearing up for the challenge and motivation that comes with building a new team to serve the members of this outstanding organization. Blair Wilburn, our Director of Business Development has moved into the role of Director of Communications and Marketing. She is bringing huge new energy and creativity to NCAR’s communications and will be spearheading the redesign of NCAR’s website, a redesign which is long overdue. We are interviewing for the other positions and are amazed at the talent NCAR is attracting. NCAR is extraordinarily well respected as an organization for the work that we do on behalf of our members and we are finding that many people want to be part of our efforts. This will allow and encourage NCAR to move forward in a new and innovative direction – always with the best interests of our members in mind.

You may be experiencing NCAR’s creativity and innovation when you see our commercials on TV, hear our ads on radio, and read our ads in the weekly newspapers serving your communities. These efforts are also about change. NCAR supports the efforts to build a better North Carolina for our families and those families choosing to relocate to this great state. We are working hard to ensure that legislative efforts on tax reform support the real estate industry recovery, not hamper or destroy it. We need your help in this effort. Eliminating the mortgage interest and property tax deductions would not be “good” change. Elimination of these deductions will lower property values, cost North Carolinians jobs, and potentially cause the housing industry to slip back into a recessionary mode. There are other legislative proposals being discussed that would equally harm the real estate industry. For example, adding an 8% tax on every service that is utilized when a family buys a home in North Carolina will be significant enough that many move up buyers, or first time home buyers, would be kept from their dream of homeownership. We cannot allow this to happen. Please visit our website www.taxreformfacts.org and sign up to join NCAR’s efforts. Share, tweet and get your friends, colleagues, families and allied business associates to join in. Find your inner activist and challenge yourself to be a catalyst of good change. Fighting the efforts that would harm our industry is not only beneficial to real estate professionals, but all of North Carolina’s citizens.

Finally, I hope that you are all taking advantage of and enjoying the market improvements we are seeing across North Carolina. That is a change I know we can all get behind. Let’s keep the momentum going. Everyone needs to do their part to ensure our industry is protected and that homeowners, potential homeowners, commercial property owners, and real property investors continue to be able to purchase and enjoy the benefits of real property ownership. Let’s keep this positive, yet still fragile, market change going.

Change equals innovation and opportunity. Improved markets lead to more jobs, increased property values, and an improved North Carolina for us all. From my perspective – BRING IT ON!

CLOSING THO u GHTS

ChANgE iS A TOpiC ThAT ARiSES fREquENTLy iN ThE wORLd Of ASSOCiATiONS i hAvE wRiTTEN ABOuT

ChANgE MORE ThAN ONCE SiNCE My ARRivAL iN NORTh CAROLiNA ThREE yEARS AgO TOdAy. ANd NEvER

BEiNg ONE TO AvOid ChANgE, BuT RAThER pREfERRiNg TO MEET iT hEAd ON, i AM pLEASEd TO BE wRiTiNg ABOuT ChANgE ONCE AgAiN

22 INSIGHT May 2013

By KRISTIN MILLER RPAC MANAGER

By KRISTIN MILLER RPAC MANAGER

By CADy THOMAS DIRECTOR OF GOVERNMENT AFFAIRS

By CADy THOMAS DIRECTOR OF GOVERNMENT AFFAIRS

By wILL MARTIN GENERAL COuNSEL

By wILL MARTIN GENERAL COuNSEL