DECEMBER 2022/JANUARY 2023 INDUSTRY LEADERS SHARE THEIR THOUGHTS ON 2023

The impact of high inflation on the insurance industry PLUS Inside KEEP ON MOVIN’ Supply chain challenges brought into focus BUSINESS: UNINTERRUPTED Reviewing business interruption coverage The key issues that lie ahead and how brokers can prepare for them WE ARE YOUR VOICE

ALLIANZ BROKER GUIDE (ISSUE 7)

As Australia’s leading specialist premium funder, we’re here to help businesses large and small manage their insurance premiums and unlock their cash flow.

For more information about how Hunter Premium Funding can benefit your clients, visit hpf.com.au

Hunter Premium Funding Limited ABN 80 085 628 913. A company of Allianz Australia Insurance Limited ABN 15 000 122 850 AFS Licence No. 234708

Ready for today. Prepared for tomorrow.

ACN 006 093 849

ABN 94 006 093 849

Insurance Adviser magazine is the monthly magazine of the National Insurance Brokers Association (NIBA).

Insurance Adviser magazine is published by NIBA

Publisher

Philip Kewin, CEO, NIBA

T: (02) 9459 4305

E: pkewin@niba.com.au

W: niba.com.au

Communications Manager

Wendy Martin

NIBA Editor

Amy Cai

Editorial enquiries

E: editor@niba.com.au

National Sales Manager

Tony May

E: tmay@niba.com.au

Design

Citrus Media www.citrusmedia.com.au

NIBA gives no warranty and makes no representation that the information contained in this magazine is, and will remain, suitable for any purpose or free from error.

To the extent permitted by law, NIBA excludes responsibility and liability in respect of any loss arising in any way (including by way of negligence) from reliance on the information contained in this magazine or otherwise in connection with it.

The contents of Insurance Adviser are protected by copyright and NIBA reserves its rights in this regard.

FEATURES

NIBA.COM.AU / 3

CONTENTS December 2022/January 2023

18 INDUSTRY LEADERS SHARE THEIR THOUGHTS ON 2023 The key issues that lie ahead and how brokers can prepare for them 20 GETTING SUMMER READY Tips on assisting clients with travel insurance and natural disasters

CONTENTS December 2022/January 2023 4 / INSURANCE ADVISER DECEMBER 2022/JANUARY 2023 36 KEEP ON MOVIN’ Supply chain challenges brought into focus 44 BUSINESS: UNINTERRUPTED Reviewing business interruption coverage IN EVERY ISSUE NIBA CEO Welcome 6 Member Benefits 8 Representation 12 Industry Bulletin 16 EVENTS Forthcoming Events 10 REFERENCE Community Hub 54 Insurer Strength Ratings 60 Insurance Journey: Dale Hansen 64 25 ALLIANZ BROKER GUIDE The impact of high inflation on the insurance industry FEATURES

Global experience that drives your local partnership

As one of the world’s largest insurers with over 100 years’ experience in Australia, Allianz is here to help when you need it most. With state-based sales and underwriting experts working alongside our dedicated claims team, we’re ready to assist you and your customers, no matter where you are.

For more information, speak to your Account Manager today or visit www.allianzengage.com.au

Go Further, Together.

Insurance issued by Allianz Australia Insurance Limited ABN 15 000 122 850, AFS Licence No.234708. This information is general advice only and does not take into account your objectives, financial situation or needs. Consider the relevant PDS in deciding whether to buy or continue to hold any insurance products.

BRING ON 2023

As the year draws rapidly to a close, we can only reflect on what has been another eventful 12 months. Insurance has been a regular conversation point throughout Australia, as we continue to experience extreme weather events and the increasing risk of cyber threat. Supply chain issues have exacerbated recovery efforts and the shortage of experience personnel has impacted the industry’s ability to respond efficiently and effectively. Many brokers I have spoken to are looking forward to a well-earned Christmas break, and let’s hope the thousands of people and communities impacted by floods can enjoy some respite and focus on cleaning up and rebuilding.

At the time of writing, the NSW floods have entered their 75th day and with some areas having been flooded three times in the last two years, conversations around planning, resilience and mitigation are becoming far more mainstream and with a much greater sense of urgency. Seeing some of the families impacted by the recent floods in Central West NSW, we all saw a sense of fatigue. Once the attitude was ‘we will just have to clean up and rebuild’. Now, many are not so sure.

Cyber threat has long been looming as a major issue and we saw this firsthand, with the recent breach with Optus and the hacking of Medibank, exposing confidential client information via the dark web. This will no doubt continue to be an issue, and while the Government has taken steps to redouble efforts to fight cybercrime, it’s something we should all be mindful of even in our own businesses.

If there is one silver lining, it is that COVID-19 lockdowns and compulsory distancing measures are disappearing fast into the history books.

Having just completed my first full year at NIBA, it has been my pleasure to meet many members at different events throughout the year. We started 2022 with some hesitancy as the Convention deferred from 2021 was rescheduled to February 2022. It seems so long ago that we nervously embarked on an event staggered over five states in three weeks. I recall when we kicked off in Melbourne – it was face masks on planes and in taxis and no handshakes, the risk being that at any time, a positive COVID-19 test could mean being locked down and quarantined for up to two weeks.

Since then, we have virtually returned to normal, having held our highly popular gala lunches. More recently at our sold-out NIBA Summit and Celebration Dinner, we celebrated not only the end of the year but 40 years of NIBA, as well as the presentation of the insurer awards and the Young Broker and Broker of the Year Awards. A great night was had by all, and it went off almost without a hitch.

Last month, I mentioned that in preparation for our 40 year celebrations, I was researching the origins of NIBA, the legislative reform occurring in the late 1970s and early 1980s, and the importance for one voice for insurance brokers. So, it was with a sense of pride and relief that we

6 / INSURANCE ADVISER DECEMBER 2022/JANUARY 2023

CEO / Welcome

Lisa’s

Just one of the fabulous Not for Profit organisations that we have been able to assist with funds from our annual Small Grants Program.

Kangaroo Retreat rescues, rehabilitates and releases wildlife, including injured and orphaned joeys, kangaroos, wallabies and possums in the Port Headland region of Western Australia.

Kangaroo Retreat rescues, rehabilitates and releases wildlife, including injured and orphaned joeys, kangaroos, wallabies and possums in the Port Headland region of Western Australia.

2020 2019 2018 2017 2016

Insuring Not for Profits - it’s all we do

WHY NIBA MATTERS TO ME

Members share why NIBA is important to them, and how their involvement has enabled them to support the broking industry.

“NIBA is the one voice that represents the broking profession to all stakeholders.

When I look at other countries around the world without an industry association like NIBA, it’s quite clear that their level of regulation and professional standards are not as well established, because there is no central voice advocating for the industry.

Without NIBA, there is no question that our profession would not be what it is today.”

DALE HANSEN CEO, Austbrokers Coast to Coast

ABOUT NIBA

OUR MISSION

NIBA is the one voice for insurance brokers in Australia, representing their interests and promoting high standards of professionalism and competence.

OUR OBJECTIVES

Representation

We represent the interests of members and their clients to governments, regulators, industry stakeholders, the media and the community in a manner that is respected and relevant. We have forged strong relationships at a state and national level to ensure that your interests are represented.

Professionalism

We set and promote high standards of professional practice for insurance brokers for the benefit of their clients and the community through the development of professional standards, QPIB, CPD accreditation and the Insurance Brokers Code of Practice.

Community

We provide members with opportunities to meet, share, grow and prosper, and build professional networks with the wider intermediated insurance community that will last throughout whole careers.

GET IN TOUCH!

Whatever your age, or level of experience, NIBA has brokers’ best interests at the core of everything we do. Find out what we can do to help benefit your business and your team at niba.com.au/membership

NIBA / Member Benefits 8 / INSURANCE ADVISER DECEMBER 2022/JANUARY 2023

The independent NIBA Broker Market Survey was conducted from July to August 2022 and compared 24 insurers and insurance underwriting agencies in Australia. Liberty Specialty Markets is a trading name of Liberty Mutual Insurance Company, Australia Branch (ABN 61 086 083 605) incorporated in Massachusetts, USA (the liability of members is limited). Lines of Business: ► Professional & Financial Risks ► Casualty ► Energy, Property & Construction ► Crisis Management ► Accident & Health ► Financial Risk Solutions ► Marine ► Global Transaction Solutions ► Surety ► War & Terrorism ► Treaty Reinsurance (LM Re) Specialisations: ► Directors & Officers ► Professional Indemnity ► Financial Institutions ► IT Liability ► Infrastructure & Construction ► Workers’ Compensation ► Environmental libertyspecialtymarkets.com.au ► Exploration & Production ► Renewable Energy ► Oil, Gas, Petrochemical & Chemical ► Marine General Liabilities ► Hull & Cargo ► Product Recall ► Weather Follow us on LinkedIn 2021 Thanks for recognising Liberty for the second consecutive year

NIBA EVENTS

NIBA stages a variety of educational and social events across Australia for the whole intermediated insurance community.

SAVE THE DATE FOR YOUR STATE’S 2023 GALA LUNCH AND THE NIBA CONVENTION!

2023 NIBA VIC GALA LUNCH

WHEN: Friday 19 May 2023

2023 NIBA WA GALA LUNCH WHEN: Friday 14 July 2023

2023 NIBA QLD GALA LUNCH

WHEN: Wednesday 19 July 2023

2023 NIBA NSW GALA LUNCH WHEN: Friday 21 July 2023

2023 NIBA SA GALA LUNCH

WHEN: Friday 28 July 2023

2023 NIBA CONVENTION

WHERE: The Star, Gold Coast WHEN: 8 – 10 October 2023

Check out what’s happening close to you and register via the events calendar at niba.com.au/ events

NIBA SAYS CONGRATULATIONS

NIBA IS THRILLED TO WELCOME THE FOLLOWING PRINCIPAL MEMBER ON BOARD:

Strata Insurance Services Pty Limited

NIBA CONGRATULATES THE FOLLOWING MEMBERS FOR RECEIVING THEIR QPIB DESIGNATIONS:

Stuart Russell, Austbrokers Canberra

Sandra Barrett, Trans-West Insurance Brokers Pty Ltd

Karine Hindle, Elkington Bishop Molineaux Insurance Brokers Pty Ltd

Brett Larkin, LARK Insurance Pty Ltd

Louise McColl, AEI Insurance Broking Group

Debbie Storey, BJS Morton Insurance Brokers (NSW) Pty Ltd

Renae Testoni, Spencer & Bennett –Yenda Prods Pty Ltd

Cyndie Gusdorf, Consolidated Insurances Pty Ltd

Daniel Roussounis, Consolidated Insurances Pty Ltd

Colin Gomez, Eastern Equity Insurance Brokers

Simon Sickerdick, Managed Insurance Solutions

Matthew Allen, MA Insurance Services Pty Ltd

Felicity Evensen, Elkington Bishop Molineaux Insurance Brokers Pty Ltd

NIBA CONGRATULATES THE FOLLOWING MEMBERS FOR BECOMING AN ASSOCIATE MEMBER:

Jessica Potter, DKG Insurance Brokers

Lucy Willis, Gow-Gates Insurance Brokers Pty Ltd

Ilene George, Moody Kiddell & Partners (Insurance) Pty Limited

Kahlee Lennox, Northern Insurance Solutions Pty Ltd

Clare Somerville, Sirius Insurance Pty Ltd

Adrian Leong, Planned Cover

Nicole Walravens, DanceSurance

10 / INSURANCE ADVISER DECEMBER 2022/JANUARY 2023

/

STAY UPDATED!

NIBA

Events

8 – 10 October 2023

The Star, Gold Coast

NIBA is delighted to be holding the 2023 NIBA Convention on the Gold Coast. Please save the date and mark it in your calendar. It’s an event not to be missed.

NIBA.COM.AU / 11 SAVE THE DATE 2023

NIBA CONVENTION

2022 YEAR IN REVIEW

While the Quality of Advice Review has been a central focus of NIBA’s policy and advocacy work this year, there have also been a number of other issues NIBA has focused on. In addition to providing a number of submissions, NIBA also held regular stakeholder engagement meetings with regulators and government, provided technical feedback to ASIC as part of their regulatory relief work, attended several industry roundtable meetings, and provided a number of confidential submissions on issues relevant to members.

ALRC REVIEW OF FINANCIAL SERVICES LEGISLATION

NIBA provided two submissions to the Australian Law Reform Commission’s Review of the Legislative Framework for Corporations and Financial Services Regulation. In a largely technical review, the ALRC has been tasked with investigating the potential simplification of laws that regulate financial services in Australia. Interim Report A, which was tabled in Parliament late last year, contained 16 proposals and a number of recommendations, which the Government could begin implementing immediately. Interim Report B, which was released in September of this year, proposes an alternative legislative model made up of a simplified Corporations Act, a single consolidated legislative instrument that contains exclusions, exemptions and other necessary details, and thematically consolidated ‘rulebooks’ containing prescriptive detail.

A third Interim Report focusing on the potential reframing or restructuring of Chapter 7 of the Corporations Act will be released in August 2023 with the final report due by 30 November 2023.

NEW SOUTH WALES FLOOD INQUIRY SUBMISSION

Following widespread flooding in many parts of New South Wales earlier this year, the NSW Government commissioned an independent inquiry into the preparation for, causes of, response to and recovery from the 2022 catastrophic flood event.

NIBA provided a submission to the inquiry, highlighting the need for better land-use planning, significant investments in mitigation and the abolition of the Emergency Services Levy (ESL) to reduce premiums and encourage a higher uptake of optional flood cover.

NIBA’s submission highlighted the success of previous flood mitigation works in Queensland, as well as the need for urgent action on insurance affordability through the abolition of the Emergency Services Levy.

CYCLONE REINSURANCE POOL

NIBA provided submissions to both the Senate Economics Legislation Committee review of the Treasury Laws Amendment (Cyclone and Flood Damage Reinsurance Pool) Bill 2022 and the Joint Select Committee on Northern Australia Review into the Cyclone and Flood Damage Reinsurance Pool.

While NIBA’s submissions were generally supportive of the reinsurance pool, NIBA raised concerns over the proposed level of savings the Pool would deliver, the classification of aged and residential care properties as commercial properties, the 48-hour damage period for flooding subsequent to a cyclone, and the lack of policy mechanisms to encourage insurers to return to the Northern Australian Market. In addition to providing a submission, NIBA also appeared before the Joint Select Committee on Northern Australia to provide evidence to the review.

NEW SOUTH WALES SMALL BUSINESS STRATEGY

Earlier this year the NSW Government announced a public consultation on its new Small Business Strategy, which will inform the Government’s strategy and priorities for the sector over the next three years.

NIBA’s submission focused on the NSW Emergency Services Levy (ESL) and the disproportionate impact it and other insurance-based taxes have on small businesses. The submission also highlighted the increasing burden the ESL poses to insurance policyholders, with the

contribution target (the amount collected by general insurers) rising 48 per cent since the decision to abolish the ESL was delayed in 2017.

TASMANIAN HOME WARRANTY CONSULTATION

Earlier this year, the Tasmanian Government announced its intention to reintroduce home warranty insurance, following the high-profile collapse of a number of builders in the state. The Government sought to consult with industry on the development of a new model for the home warranty scheme.

As part of the consultation process, a number of proposals were put forward aiming to balance consumer protection with the long-term economic viability of the scheme and building costs. The proposed scheme would use a “last resort” model consistent with most Australian jurisdictions and provide cover for incomplete or defective building work in the event that a builder dies, disappears or become insolvent.

NIBA’s submission supported the reintroduction of the scheme as a last-resort model and the proposed maximum claim limit of $200,000. However, NIBA cautioned that complementary reforms to reduce the overall risk of the scheme would be required to ensure the long-term viability of the scheme. NIBA’s response highlighted that in a hardening market, insurance brokers play an even more critical role in helping small businesses navigate the insurance landscape and ensuring their cover remains appropriate to their level of risk.

ASIC INDUSTRY FUNDING MODEL

Five years on from the introduction of the ASIC Industry Funding Model (IFM), the Albanese Government announced a review into the IFM, in light of the

12 / INSURANCE ADVISER DECEMBER 2022/JANUARY 2023

REPRESENTATION / Year in Review

has never

more relevant than right

“QPIB

been

now.”

THE

QPIB – A STATEMENT OF PROFESSIONALISM Apply online at niba.com.au or email NIBA Memberships Manager Audi Witsen – awitsen@niba.com.au • QUALIFIED PRACTISIN G INSURANCE BROKERQPIB

– JORDYN GILBERT, 2019 WA YOUNG PROFESSIONAL BROKER OF

YEAR

2022 YEAR IN REVIEW (CONTINUED)

significant regulatory changes within some industry sectors resulting in increased cost pressures.

The Review will consider and, where appropriate, make recommendations regarding:

• the types of costs and nature of ASIC’s activities that are recovered from industry, and how those costs are recovered;

• how ASIC allocates costs across industry subsectors;

• whether key aspects of the design and legislative framework for the IFM remain appropriate, including in light of structural changes in parts of industry;

• the IFM’s flexibility to respond to changes in industry, including emerging industry sectors; and

• the suitability of transparency and consultation mechanisms, including the CRIS, and how ASIC could improve the accuracy of its estimates of costs to subsectors.

NIBA provided a submission to the review, supporting the user-pays model while also highlighting the need for greater transparency from the regulator as to how costs are apportioned where activity impacts multiple sub-sectors.

NEW SOUTH WALES WORKERS COMPENSATION SYSTEM

As part of their supervision of the state’s insurance and compensation schemes, the NSW Standing Committee on Law and Justice held a review of the NSW Workers Compensation System. The Committee is required to review the operation of the scheme every two years in line with legislation, this time choosing to focus on the increase in psychological claims.

NIBA’s submission raised concerns over the continued decline of icare’s financial position, with reports that the deficit increased to $1.5 billion in the six months to December 2021. NIBA’s submission also highlighted declining service standards and poor claims management practices that have led to a decline in return-to-work rates and increases in psychological trauma. The submission noted that many of these issues have previously been raised by the State Insurance Regulatory Authority (SIRA), however little action has been taken to

address these issues since the report was released in 2019.

ASIC BREACH REPORTING OBLIGATIONS

As part of their 2022/23 Core Strategic Priorities, the Australian Securities and Investments Commission (ASIC) has begun consulting on a range of issues and proposals to improve the operation and implementation of the reportable situations regime (formerly known as breach reporting). ASIC consulted on 15 proposed changes aimed to provide greater clarity to financial services providers and enable accurate data collection. ASIC also identified a further seven issues for further engagement as part of their broader plan of work around the reportable situations regime.

QUALITY OF ADVICE REVIEW

Finally, the long-awaited Quality of Advice Review kicked off this year after the Royal Commission recommended that the existing exemptions to the conflicted remuneration provisions be examined by ASIC back in 2019. The broad-reaching review is tasked with examining the regulatory framework surrounding financial advice, including risk advice, to “identify opportunities to streamline and simplify regulatory compliance obligations to reduce cost and remove duplication”, with the Review recognising that the costs of complying with these regulations are ultimately borne by consumers.

NIBA provided a comprehensive response to the initial issues paper, which focused on the very real differences between risk advice and other types of financial advice and highlighted the significant impact the one-size-fits-all approach to regulation of financial advice has had on the general insurance industry.

In considering whether or not broker commissions should be retained, NIBA’s submission argued that the review should have regard to the suitability of existing protections already in place to counteract any perceived risk. NIBA also highlighted the consequences of removing broker commissions including an increase in underinsurance and non-insurance levels, lower claim settlements, and a reduction in the affordability of advice.

This Issues Paper was followed by a further consultation paper that outlined a number of proposals relating to the definition of ‘personal advice’ and the regulation of ‘general advice’ as a financial service, as well as disclosure documents such as Statements of Advice and Financial Services Guides, and the Best Interest Duty and Safe Harbour provisions.

Proposals relating to conflicted remuneration were detailed in a separate proposals paper released in October. The Review proposed to retain the current exemption to the conflicted remuneration provisions for general insurance and consumer credit insurance products with client consent.

The Review will hand its final report, including a list of recommendations to Government, by 16 December 2022.

NEW SOUTH WALES HOME WARRANTY COMPENSATION SCHEME

In response to the Independent Pricing and Regulatory Tribunal’s (IPART) report on the New South Wales Home Warranty Compensation Scheme, the State Insurance Regulatory Authority (SIRA) announced a number of proposed reforms intended to provide greater protection to NSW homeowners.

NIBA provided a submission on behalf of the intermediated insurance industry, arguing against any changes which would negatively impact the long-term economic viability of the scheme. NIBA argued that multiple parties had already highlighted their concerns over the viability of the scheme. NIBA’s submission also highlighted the moral hazard that would be created by providing an incentive for businesses to not obtain insurance, knowing that the homeowner would be covered.

NIBA’s submission restated its support for a competitive home warranty market. NIBA argued that in order to make the scheme more attractive to private insurers, the underlying risk of the pool needs to be reduced. Rather than reinstating a sole insurer model, NIBA encouraged SIRA to work with industry to reform the existing regulatory framework and product design so as to encourage participation from private insurers.

14 / INSURANCE ADVISER DECEMBER 2022/JANUARY 2023 REPRESENTATION / Year in Review

OfficeTechNow offers an easy-to-use approach for sharing, distribution and storage of your workplace documentation with all of the standard OfficeTech features including the workflow tasking module, template tasks and more.

Browser based so you can access from anywhere with an internet connection. The result is a paperless environment that will change the way your office operates.

The browser based document management solution. Register for a free demonstration

Full integration with Client Requirements • Office 365 • Internet Connection Secure • 2 factor authentication • Fully secure Azure environment • Disaster recovery and backups Technosoft Solutions (Aust) Pty Ltd +61 39817 8100 info@technosoftsolutions.com.au Connect with us on Linkedin for product updates Visit our website to Register today technosoftsolutions.com.au

LATEST IBCCC REPORT FINDS “WIDESPREAD GOOD PRACTICE” IN CODE COMPLIANCE AMONGST BROKERS

The Insurance Brokers Code Compliance Committee (IBCCC) has released an Own Motion Inquiry report called Good Practice and Company Culture, finding that many brokers have established good processes and procedures to build a company culture that encourages good behaviour and Code compliance.

As a follow-up to the Culture is Key report published last year, the new report summarises key findings on company culture from the

responses supplied by brokers in the 2021 Annual Compliance Statement questionnaire.

According to these findings, many brokers have established good processes and procedures in place to facilitate good behaviour and Code compliance, with broker responses indicating widespread good practice.

Seventy-six per cent of brokers reported having procedures in place to identify breaches or potential issues, and 66 per cent of brokers reported

WHAT DOES GOOD CODE PRACTICE LOOK LIKE?

using regular staff training sessions to learn from past Code breaches.

Sixty-seven per cent reported using checklists to ensure clients were provided with all necessary information, and 65 per cent also reported conducting an external compliance audit within the past three years to identify gaps or weaknesses in their compliance processes.

NIBA CEO Philip Kewin said, “it was very encouraging to see brokers setting standards above the minimum as well as learning from past breaches.

“Considering the introduction of the new Code of Practice and a renewed focus on process, procedures and compliance, we should see continuous improvement and ongoing development.”

The IBCCC also identified various areas of improvement for brokers, in particular incorporating different training methods, proactively monitoring breaches and looking for systemic breaches.

The IBCCC has also provided the following recommendations to assist subscribers with improving their compliance frameworks.

POLICY RENEWAL STANDARDS

Set an internal benchmark for renewals that is higher than the legal minimum, such as 21 to 28 days in advance of policy expiring. This demonstrates an awareness of good practice and a commitment to high standards.

INTERNAL TRAINING

Use multiple methods to train staff around past breaches and lessons learnt, such as holding training sessions, incorporating training into existing regular meetings, and sharing written updates on timesensitive issues.

CONDUCTING AUDITS AND DETECTING BREACHES

Conduct regular, structured internal audits across a broad sample of files. Aim to conduct external compliance audits every 12 to 24 months. Create reports for when things don’t go according to plan, and encourage staff to declare breaches, conflicts or compliance issues.

ADAPTING PRACTICES TO THE CLIENT’S PERSPECTIVE

Disclose information on fees and commissions in plain English and in multiple documents, and explain them to clients. Explore using different methods to explain, such as short videos.

IDENTIFYING SYSTEMIC BREACHES

When a breach occurs, consider whether it may be systemic and occurring multiple times. Make the effort to understand its root causes, and to investigate if similar events may have affected other clients.

To read the full report, visit insurancebrokerscode.com.au/company-culture-producing-better-outcomes-for-customers

16 / INSURANCE ADVISER DECEMBER 2022/JANUARY 2023 NEWS / Industry Bulletin

JUST ONE IN FOUR SMALL BUSINESSES HAVE DISASTER PLANS

Only one in four small and family businesses have a business continuity plan in the event of a disaster, according to an inquiry report released by the Australian Small Business and Family Enterprise Ombudsman.

The Small Business Natural Disaster Preparedness Resilience Inquiry Report found a concerning trend of underpreparedness among 2,000 businesses surveyed in February 2022.

While most businesses reported as feeling somewhat prepared for future disasters,

only one in four small and family businesses surveyed actually had disaster plans, and around 50 per cent had no plans at all.

In addition, the report found that approximately half of small and family businesses surveyed could specifically recall receiving information or assistance around responding to or recovering from a natural

disaster, whether from government or business sectors.

The report has found that small and family businesses are most likely to be severely affected by disasters, and that this may be at least partially due to them also being the least likely to have preparedness plans, be aware of additional supports, or use any entity for information and assistance.

These findings also indicate the clear opportunity for brokers to assist small business with building their preparedness for future disasters.

Six point four million Australian adults were victims of data breaches over the last 12 months, according to a new survey conducted by the Australian National University.

32.1 per cent of the 3,500 Australians surveyed for the ANU paper on data breaches in Australia said that they or a member of their household had been exposed to a data breach in the past year.

The paper flags that this is likely to be an underestimate of the true number of households affected, given there are cases of people being unaware of when

their personal data has been the subject of a data breach.

Additionally, as the survey was conducted weeks prior to Medibank’s public announcement of its recent data breach, where data on 9.7 million current and past customers was leaked, the real number of Australians exposed to cybercrime is almost certainly significantly higher.

In comparison, only 11.2 per cent of Australians surveyed said that they were victims of serious crimes such as burglary or assault over the past five years.

This stark difference exposes the wide prevalence of cybercrime, making it one of the fastest growing types of crimes in Australia.

According to the report, the age group most vulnerable to data breaches were Australians aged 25 to 34, with 41.5 per cent of those surveyed reporting that they had been victims of data breaches.

With the survey conducted in October 2022 shortly after the Optus data breach, the report found a large decline in trust for telecommunications companies with regards to data privacy.

NEWS / Industry Bulletin NIBA.COM.AU / 17

ONE IN THREE AUSTRALIANS EXPOSED TO DATA BREACHES IN THE PAST 12 MONTHS

GETTING SUMMER READY

Australians are gearing up for the holidays this summer, whether it’s travelling abroad or spending time at home.

During the summer season, it is important to remain vigilant – both against the ongoing threat of natural disasters at home, and against any factors that may arise from travelling in an uncertain world. Brokers share their tips for staying protected this summer, both for travellers and any clients facing the risk of disasters.

TRAVELLING IN THE FESTIVE SEASON?

MEGGAN FREESTONE National Placement Manager, Accident & Health – Aon

Since 1 November 2021, fully vaccinated Australians have been able to depart Australia without seeking an exemption.

Whilst the climate of restrictions on overseas travel has begun to settle and normalise over the past 12 months, travellers do still need to monitor border settings and quarantine requirements in other countries as they continue to evolve. It remains very important that brokers continue to stay abreast of the changes to enable them to keep their clients informed. For anyone travelling overseas, you will need to consider the requirements of airlines, transit, and destination countries, as well as any arrangements required for returning to Australia.

You should specifically check if your destination requires compulsory insurance cover for entry, including COVID-19 medical expenses. This has been one of the biggest challenges of recent times with requests for evidence of insurance coming late in the piece – or even whilst the traveller is at the boarding gate!

Some insurers now offer limited cover for COVID-19, however some leisure travel polices (often direct insurers) still contain strict exclusions in this regard. In addition, the availability of financial insolvency cover is limited in its availability across the market.

In all cases, it is imperative that you first check for the latest updates of where you can travel by visiting the Department of Foreign Affairs and Trade’s Smartraveller website at smartraveller.gov.au.

COVID-19 OVERSEAS MEDICAL EXPENSES COVER

This cover applies if you’re diagnosed with

COVID-19 by a qualified medical practitioner during your journey and includes cover for costs resulting from any medical treatment and ambulance transportation you require when suffering from COVID-19.

Insurers cannot pay for any medical costs resulting from COVID-19 if you’re travelling to a country that is subject to ‘Do not travel’ advice from Smartraveller at the time you enter the country or part of the country. In certain instances, subject to prior written agreement from insurers, you may be able to seek formal endorsement to include this type of travel – but as always, this will be subject to underwriting appetite and specific agreement.

The cost of medical treatment in overseas countries continues to increase, and availability of care may be limited, therefore seeking cover with the maximum coverage available is imperative for all travellers – for all conditions, not only COVID-19.

COVID-19 AMENDMENT OR CANCELLATION COSTS COVER

If you’re travelling within Australia or overseas on an international, inbound or domestic policy, cover can be provided for a number of COVID-19-related cancellation and amendment situations.

This may include:

• If you are diagnosed by a qualified medical practitioner with COVID-19 prior to your departure and can no longer travel; and/or

• You need to cancel or amend your trip as a non-travelling relative or business partner in Australia or New Zealand contracts COVID-19 and is in a lifethreatening condition.

COVID-19 ADDITIONAL EXPENSES COVER

If you’re an international or domestic travel insurance policyholder, cover can be provided for several additional expenses incurred,

such as costs of quarantine or isolation if you’re diagnosed with COVID-19 during your trip, if you pass away on your trip because of COVID-19, or if you need to amend your trip because your non-travelling relative or business partner residing in Australia or New Zealand becomes sick due to COVID-19. However, this coverage is heavily dependent on the local guidelines and whether quarantine is enforced. Otherwise, the acceptance of claims of this nature will likely be dependent on medical advice.

For example, in Australia there are no longer any government imposed restrictions on isolating due to being a close contact. Therefore, obtaining a medical certificate or authorisation of being unable to travel is imperative as change of mind or ‘disinclination to travel’ is not covered by the policy.

Insurers cannot pay for any additional expenses resulting from COVID-19 if your claim is related to you having travelled to a country that is subject to ‘Do not travel’ advice from Smartraveller at the time you enter the country or part of the country.

It is important to note that no policies are providing cover for the following scenarios: • you incur costs or expenses due to mandatory quarantine or isolation orders required to cross a border, such as a border between states, countries, or regions; and/or

• the government bans travel before or during your trip, such as through ‘Do Not Travel’ travel warnings, government-directed border closures, or mandatory quarantine or self-isolation requirements related to cross area, border, region, or territory travel.

As a general guide, it is the responsibility of travellers to be aware of factors impacting their trip before travel, and to focus on risk mitigation where possible. In the current climate, more so than ever before, if you can’t afford travel insurance, you unfortunately cannot afford to travel.

18 / INSURANCE ADVISER DECEMBER 2022/JANUARY 2023 FEATURE / Business Interruption Insurance

CHECKLIST FOR RESPONDING TO YOUR CLIENTS DURING A NATURAL DISASTER

CATHERINE TROYAHN National Manager Claims Customer Relationship Management – Allianz

BEFORE AN EVENT

Confirm your clients have considered their individual needs when deciding on cover

As a broker, you’re in the best position to understand your client’s individual needs and ensure they consider their needs when making decisions relating to insurance cover.

There are a lot of customers out there that don’t always think it could happen to them. The reality is that it can happen to anyone – brokers play an important role in communicating that.

Discuss a strategy or action plan for possible scenarios

It’s important for brokers to inform their clients about the value of preparing for potential worst-case scenarios.

Those prepared with an action plan will potentially mitigate some of their loss.

Encourage your clients to clean their gutters and remove any rubbish that could fuel a fire or become flying debris in a storm, for example.

It goes without saying that your client’s safety and wellbeing is paramount, so it’s critical they evacuate when they need to.

DURING AN EVENT

Support your customer impacted by an event

As we’ve seen in the recent flood crisis, climate-related events can last for long periods of time , resulting in some customers not able to return to their properties quickly.

As their broker, you can play an important role by working closely with your customer, so they understand the cover available to them and working with the insurer in the provision of emergency accommodation and financial assistance where cover for an insured loss is available.

AFTER AN EVENT

Talk your clients through the claims process

Ensure your client knows what to expect from the claims process and manage their expectations in relation to timeframes.

In total loss situations, the insurer will endeavour to settle the claim quickly. Partial settlements may take a little longer as the insurer establishes the extent of the loss.

Identify the parties that are involved in the process of a claim, such as Loss Adjusters, Builders, Engineers

UNDERWRITING CONSIDERATIONS AND EMERGING CLAIMS TRENDS

From the perspective of underwriting and claims trends, we are starting to see a mix of the following, though note this list is not intended to be exhaustive:

• Large groups travelling together receive extra scrutiny during the underwriting stage, due to the concentration of risk and potential large loss in the event of a cancellation;

• Deprivation of baggage claims are on the rise, due to carrier baggage handling delays;

• Medical evacuations are proving to be more complicated and expensive, creating greater underwriting scrutiny and increased premiums; and

• Anecdotally, we are beginning to see an increase in petty crime in traditional tourist areas.

etc. and outline the information your client may have to provide to the Insurer, or any other parties involved in the claim.

Providing this context will help your client understand the process.

Work

collaboratively Brokers can help support their customers’ needs by working collaboratively with the insurer, so the insurer understands that customers immediate needs.

Where your customer has not purchased cover for their loss, is under insured, or an exclusion applies, brokers should set expectations with their customer and work with the insurer on communicating the messages to the customer. Working collectively as a team will ensure a much better outcome for the client.

This article has been prepared by Allianz Australia Insurance Limited ABN 15 000 122 850 AFSL 234708 (“Allianz”). Information contained in this article is accurate as at 24 November 2022 and may be subject to change. In some cases information has been provided to us by third parties and while that information is believed to be accurate and reliable, its accuracy is not guaranteed in any way. Any opinions expressed constitute our views at the time of issue and are subject to change. Neither Allianz, nor its employees or directors give any warranty of accuracy or accept responsibility for any loss or liability incurred by you in respect of any error, omission or misrepresentation in this article.

Please note the information in this article is general in nature and does not take into account your objectives, financial situation or needs. You should consider obtaining independent advice before making any decisions based on this article.

NIBA.COM.AU / 19

INDUSTRY LEADERS SHARE THEIR THOUGHTS ON 2023

As 2022 draws to a close, it is time to turn our attention to what lies ahead for brokers in the coming year.

We reached out to four industry leaders, who have each shared their thoughts on the key trends, challenges and issues that brokers will need to consider in 2023 – and how they can best prepare for the road ahead.

20 / INSURANCE ADVISER DECEMBER 2022/JANUARY 2023 COVER STORY / Industry Leaders on 2023

Jennifer Richards

Chief

Executive Officer,

Aon Australia Volatility is the new normal

The complexity of the forces we are seeing now is profound. From concerns about recession for many countries, inflation, the ongoing pandemic and geopolitical instability, to hyperinflation and supply chain disruption, it seems that volatility is now becoming the norm. On top of that, we are also facing the seismic forces of climate change and natural catastrophes that we’ve experienced through 2022.

A key issue facing the insurance industry is climate. Businesses are increasingly looking at current and future impacts on their operations, at the same time as regulatory, legal and societal actions related to net zero commitments and environmental, social, and governance (ESG) factors are having an effect.

Cyber is another area of change and challenge, where demand is high, and insurers are cautious. Recent cyber attacks that have targeted companies with large customer databases in Australia really highlights the growing importance of cyber insurance. If clients don’t have the right levels of security in their business and adequate cyber maturity, getting cover in place can be really challenging.

FILLING THE RELEVANCE GAP

Overall, the key issue facing brokers in 2023 is relevance. We need to address the relevance gap that exists between insurance buyers’ risk concerns and the products available in the market to answer those concerns.

The last few years have seen unprecedented innovation and digital disruption accelerated by COVID-19, which has created new, complex and previously unknown risk profiles. We cannot understand these new risks from a historical perspective. What we need instead is predictive analysis that can provide insight into new, emerging risks. The investment in data and analytics is key to supporting buyers to identify and quantify these new risks to insurers, and successfully bringing these new risks to the market. This is what will allow brokers to stay relevant in the current environment.

NIBA.COM.AU / 21

Regulation is another key issue for 2023, as insurers deal with the volume of new regulation introduced following the Hayne Royal Commission.

Nick Harris

Chief Executive Officer, Pacific Marsh

Dynamism and resilience in an ever-changing market

In 2023, brokers will continue to find themselves seeking how to best support clients in navigating an intensive period of risk evolution. We predict the velocity of this change will be particularly concentrated around areas such as cyber incident impact, the implications of inflation on areas such as valuations and cashflow, as well as organisations managing people risk and being proactive in their strategies around people.

Overall, we see the insurance market conditions improving in 2023, with competition now returning across most classes of insurance. However, we expect insurers to remain cautious, with risk selection being critical. Additionally, no doubt this past year’s continual weather events will affect catastrophe cost, retentions and coverage.

STAYING AHEAD OF THE CURVE

The sheer pace of change around risk is the challenge brokers now face. Brokers will be called on to respond with dynamism and remain ahead of the curve on the context in which their clients operate.

Furthermore, the speed of change can outpace the accuracy and dependability of information in the market, the public domain, and ultimately in boardroom conversations. This means that brokers increasingly need to work with clients on clarity and cut through client confusion or even overwhelm. A case in point is cyber insurance.

In this climate, brokers will become advisers for how clients can best demonstrate return on investment internally, at a time when boards are approaching renewals with more reluctance or financial conservatism. Resilience is now more vital than ever.

Given these challenges, there is a critical need for brokers to also be aware of the deepening pressures they are working under, and to take proactive steps to maintain their own wellbeing and mental health, as well as supporting their colleagues in doing this.

To equip themselves, brokers need to adopt a more flexible mindset, as well as make a shift from solving purely for known and historical transactional risk towards approaching challenges with a problem-solving mindset. Brokers need to consider how they’ll use innovative ideas, challenge the status quo and challenge the market to consider alternate ways to solve for complex client needs and market issues. Something we’re continually investing in is to be the risk adviser of the future. I know our Marsh brokers are prepared –our role in helping our clients build resilience is a responsibility we take very seriously.

Just as with this past year, brokers should continue to engage in the renewal process as early as possible and evolve to better serve clients. This means a greater emphasis on advice on emerging challenges, as well as insight-led solutions and proactive risk management in order to help clients stay ahead of risk.

22 / INSURANCE ADVISER DECEMBER 2022/JANUARY 2023

COVER STORY / Industry Leaders on 2023

Simon Weaver

Head of Australasia and Head of Risk & Broking, Asia and Australasia, WTW

Providing quality advice through difficult economic conditions

With inflationary constraints and an uncertain economic climate, many of our clients are under unprecedented pressure. The double-edged sword here is that some businesses will not only struggle for their survival, but also with the availability and affordability of insurance cover. The quality of advice brokers need to provide, particularly over the next 12 to 24 months, has never been so important.

If these conditions continue into a prolonged downturn, it will be something a lot of people working in insurance broking firms haven’t experienced. We need to work with our teams to help them prepare for it and to use the risk and analytical tools we have to their fullest extent to drive the best possible outcomes for clients.

At the same time, the last two years of working remotely haven’t done the industry any favours. Younger brokers have largely missed out on the experience and exposure they get from being in the office to learn from more senior people, and the ability to immerse themselves in their clients’ businesses, to truly understand their needs and requirements.

PREPARING FOR THE ROAD AHEAD

During more challenging economic times, we have to reiterate to our brokers to have empathy with clients. We need to go back to the basics of developing personal connections, because that’s where the level of understanding of our clients will come from.

One big issue which has come out of the pandemic is the genuine lack of presentation skills among brokers – we’ve hidden behind video calls for too long. We also need to reconnect with an entrepreneurial spirit that will help our clients get through this crucial period. When we’re confronted with capacity withdrawn or terms and conditions imposed, some brokers are too quick to say they have no answer.

These times call for creativity – fresh ideas and thinking. It’s not just pushing a submission off to London when capacity in Australia is lacking – when that happens, more often than not, the risk is viewed through the lens of already being distressed.

Apart from getting teams together and learning from each other, which is the way almost all senior brokers developed their craft, we need to develop better digital service capabilities, so that we can be there for clients in an advisory role rather than an administration capacity.

We also need to meet the regulatory change that is coming – the new Insurance Brokers Code of Practice which recently came into effect, and what arises from the Quality of Advice Review. These initiatives will improve the industry, but it puts a significant imposition on all participants to have the right administration processes in place. Technology can help us with that, so that we can focus on being risk partners to our clients.

NIBA.COM.AU / 23

Sarah Lyons

Chief Executive, Gallagher Australia

Chief Executive, Gallagher Australia

A shifting market landscape

BUILDING CYBER DEFENCES

The cyber insurance market landscape will continue to shift when new threats are identified. The global insurance market is currently working to address systemic and catastrophic widespread risk.

There is evidence that premium growth is stabilising for businesses that can demonstrate a strong process-driven cyber risk management strategy, where cyber security and cyber resilience are recognised to be enterprise and operational risks on the board agenda.

Underwriters are looking for clients to have the right controls in place for their business, and for this audit and measurement of controls to also extend to the clients’ suppliers and business partners.

Now with significant focus from the Government and regulators, we expect to see robust data security becoming even more critical in order to defend against cybercrime and to satisfy the contractual requirement of holding cyber insurance. Businesses seeking cyber cover will need to be prepared to answer questions from insurers about how many sensitive records they hold, how they are secured, whether they include privately identifiable data and how old records are purged.

NAVIGATING THE ECONOMIC AFTERSHOCKS

Inflation is another issue that is definitely worthy of a mention. During periods of inflation, businesses are at higher risk of being underinsured, so brokers have a key role to play here. Inflation, cost and availability of materials, labour shortages and natural disasters are all contributing to a situation where property sums insured are at risk of falling short of the cost of reinstatement.

Compounding that, pressure on claims processing and the difficulty of accessing trades are prompting some insurers to offer cash settlements instead of reinstatement. Care needs to be taken by businesses to understand the full costs of rebuilding or repairs before accepting settlement offers.

Equally, the standard 12 month indemnity period may no longer be sufficient to allow for extended delays in accessing materials and/or labour.

Another area we are seeing an uptick in interest on is selfinsurance arrangements. Some businesses are considering alternative insurance arrangements through captives or cell captives. If a business meets the criteria for inclusion, they may be able to self-insure through a shared pool.

24 / INSURANCE ADVISER DECEMBER 2022/JANUARY 2023

COVER STORY / Industry Leaders on 2023

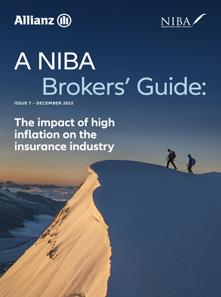

A NIBA Brokers’ Guide:

The impact of high inflation on the insurance industry

ISSUE

7 – DECEMBER 2022

High inflation and the impact on insurance customers 28

Inflation impact: what the current economic climate means for insurance 30

Keeping pace with rising inflation 32

The impact on claims and the supply chain 34

The NIBA Brokers’ Guides are brought to you through a partnership between Allianz Australia Insurance Limited (Allianz) and NIBA. We hope the knowledge of our subject matter experts, coupled with Allianz’s industry expertise, helps you and your clients prepare for the future. We welcome ideas for future subjects – please email your suggestions to editor@niba.com.au.

Contents

26 NIBA GUIDES: Issue 7 – December 2022

Welcome note

After navigating our way through the global pandemic, we found the spectre of global inflation waiting patiently for us – presenting a whole new set of challenges to tackle.

The very real impact of the inflationary environment we’re living in can be felt every month in our mortgage repayments, every quarter in our energy bills, and every time we visit the supermarket.

Belts are being tightened, and as businesses scrutinise every line item of their budget in the hope of identifying some easily achieved savings, insurance is often one they’ll put a question mark against.

We’ve talked all through COVID-19 about the vital role brokers have to play, and as we head into 2023, that role is evolving, but is more important than ever.

While clients will have an understanding of the impact this inflationary environment will have on their day-today, they may not fully understand the impact on the insurance sector.

And, it’s important they do – because, while they may identify insurance as having the potential to save some money, the reality is it’s far more likely to increase in cost.

From replacement values to supply chains, the difficulty in getting repair work done to the increasing threat of extreme weather, the challenges keep on mounting up for businesses across the country.

This presents an opportunity for brokers, yes, and it’s one that our business community absolutely needs you to act upon.

There’s never been a more opportune moment to fully embrace the role of risk adviser. Businesses are facing an unprecedented complex web of risk, and they need the right advice, and the right protection, to confidently step into it.

Over the coming months, the challenges are likely to grow, which is why this edition of our Brokers’ Guide is focused on inflation.

From the impact it’s having on the insurance industry to the way it’s affecting supply chains, we’ve explored the inflationary environment from a number of angles – ultimately, to arm you with the context and the conversations to be having with clients.

Times are tough, undoubtedly – however, the need for a proactive, caring risk adviser has never been greater.

And both Allianz and NIBA are here to support you every step of the way.

PHILIP KEWIN Chief Executive Officer, NIBA

PHUONG LY Chief General Manager, Commercial at Allianz

NIBA GUIDES: Issue 7 – December 2022 27

High inflation and the impact on insurance customers

Australia is facing record-high inflation levels, with the September 2022 quarter marking annual inflation of 7.3 per cent the highest rate in 32 years1 . It’s no surprise that inflation is impacting insurance customers, brokers and underwriters – but there are opportunities for greater education and support for broker clients.

Strains on supply chains, uncertainty, the war in Ukraine, and knock-on effects of the COVID-19 pandemic are all contributing factors to the current rise in the cost of living and soaring inflation rates.

Brokers need only look at asset values in vehicle insurance where, for the first time in recent history, market value is outstripping agreed value in many cases.

“It’s not something I’ve ever seen before, this sort of rapid change. Certainly, for the entire time I’ve been involved in insurance, vehicle values have depreciated,” says James Fitzpatrick, Chief Technical Officer at Allianz.

“With the extensive flooding we’ve seen in the last 12 months, one of the things that follows is the demand surge in labour and materials cost in areas where we’ve seen these natural disasters can outstrip what we would have expected in terms of building inflation,” says Fitzpatrick.

In uncertain times, says Fitzpatrick, there is an opportunity for brokers to show value and provide a calm influence and good advice to their clients.

Supply and demand adds pressure

Cameron Sheild, Strategic Risk Advisor at Lockton’s Melbourne office, has seen first-hand the impact of supply and demand on inflation.

“Obviously, as brokers we understand capital supply demand and how it impacts our market cycles. The time it has taken to arrange an assessor and various tradespeople required to complete the works in my estimate has tripled,” says Sheild.

“Delays have occurred in the process due to the supply and demand availability, and this has had a downstream impact on not only claims inflation that is passed on to the client but also the delay in the indemnity, settlement and repair losses.”

Underinsurance – a risk to be wary of

As we continue to see assets changing in price and different rates of inflation based on the interruption to the supply chain, as well as labour and energy pressures, there is pressure on replacement values for customers.

“When using averages, both clients and brokers need to be really clear on the current valuation of assets and also allow for what might come through in terms of further inflation over the year,” says Fitzpatrick.

Sheild agrees underinsurance is “high on the insurance agenda” and says certain markets are now not looking at insuring assets unless an updated valuation has been undertaken.

“Every broker needs to be asking their clients about valuations. And not only that, but as a broker, we just cannot accept the valuation number. I believe we’ve got a duty for accurate valuation disclosure, in terms of serving our clients and helping them.”

An increase in high-value severe losses

After Australians have experienced multiple natural disaster events from bushfires, hail, flooding and cyclones, the recovery inputs effect supply and demand which in turn impacts inflation.

“Effectively, what we’re seeing is an increase in severe losses,” says Sheild. “It’s not just a matter of low-value frequency losses that always occurred. We’re now seeing high-value severe losses frequently occurring.”

“We’ve seen underwriting authorities being taken away, we’ve seen the process taking a lot longer, and the underwriters themselves are under immense pressure, and the loss ratios are only increasing.”

1Consumer Price Index, Australia, September Quarter 2022, Australian Bureau of Statistics,

28 NIBA GUIDES: Issue 7 – December 2022

www.abs.gov.au/statistics/economy/price-indexes-and-inflation/consumer-price-index-australia/sep-quarter-2022

1.

Proactively inform your clients and set their expectations. Ensure any insurance offering is sound and appropriate, particularly examining agreed value versus market value policies in the current climate. 2. Innovate and consider how clients can manage risk. What other policy terms and conditions might be adjustable to help get the balance between risk and the cost of insurance? 3. Question your clients on all their values – property values, business interruption and indemnity periods – to ensure your clients understand the risk of undercooked values leading to a short-changed insurance payout. 4. Define your clients’ appetite for risk, and the ability to withstand inflation replacement values. 5.

A broker needs to be able to understand a client’s business and risk profile to adequately procure suitable insurance. Look at property valuations, review business interruption exposure, and review their balance sheet in terms of the financial KPIs and risk tolerance.

Five ways brokers can support their clients in a high-inflation environment

NIBA GUIDES: Issue 7 – December 2022 29

Inflation impact: what the current economic climate means for insurance

High debt, user spending, strong consumer demand and global economic conditions continue to drive inflation – and it’s impacting almost every facet of our personal and professional lives.

And, with forecasts suggesting this isn’t a short-term situation, it looks as if we’re all going to have to buckle in for the ride.

“It’s just difficult for a lot of people out there,” says Phuong Ly, Chief General Manager Commercial at Allianz.

“The cost of living is going up, energy prices are going up, and the geopolitical environment, on top of all that, is creating a huge amount of uncertainty for everyone.”

“The challenge for most governments is providing leadership and giving people a direction in which they’re taking the country, as well as communicating what are they going to do and to support to keep inflation manageable.”

Broker Dale Hansen, CEO of Austbrokers Coast to Coast based in Burleigh Heads, Queensland, says the government

is struggling to know what levers to pull to bring inflation under control while minimising harm to the family budget.

“Inflation is the fact that we overheated the economy by injecting too much cash into the economy without there being a cache. We fundamentally printed money to get Australia through the COVID-19 crisis.”

Hansen is confident that Australia will ride out this period better than most, although acknowledges significant inflationary pressures are still on the horizon for insurance policyholders, with increases across some supply chains still expected.

“An inflationary increase isn’t necessarily going to account for that, and for a lot of people, I fear when something goes wrong, they are going to be in a very challenging space.”

30 NIBA GUIDES: Issue 7 – December 2022

Impact on the sector ongoing

As the cost of capital, labour and materials continue to increase, the cost to claim and cost of acquiring funds increases, as does third-party costs which all add to rising insurance costs.

As reinsurance claims continue to rise, along with increased catastrophes placing greater risk on insurers, the sector is left in need of a multi-faceted approach to bring down insurance costs.

Hansen is finding the availability of products due to decreased appetite for risk a far greater issue for his clients.

“We’ve seen a decrease in competition as we’ve seen some underwriters offering that product leave the market, and not seeking to have any availability in that asset class.”

The market is suffering from decreased capacity as brokers struggle to find suitable insurance policies for some risks like professional indemnity, cyber, property – which Hansen says is ‘very challenging for brokers’.

Opportunity for brokers to reinvent

Ly says insurance is often a ‘grudge purchase’ for customers, but this offers a huge opportunity for brokers to lead the way on educating and informing clients of the drivers behind the change and uncertainty in the current market.

“Take the opportunity to provide insights and thought leadership for your customers. Keep them informed about what is impacting the market and how to best equip themselves to be ready now and for what lies ahead. Being informed of the issues, will ensure your customers can make the best choices for their needs.”

Hansen believes this is the right time for brokers to innovate and be of value to clients.

“We need to reinvent ourselves,” he says. “We provide advice as a service. First and foremost, that’s what we are, that’s what we do. We need to see ourselves as professionals, and we need to charge for our advice.

“The general public has never needed an insurance broker more than they need one now. If anything’s proved this, it’s the catastrophes that have run across the eastern seaboard for the last 12 months.”

Five things brokers need to know about inflation

The high level of underinsurance in Australia isn’t going anywhere and the cost of rebuilding or replacement is increasing. Check your clients are sum insured for the correct amount.

Accurate valuations are critical in the current market. The old adage of just increasing your sum insured by inflation or CPI won’t cut it.

Brokers need to focus on the quality of advice to be a salve for clients facing uncertainty in their economic futures. Increasingly, the broker is becoming a critical point of contact for clients.

Understand the impact of inflation on a client’s business from the right sum insured level or if profit levels will be impacted by inflation.

Really get to know your clients. A good asset management plan and a good business continuity plan are key to helping clients present their risk in the best possible light.

1.

2.

3.

4.

5.

NIBA GUIDES: Issue 7 – December 2022 31

Keeping pace with rising inflation

In times of rising inflation, the broker relationship is about making sure your customer’s insurance stacks up.

In times of stress, people need experts to rely on. And, in a high inflationary environment, insurance brokers have a hugely important role to play to help clients navigate through the coming months and years.

It’s going to be a few months of tough conversations with clients to ensure they fully understand what the impact of high inflation means for them – both in terms of premiums, but also should a loss occur.

Underinsurance is an already pressing concern across Australia. Many customers are firmly focused on finding ways to cut back and save money, while the rising costs of repairs and rebuilding are widening the gap between valuations and true replacement costs.

“Most people are well aware that costs are on the increase, but have they actually done the math to assess the real cost to them if the worst case scenario was to happen?” asks Danny Adams, General Manager Insurance Claims for Allianz.

“The recent flood recovery in Victoria is a tragic indication of what can happen when customers elect to take the risk of underinsurance. They just can’t get back to where they were before their loss was based on their level of cover.”

Reviewing policies in an inflationary environment

It’s vital to touch on any exclusions in existing cover that should be reconsidered in the context of high inflation and detail the potential implications of declining the options presented. Valuations and terms and conditions that have been in place for some time will need to be reviewed to allow for the flow-on effect of rising costs. In the case of commercial property insured for potential damages, restoration costs have increased significantly.

In addition, it’s essential to be thorough with an assessment of assets. Valuations based on the original purchase price will warrant a reality check.

“The conversation to have with a customer whose business hinges on having the company vehicle, for example, is ‘what needs to happen to future-proof your turnover in these tough times when repairs or replacements can take

months instead of weeks?’ ” Adams says.

Your customer relies on their insurance to come through for them once they lodge a claim, so a thorough review of policy inclusions and maintaining up-to-date valuations is vital in times of rising inflation.

Adams says, “Connecting regularly to keep that conversation going and review your customer’s current situation is so important in these rapidly changing times. We’re always looking for ways to improve the customer experience and sharing up-to-date knowledge with the insurer prepares us to fulfil expectations.”

Adding value will always come down to more than just the raw, upfront cost.

The dependability of an insurer’s supply chain largely determines their capacity for satisfactorily restoring your client’s home or business to full function, according to Bradley Bartlem, CEO of Hunter Premium Funding.

“In the context of a post-pandemic economy and political turmoil in Eastern Europe, premium funders who’ve developed robust strategies for dealing with market volatility will provide greater customer assurance than bespoke processes and supply chains.”

Bring solutions to your clients’ pain points

Cash flow is commonly a big source of stress for business owners in times of high inflation. Where you’ve identified a need to substantially increase a customer’s existing level of cover, providing them with the option of a premium funding product to meet that extra cost can be the real value-add. “Poor cash flow forecasting and financial management is the downfall of more than 80 per cent of businesses that fail,” Bartlem says.

“The flexibility of paying in instalments, instead of a lump sum, can be a welcome solution to the stress of cash flow in uncertain times.”

Not readily available in other industries, this facility can make it accessible for your client to commit to the level of cover they need.

32 NIBA GUIDES: Issue 7 – December 2022

“Soaring interest rates have prompted traditional lenders to crack down on borrowing requirements. This way, you help your customer to afford essential safeguarding of their business by freeing up the cash flow they need, without all the paperwork,” says Bartlem.

“Increasingly, it’s a benefit for many customers to be with a premium funder that has the capacity to be able to work with their clients through situations of hardship and work with the broker to bring them through that rough patch financially.”

In response to the widespread impacts of rising inflation, it’s vitally important for brokers to demonstrate their value to clients.

Making sure they have not only the right levels of cover in place, but access to premium funding should they need it, are two essential ways to help ensure clients emerge from this inflationary period unscathed.

Tips to start the conversation

Don’t wait until it’s time for renewal to prompt your customer to stay on track for the protection they need.

Check in regularly to discuss how their situation or needs may have changed and allow plenty of time for them to consider the options you present them with for better value insurance.

Encourage a review of existing policies and inclusions and talk through potential scenarios of how the process of a claim might look for them, and where updating valuations may be in their best interests.

Challenge the idea that cutting upfront costs will save money. Help clients understand the potential impact of underinsurance.

1.

NIBA GUIDES: Issue 7 – December 2022 33

2.

3.

4.

The impact on claims and the supply chain

As global inflation triggers supply chain delays and chronic labour shortages, it’s imperative that clients understand what this means for insurance claims.

The crippling, flow-on effects of high inflation are being seen in the soaring cost of goods and services, in tandem with limited availability, leading to increased complexities and lengthy delays for claims resolution.

The impact of the supply chain difficulties affecting businesses across the globe continues to have a significant impact on claims. Port closures, labour shortages and COVID-related delays – not to mention the war in Ukraine – mean that supply is stifled, and the wait for goods to be received – and claims to be resolved – can be lengthy.

Head of Claims at Gallagher, Adam Squire, says that supply chain challenges are particularly noticeable in the case of vehicles, for example. “Spare parts are increasingly difficult to source, so even longer wait times are unfortunately a reality. If the car is a necessity for people’s livelihood, they’re faced with an even bigger problem.”

Supply chain issues across the board create an economic climate where it’s vital to review the value assets are insured for.

Squire encourages brokers to seize the opportunity to really look after clients by anticipating their needs and guiding them to adopt the added protection they need to counter the effects of high inflation.

“Setting the sum insured can seem like a straightforward paper exercise but becomes a complex consideration once shortages come into play. When it comes to the crunch of lodging a claim, that’s where the rubber hits the road, and you see how well your broker has advised you. Well-informed recommendations will pre-empt make-or-break outcomes for your client and make adjustments accordingly.”

34 NIBA GUIDES: Issue 7 – December 2022

Reviewing cover to account for supply chain challenges

There’s nothing worse than having to go out to inform a client they’re drastically underinsured once they’ve suffered a loss, so using current supply chain challenges as a lead into the conversation is a smart way to tackle it.

Luke Smith, Head of Property Short Tall Claims for Allianz, says, “Sharing the bad news about rising replacement costs is a far easier conversation to have while there’s the opportunity for the client to update their cover. You might start by asking whether they’re following the news and the impacts that things like the war in Ukraine are having on the global supply of commodities.

“Be well informed enough yourself to help them grasp the tough cycle this has triggered, whereby it’s taking more time to process claims, and the levels of cover they’ve had in place may no longer be adequate for their needs as the costs of materials and labour continue to climb.”

Ramping up risk advice

This is a market that compels brokers to become risk advisers to their clients.

A short supply of materials and labour means that rebuilding costs have gone through the roof, and it’s necessary for business owners to think about the right level of cover.

Sally Coulton of WTW explains, “Brokers need to be having early conversations with clients about their declared values. Insurers will pay particular attention to ensure correct replacement values are being declared. Given inflation and supply chain shortages, brokers should also recommend that clients obtain professional valuations.

“It is important for clients to ensure they won’t be prejudiced in the event of a claim by co-insurance clauses in policies if they have underdeclared their values. In the current economic climate, a review of policy sums insured may be required to cater for a rise in values and confirm they would have adequate protection for a significant loss.”

Have customers who’ve been wise enough to take out business interruption cover accurately anticipated what it will take for them to keep their business going for an extended period, at inflated running costs?

Provisions for leasing alternative premises or loss of profit may fall short if their current level of cover was calculated prior to the current supply chain challenges. “Indemnity periods are critical for clients, taking repair and rebuild challenges – which can be difficult and lengthy – into consideration,” says Coulton.

In prior years these periods may have been sufficient but may now need to be increased to ensure adequate business interruption protection is in place. We are seeing widespread time delays that are occurring for reinstatement works.”

For brokers, it’s about helping clients balance cost considerations with an appetite for risk.

“It all comes back to early engagement with clients,’’ Coulton says. Brokers need to gain a full understanding of their clients’ businesses and tolerance for risk. Only then, can a broker suggest higher risk retention options to consider, if containing premium expenditure is required.”

Ultimately, as this inflationary environment continues into the foreseeable future, together with other geopolitical factors, the global supply chain will continue to prove challenging.

By ensuring clients’ insured values are accurate, and provision has been made for supply chain delays, brokers can help reduce the potential impact the supply chain may have on the resolution of claims.

Key takeouts for brokers

1.

Global events are putting even more pressure on supply chains, with costs increasing and some goods being in short supply – therefore, a review of insured values is essential.

2.

The reality today is that the time it takes to fulfil repair work is being lengthened by supply chain delays, so reviewing the length of coverage clients have for, for example, business interruption is vitally important. One year may no longer be adequate.

3. Make sure you’re well informed about the factors impacting the global supply chain – it will help when having conversations with clients.

NIBA GUIDES: Issue 7 – December 2022 35

NIBA Guides

Member Helpline: Tel: 02 9459 4300 / niba@niba.com.au / www.niba.com.au National Insurance Brokers Association Suite 4.01B, Level 4, 31 Market Street / Sydney NSW 2000