MARCH 2024 REVIEW

• 964,073 passengers traveled through John Wayne Airport in March 2024, which was a 3.1% Year-OverYear (YoY) decrease compared to March 2023.

• Total Year-to-Date (YTD) passenger traffic through March is pacing slightly below 2023 (-0.4%).

• Newport Beach Hotels, however, saw gains in every key metric in March 2024.

• Demand increased a healthy 11.6%, but a 10.2% increase in Supply softened Occupancy gains to a modest 1.3% YoY increase.

• ADR grew slightly (+2.1%), but the strong growth in Demand drove total Revenue a whopping 14.0% higher than the same month last year.

• Short-Term Rentals in Newport Beach showed mixed results in March 2024 compared to March 2023.

• Occupancy fell 2.3% YoY to 42%.

• ADR grew 5.2% to $490.

• RevPAR increased 2.8% to $203.

Source: John Wayne Airport, STR, and Key Data

• “The economy performed well in March, but inflation also reached its highest level (3.5% YOY, as measured by the Consumer Price Index, or CPI) since September. The interplay of economic output and inflation reflect The Federal Reserve’s efforts to reduce inflation without throttling the economy with high interest rates. However, March’s higher inflation rate might have been more troubling if it accompanied weakening economic performance.”

• “Fortunately, economic performance was quite strong. The March jobs report showed that a strong 303,000 new jobs were added to the economy. This was the strongest month for new jobs since May 2023, helping push the unemployment rate down from 3.9% in February to 3.8% in March. Hourly earnings growth, while still above inflation, declined slightly, from 4.3% YOY in February to 4.1% in March, meaning the uptick in inflation doesn’t appear to be driven by a wage spiral just yet.”

• “The month’s performance seems to indicate both that more needs to be done to address inflation and that the economy isn’t suffering substantially. The Federal Reserve may have delayed its rate cuts, and there is some speculation that there may only be two cuts in 2024, rather than the three many experts hoped for. On the other hand, the changes are small, and the Fed may chalk up the higher inflation in March to statistical noise as more data comes in.”

• U.S. hotel demand contractions have not been felt equally across hotel classes.

• The divergence: Economy and Midscale chains are trailing year-over-year levels, while Upper Upscale and Luxury chains continue to grow.

• Another sign of upper-income travel strength: International travel by U.S. residents has grown over the past year—rising by 23% in 2023 and up by another 13% in the first quarter of 2024.

• While wealthier households remain on the go, more budget-conscious travelers are likely cutting back to account for higher prices, rents and interest rates.

• Overseas international travel to the U.S. reached 88% of 2019 levels as of March.

• India leads the way at 57% above 2019 levels and Spain, Colombia, and Italy all continue to pace ahead as well.

• Meanwhile, China lags at just 50% of 2019 levels, though recovery is picking up speed.

• A headwind to keep in mind: Currency depreciation in major source markets makes U.S. travel more expensive.

• Smooth sailing for cruises: Global cruise passenger activity is expected to exceed the pre-pandemic peak by 18% in 2024. Younger generations have demonstrated higher levels of satisfaction, a positive signal for the future of the industry.

• The U.S. hotel industry reported higher performance results from the previous month, but mixed comparisons year over year, according to March 2024 data from CoStar. CoStar is a leading provider of online real estate marketplaces, information, and analytics in the property markets.

• March 2024 (percentage change from March 2023):

• Occupancy: 63.7% (-2.5%)

• Average Daily Rate (ADR): $159.79 (+0.4%)

• Revenue per Available Room (RevPAR): $101.81 (-2.2%)

• Among the Top 25 Markets, Miami experienced the highest levels in each of the three key performance metrics: Occupancy (+2.3% to 83.5%), ADR (-0.6% to $284.14) and RevPAR (+1.6% to $237.25).

• Markets with the lowest Occupancy for the month included Minneapolis (54.7%) and Detroit (55.1%).

• The Top 25 Markets showed higher occupancy and ADR than all other markets.

• The combination of slowing supply and surging demand increased March occupancy. After overcoming January’s weak occupancy, 2024 has so far enjoyed higher occupancies YOY, with February 0.9% higher and March 2.0% higher. These two months of positive YOY occupancy growth come after a 23-month streak of falling YOY occupancies following the remarkable highs of 2021.

• On the other hand, the positive occupancy result in March may be owed entirely to the Easter shift, since when examining the individual weeks in March, the first three weeks’ occupancy is, on average, down about 2.2%. The final week of March had an occupancy of 62.9%, up from March 2023, when the last week had an occupancy of 57.9%.

• Arguably, the most dramatic trend from the past few months is the renewed pricing power that arose from the reversal of occupancy declines.

• In response, ADR growth has flipped from a YOY decline of 3.9% in November to a gain of 4.0% in March. The RRI never reached negative growth in 2023, implying that while ADR declined on average, this was due to a mix shift; new properties were lower-priced than existing.

• Still, weak growth between 0-1% characterized much of the RRI performance of the past year. March’s 6.5% YOY was RRI’s strongest month since early 2022.

SHORT-TERM RENTALS (continued)

• Key U.S. STR Performance Metrics for March 2024

• RevPAR increased 6.1% YOY to $196.15

• Available listings were 1.57 million, up 12.3% YOY

• Total demand (nights) rose 15.2% YOY

• Occupancy was 2.0% higher YOY at 60.2%

• ADRs increased 4.0% YOY to $326.02

• RRI increased by 6.5% YOY

• Nights booked increased by 12.5% YOY

Source: John Wayne Airport

TOTAL PASSENGERS BY YEAR (2019 – 2024 YTD) MILLIONS

Source: John Wayne Airport

(Jan - Mar)

Source: STR and Key Data

• Average Daily Rate (ADR) – A measure of the average rate paid for rooms sold, calculated by dividing room revenue by rooms sold.

• ADR = Room Revenue / Rooms Sold

• Demand (Rooms Sold) – The number of rooms sold in a specified period (excludes complimentary rooms).

• Supply (Rooms Available) – The number of rooms in a hotel or set of hotels multiplied by the number of days in a specified period.

• Occupancy – Percentage of available rooms sold during a specified period. Occupancy is calculated by dividing the number of rooms sold by rooms available.

• Occupancy = Rooms Sold / Rooms Available

• Room Revenue – Total room revenue generated from the guestroom rentals or sales.

• Revenue Per Available Room (RevPAR) – Total room revenue divided by the total number of available rooms.

• RevPAR = Room Revenue / Rooms Available

Newport Beach Hotel Occupancy increased 1.3%, ADR increased 2.1%, and RevPAR increased 3.4% vs. the same month last year

Newport Beach Hotel Occupancy increased 1.3%, ADR increased 2.1%, and RevPAR increased 3.4% vs. the same month last year

2022 2023 2024

Newport Beach Hotel Occupancy increased 1.3%, ADR increased 2.1%, and RevPAR increased 3.4% vs. the same month last year

2022 2023 2024

Newport Beach Hotel Demand increased 11.6%,Supply increased 10.2%, and Revenue increased 14.0% vs. the same month last year

2022 2023 2024

Newport Beach Hotel Demand increased 11.6%,Supply increased 10.2%, and Revenue increased 14.0% vs. the same month last year

Beach Hotel Demand increased 11.6%,Supply increased 10.2%, and Revenue increased 14.0% vs. the same month last year

• Guest Nights – Total nights reserved by guests for a specified period. Also referred to as Properties Sold or Nights Sold.

• Occupancy – The percentage of guest nights booked out of the total nights in a specified period.

• Occupancy = Guest Nights Booked / Total Nights

• Unit Revenue – The rental revenue from Guest Nights. This does not include taxes or Other Revenue (e.g. resort fees, bike rentals, ski rentals, and concierge revenue).

• Average Daily Rate (ADR) – The average Unit Revenue paid by guests for the Guest Nights in a specified period.

• ADR = Unit Revenue / Guest Nights

• Revenue Per Available Rental Night (RevPAR) – Total Unit Revenue divided by Guest Nights in a specified period.

• RevPAR = Total Unit Revenue / Guest Nights or Occupancy x ADR

Newport Beach STR Occupancy decreased 2.3%,ADR increased 5.2%,and RevPAR increased 2.8% vs. the same month last year

Newport Beach STR Occupancy decreased 2.3%,ADR increased 5.2%,and RevPAR increased 2.8% vs. the same month last year

2022 2023 2024

Newport Beach STR Occupancy decreased 2.3%,ADR increased 5.2%,and RevPAR increased 2.8% vs. the same month last year

2022 2023 2024

Los Angeles CA

Phoenix AZ

San Diego CA

San Francisco-Oakland-San Jose CA

Las Vegas NV

Sacramento-Stockton-Modesto CA

Salt Lake City UT

Denver CO

Palm Springs CA

New York NY

Source: Zartico (Visitor device count (n) = 23,844)

San Francisco-Oakland-San Jose CA

Phoenix AZ

Sacramento-Stockton-Modesto CA

Los Angeles CA

Las Vegas NV

Denver CO

Spokane WA

Honolulu HI Chicago IL

Seattle-Tacoma WA

Source: Zartico (Visitor device count (n) = 23,844

John Wayne Airport, Orange County Universal Studios

San Diego Zoo

Sea World

South Coast Plaza

Anaheim Convention Center

Legoland Resort

California Adventure Park

Mission Of San Juan Capistrano

Knott's Berry Farms

% OBSERVED

Source: Zartico (Visitor device count (n) = 23,844)

Hotel Night Stays by Campaign

Return On Ad Spend by Campaign

CAMPAIGN ANALYSIS: SOJERN VISIT NEWPORT BEACH SUMMER 2023

Sojern: Visit Newport Beach Summer 2023 Campaign Analysis

Flight Dates: 7/1/2023 – 9/21/2023

Reporting Dates: 7/1/2023 – 9/21/2023

Total Events* Confirmed Travelers Hotel Night Stays

Bookings

*Total Events include flight, lodging, and car bookings

Estimated Economic Impact = $6,467,378

(Confirmed Total Travelers x Avg Spend Per Traveler = Total Estimated Traveler Spend)

ROAS (Return On Ad Spend) = 143:1

(Total Estimated Traveler Spend / Media Spend = ROAS)

*Campaign analysis does not include the impact of any additional media channels (such as PR, social media, etc.)

CAMPAIGN ANALYSIS: SOJERN VISIT NEWPORT BEACH FALL 2023

Sojern: Visit Newport Beach Fall 2023 Campaign Analysis

Flight Dates: 9/7/2023 – 11/15/2023

Reporting Dates: 9/7/2023 – 11/15/2023

Total Activities* Confirmed Travelers Hotel Night Stays

Bookings

*Total Activities include flight, lodging, and car bookings

Estimated Economic Impact = $9,952,075

(Confirmed Total Travelers x Avg Spend Per Traveler = Total Estimated Traveler Spend)

ROAS (Return On Ad Spend) = 109:1

(Total Estimated Traveler Spend / Media Spend = ROAS)

*Campaign analysis does not include the impact of any additional media channels (such as PR, social media, etc.)

CAMPAIGN ANALYSIS: SOJERN VISIT NEWPORT BEACH FY24 EVENTS – FORMULA 1

Sojern: Visit Newport Beach FY24 Events Formula 1 Campaign Analysis

Flight Dates: 11/2/2023 – 11/30/2023

Reporting Dates: 11/2/2023 – 11/30/2023

Total Events* Confirmed Travelers Hotel Night Stays

*Total Events include flight, lodging, and car bookings

Estimated Economic Impact = $700,077

(Confirmed Total Travelers x Avg Spend Per Traveler = Total Estimated Traveler Spend) ROAS (Return On Ad Spend) = 25:1

(Total Estimated Traveler Spend / Media Spend = ROAS)

*Campaign analysis does not include the impact of any additional media channels (such as PR, social media, etc.)

CAMPAIGN ANALYSIS: SOJERN VISIT NEWPORT BEACH HOLIDAY 2023

Sojern: Visit Newport Beach Holiday 2023 Campaign Analysis

Flight Dates: 11/7/2023 – 1/5/2024

Reporting Dates: 11/7/2023 – 1/5/2024

Total Events* Confirmed Travelers Hotel Night Stays

Bookings

*Total Events include flight, lodging, and car bookings

Estimated Economic Impact = $4,106,334

(Confirmed Total Travelers x Avg Spend Per Traveler = Total Estimated Traveler Spend)

ROAS (Return On Ad Spend) = 79:1

(Total Estimated Traveler Spend / Media Spend = ROAS)

*Campaign analysis does not include the impact of any additional media channels (such as PR, social media, etc.)

CAMPAIGN ANALYSIS: SOJERN VISIT NEWPORT BEACH FY24 SUPER BOWL

Sojern: Visit Newport Beach FY24 Super Bowl Campaign Analysis

Flight Dates: 2/1/2024 – 2/20/2024

Reporting Dates: 2/1/2024 – 2/20/2024

*Total Events include flight, lodging, and car bookings

Estimated Economic Impact = $219,632

(Confirmed Total Travelers x Avg Spend Per Traveler = Total Estimated Traveler Spend)

ROAS (Return On Ad Spend) = 11:1

(Total Estimated Traveler Spend / Media Spend = ROAS)

*Campaign analysis does not include the impact of any additional media channels (such as PR, social media, etc.)

CAMPAIGN ANALYSIS: SOJERN VISIT NEWPORT BEACH FY24 WINTER

Sojern: Visit Newport Beach FY24 Winter Campaign Analysis

Flight Dates: 1/5/2024 – 3/18/2024

Reporting Dates: 1/5/2024 – 3/18/2024 Total Events* Total Travelers Hotel Night Stays

Bookings

*Total Events include flight, lodging, and car bookings

Estimated Economic Impact = $7,594,953

(Confirmed Total Travelers x Avg Spend Per Traveler = Total Estimated Traveler Spend)

ROAS (Return On Ad Spend) = 86:1

(Total Estimated Traveler Spend / Media Spend = ROAS)

*Campaign analysis does not include the impact of any additional media channels (such as PR, social media, etc.)

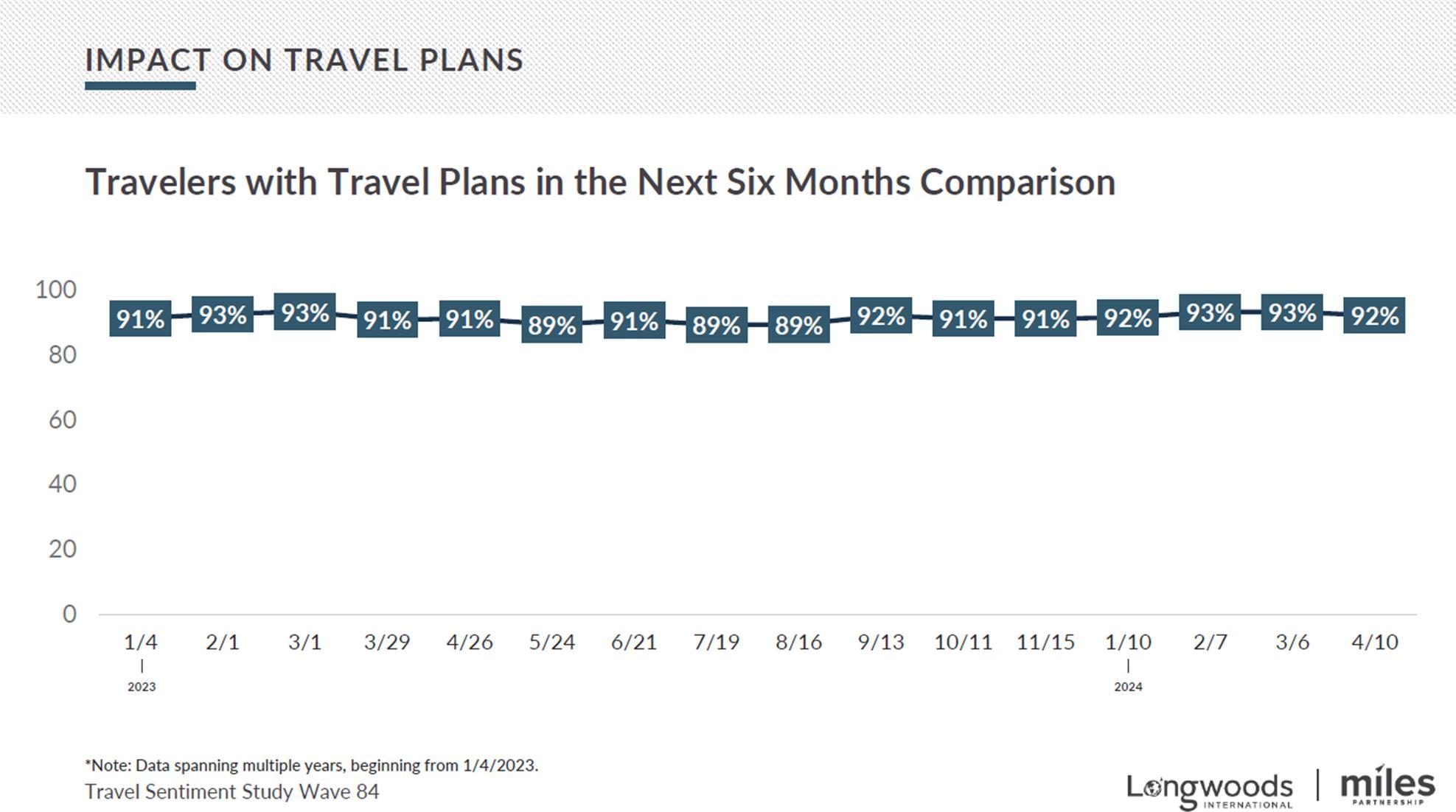

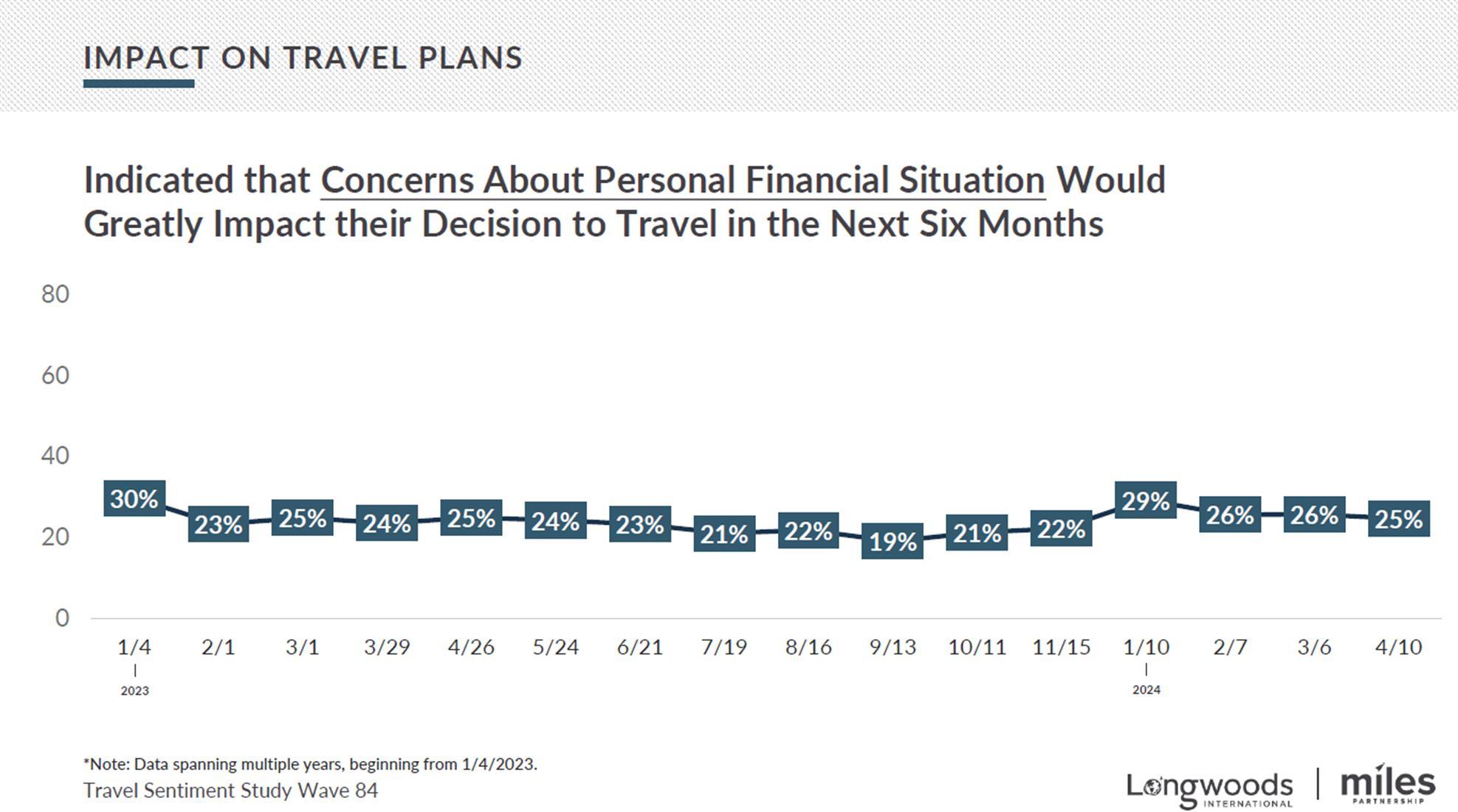

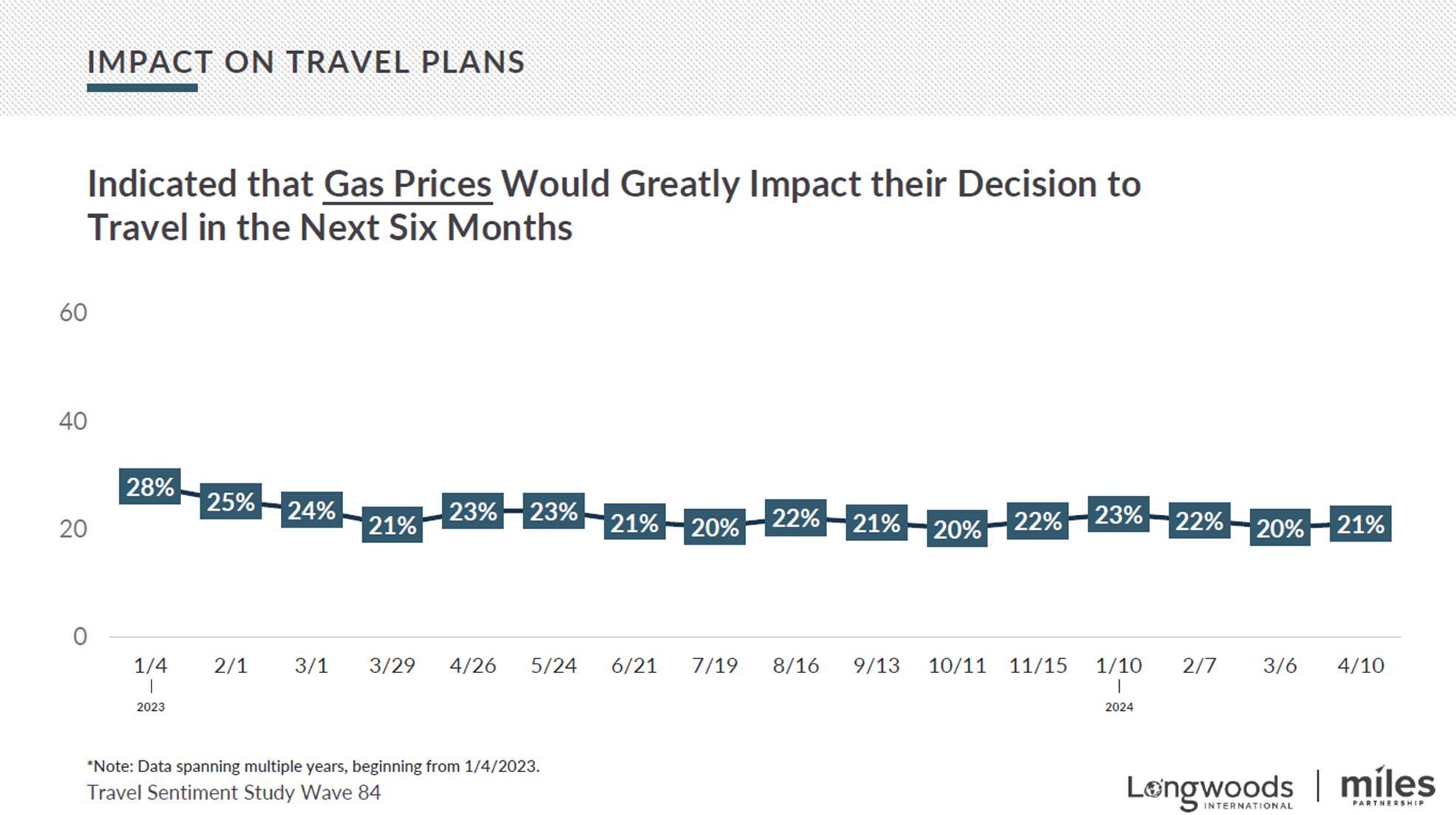

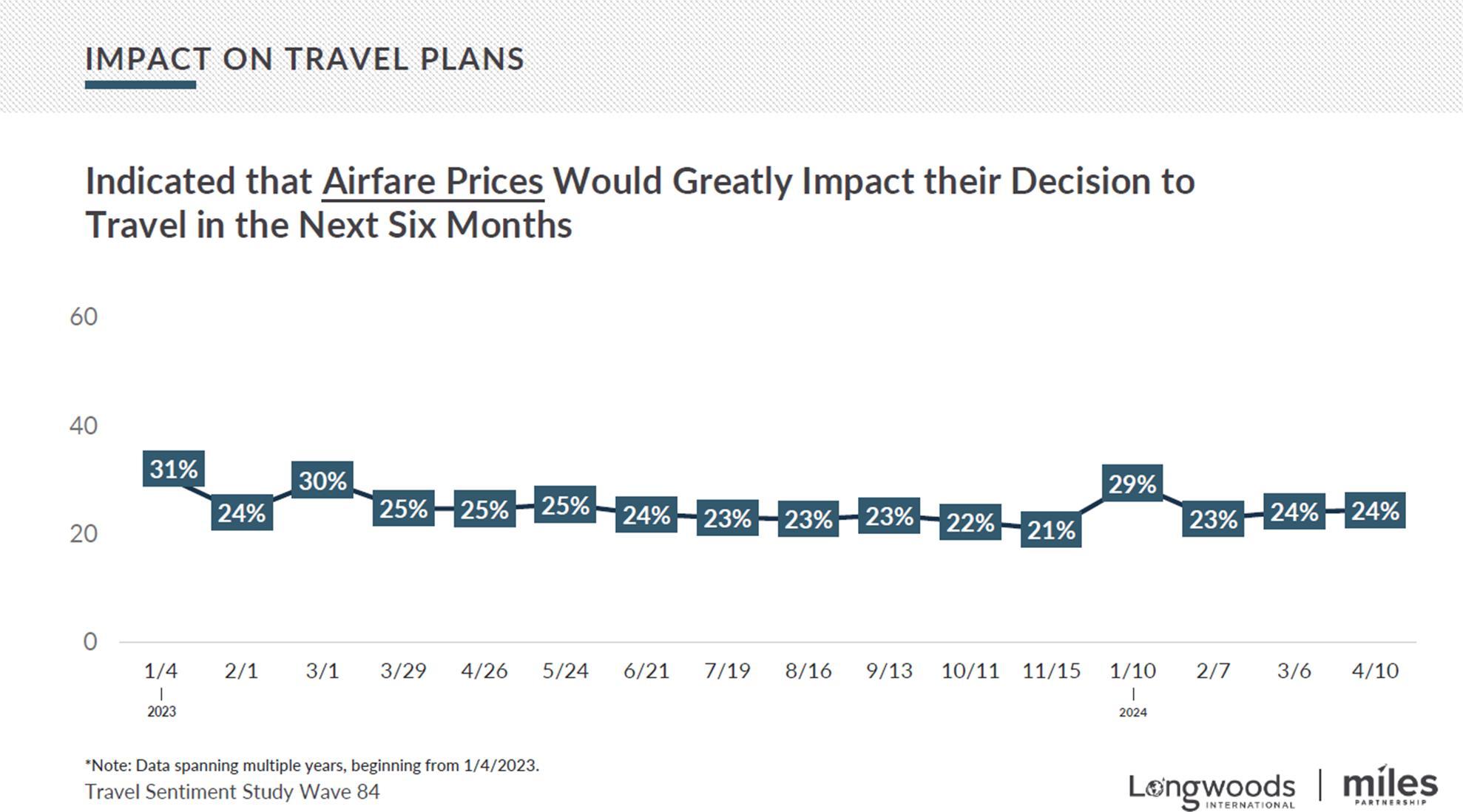

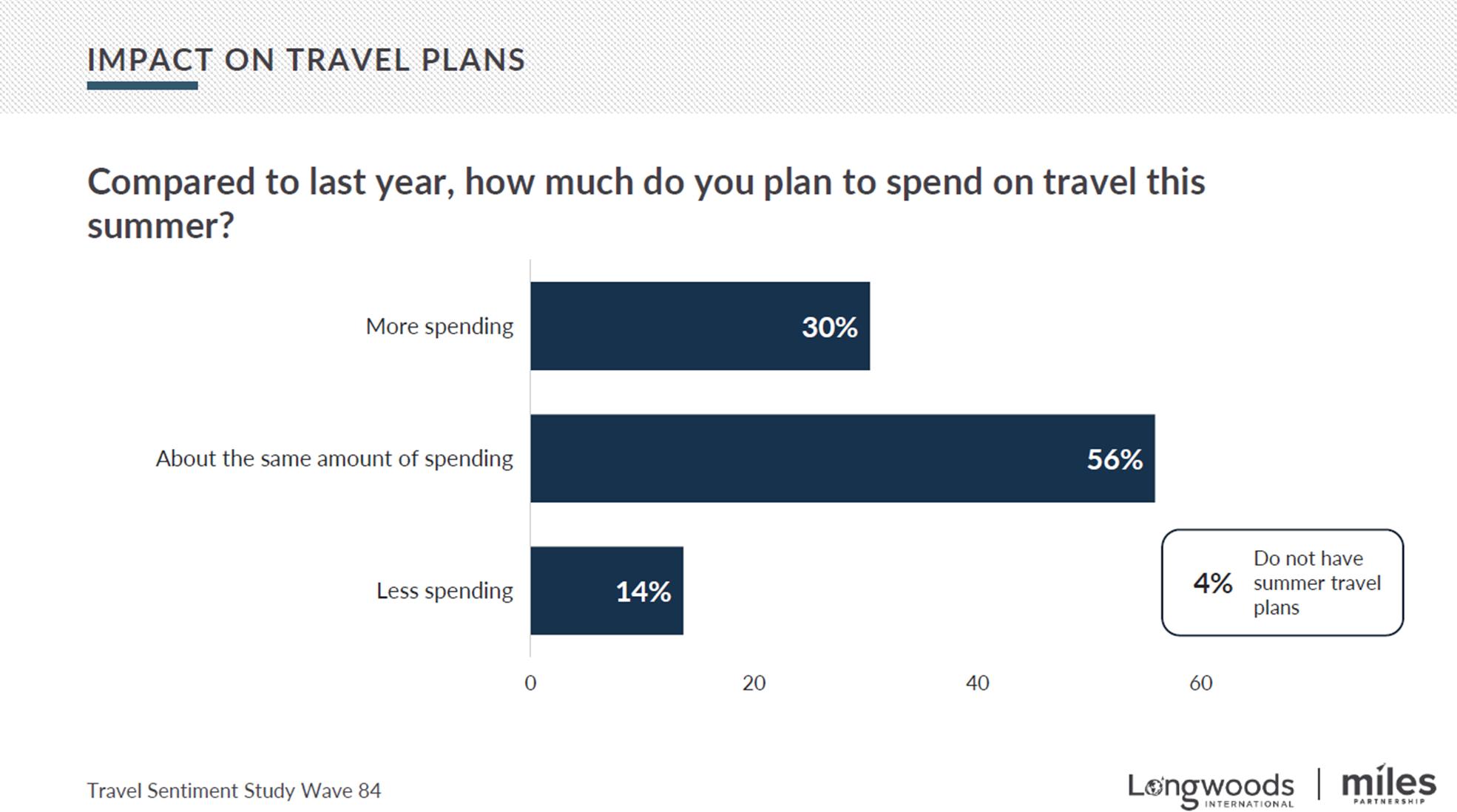

Source: Longwoods International

Source: Longwoods International

Source: Longwoods International

Source: Longwoods International

Source: Longwoods International

Source: Longwoods International

Source: Longwoods International

Source: Longwoods International

Source: Longwoods International

Source: Longwoods International

Source: Longwoods International

Source: Longwoods International

Source: Longwoods International

Source: Longwoods International