Reimagine: Differently APRIL 2023 WE ARE YOUR VOICE CREATING CERTAINTY IN UNCERTAIN TIMES SME Insurance A CAUTIOUS PATH AHEAD FOR D&O Directors and Officers insurance 2023 NIBA CONVENTION 8 – 10 October 2023 The Star, Gold Coast

Financial flexibility

Cloud applications can be purchased incrementally with very little upfront expense. You can try first and scale up as your business grows

Zero-barrier participation

Central offices, remote workers, distributed teams and mobile individuals benefit from the same experience irrespective of device

IT simplicity

The IT infrastructure liabilities of security, redundancy and scalability are shifted to the cloud services provider which helps you focus on productivity

CLOUD

DOCUMENT MANAGEMENT

BASED

Contact us today to find out how easy it is to streamline your office workflows +61 3 9817 8100 info@technosoftsolutions.com.au technosoftsolutions.com.au

ACN 006 093 849

ABN 94 006 093 849

Insurance Adviser magazine

is the monthly magazine of the National Insurance Brokers Association (NIBA).

Insurance Adviser magazine is published by NIBA

Publisher Philip Kewin, CEO, NIBA

T: (02) 9459 4305

E: pkewin@niba.com.au

W: niba.com.au

Communications Manager

Wendy Martin

Editorial enquiries

E: editor@niba.com.au

National Sales Manager

Tony May

E: tmay@niba.com.au

Design Citrus Media www.citrusmedia.com.au

NIBA gives no warranty and makes no representation that the information contained in this magazine is, and will remain, suitable for any purpose or free from error.

To the extent permitted by law, NIBA excludes responsibility and liability in respect of any loss arising in any way (including by way of negligence) from reliance on the information contained in this magazine or otherwise in connection with it.

The contents of Insurance Adviser are protected by copyright and NIBA reserves its rights in this regard.

NIBA.COM.AU / 3 CONTENTS

2023 FEATURES

April

27 THE TRUE BUSINESS OF BROKING

Keeling of BMS

Coast, Burleigh

her ongoing work to

residents and communities. 12 WELCOME TO THE STAGE… Join us on 8–10 October on the Gold Coast to hear from a number of exceptional people about how to think differently. REGISTER NOWSuper early bird tickets available

Wendy

Coast to

Heads shares

help flood-affected

CONTENTS April 2023 4 / INSURANCE ADVISER MARCH 2023 IN EVERY ISSUE NIBA CEO Welcome 6 Member Benefits 8 Representation 16 NEWS Industry Bulletin .......................................... 18 PROFESSIONALISM Getting more social in 2023 ....................... 26 In conversation with Jenny Bax, UAC CEO 30 EVENTS Forthcoming Events 10 Event pictorials 56 REFERENCE Community Hub 51 Insurer Strength Ratings 57 FEATURES 32 CREATING CERTAINTY IN UNCERTAIN TIMES SME Insurance DISPLAY ADVERTISING INDEX – APRIL 2023 Technosoft IFC Allianz 5 Brooklyn 7 Hunter Premium Funding 9 NIBA Convention 15 Ebix 17 Community Underwriting 19 UAC 21 Vero 35 QPIB 37 Zurich 39 Community Broker Network 41 Liberty 45 NIBA Advertising 47 ASR 49 Code of Practice IBC CGU OBC If you’d like to advertise your products and services through NIBA, please contact Tony May today on (02) 9459 4303 42 A CAUTIOUS PATH AHEAD FOR D&O Directors and Officers insurance

Global experience that drives your local partnership

As one of the world’s largest insurers with over 100 years’ experience in Australia, Allianz is here to help when you need it most. With state-based sales and underwriting experts working alongside our dedicated claims team, we’re ready to assist you and your customers, no matter where you are.

For more information, speak to your Account Manager today or visit www.allianzengage.com.au

Go Further, Together.

Insurance issued by Allianz Australia Insurance Limited ABN 15 000 122 850, AFS Licence No.234708. This information is general advice only and does not take into account your objectives, financial situation or needs. Consider the relevant PDS in deciding whether to buy or continue to hold any insurance products.

WHEN THE RUBBER HITS THE ROAD

It has been over a year since the commencement of the floods in northern NSW and southern Queensland and the mop-up continues. In some areas such as Lismore, there has been a lot of attention but still a lot to do. In other areas outside of Lismore, it has been slower.

Recently, NIBA has engaged the Insurance Council of Australia (ICA) and the Northern Rivers Reconstruction Council (NRRC) to give practical, on the ground feedback from brokers in an effort to smooth the process, and importantly, to learn for the future.

Frankly, I was blown away by the lengths brokers have been going to, in order to assist their clients in their time of need. This month’s Insurance Adviser with Wendy Keeling from BMS Coast to Coast in Burleigh Heads in southern Queensland, and it is an excellent example of what brokers do, not just ensuring their clients have the right cover in place, but making sure that they and the insurer, deliver when it counts. I’m sure there are many similar examples, but we wanted to highlight these particular ones.

For many residents in these areas, it has all become too much – cleaning up, rebuilding, and raising the height of the house to recommended levels, only to be inundated again. The NRRC has started to make offers to residents to buy them out at pre-flood valuations. At the time of writing, some 61 offers had been made of a possible total of 850 in the first tranche.

The challenge will be what the community looks like if only some agree to sell in what is a voluntary program. Schools, infrastructure, planning is all contingent upon a vibrant sustainable community.

The challenge for us is how we learn from the past and build a better future. This will require a sustained effort for all stakeholders and brokers will play a key role as we engage with the various bodies.

Another topic that has become more prevalent while still related to the great job being done by brokers in NSW and QLD and indeed across Australia, is how we bring more people into the broking profession. We are seeing once again through the Vero-sponsored 2023 Young Broker of the Year award nominations, extremely accomplished and talented young brokers who love what they do, and go about their trade with such passion.

How is it that we are just not that good at telling the story of how diverse, empowering and rewarding the role of a broker can be?

6 / INSURANCE ADVISER APRIL 2023

CEO / Welcome

WHY NIBA MATTERS TO ME

Members share why NIBA is important to them, and how their involvement has enabled them to support the broking industry.

“NIBA plays a critical role in ensuring that its members adhere to the highest standards of professionalism and ethical conduct. The importance of the trust and confidence this instils in both brokers and their clients cannot be understated, especially in a post-Royal Commission world.

By upholding these standards, NIBA creates a level playing field where clients can rely on members for the very best of guidance and advice in navigating the complexities of insurance.”

NIKITA WILLIS

Client Manager, BMS Risk Solutions Pty Ltd

NIBA SAYS CONGRATULATIONS

NIBA WELCOMES THE FOLLOWING PRINCIPAL MEMBERS ON BOARD

Arete Risk & Insurance Solutions

NIBA CONGRATULATES THE FOLLOWING MEMBER FOR THEIR FELLOWSHIP

Gabrijel Kapiteli, Modulus Insurance Group Pty Ltd

NIBA CONGRATULATES THE FOLLOWING MEMBERS FOR RECEIVING THEIR QPIB DESIGNATIONS

Roy Catanzariti, RCA Insurance Services Pty Ltd

Callum McKinnon, CM Risk Services Pty Ltd

Philippa Wright, Silks Insurance Pty Ltd

Alana Williamson, Guardsafe Insurance Brokers Pty Ltd

ABOUT NIBA

OUR MISSION

NIBA is the one voice for insurance brokers in Australia, representing their interests and promoting high standards of professionalism and competence.

OUR OBJECTIVES

Representation

We represent the interests of members and their clients to governments, regulators, industry stakeholders, the media and the community in a manner that is respected and relevant. We have forged strong relationships at a state and national level to ensure that your interests are represented.

Professionalism

We set and promote high standards of professional practice for insurance brokers for the benefit of their clients and the community through the development of professional standards, QPIB, CPD accreditation and the Insurance Brokers Code of Practice.

Community

Nicola Wilson, Oracle Group (Australia) Pty Ltd

Steven Richards, RSM Group Pty Ltd

Alexander Rowland, Willis Temby Insurance Brokers Pty Ltd

Nico West, Oracle Group (Australia) Pty Ltd

David Woollams, Insurance Solutions Australia Pty Ltd T/as AGL Aviation

NIBA CONGRATULATES THE FOLLOWING MEMBER FOR RECEIVING THEIR QFSR DESIGNATION

Tracy Senica, Aon Risk Services Australia Ltd

NIBA CONGRATULATES THE FOLLOWING MEMBERS FOR BECOMING AN ASSOCIATE MEMBER

Ray Karnain, Lockton Companies Australia

Brandon Ng, Knightcorp Holdings Pty Ltd

We provide members with opportunities to meet, share, grow and prosper, and build professional networks with the wider intermediated insurance community that will last throughout whole careers.

GET IN TOUCH!

Whatever your age, or level of experience, NIBA has brokers’ best interests at the core of everything we do. Find out what we can do to help benefit your business and your team at niba.com.au/membership

8 / INSURANCE ADVISER APRIL 2023 NIBA / Member Benefits

For more information about how Hunter Premium Funding can benefit your clients, visit hpf.com.au

As Australia’s leading specialist premium funder, we’re here to help businesses large and small manage their insurance premiums and unlock their cash flow.

Hunter Premium Funding Limited ABN 80 085 628 913. A company of Allianz Australia Insurance Limited ABN 15 000 122 850 AFS Licence No. 234708 Ready for today. Prepared for tomorrow.

NIBA EVENTS

NIBA stages a variety of educational and social events across Australia for the whole intermediated insurance community.

UPCOMING EVENTS

2023 NIBA VIC YP SEMINAR: MARINE INSURANCE WITH BHSI

WHERE: BHSI, Suite 2, Level 9, 360 Elizabeth Street, Melbourne

WHEN: Thursday 13 April 2023

Hosted by the NIBA Vic Young Professionals Committee, join us on Thursday 13 April for an insightful seminar on Marine Insurance, presented by Bosko Kicanovic, Marine Underwriter at Berkshire Hathaway Specialty Insurance.

The seminar will feature an update on the global marine industry, including a deep dive into key risk classes and a specific focus on cargo insurance. Bosko will cover claims, recoveries, inflation factors, and supply chain challenges, providing you with valuable insights and practical knowledge.

2023 NIBA VIC SEMINAR: EYE ON THE HORIZON

WHERE: RACV City Club, 501 Bourke Street, Melbourne

WHEN: Wednesday 19 April 2023

We will be hosting an engaging panel discussion on what brokers can expect to see in the market in 2023 and beyond.

Our panellists will provide insights to changes and upcoming trends broker can expect to face over the coming year from experts in placements and broking, as well as insights from our insurer sponsor partners CGU and Solution Underwriting.

Panel members include:

• Theresa Lewin, Financial Institutions Practice Leader, Professional & Financial Risks – Gallagher

• Matt Schinck, Head of Placement, National – Aon

• Callum Brown, Account Director –Comprehensive Insurance Solutions

• Mark Chisholm, National Underwriting Manager, Property – CGU

• Anita Lane, Director – Solution Underwriting

Panel facilitated by Kevin Baker, Aon –NIBA Vic/Tas Divisional Committee Chair.

2023 NIBA QLD YP SEMINAR: EFFECTIVE NETWORKING STRATEGIES

WHERE: Captain's Room, 1 Greg Chappell Street, Albion, Qld 4010

WHEN: Tuesday 2 May 2023

Business success isn’t solely about the products or services you offer, it’s also

about the relationships you build with others. People do business with people they like, and that's why networking has become an essential skill for career progression and ongoing success in today's competitive market.

To build on your professional confidence and credibility, you need to learn how to network effectively and develop key alliances. In an interactive and enjoyable presentation facilitated by Nikki Heald, Director of Corptraining, you'll learn how to:

• Define networking and its true purpose

• Generate conversation and small talk

• Implement correct networking etiquette

• Beyond the business card – how to nurture key alliances

• Understand the value of internal and external networks.

Afterwards, you'll have the opportunity to put your new knowledge into practice by networking with fellow attendees over drinks and nibbles.

By doing so, you'll be able to build your confidence and credibility, which will help you to develop valuable business relationships and achieve ongoing success in your career.

10 / INSURANCE ADVISER APRIL 2023 NIBA / Events

STAY UPDATED! Check out what’s happening close to you and register via the events calendar at niba.com.au/ events

2023 NIBA / UAC MELBOURNE

UNDERWRITING EXPO

WHERE: The Palladium, Melbourne

WHEN: Friday 19 May 2023

Looking to stay ahead of the curve in the ever-evolving world of insurance? Join us in the Palladium at Crown Melbourne for the annual 2023 NIBA/UAC Melbourne Underwriting Expo.

Discover the latest products and services from a range of underwriters and explore new opportunities to grow your business.

Are you a member of UAC and interested in exhibiting? Register today to showcase your people and capabilities while connecting with important local decision-makers and creating new business leads.

2023 NIBA VIC GALA LUNCH

WHERE: Crown Aviary, Melbourne

WHEN: Friday 19 May 2023

Registrations are now open for the 2023 NIBA Vic Gala Lunch on Friday 19 May at Crown Melbourne.

Connect with industry peers over a two-course plated lunch and hear from Dr Dan Pronk, The Combat Doctor, as he shares his inspiring story of battlefield medicine and resilience.

The event also celebrates the very best in Victorian and Tasmanian broking and will see the announcement of the QBE-sponsored Vic/ Tas Broker of the Year, and the Vero-sponsored Vic/Tas Young Broker of the Year state winners.

This event is a sell-out every year, so be sure to secure your tickets early.

2023 NIBA NSW GALA LUNCH

WHERE: The Fullerton, Sydney WHEN: Wednesday 12 July 2023

2023 NIBA WA GALA LUNCH

WHERE: Crown Perth WHEN: Friday 14 July 2023

2023 NIBA QLD GALA LUNCH

WHERE: Convention & Exhibition Centre, Brisbane WHEN: Wednesday 19 July 2023

2023 NIBA CONVENTION

WHERE: The Star, Gold Coast

WHEN: Sunday 8 October to Tuesday 10 October 2023

2023 NIBA SA GALA LUNCH

WHERE: SkyCity, Adelaide

WHEN: Friday 21 July 2023

UAC EXPO –

9 AUGUST 2023

SAVE

THE DATES

UAC Norwest Sydney Underwriting Expo

14 SEPTEMBER 2023

UAC Adelaide Underwriting Expo

18 OCTOBER 2023

UAC Wollongong Underwriting Expo

15 NOVEMBER 2023

NIBA UAC WA Underwriting Expo

More information is available on the UAC website, www.uac.org.au/events/

NIBA.COM.AU / 11 Events / NIBA

WELCOME TO THE STAGE …

On 8-10 October, the industry is descending on the Gold Coast for the 2023 NIBA Convention. We’re focused on ‘thinking differently’ this year, and we’ve enlisted a number of exceptional people to help us do just that over the course of the three days. Here are a handful of the people you can look forward to hearing from, and meeting, at The Star later this year.

Sam’s a sports broadcasting pro, and her award-winning work spans print, television, podcasts, and radio. She spent 13 years writing for Melbourne’s The Age and Sunday Age, and The Sydney Morning Herald newspapers, and in that time reported from three Olympic Games.

She has also reported from the men’s Tour de France and the landmark first women’s Tour de France, in print, on radio and ABC television, and has also covered men’s AFL on Channels Seven and Ten for more than 15 years.

She was part of Seven’s recordbreaking broadcast of the 2018 Commonwealth Games, a panellist on Channel Ten’s Before the Game for 10 years, has covered every season of AFLW since its inception in 2017, hosts a weekly ABC podcast, and has featured in the ABC’s Agony Aunts series.

In 2018, Sam published her first book, Roar, which is the definitive account of the birth of the Australian

Football League’s elite competition for women, and is formally endorsed by Australia’s first woman Prime Minister Julia Gillard.

That topic has been the subject of numerous keynote presentations for Sam – including one at the Australian Embassy in Paris.

Sam’s won a raft of journalism awards, including two Melbourne Press Club Quills, a Walkley, the AFL Players’ Association and AFL Coaches Association media prizes, and an Australian Sports Commission media award.

Throughout 2022, she co-hosted the Australian national speaking tour of basketball legend Luc Longley in soldout shows, and moderated live events with Australian of the Year Adam Goodes in 2019.

Throughout Sam’s career, she’s never been afraid to ‘think differently’ about sport – and we’re delighted that she’ll be hosting our 2023 NIBA Convention.

12 / INSURANCE ADVISER APRIL 2023 2023 NIBA CONVENTION / Welcome to the Stage….

INTRODUCING OUR MASTER OF CEREMONIES…

Sam Lane

OUR OPENING SPEAKER… DR Jordan Nguyen

If you’re looking for someone to inspire you to ‘think differently’ then this is your man. Dr Jordan Nguyen is the Founder and CEO of Psykinetic, a social business creating futuristic, inclusive and empowering technologies to improve independence and quality of life for people living with disability, in aged care and beyond.

Jordan designs life-changing technologies to transform lives and the business is committed to bringing positive, sustainable and life-altering change.

Together with his team, Jordan has successfully created a mind-controlled wheelchair, numerous virtual and augmented reality applications, inclusive gaming, an instrument that enabled a friend with cerebral palsy to perform live music with her eye movements and blinks, and devices that make it possible to control household appliances

or even drive cars using only the tiny electrical signals created from eye movements.

As well as creating and making some incredible ideas a reality, Jordan has also written A Human's Guide to the Future, and is an award-winning documentary maker and presenter.

In 2016, he collaborated with the Australian-based production company, The Feds, and the ABC Catalyst to create and present his first TV documentary, Becoming Superhuman, which went on to win many prestigious awards both locally and internationally.

His work is regularly featured in the media, and he has since gone on to present a second ABC Catalyst documentary, Meet The Avatars, exploring the impacts of virtual reality – including creating virtual interactive avatars to preserve memories of loved ones.

He has also presented numerous documentaries with Discovery Channel and National Geographic – including Frontiers of Science, Smart China Start up Revolution, Vietnam: Connecting East Africa, and Tibet: Living on the Roof of the World. He recently founded his own media company and aims to continue creating world-changing content on the intersection between technology and humanity.

Jordan is committed to improving as many lives as possible, and becoming a driving force behind both human and technological evolution as we move into the future.

In November 2022, the Dr Jordan Nguyen Innovation Centre at Baulkham Hills North Public School was officially opened – named by the school’s students. Jordan was a finalist for NSW in Australian of the Year in 2017, and a finalist in the AmCham (American Chamber of Commerce) awards for Artificial Intelligence.

He was named in the six Harper's BAZAAR’s Visionary Men of 2019, has made the list of Australia’s Most Innovative Engineers by Engineers Australia’s Create magazine, was named twice in Onalytica’s Top 100 Global Influencers on Virtual Reality, travelled on a Think Inc tour with Steve Wozniak and won the Australian Computer Society’s (ACS) ‘ICT Professional of the Year’ Digital Disruptors’ Award.

As well as that, he’s also had the honour of being MC for An Evening With President Barack Obama, on Obama’s last visit to Sydney.

If that’s not an impressive CV, we don’t know what is!

In October, Jordan will speak at the NIBA Convention about his career, and the importance of ‘thinking differently’.

This is certainly one that you simply cannot miss.

NIBA.COM.AU / 13 2023 NIBA CONVENTION / Welcome to the Stage….

NIBA CONVENTION / Welcome to the Stage….

determining factor in the success we enjoy over the coming decade. And Dr Bronwyn King AO is someone who is well-accustomed to challenging the norm and asking those difficult questions.

That talk was eight years in the making, after she discovered, in 2010, that she was inadvertently investing her super in tobacco companies through one of her superannuation’s default options.

OUR PLENARY SPEAKER…

Dr Bronwyn King AO

Thinking differently about how we do business – and the work our businesses do – is going to be a

A radiation oncologist by trade, Dr King is a social entrepreneur, movement maker and a globally renowned humanitarian on a mission to inspire and transform organisations into purpose-driven businesses. She has worked with everyone from the terminally ill to the fittest athletes in the Australian Swim Team, and her engagement across the global corporate, finance, health and diplomatic sectors has provided unique insights into universal power structures, how to build trust, harness influence and sidestep ‘the impossible’.

Her 2018 TEDxSydney talk, ‘You May Be Accidentally Investing in Cigarette Companies’ has been viewed more than three million times.

As a result, she founded Tobacco Free Portfolios, and took her place on the stage at the United Nations in New York to launch The Tobacco-Free Finance Pledge, a global initiative she led, which now has more than 200 signatories – global financial institutions with combined assets under management of more than AUD $25 trillion.

This is a plenary session you’ll remember for a long, long time. As a speaker, Dr King is exceptional – her presentations are uplifting and engaging, with a focus on business outcomes and practical takeaways for every audience member. And for brokers, there’s a tangible inspiration to gain from understanding her alignment to cause – and the impact that consequently can make.

Our closing session of the 2023 NIBA Convention will be brought to you by Gus Balbontin – someone who’s created a career, or, more accurately, a life, by thinking very differently indeed.

Born and bred in wild Patagonia, Gus Balbontin never allowed his small town and humble beginnings to get in the way of his dreams. He had –still has! – a healthy disrespect for authority and a severe case of FOMO – and this saw him arrive in Australia at just 17.

By the age of 22, he had dropped out of uni, hitchhiked to South America, set up his first business and landed his dream job at Lonely Planet.

Fast forward just a few more years, and he was leading the company globally, working with businesses such as Google X, Nokia and Amazon on the latest technology, creative cultures and high-performing teams.

However, his yearning for more saw him move on from corporate life, so he hung up his boots as the Executive Director and CTO of Lonely Planet and moved back to his entrepreneurial roots, becoming an investor, founder and mentor across the start-up ecosystem in Melbourne. He loves sharing stories that make an impact on people’s lives and businesses, and over the last three years, he has presented to audiences across regional Australia, New Zealand, North America, Europe, South America and Asia. His session will leave you inspired –his simplicity disarms you, his energy infects you, and his counterintuitive way of looking at the world will motivate you to do things differently.

And, from the Convention’s closing session, what more could you possibly want?

Balbontin

OUR CLOSING SPEAKER Gus

14 / INSURANCE ADVISER APRIL 2023 2023

8-10 OCTOBER 2023

REGISTER NOW!

Be quick to secure your full NIBA Member Convention registration ticket at the super early bird price of $990. That’s a $380 saving off the standard price. Group tickets of eight or more delegates are available. Conditions apply.

Think Differently

Reimagine:

THE STAR, GOLD

Proudly sponsored by Register at: www.2023nibaconvention.com.au/registration SUPER EARLY BIRD PRICES APPLY UNTIL 5 JUNE

COAST

WE ARE YOUR VOICE!

The following is an overview of some of the things NIBA has been examining on behalf of members.

TASMANIAN HOME WARRANTY SCHEME

Late last year, the Tasmanian Government released the draft Residential Building (Home Warranty Insurance Amendments) Bill 2022 for stakeholder and public consultation. If passed, the Bill will reintroduce a home warranty scheme for Tasmania.

Similar to home warranty schemes in other mainland states, the scheme will provide Tasmanian homeowners with protection against incomplete or defective building work in the event their builder dies, disappears, or become insolvent. NIBA has reviewed the draft Bill and indicated its support for the Bill in its current form.

AUSTRALIAN FINANCIAL COMPLAINTS AUTHORITY

The Australian Financial Complaints Authority (AFCA) has announced it will undertake public consultation on proposed changes to its official rules and operational guidelines. The proposed changes are largely designed to implement recommendations of the Treasury-led Independent Review of AFCA.

Consistent with the recommendations of the Review, the proposed changes do not seek to increase AFCA’s jurisdiction or the monetary limits, of the AFCA Scheme. AFCA proposes changes to its Rules and Operational Guidelines in the following general areas:

1. Excluding complaints lodged by professional or sophisticated investors unless exceptions apply.

2. Ensuring complaints do not progress to case management or decision status where an appropriate offer of settlement has already been made.

3. Excluding complaints that share the same subject matter and content as a previously discontinued complaint.

4. Enabling determinations to be corrected or reissued where a clerical error or mistake has been made.

5. Enabling AFCA to not consider complaints lodged by a “paid representative” where they do not hold an ACL/AFSL or are not acting in the client’s best interests, and where appropriate, exclude them from lodging future complaints for up to 12 months.

6. Excluding complaints who submit multiple complaints that are closed or discontinued by AFCA.

7. Discontinuing complaints because of unreasonable and inappropriate conduct including bullying, harassment, intimidation and abuse.

8. Enabling AFCA to discontinue a complaint where the complainant has not suffered any loss.

9. Minor changes to definitions and language to update certain areas of the Rules arising from legislative change, to provide greater clarity and transparency of the scheme’s operation overall.

NSW EMERGENCY SERVICES LEVY

The recent New South Wales election and change of government will provide a new opportunity for NIBA to continue advocating for the abolition of the

Emergency Services Levy. Prior to the election, the Insurance Council of Australia (ICA) launched an advertising campaign, encouraging the incoming government to “find a fairer way” to fund the NSW Fire and Emergency Services. At the time, NIBA expressed its support for the campaign and committed to working with the successful government to find an alternative funding model. The levy was almost abolished in 2017 by the Berejiklian Liberal Government but was deferred at the last minute due to concerns that the reform would increase costs for some businesses.

NIBA has previously advocated for the abolition of the levy including meeting with the Minister responsible for the levy and providing submissions to numerous government inquiries. NIBA looks forward to working with the new Labor Government to improve insurance affordability and community resilience and will continue to advocate for the removal of the ESL as a priority.

CONTACT NIBA

As always, brokers who have questions about these or any other government or regulatory matters should feel free to contact NIBA CEO Philip Kewin at: pkewin@niba.com.au

16 / INSURANCE ADVISER APRIL 2023 NIBA / Representation

The NEXT generation

Cloud software solutions for insurance intermediaries by EBIX, Australia’s #1 InsurTech provider

WinBEAT is Australia’s most popular broking system solution designed specifically for General Insurance Intermediaries.

After 4 years of development, we are happy to introduce WinBEAT NEXT: A browser-based software program designed specifically for General Insurance Intermediaries.

WinBEAT NEXT combines a state-of-the-art software environment with a feature-rich processing environment.

You no longer have to rely on your IT provider to perform upgrades or updates. The Ebix Australia team takes care of everything. Register your interest for WinBEAT NEXT via the link below.

ebix.com.au/winbeatnext2023

Data security and integrity

Available online 24/7

Over 50 new features

NIBA.COM.AU / 17

GLOBAL REGULATORY CHANGES A KEY TOPIC AT WFII

NIBA President Gary Okely, NIBA

Immediate Past President Diane Phelan and NIBA CEO Phil Kewin attended the annual meeting of the World Federation of Insurance Intermediaries (WFII) in Singapore in early March.

WFII is a gathering of insurance broking associations and senior broking members from the United Kingdom, Europe, South Africa, North and South America and the Asia Pacific Region.

The meeting discussed major issues and challenges facing insurance brokers around the world, including the difficult market, insurance for natural disasters, impacts of technological change and the challenge of attracting and retaining sufficient talent.

Dianne Phelan, NIBA Immediate Past President said “It was interesting to see how the regulatory world has changed since June 2022. At the last meeting, we presented to the group on the Quality of Advice review and the introduction of the new Code of Practice”.

“The importance of continuing a journey of self-regulation by transparency of

remuneration and our terms of engagement were a focus and largely dismissed as not relevant. At the time, most other Countries were of the opinion that commissions would never be a topic of discussion, but these same Countries are now faced with suggested regulatory change to introduce a ban on commission”, she added.

NIBA CEO Phil Kewin was asked to present an update on the status of the Quality of Advice review and NIBA's proactive approach to self-regulation, which is now seen as a pointer for other countries facing similar regulatory reform.

WFII also sets the agenda for discussions with industry regulators and met with representatives from the International Association of Insurance Supervisors (IAIS) which is the international standards setting body of the insurance sector and the OECD which actively examines insurance issues and challenges via its Insurance and Private Pensions Committee. We are part of the OECD and the Australian regulator, ASIC, like all regulators in developed markets are members of IAIS, so the importance

of broking associations coming together is extremely important.

“It provides the opportunity to be at the forefront of changes that might not be affecting broking in Australia now, but may be part of the strategy for the future”, Phelan added.

“The use of AI was another focus. It is something we discussed at length during the broker strategy review that the Board completed in 2020. This is an area where successful brokers will be focusing their time – using AI to provide efficiency and knowledge gaps to their people’’, she added.

NIBA CEO Philip Kewin said “it is amazing how similar the issues are around the world, from accessibility and affordability of insurance, to bringing new talent into the profession. ESG is top of mind in Europe, whereas in other markets it is an emerging topic. The world is shrinking, so it has become not so much an issue of whether or not something occurs in one market versus another, but more so sharing and collectively benefiting from the various examples.

18 / INSURANCE ADVISER APRIL 2023 PROFESSIONALISM / Industry Bulletin

Lisa’s Kangaroo Retreat rescues, rehabilitates and releases wildlife, including injured and orphaned joeys, kangaroos, wallabies and possums in the Port Headland region of Western Australia.

Just one of the fabulous Not for Profit organisations that we have been able to assist with funds from our annual Small Grants Program.

Insuring Not for Profits - it’s all we do

2021 2020 2019 2018 2017 2016

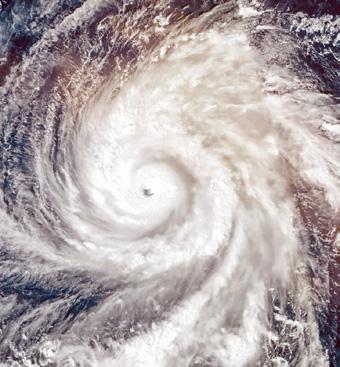

CYCLONE REINSURANCE POOL INQUIRY REPORT RELEASED

The Federal Government has released its first report into the Inquiry into the Cyclone Reinsurance Pool.

The report comes after the Hon Stephen Jones MP, Assistant Treasurer and Minister for Financial Services referred an inquiry into the operation and implementation of the Cyclone Reinsurance Pool to the Joint Select Committee on Northern Australia in October 2022.

The Joint Select Committee on Northern Australia is responsible for the scrutiny and oversight of the work of executive government related to Northern Australia.

The Committee’s interest in conducting an inquiry into the pool arose because of concerns about:

• the implementation of the pool to date;

• the reasons for a slow initial take up of the pool by insurers;

• why the pool appears to not yet have reduced insurance premiums for many consumers despite this being its key objective; and relatedly

• community expectations about the extent and timeframe of the anticipated premium reductions.

The report outlines seven main recommendations.

A copy of the report is available at Inquiry into the Cyclone Reinsurance Pool –Parliament of Australia (aph.gov.au).

NIBA WELCOMES NEW NSW LABOR GOVERNMENT

NIBA welcomes the new Minns Labor Government and congratulates them on the NSW election win.

NIBA looks forward to continuing to work wh the NSW Government to remove the Emergency Services Levy (ESL) from insurance premiums and look at alternative solutions for funding.

As many members would know, the ESL is a tax applied to insurance, adding about 18 per cent to home insurance premiums and up to 40 per cent to business premiums in the State.

Removing the ESL from insurance would result in a drop in premiums, reducing cost of living pressures on NSW families.

Given the growing impact of extreme weather events across the State, the urgency of removing the ESL is paramount.

During the election campaign, the Insurance Council of Australian (ICA) released ‘A Stronger NSW’, which outlined nine policy

recommendations for the next NSW Government to put downward pressure on the cost of insurance.

The report called on the NSW Government to find a fairer way to

fund emergency services and bring NSW in line with every other mainland state and territories in Australia. NIBA will keep members updated on the ESL.

20 / INSURANCE ADVISER APRIL 2023 PROFESSIONALISM / Industry Bulletin

ECONOMIC CONCERNS INFLUENCE BUSINESS INSURANCE DECISIONS FOR SMES

The 2023 Vero SME Insurance Index report has revealed that 47% of businesses surveyed are making changes to their business insurance as a result of economic concerns. See the report and webinar for details.

The recently released 2023 Vero SME Insurance Index report has revealed that 47% of 1,750 Australian businesses surveyed are making changes to their business insurance as a result of economic concerns.

The report outlines that economic pressures combined with price perceptions of brokers could see Australian businesses making decisions about their insurance in a bid to curb expenses, that could ultimately cost them more.

The independent research commissioned by Vero, also highlighted the following findings:

• Client satisfaction with brokers remains remarkably high After a huge uptick in 2022, broker satisfaction remained high at 78%, which was reflected across all business sizes from micro to large sized businesses.

• Direct buyers increasingly considering using a broker 62% of respondents said that they would consider using a broker, a significant increase from 50% in 2022, while direct users saying they would not consider using a broker down from 27% to 20%.

• Broker clients had greater satisfaction with their claims experience

This year 68% of broker clients who made a claim say that they were satisfied with the experience,

compared to only 48% of direct clients, which is a similar result to last year.

• Risk of underinsurance

Many businesses may be at risk of underinsurance without adequate broker engagement. 61% of businesses are planning changes to their business in the next year, but 41% admit insurance is the last thing they consider when making the changes.

• Cost of engaging a broker Price perceptions continue to hinder direct buyers making the switch, with more than one third (36%) believing it would be more expensive to go through a broker –up from 25% in 2019.

THE VALUE OF A BROKER HAS NEVER BEEN MORE IMPORTANT

Vero’s Head of Distribution, Anthony Pagano said the report reinforced that the value of broker expertise has never been more important, but it is critical brokers engage with their clients to be seen as a trusted insurance and risk advisor, not another cost to be managed.

“The report clearly shows that Australian Businesses are looking for

ways to manage the pressure of the economic conditions. But making uninformed decisions about their insurance, or even making changes to their business without thinking about the insurance implications, may put themselves at risk,” Mr Pagano said.

“The research has shown what we already know - that this is a huge opportunity for brokers to demonstrate their value through proactive engagement and offering expertise. We know times are tough, and small businesses may find themselves without the coverage they believe they have, because they did not fully understand the consequential impacts or go it alone.

“Particularly when it comes to renewals, for brokers to take the time and truly understand the business operations and aspirations of their clients and understand what if any changes need to be reflected in the policy. It’s staggering to learn that almost a third of clients aren’t considering any changes at renewal time, when we know most of them will have made some changes and/ or be exposed to emerging insurable risks and even those who haven’t in this inflationary time may find their cover no longer sufficient.”

For full details on the research findings, refer to the 2023 Vero SME Insurance Index Report (www.vero.com.au/broker/news-insights/sme-insurance-index.html ) and supporting webinar at (www.vero.com.au/broker/news-insights/sme-insurance-index/vero-sme-insurance-index-2023-webinar.html )

22 / INSURANCE ADVISER APRIL 2023 PROFESSIONALISM / Industry Bulletin

ICA has requested that funding for the Disaster Ready Fund (DRF) be extended past the five-year budgeted commitment to a 10-year rolling program to better protect communities from the impact of extreme weather conditions.

The ICA welcomed the establishment of the DRF in the October budget. The DRF provides up to $200 million annually to be invested in disaster mitigation for five years from next financial year.

However, given the impacts of recent extreme weather events and the ongoing threat of climate change, the ICA is calling for this funding to be extended to a 10-year rolling program.

An ongoing DRF would ensure that Australians receive the benefits of resilience and mitigation investment for years to come and allow governments and communities to plan for long-term

projects that put downward pressure on insurance premiums.

To ensure the funding does not fall short in real terms because of rising inflation, the ICA is also calling on the Government

ICA SEEKS 10-YEAR ROLLING DISASTER RESILIENCE FUNDING PROGRAM DISASTER FUNDING AVAILABLE FOLLOWING NSW BUSHFIRES

to index DRF funding. A 10-year indexed program would cost the budget about $2.5 billion over the medium term, $1 billion less than the cost of disaster recovery payments and allowances in 2022 alone.

Disaster assistance is now available for councils and residents in Bathurst, Bogan, Brewarrina, Coonamble, Dubbo, Mid-Western, Walgett and Warren following severe bushfires earlier this month.

Assistance is being provided through the jointly funded CommonwealthState Disaster Recovery Funding Arrangements (DRFA).

Federal Minister for Emergency Management, Murray Watt, said the bush fires across Central and Central West NSW have impacted more than 40,000 hectares of mostly isolated farmland, destroyed properties and hundreds of livestock.

New South Wales Minister for Emergency Services and Resilience, Steph Cooke, said the assistance will support councils, property owners, farmers and primary producers to cleanup and recover from the bush fires.

“Recent bush fires have had a devastating impact on a number of communities across New South Wales, which is why it is so important that we help residents get their lives back on track and councils make crucial repairs to public assets,” Minister Cooke said.

“The NSW and Australian governments are working together to assist these eight council areas through the recovery process, with

additional areas expected to be disaster declared shortly following more recent fires.”

Assistance available under the DRFA may include:

• Help for eligible people whose homes or belongings have been damaged (eligibility criteria apply).

• Freight subsidies for primary producers.

• Concessional interest rate loans for small businesses, primary producers, and non-profit organisations.

• Support for affected local councils to help with the costs of cleaning up and restoring damaged essential public assets.

NIBA.COM.AU / 23 PROFESSIONALISM / Industry Bulletin

For information on personal hardship and distress assistance, contact Service NSW on 13 77 88 or visit www.nsw.gov.au

www.ica.com.au

Further details are available on the ICA website:

CONSULTATION BEGINS FOR AFCA PROPOSED RULE CHANGES

AFCA has opened consultation on proposed changes to the rules that govern its work helping consumers and financial firms to resolve complaints.

The Australian Financial Complaints Authority is opening public consultation on proposed changes to the rules that govern its work helping consumers and financial firms to resolve complaints.

The proposed changes to its official Rules, and associated amendments to its Operational Guidelines, are largely designed to implement recommendations of the Treasury-led Independent Review of AFCA.

“AFCA has a significant three-year program of work underway to implement the Independent Review recommendations,” Deputy Chief Ombudsman Dr June Smith said. “Our proposed Rules and Operational Guidelines changes are an important component of that program.

“The aim is to ensure AFCA continues to deliver fair, independent, efficient and effective solutions for financial disputes,” Dr Smith said.

SUMMARY OF PROPOSED CHANGES

AFCA proposes changes to its Rules and Operational Guidelines in the following general areas, to address the Independent Review Report recommendations:

1. The management of unreasonable and inappropriate conduct within the scheme, to strengthen AFCA’s ability to deliver procedural fairness under Recommendation 2, to manage the conduct of fee paid representatives who engage with the scheme under Recommendation 4, and to build greater efficiency and timeliness in complaint handling in response to Recommendation 5.

2. Dealing with complaints where an appropriate offer of settlement has been made or where issues in dispute have been previously settled. These changes respond to Recommendations 1, 2, 5 and 7 to ensure only unresolved issues in dispute are progressed and that matters do not progress to case management or decision status where appropriate offers of settlement have already been made.

3. Excluding complaints lodged by professional or sophisticated investors unless exceptions apply, as required by Recommendation 6.

4. To enhance the visibility, accessibility and performance of the Forward Looking Review mechanism, under Recommendation 9.

5. Clarity about the effect of AFCA determinations and how the slip rule works to ensure greater transparency and understanding of AFCA’s decision making under Recommendation

2. This is designed to ensure that complaints are finalised in a more timely and efficient manner under Recommendation 5.

6. Minor changes to definitions and language to update certain areas of the Rules arising from legislative change, to give greater clarity and transparency of the scheme’s operation overall.

The AFCA rules and Operating Guidelines are available at AFCA Rules and Guidelines | Australian Financial Complaints Authority. Consultation on the proposed changes close on 22 May.

24 / INSURANCE ADVISER APRIL 2023 PROFESSIONALISM / Industry Bulletin

IBCCC RELEASES ITS ANNUAL DATA REPORT, WITH DATA BREACH REPORTING UNDER THE SCANNER

The Insurance Brokers Code Compliance Committee (IBCCC) launched its Annual Data Report in early April, highlighting important findings around data breach reporting that the industry should take note of.

The report, which analyses findings from data provided by insurance brokers who subscribe to the Insurance Brokers Code of Practice, found that more than half of subscribers self-reported no code breaches in 2021. According to Oscar Shub, Chair of IBCCC, this should be taken with a grain of salt.

“While reporting zero breaches of the Code may sound impressive, it does not necessarily mean a subscriber is doing well,” he said.

“It generally means that there are deficiencies in the processes and systems used to monitor compliance. We know that breaches will occur from time to time, even with the best compliance frameworks in place. So, reporting no breaches does not reflect perfection as much as it reflects

poor monitoring and a failure to embrace a culture of reporting.”

While more can be done when it comes to reporting data breaches, the report also includes some key insights that show that the industry is undergoing a cultural shift and is currently in a transition period. Self-reported breaches were higher in 2021 when compared to the previous year, with 48% of subscribers self-reporting breaches as opposed to 44% in the year prior.

Philip Kewin, NIBA CEO considers these to be welcome signs in moving the needle towards adopting a culture of reporting for the industry.

“We still have a way to go in terms of breach reporting,” he said. “While we are heading in the right direction, I believe the new Insurance Brokers Code of Practice which came into effect last year, will enable subscribers to more readily identify breaches given the clearer wording.”

Mr Kewin also emphasised the positive outcomes for those who have already gone through this cultural shift and transition.

“Importantly, those who are embracing the process are learning from doing so and are improving their processes and systems to enhance their client outcomes,” he said. The report recognised some common themes when looking at the most important reasons for the breaches taking place. There were three common themes, including:

• lateness in issuing policy renewal notices to clients

• lack of clear communication and poor record keeping

• brokers being unaware that their actions were an actual or perceived conflict of interest.

The report offers an invaluable 12-month snapshot of the industry, with key findings shedding a light on where the industry has performed well and where it could do better, especially from a compliance perspective.

You can read the full Annual Data Report from the Insurance Brokers Compliance Committee’s website, www.insurancebrokerscode.com.au.

NIBA.COM.AU / 25 PROFESSIONALISM / Industry Bulletin

GETTING MORE SOCIAL IN 2023

BY NICK HILL Director of Hillster Marketing

The digital world continues to develop at a blistering pace. A difference from previous years, especially in certain States, is the resurgence of ‘in real life’ meetings and events. This hasn’t altered the continual development of digital technologies but adds more opportunities for brokers to communicate with clients and prospects.

So, whether now is the time to finally give your social profiles a boost, or you’ve been producing consistent content but in need of some inspiration, here are five tips to help you kick goals for the rest of the year.

1. How are your basics?

Are you focusing on the right channels, e.g., LinkedIn for specific industries and larger organisations or Facebook and Instagram for smaller, family businesses in specific geographical areas. Do you have a good size following? If not, focus on growing one and make sure your profile is up to date and something you are proud of.

2. Your offline (aka real life) activities are great for engaging people in social media

Brokers are well known for being active members of their local communities in so many ways. Promoting these, and importantly tagging people in your posts, will greatly extend the reach of your activities.

3. Take advantage of time-saving software

Services like Hootsuite or Buffer can help you schedule social posts across multiple platforms, making posting easier, quicker and more centralised. Just watch out for some posting software’s abilities to post to LinkedIn (and tag people in posts).

4. Feeling adventurous?

Give ChatGPT or other AI products a go. Their content may not be perfect but even just getting them to suggest a topic list for blog posts can help you boost the number of useful posts you publish.

5. The bottom line is still the bottom line Don’t forget to measure what you do and invest your resources in the most effective places – this won’t be just digital. All marketing, in fact all business activities, should help your business progress and develop. While it can be tempting to think social media activities have failed if you’ve not sold a policy after a couple of posts, remember it is a long ball game and is an investment in your brand and profile.

Lastly, social media can be overwhelming, especially when you have a mountain of other business tasks to deal with. Investing some time and resources in a manageable action plan, that is integrated with your broader online and offline activity will make activity more effective and make your life easier too.

NEED A HAND?

Nick is offering a free 30 minute social media diagnostic session for all insurance industry organisations. Nick can be contacted on 0419 371 018 or email nick@hillster.com.au.

26 / INSURANCE ADVISER APRIL 2023 PROFESSIONALISM / Getting more social in 2023

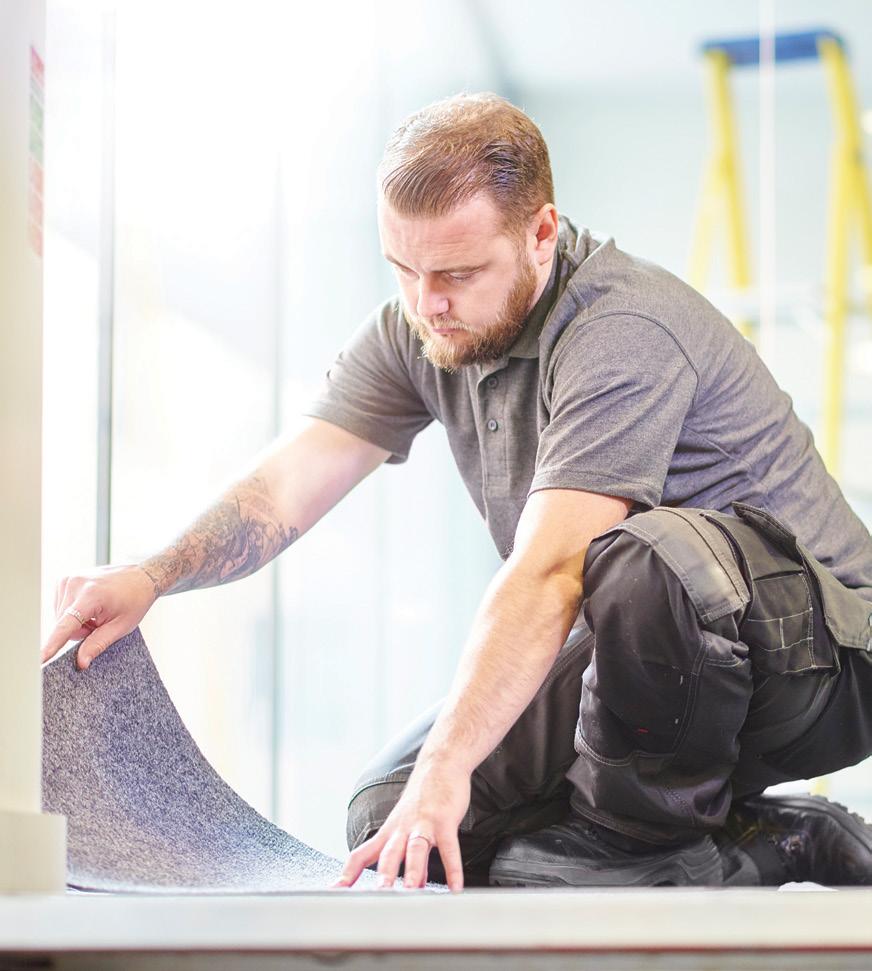

The true business of broking

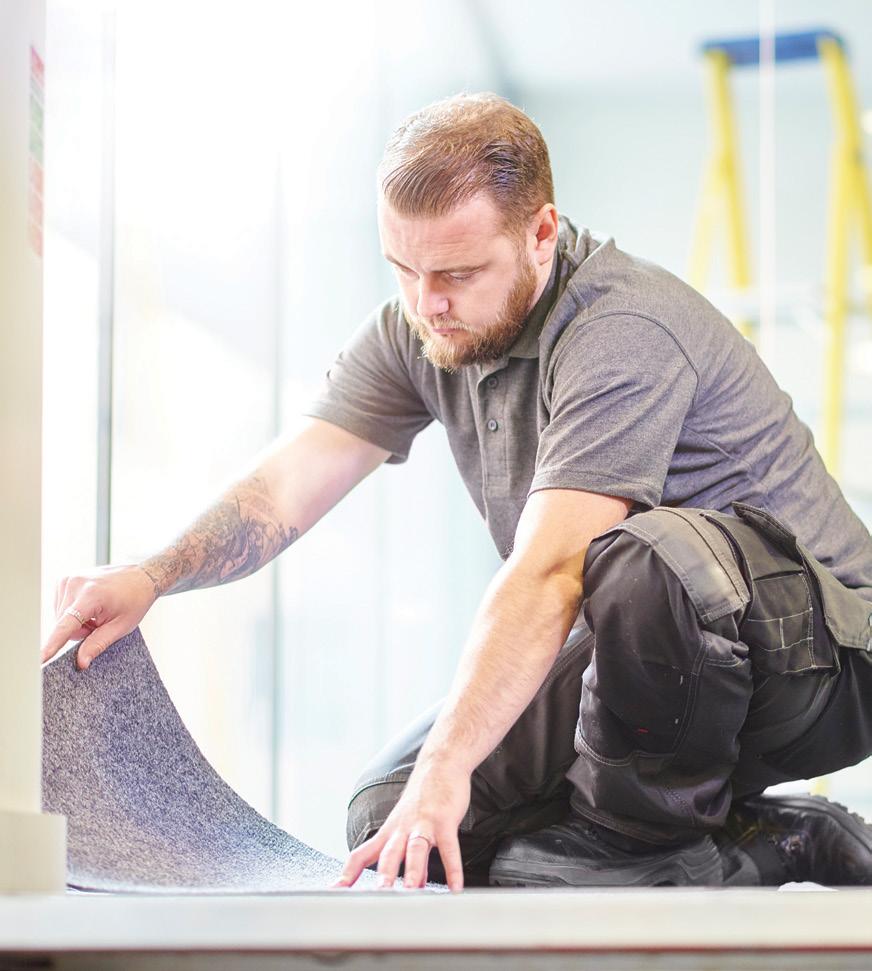

The flood disasters in northern New South Wales and southern Queensland devastated communities. Thankfully, brokers were there to play a role in speeding up the recovery. Insurance Adviser spoke with Wendy Keeling of BMS Coast to Coast in Burleigh Heads to discover the lengths she and the team went to, to help the local community begin to get back on its feet.

COMMUNITY / The True Business of Broking NIBA.COM.AU / 27

It’s a well-worn saying in the industry – you only get to understand the true value of a broker when it’s time to make a claim. And for many on the north-eastern coast of NSW and southern Queensland, that notion’s been well and truly put to the test over the past couple of years.

While placing a policy can bring challenges for brokers, managing claims and – equally importantly – managing clients during that claims process, is when the true value of working with a broker really comes to the fore.

Wendy Keeling knows this only too well. The Claims and Office Manager of BMS Coast to Coast in Burleigh Heads, Queensland, was only a day into her new role when the rain started to fall, so she immediately got into the car and ended up spending the best part of three months on the ground helping people, clients and non-clients alike, get their claims in.

“We were out every single day,” explains Keeling, who prior to joining Dale Hansen’s BMS Coast to Coast worked in loss adjusting.

“We had a car laden up with food and water and dog food and basically drove around seeing our clients who were cut off. Supermarkets were empty, and we were walking into premises of family-owned businesses that didn’t know if they’d ever get back up and running again.”

Of course, it wasn’t the first time flooding had hit the regions and Keeling says the sense of despondency was palpable, particularly among those who’d been through the last flood, and had rebuilt everything to a higher level, and still suffered.

“That brought home very, very quickly to me just how big this catastrophe was – not in geographical terms, but in the emotional sense.

“This was bigger than anything I’ve ever experienced. I’ve been involved in the response to Cyclone Debbie, and I’ve done the Townsville floods, but this was different.

“Going out as a broker, to your own clients, seeing them so desperate, not knowing if they were going to survive, is a very humbling experience.”

A warm smile and a big hug

The response of Wendy and the team at BMS Coast to Coast was a shining example of all that’s good about insurance, and illustrated perfectly the way brokers can help the communities they’re part of. Wendy says seeing a friendly face and receiving a warm hug genuinely does make a difference – and the scenes she witnessed motivated her and the team to help as much as they possibly could.

“After seeing the trouble people were in, I came back with the attitude that we needed to do something different, and that we should be really looking at this catastrophe in a different light.

“We contacted every single client within 48 hours. I just took all of our brokers and assistants off all the work they were doing and they rang every single client just to make that personal call, see how they were, lodging every single claim that we could straight away through our in-house claims team.

“I then personally appointed restorers and builders, using my networks, to some of those clients that I knew needed them the most.”

Having someone on your side

Wendy’s a great believer in the relational side of insurance – those relationships make all of the difference, particularly when it comes to claims, and over the months that followed she dedicated herself to getting claims paid.

“I personally have attended almost every single hydrology appointment, pointed out every stormwater drain, and I’ve overturned countless decisions that have initially told us it was flood, when in reality it wasn’t the proximate cause of the damage.

“We’ve also done so much personal stuff. I’ve moved people in my car into temporary accommodation because a taxi wasn’t covered. I got five members of the team here to go around to a lady’s house, and we moved all of her boxes into the house for her. I wanted to do that because I wanted the staff to see that these are real people – they’re not just policyholders or statistics.”

The extent to which Wendy has helped some of the most vulnerable members of the community reinforces the dedication she and the BMS Coast to Coast team has.

“One of my clients, who is the one that touched my heart more than any – and I visit her every couple of months – has severe stress, anxiety, PTSD and all different sorts of medical conditions.

“I would go see her regularly, and the claim just went from bad to worse – we even got to a point where the tiler had gone in and laid the wrong colour tiles.

“I put her in the car and we went and purchased new ones so I could take them back to get the tiler to pull them up there and then because I knew there would be a delay if we didn’t do it immediately. I bought her an air conditioning unit with our money because she didn’t have one in her temporary accommodation and just basically had to hold her hand through every single Loss Adjuster appointment every single builder appointment.”

Being on the ground has made a huge difference from a community perspective, and investing that much into the community has naturally attracted enquiries from others asking how BMS Coast to Coast can help, to the extent that the business has been managing claims on policies they didn’t even write –purely because it’s the right thing to do.

The need for change

A major topic that’s been highlighted by this disaster, says Wendy, is the definition of a vulnerable person.

“I’ve helped a number of vulnerable clients. Some with PTSD, one who tried to commit suicide last year. People have had strokes. And all the industry says we need to do is identify vulnerable people and that’s it – it stops, and there’s no guidance for insurers about what to do from there. If we’re lucky, there’s a little marker on the system to say a person’s vulnerable, and that’s it.

“I’m attending all sorts of meetings, I’m speaking with NIBA and the ICA to help the industry identify and categorise what vulnerable is, so we can collectively better help people.

“I’m trying to drive this change, and have an industry-wide conversation about this because I don’t think the solution is that difficult.

“I sat with someone who I thought we were losing, and I told her I couldn’t change what had happened, but I promised her I’d try not to let that happen to anyone again, and that motivates me to change how we deal with those who need us most.”

28 / INSURANCE ADVISER APRIL 2023 COMMUNITY / The True Business of Broking

NIBA.COM.AU / 29

“Going out as a broker, to your own clients, seeing them so desperate, not knowing if they were going to survive, is a very humbling experience.”

– Wendy Keeling, Claims and Office Manager, BMS Coast to Coast

In conversation with Jenny Bax, CEO of UAC

NIBA and UAC have always enjoyed a productive relationship, partnering to deliver many events that have added significant value to both brokers and underwriters. Therefore, we were delighted to get the opportunity to speak with Jenny Bax, UAC’s inaugural CEO. Jenny was appointed earlier this year, so we caught up to discuss her first few months in the hot seat, views on the industry, and plans for the organisation’s future.

What attracted you to the role at UAC?

I was lucky enough to work at Allianz as General Manager, Underwriting Agencies, managing their owned, unowned and global agencies. I loved the niche market that each of them specialised in and realised early on that agencies have a passion for their business, their product, their people and the end customer that really is second to none.

When the role of CEO UAC was advertised, I jumped at the chance to join a member-led organisation that connects brokers with our underwriting agency partners. As the inaugural CEO, the role allows me to guide the future of UAC, driving a new strategic plan through the business that provides a real clear roadmap for our members’ success.

Almost three months in, how are you finding the role, and UAC more generally?

It’s been full-on, but I’ve had so much fun. William Legge left the business in a solid position, so that’s allowed me to focus on the future. He was very supportive of me and my new role, and he couldn’t do enough to help me get up to speed as quickly as possible.

I was only two weeks into my role when we held the UAC/ Lloyds Sydney Underwriting Expo, and I have to say, what an experience! We had a record number of exhibitors, and over 600 brokers attending throughout the morning – the buzz on the floor was electric. We’ve since had our inaugural Gold Coast Expo, which carried the same level of buzz for both exhibitors and brokers.

We’ve got an amazing board supporting myself and the UAC members, which really helps. I think the whole point of creating the CEO role was to elevate the position to support the agencies in dealing with the regulators, government and other national bodies. And I think that’s been well respected and accepted by all parties. It’s early stages, and so far, I can only say it’s been very satisfying. That’s not to say it hasn’t had its challenges, and it’ll continue to have its challenges, but I have a smile on my face, which is a good way to be.

What’s your view on the insurance market at present? What are the key issues at play?

There have obviously been those legislative burdens over the past few years that have placed a lot of pressure on all parties as we’re still implementing a lot of that legislation, but the biggest issue right now is the cost impost for business. It’s enormous, and it’s impacting the affordability and availability of insurance for end customers. Costs are going to continue to rise with reductions in capacity and increased reinsurance costs, and inflation is going to continue to impact everything, including employee costs, the costs of materials and the labour supply chain. If there’s a recession, we may see an increase in claims lodged in the SME sector, and that’s going to contribute to the current market environment that we’re in now.

Talent is another major issue across the industry everywhere. We’ve got an ageing workforce, and a lot of intellectual property is being lost as people retire. We’ve always had trouble getting young people into the industry, but we need to work collaboratively and collectively as an industry to advocate and create opportunities

30 / INSURANCE ADVISER APRIL 2023 PROFESSIONALISM / Interview

with Jenny Bax

that excite the younger people. We’ve got the capacity to drive change as an industry – social change, social issues, climate change and risk management. If we can improve our messaging to the young people coming out of university, help them to understand what we are doing that will impact climate and social outcomes into the future, I think we can attract a new level of talent.

What role should UAC play in the industry, and what are the key areas of opportunity?

Elevating the role to CEO was specifically to ensure that we are playing a more involved role in decision-making, and ensuring we have a seat at the table in relation to some of those discussions. Our figures indicate that underwriting agencies write about $8 billion worth of GWP in the Australian market – that’s about 17 per cent of the overall GWP.

We’re a member-led organisation, representing 130 members in Australia. We help connect agencies to potential markets locally and globally. My role involves greater engagement with government, regulatory authorities and other national bodies to ensure that our members are equipped to make informed decisions. We also have relationships with international MGA bodies, which allows us to understand and learn what’s happening in those markets outside of Australia.

What are your strategic priorities for UAC in the short, medium and longer term?

In the short term, it’s about meeting the members and understanding their business and the issues confronting

them. It’s also vitally important to understand their thoughts on us – understand how they would like us to support them now and into the future, and understand what they expect of me as a CEO.

From a medium and longer-term perspective, the board has signed off on a three-year four-pillar strategic plan that is going to deliver a roadmap of success for our members.

The first pillar is Connected, and it’s about building on UAC’s successful foundations, while the second pillar, Influential, refers to investing in advocacy and leveraging members’ industry insights. Future Fit is about offering essential resources and information, and Viable relates to strengthening our associations to deliver for members. It’s really important that we make this plan visible to everyone so that they can see the value in UAC, and its release is high on my priority list.

And finally, how important is that underwriter/ broker relationship?

With the market shrinking and major carriers withdrawing from segments, brokers are becoming increasingly creative in the ways they structure programs for the customer. This ensures that we continue to innovate and find solutions for the broker and their customer. Underwriting agencies complement the major carriers and provide additional distribution avenues for the broker, which ensures that we will continue to play an integral role in the Australian insurance landscape.

NIBA.COM.AU / 31

“It’s early stages, and so far, I can only say it’s been very satisfying. That’s not to say it hasn’t had its challenges, and it’ll continue to have its challenges, but I have a smile on my face, which is a good way to be.”

CREATING IN UNCERTAIN TIMES CERTAINTY

The SME community is integral to Australia. The challenges keep on coming, and brokers have an increasingly important role to play.

By MARTIN WANLESS

32 / INSURANCE ADVISER APRIL 2023

NIBA.COM.AU / 33 FEATURE / SME Insurance

For SMEs across the world, the past few years have been anything but predictable. A pandemic, global politics and the war in Ukraine have affected businesses across the world, while here in Australia, weather events have merely compounded an already difficult situation.

“There’s a whole heap of things going on that are outside of the control of businesses,” says Anthony Pagano, Head of Distribution at Vero.

“You’ve got the cost of inflation, labour shortages, material impacts, and interest rate rises, and those current economic conditions are the biggest concern for business right now.”

That thought is backed by insights from Vero’s 2023 SME Insurance Index Report, which found 61 per cent of businesses held economic concerns, with inflation and supply costs featuring at the top of their list.

Matthew Millener, Head of SME and Dealer Commercial at Allianz, says the economic situation is having a direct impact. “The increasingly challenging economic environment creates its own problems. Australia is facing record levels of inflation due to disrupted supply chains, the surge in energy prices, the severe weather events and the ongoing impacts of the COVID-19 pandemic.

“We are seeing drops in business and consumer confidence following recent interest rate increases, and this puts businesses under pressure to save money.”

CHANGING DYNAMICS OF THE SME WORLD

Of course, the many external challenges facing businesses have had a direct impact on what they do and how they do it – something that’s got to be taken into account at renewal time.

Damien Gallagher, Executive Manager at CGU, says, “It’s vital that SME clients ensure their policy reflects their current business and trading conditions.

“There have been a lot of changes in the past few years due to the pandemic, so it’s important that business owners are having upfront conversations with their brokers about how their operations might have changed and whether their current policy coverage is appropriate. This includes their approach to stock levels, new equipment and machinery, staffing, as well as flexible working arrangements and business continuity plans.”

34 / INSURANCE ADVISER APRIL 2023 FEATURE / SME Insurance

“YOU’VE GOT THE COST OF INFLATION, LABOUR SHORTAGES, MATERIAL IMPACTS, AND INTEREST RATE RISES, AND THOSE CURRENT ECONOMIC CONDITIONS ARE THE BIGGEST CONCERN FOR BUSINESS RIGHT NOW.”

ANTHONY PAGANO, HEAD OF DISTRIBUTION AT VERO

Be that broker with a deeper perspective

SME Insurance Index

2023

insights

The findings from the 12th annual Vero SME Insurance Index are now available. Uncover key trends, common attitudes and insights from over 1,750 Australian businesses from micro through to large businesses. Be that broker with a deeper perspective on the status of the market, as well as the emerging trends and opportunities.

Scan the QR code to watch the webinar on-demand or download the report findings. vero.com.au/broker

Insurance issued by AAI Limited ABN 48 005 297 807 trading as Vero Insurance.

Of course, a major consideration at renewal time is sums insured, and Millener says, “Underinsurance is a considerable risk in the current climate. With an increase of commercial construction costs of around 8-9% over the last year, sums insured can quickly become inadequate.”

Graeme Berwick, Executive Director at Community Underwriting Agency, says underinsurance is a significant current issue across the market, and NFP SMEs are not immune. The costs of repairing or replacing assets has gone up significantly in the last few years and has more to run.

“Any broker accepting a rollover of declared values from previous years is doing their client a disservice and, in our space, NFPs need quality advice to protect them from claim payments having co-insurance applied.”

RENEWAL TIME QUESTIONS

Renewal time is a good opportunity for SMEs to check that their business cover is providing the scope that they need.

Matthew Millener, Head of SME and Dealer, Commercial at Allianz, says brokers may wish to consider the following questions:

• Are the disclosures on business activities still accurate, or has the business changed during the year?

• Is the business adequately insured, and has it grown?

• Are the BI sum insured values and turnover estimates still accurate?

• Is the client utilising property valuation and replacement calculators?

• Does the client understand the terms of the policy?

• Is their commercial insurance adequate to cover a loss?

• Are they employing a robust risk management strategy for their business?

• Are they fully utilising the expertise and guidance that you can provide?

36 / INSURANCE ADVISER APRIL 2023 FEATURE / SME Insurance

QPIB – A STATEMENT OF PROFESSIONALISM

Apply online at niba.com.au or email NIBA Memberships Manager Audi Witsen – awitsen@niba.com.au

• QUALIFIED PRACTISIN G INSURANCE BROKERQPIB

“QPIB has never been more relevant than right now.”

– JORDYN GILBERT, 2019 WA YOUNG PROFESSIONAL BROKER OF THE YEAR

Gallagher agrees that brokers can play a critical role in helping clients understand and protect against underinsurance.

“We understand that brokers aren’t valuers, however, by asking clients the right questions, they could help address the risk of underinsurance.”

INCREASING BROKERS’ IMPORTANCE IN THE EYES OF SMES

The challenge for brokers is to elevate the understanding of what they can offer SMEs. While the Vero SME Insurance Index showed that three quarters of businesses engage with brokers, only 14 per cent buy almost all policies through a broker.

And presenting a significant opportunity is the insight that 41 per cent of SMEs admit that, when making business changes, insurance is the last thing they consider.

Pagano says, “The question then is, what’s the role we can play to make sure insurance is more front of mind? When clients are purchasing buildings, they engage with their financier, solicitor and accountant up front, but they would generally ring up their broker at the last minute and say, ‘I’m settling on a property tomorrow, can you do X, Y and Z?’ It’s the same if they’re buying a vehicle.

“They’re going into contracts with third parties without really understanding the ramifications of those contracts, whether it be through hold harmless agreements or

otherwise. When clients are making any decision about business operations, assets or livelihood, we need them to think of brokers in the same vein as banks, solicitors and accountants.

“Keep us informed, because that’s when we can actually add value – we can help identify that a property’s in a high-risk area for bushfires or cyclones, and we can help get greater protection by suggesting some contractual amendments.

“It’s about communicating more and sharing more, so clients understand more about how brokers can help.”

And imparting that knowledge and information clearly and regularly is surely the first step to achieving that.

38 / INSURANCE ADVISER APRIL 2023 FEATURE / SME Insurance

This information is general advice only and does not take into account your objectives, financial situations or needs. You should obtain and consider the relevant Product Disclosure Statement and Policy Wording (as applicable) from zurich.com.au before making a decision. A target market determination is available at zurich.com.au/GI-TMDs or by calling us on 132 687. The issuer of general insurance products is Zurich Australian Insurance Limited (ZAIL), ABN 13 000 296 640, AFS Licence Number 232507 of 118 Mount Street, North Sydney NSW 2060. ZU24171 V3 03/23 LEWG-019653-2023 Small property claims paid in 24–48 hours. Easy. Zurich aims to pay eligible property claims under $30,000 within 24–48 hours of receiving all required information. Our dedicated team can fast-track claims where the item has already been repaired or replaced, or we have received reasonable quotes, so customers can get back to business. zurich.com.au/PSS Zurich Property Insurance made easy.

CASE STUDY THE IMPORTANCE OF VALUE, RATHER THAN COST

CGU’s Executive Manager, Damien Gallagher, shares the story of a recent claim, which emphasises the importance of insuring items at their true value.

“A small manufacturing business employing approximately 30 people purchased a critical piece of machinery at a discounted price, and they listed that piece of machinery in their policy at the discounted price, rather than the market rate.

“Unfortunately, the manufacturing facility experienced a fire, which

the life of the policy to account for the significant increases in costs due to inflation and supply chain impacts during the pandemic.

“This meant the sum insured was not sufficient for a like-for-like replacement, and as a result, the client needed to replace it with a smaller piece of machinery that had a lower production capacity. This impacted their existing financing arrangements and forced them to take additional financing for a lowercapacity machine.

to continue working to account for the financial impact.

“It’s a terrible outcome for that client, and it highlights why it’s so important to review sums insured regularly and really interrogate clients on replacement costs of items.

“In this specific case, we calculated that if the client had spent an additional $5,000 in premium over the life of their policy, they would have been covered in full for that machinery.

“People are often hesitant to pay more for insurance, which is understandable given the current environment and the cost of living pressures we are all feeling. While it is up to clients to determine what level of risk they are willing to accept, the broker plays an important role in ensuring the client considers what that risk could be, so they can make an informed choice about their insurance cover.”

FEATURE / SME Insurance

“UNDERINSURANCE IS A CONSIDERABLE RISK IN THE CURRENT CLIMATE. WITH AN INCREASE OF COMMERCIAL CONSTRUCTION COSTS OF AROUND 8-9% OVER THE LAST YEAR, SUMS INSURED CAN QUICKLY BECOME INADEQUATE.”

MATTHEW MILLENER, HEAD OF SME AND DEALER COMMERCIAL AT ALLIANZ

cbnet.com.au/discover-cbn

A CAUTIOUS PATH AHEAD FOR D&O

While new capacity has opened up in the D&O space, fresh challenges and an uncertain fiscal environment require a measured approach.

By MARTIN WANLESS

By MARTIN WANLESS

42 / INSURANCE ADVISER APRIL 2023

NIBA.COM.AU / 43

/ Directors and Officers Insurance

FEATURE

With many facets of the business world – indeed, society as a whole – it feels as if we’re cautiously stepping forward, wondering what the next thing will be that catches us slightly off guard. It may not be anything that completely blindsides us as COVID-19 did; rather, it could be something that we’re already aware of, albeit within a sea of other challenges.

In relation to Directors and Officers insurance, there are a couple of likely suspects. Cybersecurity is one that’s leapfrogged to the top of most business’s priority lists over the past year or so, and ESG is another.

“ESG springs to mind, but it feels like the conversation around ESG has slightly matured given the increasing level of commentary, scrutiny, and focus it now receives,” says Chris Gough, Head of Property and Casualty, Australia & New Zealand, Chubb Insurance.

“Balancing the need to pay proper attention to ESG with the risk of

‘greenwashing’ is a real challenge for clients at the moment, and therefore for their insurers. Cover in this area will be something to watch in coming years, whether it is enhanced or restricted, and perhaps both, depending on a client’s risk profile.”

Meredith Lieu, Australian D&O Commercial Portfolio Manager, Liberty Specialty Markets, agrees. “ESG is a key focal point at the moment. This applies to all companies to varying degrees and the reporting requirements that go hand in hand with it.