4 minute read

Take advantage of

BY: RANDAL C. HILL

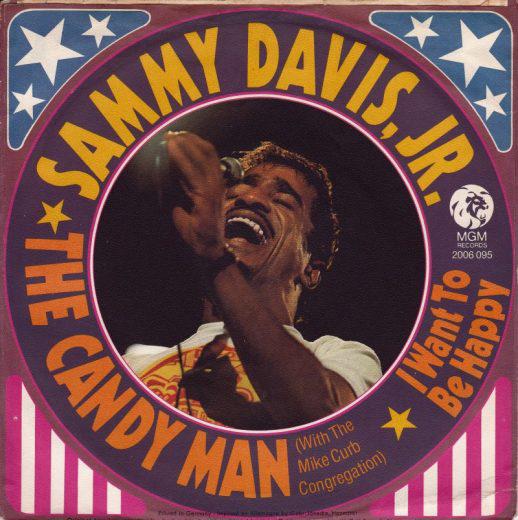

“It’s horrible. It’s white bread; it’s ‘cute-ums’.” Sammy Davis, Jr., couldn’t imagine singing lyrics that included such cloying phrases as “groovy lemon pies.” But Davis was being pressured to record “The Candy Man” by his manager and Mike Curb, the 26-year-old hotshot president of MGM Records. Curb was convinced that the song had “hit” written all over it—but only if done by Sammy. Before he approached the legendary vocalist, Curb recruited his 16-member recording group—the Mike Curb Congregation—to tape a childlike background for “The Candy Man.” As a member of the legendary Rat Pack, Sammy had earned celebrity by performing for sophisticated adult audiences. Was he willing to risk his reputation by recording a featherweight kiddie ditty? Willie Wonka and the Chocolate Factory was the classic 1971 movie based on the 1964 book Charlie and the Chocolate Factory by children’s writer Roald Dahl. In Dahl’s novel, the main character is Charlie Bucket, who, along with four other juveniles, visits a candy factory owned by the eccentric chocolatier Willie Wonka. British entertainment partners Anthony Newley and Leslie Bricusse had created the music for the film’s soundtrack. The first tune heard is “The Candy Man.” Sung by actor Aubrey Woods as the neighborhood candy-store owner named Bill, the shopkeeper enthusiastically extols the magical properties of Wonka’s seductive sweets. Woods did a serviceable job on the tune, but Newley hated the rather stiff rendition and felt that Woods’s version could easily doom a potential hit single. Newley decided to record his own interpretation, but Mike Curb got the jump on him. Eventually, Sammy capitulated, still fearing that this could become a regrettable decision. Focused on a forthcoming trip to Vietnam to entertain the troops, he hurried through “The Candy Man” in two takes. When he listened to the playback in the recording studio, Davis moaned, “This record is going straight into the toilet, and it may just pull my whole career down with it.” To his amazement (but not Curb’s), the single caught the nation’s ear when music fans of all ages embraced the joy that Davis offered here. “The Candy Man” shot to Number One on Billboard’s chart and even earned a Grammy nomination. In time, the 45 topped playlists worldwide. “There are lots of regional hits, but rarely does a record become an international hit,” Davis explained later, probably with a smile and perhaps a slight feeling of guilt. “With a 5% royalty, I made half a million dollars.”

Image from stereogum.com

SAVE TAXES WITH A “LIVING” TRUST

by William R. Mumbauer - Attorney - www.flwillstrustsprobate.com

A reader asks: My mother wants to add my name to the deed to her home to avoid probate when she dies. Is this a good idea from a tax standpoint? la w

Response: It depends. If your mother’s home has appreciated significantly, adding you as a joint owner on her deed will end up costing you much more in capital gain taxes when you sell the home after she dies then what you will save by avoiding probate. For example, let’s say your mother’s house was worth $100,000.00 when she bought it, but the day she dies its worth $300,000.00. If you inherit the home, you will also inherit the stepped-up basis (or date of death value) of $300,000.00. This means that if you then sell the home, you would have no gain and you would owe nothing in taxes. However, if you are added to your mother’s deed, you will receive the stepped-up bases in only half of the value of your mother’s home when she dies. If you turn around and sell the home, you will be stuck with significant capital gain taxes on one-half of the appreciated value of $200,000.00 of your mother’s home. A much better approach would be for your mother to place her home into a “Living” Trust naming you as the beneficiary. Not only will the time, expense and aggravation associated with probate be avoided, but you will have no tax liability when you sell the home.

Mr. Mumbauer, a 5th generation Floridian, has maintained a law practice in Brandon, Florida since 1980 with emphasis on estate planning. Mr. Mumbauer takes special pride in representing the senior community by maintaining a sensitive and practical approach to problem solving. Mr. Mumbauer is a member of the National Academy of Elder Law Attorneys and the Elder Law Section of the Florida Bar. Mr. Mumbauer is also a Mentor in probate law and has been qualified by the Second District Court of Appeal in Florida as an expert witness in matters involving the drafting of Wills. Mr. Mumbauer’s Martindale-Hubbell Peer Review Rating among judges and lawyers for Legal Ability is High to Very High and his General Recommendation Rating is Very High. His articles are based on general principles of law and are not intended to apply to individual circumstances.