WINTER 2022/23 WHAT IS AND ISN'T INCLUDED IN THE INFLATION REDUCTION ACT OF 2022 4 TIPS FOR IMPROVING YOUR HIRING RESULTS UPSELLING CLIENT ADVISORY SERVICES: BEYOND THE BUZZWORDS

RALPH ALBERT THOMAS, CPA (DC), CGMA Chief Executive Officer & Executive Director rthomas@njcpa.org

THERESA HINTON Chief Operating Officer thinton@njcpa.org

DON MEYER, CAE Chief Marketing Officer dmeyer@njcpa.org

RACHAEL BELL Managing Editor rbell@njcpa.org

KATHLEEN HOFFELDER Senior Content Editor khoffelder@njcpa.org

DIANE ESPIRITU Senior Graphic Designer despiritu@njcpa.org

THE NEW JERSEY SOCIETY OF CERTIFIED PUBLIC ACCOUNTANTS

105 EISENHOWER PARKWAY SUITE 300, ROSELAND NJ 07068 973-226-4494 | NJCPA.ORG #NJCPAMAG

READ NEW JERSEY CPA ONLINE AT NJCPA.ORG/ NEWJERSEYCPA

TO ADVERTISE OR PROVIDE SPONSORED CONTENT

IN NEW JERSEY CPA Visit njcpa.org/advertising or contact Eileen Proven at eproven@njcpa.org or 862-702-5640

4

Upselling Client Advisory Services: Beyond the Buzzwords

Accounting advisories have grown by leaps and bounds, but only the most practical and vital services are being utilized the most. Data analytics, CFO budgeting services and cash flow forecasting are all add-on services to routine tax and audit practices.

6 What Is — and Isn’t — Included in the Inflation Reduction Act of 2022

The Inflation Reduction Act provides for major tax changes to the corporate alternative minimum tax and a surtax on the repurchase of corporate stock. It also includes significant funding for the IRS. Removed at the last minute, though, was any change to the taxation of carried interest.

8 4 Tips for Improving Your Hiring Results

A thorough routine for hiring can be the difference between failing to attract qualified candidates and finding the perfect fit for the organization. It’s equally important to have a job that matches a candidate’s natural style of work.

2

14

CLOSE UP

NJCPA Members Approve Bylaws Changes 10

BUSINESS MANAGEMENT

Key Metrics Businesses Need to Watch Pre-Recession

An Organizational Change Management Approach Ensures DEI and DEIB Are Sustainable 12

FINANCIAL PLANNING SERVICES

SPONSORED CONTENT

Rising Interest Rates Could Reduce Lump-Sum Pension Payouts

An Early Harvest?

FIRM MANAGEMENT Strategy Debate: Value Billing versus Hourly

SPONSORED CONTENT How to Reduce Customer Churn and Keep Clients Happy During Tax Season 16

PROFESSIONAL DEVELOPMENT

Virtual Interviews: Five Tips for Excelling Through the Screen 18

RISK & COMPLIANCE 6 Essential Practices to Protect Your Firm from Cyberattacks 19

TAX

Higher Education Tax Credits: What Are the Requirements?

The Death of Deducting Litigation Expenses: What’s Next?

21 TECHNOLOGY Year-End Crypto Tips for Practitioners 22 NJCPA NEWS y NJCPA CEO Ralph Albert Thomas to Retire in June y Applications Being Accepted for NJCPA Scholarships

y Mentoring Comes Full Circle with Internships

y 10 CPA Exam Fee Lottery Winners Selected

y NJCPA Publishes Audit Report 26

CLASSIFIEDS 28

MEMBER PROFILE

Della Hammer Cherchia, CPA, CGMA

THE MAGAZINE OF THE NEW JERSEY SOCIETY OF CERTIFIED PUBLIC ACCOUNTANTS WINTER 2022/23

contents

NJCPA Members Approve Bylaws Changes

In October, eligible NJCPA members were invited to participate in a bylaws vote affecting membership categories and the professional conduct suspension/ termination process. The vote, conducted by third-party vendor AssociationVoting, resulted in 1,546 member votes. The adop tion of proposed amendments required an affirmative vote of the majority of votes cast. All of the proposed changes to the membership categories and the professional conduct process were approved.

CHANGES TO MEMBERSHIP CATEGORIES

The approved changes to the membership categories address the profession’s CPA pipeline challenges along with anticipating the ongoing changes in the profession impacting the Society. The approved changes are as follows:

y The CPA Candidate and Associate membership classes will merge into a new membership class named Affiliate (approved by 79 percent of voting members). The following individuals will qualify for Affiliate membership:

• Those who have completed the academic requirements to become a CPA and are pursuing further requirements necessary to become a CPA (the previous CPA Candidate qualifications)

• Professional staff working in an accounting or finance position under the supervision of a CPA

• Any chartered accountant or its equivalent in any country other than the United States (the previous Associate qualifications)

• Instructors of accountancy in schools of collegiate standing

• Non-CPA owners, partners, shareholders or principals of firms licensed by the New Jersey State Board of Accountancy

Affiliates will not be allowed to vote on ballot measures presented to the membership but may be eligible for limited leadership positions including chapter board positions, committee chairs, group leadership and appointed committees. When an Affiliate becomes a CPA, he or she shall be elevated to CPA member.

y The definition of the Student member class will change to “An undergraduate or graduate student who has an interest in accounting, finance, business or information systems” (approved by 85 percent of voting members).

y The Fellow member class will be renamed CPA member; eligibility remains the same (approved by 80 percent of voting members).

“The NJCPA and the profession are at risk of losing talent, influence and opportu nity,” said Kathleen Powers, CPA, CGMA, PSA, 2022/23 NJCPA president and CFO

New Jersey CPA (ISSN 1534-6692) is published quarterly by the New Jersey Society of Certified Public Accountants, 105 Eisenhower Parkway, Suite 300, Roseland, NJ 07068.

Issue No. 93 Copyright © 2022 New Jersey Society of Certified Public Accountants. Annual membership dues include $9 for a one-year subscription to New Jersey CPA magazine. Members may not deduct the subscription price from dues.

Periodicals postage paid at Roseland, NJ, and at additional mailing office. POSTMASTER: Send address changes to New Jersey CPA, 105 Eisenhower Parkway, Suite 300, Roseland, NJ 07068-1640.

The materials and information contained within New Jersey CPA are offered as information only and not as practice, financial, accounting, legal or other professional advice. The opinions expressed herein are those of the authors and not necessarily those of the New Jersey Society of CPAs. Publication of an advertisement in New Jersey CPA does not constitute an endorsement of the product or service by the New Jersey Society of CPAs.

at The Matheny Medical and Educational Center. “The approved bylaws changes update terminology and simplify and consolidate categories, making it as easy as possible for graduates/new professionals to remain NJCPA members and start taking advantage of the benefits of membership.”

CHANGES TO PROFESSIONAL CONDUCT PROCESS

The other approved changes to the bylaws relate to the professional conduct process for implementing what are known as “automatic” suspensions and terminations. The two amendments, which were approved by 63 percent of voting members, remove the requirement that the NJCPA Board of Trustees approve all suspensions and terminations of members in order for the NJCPA to conform to the requirements of the AICPA Joint Ethics Enforcement Program (JEEP). Under the JEEP program, the AICPA investigates cases and refers its findings and recommendations to the NJCPA Professional Conduct Committees (PCC).

Certain disciplinary actions issued by various government agencies require automatic NJCPA termination or suspension without a hearing. However, in the previous version of the NJCPA bylaws, Board approval was required, which contradicts the JEEP’s automatics provisions and slows down the PCC processing of these cases.

“These changes to the professional conduct section of our bylaws will expediate the processing of certain cases involving suspension or terminations of membership and will have no impact on the severity of disciplinary actions,” added Powers.

The bylaws changes will go into effect June 1, 2023. The Affiliate category will be open for applications at that time.

For more details on the changes to the bylaws, visit njcpa.org/bylaws.

CLOSE UP

2 WINTER 2022/23 | NEW JERSEY CPA

Simplicity

Do it all online – no need for paper forms, software or even envelopes and stamps. You can also import the data directly from Excel, QuickBooks® or Xero accounting software. We save your payer and recipient data year-over-year to make future filings even easier.

Security

As an authorized e-file transmitter, we protect your data using the strongest encryption program available. Data is then transmitted to our high-security, SOC 2-certified print-and-mail facility.

Savings

Pay only for the number of forms you file even if it’s only one. Plus, save the labor costs of printing, mailing and manually submitting the forms. TIN matching is also available on a per contact basis, saving you money and helping you avoid costly mismatches.

3 NEW JERSEY CPA | WINTER 2022/23 It’s Easy! Visit efile4Biz Today Remember – no software, no forms, no envelopes, no postage … and a lot less of your valuable time. ©2022 ComplyRight, Inc. *Offer details: Offer expires 1/26/23 at 11:59 p.m. ET. Enter Code 15OFFB12 at checkout. Discount cannot be used for Direct-to-State Filing, Edits, Corrections, TIN Matching, Form Credits, Service Bureau or Subscription Plans or combined with any other offer or applied to previously placed orders. Limit one discount per customer.

No Software – No Forms – No Hassle Print, Mail & E-File with efile4Biz Looking for an Easier Way 1099 W-2 SAVE 15%! Enter code 15OFFB12 at checkout* to Do 1099s & W-2s?

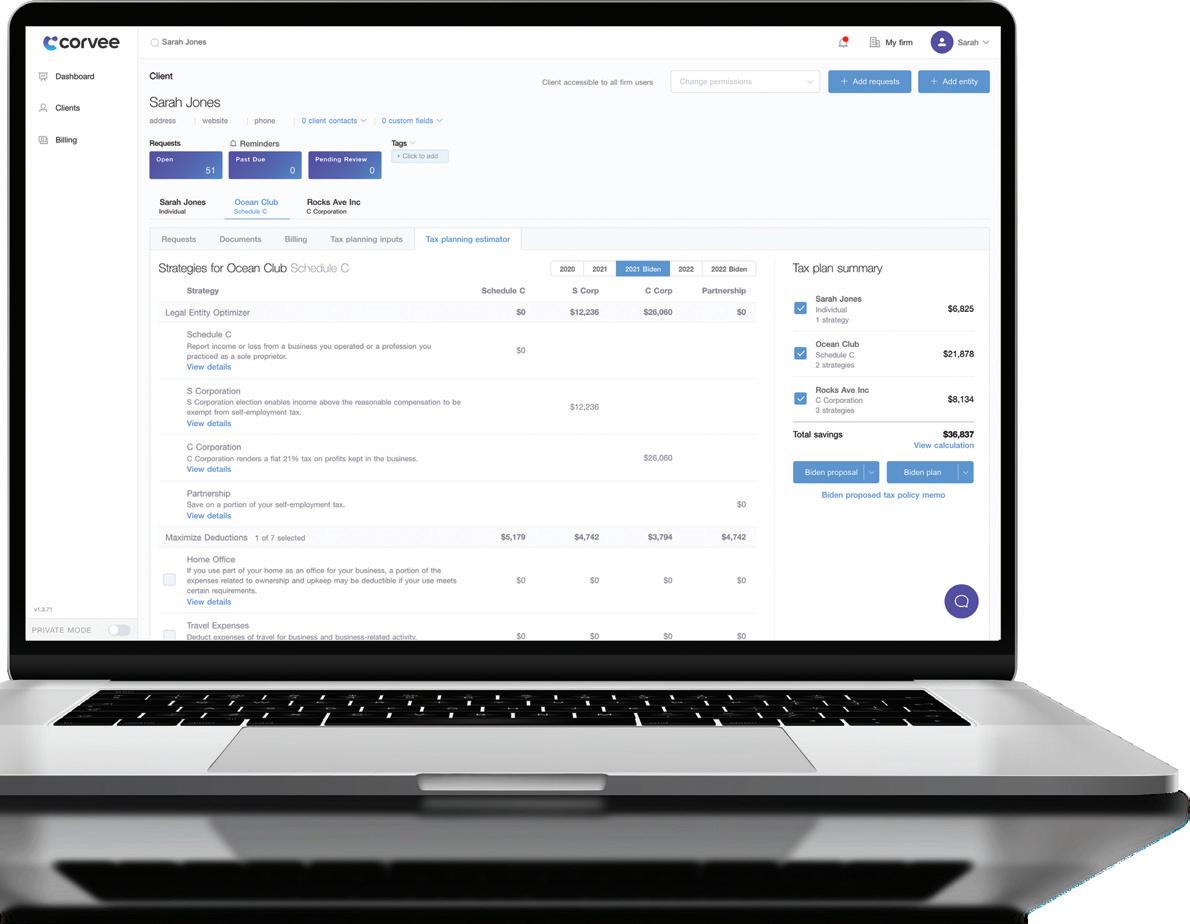

UPSELLING CLIENT ADVISORY SERVICES: BEYOND THE BUZZWORDS

By KATHLEEN HOFFELDER NJCPA SENIOR CONTENT EDITOR

By KATHLEEN HOFFELDER NJCPA SENIOR CONTENT EDITOR

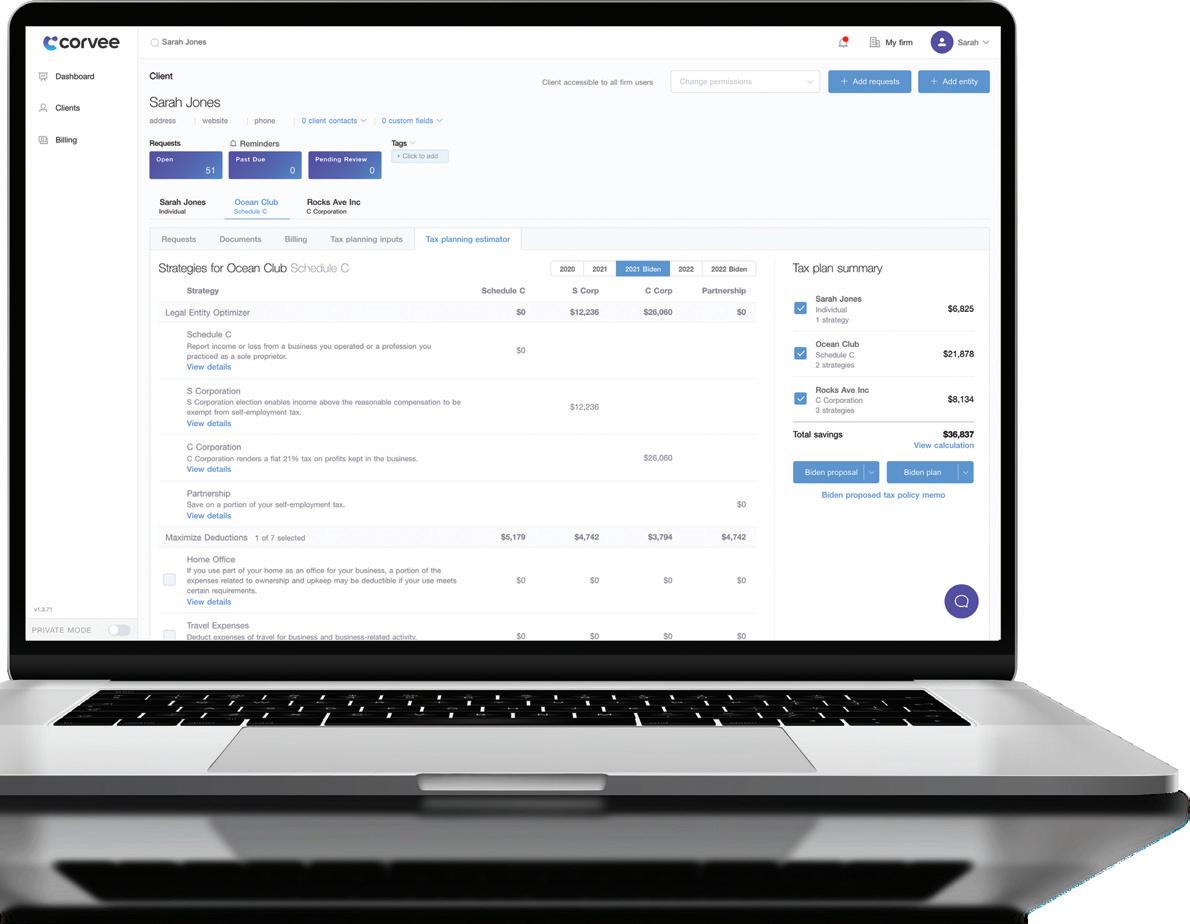

Upselling CAS, or increasing services offered to traditional tax and accounting clients, has been popular. But is there room to continue to upsell more services, and is upselling CAS needed to be competitive?

80 percent of respondents plan on offering or expanding advisory services in the future, and only 25 percent considered themselves a traditional firm, offering tax and compliance services.

Client advisory services (CAS), also referred to as client accounting services, have been providing a way for organizations to receive practical, hands-on solutions to increase cash flow, create opportunities for expansion, reduce costs with automation and more efficiently use data and analytics to monitor business needs. In short, CAS has grown up to be the youthful, energetic sibling in a family of well-established accounting and tax client offerings.

The answers depend. Indeed, those who have started offering CAS have shown a steady bump in revenue. As noted in a December 2021 Journal of Accountancy article showing results from a Client Advisory Services Benchmark Survey from CPA.com and the American Institute of CPAs’ (AICPA) Private Companies Practice Section (PCPS), “Client advisory services (CAS) practices saw a 20% growth rate in terms of net client fees per professional during fiscal year 2019 and the first few months of 2020.” That growth, it explained, outpaced the 12-percent growth CAS practices reported in 2018, when the inaugural benchmark survey was conducted.

A global take on CAS also showed an increase. According to a Spotlight Reporting 2021/2022 Global Advisory Trends Report, which included more than 600 responses from accounting professionals worldwide in July and August 2021, almost

So, which CAS are being upsold or considered leading contenders today?

Outsourced accounting and CFO services, workflow, risk management, advanced KPI reporting and business valuation services, to name a few.

“The services that clients are most interested in are generally more complex,” explained Christopher R. Cicalese, CPA, MSTFP, associate partner at Alloy Silverstein Accountants and Advisors.

To him, providing business performance insight like that of a CFO is popular.

Hayley Mayer, EA, a principal at Prager Metis, has also seen interest from clients in CFO services. “Many times, clients require assistance with a more-customized financial reporting package which is a natural for our CFO advisory services,” said Mayer.

“It’s an easy sell if the client currently has temporary staff handling their bookkeeping or if they are looking to reduce the amount

FEATURING (in order of appearance)

CHRISTOPHER R. CICALESE, CPA, MSTFP

Associate Partner

Alloy Silverstein Accountants and Advisors

HAYLEY MAYER, EA

Principal Prager Metis

SEAN P. BREHENEY, CPA, MBA Principal PKF O’Connor Davies, LLP

4 WINTER 2022/23 | NEW JERSEY CPA

of bookkeeping needed. Outsourcing is also a great way for the client to save money as they will not have to cover the cost of employee benefits and employer taxes,” she added. “It can also be an easy sell if the client currently has a part-time employee only coming in a few days a week; in this scenario, the client could benefit from CAS in that they would receive services more frequently since they are not dependent upon someone being present in the office.”

Retirement planning, wealth manage ment and trust/estate planning are also in favor as additional services. “With a large, aging population of business owners starting to look at the approaching future, many are focused on maximizing and preserving their wealth for themselves during retirement as well as for their future generations,” said Sean P. Breheney, CPA, MBA, principal at PKF O’Connor Davies, LLP. Utilizing client information that they are already engaged to review, he said, helps them highlight areas of need and/ or exposure as well as how to provide the services that would fill those areas of need.

However, Breheney cautioned that upselling can be either an easy or a difficult process. “Which path you are able to take depends on when you decide to take the jump. Approaching the subject of additional

services and how you are able to assist with them can be much easier if it is done during a quarterly review, tax planning meeting or even as a part of routine tax preparation,” he explained.

NEW WAYS TO BILL

The move to add new service offerings automatically lends itself to new billing structures, which can complicate issues with clients accustomed to hourly billing. CAS generally requires instituting a valuebased approach to billing as opposed to the more traditional hourly billing. According to the Journal of Accountancy article citing the CPA.com/AICPA survey, 28 percent of firms had value billing in 2020 for their CAS, compared with 10 percent in 2018. Also in 2020, 60 percent of respondents noted having fixed-fee pricing (which is usually per month), compared with 40 percent in 2018.

The timing of when to switch to such a new fee structure also needs to be considered to have the best results with clients. “If accounting firms switch their billing structure before the five-year mark, buyers are more than twice as likely to comply with the new arrangement than buyers who have been with an accounting firm for five or more years,” according to a

2020 CPA.com/Bill.com/Hinge Research Institute report on Business Model Trends for Accounting Advisory Services.

NOT FOR EVERYONE

Though attractive, upselling can cause challenges if a firm is not staffed accordingly or ready for the challenges that those new service offerings may entail. “Upselling is not necessarily for everyone, as you need to make sure you have the capacity and expertise to perform the services at your standard,” added Cicalese. “Potentially, by upselling additional services without the capacity, you could provide a bad experience to the client and harm your professional reputation.”

And not all industries are easily adaptable to CAS methods and procedures. As Mayer noted, “a client in the real estate industry may require specialized software that your current staff is not trained in. It’s important to consider that if the client is not satisfied in this instance, you might not only lose the client for CAS but also as a tax client.”

She believes upselling these services is still necessary to compete. “Providing a one-stop shop simplifies things for the client by having their whole team under one roof. Ideally, if you already have a trusted relationship with a client, they will be more apt to consider you for other services they may need,” said Mayer.

Breheney cautioned that firms should not rely on upselling alone, however, to remain competitive in today’s marketplace. “I do not believe that it is necessary to upsell clients in order to survive competitively, though it can be of use in the absence of an effective marketing strategy. Gaining attention for oneself in such a market is achieved by showing your potential client base how you are different compared to your competition, by the added value you create with the services you provide,” he explained. “Upselling, while a valuable tool for any CPA, does not allow for a similar impact.”

READ MORE CAS KNOWLEDGE HUB njcpa.org/hub/cas

5 NEW JERSEY CPA | WINTER 2022/23

WHAT IS — AND ISN’T — INCLUDED IN THE INFLATION REDUCTION ACT OF 2022

By ADAM L. SANDLER, J.D., LL.M. AJ WEALTH LLC

The IRA provides for two major tax changes — a 15-percent corporate alterna tive minimum tax (AMT) and a 1-percent surtax on the repurchase of corporate stock. More importantly, the IRA allocates approximately $80 billion in funding to the IRS. However, any change to the taxation of carried interest is notably missing from the final version of the law.

CORPORATE MINIMUM TAX

The Inflation Reduction Act of 2022 (IRA) was signed into law by President Biden on Aug. 16, 2022. It has been championed by the administration and Congress as the most sweeping climate and energy reform in history, although it’s a far cry from the various tax proposals that have been made over the past few years.

The IRA imposes a new AMT on corpora tions (other than S corporations, regulated investment companies and real estate investment trusts) equal to 15 percent of their “adjusted financial statement income” (AFSI) if AFSI exceeds an average of $1 billion annually over a three-year period (i.e., the tax-year at issue and the prior two tax-years).

AFSI is defined under IRC § 56A as “the net income or loss of the taxpayer set forth on the taxpayer’s applicable financial statement for such taxable year, adjusted as provided in this section.” In general, an applicable financial statement is one that is prepared in accordance with generally accepted accounting principles and meets the requirements of IRC § 451(b)(3).

The corporate AMT is effective for tax years beginning after Dec. 31, 2022.

STOCK REPURCHASE SURTAX

The IRA imposes a 1-percent surtax on the fair market value of any stock in a publicly traded domestic corporation that is “repurchased” by such corporation through

a redemption or economically similar transaction (see IRC § 4501). Of course, there are exceptions. The IRA does not impose the surtax where the repurchase is:

y Part of a tax-free reorganization

y Contributed to an employer-sponsored retirement plan or employee stock ownership plan

y For less than $1 million (in the aggregate of all repurchases during the tax-year)

y Made by a dealer in securities in the ordinary course of business y Made by a regulated investment company or real estate investment trust y Treated as a dividend

Like the corporate AMT, the new law applies to stock repurchases occurring after Dec. 31, 2022.

IRS FUNDING

It is no secret that the IRS has consistently struggled to perform. There are widespread reports of unanswered phone calls, millions of unprocessed paper returns, archaic technology and a workforce decimated by the COVID-19 pandemic. The IRA’s distribution of approximately $80 billion in funding to the IRS over the next 10 years is expected to address these issues, increase productivity and capture foregone revenue. The IRA allocates the funds as follows:

y $3.18 billion for taxpayer services y $45.63 billion for enforcement

6 WINTER 2022/23 | NEW JERSEY CPA

y $25.32 billion for operations support y $4.75 billion for business system modernization y $15 million for development of a new e-file system

y $403 million for general administration y $104 million for tax policy y $153 million for Tax Court y $50 million for Treasury office expenses

THE CARRIED INTEREST SAGA

The most interesting and controversial proposed tax change was eliminated from the bill at the eleventh hour to secure Senator Kyrsten Sinema’s vote — taxation of carried interest.

Pooled investment vehicles like private equity (PE) funds are typically structured as a partnership made up of one general partner (the PE firm that manages the fund) and numerous limited partners (“silent” individual investors). The general partner raises capital to purchase a portfolio of several private companies with the intention of selling those interests for a profit by the end of the fund’s term.

While the individual members of the PE firm may invest directly in the portfolio companies through “co-investment” vehicles, the PE firm itself generally makes little to no capital investment as the general partner. It is compensated with a manage ment fee and a profits interest in the fund’s performance. This profits interest is known as “carried interest” or simply “carry.” While not used in every case, the “2 and 20” model is commonly used to structure these fees — a 2-percent management fee and a 20-percent carry in excess of any hurdle. The remaining profits are distrib uted to all the investing partners, pro rata, subject to any adjustments in the distribu tion waterfall.

When the fund sells a portfolio company, it generates a capital gain. Because the interest in the portfolio company would likely be held for more than three years before sale, the gain that flows through to the general partner and out to the members of the PE fund as carry qualifies for long-term capital gain (LTCG) treatment. Thus, carried interest is taxed at a much lower rate than ordinary income or short-term capital gain (STCG).

This tax treatment has received much opposition over the years by those who would like to see carry taxed at the higher ordinary income rates. Some headway was made by the opposition in 2017 when the Tax Cuts and Jobs Act enacted IRC § 1061, which governs the way carried interest is currently taxed. Sec. 1061 increased the required holding period for LTCG treatment of carried interest from one year to three years. In practice, however, it minimally affects carried interest for PE funds because portfolio companies are likely to be held by the fund for more than three years.

The proposed changes that did not make it into the IRA would have amended Sec. 1061 by affording LTCG treatment at the individual partner level to gain which is realized more than five years after the later of (1) the date on which the individual partner (the taxpayer) acquired substan tially all of its interest in the general partner of the fund or (2) the date on which the fund acquired substantially all of its assets. This five-year rule would have instituted a significant hurdle for PE firms to receive LTCG treatment of carried interest, but for now, taxation of carried interest remains unchanged.

READ MORE

INFLATION REDUCTION ACT KNOWLEDGE HUB njcpa.org/hub/ira

LEARN MORE

Dec. 7, 16 and additional dates, Live Webcast

INFLATION REDUCTION ACT OF 2022: EXPLANATION AND PLANNING

Dec. 8, 9 and additional dates, Live Webcast

THE BEST FEDERAL TAX UPDATE COURSE njcpa.org/events

Adam L. Sandler, J.D., LL.M., is the director of wealth planning at AJ Wealth LLC and can be reached at adam@ajwealthllc.com

7 NEW JERSEY CPA | WINTER 2022/23

4 TIPS FOR IMPROVING YOUR HIRING RESULTS

By JACQUELINE LOMBARDO, MHR BOOMER CONSULTING, INC.

Almost all business owners and hiring managers have thought they had the perfect candidate only to discover the candidate’s expectations don’t align with the organization’s needs. Or, during negoti ations, the organization doesn’t offer a key benefit that the candidate is looking for.

While hiring is not a one-size-fits-all process, below are four key actions organi zations should consider.

LEVERAGE CONATIVE SKILLS

When it comes to people’s minds, there are three parts:

y Cognitive (intelligence)

y Affective (feelings and emotions)

y Conative (doing)

According to the Kolbe Corp (kolbe.com/ kolbe-wisdom), people’s conative minds contain the instincts and innate attributes that define their natural method of operation (MO). Individuals are more productive, comfortable and successful when they work in their natural style. One’s conative mind drives action, and actions drive performance.

A company could have two candidates with the same education, skills and profes sionalism, but they would each do the job differently, and one may better align with how the organization needs the job done.

What if employers could identify if a job’s demands would line up with the candidate’s instinctive way of working? This would help increase retention and productivity and reduce job-related stress.

By leveraging conative assessments, such as the Kolbe A™ Index, organizations can help define role requirements and supervisor

compatibility. Employers can also build a range of success that will help them identify the fundamentals of how a successful person will take action in a specific job role, screen candidates, stream line the hiring process and ultimately reduce turnover.

OFFER WELL-BEING PROGRAMS

The past few years have created unique challenges for many people — not only in their professional lives but also in their personal lives. Now, more than ever, job seekers are looking to see what programs an organization has that support their mental and emotional health, work-life balance and flexibility. An organization’s well-being programs (or lack thereof) can greatly impact whether a candidate wants to work for the organization.

Employers should take some time to review their current offerings in the following areas:

y Mental health and emotional wellbeing. Does the organization have an employee assistance program (EAP)?

EAPs are a great way to provide a

Hiring can be one of the most stressful aspects of running a business. It’s also costly — especially if a new hire doesn’t work out.

8 WINTER 2022/23 | NEW JERSEY CPA

confidential source that employees can use when facing challenges. These programs provide employees with resources such as therapy, substance abuse programs, financial counseling and crisis management. Mindfulness and meditation programs or apps can also be valuable resources. Apps such as Calm (calm.com) and Head space (headspace.com) now offer corporate plans.

y Work-life balance. How does the organization promote work-life balance? Does it offer remote working arrange ments? Are there flexible work hours or is the team required to work from nine to five? Are staff encouraged to take time off and have proper backup coverage to make them feel comfortable unplugging? What kind of parental and adoption leave policies are in place?

Multiple policies and programs can support employee well-being, but it’s essential to have a well-thought-out program that employees find valuable. Establish an employee-driven wellness committee to help build and sustain the wellness culture

of the organization. Then, when it comes to hiring, candidates will not only see that the company supports well-being, but they will also know that employees have a voice and say in the things that matter the most to them.

CONSIDER HIRING INCENTIVES

Hiring incentives can help attract and retain talent. But, if the organization has hiring incentives, are they communicated to the team? Employers often offer benefits for candidate referrals, and for a good reason. According to a CareerBuilder ebook, 82 percent of employers rated em ployee referrals highest in terms of return on investment.

There are many ways to incentivize employee referrals, including:

y Tiered system. Employees can get more rewards based on how far their referral goes in the hiring process. For example, having someone apply might be worth $100. If their candidate gets a job offer, the bonus might jump to $500.

y Long-term payout. Referral bonuses are paid depending upon how long the candidate stays. For example, once their candidate is hired, the referring employee receives $500. At the new hire’s six-month anniversary, the referrer gets another $500 bonus.

y Lump sum. Referral bonuses are paid in one lump sum once the new hire starts working.

LEVERAGE OUTSOURCING

Outsourcing is an excellent option for having someone who is not part of the company’s full-time or permanent staff complete a task or project for the organization. This on-demand help allows the staff to focus on other aspects of the business while still providing excellent client service.

Here are a few ideas of tasks and projects that can be outsourced:

y Administrative work. Some admin istrative tasks seem to take too much time but are vital for keeping the com pany running efficiently. For example, consider working with a virtual assistant to manage executives’ inboxes, schedule

appointments, perform data entry work and more.

y Tax preparation. This is a great way for accounting firms to acquire seasonal help during the busy season or expertise in specific niches.

y Technology. Freelance or contract IT professionals can help handle all or part of a company’s IT needs, from software development to maintenance and support.

y Project management. An outsourced project manager can bring unique skills to the organization and help get projects completed on time and on budget.

Finding the right hire for an organiza tion is essential to running a successful business. The company must align with the candidate’s core values, wants and needs and vice versa. Take a good look at the tips above, compare them to existing hiring processes and identify changes that can be incorporated immediately. Well-constructed hiring processes can be the difference between failing to attract qualified candidates and finding the perfect fit for the organization.

Jacqueline Lombardo, MHR, is a project manager at Boomer Consulting, Inc. She can be reached at jacqueline.lombardo@boomer.com.

LEARN MORE

Feb. 16, Live Webcast (replay on Feb. 28) 2023 HIRING AND COMPENSATION TRENDS (free for NJCPA members)

Dec. 28, Live Webcast CREATING & DEPLOYING FLEXIBLE WORK OPTIONS

THE

THE RIGHT

On Demand THE TEAM, THE TEAM,

TEAM: GETTING

PEOPLE ON THE BUS njcpa.org/events

9 NEW JERSEY CPA | WINTER 2022/23

READ MORE EMPLOYEE MANAGEMENT KNOWLEDGE HUB njcpa.org/hub/ employeemanagement

Key Metrics Businesses Need to Watch Pre-Recession

BY SALVATORE SCHIBELL, CPA, CFP®, CGMA, LAWSON, RESCINIO, SCHIBELL & ASSOCIATES, P.C.

may change. This metric can indicate the estimated demand for products now and in the immediate future.

y Consumer spending: The U.S. Depart ment of Commerce releases a monthly report on economic activity. This report assesses personal wealth and how much disposable personal income people have. When people have higher disposable income, they are more likely to spend.

y Cash flow is critical to the success of any business. Renegotiating customer payment terms, enforcing late payment fees, offering early payment discounts and changing invoice cycles to encourage customers to pay faster are all measures that can help with cash flow.

We are in uncertain times caused by inflation, geopolitical unrest and other influences. Inflation is a significant threat to the financial stability of the economy. The Federal Reserve’s monetary policy of increasing interest rates to control inflation is an important step. Still, the result will cause an economic slowdown affecting all aspects of doing business. Most economists say we should prepare for the possibility of a recession. Here are some of the key metrics business owners should watch.

GLOBAL AND REGIONAL METRICS

Global and regional metrics give a macro economic view of consumer and industry buying behavior.

y Unemployment: The U.S. Bureau of Labor Statistics releases monthly and yearly employment data. The employ ment figures signal if the labor markets are going up or down. A steep decline could indicate that a recession is on the horizon. Employers should keep a close eye on employment levels within their organization. A drop in output often accompanies a decline in employment.

y Consumer confidence: The Consumer Confidence Report gauges how people feel about the economy. When consumer confidence is high, customers spend more and feel financially stable. When it is low, consumers spend less. A decline in consumer confidence is a warning sign that customer behavior

y Housing activity: A key metric is housing starts which tracks the number of new residential construction projects. A decline in this metric signifies that housing demand is weakening and investors are pulling back. A drop in this metric usually signals the beginning of a recession.

INDIVIDUAL BUSINESS METRICS

A business’s financial metrics can signal that the company is in trouble or provide reassurance that everything is fine.

y Sales revenue must be watched continuously; a decline could be caused by a change in consumer demand, poor customer service or variation in quality.

One tactic is to conduct a focus group and customer satisfaction survey to determine what is causing the problem and how to fix it.

y Cost of goods sold (COGS) shows how efficiently a company operates. An increase in this metric can indicate that the company is paying too much for raw materials, has inefficient production and fulfillment practices or has labor problems. Companies can renegotiate prices and payment terms with suppliers, find new sources of materials, buy in bulk, use less expensive goods and improve operating procedures and processes. Keep in mind that quality should never be compromised to reduce costs.

y Net profit margin discloses how much actual profit is made from sales by removing expenses. To improve profits, companies need to elevate their brand, increase the perceived value of their merchandise, increase average order size, streamline operations, reduce operating expenses and optimize vendor relationships.

Most key metrics point towards a recession. How companies react and scale their business will either help them survive or die. Companies need to have a strategic plan in place to combat the recession. This plan should address all business disciplines — operations, marketing, human resources, information technology and finance. Management should watch key performance indicators that can make or break the company, benchmark these metrics against business and industry data, and implement procedures and safeguards to minimize the effect.

Salvatore Schibell, CPA, CFP®, CGMA, is the tax partner at Lawson, Rescinio, Schibell & Associates, P.C. He is a member of the NJCPA Federal Taxation and State Taxation interest groups and can be reached at salschibell@lrscpa.com

LEARN MORE

Dec. 15, Live Webcast

CURRENT DEVELOPMENTS AND BEST PRACTICES FOR TODAY’S CFOs AND CONTROLLERS njcpa.org/events

BUSINESS MANAGEMENT

10 WINTER 2022/23 | NEW JERSEY CPA

An Organizational Change Management Approach Ensures DEI and DEIB Are Sustainable

BY BETH THOMAS AND JULIE KANTOR, CHANGE 4 GROWTH

Diversity, equity and inclusion (DEI) is a growing and important focus for many organizations. DEI efforts strive to create workplace environments that are welcoming and appealing to everyone by celebrating and leveraging our differences, including, but not limited to, ethnicity, education, skin color, age and sexual orientation. Companies have recognized that they are responsible for improving DEI to elevate stakeholder (employees, customers and the community) engagement. Belonging is a big component of DEI — it now has its own abbreviation. DEIB, which stands for diversity, equity, inclusion and belonging, has come into its own as a key component of a DEI strategy.

WHY DEIB?

Research shows that diversity at work and financial performance are linked. A 2018 McKinsey & Company study entitled Delivering Through Diversity found that gender and ethnic diversity are correlated with profitability. Additionally, companies committed to DEIB can better attract top talent, enhance customer and employee satisfaction, and improve decision-making. Diverse individuals bring unique life experiences and perspectives to the organization, leading to innovation, novel services/products and high-performing teams. Numerous studies show that when employees from diverse backgrounds and cultures collaborate on projects, there is a better chance that they will find solutions faster. A survey1 of more than 500 businesses found that every 1-percent increase in diversity correlates with a 3- to 9-percent rise in sales revenue.

SLOWLY MAKING PROGRESS

While DEIB and overall DEI is essential to the success of organizations, there remains a gap between what has been done and what still needs to be accomplished. Ceridian found in its 2022 Executive Survey2 that although 90 percent of respondents have a

DEI strategy, only one-third say that progress is being made in this area. PwC also found that organizations still have to make progress in designing and executing DEIB programs. Nearly a third of its Global Diversity & Inclusion Survey3 respondents indicated that only 4 percent of organizations are succeeding in critical dimensions of successful DEIB programming.

BARRIERS TO SUCCESS

Many obstacles stand in the way of becoming a diverse, equitable and inclusive orga nization. The work of DEI professionals often requires changing hearts and minds to overcome real human feelings, egos and learned behaviors. While there are laws in place to protect workers from discrimination, more work must be done to evoke lasting organizational change.

PwC found that 80 percent of leadership engagement on DEIB remains at the primary or emerging levels, and only 25 percent of organizations have DEIB goals for their leaders. A mere 17 percent of these companies have a C-suite-level diversity role, while nearly 31 percent do not have a DEIB leader.

ONE VIABLE SOLUTION

Companies must recognize that no matter how many DEIB interventions are introduced into the workplace, nothing will change if employees are not being held accountable for the environments that they are cultivating. The company’s culture must change for the organization to fully accept a diverse workforce.

Organizational change management (OCM)4 is a method of leveraging change to achieve a successful and sustainable transformation. OCM drives the successful adoption and usage of change within the business. It allows employees to under stand and commit to the shift and work effectively during it.

Margaret Regan, president and chief executive officer of The FutureWork

Institute, Inc., asked more than 300 diversity practitioners if an OCM approach would make a difference. More than 86 percent of the Inclusion Allies Coalition (IAC) webinar participants said an OCM approach is needed to drive more robust DEIB results.

Hiring a chief diversity officer, establishing goals, launching training programs and updating vision and mission statements are all important, but much more must be done to make a cultural change. OCM can provide the framework for sustainable change within an organization.

1 workstatus.io/blog/reasons-why-dei-in-theworkplace-is-essential-for-progress/

2 ceridian.com/blog/achieving-organizational-agility -through-workplace-diversity-equity-and-inclusion

3 pwc.com/gx/en/services/people-organisation/ global-diversity-and-inclusion-survey.html

4 online.hbs.edu/blog/post/organizational-changemanagement

Beth Thomas is the chairwoman and CEO of Change 4 Growth. She can be reached at bthomas@ change4growth.com. Julie Silard Kantor is vice president of leadership, culture and DEIB at Change 4 Growth. She can be reached at jkantor@ change4growth.com

LEARN MORE

Dec. 6, Jan. 3 and additional dates, Live Webcast

HOW TO BE A CHANGE LEADER Dec. 16, Live Webcast

DIVERSITY, EQUITY, INCLUSION & BELONGING njcpa.org/events

READ MORE

DIVERSITY, EQUITY & INCLUSION KNOWLEDGE HUB njcpa.org/hub/diversity

BUSINESS MANAGEMENT

11 NEW JERSEY CPA | WINTER 2022/23

Rising Interest Rates Could Reduce Lump-Sum Pension Payouts

BY JAY MOTA, CFP®, CDFA®, CHFC®, AMERIPRISE FINANCIAL

Many employees today participate in a defined benefit retirement plan. A key feature of this benefit type is that it allows some participants to choose, at the point of retirement, to either receive the vested benefit amount either in a single lump-sum payout or through a series of payments over time.

Since choosing between these two payment options is often permanent and irreversible, helping clients make a thoughtful and informed decision is key. Complicating matters in this decision-making process today, however, is rising interest rates — particularly as it relates to the value a participant receives under the lump-sum distribution option.

Rising interest rates typically have a negative impact on asset values. This is due to the way present value is calculated for an asset. The economic principal known as “discounted cash flow,” states that the current value of a financial asset is the present value of all future cash flows. Simply put, this means that the way asset values are determined is by discounting all future cash flows back to present time, using a stated discount rate (an interest rate).

Since future cash flows are reduced by the discount rate, a higher discount rate will result in a lower present value of an asset. The opposite is also true. A lower discount rate leads to a higher present value.

Consider the following example of this concept. Assuming a 4-percent discount rate, a participant would be indifferent between receiving $1,000 per month for the next 10 years (a total of $120,000 over time) or $98,770 today. However, if the discount rate is increased to 6 percent, the

participant would accept receiving $90,073 today (roughly 9 percent less) or the same fixed payment of $1,000 per month for the next 10 years. Intuitively, what the math behind these calculations is suggesting is that a participant receiving a lump-sum payout will be able to reinvest these assets at prevailing interest rates. Thus, at higher interest rates, less initial principal is required to generate future cash flows; at lower interest rates, more initial capital will be required.

Interest rates today are dramatically higher than last year as the economy wrestles with elevated inflation. For example, the yield on a 10-year Treasury bond, which acts as a common benchmark rate for the economy, has more than doubled in 2022, starting the year at 1.24 percent and closing at 3.41 percent on Sept. 14, 2022. Furthermore, specific to defined benefit retirement plans, a blend of corporate bond yields is commonly used to calculate lump-sum payout amounts. Importantly, these corporate yields are typically higher than those on Treasury bonds with similar maturities.

Stark yield increases have not only increased borrowing costs for many consumers and businesses across the economy, but they may have notably caused a reduction in lump-sum payouts for participants in defined benefit plans. Many plan participants, especially those nearing or at their desired retirement age, could soon see their lumpsum value fall should interest rates move higher or retirement plan calculations catch up with current market levels.

Understandably, participants will have questions about their course of action, including:

y Does it make more sense to take a reduced lump-sum from my pension or receive the annuity amount over time?

y Can I still afford to retire on this lump-sum value?

y What interest rate and inputs are used to calculate my specific lump-sum payout, and how likely are these inputs to change over the next year?

Savvy CPAs should be prepared to answer these questions for their clients.

This information is provided only as a general source of information and is not intended to be the primary basis for investment decisions. It is not a solicitation to buy or sell the securities mentioned and should not be construed as advice designed to meet the particular needs of an individual investor. Please seek the advice of a financial advisor regarding your particular financial concerns.

Jay Mota, CFP®, CDFA®, ChFC®, is a financial advisor at Ameriprise Financial Services, LLC. Ameriprise Financial is an NJCPA premier partner. Jay can be reached at jay.mota@ampf.com

Ameriprise

FINANCIAL PLANNING SERVICES SPONSORED CONTENT

READ MORE FINANCIAL PLANNING SERVICES KNOWLEDGE HUB njcpa.org/hub/financialplanning

MORE Dec. 8, Live Webcast SOCIAL SECURITY AND MEDICARE: PLANNING FOR YOU AND YOUR CLIENTS njcpa.org/events

LEARN

Financial, a premier partner with the NJCPA, offers flexible partnership opportunities to help increase revenues and help your clients make more confident financial decisions. Learn more

12 WINTER 2022/23 | NEW JERSEY CPA

at ameripriseadvisors.com/jay.mota

An Early Harvest?

BY DAVID TEPP, CPA, PFS, MBA, TEPP WEALTH MANAGEMENT

The past year has presented an enormous challenge to all investors. The repercus sions of aggressive Federal Reserve interest rate hikes, the highest level of inflation in decades, massive labor demand and the first major war in Europe in 80 years has strained financial markets and prompted the threat of global recession. As a result, the September plunge in the U.S. stock market offers an unusual opportunity to harvest losses. Before investors dive in and start selling, however, there are a variety of important strategies and critical tax concepts that should be considered.

ANALYZE CURRENT FINANCIAL MARKET CONDITIONS

The Fed is expected to continue raising interest rates as long as inflation remains elevated. Labor costs also remain quite high which will likely stifle corporate profitability. If the financial markets continue to project lower earnings, valuations and stock prices will likely continue to plummet. Asset allocation is always paramount but particularly so during volatile market swings. In bear markets, stocks in defensive sectors tend to perform a bit better while more-risky asset sectors may encounter greater headwinds. Now that interest rates are well off of their historic lows and with the Fed contemplating even more rate hikes, it may be a good time to consider shifting some assets from equity to bond securities.

LOCK IN LOSSES

Advisors need to select securities that offer the best opportunities for locking in losses. Certainly, if there’s a loss on an investment in which you have lost confidence, that should be among the top of the list to sell. If the underlying security is a mutual fund or ETF, then consider the industry or asset class on which the fund/ETF is targeted and whether it is consistent with the target allocation.

Remember that losses can be harvested simply by trimming holdings as opposed to divesting entirely. Extra attention should be paid to tax lots as each will often have separate tax consequences.

EVALUATE THE TAX IMPLICATIONS

It is imperative to consider each client’s personal tax situation. Remember that if there are insufficient capital gains to be off set by losses, $3,000 of accumulated losses per year can be applied against ordinary income. As a result, the client’s current and future expected marginal tax rate is an important consideration. Before beginning to harvest gains and losses, be sure to review the client’s prior tax return to understand their current capital gain/loss tax position.

If a client’s income and tax rate is expected to be lower in the future, capital loss harvesting may yield only a limited benefit.

Particular attention should be paid to the nature of the capital losses, specifically whether they are short- or long-term. Optimally, capital losses should offset short-term capital gains which are taxed as ordinary income.

CONSIDER THE WASH SALE RULE

Perhaps the trickiest area of capital loss harvesting is the IRS wash sale rule. Put simply, after selling an investment at a loss, investors must wait 30 days before or after the day of sale. If the investor disregards this rule, the loss is not deductible; instead, the loss is added to the cost basis of the underlying replacement security. The wash sale rule also prohibits the acquisition of a security 30 days prior to the sale which, in essence, creates a 61-day wash sale window.

The wash sale rule may apply if a taxpayer sells a security and then, within the allotted 30-day period, acquires a security that is deemed to be “substantially

identical.” The IRS is rather ambiguous with their definition of this term, partic ularly as it pertains to mutual funds and ETFs. Tax and financial professionals should discuss this with clients and establish the position they are willing to take before committing to further trades.

Note that the wash sale rule applies to both taxable and qualified retirement accounts for both the taxpayer and spouse. In other words, in the event of a sale of a security in a taxable account, the taxpayer and spouse are prohibited from acquiring a substantially identical security in any investment account for 30 days. Otherwise, the loss will be disallowed for tax purposes and there will be no cost-basis adjustment in the applicable qualified retirement account. (Refer to Revenue ruling 2008-5.)

As an additional consideration, any unused capital losses must be leveraged in the year of the taxpayer’s death, or they will be lost entirely. Tax and financial pro fessionals should certainly keep this mind with clients who are encountering severe health issues and consider locking in losses while they remain useful.

Taking all of these factors in consider ation, advisors may be able to help clients find a silver lining in what has been an otherwise difficult year.

David Tepp, CPA, PFS, MBA, is the owner of Tepp Wealth Management. He is a member of the NJCPA and can be reached at dtepp@teppwealth.com

FINANCIAL PLANNING SERVICES

MORE

PLANNING SERVICES KNOWLEDGE HUB njcpa.org/hub/financialplanning

MORE Dec. 29, Jan. 25 and additional dates, Live Webcast

HAIG'S PERSONAL FINANCIAL HEALTH CHECKUP njcpa.org/events

READ

FINANCIAL

LEARN

WALTER

13 NEW JERSEY CPA | WINTER 2022/23

Strategy Debate: Value Billing versus Hourly

BY DAVID A. LOPEZ, CPA, DAVID A. LOPEZ AND COMPANY, LLC

BY DAVID A. LOPEZ, CPA, DAVID A. LOPEZ AND COMPANY, LLC

I began noticing the conversations discussing the pros and cons of value pricing versus traditional hourly billing in CPA firms about four or five years ago. As a small firm practitioner, the debate intrigued me. Asking myself the following questions prompted me to dig deeper:

y Are the traditional hourly rates intimidating to small business clients?

y Should hourly-rate pricing be reserved for larger companies where management is accustomed to paying other professionals, such as lawyers, at a price point that is usually higher than accountants?

y Is the idea of value pricing too vague for smaller, maybe less-sophisticated clients?

HOURLY BILLING

Traditionally, firm management would look at billable hour reports to assess prof itability, the adequacy of current staffing levels and professional staff utilization. In some firms, the number of billable hours a CPA individually logs could even affect their compensation. This method is tried and true, but there are some downsides to the hourly billing framework:

y Slower work. When staff members are obsessed with hours charged to clients, it can slow work down. They become preoccupied with how many hours they are posting instead of working efficiently to complete a project for the client.

y Reduced profit margins. As technology advances, the time needed to complete tasks inherently lessens. If we are billing based on hours work, our invoice must be lower. It’s simple math.

y Unhappy team members. We are CPAs. We can add. Staff may not understand what the firm’s hourly rates represent, but they clearly understand their salary. Therefore, a young staffer can understand their annual salary is approximately x dollars per hour; the firm bills me at y dollars per hour; the firm is making a lot of money off me. Many managers do not educate staff on what the hourly rates represent or how they are constructed. It’s kept a mystery. Management may think this is not important, but it is. I left a firm for that exact reason.

VALUE BILLING

As CPAs, we assess value. When we audit, we must value accounts receivable, fixed assets and liabilities. So, why is it difficult for us to calculate our value to our clients?

It’s not. Just like hourly rates, value billing has its pros and cons.

I see value billing as a way to increase overall revenue and the profit margin. As mentioned above, with improvements in technology, it takes less time to complete audits, tax returns and other services. With hourly rates, less time equals lower client invoices. But has the value of that project decreased? Most likely no, so billing the value of the project as opposed to the time expended makes tremendous sense.

Our firm moved to value billing during the COVID pandemic. Since making the switch, I have seen a significant increase in gross revenue and profit margin. With value billing, our cash flow has increased and become more stable. The client knows the cost of the project in advance. Since we have an agreed-upon price, the invoice that is presented is not a surprise. Clients often have our fees already budgeted/ allocated and ready to be disbursed when they receive our bill.

If there is a downside to value billing, it has to be the time and effort expended to make the change. Moving to value billing is a change in mindset. It forces you to take time to look at your practice and honestly assess your value as an accountant. This is something many CPAs have never really done.

THE BOTTOM LINE

If I had to declare a winner, I would say value billing is the victor. Hourly-rate billing is the tradition that accountants and clients know and understand. But, for firm management, value billing is the way to go. It increases profits and productivity and truly assesses how valuable our services are in the marketplace.

David A. Lopez, CPA, is the founder of David A. Lopez and Company, LLC. He is a member of the NJCPA and can be reached at dlopez@ davidlopezcpa.com

FIRM MANAGEMENT

READ MORE FIRM MANAGEMENT KNOWLEDGE HUB njcpa.org/hub/firmmanagement

14 WINTER 2022/23 | NEW JERSEY CPA

How to Reduce Customer Churn and Keep Clients Happy During Tax Season

BY ILYA RADZINSKY, TAXDOME

No matter their size, all accounting firms are overloaded during tax season. Employees must work overtime — sometimes as much as 80 to 90 hours per week — to meet tight deadlines. During peak seasons, accounting firms can easily lose clients; 90 percent of the time, the reason clients switch accountants is because they cannot get answers, or communication with the firm is simply too onerous. Here are some tips to retain clients, build stronger rela tionships and consequently charge more for services:

CLIENT MANAGEMENT IS KEY

According to the CallMiner Churn Index, $35.3 billion is lost every year by U.S. businesses in customer churn caused by avoidable customer experience issues. Client management is vital to the smooth running of an accounting firm and in pro viding ongoing value to clients, and many practice owners see the light when they realize their client base has overwhelmed them. This can become more pronounced during tax season.

The COVID-19 pandemic has spurred both firms and clients toward the swift adoption of new technologies. As people become more accustomed to using online tools across e-commerce, banking and social media, they have come to expect this ease of use as standard.

Accounting firms can improve their interactions with clients by adopting the following practices:

y Provide different options for document submission: use the postal service, drop off paperwork, upload via a portal or share via Zoom.

y Utilize video conferences when verbal discussions are required.

y Post industry news, tax law changes or suggestions on the firm’s website or social media.

y Establish onsite chatbots or ticket systems to generate immediate responses.

PERSONALIZE WITH MODERN SOFTWARE

Emplifi data revealed that 49 percent of consumers left a company in the past year due to poor customer experience. How often do a firm’s clients switch to another firm? It’s an important question, because it costs significantly more to win new clients than to keep existing ones, yet 90 percent of accounting firms lose clients due to a lack of clear communication and guidance.

By utilizing modern digital software, accounting firms can create a personalized client experience and recapture the time they once spent on manual tasks. Consider the following recommendations:

y Send automated, yet personalized messages to nurture client relationships and balance workload during busy periods.

y Breadcrumb processes into simple steps that clients can execute easily.

y Gather information by interviewing clients remotely and asking meaningful questions about noteworthy events and changes: whether they have moved, married, divorced, or bought or sold property.

y Generate automated status emails. For example, once the client has uploaded files, confirm the information has been received and work has started on their return.

STREAMLINE PAYMENTS

According to Emplifi data, 61 percent of consumers will pay at least 5 percent more if they know they can expect a good customer experience.

During the pandemic, finding effective ways for clients to pay for accounting services

remotely became essential. Accounting firms that provide an elevated customer experience can expect their clients to accept premium pricing.

Accounting firms can help clients to pay faster by using the following tactics:

y Employ user-friendly technology to upload files and settle bills, enabling clients to perform repeatable actions independently and without referral to the firm.

y Simplify the payment process by offering multiple options: credit cards, ACH, onsite payments.

y Send friendly reminders and push notifications via the client portal to remind clients to pay without the need for manual chasing.

Losing market share means losing money, and no business owner wants that. Improved customer experience and enhanced internal procedures help to retain clients which leads to business growth. The pandemic-prompted sweeping changes to the way we do business mean that practice management software for accountants, bookkeepers and tax professionals has become an integral part of the finance process.

Ilya Radzinsky is the co-founder and chief marketing officer of TaxDome, an NJCPA member benefit provider. She can be reached at ilya.radzinsky@taxdome.com.

TaxDome is an all-in-one solution for tax and accounting professionals to manage their practices smarter, faster and more affordably. Learn more at njcpa.org/benefits

FIRM MANAGEMENT

SPONSORED CONTENT

15 NEW JERSEY CPA | WINTER 2022/23

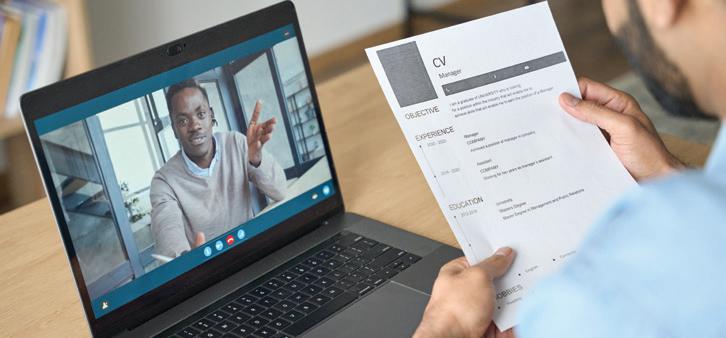

Virtual Interviews: Five Tips for Excelling Through the Screen

BY NICOLE GARCIA, TRAPHAGEN CPAs & WEALTH ADVISORS

BY NICOLE GARCIA, TRAPHAGEN CPAs & WEALTH ADVISORS

Job interviews can be intimidating, but virtual interviews can often be even more intimidating. Many employers have transi tioned to virtual recruiting and interview processes. While this has many benefits for both parties, it opens the door to some possible complications or challenges. You should enter a virtual interview with the same mentality as you would for an in-person interview. Consider the following tips for navigating a virtual interview:

CHOOSE AN APPROPRIATE WORKSPACE

Making a good first impression is essential when interviewing. In order to do so during a virtual interview, it is important to set yourself up for success.

y Ensure the area you’ll be using to take the interview has appropriate lighting and is clean, quiet and free from distractions.

y No loud pictures or wall art, piles of mpapers, open windows or distracting noises such as cellphones, children or other adults, televisions or music should be present in your interview space.

y If you don’t have an appropriate workspace at home, try a local library, university or communal workspace that offers private spaces.

TEST ALL ELECTRONICS

One of the added components of a virtual interview is making sure all of your electronic devices are working properly.

y Make sure your speakers, microphone, camera and computer are working properly the day before the interview as well as a few hours before the interview.

y Be familiar with the video software and have an account properly set up, if applicable.

y Ensure access to reliable WiFi.

y Don’t rely on your laptop’s battery power; use a power cord.

DRESS TO IMPRESS

Although the interviewer may only see you from your chest up, it is important to dress professionally from head to toe. Dress as if you were going to an in-person interview. Presenting yourself in a polished and professional manner will not only project a business intent but will also help you feel more confident.

PRESENT YOURSELF AS YOU WOULD IN PERSON

Sometimes maintaining professional man nerisms and body language can be difficult in the comfort of your own home. However, maintaining good posture and eye contact with the camera shows the interviewer that

you are giving them your undivided attention and fosters a better connection. You can also show that you are engaged in the conversation by giving a slight head nod or asking clarifying questions to reassure the interviewer that you are absorbing the information they are presenting.

BE PREPARED

Regardless of the format, you should always come to an interview well versed on your resume, the company you are interviewing with and the position you are applying for. Log into the meeting at least 10 minutes prior to the start. This shows the interviewer that you respect their time and understand the importance of being punctual. Prior to the interview, spend some time researching the company, their values, their culture and their leadership team. You should also come to the interview ready to answer questions about your skills set and prior work experience. In addition, be prepared with questions for the interviewer; this is your time to truly learn about the position and their expecta tions and show that you are interested and enthusiastic about their company.

Interviews can be overwhelming at times, but regardless of the format, try to relax, be yourself and let your personality and professionalism come through the screen. By implementing these tips, you will be in a position to establish a strong connection to achieve your goal: an offer from a quality company!

Nicole Garcia is an accountant at Traphagen CPAs & Wealth Advisors. She is a member of several NJCPA interest groups and can be reached at nicole@tfgllc.com

DO MORE

SEARCH FOR JOB OPENINGS IN THE NJCPA JOBBANK njcpa.org/jobs

PROFESSIONAL DEVELOPMENT

16 WINTER 2022/23 | NEW JERSEY CPA

17 NEW JERSEY CPA | WINTER 2022/23 Feb. 28 with code HIRENOW25.

for new talent or opportunities?

NJCPA JobBank is a top source of New Jersey’s accounting jobs.

for hiring full-time, part-time or per diem staff Seeking new work? Upload your resume and sign up for job alerts. njcpa.org/jobs

Looking

The

Ideal

6 Essential Practices to Protect Your Firm from Cyberattacks

BY JOHN GRAZIANO, CPA, CFP®, PFS, FFP WEALTH MANAGEMENT

Is your accounting firm taking steps to protect against a cyberattack? If not, you may be putting your firm’s future at risk.

On average, cyberattacks cost companies $4.24 million in 2021, up from $3.86 million in 2020. On top of that, an estimated 60 percent of small businesses go out of busi ness within six months of a cyberattack. The following best practices can help protect your firm from cyberattacks.

1. KNOW YOUR THREATS

To protect your firm from an attack, you need to know your enemy. While there are many different types of cyberattacks, accounting firms are more likely to be the targets of:

y Malware and ransomware: Ransom ware is a type of malware that encrypts files and blocks owner access. To regain access, cybercriminals demand payment, usually via cryptocurrency. Malware can infect an entire system quickly and easily, leaving a firm completely immobilized.

y Phishing texts and emails: Ransomware and viruses are often delivered to accounting firms through phishing schemes deployed via text or email. Phishing schemes hide malicious files inside seemingly innocent ones (like office documents). Once the attached file is opened, the entire system is infected.

2. TRAIN YOUR STAFF

Reports show that more than 90 percent of cyberattacks are carried out by either stealing credentials or using phishing scams to trick employees into providing access. Proper staff training can help reduce the risk of someone gaining unauthorized access to your system. All staff should be trained how to:

y Spot phishing attacks. For example, emails asking for their login information or other sensitive data should be viewed

as suspicious. Verifying these types of requests in person or over the phone can help prevent a data breach.

y Protect their credentials. For example, login information should never be written on a piece of paper or typed in a text file.

3. KNOW THE REGULATIONS

Every accounting firm should know and understand the data regulations in their respective states. Some states have more stringent rules than others.

All firms, regardless of location, must protect any client data they collect under the Gramm-Leach-Bliley Act. As part of this Act, the FTC created the Safeguards Rule, which requires businesses to:

y Designate employees to coordinate a security program.

y Identify and assess risks, and evaluate the effectiveness of current measures to protect against these risks.

y Create and implement a safeguards program.

y Choose service providers that maintain appropriate safeguards.

y Evaluate and change the program as needed.

In addition, all states have data breach notification laws. Research yours to ensure that you’re prepared to comply and properly notify clients in case of a breach.

4. DESIGN AN APPROVAL AND VALIDATION SYSTEM

An accounting firm’s system should create strict control over data access. The right approval and validation system can help prevent fraud and identity theft. For example, staff may verify or validate client requests to ensure that the client is indeed the person making the request.

5. ESTABLISH SECURITY REQUIREMENTS

Accounting firms should have clear security protocols, and all staff should be

aware of these requirements. These security requirements may include drive encryption, antivirus and antimalware software, firewalls, two-factor authentication and virtual private networks (VPNs) for remote working.

Additionally, firms should create strict access control systems to ensure that only the right people have access to data.

6. CHOOSE THE RIGHT ACCOUNTING SYSTEM

Finally, firms should choose the right accounting system. Ideally, the system should include encryption, data redundancy, auto mated backups and more to protect data.

Cybersecurity should be a top priority for accounting firms. Failure to comply with regulations or properly protect against data breaches can result not only in fines but also in a lot of stress, headaches and a damaged reputation that can be difficult to recover from.

John Graziano, CPA, CFP®, PFS, is the president and wealth management partner at FFP Wealth Management. He is a member of the NJCPA and can be reached at johng@grazianocpas.com

READ MORE

CYBERSECURITY KNOWLEDGE HUB njcpa.org/hub/cybersecurity

LEARN MORE

Dec. 5, 10, 16 and additional dates, Live Webcast

IMPLEMENTING SECURITY AND PRIVACY POLICIES

Dec. 13, Jan. 12 and additional dates, Live Webcast

CYBERSECURITY 101 FOR CPAs Dec. 19, Jan. 16 and additional dates, Live Webcast

WHY CYBERSECURITY MATTERS TO CPAs njcpa.org/events

RISK & COMPLIANCE

18 WINTER 2022/23 | NEW JERSEY CPA

Higher Education Tax Credits: What Are the Requirements?

BY DARREN THOMAS, J.D., CPA, EA, TRAPHAGEN CPAs & WEALTH ADVISORS, LLC

BY DARREN THOMAS, J.D., CPA, EA, TRAPHAGEN CPAs & WEALTH ADVISORS, LLC

LIFETIME LEARNING CREDIT

For the LLC, the maximum that may be claimed is $2,000 per year per taxpayer, for any post-high school education at an eligible educational institution. This includes grad uate-level courses and courses to acquire or improve job skills. The LLC is available for an unlimited number of tax years.

Unlike the AOTC, the LLC is not subject to the eligible student/felony drug offense restrictions. The LLC may be avail able for a student taking only one course.

The AOTC/LLC credits are based on the payment of “qualified tuition and related expenses.” Such expenses are for tuition and academic fees that are required for enrollment or attendance at an eligible educational institution. Qualified tuition and related expenses do not include personal living expenses, student activity fees, athletic fees, insurance, room and board, and transportation costs. The AOTC includes books as qualified expenses, but the LLC does not.

For several decades, the year-over-year increases in the costs of college tuition and related expenses has far outpaced the general rate of inflation. Fortunately, some of the dollars that taxpayers pay for higher education expenses for themselves, their spouse or their dependents can be turned into federal income tax savings. This can be accomplished by claiming the Federal American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC) for tuition and related expenses.

AMERICAN OPPORTUNITY TAX CREDIT

The maximum AOTC that can be claimed is $2,500 per student for the first four years of undergraduate education at an eligible educational institution. That works out to 100 percent of the first $2,000 of highereducation tuition and related expenses plus 25 percent of the next $2,000 of expenses.

Eligible educational institutions consist of accredited schools offering credit toward a bachelor’s or associate degree or other recognized post-high school credential as well as certain vocational schools.

Only the qualified tuition and related expenses of an eligible student can be used to claim the AOTC. An eligible student is one who is enrolled at least half-time in a degree or certificate program at an eligible educational institution and who has never been convicted of a federal or state felony drug offense.

CLAIMING THE CREDITS

The AOTC and the LLC may not be claimed in the same tax year for the same expenses. However, each may be claimed for different expenses. For instance, a taxpayer may claim the AOTC for the qualified tuition and related expenses of one or more qualifying dependents and, in the same tax year, also claim the LLC for the qualified tuition and related expenses incurred for himself.

To claim the credits, a taxpayer must receive a Form 1098-T payee statement from the educational institution. Also, if a taxpayer’s dependent receives the Form 1098-T, the statement is treated as received by the taxpayer.

The LLC is nonrefundable so it can only reduce regular income taxes to zero. It cannot result in the receipt of a refund from the government. The credit may be claimed against the alternative minimum tax (AMT).

In contrast, the AOTC is 40-percent refundable. As such, a taxpayer can receive a refund if the amount of the credit exceeds their tax liability. For instance, say someone has at least $4,000 in qualified expenses but has no tax liability that would be offset by the AOTC. That person would qualify for the maximum credit of $2,500 and receive a $1,000 (40 percent of $2,500) refund from the government. In addition, the AOTC may be claimed against a taxpayer’s AMT.

Qualified tuition and related expenses used in computing the AOTC/LLC credits must be reduced by tax-exempt scholarships and fellowships, certain military benefits and any other tax-exempt payments of those expenses other than gifts or bequests.

The credits are phased out for higherincome taxpayers. Current law specifies that for 2021 and later years, the AOTC and the LLC are phased out for taxpayers married filing jointly with income between $160,000 and $180,000, or singles filers with income between $80,000 and $90,000. Neither credit is available for taxpayers who are married filing separately.

Darren Thomas, J.D., CPA, EA, is a senior tax manager at Traphagen CPAs & Wealth Advisors, LLC. He is a member of the NJCPA and can be reached at darren@tfgllc.com

TAX

READ MORE FEDERAL TAXATION KNOWLEDGE HUB njcpa.org/hub/federaltax DO MORE JOIN THE FEDERAL TAXATION INTEREST GROUP njcpa.org/groups 19 NEW JERSEY CPA | WINTER 2022/23

The Death of Deducting Litigation Expenses: What’s Next?

BY WILLIAM ROTHROCK, CSSC, BRANT HICKEY

expense was directly attributable to creating a generic drug and qualified for an immediate expense by the company.

WHAT REMAINS DEDUCTIBLE?

y A settlement of $1 million taxed at a federal applicable rate for those married filing jointly leaves the plaintiff with $693,478.75 in disposable income before state tax.

Over the next three-plus years, can you help your corporate clients defray litigation costs that lost deductibility after 2017? Examining the different sections of the Tax Cuts and Jobs Act (TCJA) illuminates the enormity of the change. However, looking beyond the TCJA provides a possible solution to the loss in deductions.

Section 11045 of the TCJA eliminated the deductibility of all expenses subject to the 2-percent rule through the year 2026. Sections 13306 and 13307 further refine eliminating deductible expenses related to litigation. Specifically, identifying fines, whether punitive or penal legal fees, and the inclusion of “non-disclosure” agreements in cases of a sexual nature are no longer deductible expenses. A recent court case further narrowed the deduct ibility of legal expenses as capital versus immediately expensed.

CASE PRECEDENT

In Mylan v. Commissioner, 156 T.C. No. 10 (April 27, 2021), the IRS took the position that the legal cost of defending a patent infringement case needed to be capitalized. The line determining the deductible status of litigation expenses starts at the nature of the litigation. What types of litigation apply after the passage of TCJA? If litigation arises in pursuit of profit-seeking activity, the cost of litigation can be expensed. Does the Mylan case indicate a clear under standing of what constitutes profit-seeking behavior? Mylan’s litigation defense against patent infringement arose through the pursuit of profit indirectly, forcing them to capitalize the expense. Mylan’s litigation

The litigation costs incurred defending a company from the government, plus reme dial or compensatory damages, continue to be deductible. However, fines, penal or punitive, are not deductible.

Thus, profit-seeking and governmentrelated litigation are deductible. But what about employee-related litigation mentioned above? Clearly, defense against allegations of sexual harassment and abuse does not qualify as profit-seeking behavior. However, the TCJA explicitly addresses this form of litigation. The TCJA eliminates the deductibility of all the associated litigation expenses for cases related to actions of harassment and abuse. Notably, including a non-disclosure agreement as a settlement term reinforces the non-deductibility of litigation expenses.

THE CPA’S ROLE

How can CPAs help clients mitigate the cost of litigation? First, consider 26 U.S. Code § 104 — compensation for injuries or sickness. Employee cases related to harassment, sexual and otherwise, and sexual abuse do not qualify under 26 U.S. Code § 104. The proceeds the employee receives in settlement from the company constitute income taxable at the state and federal levels. The tax issue allows a CPA to help the defense litigation team reduce the settlement expense. Moreover, introducing a structured settlement for the client’s consideration allows the defense to reduce the actual cost of settling the case. Why? The constructive receipt doctrine determines when the income realization occurs for the plaintiff.

When considering this doctrine, the savings become clear to both parties when using a simple settlement. Consider the following example:

y Using an annual payout over three years reduces the tax liability, thus increasing the disposable income by $109,635.63 to $803,113.38.

y In addition, if the parties agree to split the benefit, it reduces litigation costs by 5.48 percent for the defense.

y Using a structured settlement, the plaintiff’s disposable income increases by $54,817.32. The defense sees their cost to fund the settlement reduced by the same amount.

When structured settlements originated, this form of needs-based cooperation represented an industry standard. Although larger insurance carriers know structured settlements, they are less aware of this particular strategy.