3 minute read

Becoming a CPA — Still a Mother’s Dream

BY KATHLEEN HOFFELDER, NJCPA SENIOR CONTENT EDITOR

While a mother may dream of many careers for her children, becoming a CPA often lands somewhere on that list. Just ask Alan E. Gumeny, a semi-retired CPA of Clifton, whose mother, Penny, proudly professed that wish publicly — long before Alan ever thought of becoming a CPA. Was it a premonition? Coincidence? Oddly, it would seem to be a bit of both.

Advertisement

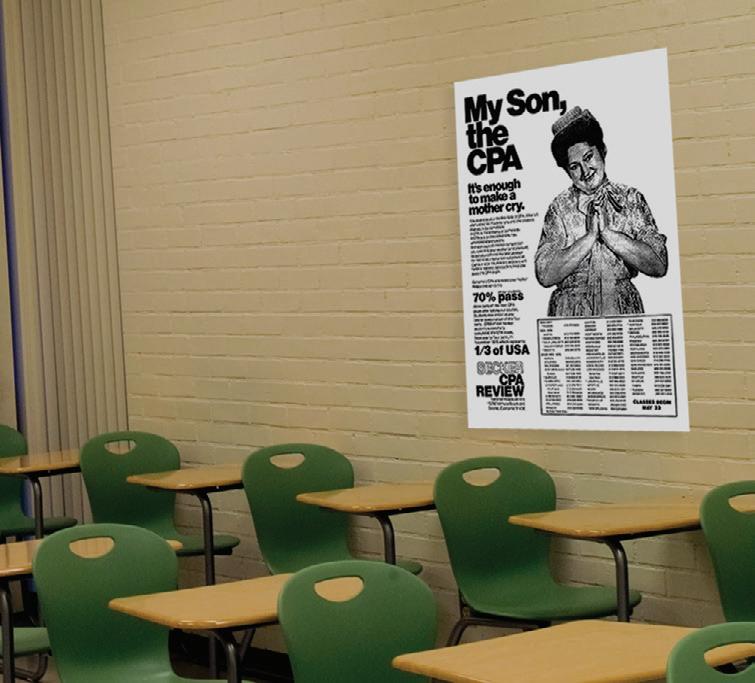

In preparing to become a CPA, Alan, who was then a student soon to be graduating from Rutgers University in the late 1970s, opted to take a Becker Review course. On the wall in the classroom was an ad featuring a woman boasting, “My son, the CPA. It’s enough to make a mother cry.” When he looked up, he realized that it was his mother who was smiling with pride in the ad.

A DIFFERENT PATH

While Alan didn’t actually take the CPA Exam at that point in his life, he did eventually become a CPA through a non-traditional route. As soon as he was of age, he joined the Army, since his parents taught him and his four brothers the importance of having a “service mentality.” That sentiment came from his mother, he says, who was raised in the Great Depression. He recalls her saying, “When good things happen to you, turn around and give back.” Alan says his mother made some “good decisions,” noting that both parents acted and modeled to take advantage of New York’s burgeoning film industry and its close proximity to Nutley, where they lived. Penny mainly took care of the children and worked at the Associated Press in New York but also did “side gigs” modeling and acting when she could.

Alan also had a knack for making good decisions. After working three years as a combat engineer building bridges and other structures in the Army, Alan utilized the GI Bill to attend Rutgers University. There, he enjoyed both engineering and accounting classes but decided on accounting as a major. Between his job with the IRS, where he worked for three years after graduating from college, the commute as well as a new baby on the way, he was unable to finish studying for the CPA Exam.

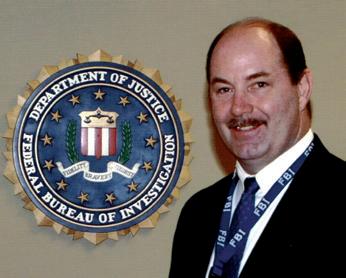

He then went on to accept a job with the FBI, where he worked for 22 years and honed his investigative and forensic accounting skills involving mostly white-collar crimes. “Many of the cases you would have were bust-out scams (where organizations would end up closing shop and selling inventory on the black market), bankruptcy scams, Ponzi schemes and insurance fraud. I had to track these guys down and get the money back,” he explains.

While at the FBI, he eventually ended up going back to a Becker Review course, taking the CPA Exam in 2002 and passing all four parts in one sitting. Imagining how his mother, who had passed away by that time, would have reacted to the news of his passing the CPA Exam, he says, “I’m sure she would have been delighted and proud over the course of events that actually came true.” And that “dream” came true in spades — not only did Alan become a CPA, but his son, Bryan, is working towards that goal at a CPA firm in New York and his daughterin-law, Kristen, and son-in-law, Keith, are both CPAs. He and his wife, Barbara, have two other non-CPA children, Eirik and Kristen, as well as five grandchildren.

Looking back, Alan speaks highly of his past job experiences, noting that having the right accounting skills helped him in all steps of his career. Alan eventually left the FBI for a six-year stint at a Wall Street law firm, retired in 2011 and later started his own consultancy.